FHA Loan Limits in Tennessee For 2023

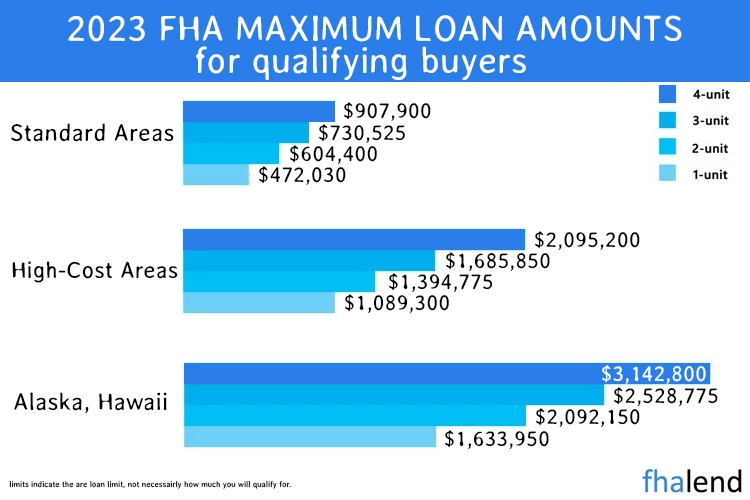

FHA loan limits in Tennessee are calculated according to a formula specified in the National Housing Act. This formula results in a “base loan limit” for each county. The base loan limit is the lower of:

- The greater of 107 percent of the median house price in the county, or

- The floor amount of $472,030.

In order to determine the base loan limit for a particular county in Tennessee state, you’ll need to know the median house price in that county. You can find this information on your own or by contacting a real estate agent in the county. Once you have the median house price, simply apply the formula specified in the National Housing Act to calculate the base loan limit.

In order to determine the base loan limit for a particular county in Tennessee state, you’ll need to know the median house price in that county. You can find this information on your own or by contacting a real estate agent in the county. Once you have the median house price, simply apply the formula specified in the National Housing Act to calculate the base loan limit.

The base FHA loan limit in Tennesse may be increased in certain “high-cost areas.” If the median house price in a given county is greater than 150 percent of the conforming loan limit ($472,030 as of 2023), then the base loan limit will be increased to an amount that is equal to 150 percent of the conforming loan limit. However, this higher limit cannot exceed $726,525.

The FHA also offers a “high-balance” loan program for certain high-cost counties in Tennessee. The high-balance loan program allows for loans that are larger than the base loan limit, but the maximum loan amount is still capped at $809,150. To qualify for a high-balance loan, your county must have a median house price that is greater than 150 percent of the conforming loan limit.

FHA Loan Limits in Tennessee by County For 2022

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| ANDERSON | $472,030 | $604,400 | $730,525 | $907,900 | $295,000 |

| BEDFORD | $472,030 | $604,400 | $730,525 | $907,900 | $234,000 |

| BENTON | $472,030 | $604,400 | $730,525 | $907,900 | $60,000 |

| BLEDSOE | $472,030 | $604,400 | $730,525 | $907,900 | $50,000 |

| BLOUNT | $472,030 | $604,400 | $730,525 | $907,900 | $295,000 |

| BRADLEY | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| CAMPBELL | $472,030 | $604,400 | $730,525 | $907,900 | $295,000 |

| CANNON | $890,100 | $1,139,500 | $1,377,400 | $1,711,750 | $774,000 |

| CARROLL | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| CARTER | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| CHEATHAM | $890,100 | $1,139,500 | $1,377,400 | $1,711,750 | $774,000 |

