FHA Loan Limits in Arizona by County in 2023

It is important to know the FHA loan limits in Arizona because they impact a variety of down payment assistance programs offered in Arizona. The many down payment help programs available in Arizona have maximum loan amounts that are higher than the FHA loan limits in the county where you are looking to buy your home. So, you are capped by the Federal Home Administration limits. If that is the case, you will not be able to use an FHA loan to be qualified for the maximum loan amount available for the down payment assistance program you have chosen.

It is important to know the FHA loan limits in Arizona because they impact a variety of down payment assistance programs offered in Arizona. The many down payment help programs available in Arizona have maximum loan amounts that are higher than the FHA loan limits in the county where you are looking to buy your home. So, you are capped by the Federal Home Administration limits. If that is the case, you will not be able to use an FHA loan to be qualified for the maximum loan amount available for the down payment assistance program you have chosen.

The current FHA loan limits in Arizona in most of the counties are $472,030 for a single-family residence. This is the FHA’s maximum loan limit, which is 65% of the conforming loan limit. The Coconino County FHA loan limit is higher because it is considered a high-cost-of-living area.

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| APACHE | 472,030 | 604,400 | 730,525 | 907,900 | 123,000 |

| COCHISE | 472,030 | 604,400 | 730,525 | 907,900 | 200,000 |

| COCONINO | 517,500 | 662,500 | 800,800 | 995,200 | 450,000 |

| GILA | 472,030 | 604,400 | 730,525 | 907,900 | 280,000 |

| GRAHAM | 472,030 | 604,400 | 730,525 | 907,900 | 202,000 |

| GREENLEE | 472,030 | 604,400 | 730,525 | 907,900 | 88,000 |

| LA PAZ | 472,030 | 604,400 | 730,525 | 907,900 | 111,000 |

| MARICOPA | 530,150 | 678,700 | 820,350 | 1,019,550 | 461,000 |

| MOHAVE | 472,030 | 604,400 | 730,525 | 907,900 | 249,000 |

| NAVAJO | 472,030 | 604,400 | 730,525 | 907,900 | 245,000 |

| PIMA | 472,030 | 604,400 | 730,525 | 907,900 | 335,000 |

| PINAL | 530,150 | 678,700 | 820,350 | 1,019,550 | 461,000 |

| SANTA CRUZ | 472,030 | 604,400 | 730,525 | 907,900 | 240,000 |

| YAVAPAI | 472,030 | 604,400 | 730,525 | 907,900 | 385,000 |

| YUMA | 472,030 | 604,400 | 730,525 | 907,900 | 225,000 |

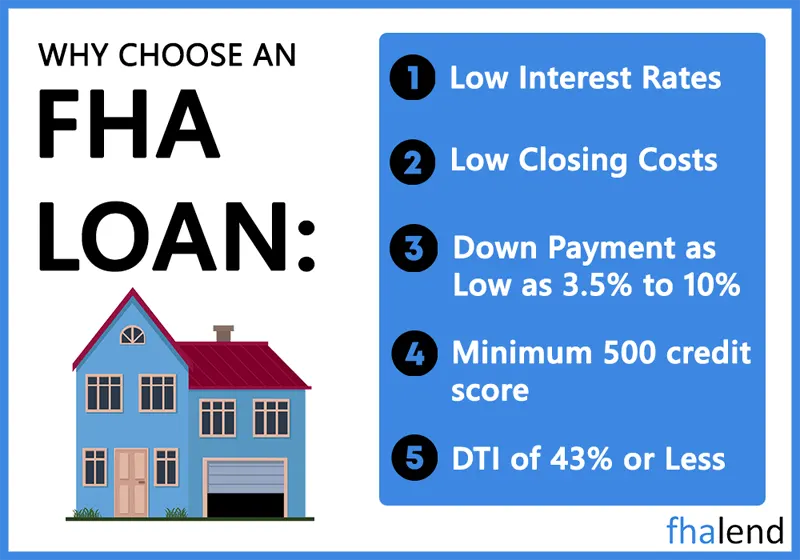

How to Qualify For FHA Loan in Arizona?

- The home must be your primary residence (no vacation homes, investments or 2nd home for FHA loan)

- Minimum Credit Score 500 (some banks have overlays)

- A debt-To-Icome ratio is lower or at 43%, however, you might be able to qualify for a loan in Arizona with “compensating factors” if your DTI is higher.

- You need to purchase a MIP, a mortgage insurance premium required by FHA

- FHA only allows loans for a primary residence, so no vacation homes or investments

- For the past two years, you cannot have had bankruptcies or foreclosures

- Documented income in the past 2 years

- 3,5% for a down payment or 10% if your credit is below 580

How FHA Loan Limits in Arizona are Determined?

