FHA Loan Limits in Minnesota For 2023

FHA loan limits in Minnesota are calculated according to a formula specified in the National Housing Act. This formula results in a “base loan limit” for each county. The base loan limit is the lower of:

- The greater of 107 percent of the median house price in the county, or

- The floor amount of $472,030.

The Federal Housing Administration (FHA) sets loan limits for different areas of the country. These loan limits are designed to protect borrowers who have low to moderate incomes from taking on too much debt.

The FHA loan limits in Minnesota are set at $472,030. This applies to most counties in the state. However, there are a few exceptions. In high-cost counties like Anoka, Carver, Chisago, Dakota, Hennepin, Isanti, Le Sueur, Mille Lacs, Ramsey, Scott, Sherburne, Washington, and Wright FHA loan limits are set at $515,200 for single units, $659,550 for duplex, $797,250 for tri-plex. The maximum loan amount is still capped at $990,800 for a four-plex.

The FHA loan limits in Minnesota are set at $472,030. This applies to most counties in the state. However, there are a few exceptions. In high-cost counties like Anoka, Carver, Chisago, Dakota, Hennepin, Isanti, Le Sueur, Mille Lacs, Ramsey, Scott, Sherburne, Washington, and Wright FHA loan limits are set at $515,200 for single units, $659,550 for duplex, $797,250 for tri-plex. The maximum loan amount is still capped at $990,800 for a four-plex.

If you’re thinking about buying a home in Minnesota, it’s important to know the FHA loan limits i Minnesota for your county. You don’t want to take on too much debt and end up struggling to make your monthly payments. But you also don’t want to miss out on the chance to buy a home because you can’t afford the down payment or the mortgage payments. With an FHA loan, you can get into the housing market without putting down a lot of money upfront. And the monthly payments are more affordable than with a conventional mortgage.

FHA Loan Limits in Minnesota by County For 2023

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| AITKIN | $472,030 | $604,400 | $730,525 | $907,900 | $174,000 |

| ANOKA | $515,200 | $659,550 | $797,250 | $990,800 | $448,000 |

| BECKER | $472,030 | $604,400 | $730,525 | $907,900 | $238,000 |

| BELTRAMI | $472,030 | $604,400 | $730,525 | $907,900 | $175,000 |

| BENTON | $472,030 | $604,400 | $730,525 | $907,900 | $250,000 |

| BIG STONE | $472,030 | $604,400 | $730,525 | $907,900 | $92,000 |

| BLUE EARTH | $472,030 | $604,400 | $730,525 | $907,900 | $245,000 |

| BROWN | $472,030 | $604,400 | $730,525 | $907,900 | $158,000 |

| CARLTON | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| CARVER | $515,200 | $659,550 | $797,250 | $990,800 | $448,000 |

| CASS | $472,030 | $604,400 | $730,525 | $907,900 | $220,000 |

| CHIPPEWA | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| CHISAGO | $515,200 | $659,550 | $797,250 | $990,800 | $448,000 |

| CLAY | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| CLEARWATER | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| COOK | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| COTTONWOOD | $472,030 | $604,400 | $730,525 | $907,900 | $118,000 |

| CROW WING | $472,030 | $604,400 | $730,525 | $907,900 | $220,000 |

| DAKOTA | $515,200 | $659,550 | $797,250 | $990,800 | $448,000 |

| DODGE | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| DOUGLAS | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| FARIBAULT | $472,030 | $604,400 | $730,525 | $907,900 | $98,000 |

| FILLMORE | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| FREEBORN | $472,030 | $604,400 | $730,525 | $907,900 | $135,000 |

| GOODHUE | $472,030 | $604,400 | $730,525 | $907,900 | $260,000 |

| GRANT | $472,030 | $604,400 | $730,525 | $907,900 | $118,000 |

| HENNEPIN | $515,200 | $659,550 | $797,250 | $990,800 | $448,000 |

| HOUSTON | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| HUBBARD | $472,030 | $604,400 | $730,525 | $907,900 | $165,000 |

| ISANTI | $515,200 | $659,550 | $797,250 | $990,800 | $448,000 |

| ITASCA | $472,030 | $604,400 | $730,525 | $907,900 | $170,000 |

| JACKSON | $472,030 | $604,400 | $730,525 | $907,900 | $107,000 |

| KANABEC | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| KANDIYOHI | $472,030 | $604,400 | $730,525 | $907,900 | $183,000 |

