FHA Loan Limits in Hawaii

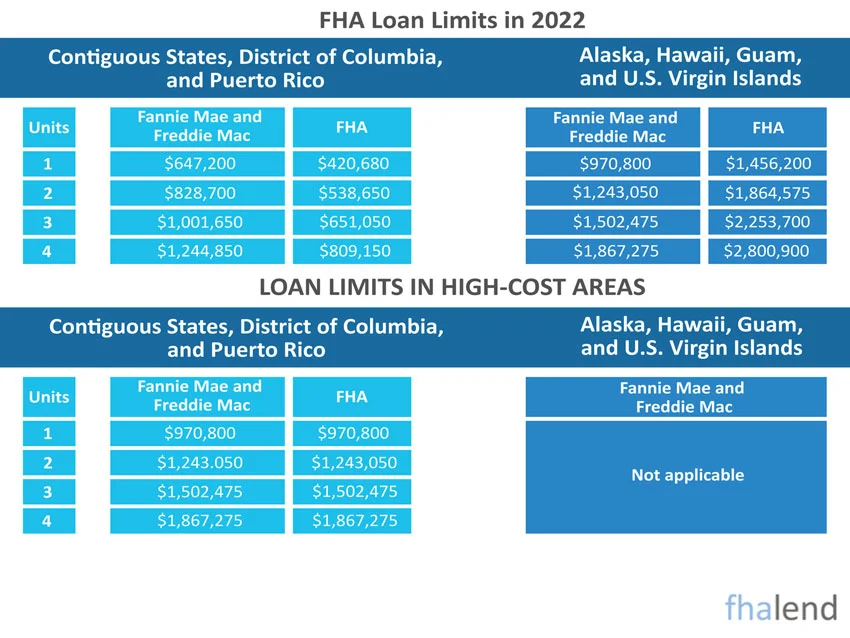

FHA loan limits in Hawaii are set by the Federal Housing Administration (FHA) and determine the maximum loan amount that FHA-insured lenders can provide to homebuyers in Hawaii. The loan limit for a single-family home in Hawaii is $970,800 as of 2022. This limit may be increased in the future if home prices continue to rise in Hawaii.

FHA loan limits in Hawaii are set by the Federal Housing Administration (FHA) and determine the maximum loan amount that FHA-insured lenders can provide to homebuyers in Hawaii. The loan limit for a single-family home in Hawaii is $970,800 as of 2022. This limit may be increased in the future if home prices continue to rise in Hawaii.

If you’re considering buying a home in Hawaii with an FHA loan, it’s important to be aware of the FHA loan limit in Hawaii your county. You can use the FHA Loan Limit Lookup Tool on the HUD website to find the loan limit for your county.

If you’re not sure how much you can afford to spend on a home, you can use the FHA Mortgage Calculator to estimate your monthly payments. This calculator takes into account your income, debts, and other factors to help you determine how much you can afford to spend on a home.

If you have any questions about FHA loan limits in Hawaii, or if you’re ready to start shopping for a home in Hawaii, contact a local REALTOR®. They can help you find homes that fit within your budget and provide guidance throughout the homebuying process.

FHA Loan Limits in Hawaii by County in 2022

| County Name | Single-Family | 2 Units | 3 Units | 4 Units | Median Home Price |

|---|---|---|---|---|---|

| HAWAII | $477,250 | $610,950 | $738,500 | $917,800 | $917,800 |

| HONOLULU | $747,500 | $956,950 | $1,156,700 | $1,437,500 | $917,800 |

| KALAWAO | $828,000 | $1,060,000 | $1,281,300 | $1,592,350 | $917,800 |

| KAUAI | $845,250 | $1,082,100 | $1,308,000 | $1,625,500 | $917,800 |

| MAUI | $828,000 | $1,060,000 | $1,281,300 | $1,592,350 | $917,800 |

Hawaii FHA Down Payment Requirements

The main thing is for you to know the FHA loan limits in Hawaii for the specific island. For borrowers who use an FHA loan to purchase a home in Hawaii, the minimum required down payment is 3.5% of the purchase price. This is slightly higher than the national average of 3.0%. However, it is still lower than the standard 20% down payment that is typically required by conventional lenders.

