FHA Loan Limits in Missouri For 2023

FHA loan limits in Missouri are calculated according to a formula set by the Housing and Economic Recovery Act of 2008. This formula is based on 150% of the national conforming loan limit. The national conforming loan limit is the highest loan amount in Missouri that Fannie Mae and Freddie Mac will insure. In 2023, that limit is $726,200 for a single-family home finance with a conforming loan. Therefore, the maximum loan amount that an FHA borrower can get is 150% of $472,030, or $1,089,300 a single home family in Missouri state for high-cost areas as conforming loan ‘ceiling’ limit.

FHA loan limits in Missouri are calculated according to a formula set by the Housing and Economic Recovery Act of 2008. This formula is based on 150% of the national conforming loan limit. The national conforming loan limit is the highest loan amount in Missouri that Fannie Mae and Freddie Mac will insure. In 2023, that limit is $726,200 for a single-family home finance with a conforming loan. Therefore, the maximum loan amount that an FHA borrower can get is 150% of $472,030, or $1,089,300 a single home family in Missouri state for high-cost areas as conforming loan ‘ceiling’ limit.

The FHA loan limits are updated every year and typically released in December. The loan limits for the coming year are usually announced in late November. The FHA increases the loan limits in areas with high housing costs and low incomes, and vice versa.

If you’re thinking of getting an FHA loan, you’ll need to know the maximum loan amount in your current county in Missouri. You can find that information on the FHA loan limits in Missouri below. Just scroll down and look for your county, and you’ll see the loan limits for a single home family, duplex, triplex, and fourplex.

FHA Loan Limits in Missouri by County For 2023

| County | FHA Limit | 2 Family | 3 Family | 4 Family | FHFA limit | Median House Price |

