Maximum FHA Loan Amount in Virginia

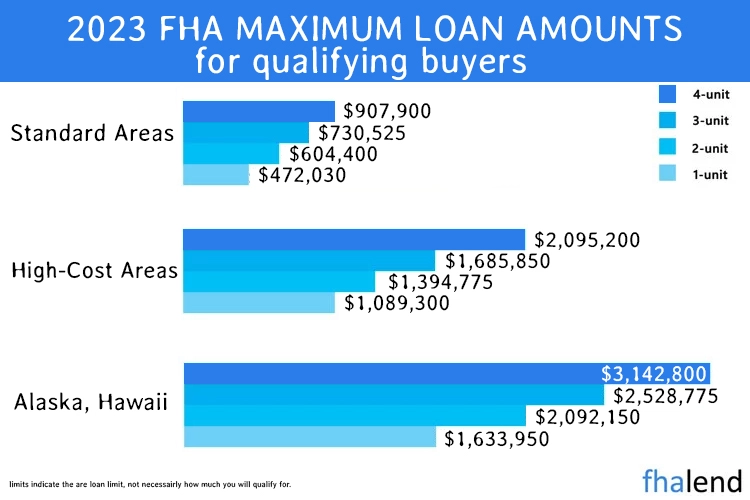

The maximum loan limit for an FHA-insured mortgage is 115% of the median home price in the county. However, there are some exceptions to this rule. For example, in high-cost counties like Fredericksburg or Manassas Park in Virginia the maximum loan limit is 150% of the median home price. This means that a borrower in one of these counties could get an FHA loan for up to $2,095,200 for 4 unit property.

The maximum loan limit for an FHA-insured mortgage is 115% of the median home price in the county. However, there are some exceptions to this rule. For example, in high-cost counties like Fredericksburg or Manassas Park in Virginia the maximum loan limit is 150% of the median home price. This means that a borrower in one of these counties could get an FHA loan for up to $2,095,200 for 4 unit property.

In Virginia, conventional loan limits have been increased from $548,250 in 2022 to $636,150 in 2023. This increase is due to the current housing market conditions across the state and is meant to help more potential home buyers qualify for larger loans. How Will an Increase in Conventional Loan Limits Impact Homeowners? A higher loan limit will enable more people to purchase homes that had previously been out of reach due to budget constraints. It will also give current homeowners more options when refinancing their mortgages.

The Federal Housing Administration (FHA) sets the maximum FHA loan amount in Virginia. The maximum FHA loan amount in Virginia varies by county and is based on home prices in the area.

If you’re interested in an FHA loan, make sure to shop around and compare rates from multiple lenders. You can use our mortgage calculator to estimate your monthly payments and see how much you’d save with an FHA loan.

If you’re ready to apply for an FHA loan, you can do so online or in person at a participating lender’s office. You’ll need to provide some basic information, including your Social Security number, income, and asset information. The lender will also pull your credit report to check your credit score and history.

Once you’re approved for an FHA loan, the lender will provide you with a commitment letter that outlines the terms of the loan. Make sure to review the terms carefully before signing the commitment letter. Once you sign the commitment letter, you’ll be on your way to enjoying the benefits of an FHA loan!

FHA Loan Limits in Virginia by a County

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| ACCOMACK | $472,030 | $604,400 | $730,525 | $907,900 | $95,000 |

| ALBEMARLE | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| ALLEGHANY | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| AMELIA | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| AMHERST | $472,030 | $604,400 | $730,525 | $907,900 | $260,000 |

| APPOMATTOX | $472,030 | $604,400 | $730,525 | $907,900 | $260,000 |

| ARLINGTON | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| AUGUSTA | $472,030 | $604,400 | $730,525 | $907,900 | $290,000 |

| BATH | $472,030 | $604,400 | $730,525 | $907,900 | $107,000 |

| BEDFORD | $472,030 | $604,400 | $730,525 | $907,900 | $260,000 |

| BLAND | $472,030 | $604,400 | $730,525 | $907,900 | $126,000 |

| BOTETOURT | $472,030 | $604,400 | $730,525 | $907,900 | $278,000 |

| BRUNSWICK | $472,030 | $604,400 | $730,525 | $907,900 | $182,000 |

| BUCHANAN | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| BUCKINGHAM | $472,030 | $604,400 | $730,525 | $907,900 | $151,000 |

