VA Loans With Low Credit Score Requirements

Homebuyers can get approved for VA loans with low credit scores. VA home loans do not have a minimum credit score requirement nor a maximum debt-to-income ratio cap as long as the borrower can get an approve/eligible per automated underwriting system (AUS). The key in getting an AUS approval for VA loans with low credit scores is to have timely payments in the past 12 months. The key to getting an AUS approval on VA home loans is to have strong residual income. VA loans are the best loan program in the nation. There is no down payment required on VA loans and no mortgage insurance requirement. VA home loans have lenient mortgage guidelines for bad credit and low credit scores.

What Is The Lowest Credit Score You Can Have For a VA Loan?

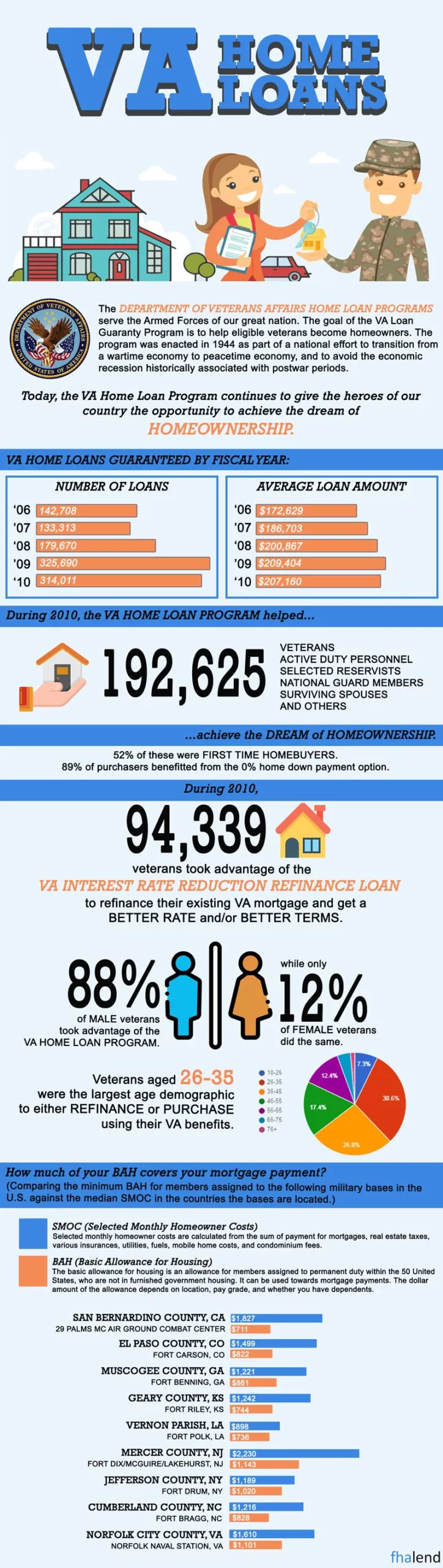

One of the greatest benefits a Veteran of the United States Armed Services can get by serving our country is to be eligible for a VA mortgage home Loan. The VA Loan Program was launched back in 1944 to reward our Veterans for their service. Many veterans returning from the Second World Ward benefited from the newly created VA home mortgage Loans. It made homeownership affordable and very easy. It meant that Veterans can Qualify For VA Loan With Bad Credit or less than perfect credit. In this article, we will discuss and cover qualifying for a VA mortgage with bad credit and lower credit scores.

Bad Credit VA Mortgage Guidelines

One of the factors that really went in creating the VA Loan Program was to streamline the complexities for Veterans applying for a VA Loan with low credit by the following:

- Being able for the veteran to qualify for VA Loan with low credit or less than perfect credit

- Reduce the hassles of getting a mortgage loan

- Making the home buying process affordable by requiring no down payment

- Allowing sellers concessions for Veteran home buyers of up to 4%

- This is so home buyers do not have to come up with any closing costs out of pocket

- If home sellers will not give sellers concessions, the Lender can offer lender credit in lieu of a higher mortgage rate

VA Funding Fee can be rolled into a Loan so no money out of pocket.

