FHA Loan Limits in Connecticut by County

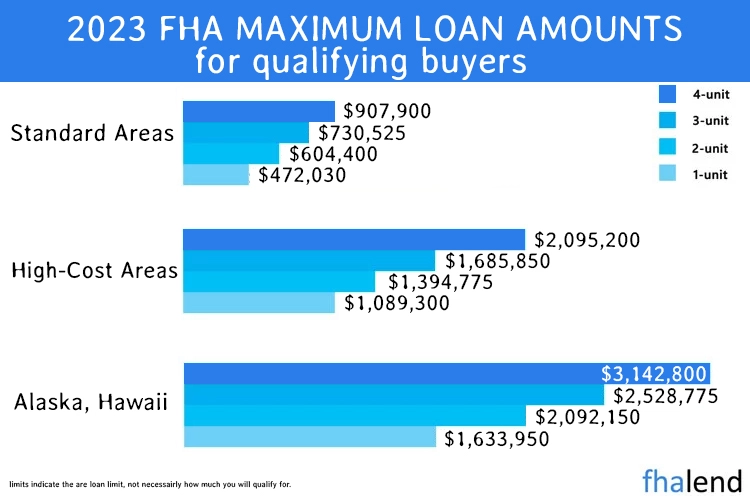

In 2023, the maximum loan amount for FHA loan limits in Connecticut is set to 472,030 from $420,680. This increase helps more people in Connecticut qualify for FHA mortgages and buy homes they may not have been able to afford before.

In 2023, the maximum loan amount for FHA loan limits in Connecticut is set to 472,030 from $420,680. This increase helps more people in Connecticut qualify for FHA mortgages and buy homes they may not have been able to afford before.

There are several benefits of FHA mortgages which include:

- FHA loans have lower interest rates than other types of mortgages- this is because FHA loans are backed by the government

- FHA loans do not require a high down payment- as little as 3.5% down can get you into a home with an FHA loan

- FHA loans are available to people with less-than-perfect credit- if your credit score is at least 500, you may be eligible for an FHA loan

If you are thinking of buying a home in Connecticut, it is important to know what the FHA loan limits are. This information will help you determine if an FHA mortgage is right for you and how much you may be able to borrow. For more information about FHA loans and other types of mortgages, contact a local mortgage lender today.

FHA Loan Limits in Connecticut state by County in 2023

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| FAIRFIELD | 707,250 | 905,400 | 1,094,450 | 1,360,100 | 615,000 |

| HARTFORD | 472,030 | 604,400 | 730,525 | 907,900 | 345,000 |

| LITCHFIELD | 472,030 | 604,400 | 730,525 | 907,900 | 305,000 |

| MIDDLESEX | 472,030 | 604,400 | 730,525 | 907,900 | 345,000 |

| NEW HAVEN | 472,030 | 604,400 | 730,525 | 907,900 | 306,000 |

| NEW LONDON | 472,030 | 604,400 | 730,525 | 907,900 | 309,000 |

| TOLLAND | 472,030 | 604,400 | 730,525 | 907,900 | 345,000 |

| WINDHAM | 472,030 | 604,400 | 730,525 | 907,900 | 400,000 |

Top 5 Reasons to Get the FHA Loan Backed by Government in Connecticut

There are many benefits of FHA loans in Connecticut. Some of the major benefits include:

1) Low down payment

One of the biggest benefits of an FHA loan is the low down payment requirement. You only need to put down 3.5% of the purchase price, which is much lower than the 20% required for a conventional loan. This can be a big help if you don’t have a lot of money saved up.

2) Flexible credit requirements

Another advantage of FHA loans is that they have more flexible credit requirements than conventional loans. This means that you may be able to get approved even if you have less-than-perfect credit.

3) Lower interest rates

FHA loans typically come with lower interest rates than conventional loans. This can save you a lot of money over the life of the loan.

4) Low closing costs

Another benefit of FHA loans is that they often have lower closing costs than conventional loans. This can be a big help if you’re on a tight budget.