In addition to the down payment requirement, borrowers must also have a minimum credit score of 580 in order to qualify for an FHA loan. Borrowers with a credit score below 580 will still be able to obtain an FHA loan, but they will be required to put down a larger down payment of 10%.

What to Look for in an FHA Lender in Hawaii?

When you’re looking for an FHA lender, there are a few things you’ll want to keep in mind. First, make sure the lender is approved by the Federal Housing Administration. This will ensure that they can offer you loans backed by the FHA. Second, you’ll want to check out the interest rates they’re offering. The lower the better, of course. But also be sure to compare the APR (annual percentage rate) so you know what the true cost of borrowing will be. Finally, make sure you’re comfortable with the loan terms being offered. The last thing you want is to end up stuck in a loan that doesn’t fit your needs. With these things in mind, you should be well on your way to finding the perfect FHA lender with no overlays for you.

FHA Loan Pre-Approval Process in Hawaii

Getting pre-approved for an FHA loan in Hawaii is a critical first step in buying a home. If you would like to apply for an FHA loan you need to know your FHA loan limits in Hawaii in the above table. The process is designed to give buyers an estimate of how much they can realistically afford to spend on a home, as well as help sellers know that the buyer is serious and has the financial ability to purchase their home.

There are a few things that potential homebuyers need to do before they can get pre-approved for an FHA loan. First, they need to make sure that they are eligible for the program. To be eligible, buyers must have a steady income, good credit, and enough money saved for a down payment and closing costs.

Once buyers have determined that they are eligible, they need to find a participating lender. Not all lenders offer FHA loans, so it is important to shop around to find one that does. Once a lender has been found, the buyer will need to fill out a loan application and provide any supporting documentation.

After the application has been submitted, the lender will review the information and make a decision on whether or not to pre-approve the buyer for an FHA loan. If the buyer is approved, they will receive a pre-approval letter that can be used when making an offer on a home.

The pre-approval process for an FHA loan in Hawaii is designed to help both buyers and sellers in the home buying process. By getting pre-approved, buyers can know how much they can realistically afford to spend on a home, which gives them an advantage when making an offer. Sellers also benefit from knowing that the buyer is serious about purchasing their home and has the financial ability to do so.

FHA Streamline Refinance and FHA Loan Limits in Hawaii

If you’re a Hawai’i homeowner with an FHA loan, you may be able to take advantage of the FHA Streamline Refinance program. The program is designed to help homeowners lower their monthly payments and/or interest rates, and can make it easier to refinance into a more affordable loan.

To be eligible for the program, you must have made all of your mortgage payments on time for the past 12 months, and you must not have increased your principal balance during that time. You’ll also need to demonstrate that you still have good employment history and income level.

If you’re interested in learning more about the FHA Streamline Refinance program in Hawai’i, read on for more information.

What is the FHA Streamline Refinance Program?

The FHA Streamline Refinance program is a special mortgage program that allows homeowners with FHA-insured loans to refinance their mortgages into new, more affordable loans.

To be eligible for the program, you must have made all of your mortgage payments on time for the past 12 months, and you must not have increased your principal balance during that time. You’ll also need to demonstrate that you still have good employment history and income level.

If you meet these requirements, you may be able to take advantage of the FHA Streamline Refinance program’s benefits, which include:

• Lower monthly payments: If interest rates have dropped since you originally took out your mortgage, you may be able to lower your monthly payments by refinancing into a new loan with a lower interest rate.

• Lower interest rates: In addition to lower monthly payments, you may also be able to lower your interest rate by refinancing into a new loan. This could save you money over the life of your loan.

• No appraisal required: In most cases, you won’t need to get an appraisal in order to refinance your home under the FHA Streamline Refinance program. This can save you both time and money.

If you’re interested in learning more about the FHA Streamline Refinance program in Hawai’i, contact a participating lender today. They’ll be able to help you determine if you’re eligible for the program and walk you through the next steps.

