FHA Loan Limits in Wisconsin

FHA loan limits in Wisconsin increased in 2023. This is great news for potential homebuyers who may have been priced out of the market in recent years. The new loan limits will provide more access to affordable financing, and open up more opportunities for homeownership.

FHA loan limits in Wisconsin increased in 2023. This is great news for potential homebuyers who may have been priced out of the market in recent years. The new loan limits will provide more access to affordable financing, and open up more opportunities for homeownership.

If you’re thinking about buying a home in Wisconsin, it’s important to know what the new loan limits will be. Here’s everything you need to know about FHA loan limits in Wisconsin in 2023.

The Federal Housing Administration (FHA) is a government agency that provides mortgage insurance on loans made by FHA-approved lenders. Mortgage insurance protects lenders against losses if borrowers default on their loans.

The FHA sets loan limits for each county in the United States. In general, loan limits are higher in counties with higher home prices. The 2022 loan limits for Wisconsin ranged from $420,680 to $809,150.

The FHA is increasing loan limits in Wisconsin in 2023. The new loan limits will range from $472,030 to $907,900. This is an increase of $15,190 to $27,500 from the 2021 limits.

The loan limit increase will make it easier for potential home buyers to get financing. It will also open up more opportunities for homeownership in Wisconsin. If you’re thinking about buying a home in Wisconsin, now is a great time to start the process.

If you have any questions about FHA loan limits in Wisconsin, or if you’re ready to start the home-buying process, contact me today. I’d be happy to help you navigate the new loan limits and find the perfect home for you and your family.

FHA Loan Limits in Wisconsin by County For 2022

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| ADAMS | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| ASHLAND | $472,030 | $604,400 | $730,525 | $907,900 | $100,000 |

| BARRON | $472,030 | $604,400 | $730,525 | $907,900 | $165,000 |

| BAYFIELD | $472,030 | $604,400 | $730,525 | $907,900 | $124,000 |

| BROWN | $472,030 | $604,400 | $730,525 | $907,900 | $235,000 |

| BUFFALO | $472,030 | $604,400 | $730,525 | $907,900 | $141,000 |

| BURNETT | $472,030 | $604,400 | $730,525 | $907,900 | $145,000 |

| CALUMET | $472,030 | $604,400 | $730,525 | $907,900 | $255,000 |

| CHIPPEWA | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| CLARK | $472,030 | $604,400 | $730,525 | $907,900 | $125,000 |

| COLUMBIA | $472,030 | $604,400 | $730,525 | $907,900 | $375,000 |

| CRAWFORD | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| DANE | $472,030 | $604,400 | $730,525 | $907,900 | $375,000 |

| DODGE | $472,030 | $604,400 | $730,525 | $907,900 | $190,000 |

| DOOR | $472,030 | $604,400 | $730,525 | $907,900 | $185,000 |

| DOUGLAS | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| DUNN | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| EAU CLAIRE | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| FLORENCE | $472,030 | $604,400 | $730,525 | $907,900 | $95,000 |

| FOND DU LAC | $472,030 | $604,400 | $730,525 | $907,900 | $160,000 |

| FOREST | $472,030 | $604,400 | $730,525 | $907,900 | $87,000 |

| GRANT | $472,030 | $604,400 | $730,525 | $907,900 | $139,000 |

| GREEN | $472,030 | $604,400 | $730,525 | $907,900 | $375,000 |

| GREEN LAKE | $472,030 | $604,400 | $730,525 | $907,900 | $166,000 |

| IOWA | $472,030 | $604,400 | $730,525 | $907,900 | $375,000 |

| IRON | $472,030 | $604,400 | $730,525 | $907,900 | $93,000 |

| JACKSON | $472,030 | $604,400 | $730,525 | $907,900 | $125,000 |

| JEFFERSON | $472,030 | $604,400 | $730,525 | $907,900 | $250,000 |

| JUNEAU | $472,030 | $604,400 | $730,525 | $907,900 | $117,000 |

| KENOSHA | $472,030 | $604,400 | $730,525 | $907,900 | $386,000 |

| KEWAUNEE | $472,030 | $604,400 | $730,525 | $907,900 | $235,000 |

| LA CROSSE | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| LAFAYETTE | $472,030 | $604,400 | $730,525 | $907,900 | $135,000 |

