Michigan FHA Loan Limits: Mortgage Guidelines 2023

If you’re in the market for a new home, you may be wondering how the FHA loan limits in Michigan for 2023 will be determined. The FHA loan limits are based on a formula that takes into account the median home price in an area. So, if you’re thinking of buying a home in an area where prices are on the rise, you may be wondering how that will affect the loan limit for your area. Here’s what you need to know about how the Michigan FHA loan limits are set and what it could mean for your home-buying plans.

If you’re in the market for a new home, you may be wondering how the FHA loan limits in Michigan for 2023 will be determined. The FHA loan limits are based on a formula that takes into account the median home price in an area. So, if you’re thinking of buying a home in an area where prices are on the rise, you may be wondering how that will affect the loan limit for your area. Here’s what you need to know about how the Michigan FHA loan limits are set and what it could mean for your home-buying plans.

The Federal Housing Administration (FHA) sets loan limits for its insured mortgages each year. The loan limit is calculated using a formula that takes into account the median home price in an area. The Michigan FHA loan limits for 2023 will be announced later this year and will take effect on January 1, 2023.

What is the Max Loan Amount for FHA in Michigan?

The Michigan FHA loan limits are calculated based on the median home price in an area. The median home price is the midpoint of all home prices in an area. So, if the median home price in your area is $300,000, the FHA loan limit for your area would be $300,000.

The Michigan FHA loan limits are set each year and are usually announced in November. The loan limits for 2023 were announced in December 2022 and took effect on January 1, 2023.

If you’re thinking of buying a home in an area where prices are on the rise, it’s important to keep an eye on the FHA loan limits for your area. The loan limits are set based on the median home price in an area, so if prices in your area are rising, the loan limit for your area will likely rise as well.

If you’re planning to buy a home in 2023, it’s a good idea to start checking FHA loan limits for your county now in Michigan, so you know in what price range you can start looking for your dream home. That way, you’ll know how much you’ll be able to borrow when you’re ready to start shopping for a home.

The FHA loan limits are just one factor to consider when you’re thinking of buying a home. If you have questions about the loan process or other factors that may affect your home-buying plans, be sure to talk to a loan officer or housing counselor. They can help you understand the FHA loan process and what you need to do to get ready to buy a home.

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| ALCONA | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| ALGER | $472,030 | $604,400 | $730,525 | $907,900 | $124,000 |

| ALLEGAN | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| ALPENA | $472,030 | $604,400 | $730,525 | $907,900 | $112,000 |

| ANTRIM | $472,030 | $604,400 | $730,525 | $907,900 | $160,000 |

| ARENAC | $472,030 | $604,400 | $730,525 | $907,900 | $120,000 |

| BARAGA | $472,030 | $604,400 | $730,525 | $907,900 | $85,000 |

| BARRY | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| BAY | $472,030 | $604,400 | $730,525 | $907,900 | $115,000 |

| BENZIE | $472,030 | $604,400 | $730,525 | $907,900 | $299,000 |

| BERRIEN | $472,030 | $604,400 | $730,525 | $907,900 | $173,000 |

| BRANCH | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| CALHOUN | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| CASS | $472,030 | $604,400 | $730,525 | $907,900 | $179,000 |

| CHARLEVOIX | $472,030 | $604,400 | $730,525 | $907,900 | $250,000 |

| CHEBOYGAN | $472,030 | $604,400 | $730,525 | $907,900 | $250,000 |

| CHIPPEWA | $472,030 | $604,400 | $730,525 | $907,900 | $178,000 |

| CLARE | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| CLINTON | $472,030 | $604,400 | $730,525 | $907,900 | $215,000 |

