FHA Loan Limits By State For 2025

Here’s the complete text with all 2024 references changed to 2025 and updated numbers:

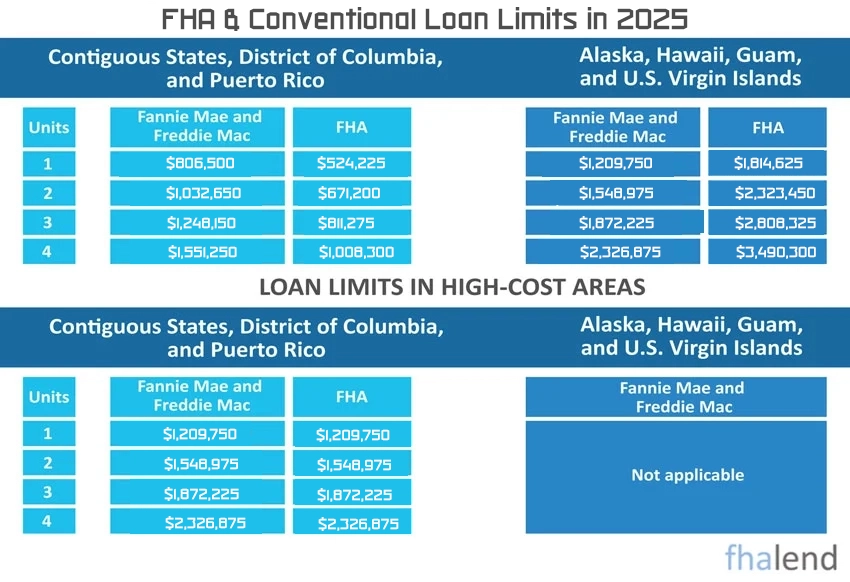

The National Loan Limits for 2025

| Conforming Limits | $806,500 |

| Loan Limit ‘Floor’ | $524,225 |

| Loan Limits ‘Ceiling’ | $1,209,750 |

| HECM maximum claim amount | $1,209,750 |

How Loan FHA Loan Limits in Each State Calculated in 2025?

The federal government establishes annual FHA Max loan limits each year based on local home price trends and a few additional factors. There’s a maximum amount you can qualify for with each federal loan program before it’s considered a jumbo loan and the Department of Housing and Urban Development (HUD) has raised the eligibility criteria for most counties in the United States. This is how to calculate the new FHA loan limits for 2025

- Determine “Anchor” Loan Amount

Before calculating the 2025 FHA floor and ceiling loan limits, HUD has determined what is considered an anchor loan amount. HUD/FHA uses the 2025 conforming loan limit (CLLs) for mortgages to be acquired by Fannie Mae and Freddie Mac in 2025 set by the FHFA (not to be confused with FHA). The amount of the loan for an anchor in 2025 is $787,750 for single-family and multifamily home loans for homeowners.

- Calculate the 2025 Floor Loan Amount

HUD calculates the FHA’s 2025 Floor Loan Amount based on two factors. This is the lowest amount that any MSA in the country can have as their Maximum FHA loan amount for 2025. These two elements are necessary for this project to be successful.

Anchor Loan Amount: $806,500

Factor: 65%

The FHA Floor Loan Amount equals the 65% rate multiplied by the anchor loan amount

$806,500 x 65% = $524,225 – FHA 2025 Floor Loan Amount - Calculate the 2025 FHA Ceiling Loan Amount

HUD determines the FHA ceiling loan amount by using an initial loan amount and the ceiling amount. This is the highest amount that any MSA can have as their Maximum FHA Loan amount for 2025 (except for high-cost areas).

Anchor Loan Amount: $787,750

Factor: 150%

The FHA Ceiling Loan Amount equals the 150% rate multiplied by the anchor loan amount. $787,750 150% = $1,182,625– FHA 2025 Ceiling Loan Amount

When the framework is set HUD has both the 2025 FHA Floor and Ceiling loan limits established. Each MSA then receives its annual FHA Loan Maximum based on FHA floor and ceiling limits and their local average home price.

Finalizing an MSA’s 2025 FHA Loan Max

Each state’s MSA’s 2025 FHA Loan Limits come from 3 basic criteria. They are as follows:

- Area’s average home price

- FHA Floor Loan Limit

- FHA Ceiling Loan Limit

When an MSA’s average home price falls within the FHA Floor and Ceiling, that MSA’s average home price becomes its 2025 FHA Loan Max. However, when an MSA’s average home price falls outside of either the FHA Floor or Ceiling, then the appropriate limit becomes that area’s 2025 FHA max loan amount.

For example, areas/MSA’s with average home prices below $512,037 take the FHA Max Loan amount at $512,037. In an area where the average home price exceeds $1,182,625 FHA Ceiling (except those noted below) take on a loan amount of $1,182,625 as their 2025 FHA Max Loan amount.

