FHA Loan Limits in Delaware by County For 2023

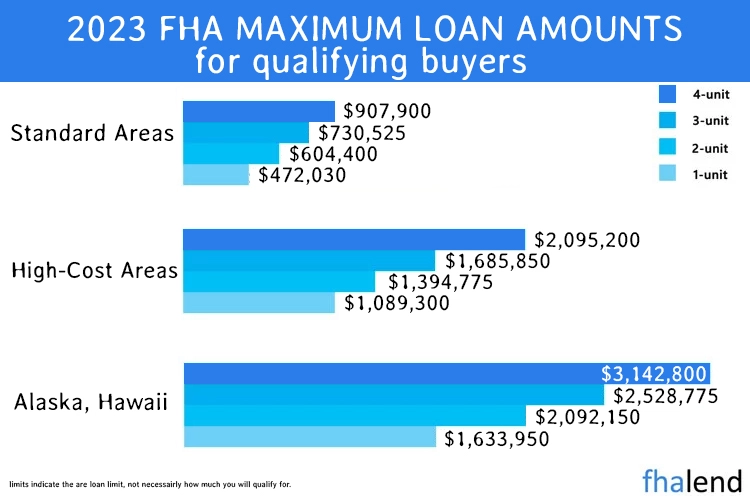

The Federal Housing Administration (FHA) sets loan limits for each fiscal year. The FHA’s loan limits in Delaware are a reflection of the maximum mortgage amounts that the agency will ensure in a given year. In 2023, the FHA increased its loan limits to $472,030 in high-cost areas.

The Federal Housing Administration (FHA) sets loan limits for each fiscal year. The FHA’s loan limits in Delaware are a reflection of the maximum mortgage amounts that the agency will ensure in a given year. In 2023, the FHA increased its loan limits to $472,030 in high-cost areas.

The FHA loan limits in Delaware are set at $647,200 for single-family homes in 2023. This limit increases to $1,050,875 for four-unit properties. While these limits may seem low compared to

If you are looking to buy a home in Delaware in 2023, it’s important to know what the FHA loan limits are. In 2023, the FHA’s loan limit for a single-family home in Delaware increased to $472,030. The limit for a four-unit property increased to $907,900 in Kent and Sussex ($818,600) counties and to $1,017,300 in New Castle county. These limits may change again in 2023, so it’s important to stay up-to-date on the latest limits.

Delaware FHA loan limits by county in 2022

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price | |

|---|---|---|---|---|---|---|

| KENT | 472,030 | 604,400 | 730,525 | 907,900 | 287,000 | |

| NEW CASTLE | 529,000 | 677,200 | 818,600 | 1,017,300 | 460,000 | |

| SUSSEX | 472,030 | 529,000 | 677,200 | 818,600 | 1,017,300 | 460,000 |

How do I apply for an FHA loan in Delaware?

When it comes to applying for an FHA loan in Delaware, there are a few things you’ll need to know. The first is that not everyone is eligible for an FHA loan. To be eligible, you’ll need to have a credit score of at least 500 and you’ll need to make a down payment of at least 3.5%. If you meet these requirements, then you can apply for an FHA loan.

The next thing to know is that there are a few different types of FHA loans. The most common is the standard FHA loan in Delaware, which is what we’ll be discussing in this article. There is also the 203k loan, which is used to finance home repairs, and the reverse mortgage, which is a loan that allows you to use your home’s equity to borrow money.

Now that you know a little bit more about FHA loans, let’s take a look at the process of applying for one. The first step is to find a lender who offers FHA loans. You can do this by doing a search on the internet or by asking friends and family for referrals. Once you’ve found a few lenders, you’ll need to compare their interest rates and terms.

Required Documents Needed For an FHA Loan in Delaware

Once you’ve selected a lender, you’ll need to provide them with some information about yourself. This will include your

- social security number

- your employment history

- and your financial information.

- The lender will also need to know the value of the home you’re looking to purchase.

After you’ve provided the lender with all of the necessary information, they’ll run a credit check and verify your employment and income. Once they’ve done this, they’ll give you a loan estimate. This document will outline the terms of your loan, including the interest rate, monthly payment, and other important details.

The next step is to complete a loan application. This can usually be done online or at the lender’s office. Once you’ve submitted the application, the lender will do a final credit check and verify your employment and income. If everything looks good, then you’ll be approved for a loan.

Once you’re approved for a loan in Delaware, the lender will work with you to finalize the details of your loan. This will include things like the interest rate, monthly payment, and other important details. Once everything is finalized, you’ll be able to close on your loan and purchase your new home.

Now that you know how to apply for an FHA loan in Delaware, it’s time to start shopping for a home. If you have any questions about the process, feel free to ask your lender or real estate agent. They’ll be able to help you every step of the way.

