FHA Loan Limits in Montana For 2023

If you are planning to purchase a home in MT with an FHA loan in 2023, it is important to be aware of the new FHA loan limits in Montana. These loan limits will vary by county and will be based on the median home price in that county. The new loan limits may impact your ability to borrow if your DTI is over 43% or you have only 3,5% to put down. If a property you trying to buy is over FHA limits in Montana for the particular county you trying to qualify you might need to go with a conventional loan which requires 10% down or a Jumbo Loan.

If you are planning to purchase a home in MT with an FHA loan in 2023, it is important to be aware of the new FHA loan limits in Montana. These loan limits will vary by county and will be based on the median home price in that county. The new loan limits may impact your ability to borrow if your DTI is over 43% or you have only 3,5% to put down. If a property you trying to buy is over FHA limits in Montana for the particular county you trying to qualify you might need to go with a conventional loan which requires 10% down or a Jumbo Loan.

Maximum Loan Amounts in Not High Cost Areas in Montana

- Single Home Family [ $472,030 ]

- Duplex [ $604,400 ]

- Triplex [ $730,525 ]

- Fourplex [ $907,900 ]

How The FHA loan limits in Montana are Determined?

FHA loan limits are determined by a few factors, the most important of which is home prices. FHA calculates its loan limits every year, using median home prices from the previous year. This process ensures that FHA loan limits in Montana keep pace with rising home prices, while also allowing for some flexibility. That’s because the loan limit isn’t a hard-and-fast number; it can be adjusted up or down depending on market conditions. Below is the list of counties, median home prices, and FHA loan limits in Montana for all 4 types of properties. Take a closer look at what they are and what you need to know if you’re planning to apply for an FHA loan this year.

FHA Loan Limits in Montana by County For 2023

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| BEAVERHEAD | $472,030 | $604,400 | $730,525 | $907,900 | $312,000 |

| BIG HORN | $472,030 | $604,400 | $730,525 | $907,900 | $205,000 |

| BLAINE | $472,030 | $604,400 | $730,525 | $907,900 | $146,000 |

| BROADWATER | $499,100 | $638,950 | $772,300 | $959,800 | $434,000 |

| CARBON | $472,030 | $604,400 | $730,525 | $907,900 | $374,000 |

| CARTER | $472,030 | $604,400 | $730,525 | $907,900 | $177,000 |

| CASCADE | $472,030 | $604,400 | $730,525 | $907,900 | $260,000 |

| CHOUTEAU | $472,030 | $604,400 | $730,525 | $907,900 | $251,000 |

| CUSTER | $472,030 | $604,400 | $730,525 | $907,900 | $282,000 |

| DANIELS | $472,030 | $604,400 | $730,525 | $907,900 | $266,000 |

| DAWSON | $472,030 | $604,400 | $730,525 | $907,900 | $166,000 |

| DEER LODGE | $472,030 | $604,400 | $730,525 | $907,900 | $206,000 |

| FALLON | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| FERGUS | $472,030 | $604,400 | $730,525 | $907,900 | $196,000 |