| CAMPBELL | $472,030 | $604,400 | $730,525 | $907,900 | $260,000 |

| CAROLINE | $472,030 | $604,400 | $730,525 | $907,900 | $290,000 |

| CARROLL | $472,030 | $604,400 | $730,525 | $907,900 | $165,000 |

| CHARLES CITY | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| CHARLOTTE | $472,030 | $604,400 | $730,525 | $907,900 | $102,000 |

| CHESTERFIELD | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| CLARKE | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| CRAIG | $472,030 | $604,400 | $730,525 | $907,900 | $278,000 |

| CULPEPER | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| CUMBERLAND | $472,030 | $604,400 | $730,525 | $907,900 | $209,000 |

| DICKENSON | $472,030 | $604,400 | $730,525 | $907,900 | $50,000 |

| DINWIDDIE | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| ESSEX | $472,030 | $604,400 | $730,525 | $907,900 | $215,000 |

| FAIRFAX | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| FAUQUIER | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| FLOYD | $472,030 | $604,400 | $730,525 | $907,900 | $195,000 |

| FLUVANNA | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| FRANKLIN | $472,030 | $604,400 | $730,525 | $907,900 | $278,000 |

| FREDERICK | $472,030 | $604,400 | $730,525 | $907,900 | $350,000 |

| GILES | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| GLOUCESTER | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| GOOCHLAND | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| GRAYSON | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| GREENE | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| GREENSVILLE | $472,030 | $604,400 | $730,525 | $907,900 | $79,000 |

| HALIFAX | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| HANOVER | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| HENRICO | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| HENRY | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| HIGHLAND | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| ISLE OF WIGHT | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| JAMES CITY | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| KING AND QUEEN | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| KING GEORGE | $472,030 | $604,400 | $730,525 | $907,900 | $395,000 |

| KING WILLIAM | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| LANCASTER | $472,030 | $604,400 | $730,525 | $907,900 | $230,000 |

| LEE | $472,030 | $604,400 | $730,525 | $907,900 | $63,000 |

| LOUDOUN | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| LOUISA | $472,030 | $604,400 | $730,525 | $907,900 | $299,000 |

| LUNENBURG | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| MADISON | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| MATHEWS | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| MECKLENBURG | $472,030 | $604,400 | $730,525 | $907,900 | $105,000 |

| MIDDLESEX | $472,030 | $604,400 | $730,525 | $907,900 | $325,000 |

| MONTGOMERY | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| NELSON | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| NEW KENT | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| NORTHAMPTON | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| NORTHUMBERLAND | $472,030 | $604,400 | $730,525 | $907,900 | $275,000 |

| NOTTOWAY | $472,030 | $604,400 | $730,525 | $907,900 | $174,000 |

| ORANGE | $472,030 | $604,400 | $730,525 | $907,900 | $320,000 |

| PAGE | $472,030 | $604,400 | $730,525 | $907,900 | $220,000 |

| PATRICK | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| PITTSYLVANIA | $472,030 | $604,400 | $730,525 | $907,900 | $112,000 |

| POWHATAN | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| PRINCE EDWARD | $472,030 | $604,400 | $730,525 | $907,900 | $177,000 |

| PRINCE GEORGE | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| PRINCE WILLIAM | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| PULASKI | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| RAPPAHANNOCK | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| RICHMOND | $472,030 | $604,400 | $730,525 | $907,900 | $176,000 |

| ROANOKE | $472,030 | $604,400 | $730,525 | $907,900 | $278,000 |

| ROCKBRIDGE | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| ROCKINGHAM | $472,030 | $604,400 | $730,525 | $907,900 | $295,000 |

| RUSSELL | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| SCOTT | $472,030 | $604,400 | $730,525 | $907,900 | $208,000 |

| SHENANDOAH | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| SMYTH | $472,030 | $604,400 | $730,525 | $907,900 | $120,000 |

| SOUTHAMPTON | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| SPOTSYLVANIA | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| STAFFORD | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| SURRY | $472,030 | $604,400 | $730,525 | $907,900 | $234,000 |

| SUSSEX | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| TAZEWELL | $472,030 | $604,400 | $730,525 | $907,900 | $126,000 |

| WARREN | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| WASHINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $208,000 |

| WESTMORELAND | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| WISE | $472,030 | $604,400 | $730,525 | $907,900 | $103,000 |

| WYTHE | $472,030 | $604,400 | $730,525 | $907,900 | $175,000 |

| YORK | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| ALEXANDRIA CITY | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| BRISTOL CITY | $472,030 | $604,400 | $730,525 | $907,900 | $208,000 |

