FHA Loan Limits in Alabama: Mortgage Guidelines 2023

2023 FHA loan limits in Alabama are set at $472,030, and there is no high-cost areas for counties in Alabama.

2023 FHA loan limits in Alabama are set at $472,030, and there is no high-cost areas for counties in Alabama.

for 2-units, the fha loan limits are set at $604,400. The FHA limits for 3 units in Alabama in 2023 sit at $730,525. You can borrow up to $907,900 when purchasing a 4-unit building with FHA loan in 2023 (house hacking – living in 1 unit and renting 3 others) in Alabama.

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| AUTAUGA | 472,030 | 604,400 | 730,525 | 907,900 | 190,000 |

| BALDWIN | 472,030 | 604,400 | 730,525 | 907,900 | 275,000 |

| BARBOUR | 472,030 | 604,400 | 730,525 | 907,900 | 119,000 |

| BIBB | 472,030 | 604,400 | 730,525 | 907,900 | 293,000 |

| BLOUNT | 472,030 | 604,400 | 730,525 | 907,900 | 293,000 |

| BULLOCK | 472,030 | 604,400 | 730,525 | 907,900 | 103,000 |

| BUTLER | 472,030 | 604,400 | 730,525 | 907,900 | 135,000 |

| CALHOUN | 472,030 | 604,400 | 730,525 | 907,900 | 125,000 |

| CHAMBERS | 472,030 | 604,400 | 730,525 | 907,900 | 175,000 |

| CHEROKEE | 472,030 | 604,400 | 730,525 | 907,900 | 135,000 |

| CHILTON | 472,030 | 604,400 | 730,525 | 907,900 | 293,000 |

| CHOCTAW | 472,030 | 604,400 | 730,525 | 907,900 | 104,000 |

| CLARKE | 472,030 | 604,400 | 730,525 | 907,900 | 146,000 |

| CLAY | 472,030 | 604,400 | 730,525 | 907,900 | 66,000 |

| CLEBURNE | 472,030 | 604,400 | 730,525 | 907,900 | 163,000 |

| COFFEE | 472,030 | 604,400 | 730,525 | 907,900 | 165,000 |

| COLBERT | 472,030 | 604,400 | 730,525 | 907,900 | 151,000 |

| CONECUH | 472,030 | 604,400 | 730,525 | 907,900 | 115,000 |

| COOSA | 472,030 | 604,400 | 730,525 | 907,900 | 149,000 |

| COVINGTON | 472,030 | 604,400 | 730,525 | 907,900 | 103,000 |

| CRENSHAW | 472,030 | 604,400 | 730,525 | 907,900 | 116,000 |

| CULLMAN | 472,030 | 604,400 | 730,525 | 907,900 | 154,000 |

| DALE | 472,030 | 604,400 | 730,525 | 907,900 | 103,000 |

| DALLAS | 472,030 | 604,400 | 730,525 | 907,900 | 65,000 |

| DEKALB | 472,030 | 604,400 | 730,525 | 907,900 | 79,000 |

| ELMORE | 472,030 | 604,400 | 730,525 | 907,900 | 190,000 |

| ESCAMBIA | 472,030 | 604,400 | 730,525 | 907,900 | 207,000 |

| ETOWAH | 472,030 | 604,400 | 730,525 | 907,900 | 152,000 |

| FAYETTE | 472,030 | 604,400 | 730,525 | 907,900 | 78,000 |

| FRANKLIN | 472,030 | 604,400 | 730,525 | 907,900 | 95,000 |

| GENEVA | 472,030 | 604,400 | 730,525 | 907,900 | 163,000 |

| GREENE | 472,030 | 604,400 | 730,525 | 907,900 | 204,000 |

| HALE | 472,030 | 604,400 | 730,525 | 907,900 | 204,000 |

| HENRY | 472,030 | 604,400 | 730,525 | 907,900 | 163,000 |

