FHA 203k Loan Requirements | Guidelines in 2024

Homebuyers can purchase fixer-uppers with a Rehab Loan program. Below are FHA 203k loan requirements and guidelines for 2024. Homebuyers shopping for a home and running into a home that is perfect but needs updating or major repairs are in luck. HUD, the parent of FHA, has FHA 203k Rehab Loans.

In this article (Skip to…)

The Benefits of FHA 203k Loan Requirements and Guidelines

203k Loans enable homebuyers who want to buy fixer-uppers or foreclosures in need of repairs to get an easy construction and acquisition mortgage loan all in one closing. A 3.5% down payment of the after-repair value of the home is required. Homeowners can customize fixer-uppers to their liking. They can even customize it by adding rooms by doing second story additions and expanding the home by doing room additions

Types Of Renovations That Are Common For Buyers Of Fixer-Uppers

Homeowners can gut and rehab the home and add everything new such as the following:

- kitchens

- bathrooms

- basement

- attic space

- new windows

- roof, siding

- gutters/downspouts

- appliances

- HVAC systems

- electrical

- plumbing

- flooring

- millwork

- fixtures

The FHA 203k Rehab Loans have been created to implement homebuyers who want to finance the cost of home repairs into the new home purchase mortgage loan. In this blog, we will cover and discuss using FHA 203k Rehab Loans to buy a -fixer-upper.

| FHA 203k Renovation Loan Key Points | ||

|---|---|---|

| The amount you may borrow for improvements is determined by the sort of loan you take out. | ||

| Conventional renovation loans generally cover cosmetic, structural, and luxury improvements to a property. | ||

| 203k loans covers more serious upragdes and they need to be approved by a HUD inspector at the end of Rehab | ||

| Renovation loans allow you to finance the purchase of a property while also paying for necessary repairs and improvements. | ||

| Luxury upgrades, such as installing a swimming pool or extending a home, are not eligible for these 203k loans. | ||