| CHESTER | $472,030 | $604,400 | $730,525 | $907,900 | $187,000 |

| CLAIBORNE | $472,030 | $604,400 | $730,525 | $907,900 | $120,000 |

| CLAY | $472,030 | $604,400 | $730,525 | $907,900 | $69,000 |

| COCKE | $472,030 | $604,400 | $730,525 | $907,900 | $76,000 |

| COFFEE | $472,030 | $604,400 | $730,525 | $907,900 | $215,000 |

| CROCKETT | $472,030 | $604,400 | $730,525 | $907,900 | $187,000 |

| CUMBERLAND | $472,030 | $604,400 | $730,525 | $907,900 | $142,000 |

| DAVIDSON | $890,100 | $1,139,500 | $1,377,400 | $1,711,750 | $774,000 |

| DECATUR | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| DEKALB | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| DICKSON | $890,100 | $1,139,500 | $1,377,400 | $1,711,750 | $774,000 |

| DYER | $472,030 | $604,400 | $730,525 | $907,900 | $115,000 |

| FAYETTE | $472,030 | $604,400 | $730,525 | $907,900 | $303,000 |

| FENTRESS | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| FRANKLIN | $472,030 | $604,400 | $730,525 | $907,900 | $215,000 |

| GIBSON | $472,030 | $604,400 | $730,525 | $907,900 | $187,000 |

| GILES | $472,030 | $604,400 | $730,525 | $907,900 | $156,000 |

| GRAINGER | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| GREENE | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| GRUNDY | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| HAMBLEN | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| HAMILTON | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| HANCOCK | $472,030 | $604,400 | $730,525 | $907,900 | $70,000 |

| HARDEMAN | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| HARDIN | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| HAWKINS | $472,030 | $604,400 | $730,525 | $907,900 | $208,000 |

| HAYWOOD | $472,030 | $604,400 | $730,525 | $907,900 | $81,000 |

| HENDERSON | $472,030 | $604,400 | $730,525 | $907,900 | $118,000 |

| HENRY | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| HICKMAN | $472,030 | $604,400 | $730,525 | $907,900 | $125,000 |

| HOUSTON | $472,030 | $604,400 | $730,525 | $907,900 | $123,000 |

| HUMPHREYS | $472,030 | $604,400 | $730,525 | $907,900 | $96,000 |

| JACKSON | $472,030 | $604,400 | $730,525 | $907,900 | $245,000 |

| JEFFERSON | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| JOHNSON | $472,030 | $604,400 | $730,525 | $907,900 | $85,000 |

| KNOX | $472,030 | $604,400 | $730,525 | $907,900 | $295,000 |

| LAKE | $472,030 | $604,400 | $730,525 | $907,900 | $73,000 |

| LAUDERDALE | $472,030 | $604,400 | $730,525 | $907,900 | $95,000 |

| LAWRENCE | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| LEWIS | $472,030 | $604,400 | $730,525 | $907,900 | $123,000 |

| LINCOLN | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| LOUDON | $472,030 | $604,400 | $730,525 | $907,900 | $295,000 |

| MCMINN | $472,030 | $604,400 | $730,525 | $907,900 | $160,000 |

| MCNAIRY | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| MACON | $890,100 | $1,139,500 | $1,377,400 | $1,711,750 | $774,000 |

| MADISON | $472,030 | $604,400 | $730,525 | $907,900 | $187,000 |

| MARION | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| MARSHALL | $472,030 | $604,400 | $730,525 | $907,900 | $248,000 |

| MAURY | $890,100 | $1,139,500 | $1,377,400 | $1,711,750 | $774,000 |

| MEIGS | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| MONROE | $472,030 | $604,400 | $730,525 | $907,900 | $120,000 |

| MONTGOMERY | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| MOORE | $472,030 | $604,400 | $730,525 | $907,900 | $215,000 |

| MORGAN | $472,030 | $604,400 | $730,525 | $907,900 | $295,000 |

| OBION | $472,030 | $604,400 | $730,525 | $907,900 | $87,000 |

| OVERTON | $472,030 | $604,400 | $730,525 | $907,900 | $245,000 |

| PERRY | $472,030 | $604,400 | $730,525 | $907,900 | $65,000 |

| PICKETT | $472,030 | $604,400 | $730,525 | $907,900 | $79,000 |

| POLK | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| PUTNAM | $472,030 | $604,400 | $730,525 | $907,900 | $245,000 |

