Texas FHA Loan Limits Increased in 2025

If you are thinking of buying a home in Texas, you will be happy to know that the Texas FHA loan limits have been raised for most counties in TX in 2025. This increase means that more borrowers will now qualify for an FHA-insured mortgage. Let’s take a closer look at what this means for Texas borrowers. The 2025 FHA loan limits range from $498,257 to $1,099,150, depending on the county where the property is located.

If you are thinking of buying a home in Texas, you will be happy to know that the Texas FHA loan limits have been raised for most counties in TX in 2025. This increase means that more borrowers will now qualify for an FHA-insured mortgage. Let’s take a closer look at what this means for Texas borrowers. The 2025 FHA loan limits range from $498,257 to $1,099,150, depending on the county where the property is located.

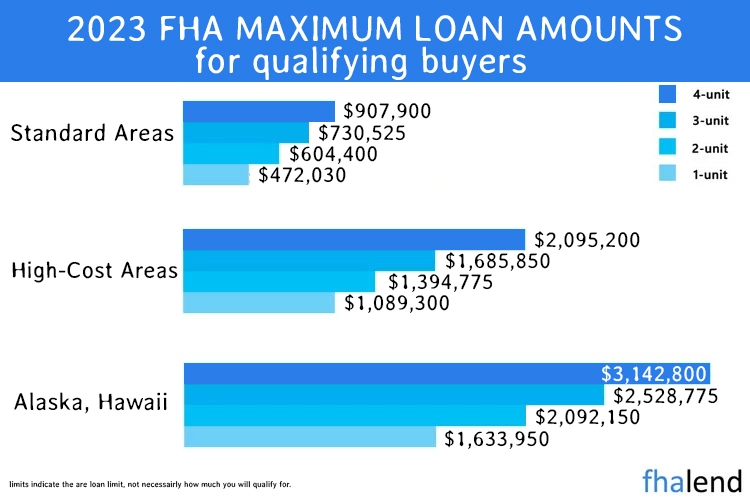

The Federal Housing Administration strives to ensure that no matter where purchasers live, they will be able to afford a modest house in their area, therefore the maximum loan amount is changed according to on areas with a greater cost of living. Across Texas, the typical loan limit is $498,257; however, this can differ by county. This applies to loans with case numbers assigned on or after January 1, 2025.

For the high-cost areas with counties like Atascosa County, Bastrop County, Caldwell County, Hays County, and Hunt County FHA loan limits are set higher than the average 90% of counties in Texas and the maximum FHA loan amount for a single home family is at $524,400. There are maximum loan restrictions for FHA-backed loans in Texas, so potential borrowers should verify their county limits before starting their house hunting. Please use our table with current loan limits below to decide how much you will need to put as a downpayment

FHA Loan Limits in Texas by County 2025

| County | FHA Limit | 2 Family | 3 Family | 4 Family | FHFA limit | Median House Price |

