FHA Loan Limits in South Carolina

If you’re considering purchasing a multifamily property in South Carolina, be sure to research FHA loan limits in South Carolina for a specific state. This information will help you determine what types of properties are within your budget and make an informed decision about which one is right for you.

If you’re considering purchasing a multifamily property in South Carolina, be sure to research FHA loan limits in South Carolina for a specific state. This information will help you determine what types of properties are within your budget and make an informed decision about which one is right for you.

FHA multifamily limits in South Carolina can vary depending on the type of property you’re interested in purchasing. However, it’s important to keep in mind that these limits may affect the prices of properties in the state. When searching for a multifamily property, be sure to keep your budget in mind and consider all of your options before making a final decision. FHA loan limits in South Carolina can vary depending on the type of property you’re interested in purchasing.

However, it’s important to keep in mind that these limits may affect the prices of properties in the state. When searching for a multifamily property, be sure to keep your budget in mind and consider all of your options before making a final decision.

FHA Loan Limits in South Carolina by County in 2022

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| ABBEVILLE | $472,030 | $604,400 | $730,525 | $907,900 | $139,000 |

| AIKEN | $472,030 | $604,400 | $730,525 | $907,900 | $275,000 |

| ALLENDALE | $472,030 | $604,400 | $730,525 | $907,900 | $38,000 |

| ANDERSON | $472,030 | $604,400 | $730,525 | $907,900 | $288,000 |

| BAMBERG | $472,030 | $604,400 | $730,525 | $907,900 | $44,000 |

| BARNWELL | $472,030 | $604,400 | $730,525 | $907,900 | $78,000 |

| BEAUFORT | $485,300 | $621,250 | $750,950 | $933,300 | $422,000 |

| BERKELEY | $538,200 | $689,000 | $832,850 | $1,035,000 | $468,000 |

| CALHOUN | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| CHARLESTON | $538,200 | $689,000 | $832,850 | $1,035,000 | $468,000 |

| CHEROKEE | $472,030 | $604,400 | $730,525 | $907,900 | $117,000 |

| CHESTER | $472,030 | $604,400 | $730,525 | $907,900 | $395,000 |

| CHESTERFIELD | $472,030 | $604,400 | $730,525 | $907,900 | $120,000 |

| CLARENDON | $472,030 | $604,400 | $730,525 | $907,900 | $165,000 |

| COLLETON | $472,030 | $604,400 | $730,525 | $907,900 | $181,000 |

| DARLINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $180,000 |

| DILLON | $472,030 | $604,400 | $730,525 | $907,900 | $58,000 |

| DORCHESTER | $538,200 | $689,000 | $832,850 | $1,035,000 | $468,000 |

| EDGEFIELD | $472,030 | $604,400 | $730,525 | $907,900 | $275,000 |

| FAIRFIELD | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| FLORENCE | $472,030 | $604,400 | $730,525 | $907,900 | $180,000 |

| GEORGETOWN | $472,030 | $604,400 | $730,525 | $907,900 | $325,000 |

| GREENVILLE | $472,030 | $604,400 | $730,525 | $907,900 | $288,000 |

| GREENWOOD | $472,030 | $604,400 | $730,525 | $907,900 | $141,000 |

| HAMPTON | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| HORRY | $472,030 | $604,400 | $730,525 | $907,900 | $311,000 |

| JASPER | $485,300 | $621,250 | $750,950 | $933,300 | $422,000 |

| KERSHAW | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| LANCASTER | $472,030 | $604,400 | $730,525 | $907,900 | $395,000 |

| LAURENS | $472,030 | $604,400 | $730,525 | $907,900 | $288,000 |

| LEE | $472,030 | $604,400 | $730,525 | $907,900 | $44,000 |

| LEXINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| MCCORMICK | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| MARION | $472,030 | $604,400 | $730,525 | $907,900 | $118,000 |

| MARLBORO | $472,030 | $604,400 | $730,525 | $907,900 | $103,000 |

| NEWBERRY | $472,030 | $604,400 | $730,525 | $907,900 | $138,000 |

| OCONEE | $472,030 | $604,400 | $730,525 | $907,900 | $197,000 |

| ORANGEBURG | $472,030 | $604,400 | $730,525 | $907,900 | $100,000 |

| PICKENS | $472,030 | $604,400 | $730,525 | $907,900 | $288,000 |

| RICHLAND | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| SALUDA | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| SPARTANBURG | $472,030 | $604,400 | $730,525 | $907,900 | $232,000 |

