FHA Loan Limits in Ohio: Mortgage Guidelines 2023

Are you looking to purchase a home, but don’t know how much you can afford? If you’re considering an FHA loan, then you’ll want to be aware of the FHA loan limits in Ohio. In this article, we’ll explain how the FHA loan limits are calculated and what they mean for you.

Are you looking to purchase a home, but don’t know how much you can afford? If you’re considering an FHA loan, then you’ll want to be aware of the FHA loan limits in Ohio. In this article, we’ll explain how the FHA loan limits are calculated and what they mean for you.

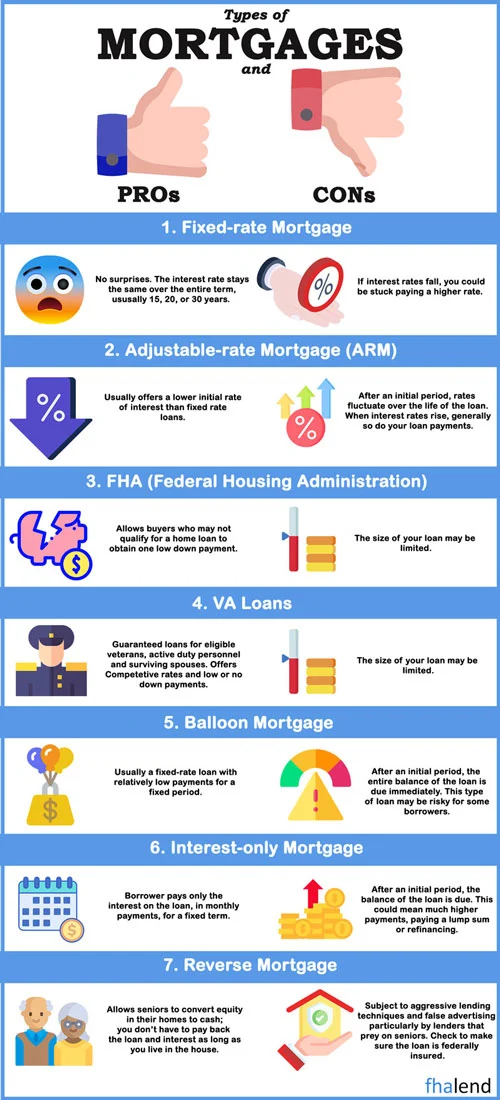

The Federal Housing Administration (FHA) is a government agency that provides mortgage insurance on loans made by FHA-approved lenders. Mortgage insurance protects lenders against losses caused by defaults on home loans.

The FHA loan limits in Ohio are the maximum loan amount that the FHA will insure. The limits are based on the median house price in each county. In order to calculate the loan limit, the FHA uses two formulas:

The first formula is used to calculate the maximum insurable mortgage for a single-family home. The second formula is used to calculate the maximum insurable mortgage for a multi-family home.

The FHA loan limits are updated each year and are announced in December. The limits for 2023 are:

Single-Family Home: $472,030

Multi-Family Home: $604,400 – $907,900

If you’re interested in an FHA loan, then you’ll need to find a lender who can approve your loan. You can use our Mortgage Finder tool to compare lenders and get started on your loan application.

What is an FHA Loan?

An FHA loan is a mortgage that’s insured by the Federal Housing Administration (FHA). They are popular among first-time homebuyers because they have less stringent credit requirements than conventional loans. However, they do require borrowers to pay private mortgage insurance (PMI) premiums, which can make them more expensive in the long run.

How to Apply For FHA Loan in Ohio in 2023

Applying for FHA loans is fairly easy and there are not many differences between applying for a conventional loan. The first step would be finding the right lender or broker who is knowledgeable and responsive. If you don’t have one please fill up this form so we can connect you with a lender who is licensed in Ohio and will make the process of obtaining an FHA loan as smooth as possible.

After contacting a lender, in most cases, you will need to fill up a 1003 application which is a residential application required by most lenders/brokers. After that, you will need to give consent so they will be able to pull your credit and see if you qualify for FHA loan.