| BUENA VISTA CIT | $472,030 | $604,400 | $730,525 | $907,900 | $134,000 |

| CHARLOTTESVILLE | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| CHESAPEAKE CITY | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| COLONIAL HEIGHT | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| COVINGTON CITY | $472,030 | $604,400 | $730,525 | $907,900 | $88,000 |

| DANVILLE CITY | $472,030 | $604,400 | $730,525 | $907,900 | $112,000 |

| EMPORIA CITY | $472,030 | $604,400 | $730,525 | $907,900 | $211,000 |

| FAIRFAX CITY | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| FALLS CHURCH CI | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| FRANKLIN CITY | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| FREDERICKSBURG | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| GALAX CITY | $472,030 | $604,400 | $730,525 | $907,900 | $133,000 |

| HAMPTON CITY | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| HARRISONBURG CI | $472,030 | $604,400 | $730,525 | $907,900 | $295,000 |

| HOPEWELL CITY | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| LEXINGTON CITY | $472,030 | $604,400 | $730,525 | $907,900 | $258,000 |

| LYNCHBURG CITY | $472,030 | $604,400 | $730,525 | $907,900 | $260,000 |

| MANASSAS CITY | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| MANASSAS PARK C | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| MARTINSVILLE CI | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| NEWPORT NEWS CI | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| NORFOLK CITY | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| NORTON CITY | $472,030 | $604,400 | $730,525 | $907,900 | $103,000 |

| PETERSBURG CITY | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| POQUOSON CITY | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| PORTSMOUTH CITY | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| RADFORD CITY | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| RICHMOND CITY | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| ROANOKE CITY | $472,030 | $604,400 | $730,525 | $907,900 | $278,000 |

| SALEM CITY | $472,030 | $604,400 | $730,525 | $907,900 | $278,000 |

| STAUNTON CITY | $472,030 | $604,400 | $730,525 | $907,900 | $290,000 |

| SUFFOLK CITY | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| VIRGINIA BEACH | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| WAYNESBORO CITY | $472,030 | $604,400 | $730,525 | $907,900 | $290,000 |

| WILLIAMSBURG CI | $507,150 | $649,250 | $784,800 | $975,300 | $441,000 |

| WINCHESTER CITY | $472,030 | $604,400 | $730,525 | $907,900 | $350,000 |

| BARBOUR | $472,030 | $604,400 | $730,525 | $907,900 | $85,000 |

| BERKELEY | $472,030 | $604,400 | $730,525 | $907,900 | $258,000 |

| BOONE | $472,030 | $604,400 | $730,525 | $907,900 | $153,000 |

| BRAXTON | $472,030 | $604,400 | $730,525 | $907,900 | $117,000 |

| BROOKE | $472,030 | $604,400 | $730,525 | $907,900 | $131,000 |

| CABELL | $472,030 | $604,400 | $730,525 | $907,900 | $186,000 |

| CALHOUN | $472,030 | $604,400 | $730,525 | $907,900 | $126,000 |

| CLAY | $472,030 | $604,400 | $730,525 | $907,900 | $153,000 |

| DODDRIDGE | $472,030 | $604,400 | $730,525 | $907,900 | $145,000 |

| FAYETTE | $472,030 | $604,400 | $730,525 | $907,900 | $120,000 |

| GILMER | $472,030 | $604,400 | $730,525 | $907,900 | $73,000 |

| GRANT | $472,030 | $604,400 | $730,525 | $907,900 | $176,000 |

| GREENBRIER | $472,030 | $604,400 | $730,525 | $907,900 | $153,000 |

| HAMPSHIRE | $472,030 | $604,400 | $730,525 | $907,900 | $350,000 |

| HANCOCK | $472,030 | $604,400 | $730,525 | $907,900 | $131,000 |

| HARDY | $472,030 | $604,400 | $730,525 | $907,900 | $145,000 |

| HARRISON | $472,030 | $604,400 | $730,525 | $907,900 | $145,000 |

| JACKSON | $472,030 | $604,400 | $730,525 | $907,900 | $153,000 |

| JEFFERSON | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $53,000 |

| KANAWHA | $472,030 | $604,400 | $730,525 | $907,900 | $153,000 |

| LEWIS | $472,030 | $604,400 | $730,525 | $907,900 | $103,000 |

| LINCOLN | $472,030 | $604,400 | $730,525 | $907,900 | $153,000 |

| LOGAN | $472,030 | $604,400 | $730,525 | $907,900 | $122,000 |

| MCDOWELL | $472,030 | $604,400 | $730,525 | $907,900 | $50,000 |

| MARION | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| MARSHALL | $472,030 | $604,400 | $730,525 | $907,900 | $159,000 |