5) available in all 50 states

FHA loans are available in all 50 states, which gives you more options if you’re looking to buy a home. FHA Lend is licensed in Connecticut, so you can start the process of financing even today with us.

If you’re thinking about buying a home in Connecticut, an FHA loan could be a good option for you. Be sure to shop around and compare rates from different lenders to get the best deal.

FHA Loan Limits in Fairfield County in Connecticut

Fairfield County in Connecticut is home to many different attractions and landmarks. The FHA loan limits in Connecticut Fairfield County are set to $695,750 for 1 unit, for 2 units are set to $890,700, triplex is at $1,076,650 and 4-units are at $1,338,000From the beaches of Fairfield Beach and Southport, to the historic homes in Greenfield Hill, there is something for everyone in this part of Connecticut. If you’re looking for a place to enjoy some outdoor activities, Fairfield County has plenty to offer. There are several parks and nature trails that wind through the county, perfect for hiking, biking, or just enjoying a leisurely stroll. For those who prefer indoor activities, there are plenty of shopping and dining options available in the various towns and cities throughout Fairfield County. No matter what your interests are, you’re sure to find something to do in Fairfield County, Connecticut.

FHA Loan Limits in Hartford County in Connecticut

Hartford County is the most populous county in Connecticut, located in the north-central part of the state. The FHA loan limits in Hartford county are set to $472,030 for single-home families, duplexes are set to $604,400, 3 units are at $730,525, and fourplex at $907,900. The county seat and largest city are Hartford, the state capital. The county was established in 1666 and named after Hertfordshire, England.

Hartford County is home to many major corporations, including United Technologies, Aetna, and Travelers. The county is also home to several top universities, including Yale University and the University of Hartford.

There are plenty of things to do in Hartford County, from exploring the many museums and historical sites to hiking and camping in one of the many parks. There’s something for everyone in Hartford County!

FHA Loan Limits in Litchfield County in Connecticut

Litchfield county in Connecticut is a beautiful and historic area. With its rolling hills, scenic lakes and rivers, and quaint towns, it’s no wonder that this county is a popular tourist destination.

The FHA loan limits in Litchfield county are set to $472,030 for single-home families, duplexes are set to $604,400, 3 units are at $730,525 and fourplex is at $907,900.

There are many things to see and do in Litchfield county. Here are just a few ideas:

- Visit one of the many historic sites, such as the Litchfield Historical Society or the Mattatuck Museum.

- Explore one of the many hiking trails, such as the Appalachian Trail or the Mattabesett Trail.

- Take a scenic drive along one of the county’s roads, such as Route 7 or Route 8.

- Visit one of the many wineries or breweries in the area.

- Enjoy a day out on one of the county’s lakes or rivers, such as Lake Waramaug or the Housatonic River.

Litchfield county is also home to some charming small towns. Some of the best-known towns in the area are Litchfield, Goshen, Cornwall, and Kent. Each town has its own unique character and attractions.

FHA Loan Limits in Middlesex County in Connecticut

Middlesex County is a county located in the south-central part of the U.S. state of Connecticut. The FHA loan limits in Middlesex county are set to $472,030 for single-home families, for duplexes are set to $604,400, 3 units are at $730,525, and fourplex at $907,900. As of the 2010 census, the population was 165,676.[1] The county was created in May 1785 from parts of Hartford and New Haven counties. Middlesex County is included in the Hartford-West Hartford-East Hartford metropolitan statistical area known as Greater Hartford. Middlesex County is a great place to live, work, and raise a family. The county offers something for everyone, from small-town charm to big-city excitement. I hope you enjoy learning about this wonderful corner of Connecticut.

