FHA Loan Limits in Iowa by County | Mortgage 2023

The Federal Housing Administration (FHA) has loan limits that vary by county and state. FHA loan limits in Iowa for a single-family home are $472,030. If you’re looking to purchase a duplex in Iowa with an FHA loan, you can borrow up to $538,650. For triplex, the limits are set to 651,050. 4-unit buildings FHA loan limits in Iowa are set to $907,900.

The Federal Housing Administration (FHA) has loan limits that vary by county and state. FHA loan limits in Iowa for a single-family home are $472,030. If you’re looking to purchase a duplex in Iowa with an FHA loan, you can borrow up to $538,650. For triplex, the limits are set to 651,050. 4-unit buildings FHA loan limits in Iowa are set to $907,900.

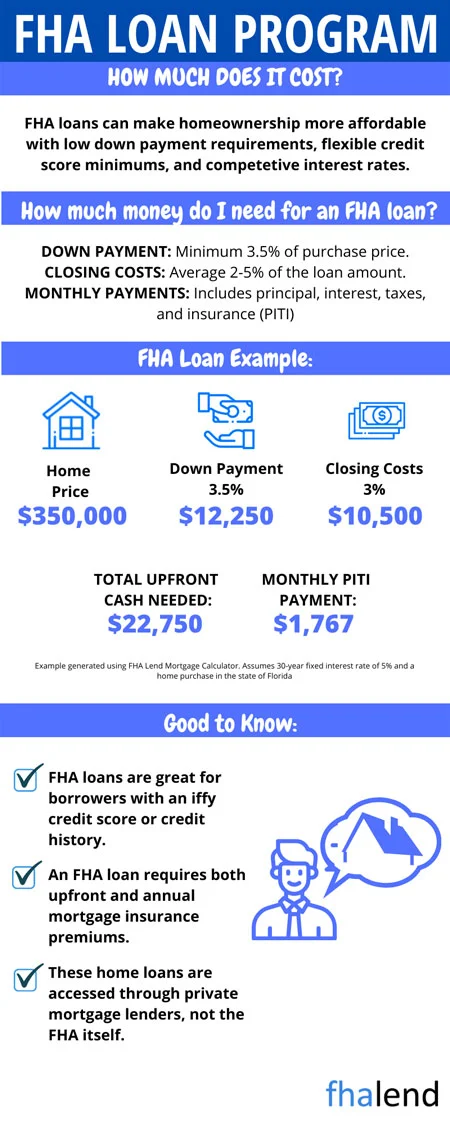

If you’re looking to take out an FHA loan in Iowa, here are some things you should know about FHA loan benefits.

- Low down payment requirements. You can qualify for an FHA loan with as little as 3.5% down.

- Flexible credit requirements. Even if you have less-than-perfect credit, you may still be able to qualify for an FHA loan.

- Competitive interest rates. FHA loans tend to have lower interest rates than conventional loans.

- Lower closing costs. With an FHA loan, you can often get help with your closing costs.

- Mortgage insurance is required with an FHA loan, but it is usually lower than private mortgage insurance (PMI).

FHA Loan Limits in Iowa by County in 2023

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| KIOWA | $472,030 | $604,400 | $730,525 | $907,900 | $104,000 |

| ADAIR | $472,030 | $604,400 | $730,525 | $907,900 | $95,000 |

| ADAMS | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| ALLAMAKEE | $472,030 | $604,400 | $730,525 | $907,900 | $115,000 |

| APPANOOSE | $472,030 | $604,400 | $730,525 | $907,900 | $83,000 |

| AUDUBON | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| BENTON | $472,030 | $604,400 | $730,525 | $907,900 | $183,000 |

| BLACK HAWK | $472,030 | $604,400 | $730,525 | $907,900 | $175,000 |

| BOONE | $472,030 | $604,400 | $730,525 | $907,900 | $239,000 |

| BREMER | $472,030 | $604,400 | $730,525 | $907,900 | $175,000 |

| BUCHANAN | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| BUENA VISTA | $472,030 | $604,400 | $730,525 | $907,900 | $137,000 |

| BUTLER | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| CALHOUN | $472,030 | $604,400 | $730,525 | $907,900 | $77,000 |

