FHA Loan Limits in Utah For 2023

FHA loan limits for Utah in 2022 are set to $472,030 in most not high-cost areas for a single-family home and $907,900 for a four-plex. These limits are based on the national conforming loan limit of $726,200 for a one-unit property. The FHA loan limits in Utah are calculated by taking 115% of the median home price in the county in which the property is located. In some cases, the loan limit may be higher than the conforming loan limit if the property is located in a high-cost area (please check below for more details).

FHA loan limits for Utah in 2022 are set to $472,030 in most not high-cost areas for a single-family home and $907,900 for a four-plex. These limits are based on the national conforming loan limit of $726,200 for a one-unit property. The FHA loan limits in Utah are calculated by taking 115% of the median home price in the county in which the property is located. In some cases, the loan limit may be higher than the conforming loan limit if the property is located in a high-cost area (please check below for more details).

If you’re looking to purchase a home in Utah with an FHA loan in 2023, it’s important to know what the loan limits are. This will help you determine how much you can borrow, and what your payments will be. Keep in mind that the loan limits are just one factor to consider when you’re applying for an FHA loan. Other factors, such as your credit score and debt-to-income ratio, will also play a role in determining whether you’re approved for a loan.

If you have any questions about FHA loans or the loan limits for Utah, please contact us and we will get you prequalified for a mortgage. They will be able to help you understand the process and ensure that you’re getting the best possible loan for your needs.

FHA Loan Limits in Utah By County For Single Homes and Multifamily

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| BEAVER | $472,030 | $604,400 | $730,525 | $907,900 | $228,000 |

| BOX ELDER | $744,050 | $952,500 | $1,151,400 | $1,430,900 | $647,000 |

| CACHE | $492,200 | $630,100 | $761,650 | $946,550 | $428,000 |

| CARBON | $472,030 | $604,400 | $730,525 | $907,900 | $213,000 |

| DAGGETT | $472,030 | $604,400 | $730,525 | $907,900 | $254,000 |

| DAVIS | $744,050 | $952,500 | $1,151,400 | $1,430,900 | $647,000 |

| DUCHESNE | $472,030 | $604,400 | $730,525 | $907,900 | $243,000 |

| EMERY | $472,030 | $604,400 | $730,525 | $907,900 | $196,000 |

| GARFIELD | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| GRAND | $543,950 | $696,350 | $841,750 | $1,046,050 | $473,000 |

| IRON | $472,030 | $604,400 | $730,525 | $907,900 | $348,000 |

| JUAB | $601,450 | $769,950 | $930,700 | $1,156,650 | $523,000 |

| KANE | $472,030 | $604,400 | $730,525 | $907,900 | $218,000 |

| MILLARD | $472,030 | $604,400 | $730,525 | $907,900 | $289,000 |

| MORGAN | $744,050 | $952,500 | $1,151,400 | $1,430,900 | $647,000 |

| PIUTE | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| RICH | $531,300 | $680,150 | $822,150 | $1,021,750 | $462,000 |

| SALT LAKE | $619,850 | $793,500 | $959,200 | $1,192,050 | $539,000 |

| SAN JUAN | $472,030 | $604,400 | $730,525 | $907,900 | $212,000 |

| SANPETE | $472,030 | $604,400 | $730,525 | $907,900 | $305,000 |

| SEVIER | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| SUMMIT | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $950,000 |

| TOOELE | $619,850 | $793,500 | $959,200 | $1,192,050 | $539,000 |

| UINTAH | $472,030 | $604,400 | $730,525 | $907,900 | $319,000 |

| UTAH | $601,450 | $769,950 | $930,700 | $1,156,650 | $523,000 |

| WASATCH | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $950,000 |

| WASHINGTON | $593,400 | $759,650 | $918,250 | $1,141,150 | $516,000 |

| WAYNE | $472,030 | $604,400 | $730,525 | $907,900 | $376,000 |

| WEBER | $744,050 | $952,500 | $1,151,400 | $1,430,900 | $647,000 |

How FHA Loan Limits Are Calculated?