|---|---|---|---|---|---|---|

| ANDERSON | $524,225 | $671,200 | $811,275 | $1,008,300 | $171,000 | $340.6 |

| ANDREWS | $524,225 | $671,200 | $811,275 | $1,008,300 | $252,000 | $340.6 |

| ANGELINA | $524,225 | $671,200 | $811,275 | $1,008,300 | $200,000 | $340.6 |

| ARANSAS | $524,225 | $671,200 | $811,275 | $1,008,300 | $284,000 | $340.6 |

| ARCHER | $524,225 | $671,200 | $811,275 | $1,008,300 | $231,000 | $340.6 |

| ARMSTRONG | $524,225 | $671,200 | $811,275 | $1,008,300 | $250,000 | $340.6 |

| ATASCOSA | $557,750 | $714,000 | $863,100 | $1,072,600 | $482,000 | $362.05 |

| AUSTIN | $524,225 | $671,200 | $811,275 | $1,008,300 | $380,000 | $340.6 |

| BAILEY | $524,225 | $671,200 | $811,275 | $1,008,300 | $158,000 | $340.6 |

| BANDERA | $557,750 | $714,000 | $863,100 | $1,072,600 | $482,000 | $362.05 |

| BASTROP | $571,550 | $731,700 | $884,450 | $1,099,150 | $474,000 | $371.15 |

| BAYLOR | $524,225 | $671,200 | $811,275 | $1,008,300 | $77,000 | $340.6 |

| BEE | $524,225 | $671,200 | $811,275 | $1,008,300 | $178,000 | $340.6 |

| BELL | $524,225 | $671,200 | $811,275 | $1,008,300 | $290,000 | $340.6 |

| BEXAR | $557,750 | $714,000 | $863,100 | $1,072,600 | $482,000 | $362.05 |

| BLANCO | $524,225 | $671,200 | $811,275 | $1,008,300 | $349,000 | $340.6 |

| BORDEN | $524,225 | $671,200 | $811,275 | $1,008,300 | $244,000 | $340.6 |

| BOSQUE | $524,225 | $671,200 | $811,275 | $1,008,300 | $197,000 | $340.6 |

| BOWIE | $524,225 | $671,200 | $811,275 | $1,008,300 | $175,000 | $340.6 |

| BRAZORIA | $524,225 | $671,200 | $811,275 | $1,008,300 | $380,000 | $340.6 |

| BRAZOS | $524,225 | $671,200 | $811,275 | $1,008,300 | $310,000 | $340.6 |

| BREWSTER | $524,225 | $671,200 | $811,275 | $1,008,300 | $250,000 | $340.6 |

| BRISCOE | $524,225 | $671,200 | $811,275 | $1,008,300 | $175,000 | $340.6 |

| BROOKS | $524,225 | $671,200 | $811,275 | $1,008,300 | $35,000 | $340.6 |

| BROWN | $524,225 | $671,200 | $811,275 | $1,008,300 | $191,000 | $340.6 |

| BURLESON | $524,225 | $671,200 | $811,275 | $1,008,300 | $310,000 | $340.6 |

| BURNET | $524,225 | $671,200 | $811,275 | $1,008,300 | $315,000 | $340.6 |

| CALDWELL | $571,550 | $731,700 | $884,450 | $1,099,150 | $474,000 | $371.15 |

| CALHOUN | $524,225 | $671,200 | $811,275 | $1,008,300 | $194,000 | $340.6 |

| CALLAHAN | $524,225 | $671,200 | $811,275 | $1,008,300 | $230,000 | $340.6 |

| CAMERON | $524,225 | $671,200 | $811,275 | $1,008,300 | $228,000 | $340.6 |

| CAMP | $524,225 | $671,200 | $811,275 | $1,008,300 | $223,000 | $340.6 |

| CARSON | $524,225 | $671,200 | $811,275 | $1,008,300 | $250,000 | $340.6 |

| CASS | $524,225 | $671,200 | $811,275 | $1,008,300 | $149,000 | $340.6 |

| CASTRO | $524,225 | $671,200 | $811,275 | $1,008,300 | $145,000 | $340.6 |

| CHAMBERS | $524,225 | $671,200 | $811,275 | $1,008,300 | $380,000 | $340.6 |

| CHEROKEE | $524,225 | $671,200 | $811,275 | $1,008,300 | $169,000 | $340.6 |

| CHILDRESS | $524,225 | $671,200 | $811,275 | $1,008,300 | $82,000 | $340.6 |

| CLAY | $524,225 | $671,200 | $811,275 | $1,008,300 | $231,000 | $340.6 |

| COCHRAN | $524,225 | $671,200 | $811,275 | $1,008,300 | $17,000 | $340.6 |

| COKE | $524,225 | $671,200 | $811,275 | $1,008,300 | $107,000 | $340.6 |

| COLEMAN | $524,225 | $671,200 | $811,275 | $1,008,300 | $99,000 | $340.6 |

| COLLIN | $563,500 | $721,400 | $872,000 | $1,083,650 | $485,000 | $365.95 |

| COLLINGSWORTH | $524,225 | $671,200 | $811,275 | $1,008,300 | $111,000 | $340.6 |

| COLORADO | $524,225 | $671,200 | $811,275 | $1,008,300 | $209,000 | $340.6 |

| COMAL | $557,750 | $714,000 | $863,100 | $1,072,600 | $482,000 | $362.05 |

| COMANCHE | $524,225 | $671,200 | $811,275 | $1,008,300 | $199,000 | $340.6 |

| CONCHO | $524,225 | $671,200 | $811,275 | $1,008,300 | $131,000 | $340.6 |

| COOKE | $524,225 | $671,200 | $811,275 | $1,008,300 | $279,000 | $340.6 |

| CORYELL | $524,225 | $671,200 | $811,275 | $1,008,300 | $290,000 | $340.6 |

| COTTLE | $524,225 | $671,200 | $811,275 | $1,008,300 | $73,000 | $340.6 |

| CRANE | $524,225 | $671,200 | $811,275 | $1,008,300 | $60,000 | $340.6 |

| CROCKETT | $524,225 | $671,200 | $811,275 | $1,008,300 | $198,000 | $340.6 |