The minimum requirement is to have 500 FICO for a 10% downpayment or if your score is above 579 then you can put down as less as 3,5%. In most cases, a loan officer will advise you how to improve your credit or if you need to pay something off from your credit report. A debt from your credit cards or any other debt can affect your DTI (debt to income ratio).

Depending on the type of transaction, a lender will require an appraisal (around $500), inspection, verification of assets, 2 months of paystub, bank statement, and W2. For the FHA streamlines in most cases, the appraisal is not required.

Depending on the type of transaction, a lender will require an appraisal (around $500), inspection, verification of assets, 2 months of paystub, bank statement, and W2. For the FHA streamlines in most cases, the appraisal is not required.

In order to qualify for an FHA loan, borrowers must have a credit score of 500 or higher. They must also have a debt-to-income ratio of no more than 43%. This means that your monthly housing expenses (mortgage payments, property taxes, etc.) should not exceed 43% of your monthly income.

If you don’t meet these requirements, don’t despair – there are still other options available to you. For example, you could try applying for an FHA 203(k) loan, which would allow you to finance both the purchase and renovation of a home. Or, you could look into alternative loan programs such as those offered by the Veterans Administration (VA) or the United States Department of Agriculture (USDA).

FHA Loan Limits in Ohio by County in 2023

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| OHIO | $472,030 | $604,400 | $730,525 | $907,900 | $320,000 |

| OHIO | $472,030 | $604,400 | $730,525 | $907,900 | $107,000 |

| ADAMS | $472,030 | $604,400 | $730,525 | $907,900 | $65,000 |

| ALLEN | $472,030 | $604,400 | $730,525 | $907,900 | $135,000 |

| ASHLAND | $472,030 | $604,400 | $730,525 | $907,900 | $159,000 |

| ASHTABULA | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| ATHENS | $472,030 | $604,400 | $730,525 | $907,900 | $145,000 |

| AUGLAIZE | $472,030 | $604,400 | $730,525 | $907,900 | $161,000 |

| BELMONT | $472,030 | $604,400 | $730,525 | $907,900 | $159,000 |

| BROWN | $472,030 | $604,400 | $730,525 | $907,900 | $320,000 |

| BUTLER | $472,030 | $604,400 | $730,525 | $907,900 | $320,000 |

| CARROLL | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| CHAMPAIGN | $472,030 | $604,400 | $730,525 | $907,900 | $160,000 |

| CLARK | $472,030 | $604,400 | $730,525 | $907,900 | $135,000 |

| CLERMONT | $472,030 | $604,400 | $730,525 | $907,900 | $320,000 |

| CLINTON | $472,030 | $604,400 | $730,525 | $907,900 | $155,000 |

| COLUMBIANA | $472,030 | $604,400 | $730,525 | $907,900 | $106,000 |

| COSHOCTON | $472,030 | $604,400 | $730,525 | $907,900 | $102,000 |

| CRAWFORD | $472,030 | $604,400 | $730,525 | $907,900 | $100,000 |

| CUYAHOGA | $472,030 | $604,400 | $730,525 | $907,900 | $290,000 |

| DARKE | $472,030 | $604,400 | $730,525 | $907,900 | $146,000 |

| DEFIANCE | $472,030 | $604,400 | $730,525 | $907,900 | $128,000 |

| DELAWARE | $488,750 | $625,700 | $756,300 | $939,900 | $425,000 |

| ERIE | $472,030 | $604,400 | $730,525 | $907,900 | $127,000 |

| FAIRFIELD | $488,750 | $625,700 | $756,300 | $939,900 | $425,000 |

| FAYETTE | $472,030 | $604,400 | $730,525 | $907,900 | $145,000 |

| FRANKLIN | $488,750 | $625,700 | $756,300 | $939,900 | $425,000 |

| FULTON | $472,030 | $604,400 | $730,525 | $907,900 | $210,000 |

| GALLIA | $472,030 | $604,400 | $730,525 | $907,900 | $125,000 |

| GEAUGA | $472,030 | $604,400 | $730,525 | $907,900 | $290,000 |

| GREENE | $472,030 | $604,400 | $730,525 | $907,900 | $220,000 |

| GUERNSEY | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| HAMILTON | $472,030 | $604,400 | $730,525 | $907,900 | $320,000 |

