FHA Loan Limits in Pennsylvania: Mortgage Guidelines 2023

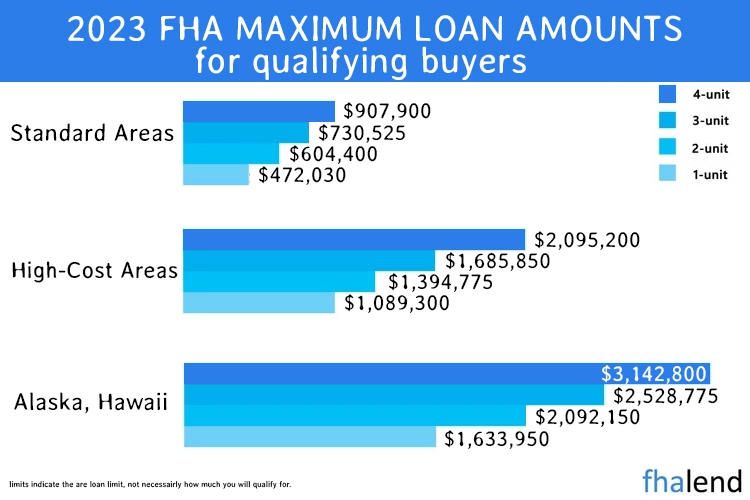

FHA loan limits in Pennsylvania for 2023 go from $472,030 up to $1,089,300for high-cost areas for a single-home family.

FHA loan limits in Pennsylvania for 2023 go from $472,030 up to $1,089,300for high-cost areas for a single-home family.

for a 2-unit home, the floor is set at $538,650 and goes up to $1,243,050 for high-cost areas. The FHA loan limits in Pennsylvania for 3-unit homes in Pennsylvania in 2023 go from 651,050 to $1,502,475 for Pike County (a high-cost county). For FHA Loan Limits for 4 Units the floor is set to $917,800 and for high-cost counties in Pennsylvania, the ceiling is set to $1,502,475 for Pike County.