| RHEA | $472,030 | $604,400 | $730,525 | $907,900 | $157,000 |

| ROANE | $472,030 | $604,400 | $730,525 | $907,900 | $295,000 |

| ROBERTSON | $890,100 | $1,139,500 | $1,377,400 | $1,711,750 | $774,000 |

| RUTHERFORD | $890,100 | $1,139,500 | $1,377,400 | $1,711,750 | $774,000 |

| SCOTT | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| SEQUATCHIE | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| SEVIER | $472,030 | $604,400 | $730,525 | $907,900 | $332,000 |

| SHELBY | $472,030 | $604,400 | $730,525 | $907,900 | $303,000 |

| SMITH | $890,100 | $1,139,500 | $1,377,400 | $1,711,750 | $774,000 |

| STEWART | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| SULLIVAN | $472,030 | $604,400 | $730,525 | $907,900 | $208,000 |

| SUMNER | $890,100 | $1,139,500 | $1,377,400 | $1,711,750 | $774,000 |

| TIPTON | $472,030 | $604,400 | $730,525 | $907,900 | $303,000 |

| TROUSDALE | $890,100 | $1,139,500 | $1,377,400 | $1,711,750 | $774,000 |

| UNICOI | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| UNION | $472,030 | $604,400 | $730,525 | $907,900 | $295,000 |

| VAN BUREN | $472,030 | $604,400 | $730,525 | $907,900 | $55,000 |

| WARREN | $472,030 | $604,400 | $730,525 | $907,900 | $165,000 |

| WASHINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| WAYNE | $472,030 | $604,400 | $730,525 | $907,900 | $61,000 |

| WEAKLEY | $472,030 | $604,400 | $730,525 | $907,900 | $95,000 |

| WHITE | $472,030 | $604,400 | $730,525 | $907,900 | $166,000 |

| WILLIAMSON | $890,100 | $1,139,500 | $1,377,400 | $1,711,750 | $774,000 |

| WILSON | $890,100 | $1,139,500 | $1,377,400 | $1,711,750 | $774,000 |

What Are the Benefits of Getting an FHA Loan in Tennessee

The Federal Housing Administration (FHA) offers several benefits to borrowers in Tennessee, making it an attractive financing option for many homebuyers. Here are some of the key advantages of FHA loans:

- Low Down Payment: FHA loans require a lower down payment than conventional mortgages, giving first-time and low-income buyers a better chance of owning a home.

- Lower Interest Rates: Since the FHA guarantees part of each loan, lenders are able to offer borrowers lower interest rates. This can save homeowners thousands of dollars over the life of their mortgage.

- Easier Qualification: The FHA doesn’t have stringent credit scores or income requirements like some other mortgage programs. This makes it easier for more people to qualify for a home loan.

- Flexible Terms: FHA loans come with a variety of terms and conditions, giving borrowers more flexibility when it comes to choosing a loan that fits their needs.

If you’re interested in learning more about FHA loans or want to apply for one, contact a lender in your area. They can help you determine if an FHA loan is right for you and walk you through the application process.

Are you interested in learning more about FHA loans? If so, be sure to check out our other blog posts or get in touch by using this form

| FHA Loan Requirements in Tennessee | |

|---|---|

| Minimum FICO Score: | 500 |

| Down Payment | 3,5% (10% with credit under 580) |

| Debt to Income Ratio | Up to 56.9% |

| Work History | 2 years of full-time employment |

| Income | Must be fully documented |

| Mortgage Insurance | Required |

What Are Two Types of FHA Loans in Tennessee?

If you’re looking at purchasing a fixer-upper home, you may be wondering what kind of loan is best for you? There are two main types of loans that can help cover the costs of repairs and renovations – the FHA 203k loan and the FHA loan. Both loans are available through the Federal Housing Administration, but there are some key differences that you should be aware of before making a decision. The FHA 203k loan is specifically designed for borrowers who want to finance both the purchase price and the repairs or renovations of a home.