| HOUSTON | 472,030 | 604,400 | 730,525 | 907,900 | 163,000 |

| JACKSON | 472,030 | 604,400 | 730,525 | 907,900 | 148,000 |

| JEFFERSON | 472,030 | 604,400 | 730,525 | 907,900 | 293,000 |

| LAMAR | 472,030 | 604,400 | 730,525 | 907,900 | 352,000 |

| LAUDERDALE | 472,030 | 604,400 | 730,525 | 907,900 | 151,000 |

| LAWRENCE | 472,030 | 604,400 | 730,525 | 907,900 | 188,000 |

| LEE | 472,030 | 604,400 | 730,525 | 907,900 | 309,000 |

| LIMESTONE | 472,030 | 604,400 | 730,525 | 907,900 | 271,000 |

| LOWNDES | 472,030 | 604,400 | 730,525 | 907,900 | 190,000 |

| MACON | 472,030 | 604,400 | 730,525 | 907,900 | 113,000 |

| MADISON | 472,030 | 604,400 | 730,525 | 907,900 | 271,000 |

| MARENGO | 472,030 | 604,400 | 730,525 | 907,900 | 71,000 |

| MARION | 472,030 | 604,400 | 730,525 | 907,900 | 120,000 |

| MARSHALL | 472,030 | 604,400 | 730,525 | 907,900 | 151,000 |

| MOBILE | 472,030 | 604,400 | 730,525 | 907,900 | 145,000 |

| MONROE | 472,030 | 604,400 | 730,525 | 907,900 | 67,000 |

| MONTGOMERY | 472,030 | 604,400 | 730,525 | 907,900 | 190,000 |

| MORGAN | 472,030 | 604,400 | 730,525 | 907,900 | 188,000 |

| PERRY | 472,030 | 604,400 | 730,525 | 907,900 | 121,000 |

| PICKENS | 472,030 | 604,400 | 730,525 | 907,900 | 204,000 |

| PIKE | 472,030 | 604,400 | 730,525 | 907,900 | 136,000 |

| RANDOLPH | 472,030 | 604,400 | 730,525 | 907,900 | 125,000 |

| RUSSELL | 472,030 | 604,400 | 730,525 | 907,900 | 270,000 |

| ST. CLAIR | 472,030 | 604,400 | 730,525 | 907,900 | 293,000 |

| SHELBY | 472,030 | 604,400 | 730,525 | 907,900 | 293,000 |

| SUMTER | 472,030 | 604,400 | 730,525 | 907,900 | 93,000 |

| TALLADEGA | 472,030 | 604,400 | 730,525 | 907,900 | 108,000 |

| TALLAPOOSA | 472,030 | 604,400 | 730,525 | 907,900 | 149,000 |

| TUSCALOOSA | 472,030 | 604,400 | 730,525 | 907,900 | 204,000 |

| WALKER | 472,030 | 604,400 | 730,525 | 907,900 | 75,000 |

| WASHINGTON | 472,030 | 604,400 | 730,525 | 907,900 | 145,000 |

| WILCOX | 472,030 | 604,400 | 730,525 | 907,900 | 101,000 |

| WINSTON | 472,030 | 604,400 | 730,525 | 907,900 | 111,000 |

FHA Multifamily Loan Limits in Alabama

Based on FHA loan limits in Alabama, if you’re looking to buy a multifamily property you can borrow up to

- $472,030for a single home family

- for duplex (2-units) $604,400

- for triplex (3-units) $730,525

- Fourplex (4-unit) $907,900

in all counties in Alabama, there are the same FHA limits, if your loan is higher than certain limits in your area you can come up with a difference at the closing as a downpayment. For example, if you’re buying a 4-unit and you need a loan for $900,000 you can come up with an extra $90,850 at the closing table and get a loan financed by lowering your risk so your mortgage rate will be lower as well.

