FHA Loan Limits in Kentucky By County

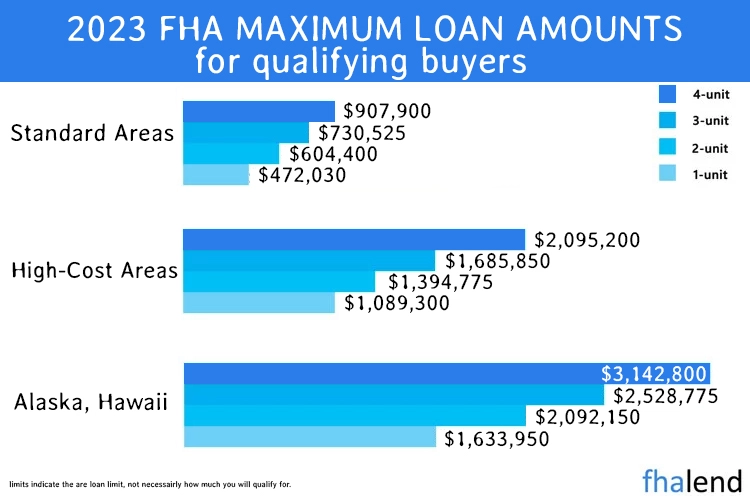

If you’re looking to buy a home in Kentucky, you’ll want to know about the different FHA loan limits. Loan limits vary by county and maximum loan amount. In most of Kentucky’s counties, the maximum loan amount is $472,030. However, for four-family units, the limit is increased to $907,900. The minimum down payment for an FHA loan is 3.5%. So if you’re buying a $400,000 home, you’ll need to come up with at least $14,000 for the down payment.

If you’re looking to buy a home in Kentucky, you’ll want to know about the different FHA loan limits. Loan limits vary by county and maximum loan amount. In most of Kentucky’s counties, the maximum loan amount is $472,030. However, for four-family units, the limit is increased to $907,900. The minimum down payment for an FHA loan is 3.5%. So if you’re buying a $400,000 home, you’ll need to come up with at least $14,000 for the down payment.

FHA Loan Limits in Kentucky For 2023

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| ADAIR | $472,030 | $604,400 | $730,525 | $907,900 | $50,000 |

| ALLEN | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| ANDERSON | $472,030 | $604,400 | $730,525 | $907,900 | $170,000 |

| BALLARD | $472,030 | $604,400 | $730,525 | $907,900 | $155,000 |

| BARREN | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| BATH | $472,030 | $604,400 | $730,525 | $907,900 | $155,000 |

| BELL | $472,030 | $604,400 | $730,525 | $907,900 | $87,000 |

| BOONE | $472,030 | $604,400 | $730,525 | $907,900 | $320,000 |

| BOURBON | $472,030 | $604,400 | $730,525 | $907,900 | $257,000 |

| BOYD | $472,030 | $604,400 | $730,525 | $907,900 | $186,000 |

| BOYLE | $472,030 | $604,400 | $730,525 | $907,900 | $167,000 |

| BRACKEN | $472,030 | $604,400 | $730,525 | $907,900 | $320,000 |

| BREATHITT | $472,030 | $604,400 | $730,525 | $907,900 | $43,000 |

| BRECKINRIDGE | $472,030 | $604,400 | $730,525 | $907,900 | $70,000 |

| BULLITT | $472,030 | $604,400 | $730,525 | $907,900 | $356,000 |

| BUTLER | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| CALDWELL | $472,030 | $604,400 | $730,525 | $907,900 | $77,000 |

| CALLOWAY | $472,030 | $604,400 | $730,525 | $907,900 | $145,000 |

| CAMPBELL | $472,030 | $604,400 | $730,525 | $907,900 | $320,000 |

| CARLISLE | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| CARROLL | $472,030 | $604,400 | $730,525 | $907,900 | $146,000 |

