FHA Loan Limits in Georgia: Mortgage Guidelines 2023

Many first-time homebuyers in Georgia choose FHA loans. Before applying and shopping for your dream home in Georgia you have to know that FHA which is HUD agency has certain rules and regulation and one of them are FHA loan limits in FHA Loan Limits in Georgia.

Many first-time homebuyers in Georgia choose FHA loans. Before applying and shopping for your dream home in Georgia you have to know that FHA which is HUD agency has certain rules and regulation and one of them are FHA loan limits in FHA Loan Limits in Georgia.

The Georgia FHA mortgage program has several benefits, including keeping in mind the budget difficulties of many homeowners who are considering purchasing their first home. Compared to most traditional mortgage loans, the FHA mortgage loan simplifies the process for the buyer.

FHA Loan Limits in Georgia by County

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| APPLING | $472,030 | $604,400 | $730,525 | $907,900 | $65,000 |

| ATKINSON | $472,030 | $604,400 | $730,525 | $907,900 | $105,000 |

| BACON | $472,030 | $604,400 | $730,525 | $907,900 | $55,000 |

| BAKER | $472,030 | $604,400 | $730,525 | $907,900 | $114,000 |

| BALDWIN | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| BANKS | $472,030 | $604,400 | $730,525 | $907,900 | $234,000 |

| BARROW | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| BARTOW | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| BEN HILL | $472,030 | $604,400 | $730,525 | $907,900 | $83,000 |

| BERRIEN | $472,030 | $604,400 | $730,525 | $907,900 | $111,000 |

| BIBB | $472,030 | $604,400 | $730,525 | $907,900 | $239,000 |

| BLECKLEY | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| BRANTLEY | $472,030 | $604,400 | $730,525 | $907,900 | $278,000 |

| BROOKS | $472,030 | $604,400 | $730,525 | $907,900 | $185,000 |

| BRYAN | $472,030 | $604,400 | $730,525 | $907,900 | $319,000 |

| BULLOCH | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| BURKE | $472,030 | $604,400 | $730,525 | $907,900 | $275,000 |

| BUTTS | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| CALHOUN | $472,030 | $604,400 | $730,525 | $907,900 | $50,000 |

| CAMDEN | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| CANDLER | $472,030 | $604,400 | $730,525 | $907,900 | $123,000 |

| CARROLL | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| CATOOSA | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| CHARLTON | $472,030 | $604,400 | $730,525 | $907,900 | $107,000 |

| CHATHAM | $472,030 | $604,400 | $730,525 | $907,900 | $319,000 |

| CHATTAHOOCHEE | $472,030 | $604,400 | $730,525 | $907,900 | $270,000 |

| CHATTOOGA | $472,030 | $604,400 | $730,525 | $907,900 | $121,000 |

| CHEROKEE | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| CLARKE | $516,350 | $661,000 | $799,000 | $993,000 | $449,000 |

| CLAY | $472,030 | $604,400 | $730,525 | $907,900 | $60,000 |

| CLAYTON | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| CLINCH | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| COBB | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| COFFEE | $472,030 | $604,400 | $730,525 | $907,900 | $105,000 |

| COLQUITT | $472,030 | $604,400 | $730,525 | $907,900 | $96,000 |

| COLUMBIA | $472,030 | $604,400 | $730,525 | $907,900 | $275,000 |

| COOK | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| COWETA | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| CRAWFORD | $472,030 | $604,400 | $730,525 | $907,900 | $239,000 |

| CRISP | $472,030 | $604,400 | $730,525 | $907,900 | $104,000 |

| DADE | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| DAWSON | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| DECATUR | $472,030 | $604,400 | $730,525 | $907,900 | $105,000 |

| DEKALB | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| DODGE | $472,030 | $604,400 | $730,525 | $907,900 | $60,000 |

| DOOLY | $472,030 | $604,400 | $730,525 | $907,900 | $63,000 |

| DOUGHERTY | $472,030 | $604,400 | $730,525 | $907,900 | $220,000 |

| DOUGLAS | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| EARLY | $472,030 | $604,400 | $730,525 | $907,900 | $70,000 |

| ECHOLS | $472,030 | $604,400 | $730,525 | $907,900 | $185,000 |

| EFFINGHAM | $472,030 | $604,400 | $730,525 | $907,900 | $319,000 |

| ELBERT | $472,030 | $604,400 | $730,525 | $907,900 | $100,000 |

| EMANUEL | $472,030 | $604,400 | $730,525 | $907,900 | $69,000 |

| EVANS | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| FANNIN | $472,030 | $604,400 | $730,525 | $907,900 | $365,000 |