The loan amount is based on the “after-improved” value of the property, which means that you can borrow extra money to make necessary repairs or renovations. This can be a great option if you’re looking at a fixer-upper that needs significant work, as you won’t have to take out a separate loan for the repairs.

The FHA loan, on the other hand, can be used for both the purchase of a home and for renovations – but it’s important to note that the repairs must be cosmetic in nature. This means that you can use an FHA loan to finance minor repairs and updates, but you can’t use it for major structural work or repairs.So, which loan is right for you? If you’re looking at a property that needs significant repairs or renovations, the FHA 203k loan may be the best option.

However, if you’re looking at a property that just needs some cosmetic updates, the FHA loan may be a better fit. Talk to your lender about which option is right for you and your situation.

FHA Loan Limits For Multifamily Properties in Tennessee

The FHA does not allow for multifamily home loans in Tennessee. As a result, the property must be classified as a “primary residence.” That implies the homebuyer must reside in at least one of the units full-time.

The FHA loan cannot be used to finance an investment property in TN. However, you can take out an FHA mortgage to buy a 2-4 unit property and live in one while renting the others.

With a low-rate FHA loan and just a 3.5% down payment, it’s feasible to obtain a multifamily loan of up to $1,335,800 in Tennessee.

If you have 10% down or more you can always go with a conventional loan or NON-Qm loan program as well.TOP 3 FHA High-Cost Areas in Tennessee. There are several cities in Tennessee that are considered high-cost areas for mortgages insured by the Federal Housing Administration (FHA). This is due to the high cost of living and/or housing in these areas. If you’re looking to buy a home in one of these cities, it’s important to be aware of the specific FHA requirements that will apply to your mortgage.

In general, you’ll need to have a higher credit score and down payment if you’re buying a home in a high-cost area. Make sure you also check the above FHA loan limits in Tennessee to be sure that FHA will allow for such a loan amount. Here are three of the most expensive FHA cities in Tennessee:

1. Nashville

Nashville is the state capital and largest city in Tennessee. It’s also one of the most expensive places to live in the state, with a cost of living that’s nearly 20% higher than the national average. If you’re looking to buy a home in Nashville, you’ll need a credit score of at least 580 and a down payment of 3.5%. For homes that cost more than the FHA limit of $294,515, you’ll need a down payment of 10%.

2. Memphis

Memphis is another large city in Tennessee with a high cost of living. The cost of living in Memphis is about 16% higher than the national average. If you’re looking to buy a home in Memphis, you’ll need a credit score of at least 580 and a down payment of 3.5%. For homes that cost more than the FHA limit of $294,515, you’ll need a down payment of 10%.

3. Chattanooga

Chattanooga is a smaller city located in southeastern Tennessee. It’s one of the most expensive cities in the state, with a cost of living that’s nearly 18% higher than the national average.

If you’re looking to buy a home in Chattanooga, you’ll need a credit score of at least 580 and a down payment of 3.5%. For homes that cost more than the FHA limit of $294,515, you’ll need a down payment of 10%.

If you’re thinking of buying a home in one of Tennessee’s high-cost areas, it’s important to be aware of the specific FHA requirements that will apply to your mortgage. With a higher credit score and down payment, you can still qualify for an FHA loan in a high-cost city.

Tennessee Down Payment Assistance Program

The Tennessee Housing Development Agency’s Great Choice Home Loan provides up to $6,000 in down payment assistance in the form of a second mortgage loan.

- Deferred option: You can get a $6,000 forgivable second mortgage as a down payment. This loan has no interest and payments are postponed until the end of the 30-year loan term, at which time it is forgiven. Repayment will be required in full if the house is sold or refinanced.

- Payment option: Receive a second mortgage for 6% of the home’s sale price and must pay it off over 15 years at the same rate as your primary house loan.

You may use the funds from both loans to pay for closing expenses and a down payment. All borrowers must complete a state-mandated course on homebuyer education before receiving a loan.

Contact the agency to learn more. And look up HUD’s list of additional Tennessee homebuyer subsidies.