Financing Terms Of FHA 203k Loans

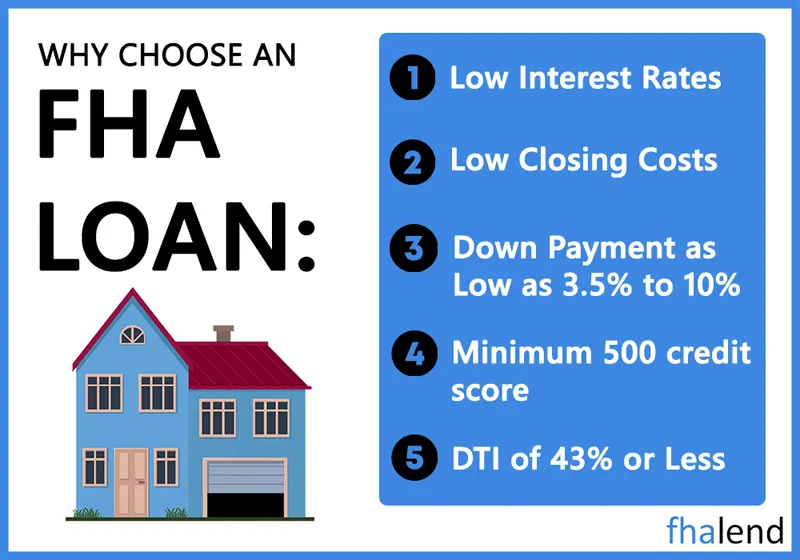

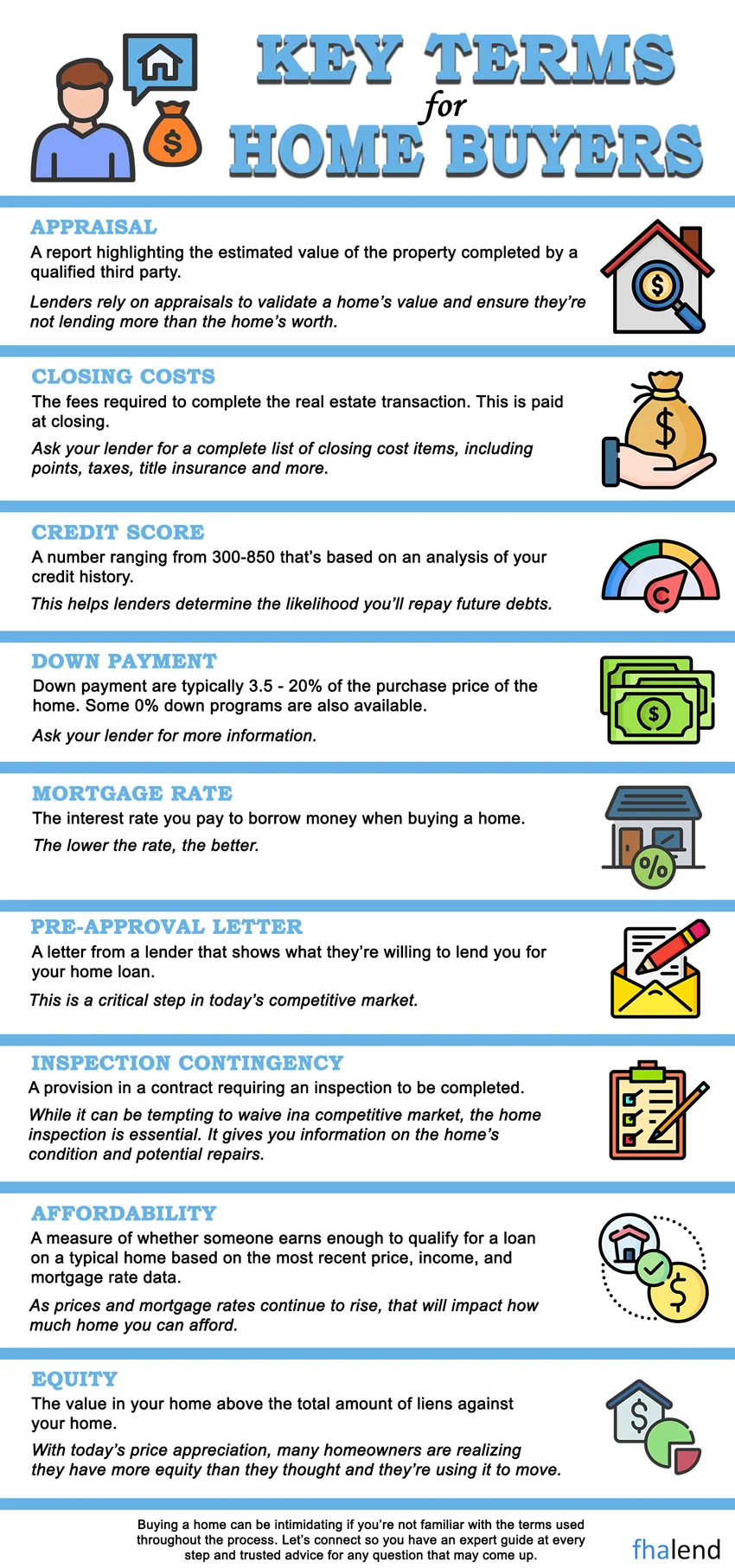

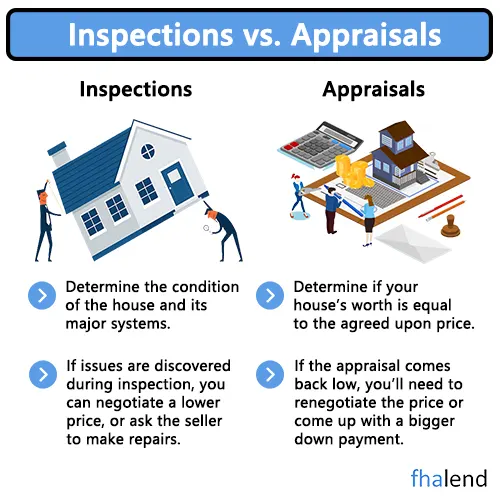

Financing terms of FHA 203k Loans include the original acquisition price of the home as well as the cost of improvements to the home. Homebuyers seeking FHA 203k Rehab Loans require a minimum credit score of 580 for a 3.5% down payment after an improved value home purchase loan.