| CRAWFORD | $472,030 | $604,400 | $730,525 | $907,900 | $120,000 |

| DELTA | $472,030 | $604,400 | $730,525 | $907,900 | $104,000 |

| DICKINSON | $472,030 | $604,400 | $730,525 | $907,900 | $95,000 |

| EATON | $472,030 | $604,400 | $730,525 | $907,900 | $215,000 |

| EMMET | $472,030 | $604,400 | $730,525 | $907,900 | $185,000 |

| GENESEE | $472,030 | $604,400 | $730,525 | $907,900 | $163,000 |

| GLADWIN | $472,030 | $604,400 | $730,525 | $907,900 | $119,000 |

| GOGEBIC | $472,030 | $604,400 | $730,525 | $907,900 | $108,000 |

| GRAND TRAVERSE | $472,030 | $604,400 | $730,525 | $907,900 | $299,000 |

| GRATIOT | $472,030 | $604,400 | $730,525 | $907,900 | $115,000 |

| HILLSDALE | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| HOUGHTON | $472,030 | $604,400 | $730,525 | $907,900 | $114,000 |

| HURON | $472,030 | $604,400 | $730,525 | $907,900 | $188,000 |

| INGHAM | $472,030 | $604,400 | $730,525 | $907,900 | $215,000 |

| IONIA | $472,030 | $604,400 | $730,525 | $907,900 | $293,000 |

| IOSCO | $472,030 | $604,400 | $730,525 | $907,900 | $120,000 |

| IRON | $472,030 | $604,400 | $730,525 | $907,900 | $116,000 |

| ISABELLA | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| JACKSON | $472,030 | $604,400 | $730,525 | $907,900 | $153,000 |

| KALAMAZOO | $472,030 | $604,400 | $730,525 | $907,900 | $198,000 |

| KALKASKA | $472,030 | $604,400 | $730,525 | $907,900 | $299,000 |

| KENT | $472,030 | $604,400 | $730,525 | $907,900 | $293,000 |

| KEWEENAW | $472,030 | $604,400 | $730,525 | $907,900 | $114,000 |

| LAKE | $472,030 | $604,400 | $730,525 | $907,900 | $72,000 |

| LAPEER | $472,030 | $604,400 | $730,525 | $907,900 | $309,000 |

| LEELANAU | $472,030 | $604,400 | $730,525 | $907,900 | $299,000 |

| LENAWEE | $472,030 | $604,400 | $730,525 | $907,900 | $168,000 |

| LIVINGSTON | $472,030 | $604,400 | $730,525 | $907,900 | $309,000 |

| LUCE | $472,030 | $604,400 | $730,525 | $907,900 | $76,000 |

| MACKINAC | $472,030 | $604,400 | $730,525 | $907,900 | $118,000 |

| MACOMB | $472,030 | $604,400 | $730,525 | $907,900 | $309,000 |

| MANISTEE | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| MARQUETTE | $472,030 | $604,400 | $730,525 | $907,900 | $165,000 |

| MASON | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| MECOSTA | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| MENOMINEE | $472,030 | $604,400 | $730,525 | $907,900 | $105,000 |

| MIDLAND | $472,030 | $604,400 | $730,525 | $907,900 | $170,000 |

| MISSAUKEE | $472,030 | $604,400 | $730,525 | $907,900 | $180,000 |

| MONROE | $472,030 | $604,400 | $730,525 | $907,900 | $193,000 |

| MONTCALM | $472,030 | $604,400 | $730,525 | $907,900 | $293,000 |

| MONTMORENCY | $472,030 | $604,400 | $730,525 | $907,900 | $103,000 |

| MUSKEGON | $472,030 | $604,400 | $730,525 | $907,900 | $160,000 |

| NEWAYGO | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| OAKLAND | $472,030 | $604,400 | $730,525 | $907,900 | $309,000 |

| OCEANA | $472,030 | $604,400 | $730,525 | $907,900 | $96,000 |

| OGEMAW | $472,030 | $604,400 | $730,525 | $907,900 | $151,000 |

| ONTONAGON | $472,030 | $604,400 | $730,525 | $907,900 | $70,000 |

| OSCEOLA | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| OSCODA | $472,030 | $604,400 | $730,525 | $907,900 | $81,000 |

