FHA Loan Limits in West Virginia

If you’re looking for a fha home loan, you should know of the term FHA loan limits in West Virginia. But what exactly is an FHA loan? In this article, we’ll take a look at the definition of an FHA loan, how it works, and some key considerations when you’re thinking about taking out an FHA loan.

How Do FHA Loans Work and What Are FHA Loan Limits in West Virginia?

When you take out an FHA loan, the FHA will insure the loan against default. This means that if you are unable to make your mortgage payments, the FHA will step in and cover the payments for you. In exchange for this insurance, lenders are able to offer FHA loans with lower down payment requirements and more relaxed credit standards.

If you do default on your loan, the FHA will pay the lender back a portion of the money they lost. The FHA will then take ownership of your home and attempt to sell it to recoup their losses.

If you do default on your loan, the FHA will pay the lender back a portion of the money they lost. The FHA will then take ownership of your home and attempt to sell it to recoup their losses.

In order to do this, the FHA imposes certain loan limits in West Virginia. The loan limit is the maximum amount that the FHA will insure. In general, these loan limits are set at 115% of the median home price in a given area. However, in some high-cost areas, the limit may be as high as 150% of the median home price.

In West Virginia, the FHA loan limit in West Virginia is $420,680 for a single-family home. This means that if you’re looking to buy a home with an FHA loan in West Virginia, you’ll need to have a down payment of at least 3.5% of the purchase price (or $14,7238).

If you’re looking to buy a more expensive home, you may be able to get a jumbo loan. A jumbo loan is a mortgage that exceeds the FHA loan limits in West Virginia. In order to qualify for a jumbo loan, you’ll need to have a higher credit score and down payment than you would for a conventional mortgage.

If you’re thinking of buying a home in West Virginia, it’s important to research the different types of loans available to you. The FHA loan limit in West Virginia is just one factor to consider when you’re looking into financing options. Talk to a lender about your options and find the best fit for your situation.

FHA Loan Limits in West Virginia by County For 2022

| County name | Single Home Family | Duplex | Triplex | Fourplex | Median sales price |