Down Payment on FHA 203k Loans

The down payment required is 3.5% of the after improved value of the home which means the appraised value of the property after it has been fully renovated. For example, if the property cost $100,000 and the renovation costs $100,000 and the after repaired value is $200,000, the borrower would need to come up with 3.5% of the $200,000 after repaired value or a $7,000 down payment.

Benefits Of 203k Loans

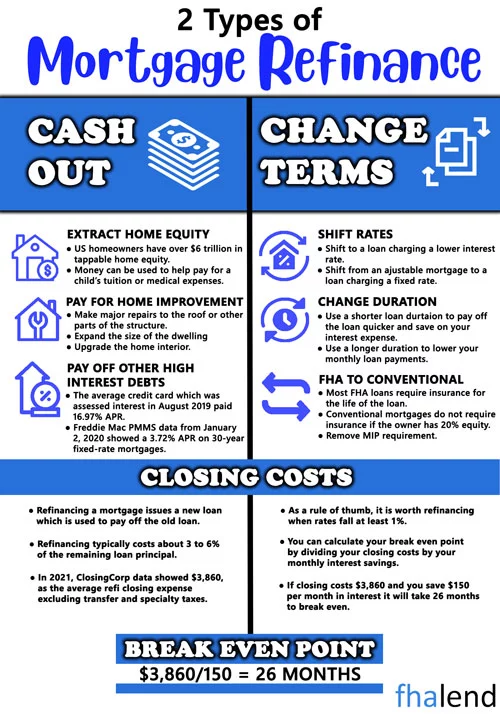

Construction loans have been popular prior to the 2008 Real Estate and Credit Collapse. Now it is next to impossible for a homeowner to get a construction or bridge loan unless the homeowner has a lot of equity in their home. With an FHA 203k Rehab Loan, a homeowner can get construction financing at the same time they get a home purchase loan. Or can do an FHA 203k Rehab Refinance Mortgage Loan with only a 3.5% down payment or 96.5% Loan to Value