| HANCOCK | $472,030 | $604,400 | $730,525 | $907,900 | $175,000 |

| HARDIN | $472,030 | $604,400 | $730,525 | $907,900 | $115,000 |

| HARRISON | $472,030 | $604,400 | $730,525 | $907,900 | $85,000 |

| HENRY | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| HIGHLAND | $472,030 | $604,400 | $730,525 | $907,900 | $118,000 |

| HOCKING | $488,750 | $625,700 | $756,300 | $939,900 | $425,000 |

| HOLMES | $472,030 | $604,400 | $730,525 | $907,900 | $180,000 |

| HURON | $472,030 | $604,400 | $730,525 | $907,900 | $119,000 |

| JACKSON | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| JEFFERSON | $472,030 | $604,400 | $730,525 | $907,900 | $131,000 |

| KNOX | $472,030 | $604,400 | $730,525 | $907,900 | $185,000 |

| LAKE | $472,030 | $604,400 | $730,525 | $907,900 | $290,000 |

| LAWRENCE | $472,030 | $604,400 | $730,525 | $907,900 | $186,000 |

| LICKING | $488,750 | $625,700 | $756,300 | $939,900 | $425,000 |

| LOGAN | $472,030 | $604,400 | $730,525 | $907,900 | $131,000 |

| LORAIN | $472,030 | $604,400 | $730,525 | $907,900 | $290,000 |

| LUCAS | $472,030 | $604,400 | $730,525 | $907,900 | $210,000 |

| MADISON | $488,750 | $625,700 | $756,300 | $939,900 | $425,000 |

| MAHONING | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| MARION | $472,030 | $604,400 | $730,525 | $907,900 | $120,000 |

| MEDINA | $472,030 | $604,400 | $730,525 | $907,900 | $290,000 |

| MEIGS | $472,030 | $604,400 | $730,525 | $907,900 | $67,000 |

| MERCER | $472,030 | $604,400 | $730,525 | $907,900 | $170,000 |

| MIAMI | $472,030 | $604,400 | $730,525 | $907,900 | $220,000 |

| MONROE | $472,030 | $604,400 | $730,525 | $907,900 | $87,000 |

| MONTGOMERY | $472,030 | $604,400 | $730,525 | $907,900 | $220,000 |

| MORGAN | $472,030 | $604,400 | $730,525 | $907,900 | $87,000 |

| MORROW | $488,750 | $625,700 | $756,300 | $939,900 | $425,000 |

| MUSKINGUM | $472,030 | $604,400 | $730,525 | $907,900 | $133,000 |

| NOBLE | $472,030 | $604,400 | $730,525 | $907,900 | $86,000 |

| OTTAWA | $472,030 | $604,400 | $730,525 | $907,900 | $210,000 |

| PAULDING | $472,030 | $604,400 | $730,525 | $907,900 | $93,000 |

| PERRY | $488,750 | $625,700 | $756,300 | $939,900 | $425,000 |

| PICKAWAY | $488,750 | $625,700 | $756,300 | $939,900 | $425,000 |

| PIKE | $472,030 | $604,400 | $730,525 | $907,900 | $115,000 |

| PORTAGE | $472,030 | $604,400 | $730,525 | $907,900 | $189,000 |

| PREBLE | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| PUTNAM | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| RICHLAND | $472,030 | $604,400 | $730,525 | $907,900 | $127,000 |

| ROSS | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| SANDUSKY | $472,030 | $604,400 | $730,525 | $907,900 | $113,000 |

| SCIOTO | $472,030 | $604,400 | $730,525 | $907,900 | $88,000 |

| SENECA | $472,030 | $604,400 | $730,525 | $907,900 | $114,000 |

| SHELBY | $472,030 | $604,400 | $730,525 | $907,900 | $155,000 |

| STARK | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| SUMMIT | $472,030 | $604,400 | $730,525 | $907,900 | $189,000 |