| OTSEGO | $472,030 | $604,400 | $730,525 | $907,900 | $291,000 |

| OTTAWA | $472,030 | $604,400 | $730,525 | $907,900 | $293,000 |

| PRESQUE ISLE | $472,030 | $604,400 | $730,525 | $907,900 | $107,000 |

| ROSCOMMON | $472,030 | $604,400 | $730,525 | $907,900 | $128,000 |

| SAGINAW | $472,030 | $604,400 | $730,525 | $907,900 | $121,000 |

| ST. CLAIR | $472,030 | $604,400 | $730,525 | $907,900 | $309,000 |

| ST. JOSEPH | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| SANILAC | $472,030 | $604,400 | $730,525 | $907,900 | $142,000 |

| SCHOOLCRAFT | $472,030 | $604,400 | $730,525 | $907,900 | $167,000 |

| SHIAWASSEE | $472,030 | $604,400 | $730,525 | $907,900 | $215,000 |

| TUSCOLA | $472,030 | $604,400 | $730,525 | $907,900 | $129,000 |

| VAN BUREN | $472,030 | $604,400 | $730,525 | $907,900 | $170,000 |

| WASHTENAW | $472,030 | $604,400 | $730,525 | $907,900 | $330,000 |

| WAYNE | $472,030 | $604,400 | $730,525 | $907,900 | $309,000 |

| WEXFORD | $472,030 | $604,400 | $730,525 | $907,900 | $180,000 |

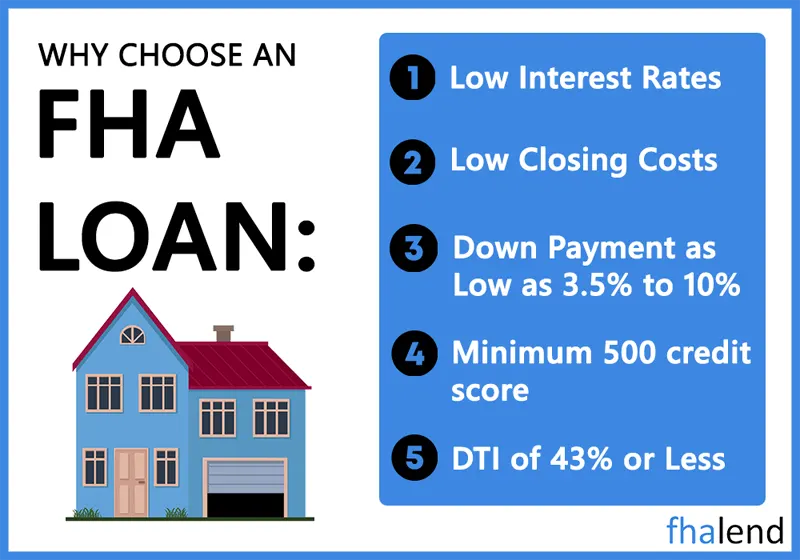

FHA loans let people take out a mortgage on a house—even when they can’t save enough for the standard 20% downpayment. In this guide, I’ll walk through the requirements to get an FHA loan. Michigan homebuyers have additional advantages, and I’ll unpack the ways Michigan residents can combine housing assistance options to save even more. Join us, and together we’ll start your Michigan homeownership journey.

What Are FHA Loan Requirements in Michigan

Each heading goes into detail about meeting distinct FHA loan requirements. Here’s the summary of the key takeaways:

- Minimum credit score: 500 or 580 when 3,5% down

- Minimum down payment: 3.5% or 10% when your FICO is between 500-580

- Maximum PTI: 40% (with a credit score of 580 or higher)

- Maximum DTI: 56.9%

- FHA loan maximum (Michigan): $472,030 – $907,900

- Required documents

- State-issued ID

- SSN

- Two years’ proof of income

- Gift income documentation

- Property Requirements

- Principal residence

- Passes FHA appraisal

- Approved home type

- Not for investment or resale

- Upfront mortgage insurance premium: 1.75% of the loan amount

- Insurance payment timeline: 11 years (or until the home is paid off)

- Bankruptcy requirements: wait 1-2 years post-foreclosure or bankruptcy

- Non-traditional credit: manual underwriting reviews bill payment history

This summary outlines the basics of FHA loan qualifications. Now, I’ll explore each element in greater detail.

