FHA Loan Limits in Nebraska in 2023

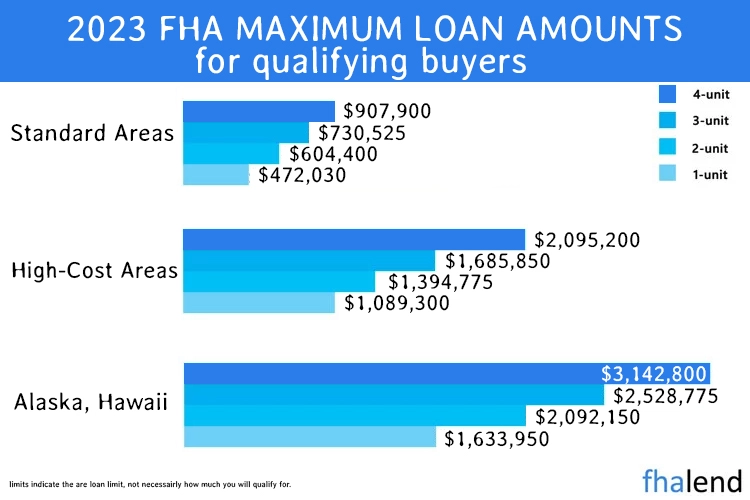

The FHA loan limits in Nebraska are calculated each year, the loan limit is based on 65% of the national conforming loan limit. The 2023 floor amount for one-unit properties is $472,030, which is up from $420,680 in 2022. The ceiling amount for one-unit properties is $970,800, which is up from $970,800 in 2022.

The FHA loan limits in Nebraska are calculated each year, the loan limit is based on 65% of the national conforming loan limit. The 2023 floor amount for one-unit properties is $472,030, which is up from $420,680 in 2022. The ceiling amount for one-unit properties is $970,800, which is up from $970,800 in 2022.

FHA loan limits in Nebraska are calculated based on the national conforming loan limit, which is the highest loan limit allowed by Fannie Mae and Freddie Mac. The limit is calculated by taking 65% of the Freddie Mac national conforming loan limit. The 2019 FHA loan limits in Nebraska are:

- One-unit properties: $472,030

- Two-unit properties: $604,400

- Three-unit properties: $730,525

- Four-unit properties: $907,900

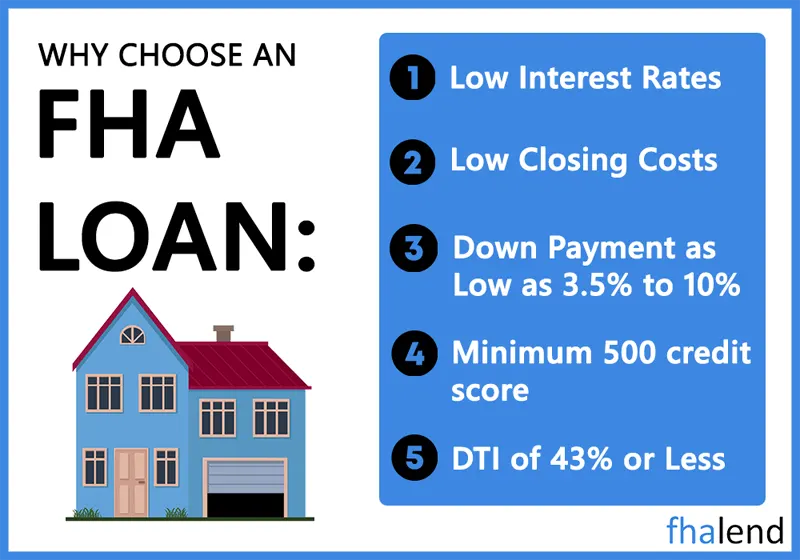

If you’re looking to get an FHA loan in Nebraska, you’ll need to have a down payment of at least 3.5% of the purchase price of the home. You’ll also need to have a credit score of at least 580 to qualify for the loan. If your credit score is between 500 and 579, you may still qualify for the loan, but you’ll need to put down 10% of the purchase price as a down payment.