FHA loan limits are determined by the area in which you purchase a home. There are maximum loan amounts for each county in every state. You can calculate the maximum loan amount for your county by multiplying the median home price in your county by 1.25. For example, if the median home price in your county is $350,000, then the maximum loan amount would be $437.500.

FHA Lenders in Utah

If you’re interested in an FHA loan, you’ll need to find a lender that offers them. Not all lenders offer FHA loans, and not all of those that do will offer them in your area. You can search for FHA-approved lenders on the Department of Housing and Urban Development’s website or call us, we are licensed in 48 states including Utah state. Once you’ve found a lender, you’ll need to fill out an application and provide documentation of your income, debts, and assets.

The lender will then forward your application to the FHA for approval. If you’re approved, you’ll receive a loan commitment from the FHA that outlines the terms of your loan. FHA loans have a few benefits over other loan types. They’re available to borrowers with less-than-perfect credit, and they require a lower down payment than most other loan types. However, they also come with some drawbacks. FHA loans have high fees and insurance premiums, and they limit the amount you can borrow.

How can I Qualify for an FHA Loan in Utah?

The Federal Housing Administration (FHA), a part of the U.S. Department of Housing and Urban Development (HUD), offers loan programs that make it easier for homebuyers to qualify for mortgages. If you are looking to buy a home in Utah and are interested in an FHA loan, there are some things you should know.

FHA Loan Credit Score Requirements

In order to qualify for an FHA loan in Utah, you must meet certain criteria set forth by the FHA. First, you must have a minimum credit score of 580 in order to qualify for the 3.5% down payment option. If your credit score is below 580, you may still qualify for an FHA loan with a low credit score and a 10% down payment. However, keep in mind that you will be required to pay private mortgage insurance (PMI) if your down payment is less than 20%.

DTI and LTV Guidelines To Qualify For an FHA Loan In Utah

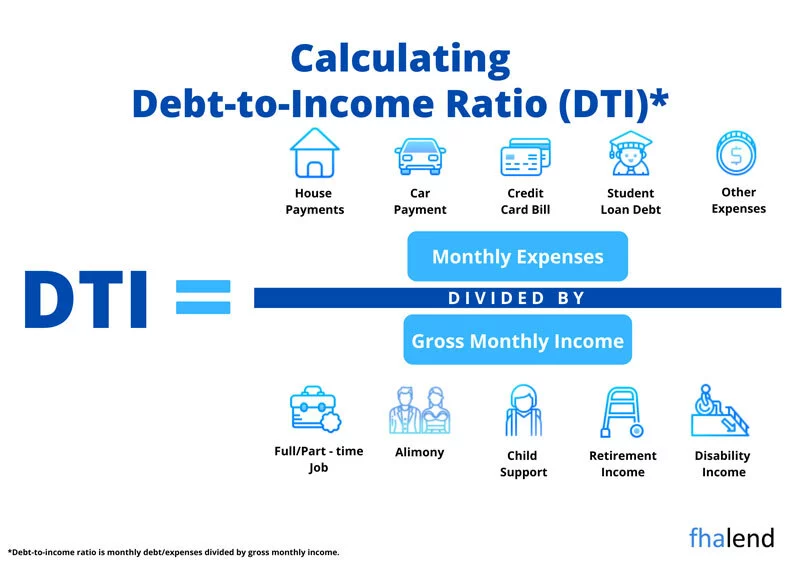

In addition to credit score requirements, you must also have a steady income and a good debt-to-income ratio in order to qualify for an FHA loan. Your debt-to-income ratio is calculated by taking your monthly debts (including your mortgage payment) and dividing it by your gross monthly income.

For example, if your monthly debts total $1,500 and your gross monthly income is $5,000, your debt-to-income ratio would be 30%. In general, the FHA prefers that your debt-to-income ratio not exceed 43%, but they will consider ratios up to 50% on a case-by-case basis.

