FHA Loan Limits in Oregon

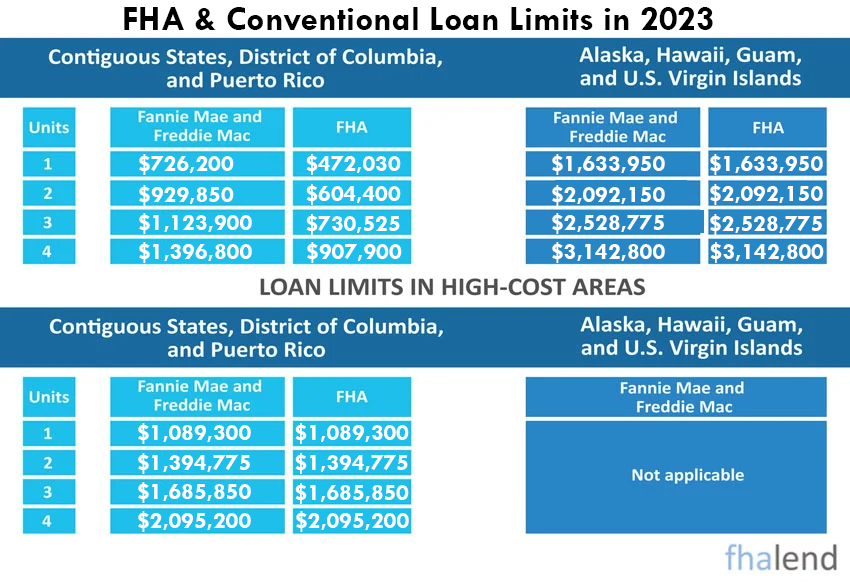

The FHA loan limits in Oregon are the maximum amount that a borrower can receive from the FHA for a single-family home. The loan limits are calculated by taking into account the median home price in each county, as well as other factors that influence home prices, such as income level and population growth.

The FHA loan limits in Oregon are the maximum amount that a borrower can receive from the FHA for a single-family home. The loan limits are calculated by taking into account the median home price in each county, as well as other factors that influence home prices, such as income level and population growth.

These limits vary depending on the type of property that you are purchasing, as well as your location and income level. In general, there are two main types of FHA loan limits in Oregon: standard limits and high-cost area limits.

FHA Maximum Loan Amount List in Oregon

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| OREGON | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| BAKER | $472,030 | $604,400 | $730,525 | $907,900 | $211,000 |

| BENTON | $560,050 | $716,950 | $866,650 | $1,077,050 | $487,000 |

| CLACKAMAS | $672,750 | $861,250 | $1,041,050 | $1,293,750 | $585,000 |

| CLATSOP | $529,000 | $677,200 | $818,600 | $1,017,300 | $460,000 |

| COLUMBIA | $672,750 | $861,250 | $1,041,050 | $1,293,750 | $585,000 |

| COOS | $472,030 | $604,400 | $730,525 | $907,900 | $303,000 |

| CROOK | $472,030 | $604,400 | $730,525 | $907,900 | $355,000 |

| CURRY | $472,030 | $604,400 | $730,525 | $907,900 | $400,000 |

| DESCHUTES | $690,000 | $883,300 | $1,067,750 | $1,326,950 | $600,000 |

| DOUGLAS | $472,030 | $604,400 | $730,525 | $907,900 | $290,000 |

| GILLIAM | $472,030 | $604,400 | $730,525 | $907,900 | $171,000 |

| GRANT | $472,030 | $604,400 | $730,525 | $907,900 | $175,000 |

| HARNEY | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| HOOD RIVER | $671,600 | $859,750 | $1,039,250 | $1,291,550 | $584,000 |

