FHA Loan Limits in Florida: Mortgage Guidelines 2025

In 2024, you can get a maximum amount for an FHA-insured mortgage in Florida up to $498,257 for a one-unit property which applies to most single-family homes or up to $1,786,950 in particularly expensive (high-cost) areas. FHA Loan limits in Florida for a two-unit home, the FHA allows you to borrow up to $637,950 for most counties; for a three-unit home, you can borrow up to $771,125; and for a four-unit home, you’re allowed to borrow up to $958,350.

In 2024, you can get a maximum amount for an FHA-insured mortgage in Florida up to $498,257 for a one-unit property which applies to most single-family homes or up to $1,786,950 in particularly expensive (high-cost) areas. FHA Loan limits in Florida for a two-unit home, the FHA allows you to borrow up to $637,950 for most counties; for a three-unit home, you can borrow up to $771,125; and for a four-unit home, you’re allowed to borrow up to $958,350.

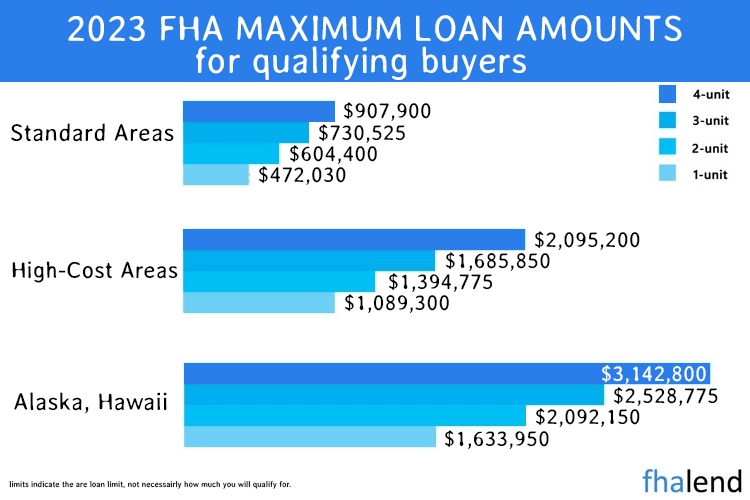

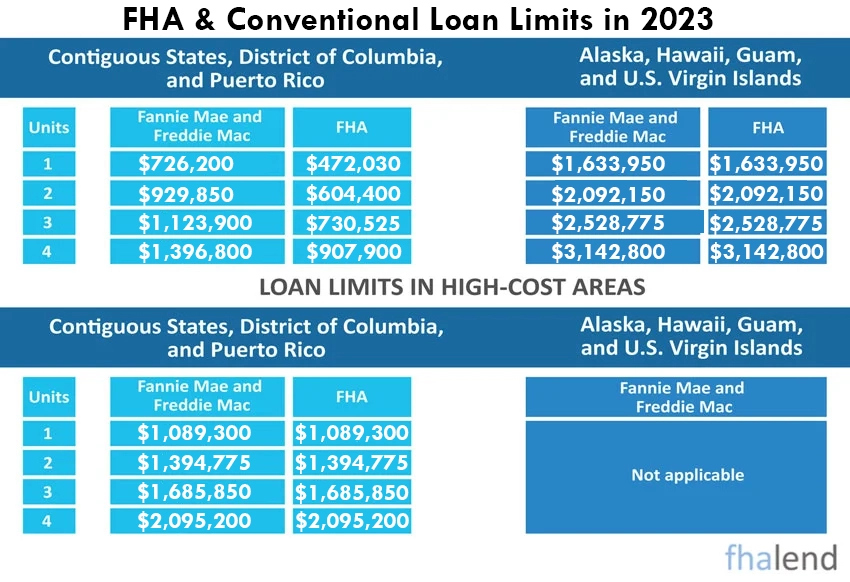

FHA loan limits are increasing in 2023. The new baseline limit – $498,257. That has been about a $26,227increase over last year’s FHA loan limit of $472,030. The Federal Housing Authority is raising its lending limits to keep up with home price inflation.