FHA Employment Requirement in Utah

FHA Employment Requirement in Utah

Finally, you must have a steady employment history in order to qualify for an FHA loan. The FHA prefers that you have been employed at your current job for at least two years, but they will consider borrowers with less than two years of employment on a case-by-case basis.

If you meet the criteria listed above, you may be eligible for an FHA loan in Utah. For more information about FHA loans, contact us today and we will pre-approve you so you can start shopping for a house tomorrow!

FHA Loan Requirements in Utah

If you’re looking to get an FHA loan, there are a few requirements you’ll need to meet. In this blog post, we’ll go over what those requirements are so you can see if you qualify.

To qualify for an FHA loan, you’ll need:

- A credit score of 500 or higher (10% for a downpayment if your score is lower than 580 if 580 scores than 3,% is required)

- A down payment of at least 3.5%

- Proof of employment and income

- A valid Social Security number

- A property that meets minimum property standards set by the FHA

- A property which meets maximum FHA Loan limits in your county in the state of Utah

If you meet all of the above requirements, you should be able to get an FHA loan. If you have any questions about the process or whether you qualify, be sure to talk to us by filling up the form. They’ll be able to help you out and get you on the right track.

Can I Refinance FHA Loan?

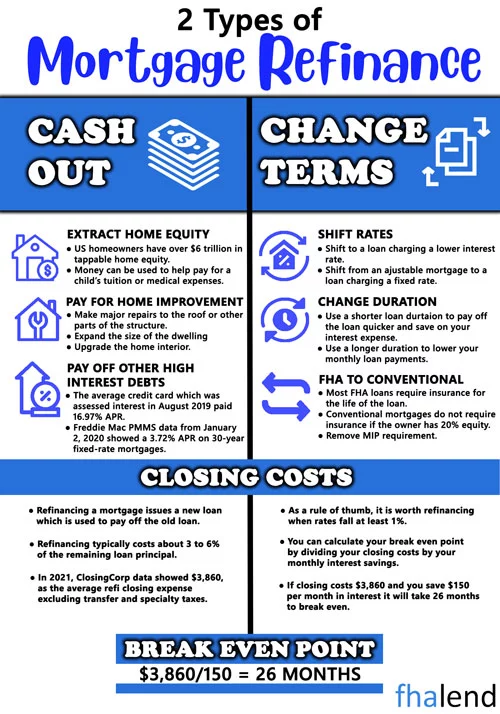

The answer is yes, you can refinance your FHA loan. There are a few things you need to know before you can refinance though. In this blog post, we’ll walk through everything you need to know about refinancing your FHA loan.

FHA loans are popular because they’re typically easier to qualify for than a conventional mortgage. That’s because the FHA sets certain minimum standards for borrowers, including minimum income and credit score requirements.

So if you’re thinking about refinancing your FHA loan, here are some things you need to know. First, there are different types of refinance options available depending on your situation. For example, you may be able to refinance your current loan into a fixed-rate mortgage with a lower interest rate, or into an adjustable-rate mortgage (ARM) that has a lower initial interest rate but may reset higher in the future.

You’ll also want to make sure that the terms of your new loan are better than the terms of your existing one. For example, if you currently have an FHA 30-year fixed-rate mortgage with a 4.5% interest rate, you’ll want to make sure that the terms of your new loan are better than that.

You’ll also want to make sure that the terms of your new loan are better than the terms of your existing one. For example, if you currently have an FHA 30-year fixed-rate mortgage with a 4.5% interest rate, you’ll want to make sure that the terms of your new loan are better than that.

If you’re not sure what type of refinancing is right for you, we can help. We have a team of experienced mortgage professionals who can help guide you through the process and find the best option for your situation.

To learn more about refinancing your FHA loan, or to get started on the process, contact us today.

Can Investors Use FHA Loans in Utah?