| SUMTER | $472,030 | $604,400 | $730,525 | $907,900 | $165,000 |

| UNION | $472,030 | $604,400 | $730,525 | $907,900 | $50,000 |

| WILLIAMSBURG | $472,030 | $604,400 | $730,525 | $907,900 | $38,000 |

| YORK | $472,030 | $604,400 | $730,525 | $907,900 | $395,000 |

What is an FHA Loan and How to Qualify in South Carolina

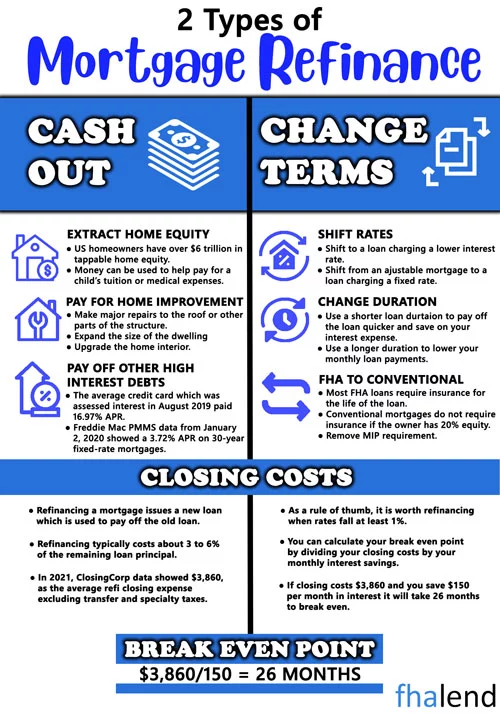

FHA loans are popular among first-time homebuyers and those with limited budgets because they require only a 3.5% down payment and have fairly lenient credit standards. You can refinance an FHA loan at any time, although you will need to meet certain requirements in order to do so. talk to your lender about their specific requirements, but generally, you will need to have made at least six months of payments on your loan before you can refinance.

You will also need to prove that you have the financial means to make the new payments, as well as any upfront costs associated with refinancing such as closing costs. Refinancing an FHA loan can be a great way to save money on your mortgage payment

How FHA Loan Limits in South Carolina Will Affect Your Property Search?

If you’re searching for multifamily properties in South Carolina, it’s important to be aware of the FHA loan limits in South Carolina set by the Federal Housing Administration (FHA). These limits determine how much you can borrow and could potentially affect your search.

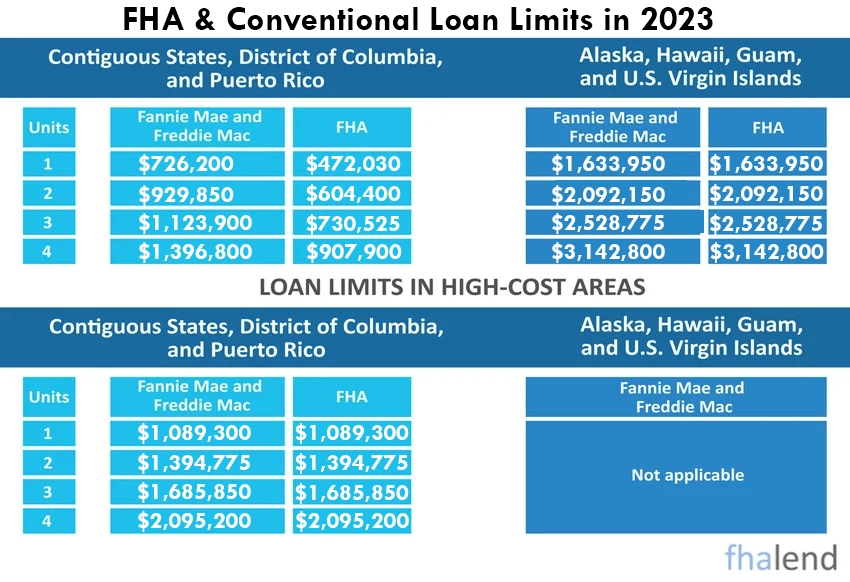

In general, FHA loan limits in South Carolina are calculated based on the area median income (AMI) for a given county. In South Carolina, the AMI is $85,500 for a one-person household and $538,650 for a four-person household. Based on these figures, the maximum loan amount you could borrow from the FHA would be:

One-person household: $726,200 x 65% = $472,030

Four-person household: $726,200 x 150% = $1,089,300

However, these are just the general loan limits. There are also FHA loan limits in South Carolina for specific property types, such as duplexes and triplexes. The maximum loan amount you could borrow for a duplex would be $604,400, while the maximum loan amount for a triplex would be $730,525.

Keep in mind that these loan limits are just maximums. You can still borrow less than the maximum amount if you want to. The important thing is to be aware of the limits so that you can properly plan your search.

Can I refinance the FHA loan in South Carolina?

Yes, you can refinance your FHA loan. In fact, refinancing an FHA loan is often a good idea for homeowners who want to take advantage of lower interest rates or get rid of their monthly mortgage insurance payments. If you have an FHA loan, you can refinance it into a conventional loan with a lower interest rate and no monthly mortgage insurance payments. However, you will need to have at least 20% equity in your home to qualify for this type of refinancing.