| JACKSON | $472,030 | $604,400 | $730,525 | $907,900 | $401,000 |

| JEFFERSON | $472,030 | $604,400 | $730,525 | $907,900 | $344,000 |

| JOSEPHINE | $472,030 | $604,400 | $730,525 | $907,900 | $375,000 |

| KLAMATH | $472,030 | $604,400 | $730,525 | $907,900 | $230,000 |

| LAKE | $472,030 | $604,400 | $730,525 | $907,900 | $142,000 |

| LANE | $481,850 | $616,850 | $745,650 | $926,650 | $419,000 |

| LINCOLN | $472,030 | $604,400 | $730,525 | $907,900 | $379,000 |

| LINN | $472,030 | $604,400 | $730,525 | $907,900 | $355,000 |

| MALHEUR | $472,030 | $604,400 | $730,525 | $907,900 | $350,000 |

| MARION | $483,000 | $618,300 | $747,400 | $928,850 | $420,000 |

| MORROW | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| MULTNOMAH | $672,750 | $861,250 | $1,041,050 | $1,293,750 | $585,000 |

| POLK | $483,000 | $618,300 | $747,400 | $928,850 | $420,000 |

| SHERMAN | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| TILLAMOOK | $472,030 | $604,400 | $730,525 | $907,900 | $355,000 |

| UMATILLA | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| UNION | $472,030 | $604,400 | $730,525 | $907,900 | $235,000 |

| WALLOWA | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| WASCO | $472,030 | $604,400 | $730,525 | $907,900 | $330,000 |

| WASHINGTON | $672,750 | $861,250 | $1,041,050 | $1,293,750 | $585,000 |

| WHEELER | $472,030 | $604,400 | $730,525 | $907,900 | $93,000 |

| YAMHILL | $672,750 | $861,250 | $1,041,050 | $1,293,750 | $585,000 |

Methods Used to Calculate FHA Loan Limits in Oregon

Median home price

The median home price in each county is taken into account when determining the FHA loan limit. This is calculated by taking the median value of all homes sold within a given county over time and comparing it to recent home values in that same county. This gives an indication of how much people are willing to pay for homes in that area, which helps inform the FHA loan limit calculation.

Income levels

In addition to median home prices, income levels also play a role in calculating FHA loan limits. For instance, in counties where incomes are higher, people are generally able to afford more expensive homes and therefore the loan limits will be higher.

Population growth

Another factor that is taken into consideration when calculating FHA loan limits in Oregon is population growth. If a county’s population is increasing rapidly, it is likely that home prices will also be on the rise. As a result, the FHA loan limit for that county will be higher than it would be otherwise.

The FHA uses these methods to calculate loan limits for each county in the United States on an annual basis. The loan limits are typically updated in the fall after home prices have been released for the year. For 2023, the loan limits range from $472,030 to $883,300 in most counties, there are also some high-cost areas where the limits are higher. Whether you are buying a home or refinancing an existing mortgage, these loan limits help ensure that borrowers have access to affordable financing options.

FHA Maximum Multifamily Loan Amounts in Oregon

A multifamily property is a real estate property that houses more than one family. These properties can come in many shapes and sizes, from small duplexes to large apartment complexes. Multifamily properties are a great investment for those looking to generate rental income and build long-term wealth.

When talking about FHA loans, there are only 3 types of multifamily properties passing HUD rules and financing up to 97,5% of the purchase price. Please see below the FHA loan limits in Oregon for all multifamily properties (Duplex, Triplex, Fourplex)

FHA Limits for a Duplex in Oregon

A duplex property is a single property that has two separate units, usually with their own entrances. Duplexes are often built as attached homes, meaning that each unit shares at least one wall with the unit next door. The advantage of owning a duplex is that you can live in one unit and rent out the other, essentially covering your mortgage payment with rental income. This can be a great way to build equity and wealth over time.

There are a few things to keep in mind if you’re considering purchasing a duplex. First, it’s important to make sure that the zoning for the property allows for this type of use. Second, you’ll need to obtain the necessary permits from your local municipality. And finally, it’s important to be aware of the potential liability issues that come with being a landlord.