As an investor, you may be wondering if you can take advantage of the benefits of an FHA loan. The answer is yes! Here’s what you need to know about using an FHA loan as an investor.

The first thing to know is that you can use an FHA loan to purchase a multifamily property – including a duplex, triplex, or fourplex. You can also use an FHA loan to purchase an investment property – including a single-family home, townhome, or condominium. However, there are some restrictions to using an FHA loan for an investment property.

The biggest restriction is that you can only use an FHA loan to purchase a property that will be your primary residence. This means that you can’t use an FHA loan to purchase a vacation home or rental property. If you’re looking to purchase an investment property, you’ll need to find another type of financing.

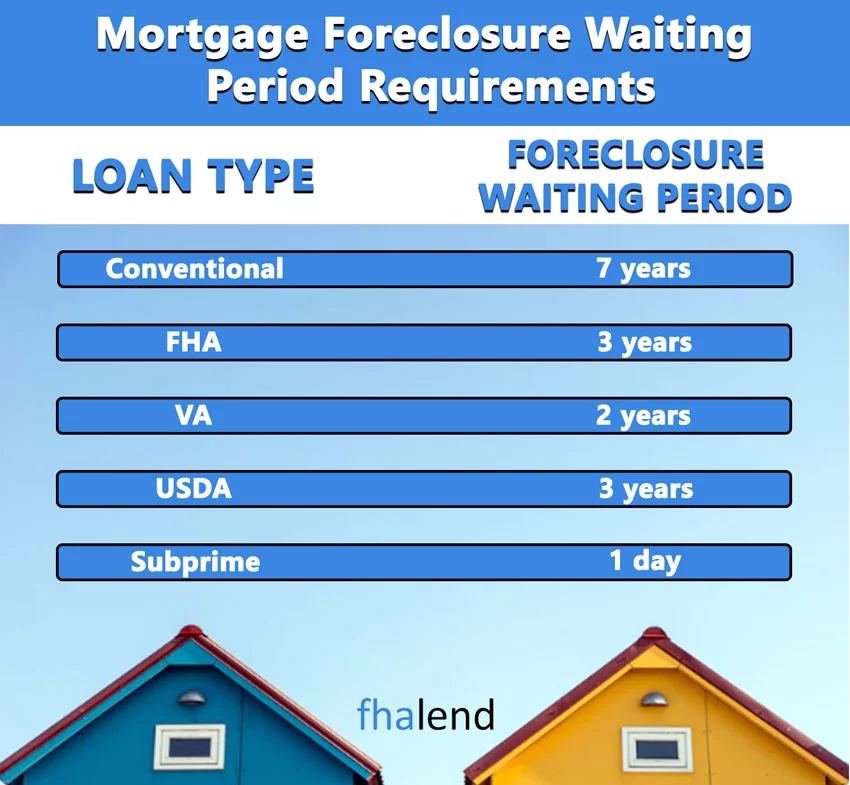

Can You Apply For FHA Loan After Bankruptcy in Utah?

If you’re considering applying for an FHA loan after bankruptcy, there are a few things you need to know. First, you’ll need to wait at least two years after your bankruptcy discharge date to be eligible for an FHA loan. Second, you’ll need to have re-established good credit during that time. And third, you’ll need to show that you’ve been able to manage your finances responsibly since your bankruptcy.

If you can meet these requirements, then you may be a good candidate for an FHA loan after bankruptcy. Here are a few tips on how to improve your chances of getting approved:

- Start rebuilding your credit as soon as possible after your bankruptcy discharge. This means making all of your payments on time, keeping your balances low, and using credit responsibly.

- Pay off any outstanding debts that you have. This will show lenders that you’re serious about cleaning up your financial act.

- Save up for a large down payment. The larger your down payment, the lower your risk level in the eyes of lenders.

