List Of Mortgage Lenders for Self Employed Borrowers

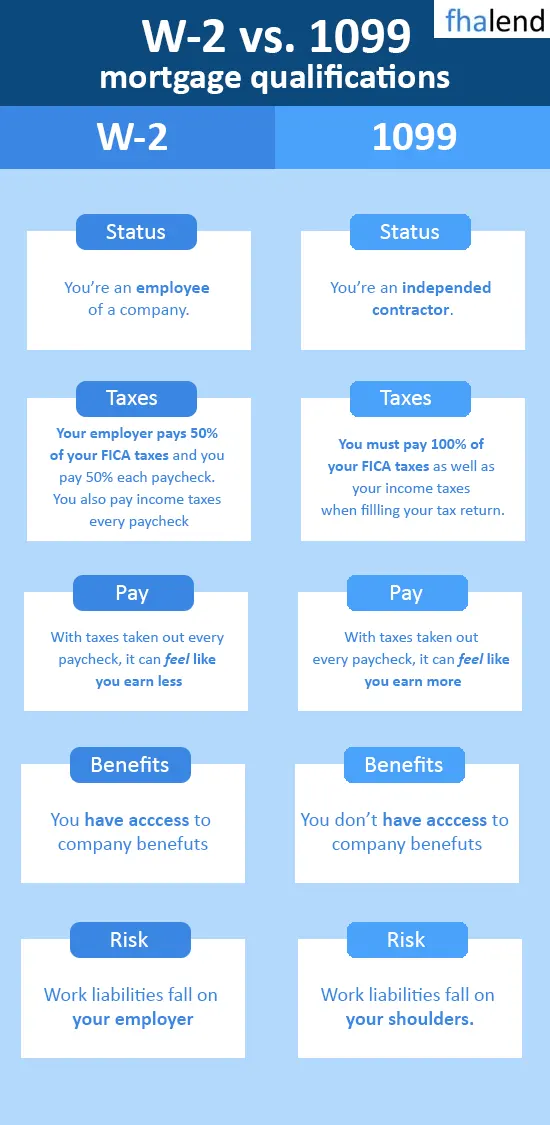

Many clients applying for a mortgage on our website is looking for a financing without having their W2 forms from last 2 years. There is not many reliable mortgage lenders for self-employed who do financing for company owners. These are business owners, realtors, commission salary workers who have 1099 from last few years instead of just regular salary income provided by their employee. So can I get approved for a mortgage if I am self-employed? Yes, you can apply with us for a loan targeted to self-employed people who are business owners and they can still qualify for a mortgage and buy their dream home.

We do self-employed financing at FHA Lend, and we are licensed in 48 states, our main goal is to help people with lower credit score or without W2s to pre-qualify for a loan so you can start shopping for a house tomorrow.

In this article (Skip to…)

Who is a Self-employed Person in HUD Guidelines

Under HUD guidelines, self-employment is defined as any trade or business in which an individual has a “material participation”. This means that the applicant must have ownership in the business and be actively involved on a daily basis for at least two years leading up to the loan application date. In addition, HUD requires that applicants demonstrate stability and predictability of their income over time.

Mortgage Lenders or Mortgage Brokers consider anyone with a 25% or greater stake in a company, or someone who is not employed through the conventional W-2 system, to be self-employed. If you’re self-employed, there are plenty of ways your income can qualify for a mortgage loan. Mortgage lenders typically consider any reliable source of steady earnings that is continuous and consistent, including but not limited to:

- Interior Design

- Realtor

- Savvy entrepreneurs

- Freelancers

- Contractors

- Seasonal work

- Gig work and side jobs

- Catering Services

- Virtual Assistants

- Personal Trainer

Guidelines To Qualify For a Self-Employed Mortgage Loan

- Bank Statements from last 1-2 years

- Minimum Downpayment of 5-15%

- FICO credit score of 580+

- Two years of business tax returns including schedules K-1, 1120, 1120S

- Business License (proof of business)

- You might need also Profits & Loss Statement, 1099 form

- List of assets

- List of Debts

Even if you feel that you won’t meet the qualifications or have been informed by other lenders that your application will not be approved, we can still assist. You don’t need to worry about meeting all of the guidelines above or having self-employment for less than two years. We’ll find a suitable mortgage option for you. Please contact us at 888-900-1020 to see your options.

Mortgage Lenders For Self-employed List for 2023

Home Express

Change Mortgage

Carrington Mortgage Services

Loan Stream Wholesale

Citadel Servicing/Acra Lending

Newrez

Oaktree Funding

HomeBridge

On Q Financial

Eligibility Criteria’s For Self-Employed Borrowers

When it comes to eligibility criteria for self-employed borrowers, HUD looks at several factors. These include annual income, cash flow/liquid assets available, credit history, and debt-to-income (DTI) ratio. HUD also considers how long the applicant has been self-employed and the nature of their business.