No Money Out Of Pocket On Home Purchase

A Veteran with a VA Loan can purchase a home with their VA Loan with zero down payment and zero closing cost and no money out of pocket:

- The government made a point that Veterans can qualify for VA Loan with bad credit

- This is because most military personnel who served our country overseas lacked credit

- Especially established good credit

- Many Veterans did not have any money saved for a down payment on a home purchase

To honor our men and women in uniform, the United States government created the VA Loan Program as a way of rewarding and thanking our Veterans after the completion of their service in helping them become homeowners with a VA Loan.

How Do VA Loans Work?

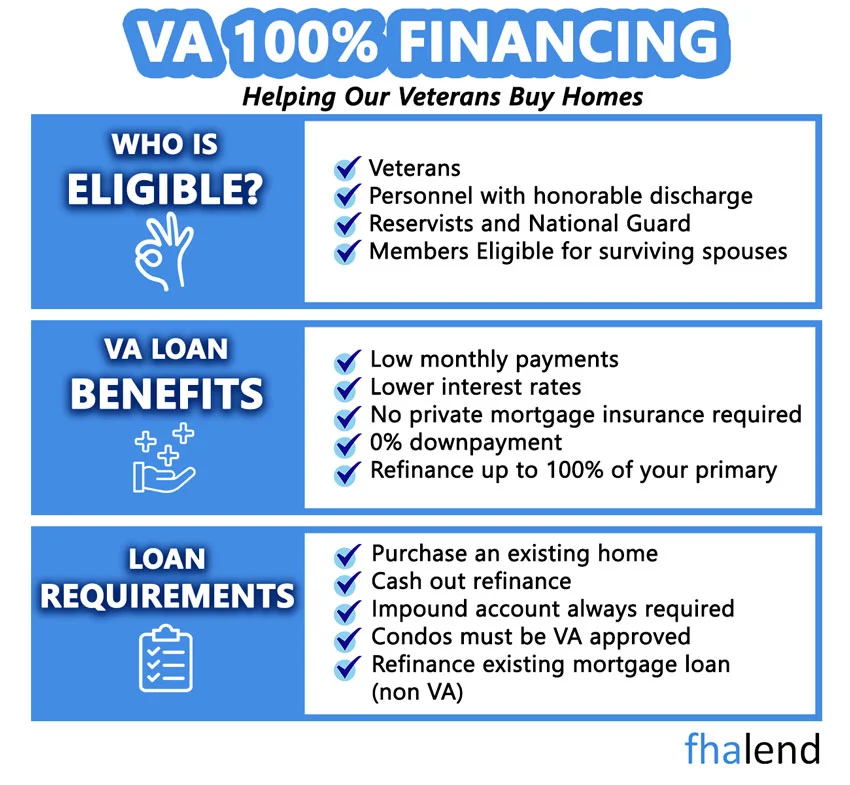

VA home loans are only limited to Veterans who have an honorable discharge with an active Certificate of Eligibility or COE.

Here are the basics on VA Loans:

- No money down

- 100% Financing

- Up to 4% of sellers concessions

- There are no maximum loan limits on VA loans

- Any VA loan higher than the conforming loan limit of $647,200 is called VA high balance loans or VA jumbo loans

- The United States Department of Veteran Affairs, or VA, is not a mortgage lender and does not originate, fund, or service VA Loans

- The Department of Veteran Affairs guarantees VA Loans to lenders

Guarantees all VA Loans will be paid and insured if the homeowner defaults on his or her Loan and goes into foreclosure.

How To Qualify For VA Loans With Bad Credit?

Borrowers with a Certificate of Eligibility can qualify for VA Loan With Bad Credit. In general, VA Lenders want to see the following:

- Veterans can qualify for VA Loan with Bad Credit but VA Lenders do want to see the timely payment in the past 12 months

- Periods of bad credit is fine, but lenders want to see re-established credit

- VA Lenders want to see stable income and good signs of anticipated income for the next three years

- Lenders want to see the veterans will be able to pay their new VA Loan timely

- Also, borrowers will be able to pay all of their other monthly income comfortable

- Lenders want to see enough disposable income by borrowers to be able to meet the VA requirements and standards for the cost of living

- Stable income under the eyes of the VA is considered 2 years of the same employment and continuation of employment for the next three years

- FHA Lend has no credit score requirements on VA Loans

- FHA Lend has no debt-to-income ratio requirements on VA Loans

- However, many lenders require a higher credit score

- VA does not have a credit score minimum so you can qualify with 500, or you can have a 550 credit score and get a VA Loan

- It is the VA Lender that requires and sets the credit scores

- This is called a VA Lender Overlay

Borrowers can qualify for VA Loans with a 60% debt-to-income ratio. Sometimes, you can get an approve/eligible with a higher debt to income ratio than 60% with strong residual income.

