FHA Loan Limits in Nevada For All Counties

FHA loan limits in Nevada are calculated according to a formula specified in the National Housing Act. This formula is based on the median home price in the state and the maximum mortgage amount that FHA will insure. The resulting loan limit is then rounded up to the nearest $1,000.

FHA loan limits in Nevada are calculated according to a formula specified in the National Housing Act. This formula is based on the median home price in the state and the maximum mortgage amount that FHA will insure. The resulting loan limit is then rounded up to the nearest $1,000.

The median home price in Nevada has been steadily increasing over the past few years. As of 2021, the median home price in the state was $358,925. This means that FHA loan limits in Nevada for 2022 are higher than they were.

Current FHA loan limits in Nevada are $472,030 a single-family home. This means that you can get an FHA-insured mortgage for up to $472,030. If you are buying a multi-family home, the loan limit is higher. FHA loan limits in Nevada for a two-family home are $604,400 and for a three-family home are $730,525. When buying a Fourplex an FHA lender will go up to $907,900 loan amount.

If you are interested in getting an FHA loan, contact us or any participating lender in your area.

FHA loans are available for both purchase and refinance transactions.

FHA Loan Limits in Nevada by County in 2023

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| NEVADA | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| NEVADA | $644,000 | $824,450 | $996,550 | $1,238,500 | $560,000 |

| CHURCHILL | $472,030 | $604,400 | $730,525 | $907,900 | $325,000 |

| CLARK | $494,500 | $633,050 | $765,200 | $950,950 | $430,000 |

| DOUGLAS | $657,800 | $842,100 | $1,017,900 | $1,265,000 | $572,000 |

| ELKO | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| ESMERALDA | $472,030 | $604,400 | $730,525 | $907,900 | $59,000 |

| EUREKA | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| HUMBOLDT | $472,030 | $604,400 | $730,525 | $907,900 | $201,000 |

| LANDER | $472,030 | $604,400 | $730,525 | $907,900 | $158,000 |

| LINCOLN | $472,030 | $604,400 | $730,525 | $907,900 | $155,000 |

| LYON | $472,030 | $604,400 | $730,525 | $907,900 | $360,000 |

| MINERAL | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| NYE | $472,030 | $604,400 | $730,525 | $907,900 | $250,000 |

| PERSHING | $472,030 | $604,400 | $730,525 | $907,900 | $102,000 |

| STOREY | $621,000 | $795,000 | $960,950 | $1,194,250 | $540,000 |

| WASHOE | $621,000 | $795,000 | $960,950 | $1,194,250 | $540,000 |

| WHITE PINE | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| CARSON CITY | $506,000 | $647,750 | $783,000 | $973,100 | $440,000 |