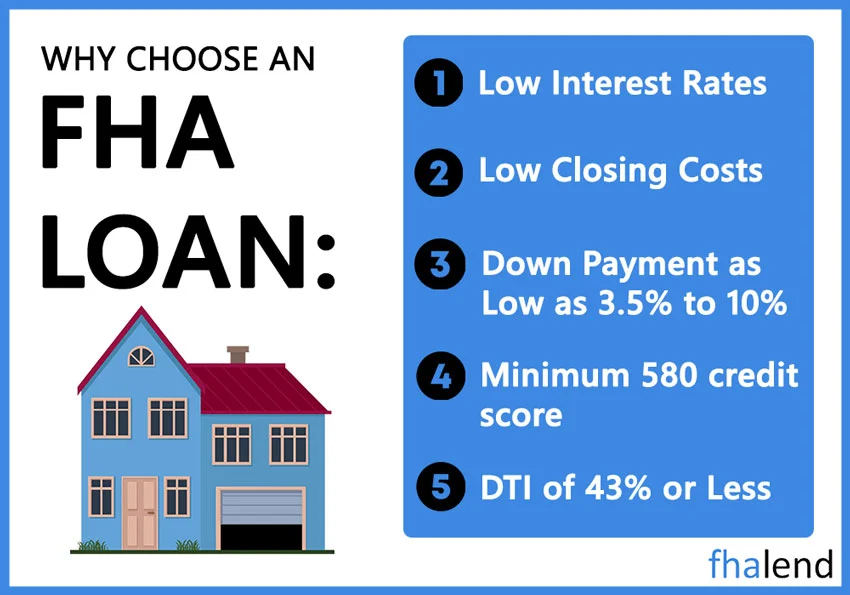

Steps to Qualify For an FHA Loan in Alabama in 2023

Employment History – to qualify for the FHA loan in Alabama you need to have a stable income. A Loan Officer will require 2 years of proof of employment W2 or 1099. You need consistent employment/income. The house you will be purchasing or refinancing with FHA in Alabama needs to be your primary residence. The government that provides the loan will not lend money on investment properties, 2nd home,s or vacation homes.

Employment History – to qualify for the FHA loan in Alabama you need to have a stable income. A Loan Officer will require 2 years of proof of employment W2 or 1099. You need consistent employment/income. The house you will be purchasing or refinancing with FHA in Alabama needs to be your primary residence. The government that provides the loan will not lend money on investment properties, 2nd home,s or vacation homes.

- Financial Statements – You need to provide your 2 most recent bank statements, 60days of pay stubs, and tax returns for the last 2 years.

- Credit Score – You must have at least a 500 FICO score to qualify for the FHA loan in Alabama. If your score is at 580 you need only 3,5% down instead of 10%. HUD requires a 3,5% down payment for the FHA Loan depending on your credit score. On a $200,000 house, you will need $7,500. If your credit score is between 500–579, and you’re buying a house worth $200.000 you need to come up with a $20,000.

- Debt-to-Income (DTI) – 43% DTI or lower. However, if you have “compensating factors” you might be able to get a loan.

- MIP – All FHA loans, regardless of the lender, require two types of mortgage insurance. Upfront Mortgage Insurance Premium and the regular Mortgage Insurance Premium are two insurances required by FHA when you buing a house in Alabama. Use our loan calculator to estimate your monthly payment and mortgage insurance costs.

- FHA Loan Limits in Alabama – FHA loans have maximum lending limits, which are set at the county level. You can view the 2023 FHA loan limits for all counties in Alabama above.

Alabama Down Payment Assistance Program

The Alabama Housing Finance Authority’s Step Up program allows you to borrow your down payment in a 10-year second mortgage. There are certain restrictions:

- Your household income may not exceed $130,600.

- You’ll need a credit score of 640 or higher (680 or higher if you make more than 80% of your region’s median income)

- The Step Up program accepts only certain forms of first (initial) mortgages: FHA, VA, or USDA loans from the Housing Finance Authority Advantage conventional loan category.

Get more information from the Step Up website. Take a look at HUD’s list of alternative options in Alabama.