| MASON | $472,030 | $604,400 | $730,525 | $907,900 | $125,000 |

| MERCER | $472,030 | $604,400 | $730,525 | $907,900 | $126,000 |

| MINERAL | $472,030 | $604,400 | $730,525 | $907,900 | $151,000 |

| MINGO | $472,030 | $604,400 | $730,525 | $907,900 | $97,000 |

| MONONGALIA | $472,030 | $604,400 | $730,525 | $907,900 | $241,000 |

| MONROE | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| MORGAN | $472,030 | $604,400 | $730,525 | $907,900 | $258,000 |

| NICHOLAS | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| OHIO | $472,030 | $604,400 | $730,525 | $907,900 | $159,000 |

| PENDLETON | $472,030 | $604,400 | $730,525 | $907,900 | $162,000 |

| PLEASANTS | $472,030 | $604,400 | $730,525 | $907,900 | $132,000 |

| POCAHONTAS | $472,030 | $604,400 | $730,525 | $907,900 | $122,000 |

| PRESTON | $472,030 | $604,400 | $730,525 | $907,900 | $241,000 |

| PUTNAM | $472,030 | $604,400 | $730,525 | $907,900 | $186,000 |

| RALEIGH | $472,030 | $604,400 | $730,525 | $907,900 | $120,000 |

| RANDOLPH | $472,030 | $604,400 | $730,525 | $907,900 | $146,000 |

| RITCHIE | $472,030 | $604,400 | $730,525 | $907,900 | $79,000 |

| ROANE | $472,030 | $604,400 | $730,525 | $907,900 | $83,000 |

| SUMMERS | $472,030 | $604,400 | $730,525 | $907,900 | $120,000 |

| TAYLOR | $472,030 | $604,400 | $730,525 | $907,900 | $145,000 |

| TUCKER | $472,030 | $604,400 | $730,525 | $907,900 | $169,000 |

| TYLER | $472,030 | $604,400 | $730,525 | $907,900 | $78,000 |

| UPSHUR | $472,030 | $604,400 | $730,525 | $907,900 | $148,000 |

| WAYNE | $472,030 | $604,400 | $730,525 | $907,900 | $186,000 |

| WEBSTER | $472,030 | $604,400 | $730,525 | $907,900 | $93,000 |

| WETZEL | $472,030 | $604,400 | $730,525 | $907,900 | $94,000 |

| WIRT | $472,030 | $604,400 | $730,525 | $907,900 | $128,000 |

| WOOD | $472,030 | $604,400 | $730,525 | $907,900 | $128,000 |

| WYOMING | $472,030 | $604,400 | $730,525 | $907,900 | $35,000 |

How to Qualify For an FHA Loan in Virginia

There are several requirements you’ll need to meet in order to qualify for an FHA loan. These include a minimum credit score of 500 (though most lenders will require a higher score but not us), a down payment of 3.5%, and proof that you can afford the monthly mortgage payments. You’ll also need to have a steady income and employment history, as well as be a U.S. citizen or legal resident alien.

If you’re looking to qualify for an FHA loan in Virginia, there are a few things you’ll need to keep in mind. In this blog post, we’ll go over what you need to know in order to qualify for an FHA loan.

One of the things you’ll need to keep in mind when qualifying for an FHA loan is your credit score. Your credit score is one of the most important factors in determining whether or not you’ll be approved for a loan. Generally speaking, the higher your credit score, the better your chances of being approved for a loan. If you have a low credit score, there are still options available to you, but you may have to put down a larger down payment.

Another thing to keep in mind when qualifying for an FHA loan is your employment history. Lenders will want to see that you have a steady job and income before they approve you for a loan. If you’ve had trouble keeping a job in the past, it may be more difficult to qualify for an FHA loan.

Finally, you’ll need to have a down payment saved up before you can qualify for an FHA loan in Virginia. The amount of the down payment will vary depending on the lender, but it’s typically around 3.5%. If you don’t have the down payment saved up, there are still options available to you, but you may have to pay private mortgage insurance (PMI).

If you’re looking to qualify for an FHA loan, keep these things in mind. With a little preparation, you’ll be on your way to homeownership in no time.

What are the Benefits of an FHA loan in Virginia?

There are several benefits of taking out an FHA loan, including the following:

- You may be able to get approved for an FHA loan in Virginia with a lower credit score or higher debt-to-income ratio than you would for other types of mortgages.

