DSR Loan For Investors Requirements

We all know that getting a loan isn’t always easy. Everything is considered, from your credit history to your employment type. When evaluating these criteria, loan officials can be very strict. Your Debt Service Ratio is one of the first things your bank will look at (DSR).

In this article (Skip to…)

Finning Investment Properties With DSR Loan

The DSR is “a tool used by banks to determine whether or not you can afford the loan you’re looking for.” The debt-service coverage ratio is a term used in corporate finance (DSCR) and measures a company’s available cash flow to meet current debt commitments. The DSCR provides investors with information about a company’s ability to pay its debts.

In the case of a mortgage, this formula effectively aids the bank in determining how much you can afford in monthly installments. Corporate, government, and personal finance all use the debt-service coverage ratio.

The DSR loan, known as a DSCR loan, is a type of secured loan, which means getting an investment mortgage without worrying about your debt-to-income ratios.

- The debt-service ratio is abbreviated as DSR.

- The debt-service coverage ratio is abbreviated as DSCR.

Whether refinancing or purchasing, the DSR mortgage is available at 30-year fixed rates and an ARM. The property’s cash flow is calculated using the debt service ratio calculator.

What is a DSR Loan

The DSR, or Debt Service Ratio, is a statistic that the bank uses to determine if you can repay the loan. Depending on the individual, each bank has its own set of standards. As a result, while some banks may accept a DSR of up to 80%, others may only take 50%. A DSR loan is a type of loan that uses your property’s income-producing potential as collateral. This means that the loan amount you can qualify for will be based on your property’s ability to generate income, rather than on your personal credit score.

The DSR limit varies depending on the individual and their net income. Some high-net-worth individuals are even permitted to have a DSR of 100%! As you can see, everything is relative. Personal debt-to-income ratios can be a problem with standard loans, but the DSR mortgage can help. Instead of using personal income, the DCR loan must meet a 100 percent ratio — there are no other ratio possibilities.

- Fannie Mae and Freddie Mac do not back these loans.

- Wholesale portfolio lending, also known as Non-QM financing, makes them available.

- This Non-QM loan program permits properties to be closed in either an LLC or a corporation.

Property Types Eligible for a DSR Loan

- Condominiums and single-family homes (warrantable and non-warrantable).

- Townhomes and duplexes

- 3 to 4 multi-unit buildings if you cannot qualify with FHA loan for multi-unit

- There are also portfolio blanket loans.

- Blanket loans for multi-unit and 5-20 unit properties.

DSCR Loan Rental Income

The rental revenue generated by the property must meet or above the lender’s coverage ratio criterion to qualify for a DSCR loan. The coverage ratio is calculated by dividing monthly rental income by the mortgage payment, and it usually ranges from 1.0 to 1.5 times, depending on the lender and borrower.

- An appraiser’s valuation of the property – The rental value of the property as determined by a qualified appraiser, which represents the market rent for the subject property.

- The real rent for which the subject property is rented if the property is leased.

If the subject property is not currently leased, the market rent for the subject property, as assessed by an appraiser, is used to calculate gross rental income. A rental addendum is employed to establish the market rent for the subject property.”

What Influences My DSR?

Several things can influence DSR, including:

- Unpredictable monthly revenue may harm your loan payments.

- Too Many monthly payments – This tells potential lenders that you have a medium to high likelihood of not repaying the loan even if you get it.

- Job Industry Banks will look at your job industry (as well as the length of time you’ve been employed) to see if it’s a stable occupation.

How to Get Approved For DSR Loan

To qualify for a DSCR loan, you’ll need to have a property that is generating income. The property can be either commercial or residential, but it must be generating rental income or income from some other source. The property must also have enough equity to cover the loan amount you’re looking to borrow. In terms of the loan itself, a DSR loan is typically structured as a line of credit. This means that you’ll be able to borrow up to a certain amount, as determined by your property’s income-producing potential, and you can use the funds for any purpose you see fit.

The repayment terms will vary depending on the lender, but you can typically expect to make interest-only payments for the first few years, with the principal amount due at the end of the loan term.

DSR Mortgage Loan Rates And Terms

Seasoned investors make a monthly income from a rental property. Taking advantage of the area’s finest rental properties necessitates having rapid access to cash to buy the property and make required repairs and improvements in order to receive the greatest return on your investment.