If you don’t have 20% equity, you can still refinance your FHA loan into a Conventional Loan with Private Mortgage Insurance (PMI). The monthly PMI payments will be higher than if you had. You can certainly refinance your FHA loan if you feel it makes sense to do so. Some borrowers opt to refinance in order to secure a lower interest rate, while others do it in order to get rid of their mortgage insurance premium (MIP).

If you have an FHA loan that originated more than five years ago, chances are good that you’re paying for MIP. MIP is required for the entirety of a loan if it originated on or after June 3, 2013; for loans originating prior to that date, MIP can be canceled once the loan reaches 78% LTV. Depending on how long you’ve been paying your mortgage and how much equity you currently have in your house.

If you have an FHA loan that originated more than five years ago, chances are good that you’re paying for MIP. MIP is required for the entirety of a loan if it originated on or after June 3, 2013; for loans originating prior to that date, MIP can be canceled once the loan reaches 78% LTV. Depending on how long you’ve been paying your mortgage and how much equity you currently have in your house.

Who Gives FHA Loan in South Carolina?

There are a few different entities that offer FHA loans. The most common is the Federal Housing Administration, which is part of the Department of Housing and Urban Development. However, there are also some private lenders that offer FHA loans. FHA loans are given by the Federal Housing Authority, a government agency. The purpose of the FHA is to increase homeownership by making it easier and more affordable for people to get mortgages.

To that end, the FHA offers low down payment loans and relaxed credit requirements. Anyone who is a qualified mortgage lender can give an FHA loan. To become a qualified mortgage lender, you must be approved by the Federal Housing Administration (FHA). The FHA does not approve individual lenders; it approves lending organizations that meet certain qualifications. These qualifications include having lending experience, being properly insured and capitalized, and demonstrating a commitment to fair lending practices.

FHA Loan Requirements in South Carolina

If you’re looking to get an FHA loan, there are certain requirements you’ll need to meet in order to qualify. In this blog post, we’ll outline those requirements so you can be better prepared when applying for an FHA loan.

The first requirement is that you must have a valid Social Security number. This is necessary in order to pull your credit history, which will be used to determine your eligibility for the loan.

Next, you’ll need to show proof of employment and income. The lender will want to see that you have a steady job and are able to make the monthly payments on the loan. They may also require some documentation of your income, such as pay stubs or tax returns.

You’ll also need to have a down payment saved up. The down payment on an FHA loan can be as low as 3.5%, but you’ll need to have some cash saved up for it.

Finally, you’ll need to meet the minimum credit score requirements set by the FHA. For most loans, you’ll need a credit score of 500 or higher. However, there are some exceptions, so it’s always best to check with your lender to see what their specific requirements are.

If you meet all of these requirements, you should be eligible for an FHA loan. Be sure to shop around and compare rates from different lenders before you decide on one, as there can be significant differences in both interest rates and fees.

How FHA Loan Limits in South Carolina are Calculated?

FHA loan limits in South Carolina are calculated according to a formula prescribed by the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac. The GSEs keep their formulas secret, but they are required to publish loan limits annually.

The current formula has been in place since 2006 when Congress enacted the Housing and Economic Recovery Act (HERA). Under HERA, the GSEs’ limit is equal to 115% of the median home price in the county or metropolitan statistical area (MSA) in which the borrower lives, with a floor and ceiling on that number.

The Federal Housing Administration (FHA) insures home loans made by approved lenders. The maximum amount for an FHA-insured loan depends on a number of factors, including the size of the property, the type of property, and whether the property is in a high-cost area.

The basic limit for an FHA-insured loan is $420,680 for a single-family dwelling in most places in the United States. However, this limit can be higher in certain high-cost areas, such as Hawaii and Alaska. In these areas, the limit is $696,950 for a single-family dwelling.

South Carolina Down Payment Assistance Program

The South Carolina State Housing Finance and Development Authority issues both mortgage loans and down payment assistance. This is intended to assist low-to-moderate-income families and individuals who are buying their first home.

The Palmetto Home Advantage mortgage is available with a regular, FHA, VA, or USDA loan. With a $0.00 monthly payment and down payment assistance up to 4% of the loan amount “with a $0.00 monthly payment,” it comes with down payment help.

The South Carolina Housing Finance Agency’s Homeownership for Everyone program is a government-sponsored mortgage assistance program that offers down payment, closing cost, and monthly mortgage payments assistance to qualified households. The goal of the program is to help low-income families buy or build their own homes by lowering the costs associated with buying or constructing a house. You can contact one of the lenders who participate in the program for further information. Check out HUD’s list of additional homeownership support programs in South Carolina.