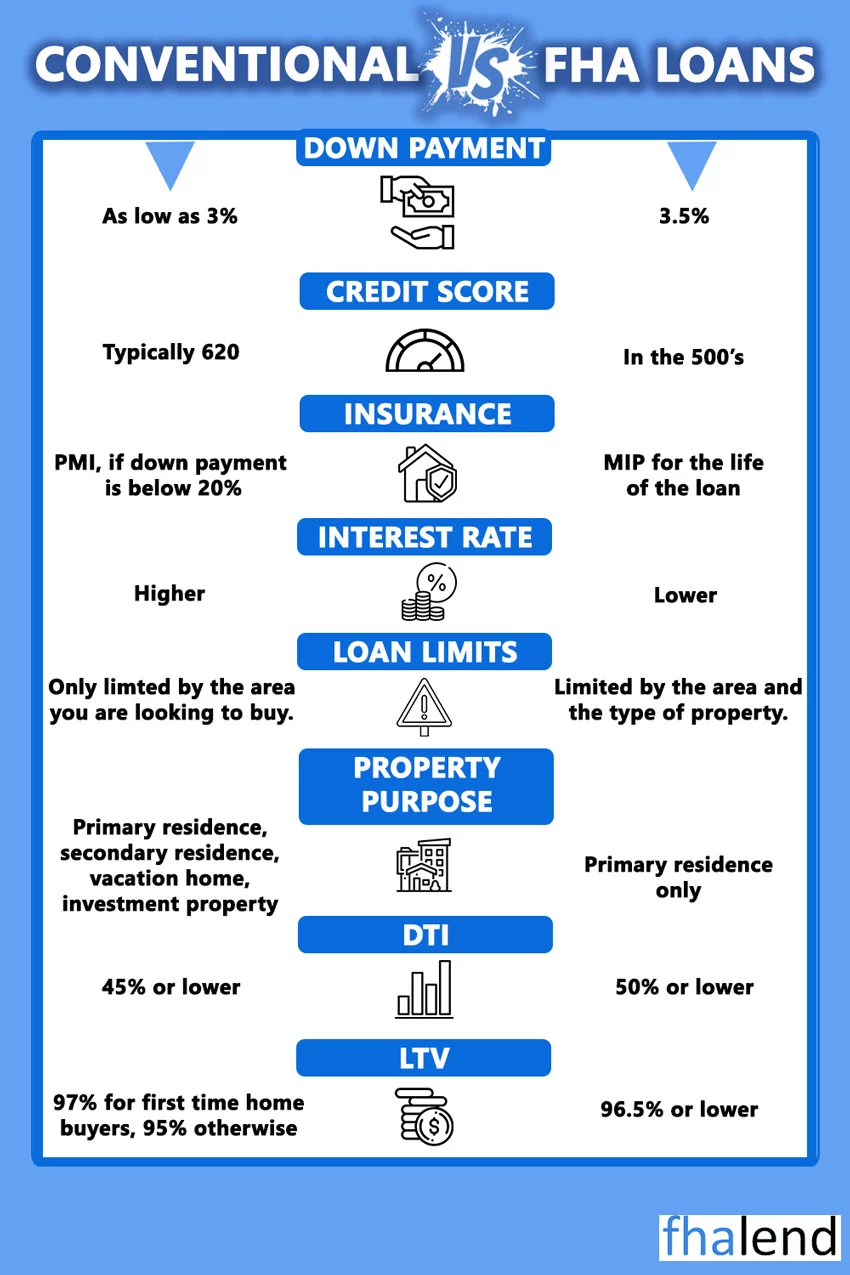

Mortgages make the process of buying a house affordable and manageable. A borrower can either opt for conventional mortgages or an FHA loan as their house financing option. An FHA loan in Pennsylvania is an example of a suitable loan for financing your next dream home. This type of loan offers many benefits to novice homeowners earning low to moderate income. This article provides an essential outline of all there is to know about FHA loans in Pennsylvania.

FHA Loan Limits in Pennsylvania for All Counties [TABLE]

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| ADAMS | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| ALLEGHENY | $472,030 | $604,400 | $730,525 | $907,900 | $286,000 |

| ARMSTRONG | $472,030 | $604,400 | $730,525 | $907,900 | $286,000 |

| BEAVER | $472,030 | $604,400 | $730,525 | $907,900 | $286,000 |

| BEDFORD | $472,030 | $604,400 | $730,525 | $907,900 | $116,000 |

| BERKS | $472,030 | $604,400 | $730,525 | $907,900 | $201,000 |

| BLAIR | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| BRADFORD | $472,030 | $604,400 | $730,525 | $907,900 | $139,000 |

| BUCKS | $529,000 | $677,200 | $818,600 | $1,017,300 | $460,000 |

| BUTLER | $472,030 | $604,400 | $730,525 | $907,900 | $286,000 |

| CAMBRIA | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| CAMERON | $472,030 | $604,400 | $730,525 | $907,900 | $70,000 |

| CARBON | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| CENTRE | $472,030 | $604,400 | $730,525 | $907,900 | $290,000 |

| CHESTER | $529,000 | $677,200 | $818,600 | $1,017,300 | $460,000 |

| CLARION | $472,030 | $604,400 | $730,525 | $907,900 | $94,000 |

| CLEARFIELD | $472,030 | $604,400 | $730,525 | $907,900 | $92,000 |

| CLINTON | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| COLUMBIA | $472,030 | $604,400 | $730,525 | $907,900 | $185,000 |