What Is an FHA Loan and How To Apply in Michigan?

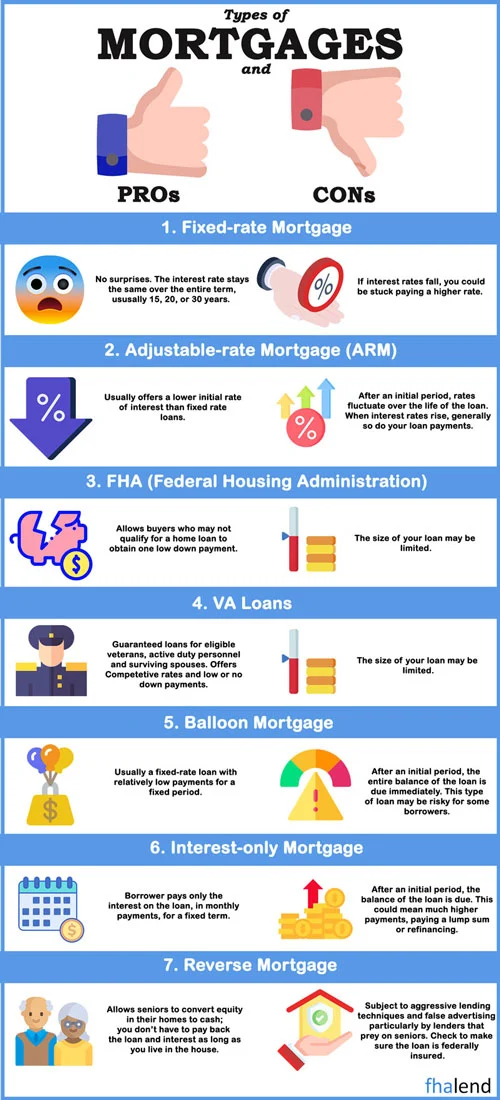

An FHA loan is a mortgage with a low downpayment requirement. Unlike other mortgage options, FHA loans in Michigan are insured by the Federal Housing Administration.

The FHA’s mortgage insurance empowers lenders to offer mortgages to a wide range of individuals and families. Lenders consider most FHA loan recipients “too high risk” for conventional loans, often due to their income.

Most FHA loan recipients are buying a home for the first time. The FHA loan program is part of the U.S. Department of Housing and Urban Development. Congress created the FHA in 1934. During the Great Depression, most Americans couldn’t afford to meet the terms of conventional mortgages.

FHA loans made homeownership more attainable. They’re still a great option for first-time homeownership today. Getting a loan is doable.

Obtaining an FHA Loan in Michigan: Federal Minimum Qualifications

FHA loans are easier to qualify for than conventional mortgages. Lenders can be flexible in their judgments of an applicant’s qualifications. But, applicants still must meet certain minimum standards to qualify.

If I’m looking to get an FHA loan in Michigan, I’ll have to keep my eye on certain rules and requirements. Most of these minimum qualifications are standard across the United States.

If I’m looking to get an FHA loan in Michigan, I’ll have to keep my eye on certain rules and requirements. Most of these minimum qualifications are standard across the United States.

Only a few—loan limits, for example—will be different in Michigan than they are in other states. The key qualifications I need to keep track of are:

- My credit score

- My initial downpayment

- My payment-to-income ratio

- My debt-to-income ratio

I needed to keep these numbers in the forefront of my mind. When I made a financial plan with an FHA loan as my goal, I used these as my goalposts. Then, I was ready to start applying for a loan.

Minimum Credit Score

The absolute minimum credit score for an FHA loan is 500. But, you need a score of at least 580 to counterbalance a high PTI.Note that 500 is the minimum score set by the FHA. But, individual lenders often impose higher requirements.