| FAYETTE | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| FLOYD | $472,030 | $604,400 | $730,525 | $907,900 | $166,000 |

| FORSYTH | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| FRANKLIN | $472,030 | $604,400 | $730,525 | $907,900 | $135,000 |

| FULTON | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| GILMER | $472,030 | $604,400 | $730,525 | $907,900 | $127,000 |

| GLASCOCK | $472,030 | $604,400 | $730,525 | $907,900 | $73,000 |

| GLYNN | $472,030 | $604,400 | $730,525 | $907,900 | $278,000 |

| GORDON | $472,030 | $604,400 | $730,525 | $907,900 | $205,000 |

| GRADY | $472,030 | $604,400 | $730,525 | $907,900 | $108,000 |

| GREENE | $515,200 | $659,550 | $797,250 | $990,800 | $325,000 |

| GWINNETT | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| HABERSHAM | $472,030 | $604,400 | $730,525 | $907,900 | $210,000 |

| HALL | $472,030 | $604,400 | $730,525 | $907,900 | $330,000 |

| HANCOCK | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| HARALSON | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| HARRIS | $472,030 | $604,400 | $730,525 | $907,900 | $270,000 |

| HART | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| HEARD | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| HENRY | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| HOUSTON | $472,030 | $604,400 | $730,525 | $907,900 | $205,000 |

| IRWIN | $472,030 | $604,400 | $730,525 | $907,900 | $100,000 |

| JACKSON | $472,030 | $604,400 | $730,525 | $907,900 | $338,000 |

| JASPER | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| JEFF DAVIS | $472,030 | $604,400 | $730,525 | $907,900 | $70,000 |

| JEFFERSON | $472,030 | $604,400 | $730,525 | $907,900 | $57,000 |

| JENKINS | $472,030 | $604,400 | $730,525 | $907,900 | $69,000 |

| JOHNSON | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| JONES | $472,030 | $604,400 | $730,525 | $907,900 | $239,000 |

| LAMAR | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| LANIER | $472,030 | $604,400 | $730,525 | $907,900 | $185,000 |

| LAURENS | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| LEE | $472,030 | $604,400 | $730,525 | $907,900 | $220,000 |

| LIBERTY | $472,030 | $604,400 | $730,525 | $907,900 | $230,000 |

| LINCOLN | $472,030 | $604,400 | $730,525 | $907,900 | $275,000 |

| LONG | $472,030 | $604,400 | $730,525 | $907,900 | $230,000 |

| LOWNDES | $472,030 | $604,400 | $730,525 | $907,900 | $185,000 |

| LUMPKIN | $472,030 | $604,400 | $730,525 | $907,900 | $250,000 |

| MCDUFFIE | $472,030 | $604,400 | $730,525 | $907,900 | $275,000 |

| MCINTOSH | $472,030 | $604,400 | $730,525 | $907,900 | $278,000 |

| MACON | $472,030 | $604,400 | $730,525 | $907,900 | $63,000 |

| MADISON | $516,350 | $661,000 | $799,000 | $993,000 | $449,000 |

| MARION | $472,030 | $604,400 | $730,525 | $907,900 | $270,000 |

| MERIWETHER | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| MILLER | $472,030 | $604,400 | $730,525 | $907,900 | $82,000 |

| MITCHELL | $472,030 | $604,400 | $730,525 | $907,900 | $70,000 |

| MONROE | $472,030 | $604,400 | $730,525 | $907,900 | $239,000 |

| MONTGOMERY | $472,030 | $604,400 | $730,525 | $907,900 | $113,000 |

| MORGAN | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| MURRAY | $472,030 | $604,400 | $730,525 | $907,900 | $185,000 |

| MUSCOGEE | $472,030 | $604,400 | $730,525 | $907,900 | $270,000 |

| NEWTON | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| OCONEE | $516,350 | $661,000 | $799,000 | $993,000 | $449,000 |

| OGLETHORPE | $516,350 | $661,000 | $799,000 | $993,000 | $449,000 |

| PAULDING | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| PEACH | $472,030 | $604,400 | $730,525 | $907,900 | $205,000 |

| PICKENS | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| PIERCE | $472,030 | $604,400 | $730,525 | $907,900 | $139,000 |

| PIKE | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| POLK | $472,030 | $604,400 | $730,525 | $907,900 | $160,000 |