|---|---|---|---|---|---|---|

| ELMORE | $498,257 | $637,950 | $771,125 | $958,350 | $191,000 | $323.7 |

| MOBILE | $498,257 | $637,950 | $771,125 | $958,350 | $157,000 | $323.7 |

| MONROE | $498,257 | $637,950 | $771,125 | $958,350 | $84,000 | $323.7 |

| MONTGOMERY | $498,257 | $637,950 | $771,125 | $958,350 | $191,000 | $323.7 |

| MORGAN | $498,257 | $637,950 | $771,125 | $958,350 | $202,000 | $323.7 |

| MONROE | $498,257 | $637,950 | $771,125 | $958,350 | $48,000 | $323.7 |

| MONTGOMERY | $498,257 | $637,950 | $771,125 | $958,350 | $163,000 | $323.7 |

| EASTERN DISTRIC | $498,257 | $637,950 | $771,125 | $958,350 | $96,000 | $323.7 |

| MANU’A DISTRICT | $498,257 | $637,950 | $771,125 | $958,350 | $124,000 | $323.7 |

| ROSE ISLAND | $498,257 | $637,950 | $771,125 | $958,350 | $122,000 | $323.7 |

| SWAINS ISLAND | $498,257 | $637,950 | $771,125 | $958,350 | $122,000 | $323.7 |

| WESTERN DISTRIC | $498,257 | $637,950 | $771,125 | $958,350 | $145,000 | $323.7 |

| MOHAVE | $498,257 | $637,950 | $771,125 | $958,350 | $238,000 | $323.7 |

| MODOC | $498,257 | $637,950 | $771,125 | $958,350 | $152,000 | $323.7 |

| MONO | $693,450 | $887,750 | $1,073,100 | $1,333,600 | $581,000 | $450.45 |

| MONTEREY | $920,000 | $1,177,750 | $1,423,650 | $1,769,250 | $800,000 | $598 |

| ALAMOSA | $498,257 | $637,950 | $771,125 | $958,350 | $209,000 | $323.7 |

| FREMONT | $498,257 | $637,950 | $771,125 | $958,350 | $285,000 | $323.7 |

| MOFFAT | $498,257 | $637,950 | $771,125 | $958,350 | $257,000 | $323.7 |

| MONTEZUMA | $498,257 | $637,950 | $771,125 | $958,350 | $286,000 | $323.7 |

| MONTROSE | $561,200 | $718,450 | $868,400 | $1,079,250 | $488,000 | $364.65 |

| MORGAN | $498,257 | $637,950 | $771,125 | $958,350 | $316,000 | $323.7 |

| MONROE | $929,200 | $1,189,550 | $1,437,900 | $1,786,950 | $808,000 | $603.85 |

| MONROE | $498,257 | $637,950 | $771,125 | $958,350 | $227,000 | $323.7 |

| MONTGOMERY | $498,257 | $637,950 | $771,125 | $958,350 | $108,000 | $323.7 |

| MORGAN | $649,750 | $831,800 | $1,005,450 | $1,249,550 | $565,000 | $421.85 |

| RICHMOND | $498,257 | $637,950 | $771,125 | $958,350 | $297,000 | $323.7 |

| DES MOINES | $498,257 | $637,950 | $771,125 | $958,350 | $188,000 | $323.7 |

| FREMONT | $498,257 | $637,950 | $771,125 | $958,350 | $89,000 | $323.7 |

| MONONA | $498,257 | $637,950 | $771,125 | $958,350 | $105,000 | $323.7 |

| MONROE | $498,257 | $637,950 | $771,125 | $958,350 | $82,000 | $323.7 |

| MONTGOMERY | $498,257 | $637,950 | $771,125 | $958,350 | $91,000 | $323.7 |

| PLYMOUTH | $498,257 | $637,950 | $771,125 | $958,350 | $190,000 | $323.7 |

| ELMORE | $498,257 | $637,950 | $771,125 | $958,350 | $324,000 | $323.7 |

| FREMONT | $498,257 | $637,950 | $771,125 | $958,350 | $343,000 | $323.7 |

| MONROE | $498,257 | $637,950 | $771,125 | $958,350 | $350,000 | $323.7 |

| MONTGOMERY | $498,257 | $637,950 | $771,125 | $958,350 | $80,000 | $323.7 |

| MORGAN | $498,257 | $637,950 | $771,125 | $958,350 | $105,000 | $323.7 |

| MOULTRIE | $498,257 | $637,950 | $771,125 | $958,350 | $97,000 | $323.7 |

| SANGAMON | $498,257 | $637,950 | $771,125 | $958,350 | $140,000 | $323.7 |

| MONROE | $498,257 | $637,950 | $771,125 | $958,350 | $305,000 | $323.7 |

| MONTGOMERY | $498,257 | $637,950 | $771,125 | $958,350 | $181,000 | $323.7 |

| MORGAN | $498,257 | $637,950 | $771,125 | $958,350 | $425,000 | $323.7 |

| MONTGOMERY | $498,257 | $637,950 | $771,125 | $958,350 | $109,000 | $323.7 |

| MORRIS | $498,257 | $637,950 | $771,125 | $958,350 | $123,000 | $323.7 |

| MORTON | $498,257 | $637,950 | $771,125 | $958,350 | $79,000 | $323.7 |

| EDMONSON | $498,257 | $637,950 | $771,125 | $958,350 | $246,000 | $323.7 |

| MONROE | $498,257 | $637,950 | $771,125 | $958,350 | $55,000 | $323.7 |

| MONTGOMERY | $498,257 | $637,950 | $771,125 | $958,350 | $170,000 | $323.7 |

| MORGAN | $498,257 | $637,950 | $771,125 | $958,350 | $88,000 | $323.7 |

| MOREHOUSE | $498,257 | $637,950 | $771,125 | $958,350 | $155,000 | $323.7 |

| PLYMOUTH | $862,500 | $1,104,150 | $1,334,700 | $1,658,700 | $750,000 | $560.3 |

| BALTIMORE | $667,000 | $853,900 | $1,032,150 | $1,282,700 | $580,000 | $433.55 |

| MONTGOMERY | $1,149,825 | $1,472,250 | $1,779,525 | $2,211,600 | $72,000 | $0.65 |

| BALTIMORE CITY | $667,000 | $853,900 | $1,032,150 | $1,282,700 | $580,000 | $433.55 |

| MONROE | $498,257 | $637,950 | $771,125 | $958,350 | $200,000 | $323.7 |

