FHA Loan Limits in Rhode Island For Single Homes & Multifamily

The FHA Loan is a great way to maximize your mortgage options in Rhode Island. In 2023, the Federal Housing Administration (FHA) has established new loan limits for every county in RI. Understanding what they are and how they affect you can help you make an informed decision when it comes to taking out a mortgage.

The FHA Loan is a great way to maximize your mortgage options in Rhode Island. In 2023, the Federal Housing Administration (FHA) has established new loan limits for every county in RI. Understanding what they are and how they affect you can help you make an informed decision when it comes to taking out a mortgage.

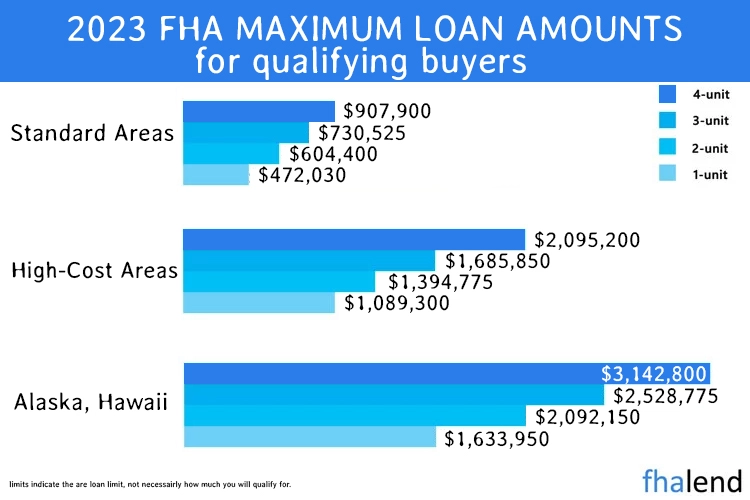

The Federal Housing Administration (FHA) loan limits in Rhode Island are calculated using a formula prescribed by the Housing and Economic Recovery Act (HERA) of 2008. The maximum FHA loan limit in Rhode Island is $661,250 for a single-home family and for a four-bedroom home is $1,271,650.

FHA Loan limits in Rhode Island are calculated for each county. If the median home price in a county is less than 65% of the national conforming loan limit, then the maximum loan limit will be $472,030. If the median home price in a county is between 65% and 80% of the national conforming loan limit, then the maximum loan limit will be equal to 100% of the national conforming loan limit ($661,250 for 2023).

To learn more about how FHA loan limits in Rhode Island are calculated please stay up-to-date on changes to the loan limits in your area, check the below table for current loan limits (we will update them every year so please bookmark our website for future records). Whether you’re a first-time homebuyer or looking to purchase a larger property, understanding how FHA loan limits in Rhode Island work can help you get into the home of your dreams faster and with less financial strain.

FHA Loan Limits in Rhode Island By County in 2023

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| BRISTOL | $661,250 | $846,500 | $1,023,250 | $1,271,650 | $575,000 |

| KENT | $661,250 | $846,500 | $1,023,250 | $1,271,650 | $575,000 |

| NEWPORT | $661,250 | $846,500 | $1,023,250 | $1,271,650 | $575,000 |

| PROVIDENCE | $661,250 | $846,500 | $1,023,250 | $1,271,650 | $575,000 |

| WASHINGTON | $661,250 | $846,500 | $1,023,250 | $1,271,650 | $575,000 |

FHA Multifamily Loan Limits in Rhode Island

FHA multifamily units are a type of housing that provides affordable rental housing to low- and moderate-income families. While there are many different types of multifamily units, they all share several common features, including a shared living space, shared utilities, and close proximity to important amenities like schools, shops, and parks. FHA loan limits in Rhode Island are the same in all counties, which means they are in high-cost areas.

Where counties in which 115% of the local median home value exceeds the baseline conforming loan limit, the applicable loan limit will be higher than the baseline loan limit.

FHA multifamily loan limits in Rhod Island for 4-unit property (fourplex) are set at $1,138,950 as the maximum amount you can borrow when applying for an FHA loan with a 3,5% downpayment. For 3 units (triplex) the FHA loan limits in all 5 counties in Rhode Island are set to $916,450. When buying a duplex a lender can lend up to $758,200 in the loan amount. For a single-home family, the FHA loan limits in Rhode Island are set to $592,250.

