FHA Loan Limits in Kansas For 2023

If you’re considering an FHA loan in Kansas, it’s important to know the FHA loan limits for your county. Here’s a look at the FHA loan limits in Kansas by county, as well as some background information on FHA loans.

If you’re considering an FHA loan in Kansas, it’s important to know the FHA loan limits for your county. Here’s a look at the FHA loan limits in Kansas by county, as well as some background information on FHA loans.

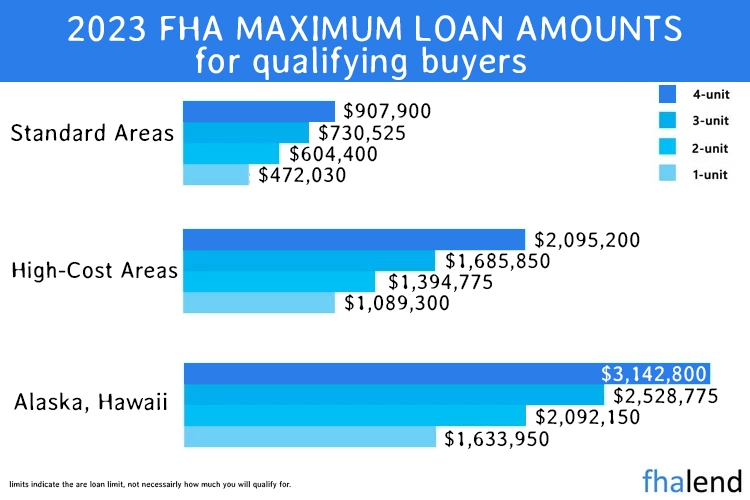

As of January 1, 2023, the maximum FHA loan limits for single-family homes in Kansas are set to $472,030. In all counties, the loan limits are the same. In Kansas, FHA loan limits are determined by the median home price in each county.

What are FHA loans?

FHA loans are mortgages insured by the Federal Housing Administration. They’re popular among first-time home buyers and people with low credit scores because they have more flexible eligibility requirements than conventional loans.

FHA Loan Limits in Kansas by County in 2023

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| ARKANSAS | $472,030 | $604,400 | $730,525 | $907,900 | $85,000 |

| ASHLEY | $472,030 | $604,400 | $730,525 | $907,900 | $59,000 |

| BAXTER | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| BENTON | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| BOONE | $472,030 | $604,400 | $730,525 | $907,900 | $172,000 |

| BRADLEY | $472,030 | $604,400 | $730,525 | $907,900 | $66,000 |

| CALHOUN | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| CARROLL | $472,030 | $604,400 | $730,525 | $907,900 | $155,000 |

| CHICOT | $472,030 | $604,400 | $730,525 | $907,900 | $50,000 |

| CLARK | $472,030 | $604,400 | $730,525 | $907,900 | $211,000 |

| CLAY | $472,030 | $604,400 | $730,525 | $907,900 | $108,000 |

| CLEBURNE | $472,030 | $604,400 | $730,525 | $907,900 | $149,000 |

| CLEVELAND | $472,030 | $604,400 | $730,525 | $907,900 | $133,000 |

| COLUMBIA | $472,030 | $604,400 | $730,525 | $907,900 | $119,000 |

| CONWAY | $472,030 | $604,400 | $730,525 | $907,900 | $154,000 |

| CRAIGHEAD | $472,030 | $604,400 | $730,525 | $907,900 | $185,000 |

| CRAWFORD | $472,030 | $604,400 | $730,525 | $907,900 | $152,000 |

| CRITTENDEN | $472,030 | $604,400 | $730,525 | $907,900 | $303,000 |

| CROSS | $472,030 | $604,400 | $730,525 | $907,900 | $111,000 |

| DALLAS | $472,030 | $604,400 | $730,525 | $907,900 | $56,000 |

| DESHA | $472,030 | $604,400 | $730,525 | $907,900 | $78,000 |

| DREW | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| FAULKNER | $472,030 | $604,400 | $730,525 | $907,900 | $208,000 |

| FRANKLIN | $472,030 | $604,400 | $730,525 | $907,900 | $152,000 |

| FULTON | $472,030 | $604,400 | $730,525 | $907,900 | $95,000 |

| GARLAND | $472,030 | $604,400 | $730,525 | $907,900 | $175,000 |

| GRANT | $472,030 | $604,400 | $730,525 | $907,900 | $208,000 |

| GREENE | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| HEMPSTEAD | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| HOT SPRING | $472,030 | $604,400 | $730,525 | $907,900 | $139,000 |