| MONTCALM | $498,257 | $637,950 | $771,125 | $958,350 | $320,000 | $323.7 |

| MONTMORENCY | $498,257 | $637,950 | $771,125 | $958,350 | $110,000 | $323.7 |

| ROSCOMMON | $498,257 | $637,950 | $771,125 | $958,350 | $140,000 | $323.7 |

| FILLMORE | $498,257 | $637,950 | $771,125 | $958,350 | $300,000 | $323.7 |

| MORRISON | $498,257 | $637,950 | $771,125 | $958,350 | $194,000 | $323.7 |

| MOWER | $498,257 | $637,950 | $771,125 | $958,350 | $150,000 | $323.7 |

| ADAIR | $498,257 | $637,950 | $771,125 | $958,350 | $162,000 | $323.7 |

| ANDREW | $498,257 | $637,950 | $771,125 | $958,350 | $211,000 | $323.7 |

| ATCHISON | $498,257 | $637,950 | $771,125 | $958,350 | $125,000 | $323.7 |

| AUDRAIN | $498,257 | $637,950 | $771,125 | $958,350 | $136,000 | $323.7 |

| BARRY | $498,257 | $637,950 | $771,125 | $958,350 | $172,000 | $323.7 |

| BARTON | $498,257 | $637,950 | $771,125 | $958,350 | $135,000 | $323.7 |

| BATES | $498,257 | $637,950 | $771,125 | $958,350 | $427,000 | $323.7 |

| BENTON | $498,257 | $637,950 | $771,125 | $958,350 | $192,000 | $323.7 |

| BOLLINGER | $498,257 | $637,950 | $771,125 | $958,350 | $205,000 | $323.7 |

| BOONE | $498,257 | $637,950 | $771,125 | $958,350 | $288,000 | $323.7 |

| BUCHANAN | $498,257 | $637,950 | $771,125 | $958,350 | $211,000 | $323.7 |

| BUTLER | $498,257 | $637,950 | $771,125 | $958,350 | $147,000 | $323.7 |

| CALDWELL | $498,257 | $637,950 | $771,125 | $958,350 | $427,000 | $323.7 |

| CALLAWAY | $498,257 | $637,950 | $771,125 | $958,350 | $224,000 | $323.7 |

| CAMDEN | $498,257 | $637,950 | $771,125 | $958,350 | $344,000 | $323.7 |

| CAPE GIRARDEAU | $498,257 | $637,950 | $771,125 | $958,350 | $205,000 | $323.7 |

| CARROLL | $498,257 | $637,950 | $771,125 | $958,350 | $136,000 | $323.7 |

| CARTER | $498,257 | $637,950 | $771,125 | $958,350 | $145,000 | $323.7 |

| CASS | $498,257 | $637,950 | $771,125 | $958,350 | $427,000 | $323.7 |

| CEDAR | $498,257 | $637,950 | $771,125 | $958,350 | $160,000 | $323.7 |

| CHARITON | $498,257 | $637,950 | $771,125 | $958,350 | $144,000 | $323.7 |

| CHRISTIAN | $498,257 | $637,950 | $771,125 | $958,350 | $285,000 | $323.7 |

| CLARK | $498,257 | $637,950 | $771,125 | $958,350 | $113,000 | $323.7 |

| CLAY | $498,257 | $637,950 | $771,125 | $958,350 | $427,000 | $323.7 |

| CLINTON | $498,257 | $637,950 | $771,125 | $958,350 | $427,000 | $323.7 |

| COLE | $498,257 | $637,950 | $771,125 | $958,350 | $224,000 | $323.7 |

| COOPER | $498,257 | $637,950 | $771,125 | $958,350 | $288,000 | $323.7 |

| CRAWFORD | $498,257 | $637,950 | $771,125 | $958,350 | $174,000 | $323.7 |

| DADE | $498,257 | $637,950 | $771,125 | $958,350 | $161,000 | $323.7 |

| DALLAS | $498,257 | $637,950 | $771,125 | $958,350 | $285,000 | $323.7 |

| DAVIESS | $498,257 | $637,950 | $771,125 | $958,350 | $182,000 | $323.7 |

| DEKALB | $498,257 | $637,950 | $771,125 | $958,350 | $211,000 | $323.7 |

| DENT | $498,257 | $637,950 | $771,125 | $958,350 | $160,000 | $323.7 |

| DOUGLAS | $498,257 | $637,950 | $771,125 | $958,350 | $166,000 | $323.7 |

| DUNKLIN | $498,257 | $637,950 | $771,125 | $958,350 | $120,000 | $323.7 |

| FRANKLIN | $498,257 | $637,950 | $771,125 | $958,350 | $350,000 | $323.7 |

| GASCONADE | $498,257 | $637,950 | $771,125 | $958,350 | $169,000 | $323.7 |

| GENTRY | $498,257 | $637,950 | $771,125 | $958,350 | $153,000 | $323.7 |

| GREENE | $498,257 | $637,950 | $771,125 | $958,350 | $285,000 | $323.7 |

| GRUNDY | $498,257 | $637,950 | $771,125 | $958,350 | $137,000 | $323.7 |

| HARRISON | $498,257 | $637,950 | $771,125 | $958,350 | $121,000 | $323.7 |

| HENRY | $498,257 | $637,950 | $771,125 | $958,350 | $182,000 | $323.7 |

| HICKORY | $498,257 | $637,950 | $771,125 | $958,350 | $130,000 | $323.7 |

| HOLT | $498,257 | $637,950 | $771,125 | $958,350 | $144,000 | $323.7 |

| HOWARD | $498,257 | $637,950 | $771,125 | $958,350 | $288,000 | $323.7 |

| HOWELL | $498,257 | $637,950 | $771,125 | $958,350 | $181,000 | $323.7 |

| IRON | $498,257 | $637,950 | $771,125 | $958,350 | $122,000 | $323.7 |

| JACKSON | $498,257 | $637,950 | $771,125 | $958,350 | $427,000 | $323.7 |

| JASPER | $498,257 | $637,950 | $771,125 | $958,350 | $190,000 | $323.7 |

| JEFFERSON | $498,257 | $637,950 | $771,125 | $958,350 | $350,000 | $323.7 |

| JOHNSON | $498,257 | $637,950 | $771,125 | $958,350 | $236,000 | $323.7 |

| KNOX | $498,257 | $637,950 | $771,125 | $958,350 | $116,000 | $323.7 |