| KITTSON | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| KOOCHICHING | $472,030 | $604,400 | $730,525 | $907,900 | $85,000 |

| LAC QUI PARLE | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| LAKE | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| LAKE OF THE WOO | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| LE SUEUR | $515,200 | $659,550 | $797,250 | $990,800 | $448,000 |

| LINCOLN | $472,030 | $604,400 | $730,525 | $907,900 | $64,000 |

| LYON | $472,030 | $604,400 | $730,525 | $907,900 | $153,000 |

| MCLEOD | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| MAHNOMEN | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| MARSHALL | $472,030 | $604,400 | $730,525 | $907,900 | $125,000 |

| MARTIN | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| MEEKER | $472,030 | $604,400 | $730,525 | $907,900 | $185,000 |

| MILLE LACS | $515,200 | $659,550 | $797,250 | $990,800 | $448,000 |

| MORRISON | $472,030 | $604,400 | $730,525 | $907,900 | $190,000 |

| MOWER | $472,030 | $604,400 | $730,525 | $907,900 | $145,000 |

| MURRAY | $472,030 | $604,400 | $730,525 | $907,900 | $124,000 |

| NICOLLET | $472,030 | $604,400 | $730,525 | $907,900 | $245,000 |

| NOBLES | $472,030 | $604,400 | $730,525 | $907,900 | $176,000 |

| NORMAN | $472,030 | $604,400 | $730,525 | $907,900 | $85,000 |

| OLMSTED | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| OTTER TAIL | $472,030 | $604,400 | $730,525 | $907,900 | $210,000 |

| PENNINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $153,000 |

| PINE | $472,030 | $604,400 | $730,525 | $907,900 | $197,000 |

| PIPESTONE | $472,030 | $604,400 | $730,525 | $907,900 | $92,000 |

| POLK | $472,030 | $604,400 | $730,525 | $907,900 | $248,000 |

| POPE | $472,030 | $604,400 | $730,525 | $907,900 | $172,000 |

| RAMSEY | $515,200 | $659,550 | $797,250 | $990,800 | $448,000 |

| RED LAKE | $472,030 | $604,400 | $730,525 | $907,900 | $89,000 |

| REDWOOD | $472,030 | $604,400 | $730,525 | $907,900 | $96,000 |

| RENVILLE | $472,030 | $604,400 | $730,525 | $907,900 | $104,000 |

| RICE | $472,030 | $604,400 | $730,525 | $907,900 | $275,000 |

| ROCK | $472,030 | $604,400 | $730,525 | $907,900 | $165,000 |

| ROSEAU | $472,030 | $604,400 | $730,525 | $907,900 | $156,000 |

| ST. LOUIS | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| SCOTT | $515,200 | $659,550 | $797,250 | $990,800 | $448,000 |

| SHERBURNE | $515,200 | $659,550 | $797,250 | $990,800 | $448,000 |

| SIBLEY | $472,030 | $604,400 | $730,525 | $907,900 | $208,000 |

| STEARNS | $472,030 | $604,400 | $730,525 | $907,900 | $250,000 |

| STEELE | $472,030 | $604,400 | $730,525 | $907,900 | $220,000 |

| STEVENS | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| SWIFT | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| TODD | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| TRAVERSE | $472,030 | $604,400 | $730,525 | $907,900 | $57,000 |

| WABASHA | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| WADENA | $472,030 | $604,400 | $730,525 | $907,900 | $145,000 |

| WASECA | $472,030 | $604,400 | $730,525 | $907,900 | $175,000 |

| WASHINGTON | $515,200 | $659,550 | $797,250 | $990,800 | $448,000 |

| WATONWAN | $472,030 | $604,400 | $730,525 | $907,900 | $112,000 |

| WILKIN | $472,030 | $604,400 | $730,525 | $907,900 | $168,000 |

| WINONA | $472,030 | $604,400 | $730,525 | $907,900 | $192,000 |

| WRIGHT | $515,200 | $659,550 | $797,250 | $990,800 | $448,000 |

| YELLOW MEDICINE | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

The FHA also offers loans that allow you to borrow more than the loan limit in Minnesota. These are called “jumbo loans.” Jumbo loans are available in any state, but the interest rates are usually higher than for regular FHA loans. The high-balance loan program allows for loans that are larger than the base FHA loan limits in Minnesota.

Backed by the Federal Housing Administration (FHA), the program offers several benefits that can make it easier and more affordable to purchase a home.