Lenders are not legally obligated to lend to everyone. Setting a higher minimum credit score lets lenders maintain a risk level they’re comfortable with. So, it’s wise to compare lenders as individuals.

Discover and compare the minimum credit score qualifications each lender sets. In general, the higher a borrower’s credit score is, the better the terms of the FHA loan will be. Recipients with higher credit scores pay lower interest rates.

Minimum Down Payment

FHA loans require recipients to make a down payment of at least 3.5%. That’s 3.5% of the market value of the home.The FHA determines the market value of a home with an appraisal. The appraiser first inspects the home the recipient is buying. Then the appraiser compares recent sales of similar properties in the area.

The required down payment is some percentage of the market value of the home. Note that 3.5% is only the minimum required downpayment for recipients with decent credit.

To land an FHA loan with a 3.5% minimum downpayment, an applicant needs a minimum credit score of 580. If my minimum credit score is 500-570, the lowest down payment option is 10%.

Zero Down Payment FHA Loan Options in Michigan

It is possible to get an FHA loan in Michigan with zero money down. Technically, the FHA loan itself will still require a down payment of 3.5% or more.But, an applicant can make the initial down payment without spending their own money. This way, the loan recipient doesn’t need to save up the down payment sum themselves.

Gift Funds

In every state, applicants can set up FHA gift funds. Relatives, employers, friends, non-profit groups, and credit unions can deposit money in a gift fund.Gift funds aren’t loans. The recipient must provide written documents proving they have no obligation to repay the funds. Then, they can use the gift funds towards the down payment.

DPA Grants

In Michigan, residents can apply for down payment assistance (DPA) grants through MSHDA. This program is exclusively for first-time homebuyers. For more on DPA programs in Michigan, read the FAQs.

Seller’s Concession

The FHA grants home sellers the option of a seller’s concession. The seller’s concession may be up to 6% of the market value of the home—enough to cover a 3.5% downpayment.In some cases, a seller will use their concession to cover the down payment and other closing costs. The seller will typically negotiate a higher asking price in return for the concession.

Maximum Payment-to-Income (PTI) Ratio

To secure an FHA loan, an applicant needs a PTI of 40%—or lower.To calculate an applicant’s PTI, the lender looks at the total of an applicant’s proposed monthly mortgage payment. Then, the lender divides that total by their effective gross income (EGI).

The resulting ratio (or quotient) must be 40% or lower.

HUD began calculating PTI with effective gross income in 1989. Department leaders believed this is a fairer way to determine the risk a given recipient may not pay back the loan than the metrics HUD used before.

An individual’s EGI is the sum of all income sources. To determine my EDI, I can add up my:

- Salary

- Wages

- Tips

- Overtime pay

- Commissions

- Passive income streams

- Income from assistance programs

The higher my EGI, the lower my PTI ratio. It’s wise to add together as many income streams as possible to maintain a low PTI.

An applicant can also try to decrease the proposed monthly mortgage payment. This can decrease PTI, but it increases the length of the loan and the interest rate.

