FHA Loan Limits in Washington

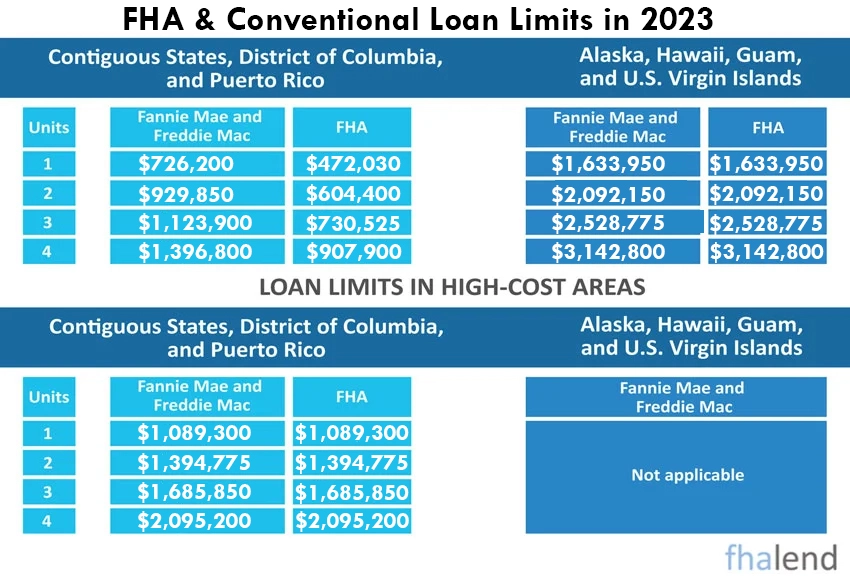

The Federal Housing Administration (FHA) sets loan limits for borrowers who use FHA-insured mortgages. In Washington, FHA loan limits range from $472,030 to $1,251,400, depending on the county.

The Federal Housing Administration (FHA) sets loan limits for borrowers who use FHA-insured mortgages. In Washington, FHA loan limits range from $472,030 to $1,251,400, depending on the county.

If you’re considering an FHA loan in Washington, here’s what you need to know about the loan limits.

County-by-county FHA loan limits in Washington

FHA loan limits vary by county and are based on median home prices in that county. In 39 counties in Washington, the FHA loan limit is $331,760. This includes Asotin, Benton, Columbia, Franklin, Garfield, Grant, Kittitas, Klickitat, Walla Walla, and Whitman counties.

In the remaining 31 counties, the FHA loan limit ranges from $472,030 to $977,500 for a single home family. The county with the highest FHA loan limit is San Juan County, where the limit is $726,525. The county with the lowest FHA loan limit is Adams County, where the limit is $437,250.

The Federal Housing Administration (FHA) sets loan limits for borrowers who use FHA-insured mortgages. In Washington, FHA loan limits range from $331,760 to $1,000,000, depending on the county.

If you’re considering an FHA loan in Washington, here’s what you need to know about the loan limits.

County-by-county FHA loan limits in Washington

FHA loan limits vary by county and are based on median home prices in that county. In 39 counties in Washington, the FHA loan limit is $331,760. This includes Asotin, Benton, Columbia, Franklin, Garfield, Grant, Kittitas, Klickitat, Walla Walla, and Whitman counties.

In the remaining 31 counties, the FHA loan limit ranges from $437,250 to $1,000,000. The county with the highest FHA loan limit is King, Snohomish or Pierce counties where the limit is $977,500. The county with the lowest FHA loan limit is Adams County, where the limit is $472,030.

FHA Loan Limits in Washington by County in 2022

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| ADAMS | $472,030 | $604,400 | $730,525 | $907,900 | $277,000 |

| ASOTIN | $472,030 | $604,400 | $730,525 | $907,900 | $310,000 |

| BENTON | $472,030 | $604,400 | $730,525 | $907,900 | $400,000 |

| CHELAN | $506,000 | $647,750 | $783,000 | $973,100 | $440,000 |

| CLALLAM | $472,030 | $604,400 | $730,525 | $907,900 | $386,000 |

| CLARK | $672,750 | $861,250 | $1,041,050 | $1,293,750 | $585,000 |

| COLUMBIA | $472,030 | $604,400 | $730,525 | $907,900 | $210,000 |

| COWLITZ | $472,030 | $604,400 | $730,525 | $907,900 | $364,000 |

| DOUGLAS | $506,000 | $647,750 | $783,000 | $973,100 | $440,000 |

| FERRY | $472,030 | $604,400 | $730,525 | $907,900 | $138,000 |

| FRANKLIN | $472,030 | $604,400 | $730,525 | $907,900 | $400,000 |

| GARFIELD | $472,030 | $604,400 | $730,525 | $907,900 | $246,000 |

| GRANT | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| GRAYS HARBOR | $472,030 | $604,400 | $730,525 | $907,900 | $274,000 |