| CRAWFORD | $472,030 | $604,400 | $730,525 | $907,900 | $105,000 |

| CUMBERLAND | $472,030 | $604,400 | $730,525 | $907,900 | $268,000 |

| DAUPHIN | $472,030 | $604,400 | $730,525 | $907,900 | $268,000 |

| DELAWARE | $529,000 | $677,200 | $818,600 | $1,017,300 | $460,000 |

| ELK | $472,030 | $604,400 | $730,525 | $907,900 | $87,000 |

| ERIE | $472,030 | $604,400 | $730,525 | $907,900 | $141,000 |

| FAYETTE | $472,030 | $604,400 | $730,525 | $907,900 | $286,000 |

| FOREST | $472,030 | $604,400 | $730,525 | $907,900 | $73,000 |

| FRANKLIN | $472,030 | $604,400 | $730,525 | $907,900 | $209,000 |

| FULTON | $472,030 | $604,400 | $730,525 | $907,900 | $108,000 |

| GREENE | $472,030 | $604,400 | $730,525 | $907,900 | $100,000 |

| HUNTINGDON | $472,030 | $604,400 | $730,525 | $907,900 | $111,000 |

| INDIANA | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| JEFFERSON | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| JUNIATA | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| LACKAWANNA | $472,030 | $604,400 | $730,525 | $907,900 | $170,000 |

| LANCASTER | $472,030 | $604,400 | $730,525 | $907,900 | $285,000 |

| LAWRENCE | $472,030 | $604,400 | $730,525 | $907,900 | $100,000 |

| LEBANON | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| LEHIGH | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| LUZERNE | $472,030 | $604,400 | $730,525 | $907,900 | $170,000 |

| LYCOMING | $472,030 | $604,400 | $730,525 | $907,900 | $160,000 |

| MCKEAN | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| MERCER | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| MIFFLIN | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| MONROE | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| MONTGOMERY | $529,000 | $677,200 | $818,600 | $1,017,300 | $460,000 |

| MONTOUR | $472,030 | $604,400 | $730,525 | $907,900 | $185,000 |

| NORTHAMPTON | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| NORTHUMBERLAND | $472,030 | $604,400 | $730,525 | $907,900 | $76,000 |

| PERRY | $472,030 | $604,400 | $730,525 | $907,900 | $268,000 |

| PHILADELPHIA | $529,000 | $677,200 | $818,600 | $1,017,300 | $460,000 |

| PIKE | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $10,000 |

| POTTER | $472,030 | $604,400 | $730,525 | $907,900 | $94,000 |

| SCHUYLKILL | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| SNYDER | $472,030 | $604,400 | $730,525 | $907,900 | $175,000 |

| SOMERSET | $472,030 | $604,400 | $730,525 | $907,900 | $106,000 |

| SULLIVAN | $472,030 | $604,400 | $730,525 | $907,900 | $98,000 |

| SUSQUEHANNA | $472,030 | $604,400 | $730,525 | $907,900 | $125,000 |

| TIOGA | $472,030 | $604,400 | $730,525 | $907,900 | $135,000 |

| UNION | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| VENANGO | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| WARREN | $472,030 | $604,400 | $730,525 | $907,900 | $76,000 |

| WASHINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $286,000 |

| WAYNE | $472,030 | $604,400 | $730,525 | $907,900 | $201,000 |

| WESTMORELAND | $472,030 | $604,400 | $730,525 | $907,900 | $286,000 |

| WYOMING | $472,030 | $604,400 | $730,525 | $907,900 | $170,000 |

| YORK | $472,030 | $604,400 | $730,525 | $907,900 | $232,000 |

What is an FHA Loan?

An FHA loan is a mortgage that’s insured by the Federal Housing Administration (FHA). These loans are designed for borrowers who may not have perfect credit or a large down payment, and they can be a good option for properties in less-than-perfect condition.

Buying a Multifamily Unit in Pennsylvania with FHA Loan

The FHA loan program is a great option for financing a multifamily unit. This type of loan is backed by the Federal Housing Administration and offers lower down payment options and flexible credit requirements, making it an attractive financing option for many borrowers.

Maximum FHA Loan Amount Pennsylvania?

So what is the maximum loan amount in Pennsylvania you can borrow from an FHA-approved lender?

The maximum FHA loan amount available in 2023 is $472,030. This is based on the current conforming loan limit of $726,200, which increased from $647,200 in 2022. The FHA loan limits in Pennsylvania are calculated as a percentage of the conforming loan limit and is updated annually. For example, the FHA loan limit in Pennsylvania for a single-family home in 2022 was 96.5% of the conforming loan limit of $420,680. The maximum FHA loan amount for a 2-unit is $538,650, for a triplex you can borrow up to $651,050, and for $809,150

The FHA loan limit is not the only factor that determines the maximum loan amount you can qualify for. Your credit score, debt-to-income ratio, and other factors will also be considered when you apply for a loan.