Purchasing and Refinancing with FHA Loan in Nevada

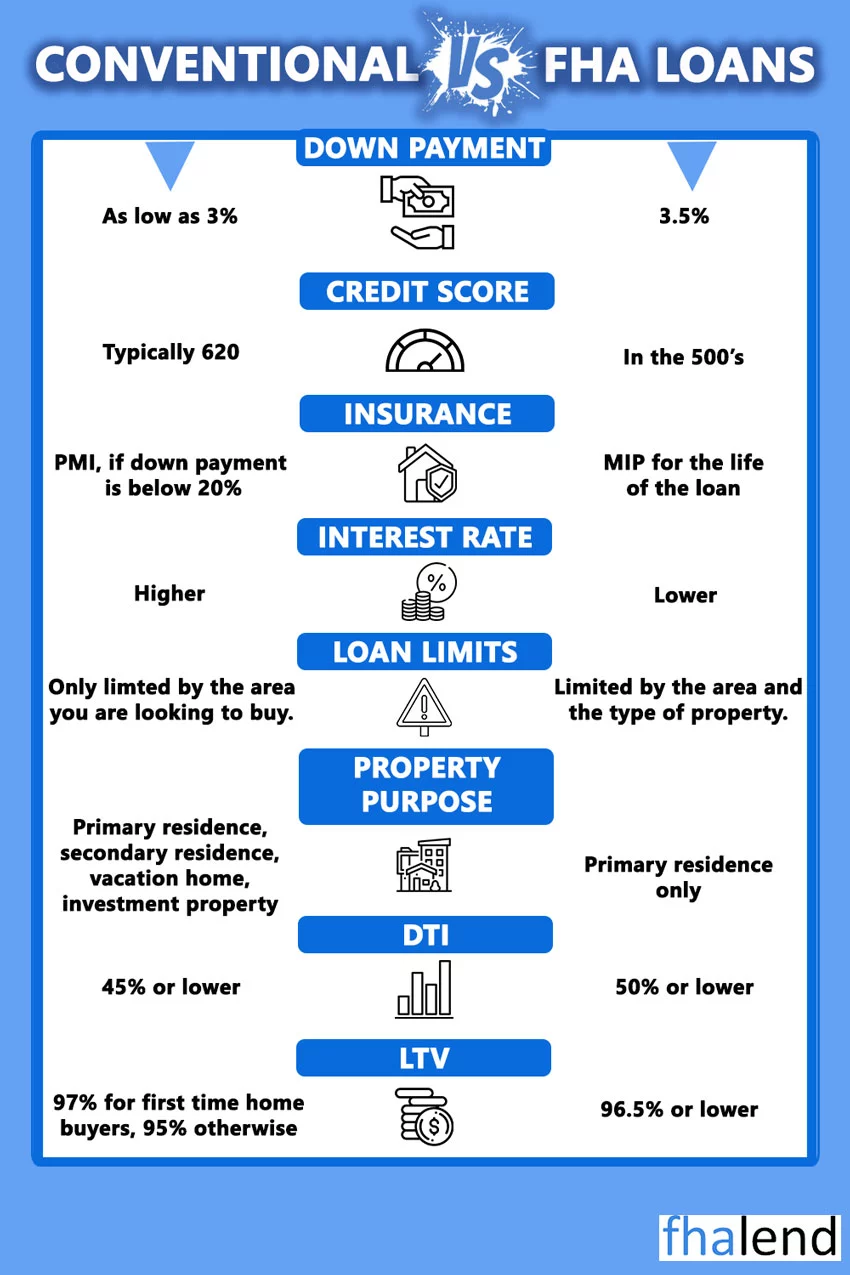

FHA loans are a popular choice for many borrowers because they offer low down payment options and flexible credit requirements. But there are two types of FHA loans available – the FHA Refinance loan and the FHA Purchase loan. So, which one is right for you?

FHA Refinance Loan Requirements in Nevada

The FHA Refinance loan is perfect for borrowers who want to lower their monthly mortgage payments or consolidate their debts. You can also use this loan to switch from an adjustable-rate mortgage to a fixed-rate mortgage, or vice versa. You can also take out your equity from a property by using a cash-out refinance FHA loan program which is available in Nevada.

If you’re looking to refinance your home, there are a few things you need to know. FHA Refinance requirements can seem daunting at first, but once you understand them they’re actually quite simple. Here’s what you need to know about FHA Refinance requirements:

1. You must have an FHA-insured mortgage and cannot exceed FHA loan limits in Nevada for your particular county.

2. Your mortgage must be current – meaning you have made all of your payments on time and there are no outstanding collections or judgments against you.

3. You must have a good payment history for the 12 months preceding your application for refinancing.

4. You must occupy the property as your primary residence.

5. You must not have been convicted of any felony in the past 10 years.

If you meet all of the above requirements, you should be eligible for FHA Refinance. The process is relatively simple and can help you save money on your monthly payments. Contact your lender to get started.

Home Purchase With FHA Loan in Nevada

Meanwhile, the FHA Purchase loan is ideal for first-time homebuyers or those looking to move up to a better property. With this loan, you can buy a home with as little as 3.5% down payment.