| LANGLADE | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| LINCOLN | $472,030 | $604,400 | $730,525 | $907,900 | $171,000 |

| MANITOWOC | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| MARATHON | $472,030 | $604,400 | $730,525 | $907,900 | $171,000 |

| MARINETTE | $472,030 | $604,400 | $730,525 | $907,900 | $105,000 |

| MARQUETTE | $472,030 | $604,400 | $730,525 | $907,900 | $142,000 |

| MENOMINEE | $472,030 | $604,400 | $730,525 | $907,900 | $135,000 |

| MILWAUKEE | $472,030 | $604,400 | $730,525 | $907,900 | $380,000 |

| MONROE | $472,030 | $604,400 | $730,525 | $907,900 | $180,000 |

| OCONTO | $472,030 | $604,400 | $730,525 | $907,900 | $235,000 |

| ONEIDA | $472,030 | $604,400 | $730,525 | $907,900 | $142,000 |

| OUTAGAMIE | $472,030 | $604,400 | $730,525 | $907,900 | $255,000 |

| OZAUKEE | $472,030 | $604,400 | $730,525 | $907,900 | $380,000 |

| PEPIN | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| PIERCE | $515,200 | $659,550 | $797,250 | $990,800 | $448,000 |

| POLK | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| PORTAGE | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| PRICE | $472,030 | $604,400 | $730,525 | $907,900 | $85,000 |

| RACINE | $472,030 | $604,400 | $730,525 | $907,900 | $212,000 |

| RICHLAND | $472,030 | $604,400 | $730,525 | $907,900 | $124,000 |

| ROCK | $472,030 | $604,400 | $730,525 | $907,900 | $185,000 |

| RUSK | $472,030 | $604,400 | $730,525 | $907,900 | $100,000 |

| ST. CROIX | $515,200 | $659,550 | $797,250 | $990,800 | $448,000 |

| SAUK | $472,030 | $604,400 | $730,525 | $907,900 | $219,000 |

| SAWYER | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| SHAWANO | $472,030 | $604,400 | $730,525 | $907,900 | $135,000 |

| SHEBOYGAN | $472,030 | $604,400 | $730,525 | $907,900 | $198,000 |

| TAYLOR | $472,030 | $604,400 | $730,525 | $907,900 | $134,000 |

| TREMPEALEAU | $472,030 | $604,400 | $730,525 | $907,900 | $159,000 |

| VERNON | $472,030 | $604,400 | $730,525 | $907,900 | $136,000 |

| VILAS | $472,030 | $604,400 | $730,525 | $907,900 | $170,000 |

| WALWORTH | $472,030 | $604,400 | $730,525 | $907,900 | $273,000 |

| WASHBURN | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| WASHINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $380,000 |

| WAUKESHA | $472,030 | $604,400 | $730,525 | $907,900 | $380,000 |

| WAUPACA | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| WAUSHARA | $472,030 | $604,400 | $730,525 | $907,900 | $282,000 |