VA Loans With Low Credit Scores And High Debt To Income Ratio (DTI)

VA Loans is a special loan program that is only available to Veterans of the United States Armed Services with a valid COE. COE stands for Certificate of Eligibility. Only Veterans who have served in a branch of the U.S. Military with an honorable discharge are eligible for a VA COE. Our government rewards those men and women in uniform who have served our country with the opportunity to purchase a home with a VA Loan. There are no minimum credit score requirements on VA loans. VA loans do not have a maximum debt-to-income ratio cap as long as the borrower can get an approve/eligible per AUS.

In the following paragraphs, we will discuss and cover qualifying for VA loans with high debt-to-income ratios as well as low credit scores.

Benefits Of VA Home Loans

Here are the benefits of VA Loans:

- No down payment is required on a home purchase with a VA Loan

- The veteran can purchase a home with 100% financing

- The VA Funding Fee can be rolled into the VA Loan

- VA allows 4% sellers concessions from the home sellers to the Veteran

- The veteran does not have to come up with any closing costs

- With the combination of no down payment required and closing costs covered by the home seller, the Veteran can close on his or her home purchase with zero money out of pocket

- No down payment required

- No closing costs required

- In the event, that the home sellers do not want to offer sellers concessions to lender can cover the closing costs with a lender credit in lieu of a higher mortgage interest rate

Again, no down payment is required and the closing costs can be paid by the lender through a lender credit closing costs.

How To Qualify With VA Loans With Low Credit Scores?

Just home buyers are Veterans of the United States Armed Forces with a Certificate of Eligibility does not automatically guarantee them a VA Loan. Do need good credit. Borrowers can also qualify for VA Loans With Low Credit Scores.

Here are other VA Mortgage Lending Requirements to qualify for VA Loans with low credit scores:

- Can qualify for VA Loans with low credit scores as low as 500 FICO

- VA does not have a minimum credit score requirement nor a maximum debt-to-income ratio cap

- Must be a Veteran of the United States Military with a valid COE, Certificate Of Eligibility

- Properties eligible are condos, townhomes, single family homes, and one to four-unit properties

- Needs to be primary residence owner occupant properties

- Second homes, investment homes, and commercial properties are not eligible

- The borrower needs to have documented income

- Need to have timely payments in the past 12 months

- There is no debt-to-income ratio requirements

- Borrowers need to meet VA Guidelines

The borrower needs to get approve/eligible per Automated Underwriting System.

How to Check Your Credit Score

If you’re not sure what your credit score is, you can check it for free on websites like Credit Karma or AnnualCreditReport.com. Once you know your credit score, you can start shopping around for lenders that offer VA loans to borrowers with your credit profile.

What Are The Credit Requirements For VA Loans with Low Credit Scores?

Just because home buyers are veterans with a valid COE does not mean they automatically qualify for a VA Loan. Most VA lenders will have their own minimum credit score requirements for VA Loans due to their overlays. Lenders may also a debt to income ratio requirements even though VA does not have a maximum DTI Cap due to their own lender overlays. VA has one of the most lenient credit requirements out of all mortgage loan programs.