| FLATHEAD | $553,150 | $708,150 | $855,950 | $1,063,750 | $481,000 |

| GALLATIN | $703,800 | $901,000 | $1,089,100 | $1,353,500 | $612,000 |

| GARFIELD | $472,030 | $604,400 | $730,525 | $907,900 | $251,000 |

| GLACIER | $472,030 | $604,400 | $730,525 | $907,900 | $159,000 |

| GOLDEN VALLEY | $472,030 | $604,400 | $730,525 | $907,900 | $174,000 |

| GRANITE | $472,030 | $604,400 | $730,525 | $907,900 | $340,000 |

| HILL | $472,030 | $604,400 | $730,525 | $907,900 | $248,000 |

| JEFFERSON | $472,030 | $604,400 | $730,525 | $907,900 | $396,000 |

| JUDITH BASIN | $472,030 | $604,400 | $730,525 | $907,900 | $219,000 |

| LAKE | $472,030 | $604,400 | $730,525 | $907,900 | $352,000 |

| LEWIS AND CLARK | $472,030 | $604,400 | $730,525 | $907,900 | $396,000 |

| LIBERTY | $472,030 | $604,400 | $730,525 | $907,900 | $121,000 |

| LINCOLN | $472,030 | $604,400 | $730,525 | $907,900 | $268,000 |

| MCCONE | $472,030 | $604,400 | $730,525 | $907,900 | $137,000 |

| MADISON | $472,030 | $604,400 | $730,525 | $907,900 | $372,000 |

| MEAGHER | $472,030 | $604,400 | $730,525 | $907,900 | $186,000 |

| MINERAL | $472,030 | $604,400 | $730,525 | $907,900 | $278,000 |

| MISSOULA | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| MUSSELSHELL | $472,030 | $604,400 | $730,525 | $907,900 | $279,000 |

| PARK | $539,350 | $690,450 | $834,600 | $1,037,200 | $469,000 |

| PETROLEUM | $472,030 | $604,400 | $730,525 | $907,900 | $71,000 |

| PHILLIPS | $472,030 | $604,400 | $730,525 | $907,900 | $229,000 |

| PONDERA | $472,030 | $604,400 | $730,525 | $907,900 | $192,000 |

| POWDER RIVER | $472,030 | $604,400 | $730,525 | $907,900 | $53,000 |

| POWELL | $472,030 | $604,400 | $730,525 | $907,900 | $238,000 |

| PRAIRIE | $472,030 | $604,400 | $730,525 | $907,900 | $181,000 |

| RAVALLI | $504,850 | $646,300 | $781,200 | $970,850 | $439,000 |

| RICHLAND | $472,030 | $604,400 | $730,525 | $907,900 | $370,000 |

| ROOSEVELT | $472,030 | $604,400 | $730,525 | $907,900 | $235,000 |

| ROSEBUD | $472,030 | $604,400 | $730,525 | $907,900 | $132,000 |

| SANDERS | $472,030 | $604,400 | $730,525 | $907,900 | $250,000 |

| SHERIDAN | $472,030 | $604,400 | $730,525 | $907,900 | $185,000 |

| SILVER BOW | $472,030 | $604,400 | $730,525 | $907,900 | $250,000 |

| STILLWATER | $472,030 | $604,400 | $730,525 | $907,900 | $374,000 |

| SWEET GRASS | $472,030 | $604,400 | $730,525 | $907,900 | $347,000 |

| TETON | $472,030 | $604,400 | $730,525 | $907,900 | $301,000 |

| TOOLE | $472,030 | $604,400 | $730,525 | $907,900 | $138,000 |

| TREASURE | $472,030 | $604,400 | $730,525 | $907,900 | $261,000 |

| VALLEY | $472,030 | $604,400 | $730,525 | $907,900 | $243,000 |

| WHEATLAND | $472,030 | $604,400 | $730,525 | $907,900 | $189,000 |

| WIBAUX | $472,030 | $604,400 | $730,525 | $907,900 | $192,000 |

| YELLOWSTONE | $472,030 | $604,400 | $730,525 | $907,900 | $374,000 |

FHA Loan Requirements When Applying for a Loan in Montana

One of the top problems when applying for an FHA loan is a low credit score. A low credit score can lead to a higher interest rate and could make it more difficult to qualify for an FHA loan. Another problem that borrowers may face when applying for an FHA loan is a high debt-to-income ratio. A high debt-to-income ratio indicates that the borrower has a high level of debt relative to their income and may have difficulty making their monthly loan payments. Borrowers with a high debt-to-income ratio may need to provide additional documentation to prove their ability to repay the loan.

- Be at least 18 years of age

- Have a valid Social Security Number and U.S. citizenship status

- Provide proof of steady employment and income for the past two consecutive years

- Live in the state of Montana as your primary residence

- Have no more than two late payments on any mortgage or rental payment over the past 12 months

- Have no bankruptcies, foreclosures, or unpaid tax liens within the last three years

- Demonstrate financial responsibility by paying all bills on time

- Have a debt-to-income ratio of no more than 43%

Finally, borrowers may also be required to pay private mortgage insurance (PMI) if they are unable to make a down payment of at least 20% of the purchase price. PMI is an insurance policy that protects the lender in the event that the borrower defaults on their loan. Make sure you check the FHA loan limits in Montana above before shopping for a house to not be surprised later when a lender will ask you to put 10% down or more.