| WINNEBAGO | $472,030 | $604,400 | $730,525 | $907,900 | $180,000 |

| WOOD | $472,030 | $604,400 | $730,525 | $907,900 | $137,000 |

How To Qualify For an FHA Loan in Wisconsin

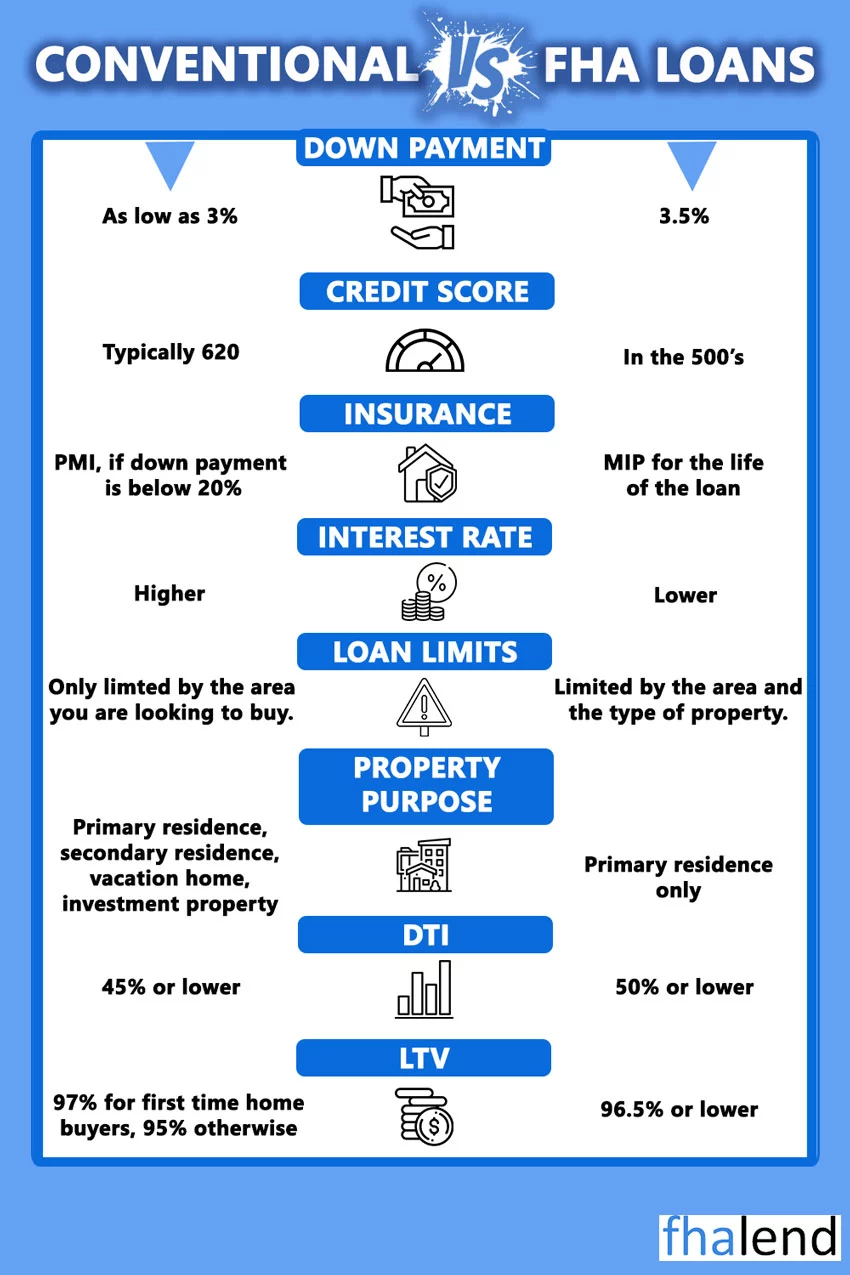

FHA loans are government-backed loans that make it easier for people with less-than-perfect credit to get financing for a home. But what exactly do you need to qualify for an FHA loan? In this blog post, we’ll go over the requirements for an FHA loan in 2022.

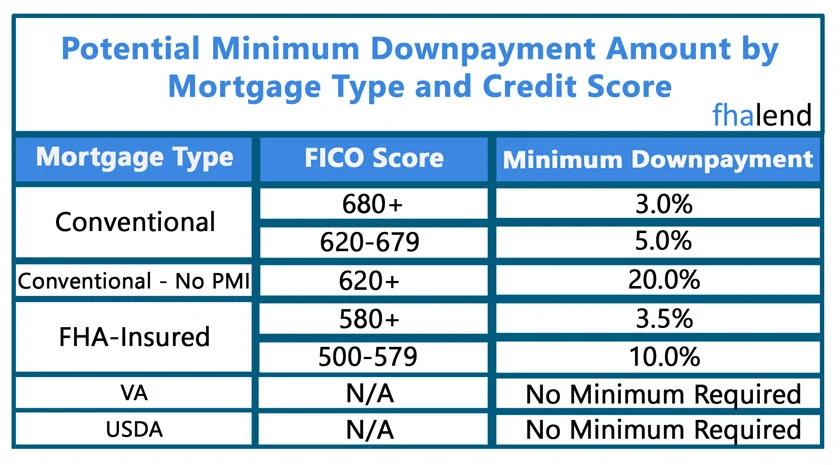

FHA Loan Limits in Wisconsin and Credit Score Requirements

If you’re looking to get an FHA loan in 2023, you’ll need to have a credit score of at least 580. This is the minimum credit score required by the Federal Housing Administration. However, if your credit score is below 580, you may still be able to qualify for an FHA loan if you can provide a minimum down payment of 10%.