|---|---|---|---|---|---|

| BARBOUR | $420,680 | $538,650 | $651,050 | $809,150 | $69,000 |

| BERKELEY | $420,680 | $538,650 | $651,050 | $809,150 | $230,000 |

| BOONE | $420,680 | $538,650 | $651,050 | $809,150 | $145,000 |

| BRAXTON | $420,680 | $538,650 | $651,050 | $809,150 | $98,000 |

| BROOKE | $420,680 | $538,650 | $651,050 | $809,150 | $112,000 |

| CABELL | $420,680 | $538,650 | $651,050 | $809,150 | $190,000 |

| CALHOUN | $420,680 | $538,650 | $651,050 | $809,150 | $95,000 |

| CLAY | $420,680 | $538,650 | $651,050 | $809,150 | $145,000 |

| DODDRIDGE | $420,680 | $538,650 | $651,050 | $809,150 | $133,000 |

| FAYETTE | $420,680 | $538,650 | $651,050 | $809,150 | $152,000 |

| GILMER | $420,680 | $538,650 | $651,050 | $809,150 | $60,000 |

| GRANT | $420,680 | $538,650 | $651,050 | $809,150 | $127,000 |

| GREENBRIER | $420,680 | $538,650 | $651,050 | $809,150 | $140,000 |

| HAMPSHIRE | $420,680 | $538,650 | $651,050 | $809,150 | $315,000 |

| HANCOCK | $420,680 | $538,650 | $651,050 | $809,150 | $112,000 |

| HARDY | $420,680 | $538,650 | $651,050 | $809,150 | $115,000 |

| HARRISON | $420,680 | $538,650 | $651,050 | $809,150 | $133,000 |

| JACKSON | $420,680 | $538,650 | $651,050 | $809,150 | $145,000 |

| JEFFERSON | $970,800 | $1,243,050 | $1,502,475 | $1,867,275 | $975,000 |

| KANAWHA | $420,680 | $538,650 | $651,050 | $809,150 | $145,000 |

| LEWIS | $420,680 | $538,650 | $651,050 | $809,150 | $100,000 |

| LINCOLN | $420,680 | $538,650 | $651,050 | $809,150 | $145,000 |

| LOGAN | $420,680 | $538,650 | $651,050 | $809,150 | $101,000 |

| MARION | $420,680 | $538,650 | $651,050 | $809,150 | $120,000 |

| MARSHALL | $420,680 | $538,650 | $651,050 | $809,150 | $175,000 |

| MASON | $420,680 | $538,650 | $651,050 | $809,150 | $99,000 |

| MCDOWELL | $420,680 | $538,650 | $651,050 | $809,150 | $40,000 |

| MERCER | $420,680 | $538,650 | $651,050 | $809,150 | $113,000 |

| MINERAL | $420,680 | $538,650 | $651,050 | $809,150 | $146,000 |

| MINGO | $420,680 | $538,650 | $651,050 | $809,150 | $89,000 |

| MONONGALIA | $420,680 | $538,650 | $651,050 | $809,150 | $235,000 |

| MONROE | $420,680 | $538,650 | $651,050 | $809,150 | $122,000 |

| MORGAN | $420,680 | $538,650 | $651,050 | $809,150 | $230,000 |

| NICHOLAS | $420,680 | $538,650 | $651,050 | $809,150 | $99,000 |

| OHIO | $420,680 | $538,650 | $651,050 | $809,150 | $175,000 |

| PENDLETON | $420,680 | $538,650 | $651,050 | $809,150 | $139,000 |

| PLEASANTS | $420,680 | $538,650 | $651,050 | $809,150 | $121,000 |

| POCAHONTAS | $420,680 | $538,650 | $651,050 | $809,150 | $100,000 |

| PRESTON | $420,680 | $538,650 | $651,050 | $809,150 | $235,000 |

| PUTNAM | $420,680 | $538,650 | $651,050 | $809,150 | $190,000 |

| RALEIGH | $420,680 | $538,650 | $651,050 | $809,150 | $152,000 |

| RANDOLPH | $420,680 | $538,650 | $651,050 | $809,150 | $125,000 |

| RITCHIE | $420,680 | $538,650 | $651,050 | $809,150 | $60,000 |

| ROANE | $420,680 | $538,650 | $651,050 | $809,150 | $73,000 |

| SUMMERS | $420,680 | $538,650 | $651,050 | $809,150 | $63,000 |

| TAYLOR | $420,680 | $538,650 | $651,050 | $809,150 | $133,000 |

| TUCKER | $420,680 | $538,650 | $651,050 | $809,150 | $160,000 |

| TYLER | $420,680 | $538,650 | $651,050 | $809,150 | $55,000 |

| UPSHUR | $420,680 | $538,650 | $651,050 | $809,150 | $116,000 |

| WAYNE | $420,680 | $538,650 | $651,050 | $809,150 | $190,000 |

| WEBSTER | $420,680 | $538,650 | $651,050 | $809,150 | $79,000 |

| WETZEL | $420,680 | $538,650 | $651,050 | $809,150 | $84,000 |

| WIRT | $420,680 | $538,650 | $651,050 | $809,150 | $130,000 |

| WOOD | $420,680 | $538,650 | $651,050 | $809,150 | $130,000 |

| WYOMING | $420,680 | $538,650 | $651,050 | $809,150 | $81,000 |

Key Considerations When Applying for an FHA Loan in West Virginia

There are a few things to consider before you apply for an FHA loan.

First

You’ll need to make sure that you meet the minimum credit score requirements. For most FHA loans, you’ll need a credit score of 580 or higher. If you have a lower credit score, you may still be able to qualify for an FHA loan, but you’ll need a down payment of at least 10%.

Second

You should be aware of the possible fees and costs associated with taking out an FHA loan. These can include mortgage insurance premiums, as well as appraisal and inspection fees.

Third

It’s important to remember that FHA loans are subject to the same qualifying standards as any other mortgage loan. This means that you’ll need to have a steady income, a good credit history, and a down payment of at least 3.5%.

If you’re thinking about taking out an FHA loan, these key considerations will help you decide if it’s the right choice for you. Please contact us if you need to find a lender in West Virginia who is FHA-approved.

What Are Benefits of Getting an FHA Loan in West Virginia

For starters, FHA loans in West Virginia have lower credit score requirements than conventional loans. So, if your credit score is not great, an FHA loan could be a good option for you.

Another benefit of FHA loans is that they come with lower down payment requirements than conventional loans. This can make it easier to qualify for an FHA loan, especially if you don’t have a lot of cash saved up for a down payment.

Another benefit of FHA loans is that they come with lower down payment requirements than conventional loans. This can make it easier to qualify for an FHA loan, especially if you don’t have a lot of cash saved up for a down payment.

Lastly, FHA loans tend to have lower interest rates than conventional loans. This can save you money over the life of your loan and make your monthly payments more affordable.