| CROSBY | $524,225 | $671,200 | $811,275 | $1,008,300 | $229,000 | $340.6 |

| CULBERSON | $524,225 | $671,200 | $811,275 | $1,008,300 | $133,000 | $340.6 |

| DALLAM | $524,225 | $671,200 | $811,275 | $1,008,300 | $160,000 | $340.6 |

| DALLAS | $563,500 | $721,400 | $872,000 | $1,083,650 | $485,000 | $365.95 |

| DAWSON | $524,225 | $671,200 | $811,275 | $1,008,300 | $150,000 | $340.6 |

| DEAF SMITH | $524,225 | $671,200 | $811,275 | $1,008,300 | $152,000 | $340.6 |

| DELTA | $524,225 | $671,200 | $811,275 | $1,008,300 | $222,000 | $340.6 |

| DENTON | $563,500 | $721,400 | $872,000 | $1,083,650 | $485,000 | $365.95 |

| DEWITT | $524,225 | $671,200 | $811,275 | $1,008,300 | $173,000 | $340.6 |

| DICKENS | $524,225 | $671,200 | $811,275 | $1,008,300 | $103,000 | $340.6 |

| DIMMIT | $524,225 | $671,200 | $811,275 | $1,008,300 | $158,000 | $340.6 |

| DONLEY | $524,225 | $671,200 | $811,275 | $1,008,300 | $107,000 | $340.6 |

| DUVAL | $524,225 | $671,200 | $811,275 | $1,008,300 | $150,000 | $340.6 |

| EASTLAND | $524,225 | $671,200 | $811,275 | $1,008,300 | $138,000 | $340.6 |

| ECTOR | $524,225 | $671,200 | $811,275 | $1,008,300 | $262,000 | $340.6 |

| EDWARDS | $524,225 | $671,200 | $811,275 | $1,008,300 | $100,000 | $340.6 |

| ELLIS | $563,500 | $721,400 | $872,000 | $1,083,650 | $485,000 | $365.95 |

| EL PASO | $524,225 | $671,200 | $811,275 | $1,008,300 | $249,000 | $340.6 |

| ERATH | $524,225 | $671,200 | $811,275 | $1,008,300 | $262,000 | $340.6 |

| FALLS | $524,225 | $671,200 | $811,275 | $1,008,300 | $269,000 | $340.6 |

| FANNIN | $524,225 | $671,200 | $811,275 | $1,008,300 | $239,000 | $340.6 |

| FAYETTE | $524,225 | $671,200 | $811,275 | $1,008,300 | $265,000 | $340.6 |

| FISHER | $524,225 | $671,200 | $811,275 | $1,008,300 | $118,000 | $340.6 |

| FLOYD | $524,225 | $671,200 | $811,275 | $1,008,300 | $128,000 | $340.6 |

| FOARD | $524,225 | $671,200 | $811,275 | $1,008,300 | $19,000 | $340.6 |

| FORT BEND | $524,225 | $671,200 | $811,275 | $1,008,300 | $380,000 | $340.6 |

| FRANKLIN | $524,225 | $671,200 | $811,275 | $1,008,300 | $230,000 | $340.6 |

| FREESTONE | $524,225 | $671,200 | $811,275 | $1,008,300 | $184,000 | $340.6 |

| FRIO | $524,225 | $671,200 | $811,275 | $1,008,300 | $159,000 | $340.6 |

| GAINES | $524,225 | $671,200 | $811,275 | $1,008,300 | $140,000 | $340.6 |

| GALVESTON | $524,225 | $671,200 | $811,275 | $1,008,300 | $380,000 | $340.6 |

| GARZA | $524,225 | $671,200 | $811,275 | $1,008,300 | $148,000 | $340.6 |

| GILLESPIE | $524,225 | $671,200 | $811,275 | $1,008,300 | $372,000 | $340.6 |

| GLASSCOCK | $524,225 | $671,200 | $811,275 | $1,008,300 | $374,000 | $340.6 |

| GOLIAD | $524,225 | $671,200 | $811,275 | $1,008,300 | $229,000 | $340.6 |

| GONZALES | $524,225 | $671,200 | $811,275 | $1,008,300 | $162,000 | $340.6 |

| GRAY | $524,225 | $671,200 | $811,275 | $1,008,300 | $231,000 | $340.6 |

| GRAYSON | $524,225 | $671,200 | $811,275 | $1,008,300 | $294,000 | $340.6 |

| GREGG | $524,225 | $671,200 | $811,275 | $1,008,300 | $226,000 | $340.6 |

| GRIMES | $524,225 | $671,200 | $811,275 | $1,008,300 | $253,000 | $340.6 |

| GUADALUPE | $557,750 | $714,000 | $863,100 | $1,072,600 | $482,000 | $362.05 |

| HALE | $524,225 | $671,200 | $811,275 | $1,008,300 | $155,000 | $340.6 |

| HALL | $524,225 | $671,200 | $811,275 | $1,008,300 | $67,000 | $340.6 |

| HAMILTON | $524,225 | $671,200 | $811,275 | $1,008,300 | $170,000 | $340.6 |

| HANSFORD | $524,225 | $671,200 | $811,275 | $1,008,300 | $157,000 | $340.6 |

| HARDEMAN | $524,225 | $671,200 | $811,275 | $1,008,300 | $79,000 | $340.6 |

| HARDIN | $524,225 | $671,200 | $811,275 | $1,008,300 | $224,000 | $340.6 |

| HARRIS | $524,225 | $671,200 | $811,275 | $1,008,300 | $380,000 | $340.6 |

| HARRISON | $524,225 | $671,200 | $811,275 | $1,008,300 | $226,000 | $340.6 |

| HARTLEY | $524,225 | $671,200 | $811,275 | $1,008,300 | $222,000 | $340.6 |

| HASKELL | $524,225 | $671,200 | $811,275 | $1,008,300 | $110,000 | $340.6 |

| HAYS | $571,550 | $731,700 | $884,450 | $1,099,150 | $474,000 | $371.15 |

| HEMPHILL | $524,225 | $671,200 | $811,275 | $1,008,300 | $164,000 | $340.6 |