| TRUMBULL | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| TUSCARAWAS | $472,030 | $604,400 | $730,525 | $907,900 | $147,000 |

| UNION | $488,750 | $625,700 | $756,300 | $939,900 | $425,000 |

| VAN WERT | $472,030 | $604,400 | $730,525 | $907,900 | $115,000 |

| VINTON | $472,030 | $604,400 | $730,525 | $907,900 | $34,000 |

| WARREN | $472,030 | $604,400 | $730,525 | $907,900 | $320,000 |

| WASHINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $142,000 |

| WAYNE | $472,030 | $604,400 | $730,525 | $907,900 | $195,000 |

| WILLIAMS | $472,030 | $604,400 | $730,525 | $907,900 | $115,000 |

| WOOD | $472,030 | $604,400 | $730,525 | $907,900 | $210,000 |

| WYANDOT | $472,030 | $604,400 | $730,525 | $907,900 | $125,000 |

| OHIO | $472,030 | $604,400 | $730,525 | $907,900 | $159,000 |

Closing on an FHA loan usually takes about 30 days to 60 days, however, some lenders can get CTC (clear to close) in a few days and close on your dream home within 2 weeks from the time the application is submitted. The FHA lender can typically underwrite the loan package within few days, sometimes even in 1 day because of all tools and streamlining the process of underwriting. The most demand for FHA loans is caused by First-time homebuyers and people who want to do an FHA cash-out refinance. Government-backed loans protect lenders from a default on mortgage (if a borrower doesn’t pay on time on 30 or 15yrs fixed mortgage). FHA loans are great for people who

- have3,5% downpayment

- 580 minimum credit score

- downpayment as a gift option

- Down payments assistance programs

- seller is able to cover up to 6% in closings costs

- easy refinancing with FHA streamlines

Can I get FHA Loan in Ohio if I’m a First-time Home Buyer Only?

Yes, the FHA loan can be used for first-time homebuyers living in Ohio, but they are not restricted to people who got the FHA loan before and want to sell their house and move to a different one. The FHA loans cannot be used for 2nd home, a vacation home or for an investment property, It need to be always used to finance a primary residence (a house you will be living in).

What are the Benefits of an FHA Loan?

There are several benefits of taking out an FHA loan, including:

- Less strict credit requirements, making them easier to qualify for than conventional loans

- Lower down payment requirements (as low as 3.5%)

- More flexible debt-to-income ratio requirements

- Available in a variety of fixed- and adjustable-rate loan options

These factors make FHA loans an attractive option for first-time homebuyers and those with less-than-perfect credit. However, it’s important to remember that they do require borrowers to pay PMI premiums, which can make them more expensive in the long run.

These factors make FHA loans an attractive option for first-time homebuyers and those with less-than-perfect credit. However, it’s important to remember that they do require borrowers to pay PMI premiums, which can make them more expensive in the long run.

If you’re thinking about taking out an FHA loan, be sure to compare it with other loan options to ensure you’re getting the best deal possible.

How Hard Is It To Get An FHA Loan?

The bottom line is that it’s not as difficult as one might think to get an FHA loan. While there are certain requirements that must be met, such as a minimum credit score and debt-to-income ratio, these are generally not as stringent as those for conventional loans.

Additionally, FHA loans offer a variety of benefits that can make them a good option for first-time homebuyers or those with less-than-perfect credit. Just be sure to compare them with other loan options to ensure you’re getting the best deal possible.

How Do I Get an FHA Loan in Ohio?

It is easy to get pre-qualified or to apply for an FHA loan. We recommend having us match you with an FHA lender in Ohio based on your personal needs (such as estimated credit and loan amount). To be matched with the right lender, please follow this link to proceed.

How Much Money Do I Need To Qualify For an FHA Loan In Ohio?

by FHA requirements you need 3,5% of the total loan amount in your bank which needs to be sourced (for 60 days or more). There are a few downpayment assistance programs available in Ohio, they have pros and cons, some of them they can lock you for 3 to 6 years from refinancing your mortgage or they do have higher rates as well. There are many programs available that provide funds to use for down payment assistance. We can help you find out if you qualify for any of them.

