FHA Loan Limits in New Mexico in 2023

The FHA loan limits in New Mexico are generally the same for all counties in a given state. However, there are some exceptions. In high-cost areas in other states, the FHA loan limits may be higher than the conventional loan limit. In addition, the FHA loan limits in New Mexico may be higher for 2-4 unit properties than for single-unit properties. The FHA loan limits in New Mexico are also adjusted annually based on changes in the average price of homes in the United States.

The FHA loan limits in New Mexico are generally the same for all counties in a given state. However, there are some exceptions. In high-cost areas in other states, the FHA loan limits may be higher than the conventional loan limit. In addition, the FHA loan limits in New Mexico may be higher for 2-4 unit properties than for single-unit properties. The FHA loan limits in New Mexico are also adjusted annually based on changes in the average price of homes in the United States.

The FHA loan limit for the state of New Mexico in 2023 is $472,030 for a single-family home. This is an increase from the previous year’s limit of $420,680, so prospective borrowers should take note if they had previously been considering an FHA loan in New Mexico.

FHA Loan Limits in New Mexico by County

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| BERNALILLO | $472,030 | $604,400 | $730,525 | $907,900 | $329,000 |

| CATRON | $472,030 | $604,400 | $730,525 | $907,900 | $188,000 |

| CHAVES | $472,030 | $604,400 | $730,525 | $907,900 | $193,000 |

| CIBOLA | $472,030 | $604,400 | $730,525 | $907,900 | $156,000 |

| COLFAX | $472,030 | $604,400 | $730,525 | $907,900 | $337,000 |

| CURRY | $472,030 | $604,400 | $730,525 | $907,900 | $211,000 |

| DE BACA | $472,030 | $604,400 | $730,525 | $907,900 | $105,000 |

| DONA ANA | $472,030 | $604,400 | $730,525 | $907,900 | $269,000 |

| EDDY | $472,030 | $604,400 | $730,525 | $907,900 | $258,000 |

| GRANT | $472,030 | $604,400 | $730,525 | $907,900 | $168,000 |

| GUADALUPE | $472,030 | $604,400 | $730,525 | $907,900 | $155,000 |

| HARDING | $472,030 | $604,400 | $730,525 | $907,900 | $87,000 |

| HIDALGO | $472,030 | $604,400 | $730,525 | $907,900 | $121,000 |

| LEA | $472,030 | $604,400 | $730,525 | $907,900 | $70,000 |

| LINCOLN | $472,030 | $604,400 | $730,525 | $907,900 | $313,000 |

| LOS ALAMOS | $583,050 | $746,400 | $902,250 | $1,121,250 | $507,000 |

| LUNA | $472,030 | $604,400 | $730,525 | $907,900 | $156,000 |

| MCKINLEY | $472,030 | $604,400 | $730,525 | $907,900 | $105,000 |

| MORA | $472,030 | $604,400 | $730,525 | $907,900 | $183,000 |

| OTERO | $472,030 | $604,400 | $730,525 | $907,900 | $205,000 |

| QUAY | $472,030 | $604,400 | $730,525 | $907,900 | $124,000 |

| RIO ARRIBA | $472,030 | $604,400 | $730,525 | $907,900 | $261,000 |

| ROOSEVELT | $472,030 | $604,400 | $730,525 | $907,900 | $179,000 |

| SANDOVAL | $472,030 | $604,400 | $730,525 | $907,900 | $329,000 |

| SAN JUAN | $472,030 | $604,400 | $730,525 | $907,900 | $234,000 |

| SAN MIGUEL | $472,030 | $604,400 | $730,525 | $907,900 | $183,000 |

| SANTA FE | $503,700 | $644,800 | $779,450 | $968,650 | $438,000 |

| SIERRA | $472,030 | $604,400 | $730,525 | $907,900 | $160,000 |

| SOCORRO | $472,030 | $604,400 | $730,525 | $907,900 | $185,000 |

| TAOS | $472,030 | $604,400 | $730,525 | $907,900 | $394,000 |

| TORRANCE | $472,030 | $604,400 | $730,525 | $907,900 | $329,000 |

| UNION | $472,030 | $604,400 | $730,525 | $907,900 | $124,000 |

| VALENCIA | $472,030 | $604,400 | $730,525 | $907,900 | $329,000 |

How do FHA Loan Limits in New Mexico Affect Qualifying For a Mortgage?

FHA loan limits in New Mexico generally affect the size of the mortgage that a potential homebuyer can take out. In some cases, FHA loan limits in New Mexico may also affect the interest rate that a potential homebuyer can get on their mortgage. The Federal Housing Administration (FHA) is a government-backed organization that provides insurance for lenders in the event of a borrower defaulting on their mortgage.

This insurance protects lenders from losses and allows them to offer mortgages with more favorable terms to borrowers. The FHA sets loan limits for each county in the United States, and these loan limits are generally higher than those set by conventional lenders. This means that borrowers who use an FHA-insured mortgage may be able to finance a larger loan amount than they would be able to with a conventional mortgage. In some cases, this may also lead to a lower interest rate on the FHA-insured mortgage.

When Congress established the FHA in 1934, they set loan limits at 80 percent of the value of the home. This loan limit was increased to 90 percent in 1942 and then lowered again to 80 percent in 1949. In 1954, the loan limit was raised to 95 percent of the value of the home and then decreased once again to 80 percent in 1962. In 1968, the FHA loan limits in New Mexico were raised to 85 percent of the value of the home and then lowered to 80 percent in 1969. The FHA loan limit has remained at 80 percent since that time.

If you are considering taking out an FHA-insured mortgage, it is important to check the loan limits for your county. You can find this information on the website of the Department of Housing and Urban Development (HUD). You should also check with your lender to see if they have any additional requirements or restrictions when it comes to FHA-insured mortgages.