In this article (Skip to…)

FHA Loan Limits in Florida by County

| County | FHA Limit | 2 Family | 3 Family | 4 Family | FHFA limit | Median House Price |

|---|---|---|---|---|---|---|

| ALACHUA | $524,225 | $671,200 | $811,275 | $1,008,300 | $303,000 | $340.6 |

| BAKER | $580,750 | $743,450 | $898,700 | $1,116,850 | $505,000 | $377 |

| BAY | $524,225 | $671,200 | $811,275 | $1,008,300 | $329,000 | $340.6 |

| BRADFORD | $524,225 | $671,200 | $811,275 | $1,008,300 | $150,000 | $340.6 |

| BREVARD | $524,225 | $671,200 | $811,275 | $1,008,300 | $340,000 | $340.6 |

| BROWARD | $654,350 | $837,700 | $1,012,550 | $1,258,400 | $569,000 | $425.1 |

| CALHOUN | $524,225 | $671,200 | $811,275 | $1,008,300 | $110,000 | $340.6 |

| CHARLOTTE | $524,225 | $671,200 | $811,275 | $1,008,300 | $325,000 | $340.6 |

| CITRUS | $524,225 | $671,200 | $811,275 | $1,008,300 | $237,000 | $340.6 |

| CLAY | $580,750 | $743,450 | $898,700 | $1,116,850 | $505,000 | $377 |

| COLLIER | $764,750 | $979,000 | $1,183,400 | $1,470,700 | $665,000 | $496.6 |

| COLUMBIA | $524,225 | $671,200 | $811,275 | $1,008,300 | $178,000 | $340.6 |

| DESOTO | $524,225 | $671,200 | $811,275 | $1,008,300 | $215,000 | $340.6 |

| DIXIE | $524,225 | $671,200 | $811,275 | $1,008,300 | $92,000 | $340.6 |

| DUVAL | $580,750 | $743,450 | $898,700 | $1,116,850 | $505,000 | $377 |

| ESCAMBIA | $524,225 | $671,200 | $811,275 | $1,008,300 | $322,000 | $340.6 |

| FLAGLER | $524,225 | $671,200 | $811,275 | $1,008,300 | $348,000 | $340.6 |

| FRANKLIN | $524,225 | $671,200 | $811,275 | $1,008,300 | $219,000 | $340.6 |

| GADSDEN | $524,225 | $671,200 | $811,275 | $1,008,300 | $269,000 | $340.6 |

| GILCHRIST | $524,225 | $671,200 | $811,275 | $1,008,300 | $303,000 | $340.6 |

| GLADES | $524,225 | $671,200 | $811,275 | $1,008,300 | $167,000 | $340.6 |

| GULF | $524,225 | $671,200 | $811,275 | $1,008,300 | $295,000 | $340.6 |

| HAMILTON | $524,225 | $671,200 | $811,275 | $1,008,300 | $87,000 | $340.6 |

| HARDEE | $524,225 | $671,200 | $811,275 | $1,008,300 | $155,000 | $340.6 |

| HENDRY | $524,225 | $671,200 | $811,275 | $1,008,300 | $230,000 | $340.6 |

| HERNANDO | $524,225 | $671,200 | $811,275 | $1,008,300 | $415,000 | $340.6 |

| HIGHLANDS | $524,225 | $671,200 | $811,275 | $1,008,300 | $219,000 | $340.6 |

| HILLSBOROUGH | $524,225 | $671,200 | $811,275 | $1,008,300 | $415,000 | $340.6 |

| HOLMES | $524,225 | $671,200 | $811,275 | $1,008,300 | $105,000 | $340.6 |

| INDIAN RIVER | $524,225 | $671,200 | $811,275 | $1,008,300 | $375,000 | $340.6 |

| JACKSON | $524,225 | $671,200 | $811,275 | $1,008,300 | $130,000 | $340.6 |

| JEFFERSON | $524,225 | $671,200 | $811,275 | $1,008,300 | $269,000 | $340.6 |

| LAFAYETTE | $524,225 | $671,200 | $811,275 | $1,008,300 | $86,000 | $340.6 |

| LAKE | $524,225 | $671,200 | $811,275 | $1,008,300 | $450,000 | $340.6 |

| LEE | $524,225 | $671,200 | $811,275 | $1,008,300 | $370,000 | $340.6 |

| LEON | $524,225 | $671,200 | $811,275 | $1,008,300 | $269,000 | $340.6 |

| LEVY | $524,225 | $671,200 | $811,275 | $1,008,300 | $303,000 | $340.6 |

| LIBERTY | $524,225 | $671,200 | $811,275 | $1,008,300 | $95,000 | $340.6 |

| MADISON | $524,225 | $671,200 | $811,275 | $1,008,300 | $84,000 | $340.6 |

| MANATEE | $547,400 | $700,750 | $847,050 | $1,052,700 | $466,000 | $355.55 |

| MARION | $524,225 | $671,200 | $811,275 | $1,008,300 | $268,000 | $340.6 |