| CARTER | $472,030 | $604,400 | $730,525 | $907,900 | $186,000 |

| CASEY | $472,030 | $604,400 | $730,525 | $907,900 | $58,000 |

| CHRISTIAN | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| CLARK | $472,030 | $604,400 | $730,525 | $907,900 | $257,000 |

| CLAY | $472,030 | $604,400 | $730,525 | $907,900 | $146,000 |

| CLINTON | $472,030 | $604,400 | $730,525 | $907,900 | $40,000 |

| CRITTENDEN | $472,030 | $604,400 | $730,525 | $907,900 | $69,000 |

| CUMBERLAND | $472,030 | $604,400 | $730,525 | $907,900 | $152,000 |

| DAVIESS | $472,030 | $604,400 | $730,525 | $907,900 | $174,000 |

| EDMONSON | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| ELLIOTT | $472,030 | $604,400 | $730,525 | $907,900 | $106,000 |

| ESTILL | $472,030 | $604,400 | $730,525 | $907,900 | $219,000 |

| FAYETTE | $472,030 | $604,400 | $730,525 | $907,900 | $257,000 |

| FLEMING | $472,030 | $604,400 | $730,525 | $907,900 | $85,000 |

| FLOYD | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| FRANKLIN | $472,030 | $604,400 | $730,525 | $907,900 | $170,000 |

| FULTON | $472,030 | $604,400 | $730,525 | $907,900 | $48,000 |

| GALLATIN | $472,030 | $604,400 | $730,525 | $907,900 | $320,000 |

| GARRARD | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| GRANT | $472,030 | $604,400 | $730,525 | $907,900 | $320,000 |