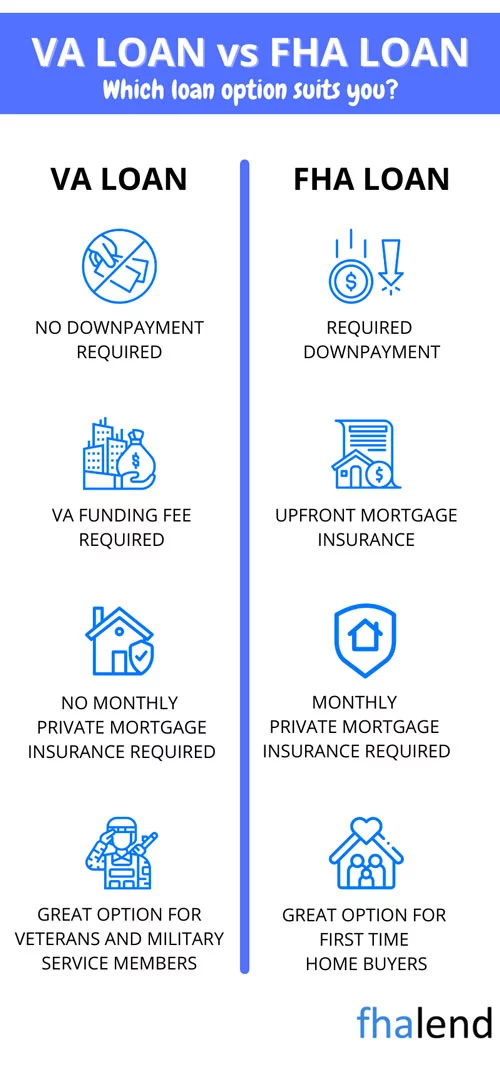

Can You Have Two VA Loans?

You can refinance your VA loan into an FHA loan or any other loan this way you can qualify again for a VA loan with a 0% downpayment. Bad credit FHA loans are available for people with 500+ credit scores and they have similar requirements to VA loans. You can get two VA loans at the same time as soon as there are two separate primary residences and this typically applies to active members with PCS orders.

Another option would be renting your current home and buying another one with a VA loan (the remaining VA loan entitlement would be used). The property needs to be your primary residence and you need to occupy it. Please fill up this quote and one of our experienced loan officers will contact you and go into details.

VA Mortgage Guidelines

Here are the basic VA Credit Requirements to get an approved/eligible per Automated Underwriting System on a VA Loan:

- VA does not have a minimum credit score requirement

- Credit scores are set by individual lenders and vary depending on their overlays

- 580 credit scores are highly recommended but not necessary

- As long as borrowers get an automated approval and can satisfy all the conditions on the AUS, VA Loan should close

- 2-year waiting period after a Chapter 7 Bankruptcy and no waiting period after chapter 13

- 2 year waiting period after the date of a short sale to qualify

- 2 year waiting period after the recorded date of foreclosure to qualify

- 2 year waiting period after the recorded date of a deed in lieu of foreclosure to qualify for a VA Loan

- Outstanding collections and charge-off accounts do not have to be paid to qualify

- There is no debt-to-income ratio cap to qualify for a VA Loan

- Debt-to-income ratio caps are VA Lender Overlays

- Deferred student loans that have been deferred for more than 12 months can be exempt from debt-to-income ratio calculations

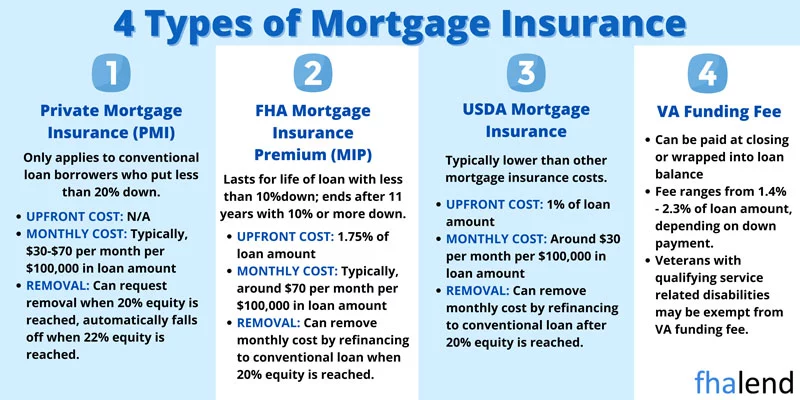

Private Mortgage Insurance VS VA Funding Fee

VA Funding Fee is a processing charge that is charged to most VA mortgages. The funding fee helps the VA loan guarantee program function so that low-cost, accessible loans can continue to be available to future veterans. VA home loans provide some of the best benefits available in today’s market. Qualifying veterans receive low-interest rates, no down payments, and no mortgage insurance premiums.