| LACLEDE | $498,257 | $637,950 | $771,125 | $958,350 | $177,000 | $323.7 |

| LAFAYETTE | $498,257 | $637,950 | $771,125 | $958,350 | $427,000 | $323.7 |

| LAWRENCE | $498,257 | $637,950 | $771,125 | $958,350 | $180,000 | $323.7 |

| LEWIS | $498,257 | $637,950 | $771,125 | $958,350 | $137,000 | $323.7 |

| LINCOLN | $498,257 | $637,950 | $771,125 | $958,350 | $350,000 | $323.7 |

| LINN | $498,257 | $637,950 | $771,125 | $958,350 | $109,000 | $323.7 |

| LIVINGSTON | $498,257 | $637,950 | $771,125 | $958,350 | $144,000 | $323.7 |

| MCDONALD | $498,257 | $637,950 | $771,125 | $958,350 | $175,000 | $323.7 |

| MACON | $498,257 | $637,950 | $771,125 | $958,350 | $151,000 | $323.7 |

| MADISON | $498,257 | $637,950 | $771,125 | $958,350 | $144,000 | $323.7 |

| MARIES | $498,257 | $637,950 | $771,125 | $958,350 | $190,000 | $323.7 |

| MARION | $498,257 | $637,950 | $771,125 | $958,350 | $195,000 | $323.7 |

| MERCER | $498,257 | $637,950 | $771,125 | $958,350 | $121,000 | $323.7 |

| MILLER | $498,257 | $637,950 | $771,125 | $958,350 | $197,000 | $323.7 |

| MISSISSIPPI | $498,257 | $637,950 | $771,125 | $958,350 | $90,000 | $323.7 |

| MONITEAU | $498,257 | $637,950 | $771,125 | $958,350 | $224,000 | $323.7 |

| MONROE | $498,257 | $637,950 | $771,125 | $958,350 | $128,000 | $323.7 |

| MONTGOMERY | $498,257 | $637,950 | $771,125 | $958,350 | $215,000 | $323.7 |

| MORGAN | $498,257 | $637,950 | $771,125 | $958,350 | $225,000 | $323.7 |

| NEW MADRID | $498,257 | $637,950 | $771,125 | $958,350 | $115,000 | $323.7 |

| NEWTON | $498,257 | $637,950 | $771,125 | $958,350 | $190,000 | $323.7 |

| NODAWAY | $498,257 | $637,950 | $771,125 | $958,350 | $152,000 | $323.7 |

| OREGON | $498,257 | $637,950 | $771,125 | $958,350 | $149,000 | $323.7 |

| OSAGE | $498,257 | $637,950 | $771,125 | $958,350 | $224,000 | $323.7 |

| OZARK | $498,257 | $637,950 | $771,125 | $958,350 | $169,000 | $323.7 |

| PEMISCOT | $498,257 | $637,950 | $771,125 | $958,350 | $116,000 | $323.7 |

| PERRY | $498,257 | $637,950 | $771,125 | $958,350 | $179,000 | $323.7 |

| PETTIS | $498,257 | $637,950 | $771,125 | $958,350 | $174,000 | $323.7 |

| PHELPS | $498,257 | $637,950 | $771,125 | $958,350 | $197,000 | $323.7 |

| PIKE | $498,257 | $637,950 | $771,125 | $958,350 | $144,000 | $323.7 |

| PLATTE | $498,257 | $637,950 | $771,125 | $958,350 | $427,000 | $323.7 |

| POLK | $498,257 | $637,950 | $771,125 | $958,350 | $285,000 | $323.7 |

| PULASKI | $498,257 | $637,950 | $771,125 | $958,350 | $205,000 | $323.7 |

| PUTNAM | $498,257 | $637,950 | $771,125 | $958,350 | $124,000 | $323.7 |

| RALLS | $498,257 | $637,950 | $771,125 | $958,350 | $195,000 | $323.7 |

| RANDOLPH | $498,257 | $637,950 | $771,125 | $958,350 | $201,000 | $323.7 |

| RAY | $498,257 | $637,950 | $771,125 | $958,350 | $427,000 | $323.7 |

| REYNOLDS | $498,257 | $637,950 | $771,125 | $958,350 | $152,000 | $323.7 |

| RIPLEY | $498,257 | $637,950 | $771,125 | $958,350 | $147,000 | $323.7 |

| ST. CHARLES | $498,257 | $637,950 | $771,125 | $958,350 | $350,000 | $323.7 |

| ST. CLAIR | $498,257 | $637,950 | $771,125 | $958,350 | $113,000 | $323.7 |

| STE. GENEVIEVE | $498,257 | $637,950 | $771,125 | $958,350 | $182,000 | $323.7 |

| ST. FRANCOIS | $498,257 | $637,950 | $771,125 | $958,350 | $179,000 | $323.7 |

| ST. LOUIS | $498,257 | $637,950 | $771,125 | $958,350 | $350,000 | $323.7 |

| SALINE | $498,257 | $637,950 | $771,125 | $958,350 | $143,000 | $323.7 |

| SCHUYLER | $498,257 | $637,950 | $771,125 | $958,350 | $162,000 | $323.7 |

| SCOTLAND | $498,257 | $637,950 | $771,125 | $958,350 | $164,000 | $323.7 |

| SCOTT | $498,257 | $637,950 | $771,125 | $958,350 | $146,000 | $323.7 |

| SHANNON | $498,257 | $637,950 | $771,125 | $958,350 | $149,000 | $323.7 |

| SHELBY | $498,257 | $637,950 | $771,125 | $958,350 | $81,000 | $323.7 |

| STODDARD | $498,257 | $637,950 | $771,125 | $958,350 | $145,000 | $323.7 |

| STONE | $498,257 | $637,950 | $771,125 | $958,350 | $265,000 | $323.7 |

| SULLIVAN | $498,257 | $637,950 | $771,125 | $958,350 | $100,000 | $323.7 |

| TANEY | $498,257 | $637,950 | $771,125 | $958,350 | $219,000 | $323.7 |

| TEXAS | $498,257 | $637,950 | $771,125 | $958,350 | $164,000 | $323.7 |

| VERNON | $498,257 | $637,950 | $771,125 | $958,350 | $163,000 | $323.7 |

| WARREN | $498,257 | $637,950 | $771,125 | $958,350 | $350,000 | $323.7 |

| WASHINGTON | $498,257 | $637,950 | $771,125 | $958,350 | $151,000 | $323.7 |