| ISLAND | $575,000 | $736,100 | $889,800 | $1,105,800 | $500,000 |

| JEFFERSON | $472,030 | $604,400 | $730,525 | $907,900 | $180,000 |

| KING | $977,500 | $1,251,400 | $1,512,650 | $1,879,850 | $850,000 |

| KITSAP | $563,500 | $721,400 | $872,000 | $1,083,650 | $490,000 |

| KITTITAS | $474,950 | $608,000 | $734,950 | $913,350 | $413,000 |

| KLICKITAT | $472,030 | $604,400 | $730,525 | $907,900 | $250,000 |

| LEWIS | $472,030 | $604,400 | $730,525 | $907,900 | $344,000 |

| LINCOLN | $472,030 | $604,400 | $730,525 | $907,900 | $279,000 |

| MASON | $472,030 | $604,400 | $730,525 | $907,900 | $330,000 |

| OKANOGAN | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| PACIFIC | $472,030 | $604,400 | $730,525 | $907,900 | $230,000 |

| PEND OREILLE | $472,030 | $604,400 | $730,525 | $907,900 | $95,000 |

| PIERCE | $977,500 | $1,251,400 | $1,512,650 | $1,879,850 | $850,000 |

| SAN JUAN | $497,950 | $637,450 | $770,550 | $957,600 | $129,000 |

| SKAGIT | $545,100 | $697,800 | $843,500 | $1,048,300 | $474,000 |

| SKAMANIA | $672,750 | $861,250 | $1,041,050 | $1,293,750 | $585,000 |

| SNOHOMISH | $977,500 | $1,251,400 | $1,512,650 | $1,879,850 | $850,000 |

| SPOKANE | $472,030 | $604,400 | $730,525 | $907,900 | $383,000 |

| STEVENS | $472,030 | $604,400 | $730,525 | $907,900 | $383,000 |

| THURSTON | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| WAHKIAKUM | $472,030 | $604,400 | $730,525 | $907,900 | $290,000 |

| WALLA WALLA | $472,030 | $604,400 | $730,525 | $907,900 | $394,000 |

| WHATCOM | $603,750 | $772,900 | $934,250 | $1,161,050 | $525,000 |

| WHITMAN | $472,030 | $604,400 | $730,525 | $907,900 | $372,000 |

| YAKIMA | $472,030 | $604,400 | $730,525 | $907,900 | $380,000 |

FHA Loan Limits in Washington for High-Cost Counties

In Washington state there are three different High-Cost FHA loan limits in Washington areas:

below are listed loan limits in: Clark, Skamania, King, Pierce, Snohomish, and Whatcom counties

Clark and Skamania Counties

single home families: $672,750, for duplex: $861,250, for triplex: $1,041,050, for 4-unit property $1,293,750

Clark County in Washington

Whether you’re moving to Clark County for work, family, or just for a change of scenery, there are a few things you should know before making the big move. From the best neighborhoods to the top schools, this guide will help you learn everything you need to know about relocating to Clark County.

One of the first things you’ll need to decide when moving to Clark County is which neighborhood is right for you. There are a variety of great neighborhoods throughout the county, each with its own unique character. If you’re looking for an affordable place to live, try Vancouver or Battle Ground. If you want to be closer to Seattle, consider living in Washougal or Camas. And if you’re looking for a rural setting, Ridgefield or La Center might be the perfect fit.

Once you’ve chosen your neighborhood, it’s time to start thinking about schools. Clark County is home to some of the top schools in Washington State, so you’re sure to find a great education for your children. If you’re looking for a private school, Vancouver Academy and Union High School are both excellent options. For public schools, Washougal School District and Vancouver Public Schools are two of the best in the state.

Now that you know a little bit more about moving to Clark County, it’s time to start planning your move! With its beautiful scenery, great schools, and friendly people, Clark County is the perfect place to call home.

Skamania County in Washington

If you’re thinking of moving to Skamania county in Washington, there are a few things you should know. This guide will outline some important information about the county, including the cost of living, the climate, and the attractions. With this information, you can make an informed decision about whether or not Skamania county is the right place for you.

