FHA Loan Without a Spouse

Are you looking into purchasing a home and wondering if it’s possible to do so without having your spouse as a co-signer? If so, then you may be interested in learning more about getting an FHA loan without your partner. Many people are unaware that they can apply for a loan on their own, even if they’re married. In this blog post, we’ll explain what an FHA loan is, the eligibility requirements for this type of loan, and how you can apply for one without having your spouse as a co-signer.

In this article (Skip to…)

What Is An FHA Loan?

An FHA loan is a mortgage insured by the Federal Housing Administration (FHA). This type of loan requires a low down payment and generally has more lenient credit and income qualifications than conventional loans – making them a great option for many homebuyers, especially first-time homebuyers.

Who Qualifies For An FHA Loan Without a Spouse?: You may be eligible for an FHA loan without your spouse if you meet the following requirements:

- You are not married and have no dependents

- The property is for your own use and not for investment or rental purposes

- Your income meets the debt-to-income ratio requirement of 31% (housing costs cannot exceed 29% of gross monthly income)

- You do not currently have any other outstanding mortgages or liens against the property.

How to Apply For An FHA Loan Without Your Partner?

Applying for an FHA loan without your partner is similar to applying with a spouse. You will need to provide the same documentation and information as a married applicant, just without your partner’s signature or credit report. Here are the documents you’ll need to get an FHA loan without your partner:

- Proof of income (tax returns, pay stubs, etc.)

- Bank statements

- Credit reports

- Mortgage application

- Property appraisal

- Down payment funds

FHA Loan Without a Spouse in a Community Property State

The legal requirements of your state could affect the mortgage loan process. Do you reside in a community property state? Community property regulations dictate how liabilities acquired throughout marriage are to be separated during divorce proceedings. This can also influence the debt-to-income ratio so that lenders need to confirm any financial commitments made by borrowers where relevant.

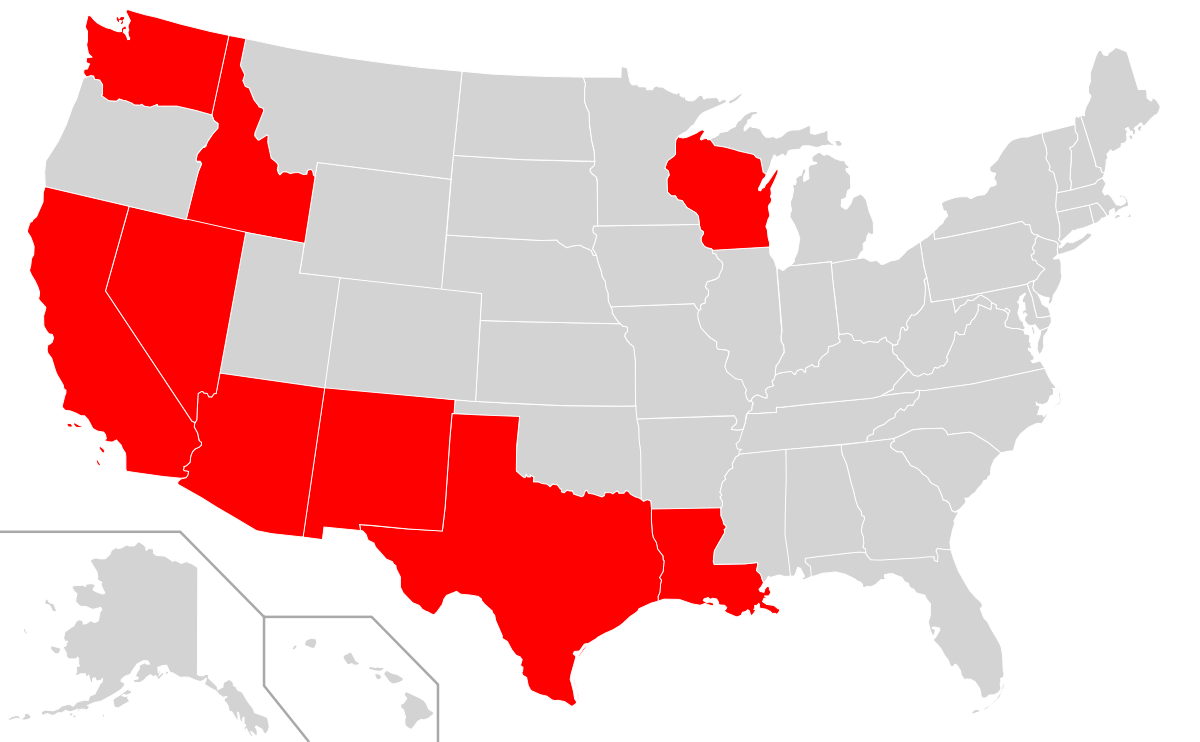

In the majority of states, it is not necessary for your partner to be named on the mortgage loan. But if you are taking out an FHA loan in one of nine community property states, their debts may still influence your capability to get a mortgage even though they won’t show up on the mortgage loan.