The maximum limits are set at $538,650 for most counties however there are high costs is in Oregon as well (Benton County, Clackamas County, Clatsop County, Columbia County, Deschutes County, Hood River County, Multnomah County, Washington County, Yamhill County)

FHA Limits for a Multifamily Triplex in Oregon

A triplex property, also known as a multi-family dwelling or multifamily residence, is a type of real estate that consists of three separate living units. Triplex properties are popular among investors and homeowners who are looking for additional income streams from renting out the other units in their homes. In today’s housing market, triplexes are becoming increasingly popular as more and more people seek to rent rather than buy their homes.

The FHA loan limits in Oregon for Triplex are set at $730,525 for most counties. In Oregon, there are 11 counties with higher FHA loan limits for 3-unit properties. Please check the above table for the specific county you live in.

FHA Multifamily Limits for a Fourplex in Oregon

Fourplex properties are large multi-unit residential buildings that contain a total of four separate living spaces. They are often popular among investors and real estate developers, as they can generate substantial income by renting out individual units to tenants. There are many different factors that contribute to the appeal of fourplex properties, including their affordability, flexibility, and potential for investment returns. In addition, they typically require lower maintenance costs than other types of multifamily residences due to their simple design and smaller size. The FHA loan limits in Oregon for fourplex properties are set at $907,900 in most counties. There are some exceptions you can find in the above table.

FHA Loan Requirements in Oregon

FHA Loan Requirements in Oregon

FHA loan requirements are specific guidelines that must be met in order to qualify for an FHA loan. These requirements include a minimum credit score, a certain down payment amount, and proof of income. Additionally, FHA loans may have limitations on things like the location and condition of the property you are looking to purchase. We do all types of FHA loans from refinances to mixed-use and jumbo loans. Please apply here to check your eligibility.

In order to qualify for a forward mortgage, you’ll need to meet certain basic eligibility requirements. These include having a steady source of income and a credit score that is at least 580 or higher. You may also be required to show proof of employment or pay stubs, as well as provide details about any outstanding debt obligations. Additionally, you’ll likely have to put down at least 3.5% of the purchase price as a down payment.

The federal government shields FHA loans, enabling lenders to lend funds without any risks. This makes it simpler for potential buyers to pre-qualify for an Illinois FHA home loan. Here’s what else you should be aware of when considering requirements for FHA loans in Oregon:

Employment History Requirements

To further add strength to your debt-to-income ratio, show two years of uninterrupted employment history. It’s essential that there are no gaps between jobs that may arouse suspicion.

Although recent college graduates who have already secured work within their field might not need this requirement, it is still up to your loan officer whether or not they will take into account your current history in making the decision.

Mortgage Insurance Premium for FHA Loan

To obtain an FHA loan, you’ll need to budget for a one-time 1.75% mortgage insurance premium (MIP) that will be included in your total loan amount. No separate payment is required and the MIP can be financed.

DTI Requirements for FHA Loan

Generally, lenders prefer a debt-to-income ratio of less than 43%, but this may differ from one financial institution to another. It’s useful to keep in mind that understanding your finances is not only invaluable for securing a mortgage but also assists you in developing and maintaining a viable budget over time.

To ensure you are able to comfortably afford monthly payments on your long-term loan, it is important that you accurately assess the balance between expenses incurred versus income earned.

Down Payment Requirements for FHA Loan

You can take advantage of FHA-insured loans to make a modest 3.5% down payment if your credit score is above 580 points. However, should your score fall between 500 and 579, lenders in Oregon may require you to put up 10%.

Credit Score & History

If you’re in the market for a new home, the first thing to do is build your credit. If it’s not at its peak yet, don’t despair – there are still options available! If your FICO score is above 580 then you can access up to 96.5% of your chosen house’s value without any further issues.

Oregon Down Payment Assistance Program

For first-time buyers, the Oregon Housing and Community Services (OHCS) offers down payment assistance programs. They’re designed for “low-and very low-income families and individuals,” with a particular focus on underserved populations. The state organization distributes money to various local organizations that provide direct assistance to purchasers.

There is a list of those organizations on the OHCS website, as well as the counties or counties they serve. Every agency is linked to via links on the OHCS website. Also, check out HUD’s list of additional homeownership assistance programs in the state.