| GRAVES | $472,030 | $604,400 | $730,525 | $907,900 | $100,000 |

| GRAYSON | $472,030 | $604,400 | $730,525 | $907,900 | $372,000 |

| GREEN | $472,030 | $604,400 | $730,525 | $907,900 | $125,000 |

| GREENUP | $472,030 | $604,400 | $730,525 | $907,900 | $186,000 |

| HANCOCK | $472,030 | $604,400 | $730,525 | $907,900 | $174,000 |

| HARDIN | $472,030 | $604,400 | $730,525 | $907,900 | $187,000 |

| HARLAN | $472,030 | $604,400 | $730,525 | $907,900 | $35,000 |

| HARRISON | $472,030 | $604,400 | $730,525 | $907,900 | $128,000 |

| HART | $472,030 | $604,400 | $730,525 | $907,900 | $128,000 |

| HENDERSON | $472,030 | $604,400 | $730,525 | $907,900 | $244,000 |

| HENRY | $472,030 | $604,400 | $730,525 | $907,900 | $356,000 |

| HICKMAN | $472,030 | $604,400 | $730,525 | $907,900 | $47,000 |

| HOPKINS | $472,030 | $604,400 | $730,525 | $907,900 | $113,000 |

| JACKSON | $472,030 | $604,400 | $730,525 | $907,900 | $50,000 |

| JEFFERSON | $472,030 | $604,400 | $730,525 | $907,900 | $356,000 |

| JESSAMINE | $472,030 | $604,400 | $730,525 | $907,900 | $257,000 |

| JOHNSON | $472,030 | $604,400 | $730,525 | $907,900 | $97,000 |

| KENTON | $472,030 | $604,400 | $730,525 | $907,900 | $320,000 |

| KNOTT | $472,030 | $604,400 | $730,525 | $907,900 | $57,000 |

| KNOX | $472,030 | $604,400 | $730,525 | $907,900 | $146,000 |

| LARUE | $472,030 | $604,400 | $730,525 | $907,900 | $187,000 |

| LAUREL | $472,030 | $604,400 | $730,525 | $907,900 | $146,000 |

| LAWRENCE | $472,030 | $604,400 | $730,525 | $907,900 | $246,000 |

| LEE | $472,030 | $604,400 | $730,525 | $907,900 | $91,000 |

| LESLIE | $472,030 | $604,400 | $730,525 | $907,900 | $95,000 |

| LETCHER | $472,030 | $604,400 | $730,525 | $907,900 | $76,000 |

| LEWIS | $472,030 | $604,400 | $730,525 | $907,900 | $55,000 |

| LINCOLN | $472,030 | $604,400 | $730,525 | $907,900 | $167,000 |

| LIVINGSTON | $472,030 | $604,400 | $730,525 | $907,900 | $155,000 |

| LOGAN | $472,030 | $604,400 | $730,525 | $907,900 | $148,000 |

| LYON | $472,030 | $604,400 | $730,525 | $907,900 | $134,000 |

| MCCRACKEN | $472,030 | $604,400 | $730,525 | $907,900 | $155,000 |

| MCCREARY | $472,030 | $604,400 | $730,525 | $907,900 | $68,000 |

| MCLEAN | $472,030 | $604,400 | $730,525 | $907,900 | $174,000 |

| MADISON | $472,030 | $604,400 | $730,525 | $907,900 | $219,000 |

| MAGOFFIN | $472,030 | $604,400 | $730,525 | $907,900 | $32,000 |

| MARION | $472,030 | $604,400 | $730,525 | $907,900 | $156,000 |

| MARSHALL | $472,030 | $604,400 | $730,525 | $907,900 | $132,000 |

| MARTIN | $472,030 | $604,400 | $730,525 | $907,900 | $139,000 |

| MASON | $472,030 | $604,400 | $730,525 | $907,900 | $98,000 |

| MEADE | $472,030 | $604,400 | $730,525 | $907,900 | $187,000 |

| MENIFEE | $472,030 | $604,400 | $730,525 | $907,900 | $155,000 |

| MERCER | $472,030 | $604,400 | $730,525 | $907,900 | $145,000 |

| METCALFE | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| MONROE | $472,030 | $604,400 | $730,525 | $907,900 | $60,000 |

| MONTGOMERY | $472,030 | $604,400 | $730,525 | $907,900 | $155,000 |

| MORGAN | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| MUHLENBERG | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| NELSON | $472,030 | $604,400 | $730,525 | $907,900 | $205,000 |

| NICHOLAS | $472,030 | $604,400 | $730,525 | $907,900 | $119,000 |

| OHIO | $472,030 | $604,400 | $730,525 | $907,900 | $107,000 |

| OLDHAM | $472,030 | $604,400 | $730,525 | $907,900 | $356,000 |

| OWEN | $472,030 | $604,400 | $730,525 | $907,900 | $76,000 |

| OWSLEY | $472,030 | $604,400 | $730,525 | $907,900 | $30,000 |

| PENDLETON | $472,030 | $604,400 | $730,525 | $907,900 | $320,000 |

| PERRY | $472,030 | $604,400 | $730,525 | $907,900 | $109,000 |

| PIKE | $472,030 | $604,400 | $730,525 | $907,900 | $87,000 |

| POWELL | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| PULASKI | $472,030 | $604,400 | $730,525 | $907,900 | $125,000 |

| ROBERTSON | $472,030 | $604,400 | $730,525 | $907,900 | $55,000 |

| ROCKCASTLE | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| ROWAN | $472,030 | $604,400 | $730,525 | $907,900 | $126,000 |

| RUSSELL | $472,030 | $604,400 | $730,525 | $907,900 | $63,000 |

| SCOTT | $472,030 | $604,400 | $730,525 | $907,900 | $257,000 |

| SHELBY | $472,030 | $604,400 | $730,525 | $907,900 | $356,000 |

| SIMPSON | $472,030 | $604,400 | $730,525 | $907,900 | $195,000 |

| SPENCER | $472,030 | $604,400 | $730,525 | $907,900 | $356,000 |

| TAYLOR | $472,030 | $604,400 | $730,525 | $907,900 | $125,000 |

| TODD | $472,030 | $604,400 | $730,525 | $907,900 | $120,000 |

| TRIGG | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| TRIMBLE | $472,030 | $604,400 | $730,525 | $907,900 | $103,000 |