If you’re looking to get an FHA loan in Nebraska, be sure to check the FHA loan limits in Nebraska for your county below. You can find the loan limits for your county on the FHA website. You’ll also need to have a down payment of at least 3.5% of the purchase price of the home and a credit score of at least 580 to qualify for the loan.

FHA Loan Limits in Nebraska by County in 2023

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| ADAMS | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| ANTELOPE | $472,030 | $604,400 | $730,525 | $907,900 | $60,000 |

| ARTHUR | $472,030 | $604,400 | $730,525 | $907,900 | $191,000 |

| BANNER | $472,030 | $604,400 | $730,525 | $907,900 | $231,000 |

| BLAINE | $472,030 | $604,400 | $730,525 | $907,900 | $104,000 |

| BOONE | $472,030 | $604,400 | $730,525 | $907,900 | $176,000 |

| BOX BUTTE | $472,030 | $604,400 | $730,525 | $907,900 | $76,000 |

| BOYD | $472,030 | $604,400 | $730,525 | $907,900 | $30,000 |

| BROWN | $472,030 | $604,400 | $730,525 | $907,900 | $72,000 |

| BUFFALO | $472,030 | $604,400 | $730,525 | $907,900 | $218,000 |

| BURT | $472,030 | $604,400 | $730,525 | $907,900 | $100,000 |

| BUTLER | $472,030 | $604,400 | $730,525 | $907,900 | $131,000 |

| CASS | $472,030 | $604,400 | $730,525 | $907,900 | $289,000 |

| CEDAR | $472,030 | $604,400 | $730,525 | $907,900 | $163,000 |

| CHASE | $472,030 | $604,400 | $730,525 | $907,900 | $186,000 |

| CHERRY | $472,030 | $604,400 | $730,525 | $907,900 | $167,000 |

| CHEYENNE | $472,030 | $604,400 | $730,525 | $907,900 | $132,000 |

| CLAY | $472,030 | $604,400 | $730,525 | $907,900 | $93,000 |

| COLFAX | $472,030 | $604,400 | $730,525 | $907,900 | $103,000 |

| CUMING | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| CUSTER | $472,030 | $604,400 | $730,525 | $907,900 | $172,000 |

| DAKOTA | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| DAWES | $472,030 | $604,400 | $730,525 | $907,900 | $105,000 |

| DAWSON | $603,750 | $772,900 | $934,250 | $1,161,050 | $525,000 |

| DEUEL | $472,030 | $604,400 | $730,525 | $907,900 | $120,000 |

| DIXON | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| DODGE | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| DOUGLAS | $472,030 | $604,400 | $730,525 | $907,900 | $289,000 |

| DUNDY | $472,030 | $604,400 | $730,525 | $907,900 | $114,000 |

| FILLMORE | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| FRANKLIN | $472,030 | $604,400 | $730,525 | $907,900 | $103,000 |

| FRONTIER | $472,030 | $604,400 | $730,525 | $907,900 | $83,000 |

| FURNAS | $472,030 | $604,400 | $730,525 | $907,900 | $67,000 |

| GAGE | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| GARDEN | $472,030 | $604,400 | $730,525 | $907,900 | $59,000 |

| GARFIELD | $472,030 | $604,400 | $730,525 | $907,900 | $156,000 |

| GOSPER | $603,750 | $772,900 | $934,250 | $1,161,050 | $525,000 |

| GRANT | $472,030 | $604,400 | $730,525 | $907,900 | $107,000 |

| GREELEY | $472,030 | $604,400 | $730,525 | $907,900 | $99,000 |

| HALL | $472,030 | $604,400 | $730,525 | $907,900 | $215,000 |

| HAMILTON | $472,030 | $604,400 | $730,525 | $907,900 | $182,000 |

| HARLAN | $472,030 | $604,400 | $730,525 | $907,900 | $152,000 |

| HAYES | $472,030 | $604,400 | $730,525 | $907,900 | $120,000 |

| HITCHCOCK | $472,030 | $604,400 | $730,525 | $907,900 | $102,000 |

| HOLT | $472,030 | $604,400 | $730,525 | $907,900 | $168,000 |

| HOOKER | $472,030 | $604,400 | $730,525 | $907,900 | $126,000 |

| HOWARD | $472,030 | $604,400 | $730,525 | $907,900 | $215,000 |

| JEFFERSON | $472,030 | $604,400 | $730,525 | $907,900 | $132,000 |

| JOHNSON | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| KEARNEY | $472,030 | $604,400 | $730,525 | $907,900 | $218,000 |