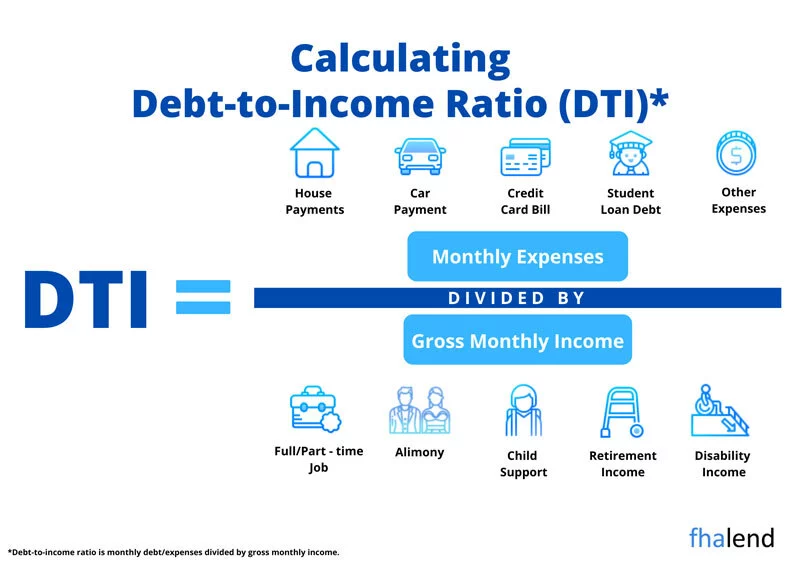

Debt-to-Income (DTI) Ratio Qualifications

To qualify for an FHA loan, an applicant needs a DTI of 56.9% or lower. Specifically, they need a back-end DTI of 56.9%. That means an applicant must spend 56.9% of their current income on debt repayments. Back-end debts do not include mortgage payments or mortgage insurance. The less income spent on debts, the better.

That said, to secure an FHA loan with a 50% DTI or higher, an applicant needs a credit score of 580 or higher. If my credit score is 500-570, my DTI needs to be lower than 50% to qualify.

That said, to secure an FHA loan with a 50% DTI or higher, an applicant needs a credit score of 580 or higher. If my credit score is 500-570, my DTI needs to be lower than 50% to qualify.

Different lenders set different maximum DTIs to qualify for an FHA loan. 50% is only the maximum set by the FHA. Lenders often set their DTI limits lower than 50%.

I used a calculator tool to figure out my DTI before applying. To reach a lower DTI, I focused on increasing my income and consolidating my debt.

Michigan FHA loan limits

The FHA sets the maximum loan amount it’s willing to insure.

The limits vary by property type. They also vary by location, as housing markets are incredibly regional. In most counties in Michigan, the Michigan FHA loan limits are as follows:

- Single-family home: $472,030

- Duplex: $604,400

- Tri-plex: $730,525

- Four-plex: $907,900

You can get financing with FHA for condominiums as well. They are treated as “single-family homes.” and they follow the same rules and guidelines. You might need to obtain a HUD Condo questionnaire and the association has specific rules related to ownership. A Michigan resident can apply for an FHA loan to buy an approved single-unit condo. Condo loan limits are the same as those for single-family homes.

FHA Rules and Requirements in MI

Applicants must meet requirements beyond debt and income. To apply for an FHA loan, an applicant needs specific documents on hand. Some rules specifically regulate the FHA loan process for individuals who’ve filed for bankruptcy.

The home in question also must meet the FHA’s standards. Not all homes qualify for funding through FHA loans.

Documentation Requirements

When I was applying for a loan through an FHA-approved lender in Michigan, I needed to get my documents together. Fortunately, there are options for qualifying documents.

Legal Residency

First, the FHA requires documents to prove the applicant is a U.S. citizen, a legal permanent resident, or a legal non-permanent resident alien. These documents may include:

- State ID

- Driver’s license

- Social Security card

- Valid green card (Form I-551)

- Valid Employment Authorization Document (EAD)

- Valid non-immigrant work visa (i.e. H-1B visa)

Anyone who wants a primary residence in the United States can apply for an FHA loan. The USCIS hosts a list of valid EAD’s. That page also explains the process to get the document you need.

Proof of Income

After that, the FHA requires income-related documents. Applicants must have at least two years of income. These documents can be:

- W-2’s

- Profit & Loss sheets (self-employed)

- Tax returns

- Pay stubs

- Written verification of employment

- Documents from third-party verification (TPV) services

If an applicant was not employed for the past two years, consecutively, there are options. Applicants may secure FHA loans with documents proving school or military enrollment.

HUD offers this in-depth guide to qualifying documents. It was last updated in 2019.

Proof of Assets

Finally, the FHA requires documents for any other assets the applicant will use towards the down payment, or to repay the loan. This includes gift funds. Asset-proving documents include:

- Verification of Deposit (VOD)

- Gift fund documentation

- Bank statement

- Written statements from all joint-account owners

All co-owners of a joint account must consent to the applicant’s use of funds within the account. That is, all co-owners must affirm the applicant’s right to use joint funds to repay the FHA loan. This must be a written affirmation.