- Get pre-approved for a loan before you start shopping for a home. This will give you an idea of what you can afford and put you in a stronger negotiating position with sellers

- Work with an experienced real estate agent who knows the ins and outs of the FHA loan process. They can help guide you through the entire process from start to finish.

If you follow these tips, you’ll be in a good position to get approved for an FHA loan after bankruptcy. Just remember to be patient and take things one step at a time. The most important thing is to rebuild your credit and show lenders that you’re a responsible borrower. With some time and effort, you can get back on the path to homeownership.

Please contact us, 70% of our borrowers have late payments, foreclosures, short sales, or bankruptcies and we get them to the finish line sooner or later.

FHA Multifamily Maximum Loan Limits in Utah

Multifamily FHA loan limits in Utah are similar in most counties however there are some high-cost areas as well including Box Elder County, Davis County, Juab County, Morgan County, Salt Lake County, Tooele County, Summit County, Utah County, Wasatch County, Washington County, and Weber County. For all others below are FHA loan limits in Utah for multifamily and single home family homes:

- single units family home: $420,680

- two units: $538,650

- three units: $651,050

- four units: $809,150

If you’re looking to purchase a multifamily property with an FHA loan, there are some additional restrictions. You’ll need to occupy one of the units on the property as your primary residence. And, the property must be owner-occupied – meaning that at least 51% of the units must be occupied by the owner.

If you’re looking to purchase a single-family home, townhome, or condominium with an FHA loan, there are no additional restrictions. You can use the loan to purchase the property and rent it out immediately.

If you’re looking for a flexible and affordable financing option for your investment property, an FHA loan could be a good option for you. Just be sure to keep in mind the restrictions on using an FHA loan for an investment property.

FHA Loan Limits in High-Cost Areas in Utah State

There are 12 counties with higher FHA loan limits in Utah. In those areas, the maximum loan amount to borrow is higher. Here are the top expensive cities:

Are you considering a move to Utah? If so, you might be wondering what the most expensive cities in the state are. Here is a list of the top three:

1. Salt Lake City

The cost of living in Salt Lake City is nearly 20% higher than the national average. Housing costs are especially high, with the median home price coming in at over $400,000.

2. Park City

Park City is another city with high housing costs, with the median home price exceeding $700,000. The cost of living here is also quite high, at nearly 18% above the national average.

3. St. George

St. George is one of the fastest-growing cities in Utah, and its booming economy has helped to drive up housing prices. The median home price here is also over $400,000, making it one of the most expensive places to live in the state.

If you are thinking about moving to Utah, these are some of the factors that you will need to consider when choosing a city to live in. Whether you prioritize affordability or other amenities like great schools or access to outdoor recreation, there is certainly no shortage of options in this beautiful state.

Utah Down Payment Assistance Program

The Utah Housing Corporation offers down payment assistance programs to help first-time home buyers achieve homeownership in the state of Utah. The UHC offers two different down payment assistance programs: the HomeFirst Down Payment Assistance Loan and the Helping Hand Down Payment Assistance Grant.

The Utah Housing Corporation (UHC) also provides down payment assistance loans to repeat buyers and new purchasers. This document from the UHC website summarizes the specifics.

- Depending on which down payment assistance loan you qualify for, you might receive up to 4% or 6% of your total loan amount.

- You’re taking out a 30-year second mortgage with an interest rate that’s 2 percentage points greater than the rate on your primary mortgage. To qualify, you must first be accepted for and accept an FHA or VA loan from UHC. This PDF from UHC’s website lays out the details.

The Helping Hand Down Payment Assistance Grant provides up to $5,000 for the down payment and closing costs. This grant does not have to be repaid.

To be eligible for either of these programs, buyers must:

- be a first-time home buyer (or have not owned a home in the past three years)

- have a household income that does not exceed 80% of the area median income

- complete a homeownership education course

- have a good credit history

For more information on these programs, please visit the Utah Housing Corporation website, you can learn more about these loans. You may also look up HUD’s list of additional Utah homeownership assistance programs.