Even with the fee, many veterans understand that VA home loans are typically the most cost-effective way to buy or refinance a property. The VA funding fee is determined proportionately to the loan amount, although not all loans need the same percentage. Funding fees for a home purchase range from 1.4% to 3.6% of the loan amount. The cost of refinancing with a VA varies between 0.5 percent and 3.6 percent depending on the program you use.

The amount of money requested by the VA is determined by several factors, including:

- The VA funding fee is a processing charge that is levied on the majority of Veterans’ loans. The loan’s objective (refinance, cash-out refinance, home purchase, etc.)

- Type of property

- Amount of money you put down

- If you are first time VA Loan beneficiary or it’s your second time applying for a VA Loan

Do I Need to Pay VA Funding Fee When Applying For a VA Loan?

The VA funding fee is not required of all veterans. A disabled veteran who receives compensation from the VA for a service-connected disability, for example, is exempt. Exemption status will most likely be verified on the veteran’s Certificate of Eligibility (COE), a document obtained from the Department of Veterans Affairs to show that the veteran is qualified for a VA loan.

- A surviving spouse of a veteran who died in active service or as a result of a service-connected disability

- A veteran eligible for VA compensation for a service-connected disability who also receives retirement or active duty pay

- A veteran who has been granted VA benefits for a service-related injury

- If a Purple Heart was granted to an active-duty service member who provided, upon or before the loan closing date, proof of receiving it

| VA Funding Fees Requirements in 2023 | |||

|---|---|---|---|

| Down Payment | First Time Use Fee | Next Time Use | |

| 5% or more | 1.65% | 1.65% | |

| > 10% | 1.4% | 1.4% | |

How Much Can You Gross up Disability Income on a VA Loan?

Regardless of their disability rating, disabled veterans with VA loan eligibility are qualified for a VA home loan if they fulfill the requirements for the loan. While standards differ, veterans generally must meet minimum service criteria, have a good credit score, satisfy the minimum income limits, and possess an acceptable debt-to-income ratio. The debt-to-income ratio is the minimum mortgage payments on all your debts divided by your gross monthly income before taxes are taken out, without factoring in any other debts.

One of the advantages of applying for a VA loan as a disabled veteran is that you may “gross-up” your disability income by 25% to be eligible. A rise in income might be the difference between approval and denial of a loan. Lenders typically prefer a credit score of 620, but having a lower credit score isn’t an immediate ban, especially if it’s from a lender like FHA Lend that will accept VA credit scores as low as 500.

To demonstrate to lenders that you’ll be able to make your payments while keeping up with other obligations, it’s critical to generate consistent, dependable revenue. The interest rates for these loans are typically lower than those for traditional mortgage financing. There are several benefits to be gained from them that aren’t available in a regular mortgage, including:

- There are no down payments required.

- No matter how little the down payment, you don’t have to pay mortgage insurance.

- Interest rates on this loan are lower than the average.

- There are no penalties for paying off your VA loan early.

- Requirements for credit scores are less stringent.

- Lower-income requirements than for conventional loans disabled veterans pay lower closing costs

- Higher loan amounts with VA Loans than with FHA loan limits

- You can get up to 100% financing for cash-out refinance loans (based on your home value)

- No money down for manufactured homes

To read more about benefits here is the VA handbook pamphlet 26-7. The disability rating of a veteran will not affect his or her chances of being accepted for a VA loan if those minimum standards are satisfied. In reality, there are numerous advantages accessible to help injured veterans acquire their own houses, refinance their mortgages, or modify their existing homes.

Remember, if you do have a low credit score, there are still options available to you. One option is to get what’s called a “manual underwrite.” This means that a human will review your application instead of relying solely on your credit score. Another option is to find a cosigner who has a strong credit history. This can help you get approved for a loan, but it’s important to remember that you’ll be responsible for repaying the entire loan, even if your cosigner is making the payments.

Comments are closed.

Comments: 2

I am 73 years old and a 100% disabled veteran who has never owned a home. I have been trying to buy a home for 2 years and I have been turned down on every corner because of my low score. All my bills are paid timely and I have been doing this for over a year. Could you please help me , I would greatly appreciate it.

Hello Milton, There is no minimum FICO score requirements for VA loan someone from our team will email you now.