| WAYNE | $498,257 | $637,950 | $771,125 | $958,350 | $101,000 | $323.7 |

| WEBSTER | $498,257 | $637,950 | $771,125 | $958,350 | $285,000 | $323.7 |

| WORTH | $498,257 | $637,950 | $771,125 | $958,350 | $100,000 | $323.7 |

| WRIGHT | $498,257 | $637,950 | $771,125 | $958,350 | $164,000 | $323.7 |

| ST. LOUIS CITY | $498,257 | $637,950 | $771,125 | $958,350 | $350,000 | $323.7 |

| MONROE | $498,257 | $637,950 | $771,125 | $958,350 | $134,000 | $323.7 |

| MONTGOMERY | $498,257 | $637,950 | $771,125 | $958,350 | $119,000 | $323.7 |

| BEAVERHEAD | $498,257 | $637,950 | $771,125 | $958,350 | $281,000 | $323.7 |

| BIG HORN | $498,257 | $637,950 | $771,125 | $958,350 | $238,000 | $323.7 |

| BLAINE | $498,257 | $637,950 | $771,125 | $958,350 | $297,000 | $323.7 |

| BROADWATER | $499,100 | $638,950 | $772,300 | $959,800 | $408,000 | $324.35 |

| CARBON | $754,400 | $965,750 | $1,167,400 | $1,450,800 | $656,000 | $490.1 |

| CARTER | $498,257 | $637,950 | $771,125 | $958,350 | $187,000 | $323.7 |

| CASCADE | $498,257 | $637,950 | $771,125 | $958,350 | $285,000 | $323.7 |

| CHOUTEAU | $498,257 | $637,950 | $771,125 | $958,350 | $252,000 | $323.7 |

| CUSTER | $498,257 | $637,950 | $771,125 | $958,350 | $298,000 | $323.7 |

| DANIELS | $498,257 | $637,950 | $771,125 | $958,350 | $257,000 | $323.7 |

| DAWSON | $498,257 | $637,950 | $771,125 | $958,350 | $173,000 | $323.7 |

| DEER LODGE | $498,257 | $637,950 | $771,125 | $958,350 | $245,000 | $323.7 |

| FALLON | $498,257 | $637,950 | $771,125 | $958,350 | $145,000 | $323.7 |

| FERGUS | $498,257 | $637,950 | $771,125 | $958,350 | $228,000 | $323.7 |

| FLATHEAD | $558,900 | $715,500 | $864,850 | $1,074,800 | $486,000 | $362.7 |

| GALLATIN | $718,750 | $920,150 | $1,112,250 | $1,382,250 | $625,000 | $466.7 |

| GARFIELD | $498,257 | $637,950 | $771,125 | $958,350 | $248,000 | $323.7 |

| GLACIER | $498,257 | $637,950 | $771,125 | $958,350 | $147,000 | $323.7 |

| GOLDEN VALLEY | $498,257 | $637,950 | $771,125 | $958,350 | $175,000 | $323.7 |

| GRANITE | $498,257 | $637,950 | $771,125 | $958,350 | $330,000 | $323.7 |

| HILL | $498,257 | $637,950 | $771,125 | $958,350 | $269,000 | $323.7 |

| JEFFERSON | $498,257 | $637,950 | $771,125 | $958,350 | $396,000 | $323.7 |

| JUDITH BASIN | $498,257 | $637,950 | $771,125 | $958,350 | $207,000 | $323.7 |

| LAKE | $498,257 | $637,950 | $771,125 | $958,350 | $375,000 | $323.7 |

| LEWIS AND CLARK | $498,257 | $637,950 | $771,125 | $958,350 | $396,000 | $323.7 |

| LIBERTY | $498,257 | $637,950 | $771,125 | $958,350 | $226,000 | $323.7 |

| LINCOLN | $498,257 | $637,950 | $771,125 | $958,350 | $307,000 | $323.7 |

| MCCONE | $498,257 | $637,950 | $771,125 | $958,350 | $178,000 | $323.7 |

| MADISON | $498,257 | $637,950 | $771,125 | $958,350 | $353,000 | $323.7 |

| MEAGHER | $498,257 | $637,950 | $771,125 | $958,350 | $177,000 | $323.7 |

| MINERAL | $498,257 | $637,950 | $771,125 | $958,350 | $322,000 | $323.7 |

| MISSOULA | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 | $354.9 |

| MUSSELSHELL | $498,257 | $637,950 | $771,125 | $958,350 | $315,000 | $323.7 |

| PARK | $563,500 | $721,400 | $872,000 | $1,083,650 | $490,000 | $365.95 |

| PETROLEUM | $498,257 | $637,950 | $771,125 | $958,350 | $184,000 | $323.7 |

| PHILLIPS | $498,257 | $637,950 | $771,125 | $958,350 | $272,000 | $323.7 |

| PONDERA | $498,257 | $637,950 | $771,125 | $958,350 | $213,000 | $323.7 |

| POWDER RIVER | $498,257 | $637,950 | $771,125 | $958,350 | $166,000 | $323.7 |

| POWELL | $498,257 | $637,950 | $771,125 | $958,350 | $231,000 | $323.7 |

| PRAIRIE | $498,257 | $637,950 | $771,125 | $958,350 | $179,000 | $323.7 |

| RAVALLI | $504,850 | $646,300 | $781,200 | $970,850 | $434,000 | $327.6 |

| RICHLAND | $498,257 | $637,950 | $771,125 | $958,350 | $379,000 | $323.7 |

| ROOSEVELT | $498,257 | $637,950 | $771,125 | $958,350 | $244,000 | $323.7 |

| ROSEBUD | $498,257 | $637,950 | $771,125 | $958,350 | $156,000 | $323.7 |

| SANDERS | $498,257 | $637,950 | $771,125 | $958,350 | $308,000 | $323.7 |

| SHERIDAN | $498,257 | $637,950 | $771,125 | $958,350 | $184,000 | $323.7 |

| SILVER BOW | $498,257 | $637,950 | $771,125 | $958,350 | $266,000 | $323.7 |

| STILLWATER | $754,400 | $965,750 | $1,167,400 | $1,450,800 | $656,000 | $490.1 |

| SWEET GRASS | $498,257 | $637,950 | $771,125 | $958,350 | $349,000 | $323.7 |

