Down Payment and Closing Costs Needed To Buy A House

Homebuyers need a down payment and closing costs to buy a house. The down payment is a fixed amount required depending on the mortgage loan program. The closing costs are dependent on the area, the type of property, and the individual borrower’s credit/income profile. However, most homebuyers do not have to worry about paying for closing costs.

Closing costs can be covered with seller concessions and/or lender credit. In this blog, we will discuss and cover the down payment and closing costs required to buy a house. There are two loan programs that do not require any down payment on home purchase: VA and USDA loans. Even without a down payment, there are closing costs that come with every home purchase transaction says Dale Elenteny.

In this article (Skip to…)

How Can Homebuyers Pay For Down Payment and Closing Costs?

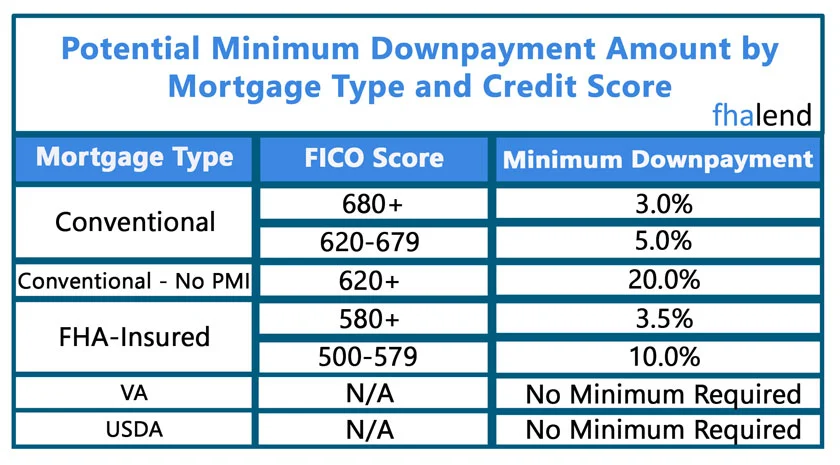

USDA and VA loans do not require any down payment requirements on a home purchase. FHA loans require a 3.5% down payment if you have at least a 580 credit score. Homebuyers with credit scores under 580 and down to 500 FICO require a 10% down payment. Conventional loans require a 3% down payment for first-time homebuyers.

Non-first-time homebuyers require a 5% down payment on conventional loans. Non-QM loans require a 20% to 30% down payment on a home purchase. Jumbo loans require a 10% to 25% down payment. Closing costs normally can be paid by seller concessions and/or lender credit.

Saving up for a down payment can take several years, so it’s important to start as early as possible. There are a few ways you can try to speed up the process:

Make a budget and stick to it

Automate your savings

Get creative with your living situation

Save your windfalls

Saving for a down payment can be a challenge, but it’s worth it in the end. Once you have the cash you need, you’ll be on your way to owning your very own home.

How Can Homebuyers Pay Closing Costs Without Their Own Money on Home Purchases?

All home purchase and refinance transactions come with closing costs.

Closing costs can be paid three different ways on a real estate home purchase transaction:

- Closing Costs can be paid by the borrower

- Closing Costs can be paid by the seller through sellers concessions

- Closing Costs can be paid by the lender through a lender credit in lieu of higher mortgage rates

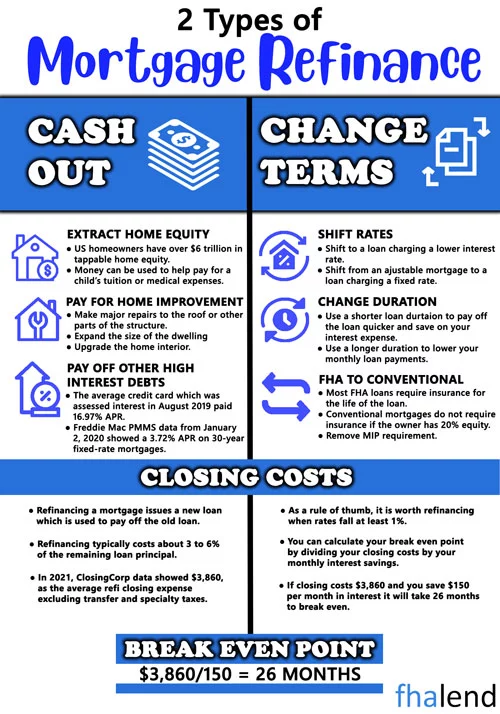

Closing Costs on Refinance Transactions

Closing Costs on a refinance mortgage loan transaction can be paid in three different ways.

- Closing Costs can be paid by the borrower where the borrower needs to bring cash to closing on their refinance loan

- Closing Costs can be paid by the lender through a lender credit in lieu of a higher mortgage interest rate

- Closing Costs can be rolled into the mortgage loan balance if there is enough equity in the home

What Are Down Payment Closing Costs On Home Loans?