| CARROLL | $472,030 | $604,400 | $730,525 | $907,900 | $141,000 |

| CASS | $472,030 | $604,400 | $730,525 | $907,900 | $85,000 |

| CEDAR | $472,030 | $604,400 | $730,525 | $907,900 | $172,000 |

| CERRO GORDO | $472,030 | $604,400 | $730,525 | $907,900 | $136,000 |

| CHEROKEE | $472,030 | $604,400 | $730,525 | $907,900 | $100,000 |

| CHICKASAW | $472,030 | $604,400 | $730,525 | $907,900 | $105,000 |

| CLARKE | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| CLAY | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| CLAYTON | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| CLINTON | $472,030 | $604,400 | $730,525 | $907,900 | $121,000 |

| CRAWFORD | $472,030 | $604,400 | $730,525 | $907,900 | $95,000 |

| DALLAS | $472,030 | $604,400 | $730,525 | $907,900 | $326,000 |

| DAVIS | $472,030 | $604,400 | $730,525 | $907,900 | $88,000 |

| DECATUR | $472,030 | $604,400 | $730,525 | $907,900 | $65,000 |

| DELAWARE | $472,030 | $604,400 | $730,525 | $907,900 | $159,000 |

| DES MOINES | $472,030 | $604,400 | $730,525 | $907,900 | $189,000 |

| DICKINSON | $472,030 | $604,400 | $730,525 | $907,900 | $270,000 |

| DUBUQUE | $472,030 | $604,400 | $730,525 | $907,900 | $195,000 |

| EMMET | $472,030 | $604,400 | $730,525 | $907,900 | $88,000 |

| FAYETTE | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| FLOYD | $472,030 | $604,400 | $730,525 | $907,900 | $99,000 |

| FRANKLIN | $472,030 | $604,400 | $730,525 | $907,900 | $86,000 |

| FREMONT | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| GREENE | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| GRUNDY | $472,030 | $604,400 | $730,525 | $907,900 | $175,000 |

| GUTHRIE | $472,030 | $604,400 | $730,525 | $907,900 | $326,000 |

| HAMILTON | $472,030 | $604,400 | $730,525 | $907,900 | $111,000 |

| HANCOCK | $472,030 | $604,400 | $730,525 | $907,900 | $107,000 |

| HARDIN | $472,030 | $604,400 | $730,525 | $907,900 | $89,000 |

| HARRISON | $472,030 | $604,400 | $730,525 | $907,900 | $289,000 |

| HENRY | $472,030 | $604,400 | $730,525 | $907,900 | $135,000 |

| HOWARD | $472,030 | $604,400 | $730,525 | $907,900 | $108,000 |

| HUMBOLDT | $472,030 | $604,400 | $730,525 | $907,900 | $125,000 |

| IDA | $472,030 | $604,400 | $730,525 | $907,900 | $84,000 |

| IOWA | $472,030 | $604,400 | $730,525 | $907,900 | $149,000 |

| JACKSON | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| JASPER | $472,030 | $604,400 | $730,525 | $907,900 | $326,000 |

| JEFFERSON | $472,030 | $604,400 | $730,525 | $907,900 | $126,000 |

| JOHNSON | $472,030 | $604,400 | $730,525 | $907,900 | $290,000 |

| JONES | $472,030 | $604,400 | $730,525 | $907,900 | $183,000 |

| KEOKUK | $472,030 | $604,400 | $730,525 | $907,900 | $78,000 |

| KOSSUTH | $472,030 | $604,400 | $730,525 | $907,900 | $102,000 |

| LEE | $472,030 | $604,400 | $730,525 | $907,900 | $112,000 |

| LINN | $472,030 | $604,400 | $730,525 | $907,900 | $183,000 |

| LOUISA | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| LUCAS | $472,030 | $604,400 | $730,525 | $907,900 | $105,000 |

| LYON | $472,030 | $604,400 | $730,525 | $907,900 | $165,000 |

| MADISON | $472,030 | $604,400 | $730,525 | $907,900 | $326,000 |

| MAHASKA | $472,030 | $604,400 | $730,525 | $907,900 | $138,000 |

| MARION | $472,030 | $604,400 | $730,525 | $907,900 | $175,000 |

| MARSHALL | $472,030 | $604,400 | $730,525 | $907,900 | $120,000 |

| MILLS | $472,030 | $604,400 | $730,525 | $907,900 | $289,000 |

| MITCHELL | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| MONONA | $472,030 | $604,400 | $730,525 | $907,900 | $85,000 |

