FHA Loan Limits in Arkansas For High-Cost Areas

The Federal Housing Administration FHA loan limits in Arkansas are based on the median home price in the state. The limit for a single-family home is $472,030, which was increased from $420,680 in 2022.  For a four-plex, the limit is $907,900, and for a duplex. There are higher loan limits for two- to four-unit properties if the units are approved by FHA. The FHA loan limits in Arkansas are the same in every county for the 2023 year.

For a four-plex, the limit is $907,900, and for a duplex. There are higher loan limits for two- to four-unit properties if the units are approved by FHA. The FHA loan limits in Arkansas are the same in every county for the 2023 year.

If you’re thinking of buying a home in Arkansas with an FHA loan, you’ll need to know the maximum loan amount you can borrow in your county. You can use the FHA loan limit calculator on HUD.gov or in the below table to find out the maximum loan amount for your county.

Some of the benefits of an FHA loan include:

- Lower down payment requirements: You only need to put down 3.5% of the purchase price of the home.

- No prepayment penalties: You can pay off your loan early without penalty fees.

- Flexible credit requirements: You don’t need a perfect credit score to qualify for an FHA loan.

- Government backing: If you default on your loan, the government will help you find a new one.

- To learn more about FHA loans and how to qualify, click here to find a mortgage lender in your area.

FHA Loan Limits in Arkansas by County List for 2023

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| ARKANSAS | 472,030 | 604,400 | 730,525 | 907,900 | 85,000 |

