FHA Loan Limits in New Hampshire – 2023 HUD Guidelines

FHA loan limits in New Hampshire are calculated based on the maximum allowed loan amount in New Hampshire for a particular county. The FHA loan limits in New Hampshire are set at 115% of the median home price in the county, with a minimum limit of $625,500. FHA loans are available for both purchase and refinance transactions.

FHA loan limits in New Hampshire are calculated based on the maximum allowed loan amount in New Hampshire for a particular county. The FHA loan limits in New Hampshire are set at 115% of the median home price in the county, with a minimum limit of $625,500. FHA loans are available for both purchase and refinance transactions.

If you’re looking to get an FHA loan in New Hampshire, you’ll need to meet certain requirements. First, you’ll need a down payment of 3.5%. You’ll also need a credit score of 580 or higher if you want to qualify for the lowest possible down payment of 10%. If your credit score is below 580, you’ll still be able to get an FHA loan, but you’ll need to put down at least 10%.

In addition to the down payment and credit score requirements, you’ll also need to have a debt-to-income ratio of 50% or less. This means that your monthly debt payments, including your mortgage payment, must be 50% or less of your monthly income.

FHA Loan Limits in New Hampshire

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| BELKNAP | $472,030 | $604,400 | $730,525 | $907,900 | $325,000 |

| CARROLL | $472,030 | $604,400 | $730,525 | $907,900 | $357,000 |

| CHESHIRE | $472,030 | $604,400 | $730,525 | $907,900 | $260,000 |

| COOS | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| GRAFTON | $472,030 | $604,400 | $730,525 | $907,900 | $275,000 |

| HILLSBOROUGH | $477,250 | $610,950 | $738,500 | $917,800 | $415,000 |

| MERRIMACK | $472,030 | $604,400 | $730,525 | $907,900 | $350,000 |

| ROCKINGHAM | $828,000 | $1,060,000 | $1,281,300 | $1,592,350 | $720,000 |

| STRAFFORD | $828,000 | $1,060,000 | $1,281,300 | $1,592,350 | $720,000 |

| SULLIVAN | $472,030 | $604,400 | $730,525 | $907,900 | $275,000 |

FHA High-Cost Areas in New Hampshire

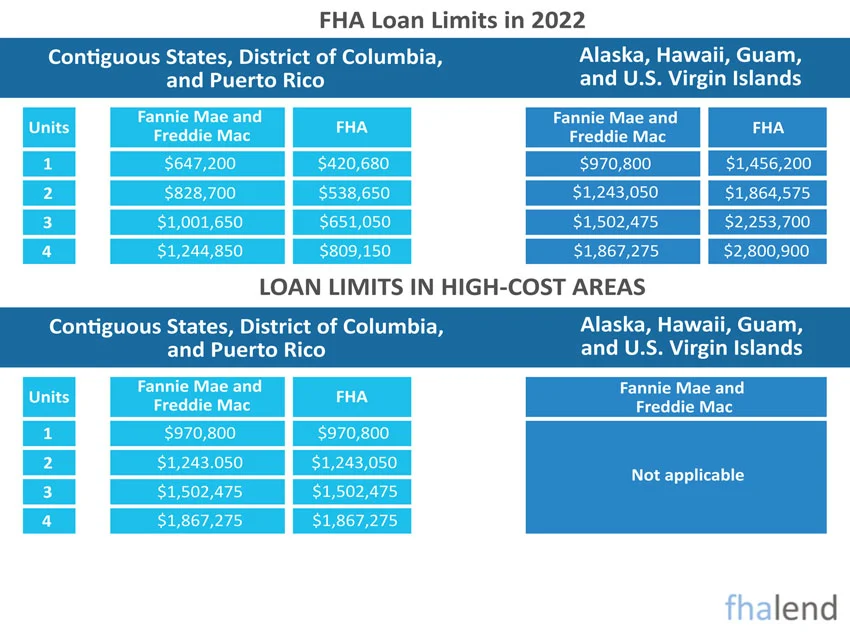

The FHA defines a high-cost area as any county where the median home price exceeds 150% of the national conforming loan limit. The national conforming loan limit for 2021 is $548,250. That means that a high-cost area must have a median home price of at least $822,375.

There are currently 188 counties designated as high-cost areas. Of those, 145 counties will lose their designation on January 1st, 2022. The remaining 43 counties will lose their designation on January 1st, 2023.

Rockingham County in High-Cost Area & FHA Loan Limits

Rockingham County in High-Cost Area & FHA Loan Limits

According to the Federal Housing Administration (FHA), Rockingham is a high-cost area in 2022. This means that home buyers who use an FHA loan to purchase a home in Rockingham will need to make a down payment of at least 10%.

The average sales price of a home in Rockingham is $300,000. This means that a buyer using an FHA loan would need to come up with at least $30,000 for the down payment.

There are several reasons why Rockingham is considered a high-cost area. The first is that the median household income in Rockingham is higher than the national average. The second reason is that home prices in Rockingham have been rising steadily for the past few years.

FHA Requirements in Rockingham County in New Hampshire

If you are considering buying a home in Rockingham, it is important to be aware of the down payment requirements. If you have the cash on hand or can get a loan from family or friends, then you will not need to worry about this requirement. However, if you do not have the cash on hand, you may need to look into other financing options. The FHA loan limits in New Hampshire and Rockingham county are set to $770,500 for single home families, and $986,400 for duplexes, for a triplex, the max loan amount is at $1,192,300, and for house hacking, with 4 units a lender can lend up to $1,481,750.