Apply For a 203k Loan In Hawaii

If you’re a first-time homebuyer in Hawaii, you may be wondering what your financing options are. The Federal Housing Administration (FHA) offers a loan program that can help you purchase a home with a down payment as low as 3.5%bu there are FHA loan limits in Hawaii you learned already and they apply here as well

With an FHA 203k loan, you can finance not only the purchase price of the home but also the cost of eligible repairs and improvements. This can be a great option for first-time homebuyers who want to make sure they have enough money to make necessary repairs and upgrades to their new home.

Here’s what you need to know about FHA 203k loans in Hawaii:

• Eligibility: In order to be eligible for an FHA 203k loan, you must meet the standard FHA lending criteria. This includes having a credit score of at least 580 and a debt-to-income ratio of no more than 43%.

• Down payment: The minimum down payment for an FHA 203k loan is 3.5%.

• Loan amount: The maximum loan amount for an FHA 203k loan in Hawaii is $765,600. This includes both the purchase price of the home and the cost of eligible repairs and improvements.

• Repayment terms: The repayment terms for an FHA 203k loan are typically 20 or 30 years.

If you’re interested in learning more about FHA 203k loans in Hawaii, contact a local FHA-approved lender today. They can help you determine if you’re eligible for this loan program and walk you through the application process.

FHA Multi-Family Loan Limits in Hawaii

All 5 counties in Hawaii are in a high-cost area, which means for all of them the FHA loan limits in Hawaii are higher than the floor price in most counties in the U.S. For a single-home family in Kauai county, you can get financing up to $845,250, for a duplex you can borrow up to $1,082,10, for a triplex a lender can lend you as much as $1,308,000, if you want to buy a multifamily 4-unit you can borrow as much as $1,625,500, Th median price in Kauai county is set at $917,800

Top Hawaii FHA lenders

If you’re looking to purchase a home in Hawaii, you’ll likely need a loan from one of the top FHA lenders. In this blog post, we’ll outline the three best FHA lenders in Hawaii and what makes them stand out.

The first on our list is the Bank of Hawaii. As the state’s largest bank, they have a long history of helping Hawaiian families achieve their homeownership dreams. They offer several different FHA loans, including a 30-year fixed-rate loan with no origination fee. They also have a team of experienced loan officers who can help you navigate the process.

The first on our list is the Bank of Hawaii. As the state’s largest bank, they have a long history of helping Hawaiian families achieve their homeownership dreams. They offer several different FHA loans, including a 30-year fixed-rate loan with no origination fee. They also have a team of experienced loan officers who can help you navigate the process.

Next on our list is American Savings Bank. They are the second-largest bank in Hawaii and have been serving families for over 100 years. They offer a 30-year fixed rate FHA loan with no origination fee and a competitive interest rate. They also have a team of experts who can help you with the home buying process.

Last on our list is Central Pacific Bank. They are the third-largest bank in Hawaii and have been serving families for over 75 years. They offer several different FHA loans, including a 30-year fixed-rate loan with no origination fee. They also have a team of experienced loan officers who can help you navigate the process.

No matter which lender you choose, make sure you compare rates and fees to get the best deal possible. And remember, the most important thing is to find a loan that fits your unique needs. We are part of Nexa mortgage which is licensed in 48 states and also in Hawaii, broker have better rates than banks, please contact us to compare rates!

FHA Loan Benefits in Hawaii

When considering an FHA loan in Hawaii, it’s important to weigh the pros and cons of this type of loan. Some of the benefits of an FHA loan include:

A lower down payment requirement

With an FHA loan, you only need to put 3.5% down on a home, as opposed to the 20% that is typically required with a conventional loan.

More lenient credit score requirements

For an FHA loan, you can qualify with a credit score as low as 580. However, for a conventional loan, you’ll need a credit score of 620 or higher.