Eligibility Requirements For an FHA Loan in Rhode Island

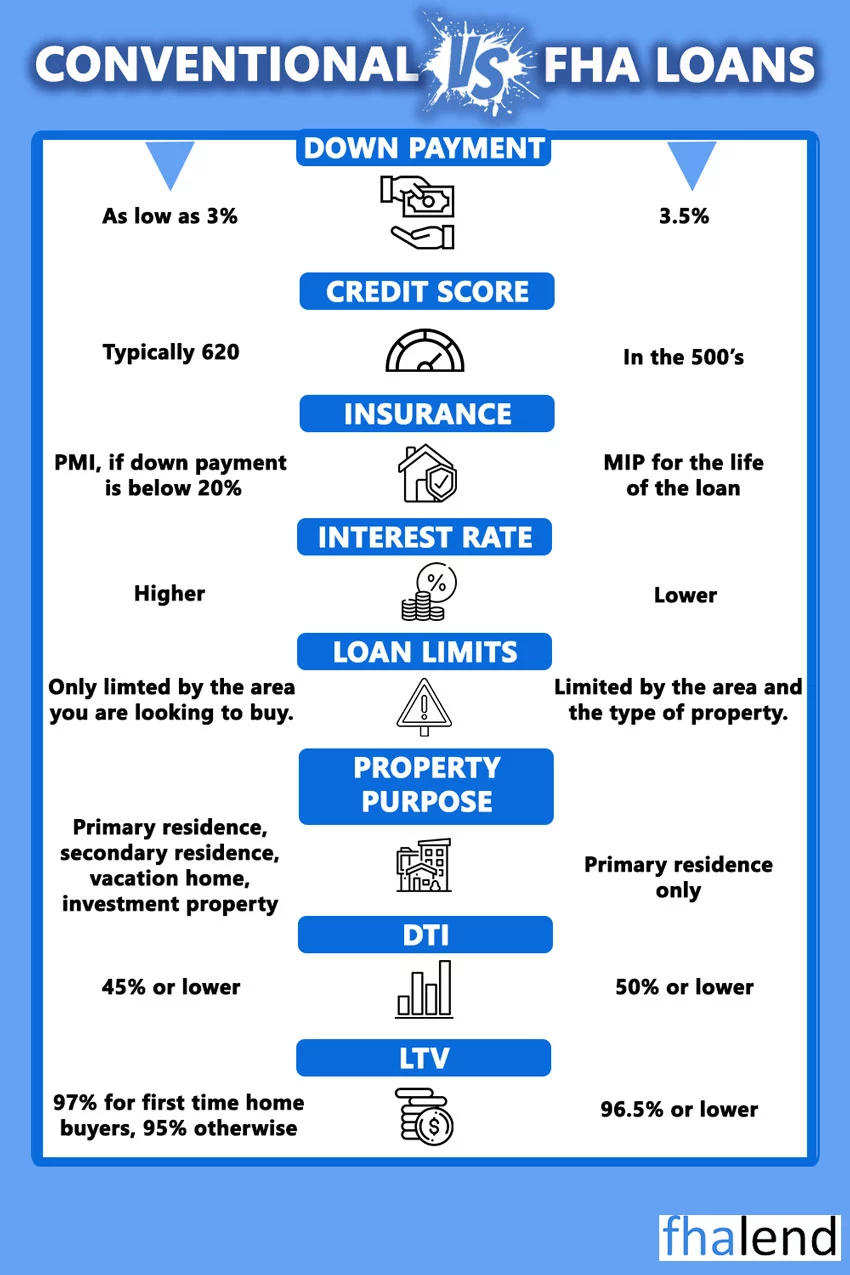

In order to be eligible for an FHA Loan in Rhode Island for 2023, you must meet certain criteria such as having a valid Social Security number, being legally able to take out a mortgage in the US, and having a credit score that meets requirements. Additionally, the FHA Loan offers an array of benefits such as low down payments, looser credit requirements, and more flexible terms.

What You Should Know Before Buying a House in Rhode Island

When buying a house in Rhode Island it’s important to know a few major differences between a housing market for example in California.

Property Taxes & Median Home Price

They are higher in Rhode Island than in California by a considerable amount however the median home price is lower than in California (on average)

Square Footage is Lower

Single-home families in California are bigger than in Rhode Island (based on average lot size)

Houses Much Older

If you grew up in a house with central air conditioning, an attached garage or an inground pool you will be disappointed. These houses are not that common in RI when compared to CA. The housing market is much older however houses have a more charming and vintage look.

Expensive Utilities

Because of muggy weather in summer and cold winters the older houses can be expensive to heat and need periodic maintenance to keep from simply falling apart. If you thinking about buying a Victorian (older style house), please do an inspection and pull the latest maintenance history to make sure that the total cost of ownership will not double.

Septic System & Lead Paint

Because most houses were built before 1978, there is an issue with lead-based paint (you need to sign disclosures when buying or selling a property in Rhode Island). You might also find an outdated septic system/well which needs to be upgraded.