Credit score requirements in Montana for FHA Loan

When it comes to obtaining an FHA loan in Montana, there are certain credit score requirements that must be met in order to get approved. For many homebuyers, the biggest obstacle in securing an FHA loan is having a sufficient credit score. The minimum credit score for an FHA loan is 580, but borrowers with scores between 500 and 579 may still qualify as soon they put 10% of the appraised value as a downpayment. In addition to meeting the credit score requirements, borrowers must also have steady employment history and income that can be verified by the lender. Those who are self-employed or who have irregular incomes may have a more difficult time qualifying for an FHA loan. Overall, the credit score requirements for an FHA loan are not as strict as they may be for other types of financing. However, borrowers must still meet the minimum requirements in order to get approved.

FHA DTI requirements in Montana

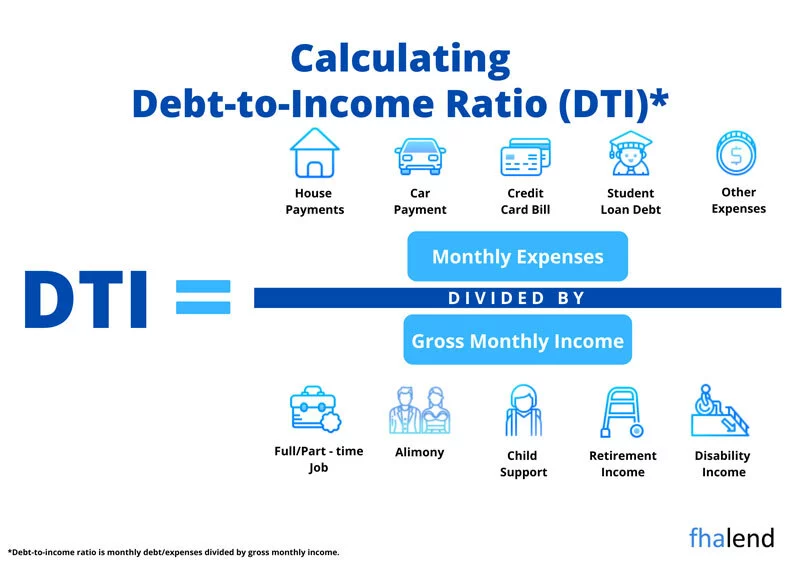

When looking at a loan, lenders will assess your debt-to-income (DTI) ratio to determine your ability to make timely payments on the amount you borrow. Your DTI ratio is calculated by adding up all of your monthly debts and dividing that number by your gross monthly income. For example, if your monthly debts total $1,000 and your gross monthly income is $4,000, your DTI ratio would be 25%. In order to qualify for an FHA loan in Montana, you must have a DTI ratio of 31% or less.

This means that no more than 31% of your monthly income should go towards paying your debts. If you have a DTI ratio of 32% or higher, you will not be able to qualify for an FHA loan in Montana. If you’re not sure what your DTI ratio is, you can use this calculator to estimate it. Keep in mind that this is just an estimate and your lender will ultimately determine yourDTI ratio when you apply for a loan.

FHA LTV requirements in Montana

The LTV (Loan-To-Value) ratio is the loan amount divided by the appraised value of the property. For example, if you’re buying a $200,000 home and taking out a $160,000 loan, your LTV ratio would be 80%.

Employment when qualifying for FHA Loan in Montana

You’ll also need to have a steady income and employment history. The lender will want to see that you have a steady job and income so that they can be confident that you’ll be able to make your loan payments on time each month.