The cost of living in Skamania county is relatively low compared to other parts of the country. The median home price is around $250,000, and the median rent for a two-bedroom apartment is $1,100. The unemployment rate is also low, at 4.4%. However, it’s important to note that the cost of living can vary depending on the specific city or town you’re planning to move to. For example, the median home price in Stevenson is $341,000, while the median rent for a two-bedroom apartment is $1,300.

The climate in Skamania county is generally mild, with an average high of 71 degrees in July and an average low of 34 degrees in January. However, it’s important to note that the county experiences a wide range of weather conditions depending on the time of year. For example, Skamania county experiences an average of 22 inches of rain per year, but this number can be higher or lower depending on the specific location and time of year.

There are a variety of attractions in Skamania county, including hiking and biking trails, waterfalls, and the Columbia River Gorge. There are also a number of wineries and breweries in the area, as well as a variety of shops and restaurants. Whether you’re looking for a place to relax or an adventure, Skamania county has something to offer.

If you’re considering moving to Skamania county, this guide should give you a better understanding of what to expect. With its mild climate, low cost of living, and variety of attractions, Skamania county is a great place to call home.

What are FHA Loan Limits in King, Pierce, and Snohomish Counties in Washington

- 1-unit: $891,250

- 2-unit $1,140,950

- 3-unit $1,379,150

- 4-unit $1,713,950

If you’re thinking of moving to King County in Washington, there are a few things you should know. In this guide, we’ll cover some of the basics of what you can expect when making the move. From finding a place to live to get around the county, we’ll give you all the information you need to make your transition as smooth as possible.

One of the first things you’ll need to do when moving to King county finds a place to live. There are a number of different options available, from apartments and condos to single-family homes and more. Once you’ve found a place that’s right for you, it’s time to start exploring all that King county has to offer.

There are plenty of things to do in King county, no matter what your interests are. If you’re a fan of the outdoors, you’ll find plenty of hiking and biking trails to explore. Or, if you prefer to spend your time indoors, there are a number of museums and art galleries to check out. No matter what your interests are, you’re sure to find something to do in King county.

Getting around King county is easy, thanks to the extensive public transportation system. Whether you’re taking the bus or the light rail, you’ll be able to get where you need to go without any trouble. And, if you’re driving, there’s no need to worry about finding parking – there are plenty of parking spots available throughout the county.

Max Loan amount in Whatcom County in Washington

- single home family: $603,750

- duplex: $772,900

- triplex: $934,250

- fourplex: $1,161,050

Hi there! If you’re reading this, it’s likely that you’re considering a move to Whatcom county in Washington state. Congratulations on making this decision – Whatcom county is a beautiful and welcoming place to call home.

To help you make the transition to your new home as smooth as possible, we’ve put together this guide with everything you need to know about moving to Whatcom county. We’ll cover topics like where to live, what to do for fun, and how to get around town. So without further ado, let’s dive in!

One of the first things you’ll need to decide when moving to a new town is where to live. Luckily, Whatcom county has no shortage of great neighborhoods to choose from. Whether you’re looking for a quiet place to raise a family or a lively downtown area with lots of things to do, you’re sure to find the perfect place for you in Whatcom county.

Once you’ve settled into your new home, you’ll want to start exploring all that Whatcom county has to offer. There are plenty of great things to do in this beautiful part of Washington state. If you’re a nature lover, you’ll definitely want to check out some of the hiking trails and parks in the area. Or, if you’re more interested in culture and nightlife, there are plenty of great restaurants, bars, and cafes to explore in Whatcom county.

Finally, once you’ve gotten settled into your new home and started exploring the area, you’ll need to figure out how to get around. Luckily, Whatcom county is served by a great public transportation system, making it easy to get around without a car. There are also plenty of bike paths and walking trails if you prefer to get around on foot or by bike.

We hope this guide has been helpful in getting you started with your move to Whatcom county. We’re sure you’ll love it here – welcome home!

Steps Before Applying For FHA Loan In Washington

Qualifying for an FHA loan is often the first step that homebuyers take when looking to purchase a new home. An FHA loan is a mortgage that is insured by the Federal Housing Administration, and there are many benefits to having this type of loan.