| ASHLEY | 472,030 | 604,400 | 730,525 | 907,900 | 59,000 |

| BAXTER | 472,030 | 604,400 | 730,525 | 907,900 | 150,000 |

| BENTON | 472,030 | 604,400 | 730,525 | 907,900 | 300,000 |

| BOONE | 472,030 | 604,400 | 730,525 | 907,900 | 172,000 |

| BRADLEY | 472,030 | 604,400 | 730,525 | 907,900 | 66,000 |

| CALHOUN | 472,030 | 604,400 | 730,525 | 907,900 | 80,000 |

| CARROLL | 472,030 | 604,400 | 730,525 | 907,900 | 155,000 |

| CHICOT | 472,030 | 604,400 | 730,525 | 907,900 | 50,000 |

| CLARK | 472,030 | 604,400 | 730,525 | 907,900 | 211,000 |

| CLAY | 472,030 | 604,400 | 730,525 | 907,900 | 108,000 |

| CLEBURNE | 472,030 | 604,400 | 730,525 | 907,900 | 149,000 |

| CLEVELAND | 472,030 | 604,400 | 730,525 | 907,900 | 133,000 |

| COLUMBIA | 472,030 | 604,400 | 730,525 | 907,900 | 119,000 |

| CONWAY | 472,030 | 604,400 | 730,525 | 907,900 | 154,000 |

| CRAIGHEAD | 472,030 | 604,400 | 730,525 | 907,900 | 185,000 |

| CRAWFORD | 472,030 | 604,400 | 730,525 | 907,900 | 152,000 |

| CRITTENDEN | 472,030 | 604,400 | 730,525 | 907,900 | 303,000 |

| CROSS | 472,030 | 604,400 | 730,525 | 907,900 | 111,000 |

| DALLAS | 472,030 | 604,400 | 730,525 | 907,900 | 56,000 |

| DESHA | 472,030 | 604,400 | 730,525 | 907,900 | 78,000 |

| DREW | 472,030 | 604,400 | 730,525 | 907,900 | 140,000 |

| FAULKNER | 472,030 | 604,400 | 730,525 | 907,900 | 208,000 |

| FRANKLIN | 472,030 | 604,400 | 730,525 | 907,900 | 152,000 |

| FULTON | 472,030 | 604,400 | 730,525 | 907,900 | 95,000 |

| GARLAND | 472,030 | 604,400 | 730,525 | 907,900 | 175,000 |

| GRANT | 472,030 | 604,400 | 730,525 | 907,900 | 208,000 |

| GREENE | 472,030 | 604,400 | 730,525 | 907,900 | 140,000 |

| HEMPSTEAD | 472,030 | 604,400 | 730,525 | 907,900 | 90,000 |

| HOT SPRING | 472,030 | 604,400 | 730,525 | 907,900 | 139,000 |

| HOWARD | 472,030 | 604,400 | 730,525 | 907,900 | 86,000 |

| INDEPENDENCE | 472,030 | 604,400 | 730,525 | 907,900 | 115,000 |

| IZARD | 472,030 | 604,400 | 730,525 | 907,900 | 95,000 |

| JACKSON | 472,030 | 604,400 | 730,525 | 907,900 | 97,000 |

| JEFFERSON | 472,030 | 604,400 | 730,525 | 907,900 | 133,000 |

| JOHNSON | 472,030 | 604,400 | 730,525 | 907,900 | 146,000 |

| LAFAYETTE | 472,030 | 604,400 | 730,525 | 907,900 | 80,000 |

| LAWRENCE | 472,030 | 604,400 | 730,525 | 907,900 | 67,000 |

| LEE | 472,030 | 604,400 | 730,525 | 907,900 | 104,000 |

| LINCOLN | 472,030 | 604,400 | 730,525 | 907,900 | 133,000 |

| LITTLE RIVER | 472,030 | 604,400 | 730,525 | 907,900 | 176,000 |

| LOGAN | 472,030 | 604,400 | 730,525 | 907,900 | 146,000 |

| LONOKE | 472,030 | 604,400 | 730,525 | 907,900 | 208,000 |

| MADISON | 472,030 | 604,400 | 730,525 | 907,900 | 300,000 |

| MARION | 472,030 | 604,400 | 730,525 | 907,900 | 179,000 |

| MILLER | 472,030 | 604,400 | 730,525 | 907,900 | 176,000 |

| MISSISSIPPI | 472,030 | 604,400 | 730,525 | 907,900 | 79,000 |

| MONROE | 472,030 | 604,400 | 730,525 | 907,900 | 112,000 |

| MONTGOMERY | 472,030 | 604,400 | 730,525 | 907,900 | 151,000 |

| NEVADA | 472,030 | 604,400 | 730,525 | 907,900 | 90,000 |

| NEWTON | 472,030 | 604,400 | 730,525 | 907,900 | 172,000 |

| OUACHITA | 472,030 | 604,400 | 730,525 | 907,900 | 80,000 |

| PERRY | 472,030 | 604,400 | 730,525 | 907,900 | 208,000 |

| PHILLIPS | 472,030 | 604,400 | 730,525 | 907,900 | 48,000 |

| PIKE | 472,030 | 604,400 | 730,525 | 907,900 | 117,000 |

| POINSETT | 472,030 | 604,400 | 730,525 | 907,900 | 185,000 |

| POLK | 472,030 | 604,400 | 730,525 | 907,900 | 107,000 |

| POPE | 472,030 | 604,400 | 730,525 | 907,900 | 150,000 |

| PRAIRIE | 472,030 | 604,400 | 730,525 | 907,900 | 100,000 |

| PULASKI | 472,030 | 604,400 | 730,525 | 907,900 | 208,000 |

| RANDOLPH | 472,030 | 604,400 | 730,525 | 907,900 | 110,000 |

| ST. FRANCIS | 472,030 | 604,400 | 730,525 | 907,900 | 68,000 |

| SALINE | 472,030 | 604,400 | 730,525 | 907,900 | 208,000 |

| SCOTT | 472,030 | 604,400 | 730,525 | 907,900 | 89,000 |

| SEARCY | 472,030 | 604,400 | 730,525 | 907,900 | 90,000 |

| SEBASTIAN | 472,030 | 604,400 | 730,525 | 907,900 | 152,000 |

| SEVIER | 472,030 | 604,400 | 730,525 | 907,900 | 90,000 |

| SHARP | 472,030 | 604,400 | 730,525 | 907,900 | 115,000 |

| STONE | 472,030 | 604,400 | 730,525 | 907,900 | 184,000 |

| UNION | 472,030 | 604,400 | 730,525 | 907,900 | 95,000 |

| VAN BUREN | 472,030 | 604,400 | 730,525 | 907,900 | 95,000 |

| WASHINGTON | 472,030 | 604,400 | 730,525 | 907,900 | 300,000 |

| WHITE | 472,030 | 604,400 | 730,525 | 907,900 | 138,000 |

| WOODRUFF | 472,030 | 604,400 | 730,525 | 907,900 | 101,000 |

| YELL | 472,030 | 604,400 | 730,525 | 907,900 | 150,000 |

The Arkansas FHA Loan Requirements for 2023 Are as Follows:

A down payment of 3.5% or 10%, if your credit score is below 580; 2-year employment history with some exceptions allowed (including self-employed), fully documented income in the past two years, and minimum 500+ Floors scored on mortgage insurance premium (MIP). The maximum debt-to-income ratio varies by region but must not exceed 43%.

FHA loans are a great option for those who want to buy their first home but have lower credit scores or don’t meet the down payment requirement. The interest rates on FHA-insured mortgages can be much lower than conservative ones, too! Plus gift funds allow you to pay less upfront by putting money into escrow while still having access when needed because it’s an assuming loan (which means there will never really come a time when someone else must invest). As well as seller closing costs contributions helping out with closing costs like title insurance and even offering up some cash towards purchasing price if required.

We’re here to help you find the best FHA lender in Arkansas in your area by completing this loan scenario form with some basic information. We won’t pull any credit reports and we’ll connect you directly to one of our top-recommended options for mortgage companies!

We’re here to help you find the best FHA lender in Arkansas in your area by completing this loan scenario form with some basic information. We won’t pull any credit reports and we’ll connect you directly to one of our top-recommended options for mortgage companies!