Low Mortgage Rates On Construction Portion Of FHA 203k Mortgages

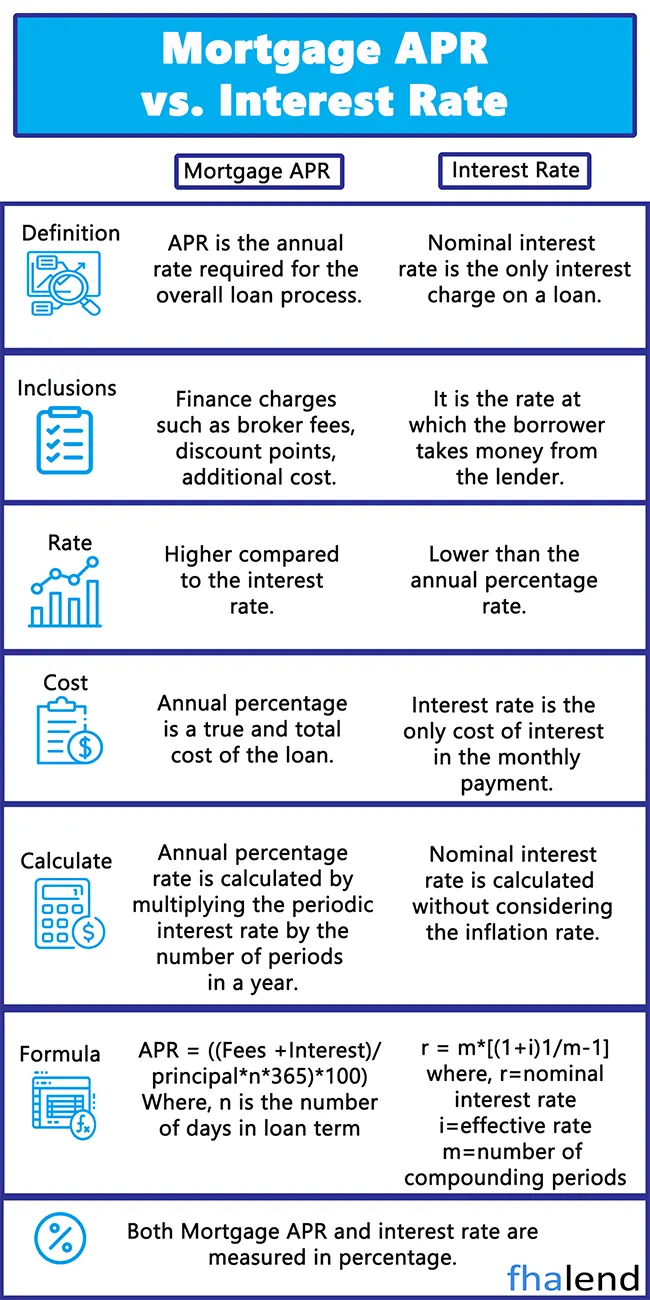

Both the acquisition and construction financing interest rates are the same. In general, construction financing is considered risky. So lenders normally charge a substantially higher interest rate on construction and bridge financing interest rates. With FHA 203k Rehab Loans, whatever the acquisition interest rate is, so are the construction portion’s interest rates. For example, if a mortgage rate is 5.25% on the FHA mortgage rate, the 5.25% will be the whole cost of the construction budget as well for the term of the 30-year fixed-rate FHA-insured mortgage loan.

FHA Rehab Loan History

The United States Department of Housing and Urban Development is the parent of the Federal Housing Administration, also known by many as FHA. FHA has implemented the FHA 203k Loans to promote the revitalization of neighborhoods where homes need rehabilitation and repairs for one to four-unit residential units. With 203k Loans, borrowers can use a single mortgage loan for the acquisition and/or refinance of their home plus the cost of repairs of rehabbing their home.

Types of Renovation Loans in 2024

| Requirements | Fannie Mae HomeStyle | FHA 203k Limited | FHA 203k Standard |

|---|---|---|---|

| Credit score | 620 | 580 | 580 (some lenders require 620) |

| Down payment | 3% | 3.5% | 3.5% |

| Types of renovations allowed | Structural, cosmetic, luxury upgrades | Cosmetic | Structural / cosmetic |

| Amount you can borrow | preapproval amount for purchase + renovations | Purchase price + up to $31,000 for renovations | Preapproval amount for purchase + renovations |