| HOWARD | $472,030 | $604,400 | $730,525 | $907,900 | $86,000 |

| INDEPENDENCE | $472,030 | $604,400 | $730,525 | $907,900 | $115,000 |

| IZARD | $472,030 | $604,400 | $730,525 | $907,900 | $95,000 |

| JACKSON | $472,030 | $604,400 | $730,525 | $907,900 | $97,000 |

| JEFFERSON | $472,030 | $604,400 | $730,525 | $907,900 | $133,000 |

| JOHNSON | $472,030 | $604,400 | $730,525 | $907,900 | $146,000 |

| LAFAYETTE | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| LAWRENCE | $472,030 | $604,400 | $730,525 | $907,900 | $67,000 |

| LEE | $472,030 | $604,400 | $730,525 | $907,900 | $104,000 |

| LINCOLN | $472,030 | $604,400 | $730,525 | $907,900 | $133,000 |

| LITTLE RIVER | $472,030 | $604,400 | $730,525 | $907,900 | $176,000 |

| LOGAN | $472,030 | $604,400 | $730,525 | $907,900 | $146,000 |

| LONOKE | $472,030 | $604,400 | $730,525 | $907,900 | $208,000 |

| MADISON | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| MARION | $472,030 | $604,400 | $730,525 | $907,900 | $179,000 |

| MILLER | $472,030 | $604,400 | $730,525 | $907,900 | $176,000 |

| MISSISSIPPI | $472,030 | $604,400 | $730,525 | $907,900 | $79,000 |

| MONROE | $472,030 | $604,400 | $730,525 | $907,900 | $112,000 |

| MONTGOMERY | $472,030 | $604,400 | $730,525 | $907,900 | $151,000 |

| NEVADA | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| NEWTON | $472,030 | $604,400 | $730,525 | $907,900 | $172,000 |

| OUACHITA | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| PERRY | $472,030 | $604,400 | $730,525 | $907,900 | $208,000 |

| PHILLIPS | $472,030 | $604,400 | $730,525 | $907,900 | $48,000 |

| PIKE | $472,030 | $604,400 | $730,525 | $907,900 | $117,000 |

| POINSETT | $472,030 | $604,400 | $730,525 | $907,900 | $185,000 |

| POLK | $472,030 | $604,400 | $730,525 | $907,900 | $107,000 |

| POPE | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| PRAIRIE | $472,030 | $604,400 | $730,525 | $907,900 | $100,000 |

| PULASKI | $472,030 | $604,400 | $730,525 | $907,900 | $208,000 |

| RANDOLPH | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| ST. FRANCIS | $472,030 | $604,400 | $730,525 | $907,900 | $68,000 |

| SALINE | $472,030 | $604,400 | $730,525 | $907,900 | $208,000 |

| SCOTT | $472,030 | $604,400 | $730,525 | $907,900 | $89,000 |

| SEARCY | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| SEBASTIAN | $472,030 | $604,400 | $730,525 | $907,900 | $152,000 |

| SEVIER | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| SHARP | $472,030 | $604,400 | $730,525 | $907,900 | $115,000 |

| STONE | $472,030 | $604,400 | $730,525 | $907,900 | $184,000 |

| UNION | $472,030 | $604,400 | $730,525 | $907,900 | $95,000 |

| VAN BUREN | $472,030 | $604,400 | $730,525 | $907,900 | $95,000 |

| WASHINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| WHITE | $472,030 | $604,400 | $730,525 | $907,900 | $138,000 |

| WOODRUFF | $472,030 | $604,400 | $730,525 | $907,900 | $101,000 |

| YELL | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| ALLEN | $472,030 | $604,400 | $730,525 | $907,900 | $121,000 |

| ANDERSON | $472,030 | $604,400 | $730,525 | $907,900 | $131,000 |

| ATCHISON | $472,030 | $604,400 | $730,525 | $907,900 | $142,000 |

| BARBER | $472,030 | $604,400 | $730,525 | $907,900 | $97,000 |

| BARTON | $472,030 | $604,400 | $730,525 | $907,900 | $127,000 |

| BOURBON | $472,030 | $604,400 | $730,525 | $907,900 | $118,000 |

| BROWN | $472,030 | $604,400 | $730,525 | $907,900 | $124,000 |

| BUTLER | $472,030 | $604,400 | $730,525 | $907,900 | $219,000 |

| CHASE | $472,030 | $604,400 | $730,525 | $907,900 | $153,000 |

| CHAUTAUQUA | $472,030 | $604,400 | $730,525 | $907,900 | $81,000 |

| CHEROKEE | $472,030 | $604,400 | $730,525 | $907,900 | $106,000 |

| CHEYENNE | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| CLARK | $472,030 | $604,400 | $730,525 | $907,900 | $97,000 |