| HENDERSON | $524,225 | $671,200 | $811,275 | $1,008,300 | $218,000 | $340.6 |

| HIDALGO | $524,225 | $671,200 | $811,275 | $1,008,300 | $207,000 | $340.6 |

| HILL | $524,225 | $671,200 | $811,275 | $1,008,300 | $219,000 | $340.6 |

| HOCKLEY | $524,225 | $671,200 | $811,275 | $1,008,300 | $173,000 | $340.6 |

| HOOD | $524,225 | $671,200 | $811,275 | $1,008,300 | $283,000 | $340.6 |

| HOPKINS | $524,225 | $671,200 | $811,275 | $1,008,300 | $239,000 | $340.6 |

| HOUSTON | $524,225 | $671,200 | $811,275 | $1,008,300 | $169,000 | $340.6 |

| HOWARD | $524,225 | $671,200 | $811,275 | $1,008,300 | $186,000 | $340.6 |

| HUDSPETH | $524,225 | $671,200 | $811,275 | $1,008,300 | $249,000 | $340.6 |

| HUNT | $563,500 | $721,400 | $872,000 | $1,083,650 | $485,000 | $365.95 |

| HUTCHINSON | $524,225 | $671,200 | $811,275 | $1,008,300 | $144,000 | $340.6 |

| IRION | $524,225 | $671,200 | $811,275 | $1,008,300 | $251,000 | $340.6 |

| JACK | $524,225 | $671,200 | $811,275 | $1,008,300 | $211,000 | $340.6 |

| JACKSON | $524,225 | $671,200 | $811,275 | $1,008,300 | $168,000 | $340.6 |

| JASPER | $524,225 | $671,200 | $811,275 | $1,008,300 | $140,000 | $340.6 |

| JEFF DAVIS | $524,225 | $671,200 | $811,275 | $1,008,300 | $236,000 | $340.6 |

| JEFFERSON | $524,225 | $671,200 | $811,275 | $1,008,300 | $224,000 | $340.6 |

| JIM HOGG | $524,225 | $671,200 | $811,275 | $1,008,300 | $73,000 | $340.6 |

| JIM WELLS | $524,225 | $671,200 | $811,275 | $1,008,300 | $150,000 | $340.6 |

| JOHNSON | $563,500 | $721,400 | $872,000 | $1,083,650 | $485,000 | $365.95 |

| JONES | $524,225 | $671,200 | $811,275 | $1,008,300 | $230,000 | $340.6 |

| KARNES | $524,225 | $671,200 | $811,275 | $1,008,300 | $197,000 | $340.6 |

| KAUFMAN | $563,500 | $721,400 | $872,000 | $1,083,650 | $485,000 | $365.95 |

| KENDALL | $557,750 | $714,000 | $863,100 | $1,072,600 | $482,000 | $362.05 |

| KENEDY | $524,225 | $671,200 | $811,275 | $1,008,300 | $180,000 | $340.6 |

| KENT | $524,225 | $671,200 | $811,275 | $1,008,300 | $163,000 | $340.6 |

| KERR | $524,225 | $671,200 | $811,275 | $1,008,300 | $288,000 | $340.6 |

| KIMBLE | $524,225 | $671,200 | $811,275 | $1,008,300 | $292,000 | $340.6 |

| KING | $524,225 | $671,200 | $811,275 | $1,008,300 | $50,000 | $340.6 |

| KINNEY | $524,225 | $671,200 | $811,275 | $1,008,300 | $173,000 | $340.6 |

| KLEBERG | $524,225 | $671,200 | $811,275 | $1,008,300 | $180,000 | $340.6 |

| KNOX | $524,225 | $671,200 | $811,275 | $1,008,300 | $78,000 | $340.6 |

| LAMAR | $524,225 | $671,200 | $811,275 | $1,008,300 | $185,000 | $340.6 |

| LAMB | $524,225 | $671,200 | $811,275 | $1,008,300 | $110,000 | $340.6 |

| LAMPASAS | $524,225 | $671,200 | $811,275 | $1,008,300 | $290,000 | $340.6 |

| LA SALLE | $524,225 | $671,200 | $811,275 | $1,008,300 | $108,000 | $340.6 |

| LAVACA | $524,225 | $671,200 | $811,275 | $1,008,300 | $199,000 | $340.6 |

| LEE | $524,225 | $671,200 | $811,275 | $1,008,300 | $250,000 | $340.6 |

| LEON | $524,225 | $671,200 | $811,275 | $1,008,300 | $199,000 | $340.6 |

| LIBERTY | $524,225 | $671,200 | $811,275 | $1,008,300 | $380,000 | $340.6 |

| LIMESTONE | $524,225 | $671,200 | $811,275 | $1,008,300 | $169,000 | $340.6 |

| LIPSCOMB | $524,225 | $671,200 | $811,275 | $1,008,300 | $93,000 | $340.6 |

| LIVE OAK | $524,225 | $671,200 | $811,275 | $1,008,300 | $162,000 | $340.6 |

| LLANO | $524,225 | $671,200 | $811,275 | $1,008,300 | $269,000 | $340.6 |

| LOVING | $524,225 | $671,200 | $811,275 | $1,008,300 | $308,000 | $340.6 |

| LUBBOCK | $524,225 | $671,200 | $811,275 | $1,008,300 | $229,000 | $340.6 |

| LYNN | $524,225 | $671,200 | $811,275 | $1,008,300 | $229,000 | $340.6 |

| MCCULLOCH | $524,225 | $671,200 | $811,275 | $1,008,300 | $139,000 | $340.6 |

| MCLENNAN | $524,225 | $671,200 | $811,275 | $1,008,300 | $269,000 | $340.6 |

| MCMULLEN | $524,225 | $671,200 | $811,275 | $1,008,300 | $157,000 | $340.6 |

| MADISON | $524,225 | $671,200 | $811,275 | $1,008,300 | $228,000 | $340.6 |

| MARION | $524,225 | $671,200 | $811,275 | $1,008,300 | $145,000 | $340.6 |

| MARTIN | $524,225 | $671,200 | $811,275 | $1,008,300 | $333,000 | $340.6 |

| MASON | $524,225 | $671,200 | $811,275 | $1,008,300 | $220,000 | $340.6 |