FHA Loan Limits in New Haven County in Connecticut

New Haven County is situated on the Long Island Sound, this county is known for its maritime traditions and history. The FHA loan limits in New Haven county are set to $472,030 for single-home families, duplexes are set to $604,400, 3 units are at $730,525 and fourplex is at $907,900. Some of the most popular attractions in New Haven county include the New Haven Green, which is a historic park in the center of downtown New Haven, and Yale University, one of the most prestigious universities in the United States. There are also a number of beautiful parks and beaches along the coast, perfect for spending a summer day outdoors.

FHA Loan Limits in New London County in Connecticut

New London county in Connecticut is a great place to live, work, and raise a family. The FHA loan limits in New London county are set to $472,030 for single-home families, for duplexes are set to $604,400, 3 units are at $730,525, and fourplex at $907,900. The county has a rich history dating back to 1614 when it was first settled by the Dutch. There are plenty of things to do in New London county, including hiking, biking, fishing, and skiing. The county is also home to a variety of businesses, including insurance companies, banks, and pharmaceuticals. If you’re looking for a great place to live, work, or raise a family, be sure to check out NEW London county in Connecticut!

FHA Loan Limits in Tolland County in Connecticut

Tolland county in Connecticut is a beautiful place to live. The FHA loan limits in Tolland county are set to $ 472,030 for single-home families, duplexes are set to $604,400, 3 units are at $730,525 and fourplex is at $907,900. The county has a rich history, and there are many things to do in the area. If you’re looking for a place to raise a family or retire, Tolland County is a great option. Here are three reasons why you should consider living in Tolland County:

Rich History

Things to do in Tolland County

Raising a Family/Retire

If you’re looking for a place to live in Connecticut, Tolland County is a great option. The county has a rich history, and there are many things to do in the area. You can also find a number of restaurants and shops in the county. If you’re looking for a place to raise a family or retire, Tolland County is a great option.

FHA Loan Limits in Windham County in Connecticut

1. Excellent schools – Windham county has some of the best schools in the state, and this is one of the main reasons families move here. With a focus on academic excellence, students are able to thrive in a supportive environment. The FHA loan limits in Windham county are set to $472,030 for single home family, for duplexes are set to $604,400, 3 units at $730,525, and fourplex is at $907,900

2. Low crime rates – another big draw for families is the low crime rate in Windham county. This means you and your family can feel safe and secure living here.

3. Friendly community – one of the best things about Windham county is the friendly community. Everyone here is welcoming and supportive, making it easy to make friends and get involved in your community.

4. Beautiful scenery – Windham county is home to some of the most beautiful scenery in Connecticut. From the rolling hills to the stunning lakes and rivers, there’s always something to appreciate.

5. Close to major cities – while Windham county is a lovely place to live in its own right, it’s also conveniently located close to major cities like Hartford and Boston. This makes it easy to get out and explore all that the area has to offer.

6. Affordable housing – last but not least, one of the top reasons to move to Windham county is affordable housing. This is a great place to buy a home or raise a family without breaking the bank.

The FHA loan program is a good fit for homebuyers in Connecticut who don’t have a large down payment or who are unable to qualify for a conventional mortgage. The FHA loan program allows borrowers to make a down payment as low as 3.5%. The program also offers lenient credit requirements, which makes it easier for borrowers with less-than-perfect credit to qualify. Check the above FHA loan limits in Connecticut and check your eligibility when you’re ready.

Connecticut Down Payment Assistance Program

Connecticut Down Payment Assistance Program

In Connecticut, the Connecticut Housing Finance Authority (CHFA) offers up to $20,000 in down payment assistance (DPA) as a second mortgage at 1% interest. Some borrowers, on the other hand, may be eligible for lower DPA rates.

- There is a $200 application fee. The minimum DPA loan amount is $3,000. Borrowing between 3% and 3.5% of the home’s purchase price is typical.

- But if you have a lot of money, you must invest it all in your down payment until you’re left with only $10,000.

To participate in this program, you must first be approved for a mortgage by a participating lender. The CHFA Down Payment Assistance Program page has a list of collaborating lenders. For additional options in Connecticut, check out this HUD website.