Closing costs vary from the loan program and the county the property is located. It is not a set percentage of a home purchase price and/or loan amount like the down payment and closing costs requirements on home purchases. Most home buyers, especially first-time home buyers, do not have to worry about closing costs.

This is because they can get covered with seller concessions and/or lender credit. All they have to worry about is the down payment. Closing Costs are any costs and fees associated with the closing of a home loan

Down Payment and Closing Costs Depend on the Loan Program, the Area, Type of Property, and Other Factors

There are closing costs that exist in one county but not another. Closing Costs will vary from state to state and county to county. Here are examples of closing costs borrowers can incur on a home closing:

- Title charges

- Recording fees

- Transfer stamps

- Property taxes to pay for the year-to-date due

- A mortgage interest that is from the closing date to the first payment due date of the new mortgage

- Mortgage Loan Origination fees

- Attorney Fees

- Appraisal And Inspection Fees

- Survey Fees

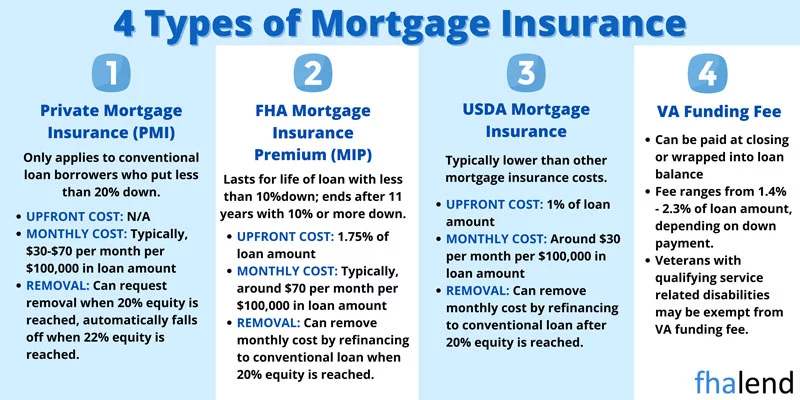

- Upfront mortgage insurance

- Upfront private mortgage insurance

- Pre-Paid: Escrows for taxes and insurance

- Discount Points to lower mortgage rates

- The document, Processing, And/Or Underwriting Fees

- One-year homeowners insurance fees

HUD Seller Concession Guidelines Versus Other Loan Programs

Each individual loan program has different closing costs. For example, FHA is mortgage expensive due to FHA Upfront mortgage insurance premium of 1.75%. However, the upfront FHA MIP can be rolled into the loan. The borrower does not need to worry about bringing the cash to close for the FHA MIP. There are many instances where the closing costs on FHA loans can be more than the 3.5% down payment required on the home purchase.

DTI Ratio And DownPayment

The DTI ratio is a crucial measurement that your bank uses to compute the maximum amount of money you may borrow. The DTI ratio compares your total monthly debts (for example, your mortgage payments inclusive of insurance and property tax payments) to your monthly pre-tax income.

If your monthly mortgage payment (with insurance and taxes) is $1,460 a month and you have a monthly income of $5,500 before taxes, your DTI is 28%. (1460 / 5500 = 0.265)

You can go backward and calculate and estimate your closing costs, downpayment, and monthly mortgage payment by multiplying your monthly income by 0.265. The $1,457 would be your monthly mortgage payment to get a 26.5% DTI. (5500 x 0.265 = 1457)

Seller’s Concession Contribution Allowance Mortgage Loan Programs

The number of sellers’ concessions allowed depends on each individual loan program:

- HUD allows up to 6% Sellers Concessions by sellers to contribute towards buyers closing costs

- VA allows up to 4% Sellers Concessions by sellers to contribute to buyer’s closing costs

- USDA permits up to 6%

- Fannie Mae and Freddie Mac permits up to 3% sellers concessions for primary and second homes

- 2% sellers concessions for investment property loans

Help With Closing Costs On Home Loans

There are two possible solutions for a home buyer with an FHA mortgage to seek help in covering his home purchase closing costs. First, borrowers can ask the seller for a seller concession, or seller contribution to assist the buyer with the closing costs of the home purchase. HUD permits home sellers to contribute up to 6% toward the buyer’s closing costs.

If the closing costs do not cost the whole 6%, the buyer cannot keep the difference and the difference goes back to the seller. If the seller is not willing to provide a seller’s concession or seller contribution, the borrower can have the lender pay the closing costs in return for taking a higher interest rate. The borrower may pay an extra 0.25% to 0.50% higher rate in lieu of getting a lender credit towards paying for closing costs.

January 16, 2022 - 5 min read