| CLAY | $472,030 | $604,400 | $730,525 | $907,900 | $138,000 |

| CLOUD | $472,030 | $604,400 | $730,525 | $907,900 | $102,000 |

| COFFEY | $472,030 | $604,400 | $730,525 | $907,900 | $162,000 |

| COMANCHE | $472,030 | $604,400 | $730,525 | $907,900 | $113,000 |

| COWLEY | $472,030 | $604,400 | $730,525 | $907,900 | $116,000 |

| CRAWFORD | $472,030 | $604,400 | $730,525 | $907,900 | $128,000 |

| DECATUR | $472,030 | $604,400 | $730,525 | $907,900 | $92,000 |

| DICKINSON | $472,030 | $604,400 | $730,525 | $907,900 | $118,000 |

| DONIPHAN | $472,030 | $604,400 | $730,525 | $907,900 | $202,000 |

| DOUGLAS | $472,030 | $604,400 | $730,525 | $907,900 | $282,000 |

| EDWARDS | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| ELK | $472,030 | $604,400 | $730,525 | $907,900 | $65,000 |

| ELLIS | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| ELLSWORTH | $472,030 | $604,400 | $730,525 | $907,900 | $144,000 |

| FINNEY | $472,030 | $604,400 | $730,525 | $907,900 | $248,000 |

| FORD | $472,030 | $604,400 | $730,525 | $907,900 | $144,000 |

| FRANKLIN | $472,030 | $604,400 | $730,525 | $907,900 | $181,000 |

| GEARY | $472,030 | $604,400 | $730,525 | $907,900 | $282,000 |

| GOVE | $472,030 | $604,400 | $730,525 | $907,900 | $131,000 |

| GRAHAM | $472,030 | $604,400 | $730,525 | $907,900 | $117,000 |

| GRANT | $472,030 | $604,400 | $730,525 | $907,900 | $179,000 |

| GRAY | $472,030 | $604,400 | $730,525 | $907,900 | $164,000 |

| GREELEY | $472,030 | $604,400 | $730,525 | $907,900 | $175,000 |

| GREENWOOD | $472,030 | $604,400 | $730,525 | $907,900 | $85,000 |

| HAMILTON | $472,030 | $604,400 | $730,525 | $907,900 | $117,000 |

| HARPER | $472,030 | $604,400 | $730,525 | $907,900 | $98,000 |

| HARVEY | $472,030 | $604,400 | $730,525 | $907,900 | $219,000 |

| HASKELL | $472,030 | $604,400 | $730,525 | $907,900 | $204,000 |

| HODGEMAN | $472,030 | $604,400 | $730,525 | $907,900 | $122,000 |

| JACKSON | $472,030 | $604,400 | $730,525 | $907,900 | $205,000 |

| JEFFERSON | $472,030 | $604,400 | $730,525 | $907,900 | $205,000 |

| JEWELL | $472,030 | $604,400 | $730,525 | $907,900 | $74,000 |

| JOHNSON | $472,030 | $604,400 | $730,525 | $907,900 | $410,000 |

| KEARNY | $472,030 | $604,400 | $730,525 | $907,900 | $248,000 |

| KINGMAN | $472,030 | $604,400 | $730,525 | $907,900 | $121,000 |

| KIOWA | $472,030 | $604,400 | $730,525 | $907,900 | $173,000 |

| LABETTE | $472,030 | $604,400 | $730,525 | $907,900 | $100,000 |

| LANE | $472,030 | $604,400 | $730,525 | $907,900 | $117,000 |

| LEAVENWORTH | $472,030 | $604,400 | $730,525 | $907,900 | $410,000 |

| LINCOLN | $472,030 | $604,400 | $730,525 | $907,900 | $99,000 |

| LINN | $472,030 | $604,400 | $730,525 | $907,900 | $410,000 |

| LOGAN | $472,030 | $604,400 | $730,525 | $907,900 | $117,000 |

| LYON | $472,030 | $604,400 | $730,525 | $907,900 | $153,000 |

| MCPHERSON | $472,030 | $604,400 | $730,525 | $907,900 | $245,000 |

| MARION | $472,030 | $604,400 | $730,525 | $907,900 | $126,000 |

| MARSHALL | $472,030 | $604,400 | $730,525 | $907,900 | $133,000 |

| MEADE | $472,030 | $604,400 | $730,525 | $907,900 | $133,000 |

| MIAMI | $472,030 | $604,400 | $730,525 | $907,900 | $410,000 |

| MITCHELL | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| MONTGOMERY | $472,030 | $604,400 | $730,525 | $907,900 | $103,000 |