| MARTIN | $596,850 | $764,050 | $923,600 | $1,147,800 | $519,000 | $387.4 |

| MIAMI-DADE | $654,350 | $837,700 | $1,012,550 | $1,258,400 | $569,000 | $425.1 |

| MONROE | $967,150 | $1,238,150 | $1,496,600 | $1,859,950 | $841,000 | $628.55 |

| NASSAU | $580,750 | $743,450 | $898,700 | $1,116,850 | $505,000 | $377 |

| OKALOOSA | $603,750 | $772,900 | $934,250 | $1,161,050 | $500,000 | $391.95 |

| OKEECHOBEE | $524,225 | $671,200 | $811,275 | $1,008,300 | $161,000 | $340.6 |

| ORANGE | $524,225 | $671,200 | $811,275 | $1,008,300 | $450,000 | $340.6 |

| OSCEOLA | $524,225 | $671,200 | $811,275 | $1,008,300 | $450,000 | $340.6 |

| PALM BEACH | $654,350 | $837,700 | $1,012,550 | $1,258,400 | $569,000 | $425.1 |

| PASCO | $524,225 | $671,200 | $811,275 | $1,008,300 | $415,000 | $340.6 |

| PINELLAS | $524,225 | $671,200 | $811,275 | $1,008,300 | $415,000 | $340.6 |

| POLK | $524,225 | $671,200 | $811,275 | $1,008,300 | $312,000 | $340.6 |

| PUTNAM | $524,225 | $671,200 | $811,275 | $1,008,300 | $115,000 | $340.6 |

| ST. JOHNS | $580,750 | $743,450 | $898,700 | $1,116,850 | $505,000 | $377 |

| ST. LUCIE | $596,850 | $764,050 | $923,600 | $1,147,800 | $519,000 | $387.4 |

| SANTA ROSA | $524,225 | $671,200 | $811,275 | $1,008,300 | $322,000 | $340.6 |

| SARASOTA | $547,400 | $700,750 | $847,050 | $1,052,700 | $466,000 | $355.55 |

| SEMINOLE | $524,225 | $671,200 | $811,275 | $1,008,300 | $450,000 | $340.6 |

| SUMTER | $524,225 | $671,200 | $811,275 | $1,008,300 | $370,000 | $340.6 |

| SUWANNEE | $524,225 | $671,200 | $811,275 | $1,008,300 | $125,000 | $340.6 |

| TAYLOR | $524,225 | $671,200 | $811,275 | $1,008,300 | $125,000 | $340.6 |

| UNION | $524,225 | $671,200 | $811,275 | $1,008,300 | $166,000 | $340.6 |

| VOLUSIA | $524,225 | $671,200 | $811,275 | $1,008,300 | $348,000 | $340.6 |

| WAKULLA | $524,225 | $671,200 | $811,275 | $1,008,300 | $269,000 | $340.6 |

| WALTON | $603,750 | $772,900 | $934,250 | $1,161,050 | $500,000 | $391.95 |

| WASHINGTON | $524,225 | $671,200 | $811,275 | $1,008,300 | $170,000 | $340.6 |

| FLOYD | $524,225 | $671,200 | $811,275 | $1,008,300 | $183,000 | $340.6 |

| FLOYD | $524,225 | $671,200 | $811,275 | $1,008,300 | $115,000 | $340.6 |

| FLOYD | $524,225 | $671,200 | $811,275 | $1,008,300 | $398,000 | $340.6 |

| FLEMING | $524,225 | $671,200 | $811,275 | $1,008,300 | $103,000 | $340.6 |

| FLOYD | $524,225 | $671,200 | $811,275 | $1,008,300 | $60,000 | $340.6 |

| LEFLORE | $524,225 | $671,200 | $811,275 | $1,008,300 | $125,000 | $340.6 |

| SUNFLOWER | $524,225 | $671,200 | $811,275 | $1,008,300 | $136,000 | $340.6 |

| FLATHEAD | $572,700 | $733,150 | $886,200 | $1,101,350 | $498,000 | $371.8 |

| LE FLORE | $524,225 | $671,200 | $811,275 | $1,008,300 | $85,000 | $340.6 |

| MIFFLIN | $524,225 | $671,200 | $811,275 | $1,008,300 | $115,000 | $340.6 |

| FLORIDA | $690,000 | $883,300 | $1,067,750 | $1,326,950 | $600,000 | $448.5 |

| FLORENCE | $524,225 | $671,200 | $811,275 | $1,008,300 | $193,000 | $340.6 |

| FLOYD | $524,225 | $671,200 | $811,275 | $1,008,300 | $128,000 | $340.6 |

| FLOYD | $524,225 | $671,200 | $811,275 | $1,008,300 | $200,000 | $340.6 |

| FLUVANNA | $592,250 | $758,200 | $916,450 | $1,138,950 | $515,000 | $384.8 |

| FLORENCE | $524,225 | $671,200 | $811,275 | $1,008,300 | $137,000 | $340.6 |

How do I qualify for an FHA loan in Florida?