Is Cosigner Allowed on FHA loans in Ohio?

Yes, the FHA allows for having a cosigner on the loan. Having Non-occupying co-borrowers is allowed for FHA loans in Ohio however one of the borrowers needs to live on the property.

Can I Get a Loan After Bankruptcy Ohio?

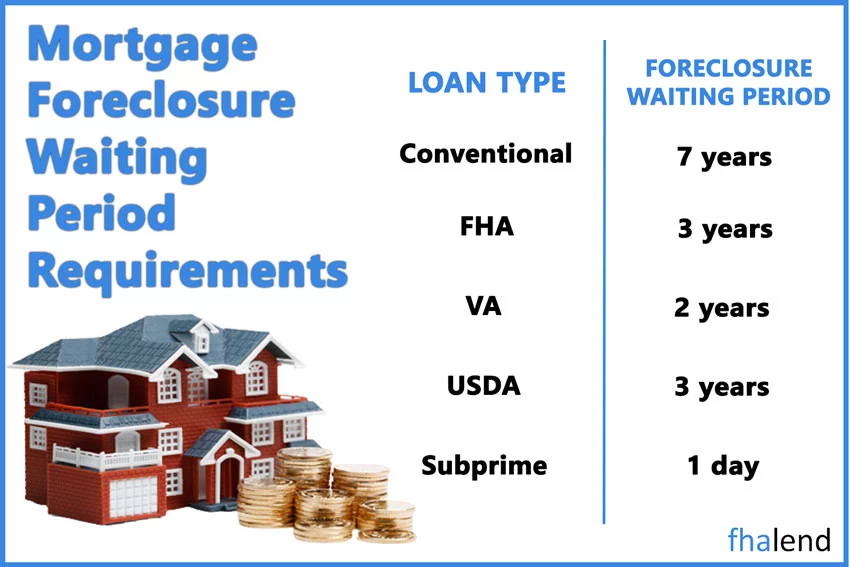

The FHA rules state that you have to be waiting at least 2 years after filing a chapter 7. For chapter 13, you must wait until you have made 12 months of payments. You will also need to provide the court trustee’s approved written confirmation. One should also note that the clock starts when one files for bankruptcy and not when they are discharged from it. The time period in which you can get an FHA loan after a foreclosure depends on a number of factors.

The three-year waiting period has been set by the FHA. But, there is an exception to this rule if there were “extenuating circumstances”. You would have to improve your credit since the foreclosure. In the event that the circumstances and credit improvements are satisfactory, you would only have to wait until after one year before you can apply for a Federal Housing Administration loan.

The three-year waiting period has been set by the FHA. But, there is an exception to this rule if there were “extenuating circumstances”. You would have to improve your credit since the foreclosure. In the event that the circumstances and credit improvements are satisfactory, you would only have to wait until after one year before you can apply for a Federal Housing Administration loan.

What Are The Options For Refinancing an FHA loan?

The are two types of refinancing for their loans. The first one is is the “FHA cashout refinance“ which you can use to pull your equity to pay your debit cards, invest or rehab your house. The second type of financing is FHA streamline refinance, which allows you to lower your interest rate, mortgage payment or get rid of private mortgage insurance when your equity is at 20% or more.

Top FHA Lenders in Ohio

Please fill up this form so we can help you find a lender in Ohio who will fit your needs, we work only with the best lenders who are specializing in FHA, VA, all government loans and NON-QM.

Ohio Down Payment Assistance Program

The Ohio Housing Finance Agency has a down payment assistance service called MyOhioHome.org, which offers 2.5% or 5% of the home’s purchase price as financial aid.

- A DPA (Debt Repayment Assistance) is a loan that is forgiven after seven years and comes in the form of a grant. You’ll have to repay the grant if you sell, transfer, or refinance before then.

- With a regular, USDA, or VA loan, you’ll need a credit score of 640 or higher. FHA borrowers will need a 650+ FICO.

- Limits apply to earnings and the price of purchases.

Visit the official website of MyOhioHome for additional information. Also, check out HUD’s list of additional homeownership assistance programs in Ohio.