The 2023 low-cost limit or “floor” is $472,030 for a single-family home and is 65% of the national conforming loan limit of $647,200. If you’re buying a multifamily home, the low-cost limits increase with each unit:

- $604,400 for a two-unit home

- $730,525 for a three-unit home

- $907,900 for a four-unit home

If you’re buying a home near an expensive part of Arizona, the high-cost limits are slightly higher than the low-cost limits. Here are the single-family limits for the three Arizona high-cost counties:

- $517,500 Coconino

- $530,150 Maricopa

- $530,150 Pinal

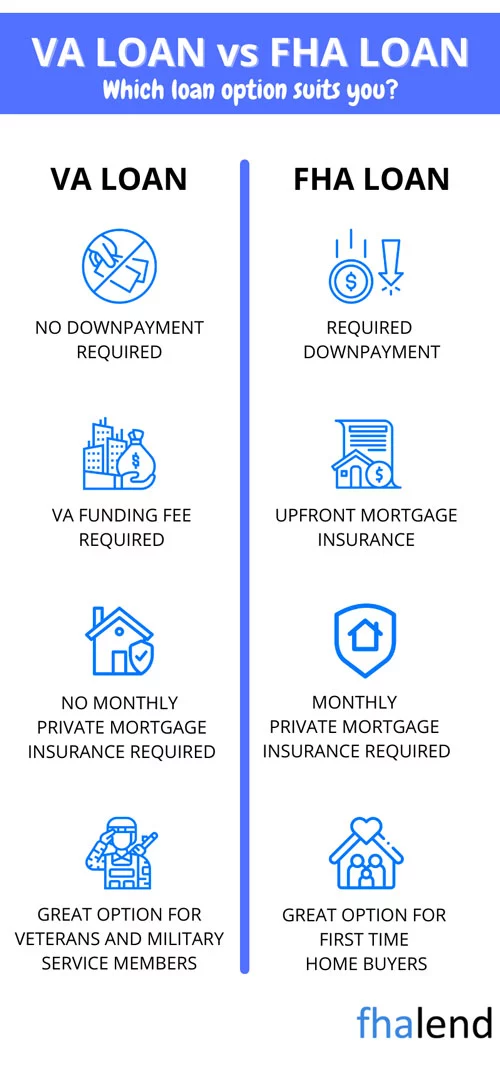

Benefits of FHA Loans in Arizona

One of the biggest benefits of an FHA loan is that it’s available to borrowers with a lower credit score than traditional loans. In most cases, you’ll need a credit score of at least 580 to qualify for an FHA loan. This makes it a good option for borrowers who have had difficulty obtaining a loan in the past.

Another benefit of FHA loans is that they come with low-interest rates. In many cases, you’ll pay a lower interest rate than you would for a traditional loan. This can save you a significant amount of money over the life of your loan.

However, there are also some drawbacks to FHA loans. One of the biggest is that FHA loans require borrowers to pay mortgage insurance premiums. These premiums can add up to a significant amount of money over the life of your loan.

In addition, FHA loans can be more expensive in the long run. This is because FHA loans come with a higher interest rate than traditional loans. So, if you plan to stay in your home for a long time, an FHA loan may not be the best option for you.

In addition, FHA loans can be more expensive in the long run. This is because FHA loans come with a higher interest rate than traditional loans. So, if you plan to stay in your home for a long time, an FHA loan may not be the best option for you.

At the end of the day, the decision of whether or not to get an FHA loan depends on your individual circumstances. So, it’s important to weigh the pros and cons before you decide. If you’re still undecided, consult with a lender by clicking the button below.

How FHA Loan Limits in Arizona Affect Your Home Purchase

In Arizona, there are 3 counties with higher loan limits than in other counties across the U.S. FHA loan limits in Arizona in Coconino County are set at (for a single home family: $517,500, for 2-unit: $662,500, triplex: $800,800 and fourplex: $995,200)

In Maricopa County FHA loan limits in Arizona are set at $530,150 for a 1-unit home and you can borrow up to $678,700 for a duplex. For 3-unit you can get up to $820,350 in financing. Lenders will lend up to $1,019,550 for a fourplex.

In Pinal County here is a breakdown:

- $472,030 – 1-unit property

- $604,400 – 2-unit property

- $730,525 – 3-unit property

- $907,900 – 4-unit property

FHA loan limits in Arizona affect borrowers’ minimum credit score requirements to obtain a loan. For example, if you trying to buy a house in Phoenix, AR for $600,000 you need to have a 620 or higher fico score. If you have a lower score you can still qualify however you need to subtract the amount you can borrow through FHA financing: $441,600 from $600,000 and come up with a difference that is $158,400.

If your score is higher than 620 you can get a conventional loan and put down as little as 5% or 10% as a downpayment. In this example, the maximum home purchase price in Phoenix Arizona is $472,030 (when you put down 3,5% – $472,030 * 3,5% = $16,521) with a tri-merge credit score higher than 579.

Maximum FHA Loan Amount With a 500 Credit Score

You can get FHA financing with a low credit score however you need to put down as much as 10% down. The maximum loan amount in Arizona in Maricopa County (Phoenix) is $441,600 ($44,160 in downpayment) so your score is at 540 you can purchase a house for up to $485,760. Different counties have different FHA loan limits in Arizona, make sure you check them before getting pre-qualified for a mortgage and start shopping.

Arizona Down Payment Assistance Program

The Arizona Department of Housing’s Home Plus initiative pays up to 5% of the first mortgage balance. The amount you may receive will be determined on the type of loan you take out.

- Both down payment and closing costs may be covered by the mortgage.

- To be eligible for the program, you’ll need a credit score of 640 or higher. For some types of mortgages, you’ll need a score of 660.

- Your yearly income must not exceed $112,785 to be eligible.

Visit the Home Plus website for more information. Take a look at HUD’s list of alternative programs for Arizona, too.