| MONROE | $472,030 | $604,400 | $730,525 | $907,900 | $82,000 |

| MONTGOMERY | $472,030 | $604,400 | $730,525 | $907,900 | $95,000 |

| MUSCATINE | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| O’BRIEN | $472,030 | $604,400 | $730,525 | $907,900 | $116,000 |

| OSCEOLA | $472,030 | $604,400 | $730,525 | $907,900 | $99,000 |

| PAGE | $472,030 | $604,400 | $730,525 | $907,900 | $83,000 |

| PALO ALTO | $472,030 | $604,400 | $730,525 | $907,900 | $92,000 |

| PLYMOUTH | $472,030 | $604,400 | $730,525 | $907,900 | $193,000 |

| POCAHONTAS | $472,030 | $604,400 | $730,525 | $907,900 | $64,000 |

| POLK | $472,030 | $604,400 | $730,525 | $907,900 | $326,000 |

| POTTAWATTAMIE | $472,030 | $604,400 | $730,525 | $907,900 | $289,000 |

| POWESHIEK | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| RINGGOLD | $472,030 | $604,400 | $730,525 | $907,900 | $60,000 |

| SAC | $472,030 | $604,400 | $730,525 | $907,900 | $85,000 |

| SCOTT | $472,030 | $604,400 | $730,525 | $907,900 | $194,000 |

| SHELBY | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| SIOUX | $472,030 | $604,400 | $730,525 | $907,900 | $185,000 |

| STORY | $472,030 | $604,400 | $730,525 | $907,900 | $239,000 |

| TAMA | $472,030 | $604,400 | $730,525 | $907,900 | $88,000 |

| TAYLOR | $472,030 | $604,400 | $730,525 | $907,900 | $62,000 |

| UNION | $472,030 | $604,400 | $730,525 | $907,900 | $89,000 |

| VAN BUREN | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| WAPELLO | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| WARREN | $472,030 | $604,400 | $730,525 | $907,900 | $326,000 |

| WASHINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $290,000 |

| WAYNE | $472,030 | $604,400 | $730,525 | $907,900 | $74,000 |

| WEBSTER | $472,030 | $604,400 | $730,525 | $907,900 | $100,000 |

| WINNEBAGO | $472,030 | $604,400 | $730,525 | $907,900 | $105,000 |

| WINNESHIEK | $472,030 | $604,400 | $730,525 | $907,900 | $183,000 |

| WOODBURY | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| WORTH | $472,030 | $604,400 | $730,525 | $907,900 | $136,000 |

| WRIGHT | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| KIOWA | $472,030 | $604,400 | $730,525 | $907,900 | $173,000 |

| KIOWA | $472,030 | $604,400 | $730,525 | $907,900 | $60,000 |

| IOWA | $472,030 | $604,400 | $730,525 | $907,900 | $375,000 |

What is the Maximum Loan Amount for FHA in Iowa?

An FHA loan in Iowa can have a maximum loan amount of $472,030 in 2023, making it a great option for many buyers in the state. However, it’s important to understand the restrictions and requirements associated with an FHA loan before you apply. In this blog post, we’ll outline what you need to know about FHA loans in Iowa, including the maximum loan amount and other important details.

If you’re considering an FHA loan in Iowa, here’s what you need to know:

- The maximum loan amount for an FHA loan in Iowa is $472,030.

- There are income and credit score requirements that must be met in order to qualify for an FHA loan.

- FHA loans in Iowa come with both upfront and annual mortgage insurance premiums that must be paid.

How FHA Loan Limits in Iowa Are Determined?

FHA loan limits in Iowa are determined by the county in which the property is located. They are generally calculated as a percentage of the median home price in that county.

For example, in 2022, the FHA loan limit in Iowa and most counties for a single-family home in most counties in the U.S. was $420,680. In high-cost areas, such as Los Angeles County, California, the limit is $1,089,300.