There are several government programs that can help you with the down payment on a home. The most well-known program is the Federal Housing Administration’s (FHA) Home Possible program. This program offers down payment assistance to buyers who meet certain income requirements.

Another option for financing your down payment is a grant. Grants are typically need-based, so you will need to demonstrate that you have a financial need for the assistance. There are several grant programs available, and you can find more information on the HUD website.

If you are looking to purchase a home in Rockingham, there are several options available to help you with the down payment. Be sure to research all of your options before making a decision.

Strafford County in High-Cost Area & FHA Loan Limits

The Strafford area is considered a high-cost area for purposes of the Federal Housing Administration (FHA) loan limits. In 2023, the FHA loan limit for a single-family home in the Strafford area will be $726,525. This is an increase from the 2021 loan limit of $ 702,000.

If you’re considering buying a home in the Strafford area in 2023, it’s important to be aware of the higher loan limits. You’ll need to budget accordingly and make sure you’re comfortable with a higher monthly mortgage payment. But don’t let the higher loan limit dissuade you from buying a home in Strafford. The area is a great place to live, with plenty of amenities and high quality of life.

The FHA loan limits in New Hampshire and Strafford county are set to $770,500 for 1-unit, $986,400 for 2-unit, the max loan amount is at $1,192,300 when you purchase a 3-unit with the FHA mortgage loan and for Fourplex you can get FHA financing for up to $1,481,750.

If you’re thinking of buying a home in Strafford in 2023, here are a few things to keep in mind:

- The FHA loan limit for a single-family home in the Strafford area will be $726,525 in 2023. This is an increase from the 2021 loan limit of $702,000.

- You’ll need to budget accordingly and make sure you’re comfortable with a higher monthly mortgage payment.

- But don’t let the higher loan limit dissuade you from buying a home in Strafford. The area is a great place to live, with plenty of amenities and high quality of life.

- When you’re ready to start shopping for a home in Strafford, be sure to contact a reputable and experienced real estate agent who can help you find the perfect home for your needs.

FHA Loan Requirements in New Hampshire

If you’re looking to get an FHA loan in New Hampshire, there are certain requirements you’ll need to meet in order to qualify. In this blog post, we’ll outline those requirements so you can see if you’re eligible for an FHA loan.

To qualify for an FHA loan, you’ll need:

- A credit score of at least 580, or 500 with 10% down payment (no-overlays broker)

- A down payment of 3.5% of the purchase price

- An approved property that meets HUD standards

- Proof of income and employment history

- Debt-to-income ratio below 43%

If you meet all of the above requirements, you should be eligible for an FHA loan in New Hampshire. If you have any questions about the process or whether you qualify, be sure to speak with a loan officer. They’ll be able to help you through the process and get you the financing you need.

15 Easy Steps To Apply For an FHA loan in New Hampshire

1

Research lenders who work with the Federal Housing Administration (FHA). You can find a list of FHA-approved lenders in New Hampshire on the HUD website or you can apply with us and we will take care of it.

2

Get pre-approved for an FHA loan. Lenders will need to see proof of your income, employment history, and credit score in order to determine if you qualify for an FHA loan.

3

Find a property you would like to purchase using an FHA loan. The property must be appraised by an FHA-approved appraiser in New Hampshire in order to qualify for the loan also if you’re going with FHA-insured loan make sure you will check your county and maximum allowed FHA loan limits in New Hampshire.

4

Make an offer on the property you would like to purchase. Be sure to include a contingency clause in your offer that states the sale is contingent upon the property being appraised at or above the purchase price.

5

Apply for an FHA loan in New Hampshire. You will need to provide the lender with your financial information, including your income, employment history, and credit score.

6

The lender will order an appraisal of the property you wish to purchase. The appraiser will determine the value of the property and confirm that it meets all FHA guidelines in New Hampshire.

7

Once the appraisal is complete, the lender will provide you with a loan estimate detailing the costs of the loan and monthly payments.

8

If you choose to proceed with the loan, you will be required to pay for a home inspection and submit any necessary documentation to the lender.

9

The lender will then underwrite the loan and issue a commitment letter.

10

Once the commitment letter is issued, you will be required to pay for a property appraisal and submit any necessary documentation to the lender.

11

The lender will then issue a loan approval and send the loan documents to a closing agent.

12

The closing agent will coordinate the closing date and time with all parties involved in the transaction.

13

At closing, you will sign all of the loan documents and hand over any down payment or closing costs to the closing agent.

14

The closing agent will then disburse the funds to all parties involved in the transaction and record the deed to the property in your name.

15

Congratulations! You are now a homeowner!

New Hampshire Down Payment Assistance Program

First-time home buyers in New Hampshire may take advantage of two different initiatives offered by the State Housing Authority. Home Flex Plus and Home Preferred Plus give up to 4% of the purchase price in down payment assistance, which is forgiven after four years if you do not sell, refinance, or declare bankruptcy during that time. Household income restrictions are in place. To qualify for aid, the most you can earn is 80% of the area’s median income (AMI) or $151,200.

Visit the government’s website for additional information. Also, check out HUD’s list of other homebuyer assistance programs in New Hampshire.