What will disqualify you from an FHA loan in Delaware?

There are many things that can disqualify you from getting an FHA loan. Here are some of the most common:

1. You have a low credit score

If your credit score is below 500, you may not be able to get an FHA loan.

2. You have a high debt-to-income ratio

Your debt-to-income ratio must be below 43%.

3. You have a history of bad credit

If you have a history of missed payments, defaults, or bankruptcies, you may not be able to get an FHA loan.

4. You don’t have a steady income

You must have a steady job or other sources of regular income to qualify for an FHA loan.

5. You don’t live in the United States

FHA loans are only available to U.S. citizens and permanent residents. Noncitizens can qualify for ITIN Loan.

6. You’re a business owner

Self-employed business owners may not be able to get an FHA loan. Here are the guidelines for self-employed.

7. You’re a student

Full-time students may not be able to get an FHA loan. Parents of students might be able to qualify for Family Opportunity Loan.

8. You’re retired

Retirees may not be able to get an FHA loan.

9. You’re buying a vacation home

You can’t use an FHA loan to buy a vacation home.

10. You’re buying a rental property

You can’t use an FHA loan to buy a rental property.

If you meet all of the requirements for an FHA loan, you may be able to get approved even if your credit score is low. However, if you have any of the above disqualifiers, you may not be able to get an FHA loan.

FHA Loan Limits in Kent County in Delaware

If you’re considering a move to Kent County, it’s important to know the average cost of a home in the area. According to Zillow, the median home value in Kent County is $219,700. This means that half of all homes in the county are worth more than $219,700, and half are worthless. The FHA loan limits in Kent county are set to $472,030 for single home family, for duplex are set to $604,400, 3 units are at $730,525 and fourplex is at $907,900

Of course, there is a lot of variation in home prices depending on the neighborhood you choose. The most expensive neighborhoods are in the city of Dover, where the median home value is $269,600. If you’re looking for a more affordable option, consider moving to one of the rural towns in Kent County. The median home value in these towns is just $176,100.

FHA Loan Limits in New Castle County in Delaware

According to the latest data from Zillow, the median home value in New Castle County is $305,100. This is a 5.8% increase from last year and a 14.3% increase from two years ago. The average rent in New Castle County is also increasing rapidly. In the past year, the average rent has increased by 6.5%. This is significantly higher than the national average of 3.6%. If you’re thinking of buying a home in New Castle County, it’s important to be aware of these trends. Keep in mind that prices and rents are likely to continue increasing in the coming years. The FHA loan limits in New Castle County are set to $529,000 for 1-unit, for 2-units are set to $677,200, triplex are at $818,600 and 4-units are at $1,017,300

FHA Loan Limits in Sussex County in Delaware

The FHA loan limits in Kent county are set to $472,030 for single-home families, for duplexes are set to $604,400, 3 units are at $730,525 and 4-unit are at $907,900. The first thing you should know about the housing market in Sussex County is that prices are on the rise. The average house price in Sussex County has increased by 5% in the past year, and experts predict that prices will continue to rise in the coming months and years. So if you’re thinking of buying a home in Sussex County, now is the time to do it. Another thing you should know about the housing market in Sussex County is that there is a lot of competition from buyers. This means that you’ll likely have to pay more than the asking price for a home that you’re interested in purchasing. However, there are a few things you can do to increase your chances of getting the best deal on a home in Sussex County. One thing you can do is make a competitive offer. If you see a house that you’re interested in buying, don’t be afraid to make an offer that’s lower than the asking price. The seller may be willing to negotiate, and you may be able to get the home for a lower price than you originally thought.

Another thing you can do is work with a real estate agent who knows the Sussex County housing market well. A good real estate agent will be able to help you find homes that are priced below market value, and they’ll also be able to negotiate on your behalf to get you the best possible price. If you’re thinking of buying a home in Sussex County, it’s important to be aware of the current state of the housing market. Prices are on the rise, and there is a lot of competition from buyers. However, by making a competitive offer and working with a knowledgeable real estate agent, you can increase your chances of getting the best deal on a home in Sussex County.

Delaware Down Payment Assistance Program

The Delaware State Housing Authority (DSHA) offers several approaches to assist homebuyers with their down payment.

- A second mortgage loan of up to 5% of the purchase price of your home is available through the DSHA Preferred Plus Program. You can use it to pay for part or all of your down payment and closing costs. When you sell the property, refinance, or cease utilizing it as your primary residence, you must return the money.

- A DSHB First-Time Home Buyer Tax Credit, which can lower your federal taxes by up to $2,000 per year, may be taken in addition to a CHFA Preferred Plus loan.

You’d have to use a participating lender and fulfill maximum income restrictions, which differ by county. The DSHA’s has more information on its website. HUD also offers information about other DPA programs in Delaware.