| PULASKI | $472,030 | $604,400 | $730,525 | $907,900 | $125,000 |

| PUTNAM | $472,030 | $604,400 | $730,525 | $907,900 | $243,000 |

| QUITMAN | $472,030 | $604,400 | $730,525 | $907,900 | $119,000 |

| RABUN | $472,030 | $604,400 | $730,525 | $907,900 | $215,000 |

| RANDOLPH | $472,030 | $604,400 | $730,525 | $907,900 | $41,000 |

| RICHMOND | $472,030 | $604,400 | $730,525 | $907,900 | $275,000 |

| ROCKDALE | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| SCHLEY | $472,030 | $604,400 | $730,525 | $907,900 | $83,000 |

| SCREVEN | $472,030 | $604,400 | $730,525 | $907,900 | $65,000 |

| SEMINOLE | $472,030 | $604,400 | $730,525 | $907,900 | $58,000 |

| SPALDING | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| STEPHENS | $472,030 | $604,400 | $730,525 | $907,900 | $139,000 |

| STEWART | $472,030 | $604,400 | $730,525 | $907,900 | $270,000 |

| SUMTER | $472,030 | $604,400 | $730,525 | $907,900 | $83,000 |

| TALBOT | $472,030 | $604,400 | $730,525 | $907,900 | $270,000 |

| TALIAFERRO | $472,030 | $604,400 | $730,525 | $907,900 | $85,000 |

| TATTNALL | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| TAYLOR | $472,030 | $604,400 | $730,525 | $907,900 | $61,000 |

| TELFAIR | $472,030 | $604,400 | $730,525 | $907,900 | $45,000 |

| TERRELL | $472,030 | $604,400 | $730,525 | $907,900 | $220,000 |

| THOMAS | $472,030 | $604,400 | $730,525 | $907,900 | $180,000 |

| TIFT | $472,030 | $604,400 | $730,525 | $907,900 | $169,000 |

| TOOMBS | $472,030 | $604,400 | $730,525 | $907,900 | $113,000 |

| TOWNS | $472,030 | $604,400 | $730,525 | $907,900 | $190,000 |

| TREUTLEN | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| TROUP | $472,030 | $604,400 | $730,525 | $907,900 | $175,000 |

| TURNER | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| TWIGGS | $472,030 | $604,400 | $730,525 | $907,900 | $239,000 |

| UNION | $472,030 | $604,400 | $730,525 | $907,900 | $160,000 |

| UPSON | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| WALKER | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| WALTON | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 |

| WARE | $472,030 | $604,400 | $730,525 | $907,900 | $139,000 |

| WARREN | $472,030 | $604,400 | $730,525 | $907,900 | $51,000 |

| WASHINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| WAYNE | $472,030 | $604,400 | $730,525 | $907,900 | $138,000 |

| WEBSTER | $472,030 | $604,400 | $730,525 | $907,900 | $60,000 |

| WHEELER | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| WHITE | $472,030 | $604,400 | $730,525 | $907,900 | $215,000 |

| WHITFIELD | $472,030 | $604,400 | $730,525 | $907,900 | $185,000 |

| WILCOX | $472,030 | $604,400 | $730,525 | $907,900 | $55,000 |

| WILKES | $472,030 | $604,400 | $730,525 | $907,900 | $100,000 |

| WILKINSON | $472,030 | $604,400 | $730,525 | $907,900 | $59,000 |

| WORTH | $472,030 | $604,400 | $730,525 | $907,900 | $220,000 |

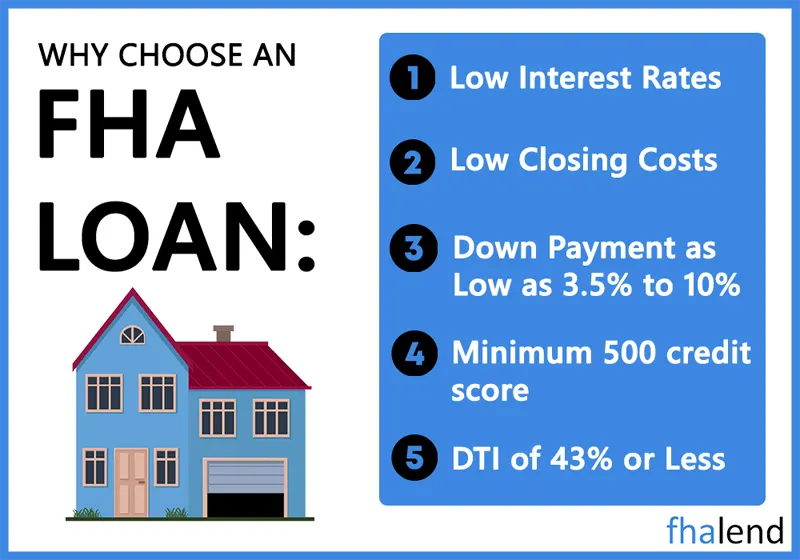

The FHA mortgage loan has a lower down payment than what is normally seen in other loans, which makes it easier on homeowners who struggle to save up for the large down payment necessary in other loans. Let’s look at the Georgia FHA loan requirements and benefits below:

15/30 years fixed rate – One of the advantages of your FHA loan in Georgia is the fixed 15 or 30-year interest rate. Loans that typically have a fluctuating interest rate do not change their interest rates for the total length of the loan. This timeframe is typically thirty years. It is this provision that allows the home buyer to budget their predetermined monthly installment ahead of time.

3,5% Low down payment – The federal government offers FHA loans, which means the borrower experiences very minimal costs in the process. FHA mortgages require the mortgage applicant to put down a minimum of 3.5%. For borrowers with less than a 580 FICO score, the downpayment is set to 10%. The loan does allow for the home seller to pay for all closing costs, up to 6% which is frequently enough to take care of almost any property sale.

Pre-qualification – for a Georgia FHA home loan is pretty simple. Because the government insures your mortgage, creditors and lending institutions make it feasible for anybody to qualify when they meet a base requirement. The first requirement is the credit history, earnings, and job history standards. The FHA mortgage loan started due to the stretched budget constraints of those first-time buyers. The reason the FHA offers an adjustable-rate mortgage option for home buyers is that it provides a relatively low payment and a low-interest rate.

Primary Residence – You have to get and stay in the home that you intend to buy. The Federal Housing Administration loans are not available for purchasing an investment property, second home, or vacation home.

Credit History – It is generally the smaller things that may damage your consumer credit. Check your income source, creditworthiness, and rent history to make sure you’re approved. Make sure you take care of everything and have a spotless record. You can get free credit from here.

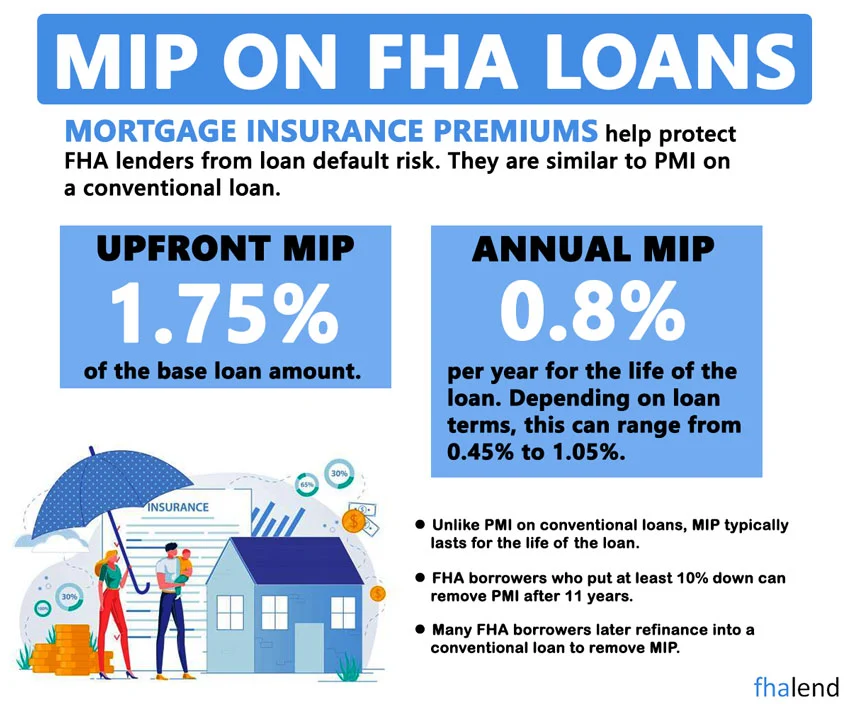

MIP/UPMIP – The Federal Housing Administration requires two types of mortgage insurance, regardless of the lender. This includes the UPMIP (Upfront Mortgage Insurance Premium) and the regular MIP (Mortgage Insurance Premium). FHA MIP acts similarly to how PMI (Private Mortgage Insurance) on a conventional loan acts. You can use our loan calculator to estimate your monthly payment and mortgage insurance costs.