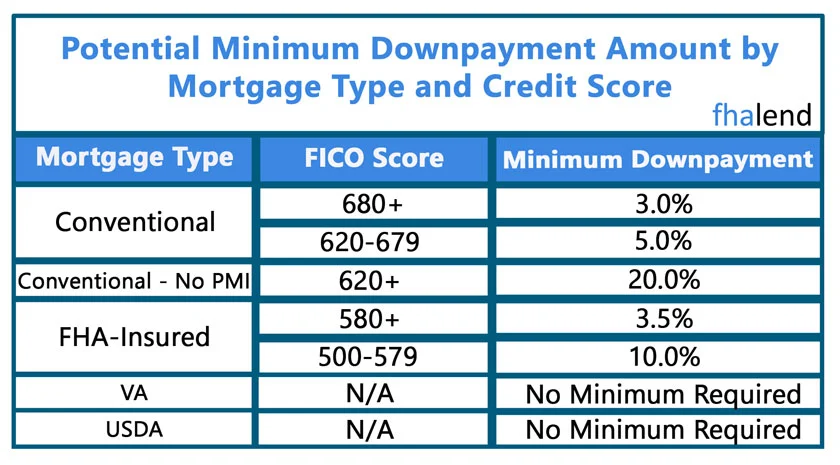

One of the main benefits of an FHA loan is that it has more relaxed credit requirements than a conventional loan. This means that if you have less-than-perfect credit, you may still be able to qualify for an FHA loan. Another benefit of an FHA loan is that it comes with a lower down payment than a conventional loan. You can put as little as 3.5% down on an FHA loan, while you would need to put at least 5% down on a conventional loan.

There are also some drawbacks to having an FHA loan. One of the biggest drawbacks is that you will have to pay mortgage insurance premiums (MIP) for the life of the loan. MIP is required on all FHA loans, regardless of the size of your down payment. You will also have to pay a one-time upfront premium when you take out an FHA loan, which can add to the cost of your home purchase.

If you are thinking about buying a home, and you think an FHA loan might be right for you, there are a few things you need to do in order to get started. First, you need to find a lender who participates in the FHA program. You can find a list of approved lenders on the HUD website.

If you are thinking about buying a home, and you think an FHA loan might be right for you, there are a few things you need to do in order to get started. First, you need to find a lender who participates in the FHA program. You can find a list of approved lenders on the HUD website.

Once you have found an FHA-approved lender, you will need to fill out a loan application and provide any required documentation. The lender will then order a credit report and an appraisal of the property you are looking to purchase.

If you are approved for an FHA loan, the lender will provide you with a commitment letter that outlines the terms of your loan. Once you have this letter, you can start shopping for a home within your price range. Keep in mind that there are some restrictions on what types of properties you can purchase with an FHA loan, so be sure to ask your lender about these restrictions before making an offer on a home.

If you have any questions about qualifying for an FHA loan, or about the FHA loan process in general, be sure to ask us. They should be able to help you through every step of the process so that you can get into your new home as soon as possible.

Loan Limits & Eligibility Requirements in Washington

When applying for an FHA loan in Washington state, one of the most important things to consider is the loan limits set forth by the government. Currently, the maximum FHA loan limit allowed in most of the counties in Washington is $726,525. This amount may vary depending on the county you are purchasing a home in. Additionally, borrowers must also meet certain eligibility requirements, such as having an income that meets or exceeds a certain threshold and have no outstanding debts that cannot be paid off within two years.

Credit Score Requirements in Washington

Another important factor to consider when applying for an FHA loan in Washington state is the credit score requirement. Generally speaking, borrowers must have at least a 580 credit score in order to qualify for an FHA loan. However, if you have a lower credit score, then there may still be other options available to you. For instance, some lenders offer special programs for borrowers with lower credit scores, and some states also provide additional assistance.

Down Payment Options in Washington

The FHA loan program does allow borrowers to put down as little as 3.5% when purchasing a home, which is lower than most other types of home loans. However, if you are unable to meet this requirement, there may be other options available to you, including grants or assistance from state or local governments. Additionally, some lenders offer special programs that can help reduce the amount of money needed for a down payment.

Washington Down Payment Assistance Program

The Washington State Housing Finance Commission (WSHFC) provides nine distinct down payment assistance programs. The price range is $10,000 or 4% of your mortgage balance up to $55,000 for qualified purchasers in Seattle.

A second mortgage is used to pay off your first mortgage. These come in the form of a second mortgage. You do not have to repay it right away, however. It will be due only when you sell, transfer, non-occupancy, or refinance the property.

On WSHFC’s website, view the list of DPAs and click through to learn more about each program. Consult HUD’s list of additional homeownership assistance programs in the state.