| KEITH | $472,030 | $604,400 | $730,525 | $907,900 | $155,000 |

| KEYA PAHA | $472,030 | $604,400 | $730,525 | $907,900 | $71,000 |

| KIMBALL | $472,030 | $604,400 | $730,525 | $907,900 | $108,000 |

| KNOX | $472,030 | $604,400 | $730,525 | $907,900 | $72,000 |

| LANCASTER | $472,030 | $604,400 | $730,525 | $907,900 | $250,000 |

| LINCOLN | $472,030 | $604,400 | $730,525 | $907,900 | $203,000 |

| LOGAN | $472,030 | $604,400 | $730,525 | $907,900 | $203,000 |

| LOUP | $472,030 | $604,400 | $730,525 | $907,900 | $121,000 |

| MCPHERSON | $472,030 | $604,400 | $730,525 | $907,900 | $203,000 |

| MADISON | $472,030 | $604,400 | $730,525 | $907,900 | $179,000 |

| MERRICK | $472,030 | $604,400 | $730,525 | $907,900 | $215,000 |

| MORRILL | $472,030 | $604,400 | $730,525 | $907,900 | $138,000 |

| NANCE | $472,030 | $604,400 | $730,525 | $907,900 | $105,000 |

| NEMAHA | $472,030 | $604,400 | $730,525 | $907,900 | $88,000 |

| NUCKOLLS | $472,030 | $604,400 | $730,525 | $907,900 | $99,000 |

| OTOE | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| PAWNEE | $472,030 | $604,400 | $730,525 | $907,900 | $30,000 |

| PERKINS | $472,030 | $604,400 | $730,525 | $907,900 | $158,000 |

| PHELPS | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| PIERCE | $472,030 | $604,400 | $730,525 | $907,900 | $179,000 |

| PLATTE | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| POLK | $472,030 | $604,400 | $730,525 | $907,900 | $157,000 |