What Are Two Types of FHA Loans in West Virginia

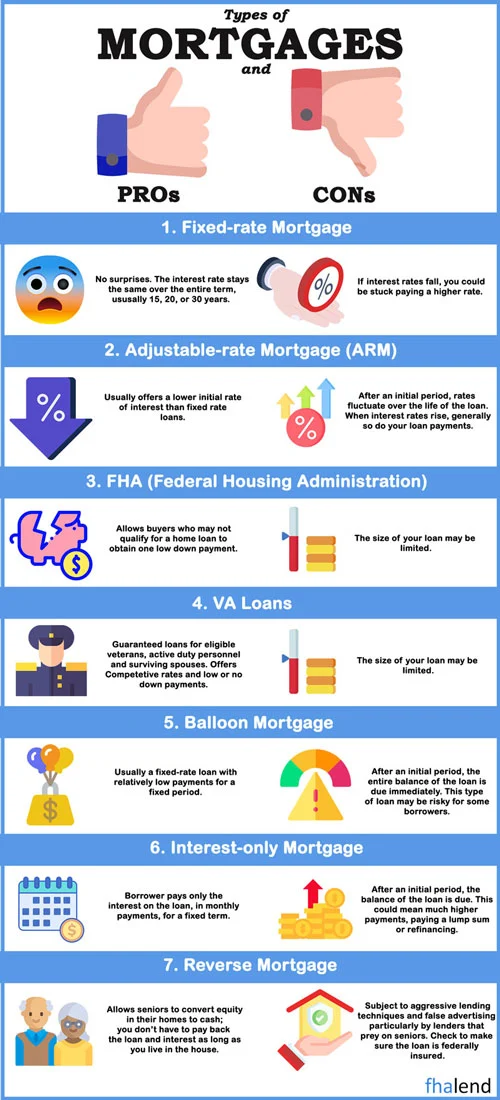

There are two types of FHA loans in West Virginia that you can choose from fixed-rate mortgages and adjustable-rate mortgages.

A fixed-rate mortgage has an interest rate that remains the same for the life of the loan, so your monthly payments will never change. This type of loan is a good choice if you plan to stay in your home for a long time.

An adjustable-rate mortgage (ARM) has an interest rate that changes over time, so your monthly payments could go up or down. This type of loan is a good choice if you plan to sell your home within a few years, or if you expect your income to increase in the future.

When you apply for an FHA loan in West Virginia, you’ll need to provide some basic information about your financial history. The lender will also need to see proof of income, employment, and residency.

TOP 3 FHA High-Cost Areas in West Virginia

There are several cities in West Virginia that are considered high-cost areas for mortgages insured by the Federal Housing Administration (FHA). This is due to the high cost of living and/or housing in these areas.

Charleston

As the state capital and most populous city in West Virginia, Charleston is a natural choice for top FHA high-cost areas. With a population of over 51,000 people, Charleston offers a variety of amenities and attractions for residents and visitors alike. The city is home to the University of Charleston and several museums and historical sites, as well as a variety of shopping and dining options.

Huntington

Huntington is the second-largest city in West Virginia with a population of over 47,000 people. The city is located on the Ohio River and is known for its lively downtown area with a variety of shops, restaurants, and bars. Huntington is also home to Marshall University and a number of historical sites and museums.

Morgantown

Morgantown, located in the north-central part of the state, is the third-largest city in West Virginia with a population of over 30,000 people. The city is home to West Virginia University and offers a variety of shops, restaurants, and bars downtown. Morgantown is also a popular destination for outdoor activities such as hiking, camping, and fishing.

If you’re a first-time homebuyer or you have limited funds for a down payment, you may be considering an FHA loan. FHA loans allow for smaller down payments than conventional loans. In addition, FHA loans can be used to purchase both single-family homes and multifamily homes. If you have any other questions related please contact us by filling up this form.

West Virginia Down Payment Assistance Program

If you’re a first-time homebuyer in West Virginia, you might be wondering what kind of down payment assistance is available to help you with the purchase of your new home. The West Virginia Housing Development Fund offers a variety of programs to help first-time homebuyers with the purchase of their first home. Here are some of the down payment assistance programs that are available through the West Virginia Housing Development Fund:

- The Homeownership Assistance Program provides up to $7,500 in down payment and closing cost assistance for eligible first-time homebuyers.

- The Mortgage Credit Certificate Program allows eligible first-time homebuyers to receive a federal tax credit equal to 20% of their annual mortgage interest paid.

- The Housing Choice Voucher Program provides eligible first-time homebuyers with up to $5,000 in down payment and closing cost assistance.

- The Neighborhood Stabilization Program provides up to $10,000 in down payment and closing cost assistance for eligible first-time homebuyers who purchase homes in designated Neighborhood Revitalization Strategy Areas.

If you’re a first-time homebuyer in West Virginia, there are a variety of down payment assistance programs available to help you with the purchase of your new home. For more information on these programs, contact the West Virginia Housing Development Fund.

Down payments and closing costs may be aided by the West Virginia Housing Development Fund.

- Depending on the mortgage you select and the size of the down payment you’ll make, you may receive anything from $5,000 to $10,000.

- A second mortgage for 15 years with a rate of 2% is available to you.

More information may be found on the program’s website. Also, read HUD’s list of additional homeownership assistance programs offered in West Virginia.