| MATAGORDA | $524,225 | $671,200 | $811,275 | $1,008,300 | $182,000 | $340.6 |

| MAVERICK | $524,225 | $671,200 | $811,275 | $1,008,300 | $239,000 | $340.6 |

| MEDINA | $557,750 | $714,000 | $863,100 | $1,072,600 | $482,000 | $362.05 |

| MENARD | $524,225 | $671,200 | $811,275 | $1,008,300 | $133,000 | $340.6 |

| MIDLAND | $524,225 | $671,200 | $811,275 | $1,008,300 | $333,000 | $340.6 |

| MILAM | $524,225 | $671,200 | $811,275 | $1,008,300 | $195,000 | $340.6 |

| MILLS | $524,225 | $671,200 | $811,275 | $1,008,300 | $266,000 | $340.6 |

| MITCHELL | $524,225 | $671,200 | $811,275 | $1,008,300 | $97,000 | $340.6 |

| MONTAGUE | $524,225 | $671,200 | $811,275 | $1,008,300 | $191,000 | $340.6 |

| MONTGOMERY | $524,225 | $671,200 | $811,275 | $1,008,300 | $380,000 | $340.6 |

| MOORE | $524,225 | $671,200 | $811,275 | $1,008,300 | $173,000 | $340.6 |

| MORRIS | $524,225 | $671,200 | $811,275 | $1,008,300 | $140,000 | $340.6 |

| MOTLEY | $524,225 | $671,200 | $811,275 | $1,008,300 | $111,000 | $340.6 |

| NACOGDOCHES | $524,225 | $671,200 | $811,275 | $1,008,300 | $216,000 | $340.6 |

| NAVARRO | $524,225 | $671,200 | $811,275 | $1,008,300 | $161,000 | $340.6 |

| NEWTON | $524,225 | $671,200 | $811,275 | $1,008,300 | $130,000 | $340.6 |

| NOLAN | $524,225 | $671,200 | $811,275 | $1,008,300 | $130,000 | $340.6 |

| NUECES | $524,225 | $671,200 | $811,275 | $1,008,300 | $265,000 | $340.6 |

| OCHILTREE | $524,225 | $671,200 | $811,275 | $1,008,300 | $167,000 | $340.6 |

| OLDHAM | $524,225 | $671,200 | $811,275 | $1,008,300 | $250,000 | $340.6 |

| ORANGE | $524,225 | $671,200 | $811,275 | $1,008,300 | $224,000 | $340.6 |

| PALO PINTO | $524,225 | $671,200 | $811,275 | $1,008,300 | $227,000 | $340.6 |

| PANOLA | $524,225 | $671,200 | $811,275 | $1,008,300 | $199,000 | $340.6 |

| PARKER | $563,500 | $721,400 | $872,000 | $1,083,650 | $485,000 | $365.95 |

| PARMER | $524,225 | $671,200 | $811,275 | $1,008,300 | $128,000 | $340.6 |

| PECOS | $524,225 | $671,200 | $811,275 | $1,008,300 | $203,000 | $340.6 |

| POLK | $524,225 | $671,200 | $811,275 | $1,008,300 | $150,000 | $340.6 |

| POTTER | $524,225 | $671,200 | $811,275 | $1,008,300 | $250,000 | $340.6 |

| PRESIDIO | $524,225 | $671,200 | $811,275 | $1,008,300 | $150,000 | $340.6 |

| RAINS | $524,225 | $671,200 | $811,275 | $1,008,300 | $245,000 | $340.6 |

| RANDALL | $524,225 | $671,200 | $811,275 | $1,008,300 | $250,000 | $340.6 |

| REAGAN | $524,225 | $671,200 | $811,275 | $1,008,300 | $184,000 | $340.6 |

| REAL | $524,225 | $671,200 | $811,275 | $1,008,300 | $179,000 | $340.6 |

| RED RIVER | $524,225 | $671,200 | $811,275 | $1,008,300 | $100,000 | $340.6 |

| REEVES | $524,225 | $671,200 | $811,275 | $1,008,300 | $308,000 | $340.6 |

| REFUGIO | $524,225 | $671,200 | $811,275 | $1,008,300 | $180,000 | $340.6 |

| ROBERTS | $524,225 | $671,200 | $811,275 | $1,008,300 | $231,000 | $340.6 |

| ROBERTSON | $524,225 | $671,200 | $811,275 | $1,008,300 | $310,000 | $340.6 |

| ROCKWALL | $563,500 | $721,400 | $872,000 | $1,083,650 | $485,000 | $365.95 |

| RUNNELS | $524,225 | $671,200 | $811,275 | $1,008,300 | $125,000 | $340.6 |

| RUSK | $524,225 | $671,200 | $811,275 | $1,008,300 | $226,000 | $340.6 |

| SABINE | $524,225 | $671,200 | $811,275 | $1,008,300 | $173,000 | $340.6 |

| SAN AUGUSTINE | $524,225 | $671,200 | $811,275 | $1,008,300 | $110,000 | $340.6 |

| SAN JACINTO | $524,225 | $671,200 | $811,275 | $1,008,300 | $174,000 | $340.6 |

| SAN PATRICIO | $524,225 | $671,200 | $811,275 | $1,008,300 | $265,000 | $340.6 |

| SAN SABA | $524,225 | $671,200 | $811,275 | $1,008,300 | $100,000 | $340.6 |

| SCHLEICHER | $524,225 | $671,200 | $811,275 | $1,008,300 | $93,000 | $340.6 |

| SCURRY | $524,225 | $671,200 | $811,275 | $1,008,300 | $144,000 | $340.6 |

| SHACKELFORD | $524,225 | $671,200 | $811,275 | $1,008,300 | $251,000 | $340.6 |

| SHELBY | $524,225 | $671,200 | $811,275 | $1,008,300 | $129,000 | $340.6 |

| SHERMAN | $524,225 | $671,200 | $811,275 | $1,008,300 | $151,000 | $340.6 |

| SMITH | $524,225 | $671,200 | $811,275 | $1,008,300 | $280,000 | $340.6 |

| SOMERVELL | $524,225 | $671,200 | $811,275 | $1,008,300 | $258,000 | $340.6 |