Lowering Your DTI FHA Loan in Montana

If your DTI ratio is too high, there are a few things you can do to try to lower it. One option is to try to negotiate with your creditors to lower your monthly payments. You can also try to increase your income by finding a better-paying job or taking on extra work. If you’re unable to lower your DTI ratio on your own, you may need to wait until your financial situation improves before applying for an FHA loan.

If you’re ready to apply for an FHA loan, be sure to shop around and compare rates and terms from multiple lenders. You can apply for an FHA loan online or in person at a bank or credit union. Be sure to have all of your financial documents ready when you apply so the process can go as quickly and smoothly as possible.

If you’re ready to apply for an FHA loan, be sure to shop around and compare rates and terms from multiple lenders. You can apply for an FHA loan online or in person at a bank or credit union. Be sure to have all of your financial documents ready when you apply so the process can go as quickly and smoothly as possible.

Other Types of FHA Loans in Montana for 2023

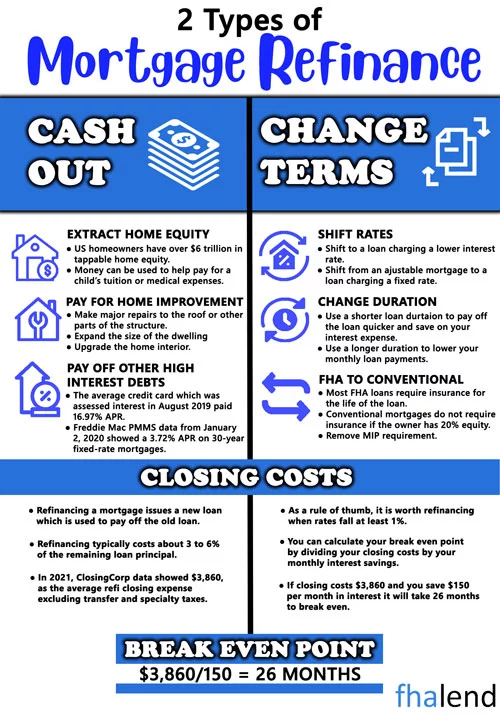

FHA Cash-Out Refinance Loan in Montana

There are several reasons why you might want to get a cash-out to refinance a loan in Montana. Maybe you want to make some home improvements or pay off other debts. Whatever the reason, a cash-out refinances loan can give you the money you need.

In order to qualify for a cash-out refinance loan, you’ll need to have equity in your home. Equity is the difference between the market value of your home and the amount you owe on your mortgage. For example, if your home is worth $200,000 and you owe $100,000 on your mortgage, you have $100,000 in equity.

There are some risks associated with a cash-out refinance loan in Montana. For one, you could end up owing more on your home than it’s worth if you borrowed a large amount of money and the value of your home decreases. Additionally, if you miss payments on your loan, you could lose your home to foreclosure. When you’re ready to get a cash-out to refinance a loan, it’s important to shop around for the best rate. Rates can vary significantly from lender to lender, so it’s important to compare rates before you decide on a loan.

FHA Streamline Refinance Loan in Montana

The FHA Streamline Refinance loan is a great way to get a lower interest rate on your mortgage. If you have an FHA loan in Montana, you may be able to refinance to a lower interest rate with this program. There are no credit or income requirements and the process is quick and easy. Contact your lender to see if you qualify.

203k Rehab Renovation Loan in Montana

203k Rehab Renovation Loan in Montana

- The Standard 203(b) loan is the most commonly used FHA loan in Montana. It’s perfect for homebuyers who are interested in a low down payment (only 3.5%) and don’t mind some extra paperwork on their mortgage application.

- The Limited 203(k) loan is designed for smaller, cosmetic home improvement projects that don’t require structural repairs or major remodeling. This loan is capped at $35,000 in total renovations, and you’ll need a 3.5% down payment.

- The full 203(k) loan is designed for major home improvement projects, such as adding an addition or finishing a basement. There’s no limit on the amount you can borrow with a full 203(k) loan – but you’ll need to put down 3.5%, plus extra funds for any project costs that exceed the value of the home.

How Are FHA Loan Limits Determined?