| RED WILLOW | $472,030 | $604,400 | $730,525 | $907,900 | $119,000 |

| RICHARDSON | $472,030 | $604,400 | $730,525 | $907,900 | $60,000 |

| ROCK | $472,030 | $604,400 | $730,525 | $907,900 | $123,000 |

| SALINE | $472,030 | $604,400 | $730,525 | $907,900 | $135,000 |

| SARPY | $472,030 | $604,400 | $730,525 | $907,900 | $289,000 |

| SAUNDERS | $472,030 | $604,400 | $730,525 | $907,900 | $289,000 |

| SCOTTS BLUFF | $472,030 | $604,400 | $730,525 | $907,900 | $231,000 |

| SEWARD | $472,030 | $604,400 | $730,525 | $907,900 | $250,000 |

| SHERIDAN | $472,030 | $604,400 | $730,525 | $907,900 | $105,000 |

| SHERMAN | $472,030 | $604,400 | $730,525 | $907,900 | $122,000 |

| SIOUX | $472,030 | $604,400 | $730,525 | $907,900 | $231,000 |

| STANTON | $472,030 | $604,400 | $730,525 | $907,900 | $179,000 |

| THAYER | $472,030 | $604,400 | $730,525 | $907,900 | $60,000 |

| THOMAS | $472,030 | $604,400 | $730,525 | $907,900 | $177,000 |

| THURSTON | $472,030 | $604,400 | $730,525 | $907,900 | $104,000 |

| VALLEY | $472,030 | $604,400 | $730,525 | $907,900 | $148,000 |

| WASHINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $289,000 |

| WAYNE | $472,030 | $604,400 | $730,525 | $907,900 | $153,000 |

| WEBSTER | $472,030 | $604,400 | $730,525 | $907,900 | $50,000 |

| WHEELER | $472,030 | $604,400 | $730,525 | $907,900 | $143,000 |

| YORK | $472,030 | $604,400 | $730,525 | $907,900 | $145,000 |

FHA Maximum Loan Amount in Nebraska State

According to the Department of Housing and Urban Development (HUD), FHA-insured home loans can be used in High-Cost Areas, but the home must have a Higher Loan Limit than conventional mortgages. In 2023, the standard loan limit for most counties across the U.S. is $420,680. But in high-cost areas, the FHA allows higher limits, so FHA maximum loan amount in Nebraska is set at $1,161,050. This gives qualified homebuyers access to more expensive homes with the low down payment option that the FHA offers.

There are high-cost areas in NE state, there are 3 counties particularly (MCPerson county, Logan County and Lincoln) where FHA loan limits for a single home, 2-unit, 3-unit, and 4-unit are different than in other counties in Nebraska.

For borrowers in Nebraska, the FHA has a maximum loan limit of $472,030 for 2023 in Nebraska. This means that your mortgage cannot exceed this amount, regardless of the size of your down payment or the home’s purchase price. This figure is based on the median home prices in the state. The loan limit in Nebraska is calculated each year and may change depending on market conditions.

This number can impact your budget and determine how much house you can afford. It’s important to work with a lender to get pre-approved for a loan before you start shopping for homes. This way, you’ll know exactly how much you can borrow and what price range to look in.

The FHA maximum loan amount in Nebraska can change each year. If you’re in the market for a home, it’s important to stay up-to-date on the latest loan limits. This way, you can budget accordingly and avoid any surprises down the road.

FHA Multifamily Loan Limits in Nebraska

What Are the Maximum FHA Loan Limits to Buy a Single Home Family (SHF) in Nebraska

In all counties excluding McPerson, you can get financing up to $472,030 based on the latest HUD guidelines, in Nebraska state.

Maximum FHA Mortgage in Nebraska For Duplex

The maximum mortgage you can apply to buy a duplex in Nebraska is $604,400. A duplex house is a home that has two floors. There is just one dining area and one kitchen in this type of conforming property. A typical central wall divides the two living spaces, which may be side-by-side or on two levels, and there are separate entrances for each. A duplex house has two floors and is purchased and inhabited by one owner. Entry points for both levels may be established separately.

Max FHA Loan Amounts in Nebraska For Triplex

FHA max loan amount you can borrow for Triplex in Nebraska is set at $651.050. A triplex building is made up of three separate dwelling units linked together in one structure, with shared walls between them. Each unit of a triplex has its own kitchen, bathroom(s), living room, independent doors to the outside, and its own address or unit number.

FHA Loan Limits in Nebraska For Fourplexes

FHA multifamily loan limits for a Fourplex in Nebraska are set to $907,900. A fourplex is a multi-family home that serves as quarters for four different families under one roof. The multifamily units can be side by side or stacked on top of one another, but they are most often a mix of both. Each unit in a typical Quadplexes has its own door, kitchen, and bathrooms, although there may be a shared foyer or entryway.

Mortgage Programs Available in Nebraska

Nebraska state is not different than other US states, you can get an FHA loan with a downpayment as low as 3,5%.

An FHA loan is a government-backed mortgage that is available to borrowers with low credit scores. These loans have more lenient eligibility requirements and can be a good option for first-time homebuyers or borrowers with limited funds for a down payment.

If you are a veteran you can get into your dream home with 0% down (100% financing) and have no maximum loan amount requirements in Nebraska.

Veterans Affairs (VA) Loan: A VA loan is a mortgage loan available to eligible veterans and surviving spouses. These loans are guaranteed by the federal government and can offer special benefits, such as no down payment or private mortgage insurance requirements.