| STARR | $524,225 | $671,200 | $811,275 | $1,008,300 | $167,000 | $340.6 |

| STEPHENS | $524,225 | $671,200 | $811,275 | $1,008,300 | $171,000 | $340.6 |

| STERLING | $524,225 | $671,200 | $811,275 | $1,008,300 | $251,000 | $340.6 |

| STONEWALL | $524,225 | $671,200 | $811,275 | $1,008,300 | $64,000 | $340.6 |

| SUTTON | $524,225 | $671,200 | $811,275 | $1,008,300 | $112,000 | $340.6 |

| SWISHER | $524,225 | $671,200 | $811,275 | $1,008,300 | $115,000 | $340.6 |

| TARRANT | $563,500 | $721,400 | $872,000 | $1,083,650 | $485,000 | $365.95 |

| TAYLOR | $524,225 | $671,200 | $811,275 | $1,008,300 | $230,000 | $340.6 |

| TERRELL | $524,225 | $671,200 | $811,275 | $1,008,300 | $99,000 | $340.6 |

| TERRY | $524,225 | $671,200 | $811,275 | $1,008,300 | $149,000 | $340.6 |

| THROCKMORTON | $524,225 | $671,200 | $811,275 | $1,008,300 | $135,000 | $340.6 |

| TITUS | $524,225 | $671,200 | $811,275 | $1,008,300 | $223,000 | $340.6 |

| TOM GREEN | $524,225 | $671,200 | $811,275 | $1,008,300 | $251,000 | $340.6 |

| TRAVIS | $571,550 | $731,700 | $884,450 | $1,099,150 | $474,000 | $371.15 |

| TRINITY | $524,225 | $671,200 | $811,275 | $1,008,300 | $147,000 | $340.6 |

| TYLER | $524,225 | $671,200 | $811,275 | $1,008,300 | $170,000 | $340.6 |

| UPSHUR | $524,225 | $671,200 | $811,275 | $1,008,300 | $226,000 | $340.6 |

| UPTON | $524,225 | $671,200 | $811,275 | $1,008,300 | $97,000 | $340.6 |

| UVALDE | $524,225 | $671,200 | $811,275 | $1,008,300 | $192,000 | $340.6 |

| VAL VERDE | $524,225 | $671,200 | $811,275 | $1,008,300 | $221,000 | $340.6 |

| VAN ZANDT | $524,225 | $671,200 | $811,275 | $1,008,300 | $225,000 | $340.6 |

| VICTORIA | $524,225 | $671,200 | $811,275 | $1,008,300 | $229,000 | $340.6 |

| WALKER | $524,225 | $671,200 | $811,275 | $1,008,300 | $234,000 | $340.6 |

| WALLER | $524,225 | $671,200 | $811,275 | $1,008,300 | $380,000 | $340.6 |

| WARD | $524,225 | $671,200 | $811,275 | $1,008,300 | $241,000 | $340.6 |

| WASHINGTON | $524,225 | $671,200 | $811,275 | $1,008,300 | $283,000 | $340.6 |

| WEBB | $524,225 | $671,200 | $811,275 | $1,008,300 | $243,000 | $340.6 |

| WHARTON | $524,225 | $671,200 | $811,275 | $1,008,300 | $204,000 | $340.6 |

| WHEELER | $524,225 | $671,200 | $811,275 | $1,008,300 | $148,000 | $340.6 |

| WICHITA | $524,225 | $671,200 | $811,275 | $1,008,300 | $231,000 | $340.6 |

| WILBARGER | $524,225 | $671,200 | $811,275 | $1,008,300 | $118,000 | $340.6 |

| WILLACY | $524,225 | $671,200 | $811,275 | $1,008,300 | $74,000 | $340.6 |

| WILLIAMSON | $571,550 | $731,700 | $884,450 | $1,099,150 | $474,000 | $371.15 |

| WILSON | $557,750 | $714,000 | $863,100 | $1,072,600 | $482,000 | $362.05 |

| WINKLER | $524,225 | $671,200 | $811,275 | $1,008,300 | $170,000 | $340.6 |

| WISE | $563,500 | $721,400 | $872,000 | $1,083,650 | $485,000 | $365.95 |

| WOOD | $524,225 | $671,200 | $811,275 | $1,008,300 | $217,000 | $340.6 |

| YOAKUM | $524,225 | $671,200 | $811,275 | $1,008,300 | $200,000 | $340.6 |

| YOUNG | $524,225 | $671,200 | $811,275 | $1,008,300 | $190,000 | $340.6 |

| ZAPATA | $524,225 | $671,200 | $811,275 | $1,008,300 | $92,000 | $340.6 |

| ZAVALA | $524,225 | $671,200 | $811,275 | $1,008,300 | $88,000 | $340.6 |

How Texas FHA loan limits Are Calculated?

The Texas FHA loan limits for were increased from 2024 to 2025. The maximum loan limit in Texas is now $498,257 for a 4-bedroom home.

The Federal Housing Administration (FHA) sets loan limits for each county in the U.S., based on median home prices in that area. The Texas FHA loan limits are set at $472,030for a single home family. For duplex, the maximum FHA loan amount you can borrow is $604,400. Triplex’s max loan amount in TX is $730,525. For a multifamily 4-unit property, you can borrow up to 907,900. This is an increase from the previous year’s loan limits for $416,300.

Texas FHA Loan Limits in High-Cost Areas

There are 3 different high-cost areas in Texas. For most counties, there are the same fha loan limits like in counties in other states. However, there are counties in TX that have higher multifamily FHA loan limits.

Multifamily FHA loan limits for SHF, Duplex, Triplex, and Fourplex in Texas.