Property Requirments in Michigan

The FHA will only back mortgages on certain properties. To qualify for an FHA loan, a home must meet these specifications:

- Principal residence

- Single-family or multi-family home (up to four units)

- Pass FHA’s minimum property standards appraisal

- FHA loan recipient takes property title in the name (or in name of the living trust)

Principal residence means the home must be the loan recipient’s primary residence. It can’t sit unoccupied.

Nor can it be an investment property. The FHA loan program is meant to increase housing stability. So, a person who intends to be a landlord or to flip houses can’t take out an FHA loan.

The home needs to be safe and high-quality. An FHA-vetted appraiser will determine if a home is up to par.

There is only one circumstance where someone can take out an FHA loan to buy a home that needs repairs. That requires a 203(k) FHA loan. 203(k) FHA loans can fund both home purchases and renovation.

Mortgage Insurance Requirements

The FHA program is a mortgage insurance program. Recipients pay for that insurance. Insurance payments are bundled into the monthly loan repayments (mortgage payments).

If the recipient makes a down payment of 10% or more, they can stop paying into the insurance after 11 years. But, if their down payment was less than 10%, they will pay the insurance for the full duration of the mortgage.

Foreclosure Waiting Period Rules

Let’s say I lose a home to foreclosure. In that case, I can’t apply for an FHA loan for the next three years. I would need at least three years of stable payments before I’m eligible to apply for an FHA loan, post-foreclosure.

FHA Loan Requirements After Bankruptcy

FHA Loan Requirements After Bankruptcy

Bankruptcy does not prevent anyone from applying for a loan permanently. If I file for Chapter 13 bankruptcy, I’m eligible to apply for an FHA loan after one year passes.

If I file for Chapter 7 bankruptcy, I need to wait two years. After that, I can apply.

FHA Loan Michigan: State Rules and Requirements

The FHA loan program is a federal program. Most requirements are the same in every state.

The main difference is the lending limits. The maximum Michigan FHA loan limits are different than the maximum in, say, California.

FHA loan recipients can combine funding sources. First-time homebuyers in Michigan should look into state-based financial assistance options.

FAQs About FHA Loans in Michigan

Michigan residents have questions about how FHA loans work in our state. I’m happy to answer the most frequently asked questions. Let’s dive in.

Can I Apply For an FHA Loan With No Credit?

Yes. You can apply for an FHA loan even if you don’t have a credit score. It is illegal for lenders to discriminate against individuals with no credit.

You’ll just need to take a few additional steps. Before you can apply, you’ll need to confer with a manual underwriter. A manual can assess a non-traditional credit history.

A manual underwriter can determine the probability that someone will repay an FHA loan. Rather than use a credit score, the underwriter looks at your history of rent or utility payments.

Once a manual underwriter has assessed these factors (and others), you can apply for an FHA loan.

How Does An FHA Lender Determine My Interest Rate?

Different lenders might offer you different interest rates on the same home. The lender sets the interest rate according to three factors:

- Credit history

- Down payment size

- Home’s market value

You can use online calculators to predict possible FHA loan interest rates. Lenders’ equations vary. Don’t hesitate to shop around and compare rates.

Can I Finance Home Repairs With an FHA Loan in Michigan?

Yes. You can finance home repairs with an FHA 203(k) loan. If you’re interested in buying a fixer-upper with an FHA loan, check out this guide.

FHA 203(k) loans are valid in Michigan. They’re also a decent mortgage option in every U.S. state.

Can I Combine FHA Loan With Other Financial Help in Michigan?

Yes! You can definitely combine an FHA loan with other forms of financial assistance in Michigan. There are five popular options for homebuyers:

- MI Home Loan

- MSHDA

- Michigan DPA

- Habitat for Humanity MI

- Municipal homebuyer assistance funds

I can outline the main benefits of each of these programs. I encourage you to explore each of them further.