| TETON | $498,257 | $637,950 | $771,125 | $958,350 | $306,000 | $323.7 |

| TOOLE | $498,257 | $637,950 | $771,125 | $958,350 | $172,000 | $323.7 |

| TREASURE | $498,257 | $637,950 | $771,125 | $958,350 | $264,000 | $323.7 |

| VALLEY | $498,257 | $637,950 | $771,125 | $958,350 | $257,000 | $323.7 |

| WHEATLAND | $498,257 | $637,950 | $771,125 | $958,350 | $192,000 | $323.7 |

| WIBAUX | $498,257 | $637,950 | $771,125 | $958,350 | $165,000 | $323.7 |

| YELLOWSTONE | $754,400 | $965,750 | $1,167,400 | $1,450,800 | $656,000 | $490.1 |

| MONTGOMERY | $498,257 | $637,950 | $771,125 | $958,350 | $86,000 | $323.7 |

| MOORE | $498,257 | $637,950 | $771,125 | $958,350 | $384,000 | $323.7 |

| RICHMOND | $498,257 | $637,950 | $771,125 | $958,350 | $114,000 | $323.7 |

| EMMONS | $498,257 | $637,950 | $771,125 | $958,350 | $76,000 | $323.7 |

| LAMOURE | $498,257 | $637,950 | $771,125 | $958,350 | $58,000 | $323.7 |

| MORTON | $498,257 | $637,950 | $771,125 | $958,350 | $313,000 | $323.7 |

| MOUNTRAIL | $498,257 | $637,950 | $771,125 | $958,350 | $154,000 | $323.7 |

| FILLMORE | $498,257 | $637,950 | $771,125 | $958,350 | $97,000 | $323.7 |

| MORRILL | $498,257 | $637,950 | $771,125 | $958,350 | $105,000 | $323.7 |

| MONMOUTH | $1,149,825 | $1,472,250 | $1,779,525 | $2,211,600 | $34,000 | $0.65 |

| MORRIS | $1,149,825 | $1,472,250 | $1,779,525 | $2,211,600 | $34,000 | $0.65 |

| LOS ALAMOS | $625,600 | $800,900 | $968,100 | $1,203,100 | $544,000 | $406.25 |

| MORA | $498,257 | $637,950 | $771,125 | $958,350 | $193,000 | $323.7 |

| MONROE | $498,257 | $637,950 | $771,125 | $958,350 | $230,000 | $323.7 |

| MONTGOMERY | $498,257 | $637,950 | $771,125 | $958,350 | $130,000 | $323.7 |

| RICHMOND | $1,149,825 | $1,472,250 | $1,779,525 | $2,211,600 | $34,000 | $0.65 |

| BELMONT | $498,257 | $637,950 | $771,125 | $958,350 | $187,000 | $323.7 |

| CLERMONT | $498,257 | $637,950 | $771,125 | $958,350 | $335,000 | $323.7 |

| MONROE | $498,257 | $637,950 | $771,125 | $958,350 | $103,000 | $323.7 |

| MONTGOMERY | $498,257 | $637,950 | $771,125 | $958,350 | $235,000 | $323.7 |

| MORGAN | $498,257 | $637,950 | $771,125 | $958,350 | $105,000 | $323.7 |

| MORROW | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 | $354.9 |

| HARMON | $498,257 | $637,950 | $771,125 | $958,350 | $60,000 | $323.7 |

| MORROW | $498,257 | $637,950 | $771,125 | $958,350 | $275,000 | $323.7 |

| TILLAMOOK | $498,257 | $637,950 | $771,125 | $958,350 | $360,000 | $323.7 |

| MONROE | $498,257 | $637,950 | $771,125 | $958,350 | $260,000 | $323.7 |

| MONTGOMERY | $557,750 | $714,000 | $863,100 | $1,072,600 | $485,000 | $362.05 |

| MONTOUR | $498,257 | $637,950 | $771,125 | $958,350 | $214,000 | $323.7 |

| WESTMORELAND | $498,257 | $637,950 | $771,125 | $958,350 | $279,000 | $323.7 |

| BAYAMON | $498,257 | $637,950 | $771,125 | $958,350 | $259,000 | $323.7 |

| COAMO | $498,257 | $637,950 | $771,125 | $958,350 | $128,000 | $323.7 |

| MOCA | $498,257 | $637,950 | $771,125 | $958,350 | $290,000 | $323.7 |

| MOROVIS | $498,257 | $637,950 | $771,125 | $958,350 | $259,000 | $323.7 |

| MOODY | $498,257 | $637,950 | $771,125 | $958,350 | $235,000 | $323.7 |

| MONROE | $498,257 | $637,950 | $771,125 | $958,350 | $150,000 | $323.7 |

| MONTGOMERY | $498,257 | $637,950 | $771,125 | $958,350 | $290,000 | $323.7 |

| MOORE | $498,257 | $637,950 | $771,125 | $958,350 | $232,000 | $323.7 |

| MORGAN | $498,257 | $637,950 | $771,125 | $958,350 | $320,000 | $323.7 |

| MONTAGUE | $498,257 | $637,950 | $771,125 | $958,350 | $182,000 | $323.7 |

| MONTGOMERY | $498,257 | $637,950 | $771,125 | $958,350 | $382,000 | $323.7 |

| MOORE | $498,257 | $637,950 | $771,125 | $958,350 | $159,000 | $323.7 |

| MORRIS | $498,257 | $637,950 | $771,125 | $958,350 | $137,000 | $323.7 |

| MOTLEY | $498,257 | $637,950 | $771,125 | $958,350 | $113,000 | $323.7 |

| THROCKMORTON | $498,257 | $637,950 | $771,125 | $958,350 | $55,000 | $323.7 |

| MORGAN | $744,050 | $952,500 | $1,151,400 | $1,430,900 | $632,000 | $483.6 |

| MONTGOMERY | $498,257 | $637,950 | $771,125 | $958,350 | $310,000 | $323.7 |

| RICHMOND | $498,257 | $637,950 | $771,125 | $958,350 | $97,000 | $323.7 |

| WESTMORELAND | $498,257 | $637,950 | $771,125 | $958,350 | $248,000 | $323.7 |

| PORTSMOUTH CITY | $690,000 | $883,300 | $1,067,750 | $1,326,950 | $600,000 | $448.5 |

| RICHMOND CITY | $631,350 | $808,250 | $977,000 | $1,214,150 | $549,000 | $410.15 |