Living in a community property state can be financially beneficial for married couples – as all debt and assets must be shared. In these 9 states, lenders are required to include the non-applicant’s debt when calculating FHA guidelines, no matter what. These nine states that adhere to this policy are:

Applying for an FHA loan without your spouse is possible with the right qualifications and documentation. If you meet the eligibility requirements and have all of the necessary paperwork in order, then you can apply for an FHA loan on your own. Remember that it’s important to shop around and find the best loan for your individual situation. With the right lender, you can get a great deal on an FHA loan without having to involve your spouse. Good luck!

Qualifying For FHA Loan When Your Spouse Has a Bad Credit Score

If you are the only one applying for the FHA loan, your spouse’s credit won’t be taken into consideration. However, their information will still be used to determine if you qualify based on the qualifying ratios. If you go with a conventional mortgage (not FHA) for your new home, the lender will not be able to consider your partner’s credit report or any debt that may appear on it.

Once couples have assessed their eligibility and improved their chances of being approved, it is important to make sure they are financially prepared for the loan. This includes having enough money saved for a down payment and closing costs, as well as making sure both spouses understand all the terms of the loan agreement before signing on the dotted line.

Does My Wife Needs To Sign a Mortgage Closing Disclosures?

By signing the mortgage agreement, a spouse offers assurance that their partner is taking out a loan for an essential home. This vital step safeguards them from any unforeseen increments to their mortgage payments.

Refinancing your home can be a tricky process, particularly for non-FHA loans as many states require signatures from both spouses. Unfortunately, there is much evidence of one spouse refinancing the house and taking money out without informing the other partner. Particularly if divorce proceedings are underway. This unethical behavior highlights why proper communication between couples is essential during financial negotiations.

Am I Still a First-time Buyer If My Spouse is Not?

If you and your partner have not owned a home within the last three years, then you are eligible to be deemed as first-time buyers. The IRS and national property laws have declared that if your spouse hasn’t owned a home in the past three years or owns one currently, you qualify as a first-time buyer. However, if either of these conditions are not met, then no matter what the case may be – homeownership by one partner is shared with their significant other since it becomes an asset for both parties.

When married, even if only one spouse is on the deed of a home, both spouses are considered owners. This means that should anything happen to either person, the property/estate will pass onto the surviving partner – regardless of whether they were listed on the deed or not. Moreover, if it has been three years since owning a house before marriage (or longer), you become eligible for first-time buyer status once again!

Can I Get an FHA Loan If My Spouse Has One?

If you are assisting a family member in being approved for a loan by co-signing, it is possible that you may be eligible to secure two FHA loans simultaneously. This would apply if the existing mortgage payment and the newly cosigned loan were both FHA mortgages; however, keep in mind this means taking full responsibility should your co-signer fail to make their payments – thus making them yours as well.

Should I Add My Fiancé to My FHA Loan?

Your finance can be added to you loan as a occupying co-borrower and help you to get qualified for a bigger loan amounts as soon as she has a job and decent credit score. She can help you with extra cash at the closing and when your mortgage broker will be calculating your DTI Ratio. If you are engaged, the FHA lender is absolved from having to include your fiancé’s credit or monthly obligations when making a determination on eligibility.

Can I Remove My Wife or Husband From My House’s Mortgage?

Yes, you can refinance your mortgage and remove your husband, wife or spouse. However you need to go through standard FHA qualification process requiring documents such us: W2, bank statements and paystubs.

Adding your spouse’s name to an existing title is simple with a quitclaim deed. However, if you desire to add the unnamed partner’s name onto an already existing mortgage, then refinancing must be completed and approved first in order for both applicants’ names to appear on the new document.

Do I need to Add My Wife if We Are Getting Divorced or In Separation?

Legally married couples must adhere to the FHA policy on non-applicant spouses; however, if you are going through a divorce and would like to refrain from involving your spouse, it is essential that you wait until after your divorce proceedings before applying for an FHA loan.

Divorce should not impede your ability to secure an FHA mortgage. However, if you have legally binding documents outlining how debts and other issues will be handled, the lender may ask for them as part of their loan application process.

Can I get Preapproved for a FHA Loan Before my Divorce is Final?

Even without a finalized divorce agreement, you can still receive preapproval for a mortgage. The caveat is that the document must include particular stipulations and be signed by both parties prior to approval. Additionally, if either party receives spousal or child support payments, this information needs to be disclosed upon your application in order to move forward with receiving the loan. Moreover, bear in mind the distinction between pre-qualification and pre-approval.

Pre-qualification provides an idea of what size loan you are eligible for, however it is a considerably less demanding process than that of getting pre-approved. With regards to the latter, full documentation will have to be provided to the lender which will then result in a conditional agreement on granting you with a mortgage.

By presenting a preapproval letter, you can demonstrate to your partner, legal counsel, the mediator and/or judge that you are capable of securing new financing when needed. To further supplement this proof of financial capability and provide greater context, lenders may want to see a property settlement agreement if it is part of your final decree as it can influence their assessment on debt-to-ratio income levels.

Moreover, they will also need to be familiar with any properties owned by your spouse so they have an understanding of what debts belong solely within your personal finances.

January 9, 2023 - 6 min read