FHA Lend has competitive loan programs created for seasoned investors in mind, allowing them to bypass the red tape and get the money they need for excellent rental houses. Our clients benefit from a personalized loan application process that ensures closing on their terms with minimal delays and hassles.

| DSR Mortgage Loan Rates And Terms | |

|---|---|

| Availability | trusts, individuals, corporations, and limited partnerships. |

| Loan Term | 30-Year Fixed-Rate Rental Loans with interest-only options |

| Loan Amount | From $75,000 to $3,500,000 |

| Loan To Value | LTV up to 80%,Rate-Term Up to 80% Cash-Out |

| Short-Term Rentals | Okay (AirBnb,VRBO) |

| Gift Funds | Allowed |

| Negative Cashflow | Allowed |

| Property Types | Single-family, condos, townhomes, multi-family 2-4 units |

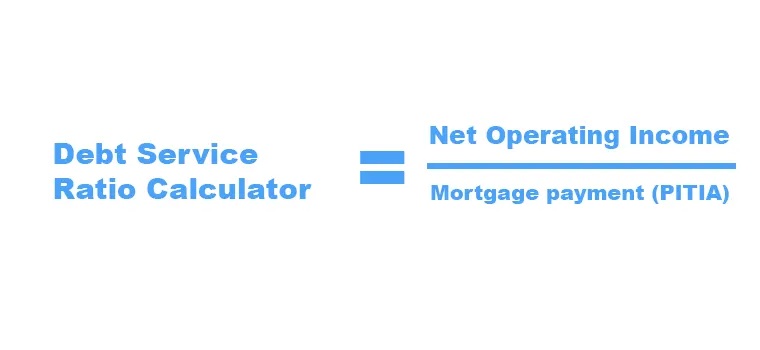

Formula and Calculation for the DSR

Calculating your DSCR is essential for any real estate investor, but knowing your desired DSCR is just as crucial.

Commercial lenders are extremely cautious when it comes to underwriting. Because personal credit records are rarely used in commercial lending, other variables influence lending choices. Because the commercial property is bought to create revenue, one of the most common criteria is to examine the income to see if it is sufficient to pay off the mortgage and leave a profit for the borrowers.

Lenders use DSR to assess the borrower’s ability to manage additional debt responsibly. A high DSR may indicate a higher risk of default, making loan approval less likely or leading to less favorable terms.

The debt-service coverage ratio is calculated using net operating income and total debt servicing for the company. Revenue minus certain operating expenditures (COE) is net operating income, excluding taxes and interest payments. It is frequently compared to earnings before interest and taxes (EBIT).

Simply multiply the result by 100 to obtain your final DSR in percentage ( percent ). Don’t get too worked up just yet! Here’s an illustration of the formula in action.

Using Excel to Calculate DSR

You can’t just divide net operating income by debt service to get a dynamic DSCR formula in Excel. Rather, you would title two consecutive cells, A2 and A3, “net operating income” and “debt service,” and then place the relevant amounts from the income statement adjacent to those cells in B2 and B3.

Enter a DSCR formula in a separate box that uses the B2 and B3 cells instead of real numeric values.

Calculating DSR Ratio With PITI

PITIA stands for the five most important components of a monthly mortgage payment beyond the size and term of the loan:

- Principal

- Interest

- Taxes

- Insurance

- Association dues

All the above five factors will affect your estimated monthly payment; let’s examine how each does so in its own way. (we will use a $300,000 mortgage as an example below)

Principal The amount you borrowed from the lender is known as the loan’s principal. In our example of a $250,000 mortgage, the principle is $250,000.

Mortgage Interest Rate The interest rate is the cost imposed by the lender on providing you with money. The higher the interest rate on a mortgage, the greater will be your monthly payments. Since interest rates are a major factor in housing affordability, homebuyers may generally borrow more when rates are low.

Let’s take our $300,000 mortgage as an example. In this case, it is a 30-year fixed-rate mortgage with an interest rate of 5.5%. (We’ll get to taxes and insurance later, so for the time being, assume there are no additional fees.)

Based on a calculation using our mortgage calculator the typical monthly payment on a loan with 6% interest and 20% downpayment is $1,830. Here’s how much the principal and interest amounts vary throughout the first few years of a mortgage:

| DSR | Principal | Interest |

|---|---|---|

| Month 1 | $238.00 | $1,200.00 |

| Month 2 | $239.19 | $1,198.81 |

| Month 3 | $240.39 | $1,197.61 |

| Month 3 | $241.59 | $1,196.41 |

Taxes Your property’s tax is collected by government agencies and used to pay for various municipal services such as water treatment and road maintenance, as well as public schools. Because of this, lenders frequently set up an impound escrow account for real estate taxes, where the lender collects a monthly payment destined for your taxes and keeps the total until your annual taxes are due.