FHA loans allow you to borrow up to 96.5% of the value of a home with an FHA loan (meaning you’ll need to make a down payment of only 3.5%). You need a credit score of at least 580 to qualify. If your credit score is between 500 and 579, you may be able to get an FHA loan as long as you can make a 10% down payment. With FHA loans, you can have a down payment that comes from savings, a financial gift from a family member, or a grant for down-payment assistance.

- Job History – Stable income and employment. Proof of employment for 2 years is required. It is ok if you have changed jobs, but you need to show consistent employment/income and you can work out of state remotely but you must move to Florida and it has to be your primary residence. You cannot purchase an investment property, vacation home, or a second home with the FHA loan.

- Financial Statements – You should expect to be required to provide your 2 most recent bank statements, pay stubs, and tax returns.

- FICO Score – To be able to qualify for the FHA loan you must have a 500 credit score or higher.

- Down Payment – HUD requires a 3,5% down payment for the FHA Loan depending on your credit score. On $400,000 house you will need $14,000. If your credit score is between 500–579, you are eligible for up to 90% financing. So the minimum down payment would be 10% of your home’s purchasing price. So if you buying a house worth $400.000 you need to come up with $40,000.

- Debt-to-Income (DTI) – 43% DTI or lower. However, if you have “compensating factors” you might be able to get a loan.

- Mortgage Insurance – All FHA loans, regardless of the lender, require two types of mortgage insurance. This includes the UPMIP (Upfront Mortgage Insurance Premium) and the regular MIP (Mortgage Insurance Premium). FHA MIP acts similarly to how PMI (Private Mortgage Insurance) on a conventional loan acts. You can use our loan calculator to estimate your monthly payment and mortgage insurance costs.

- FHA Loan Limits in Florida – FHA loans have maximum lending limits, which are set at the county level. You can view the 2022 FHA loan limits for all counties in Florida above.

How Much Are Closing Costs in Florida For FHA Loan

Closing costs are common when you’re buying or selling a property. The amount you’ll pay in Florida varies from state to state but is determined by both the property and the county it sits in. As a buyer, you will have to cover most of the fees and taxes. At the moment, the total cost of purchasing the item is going to be between $10 and $200 before taxes.

Closing costs for Florida homes are usually about 2.58% of the purchase price. It seems insignificant, but the amount of money you have to pay can quickly climb if you are buying an expensive home.

Across the state, the average home will sell for somewhere between $300,000 and $400,000. If you’re going to buy a property in that range, expect to pay between $7,740 and $10,320 in closing costs before taxes. That cost includes appraisal, settlement, and recording fees, as well as title insurance and flood certification.

There may be some fees to pay and taxes to pay.

In Florida, you might also have to pay a fee for documentary stamps (or doc stamps), which is a percentage of the sales price. Nevertheless, there are taxes. You will likely be subject to property and transfer taxes — when you add those in, you would be looking at around $8,213.44 in closing costs after taxes.