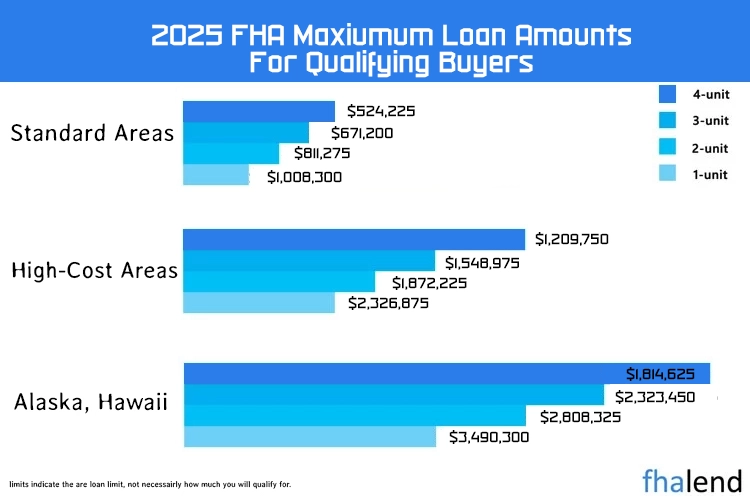

The FHA takes two key factors into account while setting lending limits: the location you reside in and the number of units you intend to purchase. The “floor” in a low-cost region will be lower than that in a high-cost area, and vice versa.

The FHA identifies high-cost locations based on the average income level, property price, and market demand. As a result, houses in heavily inhabited cities like Los Angeles will have a higher ceiling than rural or suburban areas.

Lending restrictions can differ based on the number of units you’re acquiring. A 2-unit, 3-unit, or 4-unit property will have a greater lending limit than a 1-unit home, for example.

Why Do FHA Loan Limits Matter?

- FHA loan has less strict requirements and guidelines because FHA insures the loan and lenders are more protected in case of a default on the FHA mortgage loan

- FHA mortgage interest rate might be slightly higher than conventional loans but still remain competitive.

- With a 3,5% downpayment, you can get the FHA loan if your credit score is at 580 or higher. You need to put down 10% when your credit score is low and between 500-579.

- Having bankruptcies or foreclosures might not be an issue and you can still be eligible for the FHA mortgage loan.

FHA Loan Limits Table for 2025 in Every State

Special FHA Loan Limit Exception Areas in 2025

Alaska, Hawaii, the Virgin Islands, and Guam have their own special and higher 2025 FHA Loan limits.

“Mortgage limits for the special exception areas of AK, HI, GU and VI are adjusted by FHA to account for higher costs of construction”

HUD Mortgagee loan limits table is available at and Letter 20248 (page 3)

On November 30th, (Tuesday) the Department of Housing and Urban Development (HUD) announced new loan limits for the calendar year 2025 a special exception to the Federal Housing Administration’s (FHA) loan limit. This means that FHA-insured mortgages will be available for up to $787,750 in 2025 in high-cost areas, an increase from the current limit of $766,550.

This is great news for homebuyers as it will help to make more affordable homes available in areas where prices are high. HUD Secretary Marcia Fudge said, “UD’s mission is to create strong, sustainable, inclusive communities and quality affordable homes for all..”

The increase in the loan limit is especially beneficial to those looking for homes in high-cost areas such as California, New York, and Washington D.C. In these areas, the previous limit often meant that only more expensive homes were within reach of buyers. 2025 FHA loan limits are effective for all loans with FHA case numbers assigned on or after January 1, 2025.

FHA 203k Rehab Loan Limits

FHA 203k Rehab Loan Limits

When it comes to getting a mortgage for a fixer-upper or financing the renovation of an existing property, one of the most important considerations is the rehab loan limits set by lenders. These limits vary from state to state and can make all the difference in terms of how much you can afford when it comes to buying or renovating your home.

The 203k loan limit is the maximum amount that a borrower can receive from the Federal Housing Administration (FHA) for a loan used to purchase or refinance a home. The 203k loan type has its own limit will increase to $766,550 in 2025 from $655,500 in 2024.

| 2-Unit | 3-Unit | 4-Unit | |

|---|---|---|---|

| Low-Cost Area | $655,632 | $792,441 | $984,525 |

| Mid-Range Area | $655,632 to $1,513,875 | $792,441 to $1,829,975 | $984,525 to $2,273,900 |

| High-Cost Area | $1,548,750 | $1,872,000 | $2,325,000 |

| AK, HI, Guam, & Virgin Islands | $2,270,812 | $2,744,962 | $3,410,850 |

FHA Loan Limits For Reverse Mortgage (HECM)

In addition to FHA loans, the FHA is in charge of conforming home equity conversions, commonly known as reverse mortgages. Reverse mortgages are available nationally and have a static limit. The FHA increased the loan limits for reverse mortgages from $1,149,825 in 2024 to $1,182,625 in 2025.

What if My Dream Home Price is Over The Conventional or FHA Loan Limits?

If you are over your count limits for an FHA loan you need to put down more than 3,5%. The second option would be going with a conventional loan where you will need 5%-10% as a down payment. Here is an example of how if you found your dream house in a county where FHA limits are $512,037 and conventional limits $787,750 that means the maximum house price you can be able to purchase with 5% down payment to finance it with a conventional loan is $783,750 with $39,387 as a downpayment.

FHA Multifamily Maximum Loan Amounts in High-Cost Areas

If you’re looking to finance a multifamily property with an FHA loan in a high-cost area, it’s important to know that you’ll need a larger down payment and a higher credit score to qualify for the loan.

If you are looking to buy or refinance a home in one of the many FHA high-cost areas across the country, here are some tips to help you get started:

- Do your research and work with an experienced lender who is familiar with FHA loans in your area. This will help ensure that you get all the benefits available to you and can make the process as smooth as possible.

- Consider working with a real estate agent who can assist you in finding homes on the market that meet your needs and budget.

- Take advantage of government or non-profit programs that provide assistance with down payments, closing costs, and other expenses associated with buying a home in a high-cost area.