DTI – You need to take a close look at this point. It is hard to get mortgage lenders to agree on this point, but an FHA loan with a debt load greater than 41 to 45 percent poses a high risk. You are required to have a job that lasts for two years and has no unexplained breaks.

DTI – You need to take a close look at this point. It is hard to get mortgage lenders to agree on this point, but an FHA loan with a debt load greater than 41 to 45 percent poses a high risk. You are required to have a job that lasts for two years and has no unexplained breaks.

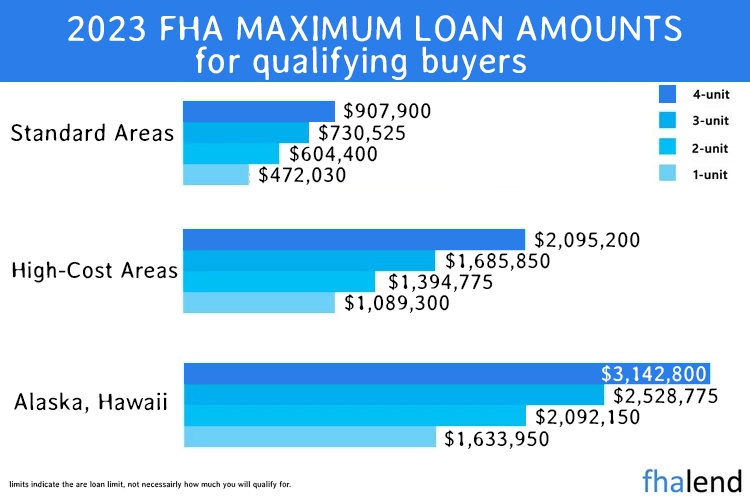

FHA loan limits in Georgia for high costs areas – There are high-cost areas in Georgia, these are counties: Butts, Carroll, Cherokee, Clayton, Cobb, Coweta, Dawson, Dekalb, Douglas, Fayette, Forsyth, Fulton, Gwinnett, Haralson, Heard, Henry, Jasper, Lamar, Meriwether, Morgan, Newton, Paulding, Pickens, Pike, Rockdale, Spalding, Walton. In these areas, you can qualify for up to $592,250 for single home family, for duplex you can borrow up to $758,200, if you’re buying a triplex you can get $916,450 financing and for a multifamily 4-unit building a lender can lend up to $1,138,950 with 3,5% down payment.

Cash reserves required – In contrast to most conventional home loan programs, Georgia’s FHA home loan is a very tempting option for first-time homeowners that have little money saved.

If you want to find a home that’s eligible, check out single-family homes and condos. If so, the home is likely fine for FHA financing, regardless of the type of sale (Foreclosure, Short Sale, REO, etc) Home buyers will find the latest 2023 FHA loan limits here. The home loan interest rates in Georgia are $472,030 for a single-unit property. Although it is possible to find some locations in Atlanta that allow for much higher loan limits than $471,500.

FHA Maximum Loan Amount in Georgia

The FHA currently sets its floor limit at 65 percent of the national conforming loan limit of $647,200 for a one-unit property. That means that the lowest maximum FHA loan amount in Georgia available in most areas is $472,030. The agency’s ceiling limit is 150 percent of the national conforming loan limit or $726,525 for a one-unit property in high-cost areas. In certain special exception areas – such as Alaska, Guam, Hawaii, and the U.S. Virgin Islands – the FHA’s ceiling limit is even higher, at 175 percent of the national conforming loan limit. These higher limits are intended to provide access to financing for properties that are relatively expensive to purchase or refinance.

If you’re considering an FHA loan, it’s important to understand the agency’s FHA loan limits in Georgia and how they might affect your borrowing power. You can use this tool to estimate how much you could borrow with an FHA loan based on the current maximum loan amount in Georgia in your area. Remember, these limits are subject to change, so it’s a good idea to check back periodically to see if they’ve been updated.

If you’re interested in an FHA loan, contact a participating lender to get started.

How FHA Loan Limits in Georgia are Calculated

FHA loan limits in Georgia are primarily determined by median home prices in a given area. The agency sets a “floor” limit – the lowest maximum loan amount available – and a “ceiling” limit – the highest maximum loan amount available. FHA loan limits in Georgia can change annually, based on changes in average home prices. For example, if median home prices in an area rise, the FHA will raise its maximum loan limit for that area to keep pace with the increase.