Does Seller Or Buyer Pay Closing Costs in Florida?

Non of the party is required to pay 100% of the costs of closing in Florida which includes fees, taxes, insurance and more. Buyers typically pay between 3% to 4% of the home loan’s value and are responsible for most of the fees and taxes. The seller usually pays between 5% and 10% of the home’s sale price. The costs vary among counties.

What Are the Restrictions On FHA loan Limits?

It doesn’t matter which type of FHA loan you seek, there will be limits on the mortgage amount. These limitations vary depending on the county. They have a loan limit in 2025 that ranges from $ 472,030 to $907,900.

It doesn’t matter which type of FHA loan you seek, there will be limits on the mortgage amount. These limitations vary depending on the county. They have a loan limit in 2025 that ranges from $ 472,030 to $907,900.

The maximum FHA loan amount for single-family homes in low-cost counties in Florida is $498,257. For example, the upper limit for FHA loans in Okaloosa County is $603,750

Some counties have housing prices somewhere in between, so the FHA loan limits are also in the middle. Monroe County in Florida where the FHA loan limit is $929,200. You can visit HUD’s website to find out the FHA loan limit in any county.

Gift Money

If you have a friend or a family member who wants to help you purchase your home, you can use their gift money. If someone gifts you cash for your down payment, you can use 100% of it for your down payment. You will need to make sure you have a down-payment gift letter from whoever gave you that money.

The gift letter must contain the donor’s name, their relationship to you, and the address of your new home.

Other information needed on the letter:

- The donor’s bank account information

- The date the donor gave you the money

- A statement saying the money is a gift

- Printed name and signature of the donor

- The exact amount of the gift

You must have a statement that explains that the money received is a gift. Your lender wants to see that the money received does not need to be paid back. If your lender needs more information, they will let you know during your home-buying process.

Conventional loans also accept gift money, but there are a few extra steps. For example, the money received must be from someone close to you. This can be a child, grandparent, aunt, uncle, in-law, cousin, or partner. If you received gift money from your employer or a charitable organization, you could use that for your FHA down payment.

How to Find an FHA Lender in Florida

There are many fantastic FHA lenders in Florida that you can choose from. You must do your research to ensure that you find the right lender for you. You can reach out to your real estate agent or friends and family for recommendations. It is always best to ask questions to potential lenders to gain a better understanding of what you need to qualify. Before you apply for an FHA loan, you will want to ensure that you know your budget.

There are mortgage calculators online where you can plug in your expenses, savings, and current income. These calculators can tell you what you can expect to pay monthly based on what you are willing to put down and the price of your house.

Once you find your lender, you should compare your pre-approval letter to other offers. This will help you compare different refinance rates and terms to ensure that you get the best deal.

Energy Efficient Mortgages

The Federal Housing Administration also backs the Energy Efficient Mortgage Program (EEM). This program allows potential homebuyers to purchase an already energy-efficient home.

These energy-efficient homes are known as Energy Star-certified buildings. You can use this program to buy and remodel older homes with energy-efficient updates if you would like to. Homebuyers have the option to roll these costs into the loan without needing a larger down payment.

Reputable FHA Loan in Florida

If you are ready to take the next step and apply for your FHA loan in Florida, the best time to start is now! If you meet the FHA loan requirements, it’s time to get you ready for homeownership. Buying a house does not need to be a stressful experience, and we here at FHA Lend understand what you need to get approved. Contact us now to learn more about what you can qualify for. Our team will not issue you a pre-approval letter unless we are sure that you are fully qualified. We are available seven days a week to answer any questions or concerns that you may have.

If you are ready to take the next step and apply for your FHA loan in Florida, the best time to start is now! If you meet the FHA loan requirements, it’s time to get you ready for homeownership. Buying a house does not need to be a stressful experience, and we here at FHA Lend understand what you need to get approved. Contact us now to learn more about what you can qualify for. Our team will not issue you a pre-approval letter unless we are sure that you are fully qualified. We are available seven days a week to answer any questions or concerns that you may have.

How are FHA Loan Limits Estimated In Florida?