So, which FHA loan is right for you? It really depends on your financial needs and goals. Talk to a mortgage specialist to learn more about the benefits of each type of loan and see which one best suits your situation.

If you’re looking to purchase a home, you may be wondering if you qualify for an FHA loan. In this article, we’ll go over the basic FHA purchase requirements so that you can see if you qualify.

The Federal Housing Administration (FHA) is a government-backed agency that provides mortgage insurance on loans made by approved lenders. The FHA insures loans on single family and multifamily homes, including manufactured homes and hospitals.

To qualify for an FHA loan, you must have a minimum credit score of 500. If your credit score is between 500 and 579, you will need to put down 10% of the purchase price as a down payment. If your credit score is 580 or higher, you can put down as little as 3.5% of the purchase price.

In addition to a credit score, you will also need to have a steady income, a valid Social Security number, and be a legal resident of the United States. You will also need to meet the lender’s requirements for employment history, debt-to-income ratio, and other factors.

If you think you might qualify for an FHA loan, contact us and we will help you get started. We will be able to help you determine if you qualify and walk you through the application process.

FHA Market in Nevada in 2023

The housing market in Nevada is expected to continue to grow in popularity in the coming years. This is due to the state’s many benefits, including its low cost of living, no state income tax, and close proximity to major metropolitan areas. As a result, more and more people are moving to Nevada each year.

If you’re thinking of buying a home in Nevada, it’s important to be aware of the current trends in the market. Here are three things to keep in mind:

1. Prices are on the rise.

Home prices in Nevada have been increasing steadily for the past few years, and they’re predicted to continue to do so. In fact, according to Zillow, the median home value in the state is expected to reach $315,000 by 2023. This is an increase of nearly 9% from the current median home value of $289,000.

2. Inventory is low.

With more and more people moving to Nevada, the demand for housing is increasing. However, the number of homes available for sale has not kept up with this demand. As a result, inventory levels are low, which can make it difficult to find the perfect home.

3. Mortgage rates are rising.

Mortgage rates have been on the rise in recent months, and they’re expected to continue to increase in the coming years. According to Freddie Mac, the average 30-year mortgage rate is predicted to reach 4.6% by 2023. Right now (April 9th 2023 rates are at 5.25% for 30 year fixed FHA loan). This is an increase from the current rate of 3.9%.

If you’re thinking of buying a home in Nevada, it’s important to be aware of these trends. By understanding the current market conditions, you can be better prepared to find the perfect home for you and your family.

High-Cost Areas in Nevada

Are you looking to purchase a home in a high-cost area in Nevada? If so, you may be wondering if you will still be able to take advantage of the FHA loan program.

The good news is that the FHA has announced that it will be continuing its loan program in high-cost areas in Nevada for the year 2023. This means that if you are looking to purchase a home in a high-cost area, you may still be able to do so with an FHA loan.

Three counties with higher FHA loan limits in Nevada are: Storey, Washoe, and Douglas. For all of them, the maximum loan amount available to purchase a single home property is $534,750, for a duplex the loan amount can be up to $684,550. An FHA-approved lender can lend you up to $827,500 if you’re buying a triplex and when you want to buy a 4-unit building you can get financing for up to $1,028,350.

Nevada Down Payment Assistance Program

The Nevada Home Is Possible Down Payment Assistance Program can give up to 4% of the loan amount toward the down payment and closing costs. This is in the form of an interest-free loan that is forgiven after three years. To be accepted for Nevada’s DPA program, you must:

- You must be a first-time homeowner, meaning you haven’t owned a property in at least three years.

- You must have a credit score of at least 660 (or 680 for manufactured homes) to buy this property.

- Your home must be your primary residence.

- At closing, you must pay a one-time $755 fee

In addition, you’ll need to satisfy your lender’s financial criteria in order to qualify for the mortgage. For further information, go to the Home Is Possible Down Payment Assistance Program’s webpage. Also, see whether there are any additional Nevada homeownership assistance programs on HUD’s list.