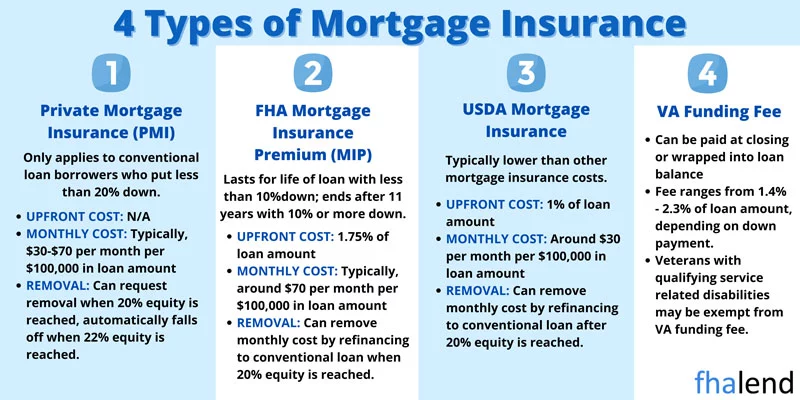

| Mortgage insurance requirement | Private mortgage insurance (PMI) for downpayment < 20%. You can remove PMI if 20% equity | UMIP 1.75% of the loan; annual MIP of 0.85% if down payment < 10%. You can refinance to a conventional loan when > 20% equity, and remove MIP | UMIP of 1.75% of the loan; annual MIP of 0.85% if down payment < 10%. You can refinance to a conventional loan when > 20% equity, and remove MIP |

Property Types Allowed on FHA 203k Loans

Property types include owner-occupant properties that are the following and can qualify for FHA 203k Rehab Loans include the following:

- condominiums

- townhomes

- modular homes

- single-family homes

- two to four-unit residential properties

203k Loans are not available for second homes or investment properties, Owner-occupied properties are only under 203k Lending Guidelines.

FHA 203k Loan Requirements 2024

One to four-unit owner-occupant properties is eligible for 203k Loans.

- The home has to have been built for at least one year

- FHA 203k Rehab Loans allow for a homeowner to convert a one-family unit to a two to four-unit family home

Cooperatives also are known as co-ops, do not qualify for 203k Loans:

- Total tear downs or partial teardowns of existing homes and rebuilding it allowed as long as a large percentage of the original foundation remains

Borrowers can take an existing modular home and relocate it to another location with a built foundation with 203k Loans.

Types Of 203k Loans

There are two types of 203k Rehab Loans. The FHA 203k Streamline Loan has a maximum construction allowance of $35,000 and no structural changes or room additions are allowed. The standard FHA 203k renovation loan has no maximum construction limit. The total construction budget is up to the maximum FHA loan limit on the acquisition and construction.

FHA 203k Streamline Renovation Loans

Borrowers can do minor repairs such as the following:

- kitchen remodeling

- bathroom remodeling

- attic remodeling

- basement remodeling

- new windows

- new appliances

- HVAC systems

- plumbing

- electrical

- decks and porches

- floors

- roofs

- siding

- painting

- other simple repairs

The Standard FHA 203k Rehab Loans allow major repairs such as structural changes, and room additions, plus there are no construction budget limits and the cost of construction can exceed $35,000.

FHA 203k Renovation Loan Requirements and Guidelines for 2024

In the following paragraphs, we will discuss and cover how President Bill Clinton save the FHA 203k rehab mortgage loan program. In the 1970s and ’80s, an FHA 203K Rehab Mortgage Loan took approximately nine months to close if it closed at all and another nine months to complete the construction. The FHA 203k Rehab Loan product was brand new and completely broken.

Red Tape With The FHA 203k Loan Requirements 2024

The real estate community was completely demoralized and disappointed that this much-heralded program had turned into another bureaucratic nightmare. During the period of the ’70s and ’80s, FHA 203k Rehab Loan Program was just another broken federal program that was pushed to the side and left unused. In this article, we will discuss and cover FHA 203k Rehab Mortgage Loan Program With No Overlays.

Birth Of The New FHA 203k Rehab Mortgage Program

The real estate brokerage community did not want to market and sell 1-to-4-unit homes and wait nine months for closing, and mortgage companies decided there were too many moving parts to close and fund them in any reasonable time frame. Believe me, I tried. I saw the value. There was a glut of properties on the market that were not financeable without some repair money. So nobody specialized in the product and it was for all intents and purposes shelved until the regulation could be changed.

President Bill Clinton And The New FHA 203k Rehab Mortgage Program

Along came Bill Clinton as the President of the United States of America in 1993. One of the responsibilities of the Department of Housing and Urban Development, HUD, is to maintain and sell FHA foreclosures, “HUD Homes”. President Bill Clinton’s HUD Secretary, Henry Cisneros saw the huge inventory and asked why they weren’t moving these properties quicker.