The United States has a debt of 16 trillion dollars. The Department of Housing and Urban Development set guidelines on the maximum amount that could be insured by the Federal Housing Administration for houses in each county of America. These limits are set based on the current year’s conforming loan limit — or how large of a mortgage Fannie Mae and Freddie Mac will purchase.

The 2022 Federal Housing Administration loan limits are going up in 2022. For reference, limits for a single-family home in 2022 range from $472,030 – $970,800 and vary by county. The range has been adjusted to a maximum of 498,257 – $958,350. So, the maximum loan amount for an FHA loan on a single-family home in a low-cost county is $498,257.

The Federal Housing Administration “floor” is the big mortgage that the agency will issue in most of the country and is 65% of the conforming loan limit. The FHA floor will be set at $498,257 in 2025.

The FHA has a ceiling that’s higher in high-cost areas. This is set at a conforming loan limit of $766,550 for single-family homes. With a few exceptions, this is generally the largest mortgage amount the agency will insure for a single-family home. In many parts of the country, loan limits fall somewhere within the range of the FHA floor and ceiling.

In the US outside of the lower 48 states, FHA loan limits are higher because of more expensive construction costs. These areas of Alaska, Hawaii, Guam, and the U.S. Virgin Islands include exceptions in them.

Florida Down Payment Assistance Program

The Florida Housing Finance Corporation (FHFC) provides four DPA options:

- The HFA Preferred Grant is a non-repayable grant given to eligible homeowners who purchase a new or existing home. Those who qualify may receive 3-5% of the home’s purchase price in the form of a non-repayable grant.

- The HFA Advantage Plus is a second mortgage that is forgiven at 20% each year over its 5-year loan term.

- The Florida Assist You may be eligible for $7,500 as an interest-free second mortgage if you qualify. You are not required to make payments on this loan. The repayment of the deficit is postponed until the property is sold or refinanced.

- Florida Homeownership Loan Program: This program loans up to $10,000 repayable in 15-year installments for homebuyers. If you sell, refinance, or cease using the property as a primary residence, the loan’s outstanding amount will be paid off in full.

- Lee County Down Payment Assistance Program – Are you a first-time homebuyer in Lee County, Florida looking for help with the down payment and closing costs? Look no further – The Lee County Department of Human Services has got you covered! You can receive up to 10% or $20,000 (whichever is lower) of the purchase price towards purchasing an existing house in Lee County.

- FHLB Down Payment Plus Program – Eligible applicants can receive up to $6,000 from the Federal Home Loan Bank Program in exchange for a forgiving down payment and closing costs grant. Low and moderate-income households are particularly encouraged to take advantage of this incredible opportunity!

- State Housing Initiatives Partnership Program (SHIP) – Administered by local governments, the SHIP program offers financial support for down payment assistance and various other housing-related services. Eligibility criteria and assistance amounts may vary depending on the county.

- Home Key Plus 2nd Mortgage – The Housing Finance Authority of Pinellas County has introduced a program to assist potential homebuyers in realizing their homeownership dreams. In addition to a primary mortgage, this program provides down payment assistance through the Home Key Plus 2nd Mortgage.

- Home Sweet Home Hillsborough Program – The Home Sweet Home Hillsborough Program, provided by the Housing Finance Authority of Hillsborough County, aims to assist homebuyers in overcoming the challenge of high down payments.

- Orange County Down Payment Assistance Program – Residents of Orange County, Florida, have the opportunity to benefit from the Down Payment Assistance Program. This program offers financial support to eligible first-time homebuyers, assisting them in acquiring a new or existing home. The funds are designated for covering qualified closing costs and the down payment associated with a mortgage transaction.

- Palm Bay HOME Down Payment Assistance Program – The HOME Down Payment Assistance Program, initiated by the City of Palm Bay in Florida, is crafted to provide support to income-eligible individuals. The program offers assistance with down payment and closing costs for the purchase of their first home, along with rehabilitation support if required.

- Head Start To HOME Ownership Program – Jacksonville’s Head Start To HOME Ownership Program, commonly referred to as H2H, is an initiative by the City of Jacksonville. This program extends down payment and closing cost assistance to eligible individuals seeking to purchase a home.

Learn more about the FHFC’s website. Also, visit HUD’s list of alternative programs for Florida to discover more.