We have access to thousands of products from FHA, USDA and VA loans to NON-QM, Asset Depletion, Bank Statement programs and DSCR loans for investors. If we not going to find you a product, than you local credit union or your local bank will not do it. As mortgage brokers with access to 200 lenders and different wholesale loan providers who don’t require a 640+ credit score for pre-approval – our goal is to provide you all available options so no one is left behind.

Programs For Self-employed People

Bank Statement Loans

If you are applying for a self-employed mortgage, these programs will require 12-24 months of your business and/or personal bank statements to ensure that regular deposits (income) have been made. Fortunately, no tax returns will be requested; this is the basis upon which approval can be granted.

One Year Tax Return Mortgage

The one year tax return mortgage is perfect for those who have just recently become self-employed. This innovative program allows borrowers to qualify with only a single year of fully documented income on their taxes, giving recent entrepreneurs the chance at financing they need and deserve.

Steps To Qualify With a Self-Employed Mortgage Lender

If you’re self employed, it is wise to initiate the following measures well in advance of submitting a loan application:

- credit Score – highest possible credit score you can attain, since it will not only help with your down payment requirement but also influence the interest rate you receive. There is no exact minimum credit score required, so do whatever it takes to get yours as high as possible!

- documents – As a self-employed individual, lenders will require 12-24 months of bank statements to use as evidence of your income when you apply for a mortgage. It is essential that all business revenue be deposited into the appropriate accounts so it can be easily accessed during this process. To avoid any complications down the line, make sure to deposit cash payments right away!

- cash – Make sure to set aside a 5%-10% down payment for your self-employed mortgage. This amount is typically required by lenders and will vary depending on your credit score.

Required Documents for Self-Employed People

Applying for a mortgage as a self-employed is different than for a regular FHA or VA loan. As such, lenders require extensive financial information to get started. If you’re self-employed, it’s likely that at least two years of your full financial history will need to be provided as documentation.

Self-employed individuals have the same access to mortgages as traditionally employed people. Applying for a mortgage is no different if you are self-employed – the qualifications remain identical: credit score, debt load, down payment amount and income all need to align with requirements. With this in mind, it’s easy to see that getting your foot on the property ladder doesn’t take any extra legwork when you’re working independently.

While the documentation of income for self-employed individuals can be more intensive than that of W-2 employees, as long as your cash flow meets loan qualifications and you’re able to provide reliable proof of steady revenue sources, purchasing a house or refinancing should still be an option. Therefore, don’t let being self-employed stop you from achieving your dreams.

To attain a home loan, most mortgage lenders necessitate at least two years of steady self-employment. Lenders define “self-employed” as someone with an ownership stake of 25% or more in a business, or who does not receive W2s from their employer. Luckily for some, there’s the possibility to bypass this two year prerequisite:

- If you’ve been self-employed for one year and can present evidence of your two years in a related field, you may be eligible. Demonstrate that the income generated from your new role is equal to or greater than what was earned in the W2 position and voila! You’re all set.

- Some lenders will accept one year of related employment, plus a single year of formal education or specialized training experience as an acceptable work history.

Best Mortgage Lenders for Self Employed Borrowers

When searching for the best mortgage lenders to support self-employed workers, it is important to identify programs tailored towards those who can use their tax returns as proof of income, or no doc loans. While traditional banks are typically not the most suitable choice when considering self employed borrowers due to how they view net income after deductions and write offs; specialized mortgage lenders will offer bank statement loans, stated income options, and other innovative loan solutions that don’t require tax returns.

Applying with an Amended Tax Return as Self-Employed Individual

Amending your tax return can happen for a variety of reasons, such as filing with incorrect information or to make changes to a return that was already filed. When filing amended returns, it’s important to be accurate and submit the correct information in order to avoid any potential complications with the IRS.

When applying for a mortgage, lenders require borrowers to provide proof of their income by submitting tax returns. When lenders review amended tax returns, they look for proof of consistency with the original return and any changes that were made. Lenders also want to make sure the taxpayer was willing to comply with filing accurately and correctly.

When applying for a mortgage with an amended tax return, it’s best to be upfront and transparent about the changes made. Make sure to provide a copy of all returns – both original and amended – along with an explanation of the changes. It’s also important to provide documentation that supports any adjustments or changes that have been made, such as bank statements or proof of deductions.

Can I Qualify With 1 Year Employment History as Self-Employed?

What income do banks look at for self-employed?

How much can a self-employed person borrow on a mortgage?

How do loan companies verify self-employment?

How much income do you need to qualify for a $300,000 home as self-employed?

How much money do you need to make to buy a $400,000 home as self-employed?

How to qualify for a 600k mortgage as self-employed?

Do self-employed individuals have access to down payment assistance?

My Spouse Is Not Self-Employed, What to Do?

Don’t let your business write-offs prevent you from obtaining home financing! Numerous startups, both large and small, may not be profitable on paper due to the losses they display on their tax returns. Although these deductions can help reduce taxes owed, they could also decrease qualifying taxable income when applying for a loan. Ensure that your hard work is rewarded by understanding how write-offs will affect mortgage eligibility.

January 22, 2023 - 10 min read