Financing A Fixer-Upper With an FHA 203k Loan

Good question Hank. 80% of these properties were un-financeable using either FHA or conventional financing because they did not meet the minimum property standards for these types of loans. They needed rehab money. HUD’s recognition of the glut of inventory on their hands moved them re-visit FHA 203k Rehab Loan Program. The amended law was rewritten with user-friendly access to buyers, real estate brokers, and the mortgage community. Today the program is a huge success story. It’s a buzzword that’s now part of the dialog in the real estate community. “Hey, let’s do a K on this property”.

Loan Officers Licensed In 48 States Who Are Experts on FHA 203k Loans

Piotr has helped lawmakers and regulators launch the New FHA 203k Rehab Loan Program. Contributing associate editors on this blog written by Alex Carlucci, a Senior Loan Officer of Nexa Mortgage LLC, Alexander Thomas Carlcucci has over 25 years of experience in the mortgage lending industry.

FHA 203k Lending Experts

Alex Carlucci is not just an expert mortgage banking professional but also a real estate expert and real estate technology guru. Alex Carlucci has hundreds of awards and certificates for his expertise in being a leader in the mortgage lending industry. Capital Lending Network, Inc. is a mortgage company licensed in 48 states with no lender overlays on government and conventional loans. CLN Mortgage has its main office in Oakbrook Terrace, Illinois. Capital Lending Network, Inc. is licensed in multiple states and has a national reputation for its no overlays on government and conforming loans.

FHA 203k Loan Programs And Lending Guidelines

For homebuyers planning on buying a home that needs renovations or currently own a home needing renovations work, HUD’s FHA 203k Loan Program may be the solution. Getting a construction loan these days is extremely difficult. Many construction lenders will make borrowers go through red tape. Getting a second mortgage and/or home equity line of credit requires equity in a home. HELOC requires credit scores of over 700 and DTI caps of 45%.

Homebuyers Buying Fixer-Uppers and Foreclosed Homes Benefit From 203k Renovation Loans

Homebuyers who are planning on purchasing a foreclosure, short sale, or REO in dire need of rehab can now qualify for FHA 203k Loan Programs with Capital Lending Network, Inc. FHA 203k Loan programs allow home buyers and homeowners to get an acquisition and construction in one single home loan with no hassles. FHA 203k Loan Programs are available only to owner-occupant homeowners (with some exceptions of having a non-occupant co-borrower). Any residential property from one to four units is eligible. In the following paragraphs, we will cover and discuss FHA 203k Loan Programs And Lending Guidelines.

What Are The Basics Of FHA 203k Loan Programs?

The United States Department of Housing and Urban Development (HUD) is the parent of the Federal Housing Administration, FHA. HUD launched FHA 203k Loan programs to promote and revitalize homes in need in repair and revitalize neighborhoods. FHA 203k Loan programs are available in all 50 states

There are two different classes of FHA 203k Loan programs:

- The first FHA 203k Loan program is called the FHA 203k Streamline which is for limited repairs and the maximum construction loan amount is capped at $35,000

- The second class of FHA 203k Loan is called the Standard 203k Loan which has no construction loan limit and a full major renovation can be done including room additions, structural changes which include moving existing walls

Both the Streamline and Standard FHA 203k Loan programs are for acquisition and construction purposes and no cash-out is allowed.

How Can I Qualify For A FHA 203k Loan Program?

Since FHA 203k Loans are FHA-insured loans. The same FHA lending guidelines apply with FHA 203K loan programs as it does with the standard FHA lending guidelines. However, lenders may impose higher guidelines with 203k Loans called mortgage lender overlays on top of the minimum mandated by HUD. Some overlays with 203k Loan programs imposed by 203k lenders may be the following:

- higher credit scores

- reserves

- lower debt to income ratios

FHA 203k mortgage rates are normally 0.50% higher than standard FHA loans.