Similarly, if median home prices fall, the FHA will lower its maximum loan limit for that area. However, there is one exception to this rule: If an area’s housing costs remain relatively stable from year to year, the FHA will not make any adjustments to the loan limits in Georgia for that county.

Do you feel that you are losing ground on achieving your homeownership goals due to your finances? You may have a financial plan or a vision board that will help you get your home. But things may still not work out.

You need to change your tact and look into viable purchasing options. Mortgages are pretty popular and proven in the real estate and property industry. The flaw in most people’s plans usually lies in understanding and making the mortgage work for you.

Despite what people may recommend, always be sure to do your due diligence. Engage experts when seeking an FHA loan in Georgia. It will save a lot of stress and get you closer to your dream home quicker.

Read on to find out more about these FHA loans.

What Are FHA Loans?

FHA mortgage loans are loans that the government finances. It lets the lenders finance you by assuring them of your entire payments.

What Are the Loan Requirements?

Though it is simpler to get an FHA loan for a mortgage than other mortgages, there are specific base requirements that you must fulfill before you can access it. The needs will revolve around ascertaining your credibility.

The process and documentation might seem tedious, but they are necessary for your security and the financier. In addition, your previous financial records will play a significant role in approving your FHA loans. So, whether you’ve been saving up or not, you will have something to savor.

The following questions will help you prepare adequately on how to get an FHA loan in Georgia:

What Are the Credit Requirements?

Various factors will affect the calculation of your credit score:

- Your debt history

- How do you pay your bills

- Amount of credit accounts

- How long you have been in debt

- Your recent financial activities

Each factor has an allocated percentage that will ultimately determine your credit score. Typically, the higher the score, the better for the lenders. Avoid using lots of credits if you intend on getting a good credit score.

Your debt-to-income ratio will also influence the type of mortgage that you will get. It is a requirement that your mortgage repayment is not more than 43% of your gross income. Therefore, ensure that you have a low DTI score to increase your chances of getting a good mortgage deal.

Lower credit scores of below 500 will prove that you are a risk to mortgage lenders, and it may be difficult for you to get an FHA loan in Georgia. Therefore, you will need to improve your credit score before considering getting a mortgage.

If you have been bankrupt, wait out for a couple of years before obtaining an FHA loan in Georgia. Then, applying will limit your chances of getting approved because of your credit history. Be sure to also build yourself before jumping right back into debt.

What is a Down Payment For FHA Loan in Georgia

Your deposit should be at least 3.5% of your total property value. Your credit score will determine how much down payment you pay.

For credit scores above 580, you will only require at least 3.5% of your loan for your deposits. For scores between 500-579, you will need 10% of your loan. So again, it goes to show how important your credit score is when getting an FHA loan in Georgia.

You need to have your deposit despite going for the FHA mortgage loan to finance your dream home. There are various ways that you can use to fund your deposit. For example, you can use your savings, ask your family to chip in or utilize any gifts that you might get.

Does Your Type of Income Matter When It Comes to FHA Loans?

Your income is an essential factor in your FHA loan application. This is because the DTI, which affects your FHA loan for a mortgage, is derived from your income.

Different types of income will require additional documentation for you to qualify for the loan. Salaried employees are considered to have the easiest path to qualifying your loan. You will only need your payslips and statements for two years, which they will evaluate your income over the period.

Your employer will also need to commit themselves in writing to the financiers to affirm that you are an employee in their firm.

Freelancers and self-employed people will also need to present their income statements for two years. It will help them analyze if you can pay up their loan. Your income will need to be consistent or rising over the period for you to have a chance of getting the mortgage.

Other acceptable types of income are dividends, pensions, retirement, or social security. You only need to prove with documentation on your sources of income. The more consistent and stable your income is, the better your chances of getting an FHA loan in Georgia.

Other acceptable types of income are dividends, pensions, retirement, or social security. You only need to prove with documentation on your sources of income. The more consistent and stable your income is, the better your chances of getting an FHA loan in Georgia.

As per the mortgage requirements, your income may not exceed the set median area income for you to qualify. Therefore, have this in mind when going for FHA loans.

You need to also factor in any deductions that you incur on your income. It will affect you significantly if you are a freelancer. Always ensure you look into these deductions and analyze your bargaining power when getting an FHA loan in Georgia.

Do You Need a Mortgage Insurance For FHA Loan?

FHA loans will always require you to get an FHA Mortgage insurance premium when signing up. The primary aim of the FHA mortgage insurance is to cushion the lender in case things go south and you cannot pay your loan.