If you’re looking to get the best interest rates on your FHA loan, you’ll need to have a credit score of at least 620. This is the minimum credit score required by most lenders. However, if you have a credit score of 580 or above, you may be able to get a lower interest rate.

To get the best terms on your FHA loan, it’s important to shop around and compare rates from multiple lenders. This will help you ensure that you’re getting the best deal possible.

FHA Loan Employment History Guidelines in Wisconsin

According to the FHA, in order to qualify for an FHA loan, borrowers must have a steady employment history. This means that borrowers must have been employed for at least two years prior to applying for an FHA loan.

Borrowers with less than two years of employment history may still qualify for an FHA loan if they can show that they have other sources of income that can be used to make mortgage payments. For example, borrowers who are self-employed may be able to show proof of income through tax returns.

The FHA also requires that borrowers have a valid Social Security number and be legal residents of the United States. Borrowers must also meet minimum credit requirements in order to qualify for an FHA loan.

If you are thinking of applying for an FHA loan, make sure you meet the employment history requirements. These requirements are in place to help ensure that borrowers will be able to make their mortgage payments on time.

Downpayment Requirements For FHA Loan in Wisconsin

When it comes to FHA loans, the down payment requirements have changed over the years. In the past, borrowers were required to have a down payment of at least 10 percent of the purchase price of the home with less than a 580 FICO score. As to HUD guidelines, borrowers are only required to have a down payment of 3.5 percent of the purchase price of the home. That low down payment requirement makes it easier for borrowers to qualify for an FHA loan and make it more affordable for borrowers to purchase a home.

If you are considering an FHA loan for your next home purchase, it is important to understand the down payment requirements. With a down payment of only 3.5 percent, you will be able to finance a larger portion of the purchase price of the home, which will lower your monthly mortgage payments. Additionally, with a smaller down payment, you will have more cash available for other expenses associated with purchasing a home, such as closing costs.

If you are considering an FHA loan for your next home purchase, it is important to understand the down payment requirements. With a down payment of only 3.5 percent, you will be able to finance a larger portion of the purchase price of the home, which will lower your monthly mortgage payments. Additionally, with a smaller down payment, you will have more cash available for other expenses associated with purchasing a home, such as closing costs.

If you are interested in learning more about the down payment requirements for an FHA loan in 2023, or if you have any questions about FHA loans in general, please contact us today. We would be happy to answer any of your questions and help you get started on the path to homeownership

FHA Loan Limits in Wisconsin For High-Cost Areas

There is only one county in Wisconsin where FHA loan limits in Wisconsin are higher than in all other counties. For St. Croix County the maximum loan amount to buy a single home is $448,500. For 2-unit the max FHA loan limits are set to $574,150. If you are buying a triplex you can lend up to $694,000. For fourplex, a lender should be able to lend you as much as $862,500

St. Croix County, Wisconsin is a beautiful place to live, work, and raise a family. The county is home to many great schools, parks, and recreation areas. There are also many great businesses and employers located in the county. St. Croix County is a great place to call home.

Is it a Good Time To Buy a House in Wisconsin Right Now?

The housing market in Wisconsin is booming right now! Here are three things you need to know about the current state of the housing market in Wisconsin:

1. Home prices are rising rapidly.

In the past year, median home prices in Wisconsin have increased by more than 5%. This trend is expected to continue in the coming years, as more and more people are looking to buy homes in Wisconsin.

2. There is a shortage of available homes.

Due to the high demand for homes in Wisconsin, there is currently a shortage of available homes on the market. This has resulted in bidding wars for many homes, and some buyers are even paying above the asking price just to secure a home.