| UNION | $472,030 | $604,400 | $730,525 | $907,900 | $79,000 |

| WARREN | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| WASHINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $123,000 |

| WAYNE | $472,030 | $604,400 | $730,525 | $907,900 | $60,000 |

| WEBSTER | $472,030 | $604,400 | $730,525 | $907,900 | $55,000 |

| WHITLEY | $472,030 | $604,400 | $730,525 | $907,900 | $146,000 |

| WOLFE | $472,030 | $604,400 | $730,525 | $907,900 | $65,000 |

| WOODFORD | $472,030 | $604,400 | $730,525 | $907,900 | $257,000 |

How FHA Loan Limits in Kentucky Are Calculated?

The FHA loan limit is calculated based on the median home price in the county where the property is located. The loan limit cannot be more than 115% of the median home price. In order to qualify for an FHA loan, borrowers must have a credit score of 580 or higher. Borrowers with a credit score below 580 may still qualify for an FHA loan, but they will need to put down a 10% down payment.

What is an FHA Loan and How To Get Approved In Kentucky

FHA loans are a type of mortgage loan that is insured by the Federal Housing Administration (FHA). These loans are designed for low to moderate income borrowers who are unable to make a large down payment. FHA loans offer several benefits, including a lower down payment requirement, more flexible credit requirements, and more lenient income requirements. In addition, FHA loans are available for both purchases and refinance transactions.

If you’re thinking about applying for an FHA loan in Kentucky, here’s what you need to know.

- Down Payment Requirements: For most FHA loans, you will need to make a minimum down payment of 3.5%. However if your credit score is 580 or higher, you may be able to qualify for a loan with a down payment of only 3.0%.

- Credit Requirements: FHA loans have more flexible credit requirements than most other mortgage products. In order to qualify for an FHA loan, you will need a minimum credit score of 500. However, if your credit score is 580 or higher, you may be eligible for a lower interest rate.

- Income Requirements: In order to qualify for an FHA loan in Kentucky, your income must be below the median household income for your area. To find out what the median income is in your area, visit the HUD website. Your total debt-to-income ratio (including your mortgage, credit cards, car loans, and any other monthly debts) can’t exceed 41% of your gross monthly income. And your monthly housing costs (including principal, interest, taxes, and insurance) can’t exceed 31% of your gross monthly income.

- Loan Terms: FHA loans offer terms of up to 30 years, which can be helpful for those who want to keep their monthly payments low.

- Fees: FHA loans come with several fees, including an up-front mortgage insurance premium and a monthly mortgage insurance premium. However, these fees are typically lower than the fees associated with other types of mortgage products.

- MIP: The Federal Housing Administration (FHA) is a government agency that provides mortgage insurance on loans made by FHA-approved lenders. Mortgage insurance protects lenders against losses from mortgage defaults and lowers the risk of offering loans to borrowers with less than perfect credit.

Closings Costs For an FHA Loan In Kentucky in 2023

Discount Points

Discount points are optional fees that can be paid in order to lower the interest rate on the loan. Each point is equal to 1% of the loan amount, so in Kentucky, they typically range from 0.5% to 2%.

Appraisal Fee

This fee pays for the appraisal of the property that is being mortgaged. It typically costs between $300 and $500 in Kentucky.

Credit Report

The credit report fee covers the cost of pulling your credit history and score. It generally costs between $30 and $50.

Underwriter’s Fee

This fee is paid to the person who reviews the loan application and decides whether or not to approve it. It usually costs around $100.

Closing Agent Fee

The closing agent is responsible for handling all of the paperwork associated with the loan. They typically charge between $200 and $400 for their services.

Title Insurance

This insurance protects the lender in case there are any problems with the title to the property. It typically costs around $1,000 in Kentucky.