There are two mandatory types of insurance that you have to get when going for FHA loans:

Upfront Mortgage Insurance Premium

You can calculate this premium by taking 1.75% of the total loan amount, and you pay it upfront once you receive the cash. Sometimes, this premium is included upfront as the loan costs in your final amount.

Annual Mortgage Insurance Premium

As the name suggests, the annual premium will vary according to the loan terms and their specifics. Usually, it will be deducted monthly after getting the yearly value that you need to pay.

Ensure that you get the specifics from the lenders and insurers to avoid getting confused with the bulky numbers and data you will have to sign at the end. It will also help you in planning your finances.

How Do You Determine the Value of Your Home When Taking an FHA Loan?

You need to understand that you will not have it with FHA Loan because you dream of a particular house. Instead, a valuer will need to assess your property and give the lender feedback on the value and availability of the home on the mortgage.

Whether you are thinking about refinancing your loan, renovating your home, or getting a new home, you will need to get the valuer to give the lenders a definite figure on the value of their loan.

Additionally, it would help if you were keen to get an FHA-approved appraiser. Without their word, you cannot get an FHA loan for a mortgage.

How Long Does It Take To Close Your FHA Loan in Georgia?

The most challenging part about obtaining an FHA loan in Georgia is waiting for feedback from their office even though there is a thirty-day rule that they must respond within the given period.

However, the onus is on you to ensure that you submit a filled form. Any missing information on an application form will make the lenders not start processing your application. The thirty-day period will only begin when you present the required data to the lenders.

What Next After Getting Your Feedback?

Once you know how to get an FHA loan in Georgia and make your application, you need to close your loan within 60 days of approval. It would also help make the necessary plans on the acquisition and ownership documents within the required period.

Types of FHA Loans

There are other types of FHA loans that might interest you while at them. These loans mainly deal with home improvements. Here are some of them:

Rehab Mortgage

Property Improvement Loan

Energy Efficient Mortgage

Construction to Permanent Mortgage

Cash-Out Refinance

FHA Streamline

The FHA streamline allows you to take an additional loan if you can satisfy their requirements:

- Be up to date with your current mortgage payments (no late payments for at least six months)

- Your home has a higher value than your loan

The advantage of this loan is getting a better payment plan and lesser insurance premiums. Ensure you consult with your FHA loan agent before taking this loan.

Conventional Loan

Steps to Take When Applying for the FHA Loan Georgia

Applying for an FHA loan in Georgia can be quite the process. With the numerous documents required, you need to prepare yourself adequately. Your first approval in the application will come from your documents’ authenticity and availability.

While presenting your documents, ensure that the necessary personnel verifies the records and are up to date. People can misinterpret outdated documents as false documents. Therefore, countercheck your documents before submitting them. If you are unsure of which documents you need, don’t be afraid to ask and consult widely.

You also need to understand your budget and make the necessary calculations on your mortgage. It will help you make a workable financial plan for the repayment process. In addition, knowing how much you will need in insurance premiums and the monthly repayments will let you know which property is within your bracket.

Avoid making plans on expectations but work with your current and available finances. Additionally, choose a meaningful piece of property or home that will meet your needs as well as your finances.

If you do not know how to calculate your mortgage payments, look for different mortgage calculators to give you an accurate figure. You can even have a mortgage expert guide you in your decisions. Lastly, always compare offers to ensure you get the best deal. FHA loans have their benefits, and you should consider the entire package before committing to them.

What Are the Limitations of FHA Loans?

The limitations of FHA loans will vary across counties and as per the type of housing that is on offer. The county will consider the value and style of housing in the area and set a given limit.

It may go up to $823000 for some counties and as low as $356,500. You can inquire about the FHA loan office in Georgia on the limits.

The property for which you take the FHA loan has to be your primary residence. The loan doesn’t cover secondary or vacation homes that may be your investments.

Which Extra Costs Will You Incur in Your Closing Costs?

You may find that your FHA loan has some additional pre-imposed costs in your closing costs. You must fulfill these costs before you get your loan. Such charges include insurance premiums, lender fees, and prepaid items that may be due once you get preapproved.

There are also third-party fees that you will get in every FHA loan disbursement. Your understanding of these costs will help you calculate and affirm the amount received and the amount you need to pay.

Mortgage Insurance premiums

As discussed earlier, you need to pay these premiums to protect the lender if you cannot pay later: they are assurances of your payment. However, they may include only the upfront insurance premiums in your closing costs.