You can also apply for a mixed-use property loan, NON-QM loan, FHA 203k rehab loan or USDA loan.

A USDA loan is a government-backed mortgage available to eligible rural homeowners. These loans offer low-interest rates and may not require a down payment.

There are many other types of mortgage loans available in Nebraska, so be sure to speak with a loan officer to find the best option for you. With careful research and planning, you can choose the type of loan that will save you money and help you achieve your homeownership goals.

Most Expensive Cities in Nebraska To Live In

According to a recent study, the most expensive city to live in Nebraska in 2023 will be Omaha. The study looked at the cost of living in different cities across the state and found that Omaha was the most expensive, with an average cost-of-living index of 107.9. This is followed by Lincoln (103.3), Grand Island (102.1), and Kearney (101.7).

According to a recent study, the most expensive city to live in Nebraska in 2023 will be Omaha. The study looked at the cost of living in different cities across the state and found that Omaha was the most expensive, with an average cost-of-living index of 107.9. This is followed by Lincoln (103.3), Grand Island (102.1), and Kearney (101.7).

The study found that the cost of housing was the biggest factor in determining the overall cost of living in a city. Omaha had an average housing costs index of 112.5, Lincoln had an index of 109.4 and Grand Island had an index of 107.2. Other factors that were considered in the study included transportation, food, utilities, and health care.

If you’re looking to save money on your cost of living in Nebraska, the best place to live in Scottsbluff. The city had an overall cost of living index of 96.3, making it the most affordable city in the state. Other affordable cities in Nebraska include Hastings (97.2), North Platte (97.6), and Norfolk (98.3).

Omaha City in Nebraska

The median home value in Omaha is $156,000. Home values have gone up 4.8% over the past year and are predicted to rise another 2.7% within the next year. The median price per square foot is $103. Prices for homes in Omaha range from $50,000 – $1,200,000.

There is currently a 1.6% vacancy rate in Omaha, which is lower than the US average of 3.7%. This means that there are more people looking to buy homes in Omaha than there are homes available on the market, making it a seller’s market.

If you’re thinking of buying a house in Omaha, now is a good time to do so! Prices are predicted to continue rising steadily in the next few years, so if you’re able to buy now, you may see your home appreciate in value down the line. However, because it is currently a seller’s market, you may have difficulty finding the perfect home at your ideal price point. Be prepared to be flexible and move quickly when you do find a house that meets your needs!

Lincoln City in Nebraska

If you’re thinking of buying a house in Lincoln Nebraska, now is a good time to do so. Prices are expected to rise again in the next few years. When considering purchasing a home in Lincoln Nebraska, be sure to consult with a real estate agent to get the most accurate estimate of what you can expect to pay. They will also be able to tell you about any special programs or incentives that may be available to help you save money on your purchase.

If you’re looking for a great place to live, work, and raise a family, Lincoln Nebraska is a perfect choice. With its low cost of living and variety of amenities, it’s no wonder that Lincoln is one of the most popular places to call home in the United States.

Grand Island in Nebraska

It’s no secret that the cost of housing in Grand Island, Nebraska is on the rise. In fact, according to a recent report by Realtor.com, the median home price in Grand Island has increased by nearly 8% over the past year. And with interest rates still near historic lows, there’s no sign of this trend slowing down any time soon.

If you’re thinking about buying a home in Grand Island, now is the time to start doing your research. In this blog post, we’ll take a look at three important factors that will impact house prices in Grand Island over the next few years: population growth, job market conditions, and interest rates.

1. Population Growth

As the saying goes, “population growth creates demand for housing.” And that’s certainly true in Grand Island, where the population is expected to grow by nearly 2% per year through 2023. This population growth will be driven by a number of factors, including an influx of retirees and an increase in the number of families moving to Grand Island for its strong schools and quality of life.

2. Job Market Conditions

Another important factor that will impact house prices in Grand Island is the job market. Currently, the unemployment rate in Grand Island is just 2.4%, which is well below the national average of 3.9%. And with several new businesses opening up in town, including a new Amazon fulfillment center, the job market is only going to get stronger in the coming years. This will help to keep demand for housing high, which will in turn drive prices up.