With the FHA loan limits in Arkansas in every county across America, it’s important to know what your maximum home purchase option can be. The base amount for a single-family residence with an average sale price is $420k – but this number will vary depending on where you live! Take advantage of our handy tool that allows users to explore their personal possibilities and see just how close they might come up to purchasing power before setting off into debt or committing themselves fully without knowing all there is about credit requirements firsthand.

How FHA Loan Limits in Arkansas are Estimated?

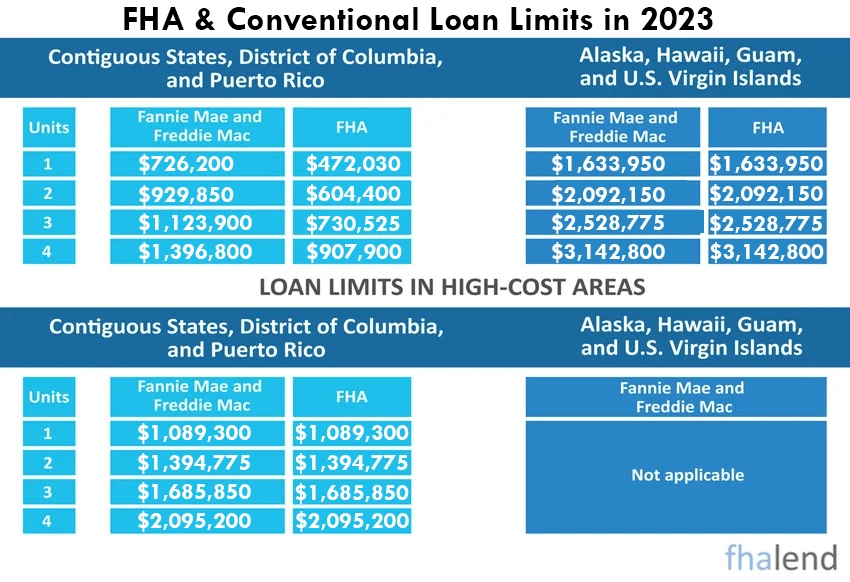

FHA loan limits in Arkansas range from 65% of conforming loan limits in most parts of the country to 150% of conforming loan limits in high-cost counties. A lender can issue the largest mortgage which is a conforming loan limit for a buyer if the bank wants to sell that loan to Freddie Mac or Fannie Mae. The lenders are selling loans to a secondary market and this way they increase a capacity (a warehouse line of credit) to be able to process more loans and handle more clients.

For 2023, the conforming loan limits are $726,200 in all counties in Arkansas. If you want to calculate your current limits you can use this equation: FHA loan limits in Arkansas of $472,030 is 65% of $726,200.

There is no high-cost counties in Arkansas however in Texas, there are few high-cost areas wherein certain counties the loan limits vary based on county. FHA loan limits in Arkansas for fourplex are set to $907,900, which is 150% of the conforming loan limit of $548,250. The FHA calls its high-cost county loan limit the “ceiling.”

In Alaska, Guam, Hawaii, and the U.S. Virgin Islands, the limit is $1,633,950, or 150% of the normal ceiling. Because of the high cost of construction and housing shortages in certain areas, there are extra-high limits set there..

Several hundred counties have limits that fall somewhere between the floor and the ceiling. In these areas, the limit is 115% of the median price for a one-family residence. Check the table above to check all FHA loan limits in Arkansas or go to the search by county tool we designed and you will have access to FHA loan limits in all 50 states.

How to Qualify for an FHA Loan in Arkansas

Be a U.S. citizen or a permanent resident alien and have a valid Social Security number Have a minimum credit score of 500 (although some lenders may require a higher score) Have at least 3.5% of the home’s purchase price available for down payment Be able to prove that you have been employed steadily for the past two years Have a debt-to-income ratio of no more than 43%

If you can meet these qualifications, you’re well on your way to being approved for an FHA loan in Arkansas. The next step is to find a participating lender and complete an application. Once you’ve been approved, you’ll be able to start shopping for your new home!

Arkansas Down Payment Assistance Program

The Arkansas Development Finance Authority (ADFA) has a number of useful initiatives. “ADFA Move-UP,” the home loan program offered by ADFA, provides “affordable” mortgages to house purchasers and may be used in conjunction with a regular FHA, VA, or USDA mortgage loan.

The Australian Defense Force Academy may be able to help you with down payment assistance if you apply for a Move-Up loan. The organization has the following support programs:

- The Arkansas Dream Down Payment Initiative (ADDI): a forgivable second mortgage up to 10% of the purchase price, not to exceed $10,000

- The Down Payment Assistance Program at the Australian Defense Force Academy (ADFA DPA) provides financial help for those who wish to buy a house in the Northern Territory.

- The maximum amount of the Mortgage Credit Certificate (MCC) is $2,000 per year. a dollar-for-dollar tax credit worth up to $2,000 per year

Visit the official websites of the ADFA Move-Up Choice and AFDA Down Payment Assistance programs to learn more, including income qualifications for your county. Also have a look at HUD’s list of alternative options in Arkansas.