Down Payment Requirement On FHA 203k Loans

Minimum down payment requirements are 3.5% down payment on the after improved value. For example, if the home buyer is purchasing a home for $100,000:

- The cost of construction is $200,000 to yield after the improved appraised value of $200,000

- The home buyer needs to come up with a 3.5% down payment of $200,000

How Can I Qualify For an FHA 203k Loan?

To qualify for an FHA loan with a 3.5% down payment, mortgage lenders will require a 580 credit score. Most 203k mortgage lenders want to see a minimum credit score of 620. This is not a HUD Guideline but rather a lender’s overlay on the particular lender. FHA only requires a 580 credit score. Borrowers who fall short of the minimum required credit score, there are quick fixes to boost credit scores up. Any experienced mortgage loan originator can assist borrowers in boosting credit scores.

Maximum Loan Limits On 203k Loans

There are maximum loan limits with FHA loan programs:

- The maximum FHA amounts can reach $970,800 on single-family homes in high-cost areas, especially in California, and New York

- Most areas in California, such as Los Angeles, San Diego, Irvine, Pasadena, LaJolla, San Francisco, San Jose, Monterey, and Lake Tahoe fall in high-cost areas and FHA Loan Limits is $970,800 on single-family homes

All 203k loan sizes cannot exceed a property’s after improved value by more than 10%.

What Types Of Work Are Allowed With 203k Loans?

Both the FHA 203k Streamline and 203k Standard mortgage loan programs have their own guidelines on what types of work are permitted and what types of work that is not permitted. For the 203k Standard rehab loan program, the types of work that is permitted are very broad

Buyers can do the following types of work:

- room additions to the home

- can do a gut rehab on the home

- can do a two-story addition to home

- structural changes can be made

- major landscaping is permitted

- foundation extensions are permitted

- There is no limit on the construction budget amount with the Standard 203k loan

- This holds true as long as the after-improved appraised value does not exceed the maximum FHA lending limit

- Homeowners can over-improve and have a higher appraised value

But homeowners would have to come up with any extra funds that go beyond the maximum FHA lending limits.

FHA 203k Streamline Rehab Loan

For properties needing minor repairs and the cost of construction of $35,000 and under, the mortgage loan borrower can select the FHA 203k Streamline loan. The type of work that can be done with an FHA Streamline mortgage loan program is much more restrictive. The homeowner cannot do any structural changes to the existing home. Room additions are not allowed. Work that is permitted is the following:

- kitchen and bathroom remodeling

- finishing an existing attic and basement

- roofing, new windows

- repairs that do not require structural changes

- patios and porches

- new siding, weatherization

- updating mechanicals such as HVAC, electrical, and plumbing, painting

- new appliances that are attached to the property and not mobile units

Mortgage Lenders Who Are Experts On FHA 203k Loans

Piotr Bieda of FHA Lend Mortgage has extensive real estate investment experience. This mortgage blog article on the birth of the New FHA 203k Rehab Mortgage Loan Program was written by Piotr Bieda, the Chief Operating Officer of FHA Lend Mortgage, Piotr Bieda is also known as The Mortgage Whisperer by mortgage and real estate professionals nationwide. Piotr Bieda is also an associate contributing writer for FHA Lend Mortgage.

Common Questions About FHA 203k Loan

What types of properties are eligible for FHA 203(k) loans

What repairs or renovations are covered by FHA 203(k) loans

Can I use an FHA 203(k) loan to purchase a fixer-upper

How does the loan disbursement work for renovations

Can I do the renovations myself with an FHA 203(k) loan

What is the difference between the FHA 203(k) Streamline and Standard loans

Is there a minimum repair cost for FHA 203(k) loans

Can I use an FHA 203(k) loan for luxury improvements

What are the interest rates for FHA 203(k) loans

Interest rates can vary, but they are typically slightly higher than traditional FHA or conventional loans due to the added risk associated with rehabilitation projects.

January 11, 2024 - 12 min read