To be clear, this doesn’t mean that every home buyer in a high-cost area will be able to get an FHA loan for 115% of the median home price. The 115% figure is simply the maximum amount that FHA will insure. Borrowers will still need to qualify for a loan based on their credit history, income, and other financial factors.

It’s also worth noting that FHA loan limits in Montana are “floors,” not ceilings. In other words, they’re the minimum amount that FHA will insure, but borrowers are free to apply for loans that exceed the loan limits in Montana.

For example, let’s say you’re looking at homes in Anaconda, Deer Lodge County, Montana. The 2023 FHA loan limit in Montana for a single-family home in the county is $420,680.

But suppose you find a property that you really love and it happens to be priced at $800,000. You could still apply for an FHA loan to finance the purchase. You would just need to come up with a down payment of 3.5% of the purchase price ($24,500), plus any additional closing costs.

How Are Loan Limits in Montana Updated?

As we mentioned, FHA loan limits are recalculated every year. The process begins in the fall when FHA releases its proposed loan limits in Montana for the coming year.

The proposed limits are then put out for public comment. After taking feedback from interested parties, FHA announces the final loan limits in late December or early January.

So if you’re planning to apply for an FHA loan in 2019, you’ll need to keep an eye on the loan limit announcements in the fall. Once the final limits are announced, you’ll know exactly how much you can borrow.

Exceptions to FHA Loan Limits in Montana

There are a few exceptions to the general rule that FHA loan limits in Montana are based on median home prices.

In certain high-cost areas, FHA’s loan limits are “ceilings,” rather than floors. That means they’re the maximum amount you can borrow, rather than the minimum.

The ceiling for 2023 is 150% of the national conforming loan limit, which is currently $ 703,800 for a single-family home. In other words, in high-cost areas, you could borrow up to $1,353,500 and still get an FHA loan (assuming you meet all of the other eligibility requirements). There are also some counties where FHA has set “floor and ceiling” limits. In these counties, the floor is equal to 115% of the median home price, while the ceiling is 150% of the conforming loan limit.

Top 3 Cities to Live in Montana

If you’re looking for a place to live that has all the amenities of a big city but with a small-town feel, then any of these three cities would be a great choice. Each one has its own unique flavor and attractions that make it worth considering as your new home.

1. Billings

Billings is the largest city in Montana and is known for its strong economy and diverse population. The city is home to several large businesses and industries, as well as a growing arts and culture scene. There are plenty of things to do in Billings, from exploring the Yellowstone River to enjoying the many parks and recreation areas.

2. Great Falls

Great Falls is a smaller city located in north-central Montana. The city is known for its beautiful scenery and outdoor recreation opportunities. Great Falls is also home to several museums and historical sites, making it a great place to learn about the history of Montana.

3. Missoula

Missoula is a city located in western Montana and is home to the University of Montana. The city has a strong economy and is known for its many parks and recreation areas. Missoula is also home to a growing arts and culture scene, with several art galleries, performance venues, and festivals throughout the year.

Montana Down Payment Assistance Program

NeighborWorks Montana provides the following three down payment assistance programs:

- 20+ Community Second: A second mortgage loan on your primary home would be due every month, and the interest rate would be 2 percentage points higher than your first mortgage. You must borrow at least $10,000 using this program, which you may do if you earn up to 125% of the median income (or 115% AMI for FHA first mortgages) in

- State Home Deferred: First-time homebuyers who make less than 80% of the area’s median income may borrow up to $50,000 with no payments required. (In the case of disability, manufactured house acquisition, or properties in high-cost areas, up to $65,000.) If you sold the property, refinanced it, or paid off

- Statewide Low Mod: Low- and moderate-income borrowers (up to 125% of area median income) may receive up to $20,000 in aid that must be paid back over a year.

NeighborWorks also provides closing cost help if you’re receiving a USDA Direct Loan, which doesn’t need a down payment.

If you want to get your house back in order, here’s what you need to know. The program has a lot of choices and restrictions, so go over the specifics on NeighborsWorks Montana’s website. Also, see if there are any other homeownership assistance programs available through HUD in the state.