| ADDISON | $498,257 | $637,950 | $771,125 | $958,350 | $295,000 | $323.7 |

| BENNINGTON | $498,257 | $637,950 | $771,125 | $958,350 | $275,000 | $323.7 |

| CALEDONIA | $498,257 | $637,950 | $771,125 | $958,350 | $175,000 | $323.7 |

| CHITTENDEN | $517,500 | $662,500 | $800,800 | $995,200 | $450,000 | $336.05 |

| ESSEX | $498,257 | $637,950 | $771,125 | $958,350 | $111,000 | $323.7 |

| FRANKLIN | $517,500 | $662,500 | $800,800 | $995,200 | $450,000 | $336.05 |

| GRAND ISLE | $517,500 | $662,500 | $800,800 | $995,200 | $450,000 | $336.05 |

| LAMOILLE | $498,257 | $637,950 | $771,125 | $958,350 | $280,000 | $323.7 |

| ORANGE | $498,257 | $637,950 | $771,125 | $958,350 | $302,000 | $323.7 |

| ORLEANS | $498,257 | $637,950 | $771,125 | $958,350 | $190,000 | $323.7 |

| RUTLAND | $498,257 | $637,950 | $771,125 | $958,350 | $200,000 | $323.7 |

| WASHINGTON | $498,257 | $637,950 | $771,125 | $958,350 | $268,000 | $323.7 |

| WINDHAM | $498,257 | $637,950 | $771,125 | $958,350 | $274,000 | $323.7 |

| WINDSOR | $498,257 | $637,950 | $771,125 | $958,350 | $302,000 | $323.7 |

| MONROE | $498,257 | $637,950 | $771,125 | $958,350 | $175,000 | $323.7 |

| MONONGALIA | $498,257 | $637,950 | $771,125 | $958,350 | $255,000 | $323.7 |

| MONROE | $498,257 | $637,950 | $771,125 | $958,350 | $99,000 | $323.7 |

| MORGAN | $498,257 | $637,950 | $771,125 | $958,350 | $269,000 | $323.7 |

| FREMONT | $498,257 | $637,950 | $771,125 | $958,350 | $280,000 | $323.7 |

How FHA Loan Limits in Missouri Can Affect Where You Buy?

For many homebuyers, the choice of where to buy a home is dictated by FHA loan limits in Missouri. But should it be? If you’re buying a home with a loan that’s backed by the federal government, there are limits in place on how much you can borrow. These limits, which are set by Congress and updated periodically, are known as conforming loan limits.

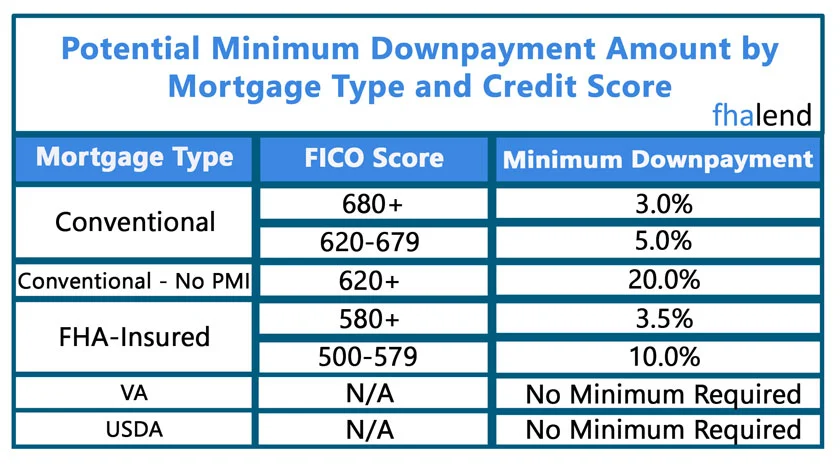

- In general, the loan FHA limits in Missouri for a conventional mortgage are $472,030. But for 4 douplex house, the limit can be as high as $907,900. That higher limit is sometimes called a jumbo loan.

- So, if you’re looking to buy a home in a high-cost area, you may need to get a jumbo loan. But what are the implications of doing so?

- For one thing, jumbo loans typically come with higher interest rates than conventional loans. That’s because they’re considered to be riskier by lenders.

- Another consideration is that not all lenders offer jumbo loans. So you may need to shop around to find one that does.

- And finally, if you’re getting a jumbo loan, you’ll need to make a larger down payment than you would with a conventional loan. That’s because lenders view jumbo loans as being riskier and they want to protect themselves in case of default.

So, should FHA loan limits in Missouri influence where you buy a home? It’s something to think about before you start your search.

How have FHA Loan Limits in Missouri Changed Through the Years?

How have FHA Loan Limits in Missouri Changed Through the Years?

FHA loan limits in Missouri have changed quite a bit over the years. In the early days of the program, FHA loans were only available for homes that were valued at $50,000 or less. Today, the FHA loan limit is $625,000 in most parts of the country and can be as high as $721,050 in high-cost areas.

The FHA loan limit in Missouri is the maximum amount that a borrower can qualify for. It is important to note that the FHA does not lend money to borrowers – they only insure loans made by private lenders. This insurance protects the lender from losses if the borrower defaults on the loan.

The FHA loan limit is set each year by the Federal Housing Finance Agency (FHFA). The FHFA looks at home prices in different parts of the country and sets the loan limit in Missouri based on the median price of a home in those areas.

If you are thinking about taking out an FHA loan, it is important to know how the loan limit in Missouri may affect your loan amount. Here is a look at how the FHA loan limits in Missouri have changed over the years and what you can expect in 2024.

- 1934: The Federal Housing Administration (FHA) is created as part of the New Deal. One of its key functions is to insure mortgages, making it easier for lenders to offer loans to borrowers.

- This loan will be forgiven after 10 years if you do not move, sell, refinance, or pay off your first mortgage during that time.