Benefits of Choosing an FHA Loan

There are numerous advantages to choosing an FHA loan over other types of loans, including low-down payment loans, flexible credit requirements, and competitive interest rates. Additionally, with an FHA loan you won’t have to pay for private mortgage insurance (PMI).

Qualifying for an FHA Loan in Minnesota

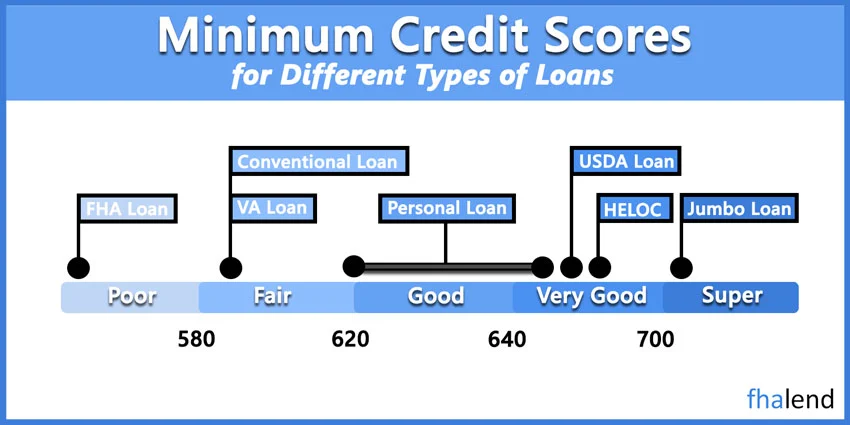

To qualify for an FHA loan in Minnesota, you’ll need to meet certain requirements. These include a minimum credit score of 580 (for most lenders), a down payment of at least 3.5%, and a debt-to-income ratio below 43%.

Finding an Experienced Lender in Minnesota

When it comes to finding an experienced lender in Minnesota, the best option is to shop around and compare rates from several different lenders. Additionally, it’s important to find a lender who understands how the FHA loan process works and can help guide you throughout the entire process.

The Minnesota FHA Loan Program 2023 is a great option for homebuyers looking for low-down payment loans, flexible Introduction: Are you ready to buy a new home but don’t have a large down payment? Or do you have less

Jumbo Loans in Minnesota State

In order to qualify for a jumbo loan, you’ll need a good credit score and a healthy income. In addition, your total debt load should be below 50% of your monthly income. Jumbo loans are also subject to stricter lending standards than traditional mortgages, so you’ll need to provide plenty of documentation proving your financial stability.

If you meet all the requirements for a jumbo loan, you can expect to receive a competitive interest rate. However, keep in mind that these loans typically come with a higher down payment requirement.

If you’re thinking about applying for a jumbo loan, it’s important to understand the requirements and how they may impact your financing options. By doing your research and working with a qualified mortgage broker, you can ensure that you get the best deal on your jumbo loan.

What are Type of Mortgage FHA Loans

There are a few different types of FHA loans available to borrowers. Understanding the differences can help you choose the best loan for your needs. For all listed below the FHA loan limits in Minnesota apply.

The following are the three main types of FHA loans:

Fixed-rate mortgage

This is a traditional mortgage with a fixed interest rate. The interest rate will stay the same for the life of the loan, and monthly payments will remain constant.

Adjustable-rate mortgage

Also known as an ARM, this type of mortgage has an adjustable interest rate that can change over time. ARMs usually start with a lower interest rate than fixed-rate mortgages, but the rate can go up (or down) based on market conditions.

Interest-only mortgage

This loan lets you pay only the interest on your mortgage for a set period of time (usually five or ten years). After the interest-only period is up, the loan will switch to a traditional mortgage where you’ll start paying both principal and interest.

FHA loans in Minnesota also come in different shapes and sizes. There are loans for people with low incomes, people who want to buy a home in a rural area, and people who want to buy a condo.

No matter what type of FHA loan you’re interested in, it’s important to work with a qualified lender who can help you find the best deal.

5 Steps To Apply For FHA Loan

If you meet these requirements, then an FHA loan in Minnesota may be the right choice for you. Here are the steps you need to take to apply for an FHA loan:

1. Get pre-approved for a mortgage. This is the first step in the process, and it’s important to do this before you start looking for a home. You can get pre-approved by a lender or through the FHA itself.

2. Find a home that meets your needs. Once you’re pre-approved, start looking for a home that meets your needs and budget. Keep in mind that you may have to buy a home that is below market value in order to meet the requirements of an FHA loan.