In order to calculate the loan limits for 2023, the FHA will use data from the Department of Housing and Urban Development’s (HUD) American Community Survey (ACS), which was released in September 2021. The ACS provides information on median home prices at the county level.

Based on the ACS data, the FHA will adjust its loan limits for each county in order to keep pace with changes in median home prices. The loan limits for 2023 will be announced in early 2021.

If you are planning to purchase a home with an FHA loan in Iowa in 2023, it is important to stay up-to-date on the latest limit amounts. You can use our above FHA Loan Limits in Iowa table to estimate your county’s limit amount.

If you have any questions about FHA loans or how the loan limits are calculated, please contact a loan officer at Low VA Rates. We would be happy to help you navigate the home-buying process.

What would disqualify you from an FHA loan in Iowa?

If you’re looking to get an FHA loan, there are a few things that could disqualify you. In this blog post, we’ll go over some of the things that could keep you from getting an FHA loan, including:

Having a low credit score

- One of the most important factors that lenders look at when considering a loan is your credit score. Your credit score is a number that represents your creditworthiness – basically, how likely you are to repay a loan on time.

- or FHA loans, you need a credit score of at least 580 to qualify. If your credit score is below 580, you’ll need to put down a 10% down payment.

- If you have a low credit score and are worried about qualifying for an FHA loan in Iowa, there are a few things you can do to improve your chances. First, make sure you pay all of your bills on time. This includes any debt payments, like credit cards or student loans. Second, try to reduce the amount of debt you owe. This will help improve your debt-to-income ratio, which is another factor that lenders look at when considering a loan. Finally, consider working with a credit counseling service to help you improve your credit score.

Not having a steady income

- Another important factor that lenders look at when considering a loan is your income. They want to make sure that you have a steady income that can cover your loan payments.

- For FHA loans in Iowa, you’ll need to show proof of a steady income, like pay stubs from your job or tax returns from the last two years. If you’re self-employed, you’ll need to provide additional documentation, like profit and loss statements from your business.

- If you don’t have a steady income, there are a few things you can do to improve your chances of getting an FHA loan in Iowa. First, consider getting a part-time job or taking on freelance work to supplement your income. Second, if you’re self-employed, try to show a consistent income over the last few years. This can be done by providing tax returns or profit and loss statements from your business.

Owing too much money in debts

- Another factor that lenders look at when considering a loan is your debt-to-income ratio. This is the amount of debt you have compared to your income. For FHA loans in Iowa, your debt-to-income ratio can’t be more than 43%.

- If you have a high debt-to-income ratio, there are a few things you can do to improve your chances of getting an FHA loan. First, try to pay off some of your debts, like credit cards or student loans. This will lower your debt-to-income ratio and make you a more attractive candidate for a loan. Second, consider increasing your income. This can be done by getting a higher-paying job or taking on additional freelance work.

What Income does FHA look at in Iowa?

The Federal Housing Administration (FHA) considers many factors when it comes to calculating income and determining loan eligibility. Some of the most common sources of income that FHA looks at include:

- Wages

- Salaries

- Tips and commissions

- Overtime pay

- Bonus pay

- Disability Income

- Child support or alimony payments

- Regular investments, such as dividends or rental income

Understanding what sources of income FHA will accept can help you determine if you qualify for an FHA loan. If you have any questions about your specific situation, reach out to a local FHA-approved lender for more information.

Is it Good to Get an FHA loan in Iowa?

FHA loans are a good option for many people. They are typically easier to qualify for than other types of loans, and they have lower interest rates. FHA loans also have some benefits that other loans do not have, such as the ability to roll closing costs into the loan. However, there are also some drawbacks to FHA loans in Iowa, such as the fact that they require borrowers to pay mortgage insurance.

If you are thinking about getting an FHA loan in Iowa, it is important to weigh the pros and cons to see if it is the right choice for you.

Pros:

- FHA loans are typically easier to qualify for than other types of loans. This is because they have lower credit score requirements and down payment requirements.

- FHA loans have lower interest rates than other loans, such as conventional loans. This can save you money over the life of your loan.

- You can roll your closing costs into your FHA loan. This means that you will not have to pay these costs upfront in cash.

Cons:

- You will have to pay mortgage insurance with an FHA loan. This is an additional cost that you will not have with other loans.