How FHA Loan Limits in Pennsylvania Are Determined in Counties

The Federal Housing Administration (FHA) sets floor and ceiling FHA loan limits in Pennsylvania for each county in the United States. The floor is the lower limit while the ceiling is the upper limit on what you can borrow with an FHA loan in a specific geographical area, such as Hawaii or Alaska.

The table below shows how these limits differ by county, depending on whether you’re buying or refinancing a home. Note that the limits are different in Hawaii and Alaska, which is why they’re listed separately.

As you can see above, the FHA loan limits in Pennsylvania differ depending on the county in which you’re buying or refinancing a home. The limits are also higher if you’re refinancing a home as opposed to buying one.

If you’re interested in an FHA loan in Pennsylvania, be sure to contact a loan officer to see if you qualify. You can also read more articles on our website for more information on how to qualify for an FHA loan.

FHA Loan Limits in Pike County, PA

The maximum FHA loan amount in Pennsylvania varies by county and is higher in counties with higher home prices. In 2023, if you live in one of the cities: Saw Creek, Hemlock Farms, Pocono Woodland Lakes, Pine Ridge, Matamoras Borough, Gold Key Lake, Sunrise Lake, Birchwood Lakes, Conashaugh Lakes, Pocono Ranch Lands, Milford Borough, Pocono Mountain Lake Estates, Fawn Lake Forest, Masthope the maximum FHA loan amount for a single-family home in the most expensive county (Pike County, PA) is set to $1,089,300. A multifamily home (2 units) is set at $1,394,775. And for 3-unit is 4 units are set to ($1,685,850 and $2,095,200).

If you’re thinking of buying a home in 2023, it’s important to start planning now. Talk to a lender to get an idea of how much you can borrow, and start saving for a down payment. The sooner you start the process, the more prepared you’ll be when it’s time to buy your home. Please fill up this form and one of our senior loan officers will contact you to help with a pre-approval process in Pennsylvania.

How To Apply For FHA Loan in Pennsylvania?

As mentioned earlier, an FHA loan is useful for first-home buyers who fail to qualify for conventional loans due to lower credit scores and low income. An FHA loan offers borrowers a down payment of 3.5% for those with credit scores of 580 and above. Before taking out an FHA loan, a requirement is the payment of mortgage insurance premiums. In case a borrower defaults, the premiums act as security to the lender.

It is important to note that FHA does not provide loans to borrowers; it only approves them. FHA-approved banks or lending institutions issue the loans. The credit score limit is not fixed. A borrower with a lower credit score can make a down payment of 10% and still access the FHA loan. But, with a lower credit score, the interest rate will be higher.

FHA Loan Requirements in Pennsylvania

The two critical requirements for qualifying for an FHA loan in Pennsylvania are credit score and the minimum down payment amounts.

Credit Score

A lower credit score does not limit a borrower from accessing the loan. As someone with a credit score of 500 to 579, I would have to pay a minimum down payment of 10%.

Income

A steady income flow or stable employment history or at least a two-year working experience for one employer. Have steady employment history (two years is preferred). Have a good credit history with no major blemishes such as bankruptcies or foreclosures – Meet the minimum income requirements (varies depending on household size).

Down Payment

A 3.5 percent minimum down payment can be a grant or a financial gift from a family member.

Property Appraisal

A property appraisal should be done by a registered and approved appraiser. An appraisal should outline and meet the minimum FHA loan standards. If the house requires repairs, the buyer and seller should agree on who pays the cost of repairs.

Nationality

A borrower must be of legal age, a US resident, have legal permanent residency status or have a valid Social Security number.

How to Improve Your Credit Score To Qualify for FHA Loan in Pennsylvania

How to Improve Your Credit Score To Qualify for FHA Loan in Pennsylvania

There are a few things that you can do to improve your credit score and increase your chances of getting approved for a mortgage. Here are a few tips:

- Check your credit report for errors.