3. Interest Rates

Finally, interest rates are another important factor to consider when trying to predict future house prices. Currently, mortgage rates are still near historic lows, but they are expected to start rising in the next few years. This means that if you’re thinking about buying a home on Grand Island, it’s best to do it sooner rather than later.

If you’re thinking about buying a home in Grand Island, Nebraska, now is the time to start doing your research. These three factors – population growth, job market conditions, and interest rates – will all have a big impact on house prices over the next few years. So, if you’re looking to buy a home in Grand Island, make sure to keep these factors in mind.

Benefits of FHA Loan in Nebraska

For one, FHA loans require a much lower down payment than most other mortgages (as little as 3.5%), which can make purchasing a home more attainable.

For one, FHA loans require a much lower down payment than most other mortgages (as little as 3.5%), which can make purchasing a home more attainable.

In addition, FHA loans are more flexible when it comes to credit score requirements, so even if your score isn’t perfect, you might still be eligible for this type of loan.

And finally, FHA loans come with low-interest rates, making them more affordable in the long run.

If you’re thinking about taking out an FHA loan in 2023, here are some of the key benefits to keep in mind.

1. Low Down Payment Requirements in Nebraska

As we mentioned, one of the biggest advantages of an FHA loan is that it requires a much lower down payment than most other mortgages. With an FHA loan, you can put as little as 3.5% down on your home purchase (as long as your home costs less than $625,000). This can make homeownership more attainable for many people who might not have the savings for a larger down payment.

2. Flexible Credit Score Requirements in Nebraska

Another advantage of FHA loans is that they have more flexible credit score requirements than most other loans. While conventional loans typically require a credit score of620 or higher, FHA loans allow for credit scores as low as 580. This can be helpful if your credit score has taken a hit due to financial hardship or other reasons. It’s also worth noting that you may be able to get an FHA loan with a lower credit score if you have a strong history of making on-time payments.

3. Low-Interest Rates

FHA loans also come with low-interest rates, which can save you money in the long run. The average interest rate on an FHA loan is around 3.5%, while the average interest rate on a conventional loan is 4%.

4. Mortgage Insurance Premiums Are Lower Than Private Mortgage Insurance (PMI)

When you put less than 20% down on a home, you’re typically required to pay for private mortgage insurance (PMI). This is an insurance policy that protects the lender in case you default on your loan. PMI can add several hundred dollars to your monthly mortgage payment, so it’s not ideal. However, with an FHA loan, you won’t have to pay PMI because the government will insure your loan instead. And even if you do have to pay mortgage insurance with an FHA loan, it will be cheaper than PMI since the premiums are lower.

5. You Can Get Assistance From a Housing Counselor in Nebraska

If you’re having trouble getting approved for an FHA loan in Nebraska or you’re not sure where to start, you can get assistance from a housing counselor. A housing counselor can help you understand the home-buying process and guide you through the steps of getting an FHA loan. And best of all, this service is free!

If you’re thinking about taking out an FHA loan in 2023, these are some of the key benefits to keep in mind. From low down payments to low-interest rates, there are several reasons why an FHA loan might be right for you. So don’t hesitate to explore this option if you’re looking to buy a home in the near future.

If you have any questions about FHA loans in Nebraska or you need assistance getting started, a housing counselor can help. And remember, this service is free! So there’s no reason not to take advantage of it.

Don’t wait any longer, reach out to us today to get started on your home-buying journey.

Nebraska Down Payment Assistance Program

The Nebraska Investment Finance Authority (NIFA) provides Homebuyer Assistance of up to $10,000 or 5% of the sale price (whichever is less) through its Homebuyer Assistance Program. Borrowers must make a minimum contribution of $1,000 to qualify. The loan comes with a 10-year term and a 1%.

Visit the NIFA’s website for more information. Also, take a look at HUD’s list of additional housing assistance initiatives in the state.