Recording Fee

The recording fee covers the cost of officially registering the mortgage with the county. In Kentucky, it is typically around $30.

Mortgage Insurance

Mortgage insurance is required on all FHA loans with a down payment of less than 20%. The premium is paid at closing and then monthly as part of your mortgage payment.

As you can see, there are a variety of different fees that you may be charged when closing on an FHA loan in Kentucky. It’s important to be aware of them all so you can budget appropriately. If you have any questions, don’t hesitate to ask your lender

If you’re interested in an FHA loan in Kentucky, it’s important to consult with a qualified lender/broker to find out if you qualify.

Best City in Kentucky To Live in

If you’re looking for the best city to live in Kentucky, look no further than Lexington. This charming city has it all – a vibrant culture, a thriving economy, and plenty of green space. And, of course, it’s home to the University of Kentucky. There are plenty of reasons to love Lexington. The city’s economy is booming, thanks to its strong healthcare and education sectors.

And, of course, there’s the University of Kentucky. This world-class institution brings plenty of cultural and economic benefits to the city. Lexington is also a great place to raise a family. The city has excellent public schools and plenty of family-friendly activities. And, if you’re looking for a little more excitement, Louisville is just a short drive away.

FHA Max Loan Amount in Lexington

So if you’re looking for the best city to live in Kentucky, look no further than Lexington. With its strong economy, thriving culture, and beautiful setting, it’s the perfect place to call home. In June 2023, the median listing home price in Lexington, KY was $340K, up 23.6% from June 2022. The median listing house price per square foot was $165. The median home sale price was $332.5K.

The maximum amount for FHA Loan in Lexington is $472,030 for a single home family, $604,400 when purchasing a duplex, and for a three-unit building you can get financing up to $730,525 and for a fourplex, a lender can lend you up to $907,900.

Kentucky FHA 203k Loans

FHA 203k loans allow you to borrow money to buy a home as well as additional cash for rehabilitation or remodeling. This program is also available in your state, and we work with lenders that support your FHA 203k loan. If you’d like to learn more about how this program works, we recommend reading our piece on FHA 203k loans.

Streamline Refinance

The FHA Streamline Refinance in Kentucky is a program offered by the Federal Housing Administration (FHA) that allows you to refinance your mortgage at lower interest rates.

The FHA streamline refinancing program is open to existing homeowners who wish to refinance at a lower rate while reducing some of the refinance expenses. You could get a reduction on your mortgage insurance premium, which is another benefit. For additional information, see our article on the FHA cash-out refinance program.

The Kentucky FHA loan preapproval procedure

If you are looking for an FHA loan, there is an optimal process you should follow to get pre-approved.

- Get a copy of your last two months’ bank statements.

- Purchase copies of your pay stubs for the previous month.

- For the past two years, obtain a copy of your tax returns.

- Check your credit and try to remove anything that is lowering your scores.

- Make sure you have enough down payment money to qualify.

- Contact an FHA lender about your loan situation.

As soon as you’ve decided on a location, begin the process of applying for an FHA loan. Speak with a lender early in the process since they may assist you with your FHA approval. This should be done months before you start looking for a home. If your credit score is low and you need to dispute errors on your credit score please read our FHA loan requirements for low credit score borrowers article.

Kentucky Down Payment Assistance Program

The Kentucky Housing Corporation offers two down payment assistance programs, which may assist you with paying for part of the purchase price.

- Regular DPA: Up to $7,500 repaid over 10 years with a rate of 3.75% is available.

- Affordable DPA: You can borrow up to $7,500. The loan repayments are staggered over 10 years, with interest of 1%. However, you must fulfill certain income criteria in order for this to apply to you. Income restrictions differ by county and family size.

For both programs, the purchase price of your house may not exceed $346,644. For additional information, including income limits for the Affordable DPA program, see the KHC’s website. Consult HUD’s list of alternative homeownership assistance programs in Kentucky while you’re at it.