| MORRIS | $472,030 | $604,400 | $730,525 | $907,900 | $123,000 |

| MORTON | $472,030 | $604,400 | $730,525 | $907,900 | $141,000 |

| NEMAHA | $472,030 | $604,400 | $730,525 | $907,900 | $196,000 |

| NEOSHO | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| NESS | $472,030 | $604,400 | $730,525 | $907,900 | $97,000 |

| NORTON | $472,030 | $604,400 | $730,525 | $907,900 | $124,000 |

| OSAGE | $472,030 | $604,400 | $730,525 | $907,900 | $205,000 |

| OSBORNE | $472,030 | $604,400 | $730,525 | $907,900 | $87,000 |

| OTTAWA | $472,030 | $604,400 | $730,525 | $907,900 | $161,000 |

| PAWNEE | $472,030 | $604,400 | $730,525 | $907,900 | $103,000 |

| PHILLIPS | $472,030 | $604,400 | $730,525 | $907,900 | $108,000 |

| POTTAWATOMIE | $472,030 | $604,400 | $730,525 | $907,900 | $282,000 |

| PRATT | $472,030 | $604,400 | $730,525 | $907,900 | $141,000 |

| RAWLINS | $472,030 | $604,400 | $730,525 | $907,900 | $132,000 |

| RENO | $472,030 | $604,400 | $730,525 | $907,900 | $180,000 |

| REPUBLIC | $472,030 | $604,400 | $730,525 | $907,900 | $88,000 |

| RICE | $472,030 | $604,400 | $730,525 | $907,900 | $104,000 |

| RILEY | $472,030 | $604,400 | $730,525 | $907,900 | $282,000 |

| ROOKS | $472,030 | $604,400 | $730,525 | $907,900 | $101,000 |

| RUSH | $472,030 | $604,400 | $730,525 | $907,900 | $92,000 |

| RUSSELL | $472,030 | $604,400 | $730,525 | $907,900 | $131,000 |

| SALINE | $472,030 | $604,400 | $730,525 | $907,900 | $161,000 |

| SCOTT | $472,030 | $604,400 | $730,525 | $907,900 | $209,000 |

| SEDGWICK | $472,030 | $604,400 | $730,525 | $907,900 | $219,000 |

| SEWARD | $472,030 | $604,400 | $730,525 | $907,900 | $145,000 |

| SHAWNEE | $472,030 | $604,400 | $730,525 | $907,900 | $205,000 |

| SHERIDAN | $472,030 | $604,400 | $730,525 | $907,900 | $156,000 |

| SHERMAN | $472,030 | $604,400 | $730,525 | $907,900 | $141,000 |

| SMITH | $472,030 | $604,400 | $730,525 | $907,900 | $99,000 |

| STAFFORD | $472,030 | $604,400 | $730,525 | $907,900 | $97,000 |

| STANTON | $472,030 | $604,400 | $730,525 | $907,900 | $99,000 |

| STEVENS | $472,030 | $604,400 | $730,525 | $907,900 | $136,000 |

| SUMNER | $472,030 | $604,400 | $730,525 | $907,900 | $219,000 |

| THOMAS | $472,030 | $604,400 | $730,525 | $907,900 | $199,000 |

| TREGO | $472,030 | $604,400 | $730,525 | $907,900 | $135,000 |

| WABAUNSEE | $472,030 | $604,400 | $730,525 | $907,900 | $205,000 |

| WALLACE | $472,030 | $604,400 | $730,525 | $907,900 | $111,000 |

| WASHINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| WICHITA | $472,030 | $604,400 | $730,525 | $907,900 | $159,000 |

| WILSON | $472,030 | $604,400 | $730,525 | $907,900 | $108,000 |

| WOODSON | $472,030 | $604,400 | $730,525 | $907,900 | $121,000 |

| WYANDOTTE | $472,030 | $604,400 | $730,525 | $907,900 | $410,000 |

How are FHA Loan Limits in Kansas Set?