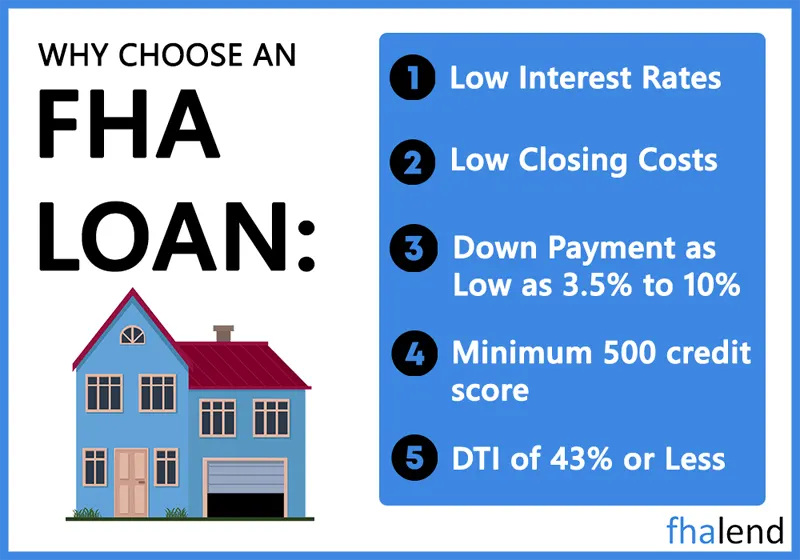

Benefits of an FHA Loan in New Mexico

There are several benefits associated with taking out an FHA loan, such as lower down payment requirements than conventional loans and more flexible credit guidelines. Additionally, the interest rate on an FHA loan is generally lower than that of a conventional loan, making it easier to get approved and pay off the debt faster.

Drawbacks of an FHA Loan in New Mexico

Despite the many advantages associated with this kind of loan, there are also some drawbacks that should be carefully considered before applying for one. For example, FHA loans require mortgage insurance premiums which can add to the overall cost and make them more expensive than conventional loans. Additionally, FHA loans are limited to certain maximum loan amounts which may be too low for some borrowers.

How Expensive is it to Buy a House in New Mexico?

How Expensive is it to Buy a House in New Mexico?

When it comes to finding the best places to live in New Mexico, there are a few key factors to consider. The first is the cost of living. New Mexico is known for being an affordable state, and that definitely extends to its housing market. In fact, the median home price in New Mexico is just over $200,000, which is much lower than the national average. Additionally, the state has no personal income tax, which makes it even more attractive to retirees and families looking to move here.

Another important factor to consider when determining the best place to live in New Mexico is the climate. The state has a semi-arid climate, which means that it experiences very hot summers and cool winters. However, there are also areas of the state that are significantly cooler, such as the mountains. This makes New Mexico a great place to live for people who enjoy both warm and cold weather.

Finally, another important factor to consider when determining the best places to live in New Mexico is the state’s economy. The state’s economy is doing well, with an unemployment rate of just 4.5%. Additionally, the state’s job growth rate is expected to be above the national average over the next few years. This makes New Mexico a great place to live for people who are looking for good job opportunities.

Best Cities to Live in New Mexico

Each of these cities has its own unique charm and offerings, so you are sure to find the perfect fit for you and your family.

Albuquerque

Albuquerque is the largest city in New Mexico, with a population of over 555,000 people. The city is located in the central part of the state and is home to a number of different attractions, including the world-famous Albuquerque International Balloon Fiesta. Albuquerque is also a great place to live if you are looking for job opportunities, as it is home to a number of major businesses and industries.

Las Cruces

Las Cruces is the second-largest city in New Mexico, with a population of just over 101,000 people. The city is located in southern New Mexico and is known for its beautiful desert landscape. Las Cruces is also home to New Mexico State University, which is the state’s flagship university.

Rio Rancho

Rio Rancho is a city located in the northwestern part of New Mexico and is part of the Albuquerque metropolitan area. The city has a population of over 93,000 people and is one of the fastest-growing cities in the state. Rio Rancho is a great place to live if you are looking for job opportunities, as it is home to a number of major businesses and industries.

Santa Fe

Santa Fe is the capital of New Mexico and is also the fourth-largest city in the state. The city has a population of just over 84,000 people and is located in the northern part of the state. Santa Fe is known for its rich cultural heritage and is home to a number of different attractions, including the Santa Fe Opera and the Georgia O’Keeffe Museum.

Roswell

Roswell is a city located in southeastern New Mexico and is best known as the site of the 1947 Roswell UFO incident. The city has a population of just over 48,000 people, and is home to a number of different attractions, including the International UFO Museum and Research Center.

Whether you are looking for a large city or a smaller town, New Mexico has something to offer everyone. These are just a few of our top picks for the best cities to live in New Mexico.

New Mexico Down Payment Assistance Program

The New Mexico Mortgage Finance Authority’s FIRSTDown DPA program provides assistance with closing costs and down payments to first-time buyers. It offers a 30-year second mortgage for up to $8,000 at a reasonable interest rate.

- This service must be used in conjunction with New Mexico’s FIRSTHome mortgage financing initiative.

- There are limits on household incomes and house purchases. However, if you’re buying in a particular region, these might be higher.

Another alternative, called HomeNow, offers up to $8,000 in down payment assistance. The distinction is that this loan can be forgiven after ten years and is only available to borrowers with a income below 80% of the area median income (AMI).

To see if you qualify, visit the authority’s website. Also, check out HUD’s list of additional homeowners’ aid programs in New Mexico.