- FHA loans have stricter guidelines than other loans. This means that it may be more difficult to qualify for an FHA loan.

- FHA loans are only available for certain types of properties. This includes single-family homes, manufactured homes, and condos. If you are interested in purchasing a different type of property, you will not be able to use an FHA loan.

Before you decide to get an FHA loan, be sure to weigh the pros and cons also please check the above FHA loan limits in Iowa. This will help you determine if an FHA loan is right for you and how much a bank can lend you as well.

How much of a Home Loan Can I Get With a 650 Credit Score in Iowa?

How much of a Home Loan Can I Get With a 650 Credit Score in Iowa?

If you have a 650 credit score, you’re not in the “excellent” range, but you’re not in the “bad” range either. You’re somewhere in the middle, which means you might be wondering how much of a home loan you can get with a 650 credit score. You can use our calculator to calculate your monthly payment here.

The answer is: it depends. A 650 credit score is not a perfect score by any means, but it’s still pretty good. Lenders will be more likely to work with you if your credit score is in the good or excellent range, but they may still be willing to work with you if your credit score is in the fair or even poor range. The amount of a home loan that you can get with a 650 credit score will also depend on other factors, such as your income and debts. Lenders will want to see that you have a stable income and that you’re not carrying too much debt. They’ll also look at your employment history and your credit history.

If you have a 650 credit score and you’re looking for a home mortgage loan in Iowa, the best thing to do is to shop around and compare rates from different lenders. Be sure to ask about any special programs that might be available for borrowers with good credit scores. You might be able to get a lower interest rate or other favorable terms.

Bottom line: a 650 credit score is not perfect, but it’s still pretty good. If you’re looking for a home loan, you should shop around and compare rates from different lenders. Be sure to ask about any special programs that might be available for borrowers with good credit scores. You might be able to get a lower interest rate or other favorable terms.

Is the FHA loan Good For First Time Home Buyers in Iowa?

FHA allows for a low down payment and relaxed credit requirements. This makes them a great option for first-time homebuyers who may not have the savings or credit score to qualify for a conventional loan.

If you’re a first-time homebuyer, you may be wondering what kind of mortgage is best for you. There are many options available, but one that is often overlooked is the FHA loan. FHA loans in Iowa are insured by the Federal Housing Administration and they allow for a low down payment and relaxed credit requirements. This makes them a great option for first-time homebuyers who may not have the savings or credit score to qualify for a conventional loan.

In order to qualify for an FHA loan in Iowa state, you will need a few things. First, you will need a down payment of at least 3.5%. This can be from your own savings or from a gift from a family member. You will also need a credit score of 580 or higher in order to get approved. If your credit score is lower than 580, you may still be able to get approved, but you will need to put down 10% instead of 3.5%.

The next thing you’ll need is proof of income and employment. You will need to show that you have a steady income in order to make the payments on the loan. You will also need to have been employed for at least two years in the same job in order to qualify. Make sure you check first above FHA loan limits in Iowa so you know how much money you can borrow depending on your county in Iowa.

Once you have all of the required documentation, you’ll need to fill out a loan application and submit it to the lender. The lender will then review your application and make a decision. If you are approved, you’ll be able to close on your loan and start shopping for your new home!

Qualifying for an FHA loan in Iowa is a great option for first-time homebuyers who may not have the savings or credit score to qualify for a conventional loan. With a low down payment and relaxed credit requirements, the FHA loan is a great way to get into your first home.

Iowa Down Payment Assistance Program

The Iowa Finance Authority provides down payment or closing cost assistance in the form of grants and loans.

- FirstHome Loan: The loan may cover 5% of the home’s purchase price, up to $5,000, without making any monthly payments. The loan would terminate when you sell or refinance the property.

- FirstHome Grant: A $2,500 grant may be used to cover closing costs or a down payment.

Both kinds of assistance are available to first-time home buyers and veterans. Others may qualify if they’re buying a house in a low-income census tract. The Iowa Finance Authority also has a similar program for repeat home buyers in Iowa.

All programs have income limits and price caps for eligible properties. You’ll also need a credit score of 640 or above to apply.

HUD’s list of alternative programs in Iowa may be found at the IFA’s website.