The HUD sets FHA loan limits in Kansas for each county, based on the median home price in that county. In Kansas, the FHA loan limits in Kansas range from $331,760 to $615,250.

FHA loan limits are set by the Federal Housing Administration (FHA) and they usually match the conforming loan limits set by the Federal Housing Finance Agency (FHFA). The FHFA is the government agency that sets national mortgage lending standards and monitors Fannie Mae and Freddie Mac, which are government-sponsored enterprises (GSEs) that help provide liquidity to the secondary mortgage market.

The FHA loan limits in Kansas is based on the median home price in a given area. For example, as of 2020, the loan limit for a single-family home in Des Moines, Iowa is $331,760. This means that if you’re buying a house in Des Moines, you can get an FHA loan for up to $331,760.

The FHA loan limits in Kansas is not the same as the maximum loan amount you can get from a lender. The maximum loan amount is based on your credit score, income, and other factors.

If you’re interested in an FHA loan, contact a lender to see if you qualify.

FHA Loan Limits in Kansas for High-Cost Areas

FHA Loan Limits in Kansas for High-Cost Areas

In Kansas state, there is five high-cost areas where FHA loan limits in Kansas are higher. These counties are Johnson, Leavenworth, Linn, Miami and Wyandotte. The FHA loan limits in Kansas are higher than in other counties in Kansas. If you’re trying to purchase a single hone family you can borrow up to $552,050. A FHA lender can lend up to $667,350 for duplex property, and up to $667,350 when you want to purchase a triplex in one of the above countries. If you are an investor an willing to buy a 4-unit building, rent 3 of them alive rent free in one of the unit you can get up to $829,350 in financing.

Johnson County

Johnson County in Kansas is a great place to live, work, and raise a family. There are plenty of things to do in the county, and it is a great place to retire. The cost of living is affordable, and the people are friendly. If you are looking for a place to call home, Johnson County in Kansas is a perfect choice.

Leavenworth County

Leavenworth county in Kansas is a great place to live. There are plenty of things to do and the people are friendly. If you’re thinking about moving to Leavenworth county, here are a few things you should know.

1. The cost of living is relatively low.

2. The community is close-knit and supportive.

3. There are plenty of opportunities for outdoor recreation.

If you’re considering a move to Leavenworth County, Kansas, these are just a few of the things you can look forward to. Contact us today to learn more about making the move to this great community.

Linn County

Linn County in Kansas is a great place to live. The people are friendly and the scenery is beautiful. There are many things to do in Linn county, including hiking, fishing, and camping. If you’re looking for a place to call home, consider Linn county in Kansas.

Miami County

Miami County is located in Kansas. The county has a population of over 4,000 people. The county seat is Paola. The county was founded in 1857. Miami County is home to several historical sites and attractions. The county is also home to several parks and recreation areas.

If you’re looking for a place to enjoy the great outdoors, then Miami County is the perfect spot for you! With over 4,000 acres of land to explore, you’ll never run out of things to do. From hiking and camping to fishing and boating, there’s something for everyone in Miami County.

Looking for a little history? Miami County is home to several historical sites and attractions. Learn about the county’s rich past at the Miami County Museum or take a self-guided tour of the Paola Historic District. There are also several Civil War battlefields and sites located in the county.

Wyandotte County

Wyandotte County is located in northeastern Kansas and is the fourth most populous county in the state. The county seat is Kansas City, which is also the largest city in the county. Wyandotte County is named after the Wyandot Indian tribe. European Americans settled the area starting in the 1830s, and the county was organized in 1859.

Wyandotte County has a diverse economy with industries such as healthcare, manufacturing, and retail. The county is home to several hospitals and medical centers, including Children’s Mercy Hospital and the University of Kansas Health System. There are also several major manufacturers located in Wyandotte County, such as Ford Motor Company, Honeywell International, and Textron Aviation.

Wyandotte County is a great place to live, work, and raise a family. The county offers a variety of parks and recreation opportunities, as well as excellent schools. If you’re looking for a place to call home in Kansas, Wyandotte County is a great option.