- Pay your bills on time.

- Keep your credit utilization ratio low.

- Avoid applying for new credit cards.

- Dispute inaccurate information on your credit report.

- Stay current on your student loan payments.

- Seek help from a credit counseling agency.

- Use a secured credit card.

- Get a co-signer.

- Monitor your credit score frequently.

Front- and Back-end Ratio

The front-end ratio should be less than 31% of my gross income. This ratio includes a tally of homeowners insurance, mortgage insurance, property taxes, HOA fees, and mortgage payments. The back-end ratio should be less than 43% of gross income. The ratio is a tally of any previous loans, car payments, or credit card payments.

Bankruptcy

When you file for bankruptcy, it’s important to know what kind of loans you can still qualify for. An FHA loan may be a good option if your bankruptcy was caused by extenuating circumstances beyond your control, like a medical emergency or job loss. Keep reading to learn more about how to get an FHA loan after bankruptcy. A borrower should prove to be two years out of bankruptcy. One year is also acceptable, but a borrower should indicate proper financial management.

One of the first things you’ll need to do when applying for an FHA loan after bankruptcy is to get a copy of your credit report. You can get a free copy of your credit report from each of the three major credit bureaus once every 12 months. Review your credit report carefully to make sure all the information is accurate. If you see any errors, dispute them with the credit bureau.

Foreclosure Notice

A minimum of three years out of foreclosure notices. But, exceptions can be made if the credit score improves. A new FHA loan is only applicable for primary residency. But, most of these requirements have exceptions tied to them and are flexible, depending on different circumstances.

A foreclosure can be a devastating event, but it doesn’t have to mean the end of your homeownership dreams. If you’re hoping to get an FHA loan after a foreclosure, you’ll need to wait at least three years before you’re eligible for financing. In the meantime, there are other ways to improve your credit score and save up for a down payment so that you can qualify for the best possible mortgage when the time comes.

If you’ve gone through a foreclosure, you know how tough it can be on your finances and your credit score. But don’t despair – there are still plenty of options available to you if you want to become a homeowner again. With some careful planning and preparation, you can get an FHA loan after foreclosure and start fresh with a new home.

Eligibility Requirements for PA FHA Loans

The Pennsylvania FHA program is sponsored by the Federal Housing Administration, a part of the United States Department of Housing and Urban Development. Through this program, prospective home buyers are able to obtain mortgages with lower down payments and interest rates than traditional loans. This makes homeownership more accessible for first-time homebuyers or those with lower income levels. In addition, the FHA also provides helpful services such as foreclosure prevention counseling and assistance in times of financial hardship.

To be eligible for an FHA loan in Pennsylvania, borrowers must meet certain requirements set forth by the government. These include having a steady employment history and a credit score of 580 or higher. Additionally, applicants must provide proof of income, have a debt-to-income ratio that is not too high, and be able to make a down payment of 3.5% or more.

Pennsylvania Down Payment Assistance Program

The Pennsylvania Housing Finance Agency (PHFA) administers a variety of down payment assistance programs. For many first-time homebuyers, coming up with a down payment can be one of the biggest obstacles to homeownership. The PHFA’s down payment and closing cost assistance program makes it possible for more Pennsylvanians to become homeowners by providing financial assistance when they need it most.

- PHFA Grant: This loan program offers a $500 grant that can be used in conjunction with an HFA Preferred loan.

- Keystone Advantage Assistance Loan Program: The second mortgage of up to $6,000 or 4% of the purchase price, whichever is less, may be obtained. It was paid off in 10 years at zero percent interest.

- Keystone Forgivable In Ten Years Loan Program (K-FIT): Offers up to 5% of the purchase price or market value (whichever is less). The rate of interest is 10% per year for ten years.

Each program has its own set of qualifying criteria and a list of acceptable mortgage loan programs. You may discover more information on the agency’s website. Also, see HUD’s list of additional Pennsylvania homeownership assistance programs.