First, where Texas FHA loan limits are at the peak for counties like Williamson County, Bastrop County, Caldwell County, Hays County, and Travis County are set at

- for the single-home family: $571,550

- for duplex $731,700

- for triplex $884,450

- for fourplex $1,099,150

For counties in Texas where the median home price is equal or higher than $392,000 in counties as Wise, County, Collin County, Dallas County, Denton County, Ellis County, Hunt County, Johnson County, Kaufman County, Parker County, Rockwall County, and Tarrant County. Texas FHA loan limits are set at:

- $563,500 for 1 unit

- $721,400 for 2-units

- $872,000 for 3 units

- $1,083,650 for 4-units

For Wilson County, Atascosa County, Bandera County, Bexar County, Comal County, Guadalupe County, Kendall County, Medina County the Texas FHA loan limits are set to

- $557,750 for a single unit

- $714,000 for two unit

- $863,100 for three-unit

- for a four-unit building $1,072,600

Steps To Do Before Applying for an FHA Loan in Texas

There are several things to consider before applying for an FHA loan. The FHA Loan is one of the most popular programs available in Texas next to NON-QM Loans and Bank Statemen Loans in Texas. One of the most important is that not all lenders offer FHA loans in Texas. You’ll need to find a lender who participates in the program and is approved by the HUD. Another thing to keep in mind is that FHA loans come with some additional fees, including an up-front mortgage insurance premium and a monthly mortgage insurance premium.

Top Best Neighborhoods in Texas To Buy a House

With that in mind, here are three of the best neighborhoods in Texas for families who want an FHA loan.

The Woodlands, TX

The Woodlands is a beautiful suburb north of Houston that’s perfect for families. It’s safe, affordable, and has a great school district. The commute time is also relatively short, making it a good option for families who work in Houston.

Westover Hills, TX

Westover Hills is another great option for families who want an FHA loan. It’s located in San Antonio, and it has a great school district, safe neighborhoods, and plenty of amenities nearby. The commute time is a bit longer than in The Woodlands, but it’s still manageable.

Frisco, TX

Frisco is a rapidly growing suburb north of Dallas that’s perfect for families. It has great schools, a safe community, and plenty of amenities nearby. The commute time is a bit longer than in the other two neighborhoods, but it’s still manageable.

FHA Mortgage Loan Requirements in Texas

The FHA loan is one of the most popular loan options in the United States, with more than 25% of all house purchases financed with an FHA Loan. Before you start looking for a home, learn about the FHA loan standards so that the whole process goes faster. There are specific FHA rules that exist in the handbook, and since there are hundreds of pages to go through, we’ve summarized the most essential facts here.

FHA loans have a few other benefits, as well. For example, FHA loans don’t come with prepayment penalties, so you can refinance your loan if you want to. And, FHA loans are assumable, which means that if you sell your home, the buyer can take over your loan. The downside of FHA loans is that they do require mortgage insurance. Mortgage insurance is an extra monthly fee that protects the lender if you default on your loan. The good news is that mortgage insurance premiums are tax-deductible.

Why Do You Need An FHA Loan And Who Are They For?

If your credit is excellent and you can put down at least 20%, an FHA loan may not be the best option for you. However, if your credit scores are low or you have a lot of debt but little to put down, then consider an FHA loan.

Appraisal Requirements in Texas When Applying for FHA Loan

An approved appraiser must conduct an appraisal on every home purchased with an FHA loan. The appraisal is required to verify that the property is worth what the buyer is paying for it. It protects both the customer and lender by ensuring that the purchase is worth what has been paid for it.

An FHA appraisal will assess the property’s worth as well as look for any of the following:

- Lead-Based Paint

- HVAC Heating and cooling

- fixtures and appliances

- Electrical & Plumbing

- Crack Foundation

- Hazards

- Drainage

- Leaky Roof

- Any wires sticking out of the wall

- Stairs without railings

- The condition of the home must be livable

Types of Home Inspections Required in Texas

In Texas, there are several types of inspections required for different types of homes. There might be different inspection requirements based on FHA, VA or Conventional loans. Buyers must obtain a general inspection for single-family residences as well as windstorm certification for coastal properties. These include a general home inspection,

- termite or wood-destroying insect inspection

- septic system inspection

- and water quality test.

A general home inspection will provide an overview of the condition of the property including structural components, plumbing systems, electrical systems, HVAC systems, and appliances. A termite or wood-destroying insect inspection looks for evidence of past or current infestations as well as protective control measures that may have been implemented.

A septic system inspection evaluates the overall condition and performance of the system including both the tank and associated drain lines. Finally, a water quality test is performed to evaluate the safety and condition of the home’s water supply. Additionally, buyers should consider obtaining an environmental inspection, which looks for issues such as mold, asbestos, and lead paint.

Gift Fund For a Downpayment For an FHA Loan in Texas?

Texas FHA loans only need a 3.5% down payment at the time of purchase, which is lower than many other loan programs that require a full 5% or more, which can save buyers between $10,000 and $50,000 depending on the purchase price of the property. The 3.5% down payment as a gift fund may be provided by a family member or employer to qualify for an FHA loan in Texas.

How Expensive is To Buy a House in Texas

There are different fees associated with FHA loans in Texas. One of the most common fees is the mortgage insurance premium (MIP). This fee is charged to help protect the lender in case the borrower defaults on the loan. The MIP amount varies based on the size of the loan and the down payment amount.

Another fee associated with FHA loans is the upfront mortgage insurance premium (UFMIP). This fee is charged when the loan is originated and helps to cover the costs of the FHA program. The UFMIP amount is generally 1% of the loan amount.

There are also some closing costs associated with FHA loans. These costs can vary, but typically include the cost of the appraisal, credit report, and title search. It is important to note that borrowers are not required to pay all of these fees. The UFMIP can be financed into the loan, and the closing costs can be rolled into the mortgage. If you are considering an FHA loan, it is important to understand the different fees involved. Talk to a lender to find out more about the specific fees associated with your loan.