Insurance There are two distinct types of insurance coverage to consider throughout the house-buying process: homeowners insurance and private mortgage insurance. The first type, homeowners insurance (sometimes referred to as property insurance), protects the buyer in the case of a natural disaster or another unforeseen catastrophe. PMI is a type of insurance that protects the lender in case you default on your mortgage and fail to pay back the loan amount. When a borrower makes a down payment of less than 20% of the property’s price, this form of insurance is required.

Association Dues to a homeowners association are frequently neglected in the budgeting process. If you acquire a home with a homeowner’s association, you will be required to pay a monthly fee to keep the facilities up and running. Fees can vary greatly, from a few dollars per month to several hundred dollars per year, so ensure that you take this into account when searching for a property.

Calculating CashFlow For DSCR Loan

The debt-service coverage ratio (DSCR) measures available cash flow to pay existing debt commitments. The DSCR is a technique used to assess companies, projects, and individual borrowers.

Macroeconomic considerations impact a lender’s minimum DSCR. It’s a crucial idea in commercial lending and real estate finance. It’s crucial when it comes to commercial real estate business loans and tenant financials, and it’s a big element of figuring out how much money you may borrow.

DSR vs. Interest Coverage Ratio

Simply divide the EBIT for the established period by the total interest payments due for that same period to get the interest coverage ratio. EBIT, also known as net operating income or operating profit, is determined by subtracting revenue from overhead and operating expenses such as rent, cost of products, freight, labor, and utilities. After deducting all essential expenses to keep the business running, this number represents the amount of cash available.

Condition of Property

Although properties must meet traditional conventional loan criteria. There are also fix and flip loans for properties that don’t meet the guidelines, they are short-term loans based on a liquidity ratio rather than a debt-service ratio.

- Funding towards the purchase of the property.

- The renovation will be financed.

- To profitably sell or refinance into a permanent debt loan type.

Consider Affordability

The DSR merely compares your total debt to your net income to determine whether you qualify for the home loan you’re seeking. This is because your monthly obligations are not the only costs you must pay. What about the other non-fixed costs, such as food and utilities?

How to Increase Your Chances to Qualify For DSR Mortgage Loan?

you can improve your DSR by either increasing your income or reducing your debt. Strategies to improve your DSR include paying off existing debts, increasing your income through salary raises or additional sources of revenue, and budgeting to manage debt more efficiently. Your DSR should be between 30 and 40%. Even while many banks may evaluate your loan application if your DSR is below 70%, it’s advisable to be careful and avoid a history of too many loan rejections. Improving your DSR begins with the following:

| Increase Your Changes To Qualify For DSR Mortgage Loan – checklist |

|---|

| Lower your overall debt |

| Maintain a solid credit score and history |

| Maintain a minimal credit card balance |

| Demonstrate your financial stability |

| Combine your earnings |

| Start building your credit history immediately if you don’t already have one |

My DSR Loan Was Denied?

Don’t let a single rejection bring you down; there are many strategies to prevent this from happening again. You can improve your situation by reducing current obligations and consolidating your loans and invoices.

If I Own a Business Can I Qualify For DRS Loan?

In order to qualify for a DSR loan, businesses must meet certain requirements. First, the business must have a strong financial history with consistent revenue and profit growth. The business must also have a good credit score and a healthy balance sheet. Finally, the business must have a solid business plan that demonstrates how the loan will be used to grow the business.

A DSR loan can be a great way to finance the growth of your business. The loan can be used to fund expansion projects, purchase new equipment, or hire additional staff. The DSR loan can also help you improve your cash flow and working capital position.

In order to qualify for a DSR loan, businesses must meet certain requirements. First, the business must have a strong financial history with consistent revenue and profit growth. The business must also have a good credit score and a healthy balance sheet. Finally, the business must have a solid business plan that demonstrates how the loan will be used to grow the business.

Are there DSR requirements for different types of loans?

Yes, different types of loans and lenders may have varying DSR requirements. Mortgage loans, for instance, often have stricter DSR criteria compared to personal loans or credit cards. It’s essential to understand the specific DSR requirements for the type of loan you are seeking.

Are there specific types of loans where DSR is particularly important?

DSR is crucial for mortgage loans, as lenders closely scrutinize a borrower’s ability to handle the long-term financial commitment of a home loan. It’s also significant in other types of loans, such as personal loans, car loans, and business loans, though the importance may vary by lender and loan type.

How to Get a DSR Loan

If you’re interested in getting a DSR loan, the first step is to contact a lender. There are many lenders or brokers like FHA Lend which offer DSR loans, so whenever you a ready give us a call or go here to apply and check your DSR Lon Eligibility. Once you contact us, you’ll need to complete an application and provide financial documentation. After your loan is approved, the funds will be deposited into your account and you can start using the money to grow your business.

October 25, 2023 - 9 min read