A lower interest rate

FHA loans often come with a lower interest rate than conventional loans. This can save you money over the life of your loan. There are some potential drawbacks to taking out an FHA loan, as well. These include:

Mortgage insurance premiums

All FHA loans require borrowers to pay mortgage insurance premiums. These can add up over time and increase the overall cost of your loan.

Limited home choices

Because of the lower down payment requirement, you may be limited in the types of homes you can purchase with an FHA loan.

Strict inspection requirements

In order to qualify for an FHA loan, your home must pass a strict inspection. This can add to the cost and hassle of buying a home.

Overall, an FHA loan in Hawaii can be a great option for those who are looking to purchase a home. Be sure to weigh the pros and cons before making a decision.

Loan Requirements in Hawaii for 2022 in High-Cost Areas

If you’re looking to purchase a home in Hawaii using an FHA loan in 2022, there are some requirements you’ll need to meet. In this blog post, we’ll outline the FHA loan requirements for buyers in Hawaii, including credit score, down payment, FHA loan limits in Hawaii, and more.

Hawaii is a unique state when it comes to FHA loans. While most states have a standard set of guidelines that borrowers must meet in order to qualify for an FHA loan, Hawaii has its own specific requirements.

One of the biggest requirements for an FHA loan in Hawaii is that the property be located within one of the four counties that make up the state: Honolulu County, Kauai County, Maui County, or Hawaii County.

Another key requirement is that the property must be your primary residence. This means that you can’t use an FHA loan to purchase a vacation home or investment property in Hawaii.

If you’re looking to secure an FHA loan in Hawaii, you’ll need a credit score of at least 580. If your credit score is below 580, you may still be able to qualify for an FHA loan, but you’ll be required to make a larger down payment.

The minimum down payment for an FHA loan in Hawaii is 3.5% of the purchase price of the home. However, if your credit score is below 580, you’ll need to make a 10% down payment.

In addition to the down payment, you’ll also need to have funds available to cover closing costs. These costs can range from 2% to 5% of the purchase price of the home.

FHA Down Payment Assistance in Hawaii State

If you’re looking to buy a home in Hawaii, you may be wondering if there are any programs that can help you with the down payment. The answer is yes! The Federal Housing Administration (FHA) offers a program called the FHA Down Payment Assistance Program. This program provides financial assistance to borrowers who are unable to make a down payment on their homes.

The FHA Down Payment Assistance Program is available to borrowers who meet certain income and credit requirements. To qualify for this program, you must have a minimum credit score of 580 and a maximum debt-to-income ratio of 43%. You must also be a first-time home buyer or someone who has not owned a home in the past three years.

If you meet these requirements, you may be eligible for up to $5,000 in down payment assistance. This money can be used towards your down payment and closing costs.

If you’re interested in learning more about the FHA Down Payment Assistance Program, contact a loan officer today. They will be able to answer any questions you have and help you determine if you qualify for this program.

Buying a home is a big decision. There’s a lot to think about when it comes to finding the perfect home and making sure you can afford it. If you’re thinking about buying a home in Hawaii, there are a few things you should know about the state’s housing market and what programs are available to help you with the purchase.

Hawaii has a strong housing market, with prices steadily increasing over the past few years. The median home price in Hawaii is $647,000, which is higher than the national average of $216,700. However, there are still plenty of affordable homes available in Hawaii. In fact, 55% of homes in the state are priced at or below $500,000.

If you’re looking for assistance with the down payment, there are a few programs available to help. The Federal Housing Administration (FHA) offers a program called the FHA Down Payment Assistance Program. This program provides financial assistance to borrowers who are unable to make a down payment on their homes.

The FHA Down Payment Assistance Program is available to borrowers who meet certain income and credit requirements. To qualify for this program, you must have a minimum credit score of 580 and a maximum debt-to-income ratio of 43%. You must also be a first-time home buyer or someone who has not owned a home in the past three years.

If you meet these requirements, you may be eligible for up to $5,000 in down payment assistance. This money can be used towards your down payment and closing costs.

If you’re interested in learning more about the FHA Down Payment Assistance Program, contact a loan officer today. They will be able to answer any questions you have and help you determine if you qualify for this program.