Also, keep in mind there are other home loan programs dedicated to specific demographics, like veterans. If you’re a member of a unique demographic, there might be loans dedicated to people like you.

MSDHA Downpayment Assistance For Borrowers in Michigan

MI Home Loan is a project through MSHDA. Michigan State Housing Development Authority (MSHDA) empowers first-time homebuyers across the state. Repeat homebuyers are eligible in targeted areas in Michigan. MI Home Loans have low, fixed interest rates and low down payment options. If I were to take out an MI Home Loan, I could choose from an FHA loan, a USDA loan, or a VA loan.

MI Home Loan Flex is a variant of the program that requires buyers to take an education course. Flex lets an individual take out a home loan while living with other adults. It’s available for qualified applicants, even when other resident adults don’t qualify.

The MSHDA runs all state housing programs in Michigan. It offers rental assistance, housing choice vouchers, fixed-rate home loans, and emergency housing programs for homeless people. In addition to the FHA loan program, MSHDA offers the Mortgage Credit Certificate (MCC) program. The MCC is a federal tax credit.

The MCC lets homebuyers credit up to 20% of their annual mortgage interest against their taxes owed. That means homebuyers can subtract 20% of their mortgage insurance payments from the total amount of taxes they owe.

So, say I, an FHA loan recipient, paid $500 in interest on my mortgage payments last year. With an MCC, I could subtract $100 from my taxes at the end of the year.

Michigan Down Payment Assistance (DPA) Requirements

MSHDA offers a down payment assistance program. The DPA is a zero-interest second mortgage.

Qualified homebuyers can take out a loan of up to $7500 through the DPA program. This loan covers the cost of a down payment and other closing costs. The recipient must make a minimum investment of 1% of the purchase price.

DPA loans are zero-interest. The borrower makes no payments until the first mortgage is paid off. Or, the borrower must begin paying back the DPA if the home is sold or refinanced.

Habitat For Humanity in Michigan

Habitat for Humanity is a non-profit organization. Homebuyers who meet requirements set by the organization can purchase a home with a guaranteed low monthly payment. Habitat for Humanity makes sure their homebuyers spend less than 30% of their income on housing every month. This rate combines the homebuyer’s mortgage, insurance, and property tax payments.

Qualified homebuyers can work with Habitat for Humanity to pay less, on top of receiving an FHA loan. This non-profit sets qualifications city by city. This page lists the qualifications an applicant needs to buy an HfH home in Detroit.

Habitat for Humanity is unique because it asks for “sweat equity.” Homebuyers trade volunteer hours for reduced rates.

Municipal Homebuyer Assistance Funds in Michigan

Homebuyer assistance funds are held by local or regional departments. These municipal funds are, typically, grants. Grants do not need to be repaid.

To find funds you qualify for, look up “housing development funds” in your city or town. For example, this page describes homebuyer grants available in Grand Rapids, Michigan. Also, search for regional “non-profit housing corporations.”

A certified FHA lending partner can help you find grants you qualify for. I know my lender helped me when I applied. Gustan Cho Associates created a guide to low-down payment home purchase programs.

These sorts of resources proved invaluable when I sought out an FHA loan. Now, hopefully, all homebuyers in Michigan have a place to start.

Get Qualified For Home Loans Today

Looking for an FHA loan, Michigan residents? Get a quote in less than five minutes.

Apply now, and our expert lenders will be in touch ASAP.

Michigan Down Payment Assistance Program

The Michigan State Housing Development Authority (MSHDA) has a number of different home buyer assistance programs available.

- MI DPA Loan: Down payment assistance of up to $7,500 is available in every state.

- MI 10K DPA Loan: In certain ZIP codes, you may receive up to $10,000 in down payment assistance. Here is a list of qualifying ZIP codes.

In addition to these DPA loans, MSHDA provides a homeownership education course and a mortgage credit certificate to help you save money on your taxes.

The MSHDA website provides further information. HUD’s website also has a list of additional housing assistance programs in Michigan.