3. Make an offer on the home. Once you find a home you like, make an offer. Keep in mind that the seller may not always accept your offer, so be prepared to negotiate.

4. Get the home inspected. Once the offer is accepted, you’ll want to have the home inspected to make sure there are no major problems. For FHA loans the appraisal is also required.

5. Finalize the loan. Once all of the inspections are done, you’ll need to finalize the loan. This will include submitting all of your paperwork and paying any closing costs.

These are just a few of the steps involved in getting an FHA loan. For more information, contact us or HUD directly. An FHA loan may be the right choice for you if you’re looking for a mortgage that has less strict requirements than a traditional loan.

Top 5 Most Expensive Areas in Minnesota

When it comes to the most expensive areas to live in Minnesota, you may be surprised by some of the places that made the list. From the Twin Cities to smaller towns near Lake Superior, these are some of the most costly spots in the state. If you’re looking for an affordable place to call home, you’ll want to avoid these areas.

1. Minneapolis-St. Paul

The Twin Cities are always at or near the top of lists of the most expensive places to live in the country. While there are certainly cheaper neighborhoods, prices continue to rise throughout the metro area. With two major cities and plenty of suburbs, there’s something to fit everyone’s budget – if you’re willing to sacrifice space and/or convenience.

2. Duluth

Duluth is another city that consistently ranks as one of the most expensive places to live in Minnesota. It’s no wonder, given its location on Lake Superior and its popularity as a tourist destination. Housing prices are high and continue to increase, making it difficult for many people to afford to live in the city.

3. Grand Marais

Grand Marais is a small town near the Canadian border that has seen a significant increase in housing prices in recent years. With its picturesque setting on Lake Superior and its close proximity to popular outdoor destinations, demand for housing has continued to grow. As a result, prices have gone up, making it difficult for people to afford to live in the town.

4. Bayfield

Just across the bay from Grand Marais is the small town of Bayfield. While it’s not as popular with tourists as its neighbor, Bayfield is becoming increasingly popular with people who are looking for a quiet place to live near Lake Superior. As a result, housing prices have been on the rise, making it one of the more expensive places to live in Wisconsin.

5. Chisago Lakes

The Chisago Lakes area is a popular spot for people who want to live in the suburbs but still be close to the Twin Cities. Housing prices are high compared to other suburbs, however, making it one of the more expensive places to live in Minnesota. If you’re looking for a suburban home, be prepared to pay a premium.

Common Issues When Applying For FHA loan in Minnesota

Common Issues When Applying For FHA loan in Minnesota

While an FHA loan can be a great option for some borrowers, there are also some common issues that can arise. Let’s take a closer look at three of these issues:

1) Difficulty getting approved

One common issue with FHA loans is that it can be difficult to get approved. This is because the government has certain requirements that must be met in order to qualify for an FHA loan. For example, borrowers must have a credit score of at least 580 in order to be approved with 3,5% down. Or 500 FICO score when putting 10% as a downpayment.

2) Higher interest rates

Another issue with FHA loans is that they often come with higher interest rates. This is because the government insurance program increases the risk for lenders, which leads to them charging higher interest rates.

3) More stringent rules

Finally, one of the biggest issues with FHA loans in Minnesota is that the rules are more stringent than those for other types of home loans. This can make it difficult for some borrowers to qualify for an FHA loan.

Despite these common issues, an FHA loan can be a great option for some borrowers. If you’re considering this type of loan, be sure to weigh the pros and cons carefully to see if it’s the right choice for you.

Minnesota Down Payment Assistance Program

Brief for Minnesota Down Payment Assistance Program: The Minnesota Down Payment Assistance Program (MDPAP) is a state-funded program designed to provide qualified home buyers with grants and loans to help cover the costs associated with purchasing a new home. The program helps reduce the financial burden of purchasing a home by providing up to 4% of the purchase price in down payment assistance.

The Minnesota Housing Finance Agency (MHFA) offers two distinct types of down payment loans to qualifying homebuyers:

- Monthly Payment Loan: Borrow up to $17,000 at the same mortgage interest rate as your first loan. Pay it down each month over 10 years

- Deferred Payment Loan: First-time buyers can borrow $11,000 free of interest. You make no payments; however, the mortgage will be paid in its entirety when you finish paying off the loan, refinance it, or sell the property.

Visit the MHFA’s website for additional information. Also, see whether there are any other mortgage-related government programs in Minnesota on HUD’s list of alternative housing assistance programs.