- The different fees associated with FHA loans in Texas

- MIP

- UFMIP

- Closing costs

- Borrowers are not required in Texas to pay all of these fees

Talk to a lender to find out more about the specific fees associated with your loan or sign up for this form and we will match you with a local mortgage broker who does FHA loans in Texas

How FHA Refinance Program In Texas Works

If you’re a homeowner in Texas and you’re looking to refinance your home, there are a few things you need to know about the process. First, you’ll need to get an estimate of your home’s value. You can do this by contacting a real estate agent or appraiser. Next, you’ll need to compare rates and terms from different lenders. Be sure to compare both fixed-rate and adjustable-rate mortgages. Finally, you’ll need to choose the loan that best suits your needs. The FHA offers several types of loans, so be sure to ask about all of your options before making a decision.

Now that you know the basics of the FHA refinance process in Texas, it’s time to start shopping around for the best deal. Be sure to compare rates, terms, and conditions from a variety of lenders. Call us at 888 900 1020 and one of our senior loan officers will guide you through the process and get you prequalified for a loan so you can start your process of shopping for your dream home. If you have any questions, be sure to fill up a form with all details so we can get back to you within an hour. They’ll be able to help you through the process and make sure you get the best possible deal.

Now that you know the basics of the FHA refinance process in Texas, it’s time to start shopping around for the best deal. Be sure to compare rates, terms, and conditions from a variety of lenders. Call us at 888 900 1020 and one of our senior loan officers will guide you through the process and get you prequalified for a loan so you can start your process of shopping for your dream home. If you have any questions, be sure to fill up a form with all details so we can get back to you within an hour. They’ll be able to help you through the process and make sure you get the best possible deal.

3 Types of Texas Down Payment Assistance Program

If you are thinking about buying a home in Texas, then you should consider taking advantage of this program. It can help you save a lot of money on your downpayment, and it can also help you get into your dream home sooner than you might think.

Qualifying properties include single-family homes, duplexes where the owner occupies at least half of it, and FHA approved condominiums or manufactured homes. However, there are restrictions on both purchasing price and average family income limits.

The Community Promise Program in Texas

The Community Promise program from the Federal Home Loan Bank of Dallas offers downpayment mortgage assistance for first-time and low- to moderate-income homebuyers.

You can download the Texas home buyer program here.

The program provides a five-year forgivable second loan up to 3% of the original loan amount that can be used toward closing costs and/or a down payment. The Community Promise downpayment mortgage assistance program is designed to help homebuyers with limited financial resources get the chance to purchase a home. For first-time homebuyers or those with low to moderate income, getting your foot in the door of homeownership can feel out of reach.

| My First Texas Home (Down payment assistance up to 5%.) |

|||

|---|---|---|---|

| Eligibility | First-time homebuyers (no ownership interest in primary residence in the past three years) • Waived for properties located in a Qualified Targeted CensusTract. • Waived for veterans. |

||

| Loan Types |

|

||

| Min FICO | 620 | ||

| DTI | Automated (AUS) Findings require 55% Max Debt to Income (DTI). Manual Underwrites must follow Agency Program Guidelines for Max DTI. |

||

| Fees |

|

||

| My Choice Texas Home (Down payment assistance up to 5%) |

|||

|---|---|---|---|

| Eligibility | No first-time homebuyer requirement for this program. | ||

| Loan Types |

|

||

| Min FICO | 620 | ||

| DTI | Automated (AUS) Findings require 55% Max Debt to Income (DTI). Manual Underwrites must follow Agency Program Guidelines for Max DTI. |

||

| Fees |

|

||

| Texas Mortgage Credit Certificate (Available as a standalone MCC or combo.) |

|||

|---|---|---|---|

| Eligibility | First-time homebuyers (no ownership interest in primary residence in the past three years) • Waived for properties located in a Qualified Targeted CensusTract. • Waived for veterans. |

||

| Loan Types |

|

||

| Min FICO | – | ||

| DTI | No Max DTI or Min FICO for MCC Program. Follow Lender Guidelines. | ||

| Fees |

|

||

But thanks to the Community Promise mortgage assistance program from the Federal Home Loan Bank of Dallas, that dream is within arm’s reach! This five-year forgivable second loan offers eligible borrowers up to 3% of their original loan amount for closing costs and/or a down payment. Keep reading to learn more about this incredible opportunity and how you can take advantage of it.

The Community Promise downpayment mortgage assistance program might just be the answer to your prayers. This comprehensive program is designed to help homebuyers with limited financial resources get the chance to purchase a home through reduced mortgage payments and additional housing opportunities.

First Texas Home / My Choice Texas Home

The Texas Homebuyer Program can assist you with all phases of the house-buying process, including finding the money for a down payment. This program is available to qualified homebuyers who have not owned a home within the last three years. The downpayment assistance is in the form of a forgivable loan that does not need to be repaid as long as the buyer remains in their home for at least five years.

Down payment assistance of up to 5% may be obtained through My First Texas Home or My Choice Texas Home. This is in the form of a low- or no-interest second mortgage that can be forgiven if you qualify for one of the programs.

Veterans and first-time home buyers may also benefit from the Texas Home Buyer Program, which provides mortgage credit certificates (MCCs) in addition to cash gifts. These might save you money on your federal taxes dollar for dollar.

Other downpayment Assistance Programs

5 Star Texas Advantage Program

Austin Down Payment Assistance Program

Harris County Community Services Department DPA Program

Homeownership Across Texas

Homes for Texas Heroes Program

Travis County – Hill Country Home Down Payment Assistance

Find out more about the program here, or see HUD’s list of additional Texas homeownership assistance programs.