Financier Fees

The lender will charge you for various services like underwriting, document preparation, and origination fees. Therefore, it would help if you were keen to identify these costs when making your calculations.

Miscellaneous Fees

Other costs will include the third-party fees and the cost of prepaid items during your signage and approval. If you cannot identify these costs by yourself, ask the mortgage agents to explain in detail how they come to effect.

Such costs include courier fees, credit report fees, appraisal fees, recording fees, notary fees, real estate taxes, flood premiums.

A rule of thumb is always to inspect and analyze your property and loan costs to account for your resources properly. You will also be required to foot these costs. Therefore, brace yourself to cater for them lest you get stuck at the last hurdle.

FHA Loan Interest Rates

Lower interest rates are one of the most attractive features of FHA loans. They are low due to the government backing, which gives the borrower more credit. The basic logic is trust in the government and its presence, even if things don’t work out.

How Can You Compare the FHA Loans to Other Mortgages?

The difference between FHA to other conventional mortgages will lie in the benefits and disadvantages of each. However, FHA loans will provide a better deal for most first-time home buyers due to the requirements and conducive rates.

But it is not limited to first-time home buyers. It is the go-to home mortgage loan because of its numerous benefits. The bottom line is you can compare them to the conventional mortgage companies in your county and gauge which type will suit your needs.

They will vary in down payments, interest rates, loan limits, loan repayment plans, and others. Also, it would help if you investigated what you have and what you can offer before taking the bold step.

Pros of Using FHA Loans

There are many benefits of using FHA loans and mortgages. First, the interest rates and deposits are pretty low compared to conventional loans. Second, it gives everyone a bare chance to own a home.

You can easily choose an adjusted repayment plan of either 15 or 30 years. It gives you a more extended period which you can plan and pay comfortably.

FHA loans do not require a high base credit score. For example, with a credit score of 500, compared to 600+ in conventional loans, you can apply for your FHA loan and get approved.

FHA loans give those who have been declared bankrupt a second chance in debt and owning a home. But you will need to sit out at least two years before applying for it.

FHA loans give you an option of refinancing if you have been keeping up with your payments. The refinancing option might prove more accessible and less cumbersome, especially since you have already gained their trust.

The loan limits of FHA loans can go up to $800k. This amount could get you a beautiful home in a lovely location within your county with proper planning.

Cons of FHA Loans

The application process is quite cumbersome, tedious, and time-consuming. The documentation needed should be up to per and accurate. This application usually puts some people off and causes them to despair.

There are a lot of limitations on the pricing and valuation of loans and property. For example, FHA loans limit you to residing in the purchased home. It would help if you used only an FHA-approved valuer on all your assessments, which can be pretty expensive.

The closing costs will be an additional financial burden on your loan applications. However, mortgage experts put it at around 6% of your total charges.

The county location and price limits limit FHA loans. These limitations will vary as per the inflation and period. But it would help if you kept up with them regardless of your house and location choice.

Your chosen home will also be subject to evaluation by a member of the FHA approver team. But, they will not approve your loan if it does not meet the required safety, security, and structural integrity standards. This rejection will send you back to the drawing board.

Ultimately, these drawbacks are usually for your good. But the daunting process is what makes them quite a disadvantage.

Which Precautions Should You Not Take When Thinking About FHA Loans?

You should always be ready for anything. It might be approval or disapproval. Thus, be prepared to keep on trying till you achieve your dream. If you can’t do it, who will?

Additionally, be ready to put in the hard work. There is a lot that they will demand from you.

Why Choose FHA Loan Georgia?

FHA loan in Georgia is the easy way out when thinking of owning a home. You only need an in-depth understanding to be a homeowner. Read on here to learn about them.

Once you gain this knowledge, you will be in a better place to make sound decisions on your FHA loan mortgage.

Contact us for any guidance on processing, applying, and calculating your FHA loan for a mortgage.

Georgia Down Payment Assistance Program

The Georgia Dream Homeownership Program (GDHP) provides low- and moderate-income first-time home buyers with access to affordable financing.

The program includes down payment assistance loans of:

- The average price paid for the home is $7,500.

- For public protectors, educators, healthcare workers, active military personnel, and buyers who live with a disability or a disabled family member, $10,000 is the maximum compensation.

Borrowers must meet local household income restrictions and have liquid assets of no more than $20,000 or 20% of the home purchase price (whichever is greater).

You may find the information you need on the GDHP website. And, at HUD’s request, Georgia has listed additional DPA programs.