You Can Change Your Oil on Your Driveway!

In most areas, there are no homeowner associations which are common in the rest of the country, which means nobody will write you a ticket if your grass is half-inch too high or if you change your car’s oil on your driveway.

The actual process of buying a house in Rhode Island it’s similar to in the rest of the country. The FHA loan limits in Rhode Island are set the same way by HUD and the FHA requirements are the same as in the rest 49 states. Just make sure to do an inspection on a property you’re buying and hire a good real estate lawyer, realtor, and mortgage broker to handle the contract, and get clear to close on your mortgage. If the house needs repair you can get a 203k loan and get financing with FHA for major repairs.

What Are the Benefits of Getting an FHA Loan in Rhode Island

Getting an FHA loan can be a great way to take advantage of the many benefits that this type of financing has to offer. Some of the key benefits of FHA loans include lower interest rates, smaller down payment requirements, and more flexible qualification criteria.

Additionally, with an FHA loan, you may also have access to special refinance programs that can help you save even more money on your mortgage. Whether you are looking to buy your first home or refinance an existing mortgage, there are many reasons why getting an FHA loan could be a good choice for you. So if you are considering taking out an FHA loan, it is important to understand all the benefits that come with it so you can make the best decision for your financial future.

One of the biggest advantages of FHA loans is that they usually come with lower interest rates than other types of mortgages. This is because FHA loans are backed by the government, which gives lenders a certain amount of protection against losses if the borrower defaults on their loan. As a result, lenders are often willing to offer lower interest rates on FHA loans in order to attract borrowers.

How Much Money Do I Need to Buy a House in Rhode Island?

FHA loans typically have smaller down payment requirements than other types of mortgages, which can make them more affordable for first-time homebuyers or people with limited savings.

Another key benefit of FHA loans is that they have more flexible qualification criteria than other types of mortgages. For example, people with less-than-perfect credit or who have had financial difficulties in the past may still be able to qualify for an FHA loan, which can be helpful if you are trying to get your finances back on track.

Additionally, many lenders offer special refinance programs specifically designed for people with FHA loans, which can help you reduce your monthly mortgage payments and save money over time.

Overall, there are many benefits of getting an FHA loan, including lower interest rates, smaller down payment requirements, and more flexible qualification criteria. So if you are looking to buy a home or refinance an existing mortgage, it is definitely worth considering whether an FHA loan could be right for you.

What Are the Four Types of FHA Loans in Rhode Island

If you’re looking to purchase or refinance a home, there are several different types of loans that you can choose from. FHA loans are one popular option, and they come in three main varieties: refinance loans, cash-out refinance, 203k loans, and fha loans. Each one has its own specific set of benefits and drawbacks, so it’s important to understand the differences before you decide which one is right for you.

1. Refinance Loan

If you’re looking to lower your monthly mortgage payments, you may want to consider a refinance loan. With a refinance loan, you’ll be able to get a lower interest rate on your mortgage, which can save you money over the long term. However, keep in mind that you’ll need to have good credit in order to qualify for a refinance loan.

Cash-Out Refinance

The second type of FHA loan is the cash-out refinance loan. This loan allows you to refinance your existing mortgage and take out additional cash from your equity. Cash-out refinances loans can be used for a variety of purposes, such as home improvement projects, debt consolidation, or investing in other assets.

2. 203k Loans:

If you’re looking to purchase a fixer-upper, or if you need to make major repairs on your current home, you may want to consider a 203k loan. With a 203k loan, you’ll be able to finance both the purchase price of the home and the cost of the repairs. Keep in mind that 203k loans can be difficult to qualify for, and they often come with high-interest rates.

3. FHA Loans:

If you have less-than-perfect credit, you may still be able to qualify for an FHA loan. FHA loans are backed by the federal government, and they allow borrowers to put down as little as 3.5% for a down payment. However, FHA loans often come with high-interest rates and strict credit requirements, so it’s important to do your research before you apply.

No matter what your financial situation is, there’s an FHA loan that can help you reach your homeownership goals. Call us today or check your eligibility here and see if you qualify for an FHA loan.

Rhode Island Down Payment Assistance Program

The Rhode Island Housing Department has a down payment assistance program for first-time buyers who use a RIHousing loan to acquire their property.

If you’re qualified, you may get 6% of your loan amount or $15,000 (whichever is lower) in down payment assistance. According to the organization, “the interest rate on an Extra Assistance Loan will be the same as the interest rate on your RIHousing first mortgage in most situations.”

Rhode Island Housing has additional information on its website. Also, take a look at HUD’s list of other homebuyer assistance programs in the state.