- FHA loans offer competitive interest rates and flexible repayment terms, which can make them easier to manage than other types of loans.

- If you qualify for an FHA loan in Virginia, you may be able to purchase a home sooner and with less money upfront than if you used a conventional mortgage.

Overall, if you’re looking for an affordable way to purchase a home and have the necessary qualifications, an FHA loan in Virginia could be a great option for you. To learn more about how to qualify for an FHA loan and get started on your application process, contact us today.

What Are The Maximum FHA Loan Amounts in Virginia?

The maximum FHA loan amount in Virginia is the amount that you can borrow for a mortgage. These maximum loan limits vary by county, and they’re generally based on the median home price in the area.

For example, in a county with a high median home price, the maximum FHA loan limit might be higher to accommodate this. On the other hand, if the median home price is lower, the maximum FHA loan amount in Virginia may also be lower.

How Do These Limits Affect Mortgage Availability?

Because of the maximum FHA loan amount in Virginia, lenders will often turn down borrowers who need loans that exceed the maximum amount allowed by their local area. This can make it difficult to get a mortgage if you need more money than what’s available through an FHA loan.

But there are some things you can do to increase your chances of getting approved for an FHA loan, even if your needs exceed the local maximum FHA loan limits in Virginia. For example, you may want to consider looking for a home in a county with a higher maximum FHA loan amount in Virginia.

You can also try to find a lender who is willing to work with you on an individual basis. Some lenders may be willing to make exceptions to their own lending limits if they think you’re a good candidate for a loan.

If you’re thinking about getting an FHA loan, it’s important to know how the maximum FHA loan amount in Virginia can affect your mortgage. The limitation on the maximum FHA loan amount in Virginia can sometimes make it difficult to get the loan that you need, but there are steps that you can take to increase your chances of getting approved. With some research and persistence, you may be able to find a lender who is willing to work with you on your specific situation.

High-Cost Areas in Virginia

There are 27 high-cost counties in Virginia where FHA allows for higher loan amounts than the default for a single home family is $472,030, for a duplex would be $604,400, for a triplex you can get financing up to $730,525, and for a fourplex, lender can finance as much as $907,900. HUD dictates rules related to FHA loans, so make sure you check the latest maximum loan amounts above before checking on houses.

How FHA Loan Limits Are Calculated

There are different loan amounts set by FHA in each county in Virginia. Virginia is one of the states where before applying for an FHA loan you need to make sure how much money your lender can lend to you based on HUD Rules. Below is a short guide that can help you to check this.

The first factor is the number of units in the property. If you’re buying a single-family home, then the maximum loan amount will be lower than if you’re buying a multi-unit property. This is because multi-unit properties tend to appreciate at a higher rate than single-family homes, so the FHA wants to make sure that there is enough equity in the property to cover any potential losses.

The second factor is the location of the property. Properties in high-cost areas will have higher loan limits than properties in low-cost areas. This is because the FHA wants to make sure that borrowers in high-cost areas can still get access to financing, even if home prices have gone up significantly.

The third factor is the type of property being purchased. For example, if you’re buying a condo, the maximum loan amount will be lower than if you’re buying a single-family home. This is because condos tend to appreciate at a slower rate than single-family homes, so the FHA wants to make sure that there is enough equity in the property to cover any potential losses.

The fourth and final factor is the borrower’s credit score. Borrowers with higher credit scores will usually qualify for higher loan limits than borrowers with lower credit scores. This is because the FHA wants to make sure that borrowers who are more likely to default on their loans are not able to borrow more money than they can afford to repay.

Keep these factors in mind when you’re shopping for an FHA loan, and you’ll be able to get a good idea of what your maximum loan amount will be. If you have any questions, be sure to ask your lender for more information.

Virginia Down Payment Assistance Program

The Virginia Housing Development Authority provides down payment and closing cost assistance in addition to a down payment incentive. The down payment grant can be used with FHA or conventional loans, while the closing cost grant may be utilized with USDA and VA loans. Both of these subsidies may also be utilized alongside an MCC, which reduces your federal tax liability.

The Virginia Down Payment Assistance Program (VDPA) is a program that was established to help eligible first-time homebuyers in the state of Virginia purchase their first home. The program provides funds to cover down payments and closing costs, so that these buyers are able to obtain homeownership without having to come up with a large down payment.

Find out more about these down payment assistance programs on the VHDA website. Read HUD’s list of additional homeownership benefits in the state, too.