3. Mortgage rates are still low.

Despite the rising home prices, mortgage rates climbed to 5% from historically low standards. Based on raising Inflation, fed actions, and rising yields on U.S. Treasuries all point toward mortgage rates increasing through 2022. This means that now is a good time to buy a home in Wisconsin.

High-Cost Areas in Wisconsin

There are two high-cost areas in Wisconsin: Pierce County and St. Croix County. In both counties, the maximum FHA loan limits are higher than in the other 48 counties. The median price is set at $390,000 for 2022.

- in both counties for a single-family home, you can get financing up to $448,500.

- for 2-unit property, a lender can lend you up to $574,150 in Pierce or St. Croix Counties

- when buying a triplex you can get financing as much as $694,000

- for 4-unit properties, you can get up to $862,500

Benefits o Buying a House in Wisconsin

The state of Wisconsin is a wonderful place to live and raise a family. You’ll encounter down-to-earth individuals who like life and enjoy the outdoors. Here are some of the advantages of residing in Wisconsin, in addition to other states.

This is the spot for you if you enjoy beer, cheese, and bratwurst.

This is the spot for you if you enjoy beer, cheese, and bratwurst.- Living Costs in Wisconsin Are Lower Than In Most Other States The Cost of Living in Wisconsin is less than in most other states. Here, you may locate a home that is reasonably priced.

- Outdoor Activities – In Wisconsin, there are plenty of opportunities to go hunting and fishing

- There are a variety of community events and people are often pleasant.

- High tax burden.

- Wisconsin is affordable. For example, 2-bedroom apartment rent in Wisconsin cost about 26% less per month than the average in the country.

If you’ve decided to buy a house in Wisconsin and have already made up your mind, we can assist you with your mortgage. If your credit score is low and you need more answers to your mortgage-related questions read our article about FHA loans with bad credit scores

How FHA Loan Limits Are Calculated in Wisconsin

The Federal Housing Administration (FHA) loan limits are calculated based on the national conforming loan limit. The FHA loan limit is set at 115% of the median home price in each county, with a floor and ceiling on the limits.

The FHA’s “floor” is the largest mortgage the agency will insure in most of the country and is set at 65% of the national conforming loan limit of $647,200. However, thanks to high housing costs in a handful of metropolitan areas, some counties get “high-cost area” designation and have higher limits. In these areas, the FHA floor jumps to 150% of the national conforming loan limit — or $970,800. The “ceiling” applies to high-cost areas and is set at 150% of the national conforming loan limit. So in counties where the median home price exceeds that ceiling, the FHA will only insure loans up to $970,800.

For most borrowers, the “floor” and “ceiling” limits are the same: $647,200. That’s because median home prices nationwide were still below that level as recently as Q2 2022 — although they’re rising quickly now. But in some counties with very expensive housing markets, such as San Francisco, Santa Cruz, and San Diego, the FHA loan limits are much higher.

The FHA sets minimum credit standards lenders must follow to gain insurance endorsement for a loan. The agency will ensure home loans are made by qualified lenders, but it’s up to the lender to make sure that the borrower meets the FHA’s standards.

Borrowers must have a steady employment history or sufficient income from another source to qualify for an FHA loan. They must also prove that they can afford the mortgage payments and have enough money left over for other expenses after making their monthly mortgage payment.

To get an idea of how much house you can afford, try our Mortgage Calculator. Just remember that these are guidelines and that ultimately it’s up to your lender to decide how much of a mortgage you can afford.

Wisconsin Down Payment Assistance Program

The Wisconsin Housing and Economic Development Authority (WHEDA) offers a Capital Access program that reimburses up to $3,050 in down payment and closing-costs funds.

You can take advantage of this by utilizing a second mortgage that falls due only when you’ve paid off your first loan, refinanced, or moved. There are no monthly payments because of this.

The program pays a fixed-rate loan that you must repay after ten years, with no interest accruing during the term of your mortgage. Check out the website for additional information at WHEDA. You should also visit the website for the Easy Close down payment assistance program, which may provide up to 6% of your total loan amount as a 10-year fixed-rate loan at zero percent interest.

And you can check out HUD’s list of other programs in Wisconsin.