20 Things to Know Before Applying for an FHA loan

20 Things to Know Before Applying for an FHA loan

1. FHA loans are a popular choice for first-time homebuyers

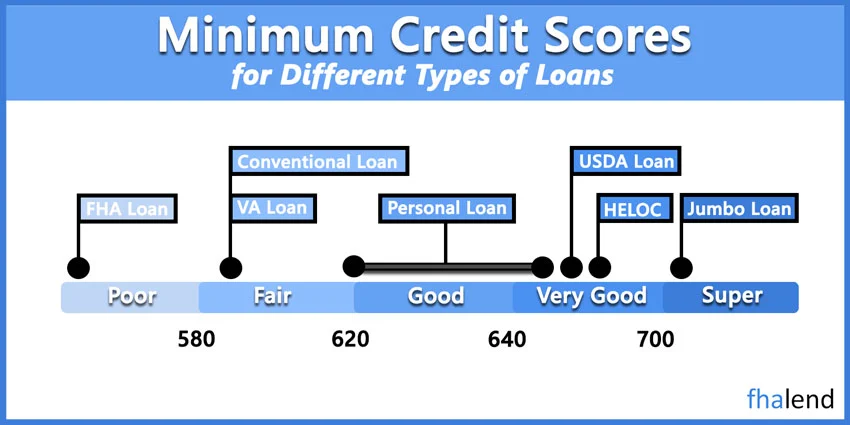

2. FHA loans have lower credit score requirements than conventional loans

3. FHA loans have more lenient income and debt requirements than conventional loans

4. FHA loans require a smaller down payment than conventional loans

5. FHA loans have different insurance requirements than conventional loans

6. FHA loans have different occupancy requirements than conventional loans

7. FHA loan limits vary by county

8. You must complete a homebuyer counseling course to get an FHA loan

9. You must have a valid Social Security number to get an FHA loan

10. You must be a US citizen or permanent resident alien to get an FHA loan

11. You must be of legal age to get an FHA loan

12. You must have a clear credit history to get an FHA loan

13. You must have a steady income to get an FHA loan

14. You must have a good debt-to-income ratio to get an FHA loan

15. You must have a valid US mailing address to get an FHA loan

16. You must be employed for at least two years to get an FHA loan

17. You must have a verifiable employment history to get an FHA loan

18. You must have a bank account in good standing to get an FHA loan

19. You must have homeowner’s insurance to get an FHA loan

20. You must have a property appraisal to get an FHA loan

Please call us or fill out an application here so we can issue you a pre-qualification letter and you can start shopping for your dream house 🙂

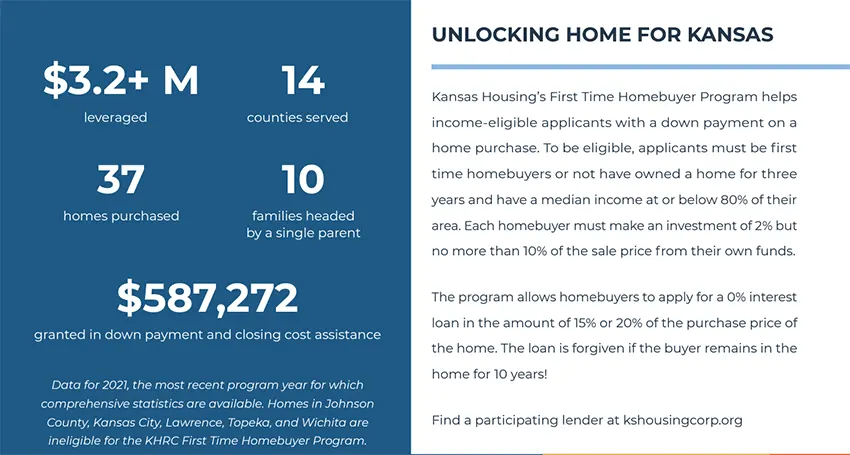

Kansas Down Payment Assistance Program

The Kansas Housing Resources Corporation (KHRC) has a down payment assistance program for first-time house buyers. Purchases in the Topeka, Wichita, Lawrence, and Kansas City metropolitan areas as well as Johnson County are not eligible for help.

The Kansas Housing Resources Corporation (KHRC) has a down payment assistance program for first-time house buyers. Purchases in the Topeka, Wichita, Lawrence, and Kansas City metropolitan areas as well as Johnson County are not eligible for help.

- You might be eligible for a loan of 15-20% of the purchase price of your home, depending on your income. And that loan should be progressively forgiven as time goes on, implying it may eventually cost you nothing.

- A minimum investment of 2% of the purchase price is required. For a $200,000 property, 2% equals $4,000.

More information may be found on the KHRC’s website. On HUD’s website, you can locate different programs for Kansas.