- To be eligible, your income must meet certain criteria, which differ by location.

| Year | Single-Family Baseline Conforming Loan Limits* | |||

|---|---|---|---|---|

| One-Unit | Two-Units | Three-Units | Four-Units | |

| 2023 | $726,200 | $929,850 | $1,123,900 | $1,396,800 |

| 2022 | $647,200 | $828,700 | $1,001,650 | $1,244,850 |

| 2021 | $548,250 | $702,000 | $848,500 | $1,054,500 |

| 2020 | $510,400 | $653,550 | $789,950 | $981,700 |

| 2019 | $484,350 | $620,200 | $749,650 | $931,600 |

| 2018 | $453,100 | $580,150 | $701,250 | $871,450 |

| 2017 | $424,100 | $543,000 | $656,350 | $815,650 |

| 2016 | $417,000 | $533,850 | $645,300 | $801,950 |

| 2015 | $417,000 | $533,850 | $645,300 | $801,950 |

| 2014 | $417,000 | $533,850 | $645,300 | $801,950 |

| 2013 | $417,000 | $533,850 | $645,300 | $801,950 |

| 2012 | $417,000 | $533,850 | $645,300 | $801,950 |

| 2011 | $417,000 | $533,850 | $645,300 | $801,950 |

| 2010 | $417,000 | $533,850 | $645,300 | $801,950 |

| 2009 | $417,000 | $533,850 | $645,300 | $801,950 |

| 2008 | $417,000 | $533,850 | $645,300 | $801,950 |

| 2007 | $417,000 | $533,850 | $645,300 | $801,950 |

| 2006 | $417,000 | $533,850 | $645,300 | $801,950 |

| 2005 | $359,650 | $460,400 | $556,500 | $691,600 |

| 2004 | $333,700 | $427,150 | $516,300 | $641,650 |

| 2003 | $322,700 | $413,100 | $499,300 | $620,500 |

| 2002 | $300,700 | $384,900 | $465,200 | $578,150 |

| 2001 | $275,000 | $351,950 | $425,400 | $528,700 |

| 2000 | $252,700 | $323,400 | $390,900 | $485,800 |

| 1999 | $240,000 | $307,100 | $371,200 | $461,350 |

| 1998 | $227,150 | $290,650 | $351,300 | $436,600 |

| 1997 | $214,600 | $274,550 | $331,850 | $412,450 |

| 1996 | $207,000 | $264,750 | $320,050 | $397,800 |

| 1995 | $203,150 | $259,850 | $314,100 | $390,400 |

| 1994 | $203,150 | $259,850 | $314,100 | $390,400 |

| 1993 | $203,150 | $259,850 | $314,100 | $390,400 |

| 1992 | $202,300 | $258,800 | $312,800 | $388,800 |

| 1991 | $191,250 | $244,650 | $295,650 | $367,500 |

| 1990 | $187,450 | $239,750 | $289,750 | $360,150 |

| 1989 | $187,600 | $239,950 | $290,000 | $360,450 |

| 1988 | $168,700 | $215,800 | $260,800 | $324,150 |

| 1987 | $153,100 | $195,850 | $236,650 | $294,150 |

| 1986 | $133,250 | $170,450 | $205,950 | $256,000 |

| 1985 | $115,300 | $147,500 | $178,200 | $221,500 |

| 1984 | $114,000 | $145,800 | $176,100 | $218,900 |

| 1983 | $108,300 | $138,500 | $167,200 | $207,900 |

| 1982 | $107,000 | $136,800 | $165,100 | $205,300 |

| 1981 | $98,500 | $126,000 | $152,000 | $189,000 |

| 1980 | $93,750 | $120,000 | $145,000 | $170,000 |

As you can see, the FHA loan limit has been on a steady increase over the years. If you are thinking about taking out an FHA loan in 2020, you will be able to borrow up to $765,600 in most parts of the country. In high-cost areas, the loan limit is even higher at $721,050.

If you are considering an FHA loan, it is important to compare your options and make sure that you are getting the best deal possible. Shop around with different lenders and compare interest rates, fees, and terms. Be sure to ask about the loan limit in your area and how it may affect your loan amount.

A final word of advice – when you are ready to apply for a loan, make sure that you shop around for the best deal possible. Don’t just go with the first lender that you find. Compare interest rates, fees, and terms to make sure that you are getting the best deal possible. Click here and we will connect you with the right lender in Missouri state.

How To Find a Home in Today’s Market and Qualify For an FHA Loan

When it comes to buying a home, there are a lot of things to consider – especially if you’re looking in today’s market in Missouri. From saving up for a down payment to getting approved for a mortgage, the process can be daunting. But with careful planning and research, it’s definitely possible to find your dream home – even in an expensive market.

Here are a few tips to help you navigate the process of buying a home are:

1. Start saving early and be realistic about your budget.

If you’re looking to buy a home in a high-cost area, it’s important to start saving as early as possible. You’ll likely need a larger down payment than if you were buying in a less expensive market, so it’s important to plan ahead. It’s also important to be realistic about your budget. In a high-cost area, you may have to sacrifice some of your must-haves in order to stay within your price range.

2. Get pre-approved for a mortgage.

One of the most important steps in the home-buying process is getting pre-approved for a mortgage. This will give you an idea of how much you can afford to spend on a home, and it will also show sellers that you’re serious about buying. When you’re looking at homes in a high-cost area, it’s especially important to get pre-approved so that you don’t waste your time looking at properties that are out of your price range.

3. Work with a real estate agent who knows the market.

When you’re buying a home in a high-cost area, it’s important to work with a real estate agent who knows the market. They can help you find homes that fit your budget and your needs, and they can also offer advice on the best way to negotiate in a competitive market.

4. Be prepared to compromise.

In a high-cost housing market, it’s important to be prepared to compromise. You may not be able to find your dream home right away, or you may have to make some sacrifices in terms of location or amenities. But if you’re willing to be flexible, you’ll eventually find a home that’s perfect for you – even in a high-cost area.

If you’re thinking about buying a home in a high-cost area in Missouri, following these tips can help you navigate the process successfully. With careful planning and a little bit of flexibility, you can find your dream home – no matter what the market looks like.

Missouri Down Payment Assistance Program

The Missouri Housing Development Commission (MHDC) offers down payment assistance to both first-time and repeat purchasers. This is done through the provision of a second mortgage loan with a maximum limit of 4% of the home’s purchase price.

The website of the Missouri Housing Development Commission can be very useful. Also, check out HUD’s list of additional Missouri homeownership assistance programs, including one run by the Delta Area Economic Opportunity Corporation.