Bank Statement Loans Texas For Self-Employed Borrowers [2023]

Texas homebuyers can now find bank statement loans. Self-employed people may qualify for a stated income loan with 12 months worth of tax returns as proof that they have been generating cash flow, without having to provide more than one year’s worth at once! These types used to exist under different names like “stated-income” or even no documentation but over time the programs disappeared only coming back recently in what is considered today bank statement loans in Texas.

In this article (Skip to…)

Future of Non-QM and Bank Statement Loans in Texas

The entire mortgage industry came to a complete halt after the coronavirus outbreak hit in February 2020. Non-QM borrowers who had solid pre-approvals and borrowers who had a clear to close prior to the pandemic outbreak in February 2020 had their dreams shattered when lenders pulled non-QM and alternative mortgage programs. Non-QM loans including bank statement mortgages for self-employed borrowers were halted for several months.

Benefits of Bank Statement Loans Texas And Requirements

Non-QM loans have never been stronger. Our main subject matter in this blog is bank statement mortgages for self-employed borrowers. However, we will touch on some of our hottest and most popular non-QM mortgage programs in later paragraphs.

Until bank statement mortgages came back in the marketplace, business owners and/or self-employed homebuyers had a rough time trying to qualify for a home mortgage. Self-employed wage earners have benefits in taking substantial unreimbursed business expenses. What this means is they can write off substantial business expenses. By doing so, they pay less in taxes. The single biggest hindrance in qualifying for a home mortgage for self-employed homebuyers is the adjusted gross income on their income tax returns. No longer a problem with the 12-month bank statement mortgage program at Gustan Cho Associates. Mortgage underwriters allow borrowers to either use their personal and/or business bank statements. You need to decide which bank statements you will be using.

What Is Adjusted Gross Income

Their income after deductions is the adjusted gross income lenders go by. Lenders will average the adjusted gross income of their income tax returns and averaged them for the past two years. The monthly average of the past two years’ adjusted gross income is the income used as the qualified income. This often backfired on self-employed homebuyers.

Mortgage Qualification With Negative Income on Tax Returns

There are many cases where self-employed borrowers did not have any income and/or had a negative income. Being self-employed is great when taking substantial write-offs but not good when it comes to qualifying for a mortgage. Now with the re-emergence of 12-month bank statement loans for self-employed borrowers, entrepreneurs can now qualify for a mortgage without needing to provide their income tax returns. 12 months of bank statement deposits will be used in lieu of the past two years of income tax returns. Withdrawals do not matter nor does it count.

Bank Statement Mortgages For Self-Employed Borrowers

How Bank Statement Loans Work

You cannot use a mix and/or combination on both personal and business bank statements. It needs to be one or the other. All bank statement deposits will be added for the past twelve months and then divided by 12 months. The average bank statement deposit will be used as the qualified income of the borrower. Withdrawals do not matter. Only the past twelve months of bank statement deposits will be used.

12-Month Bank Statement Loans

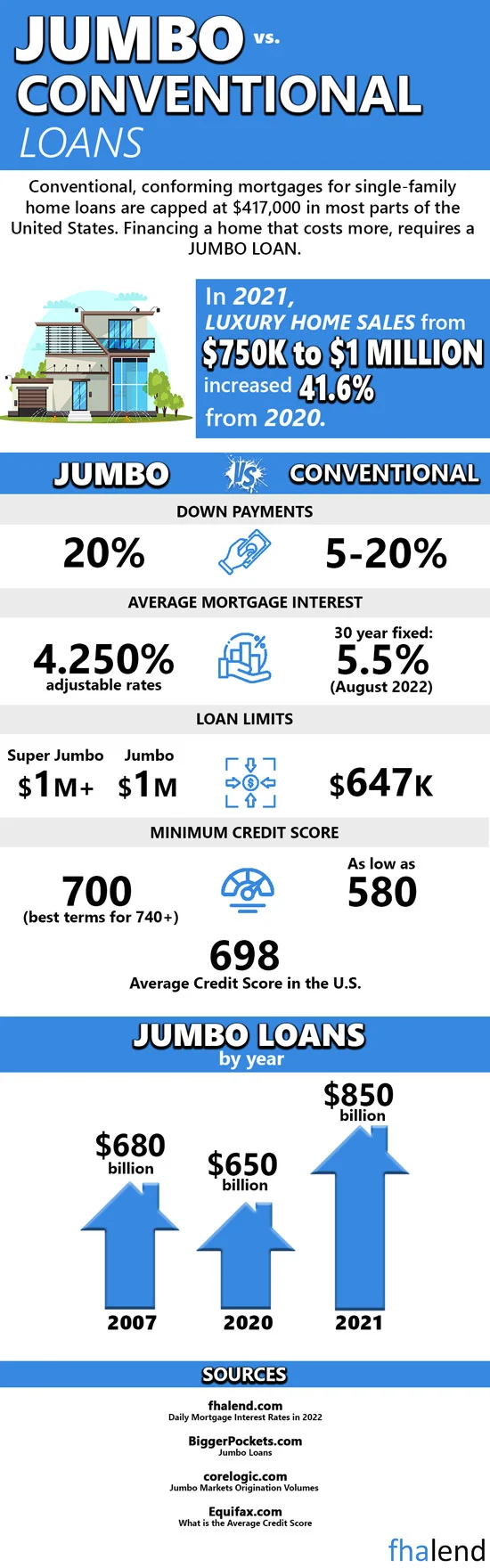

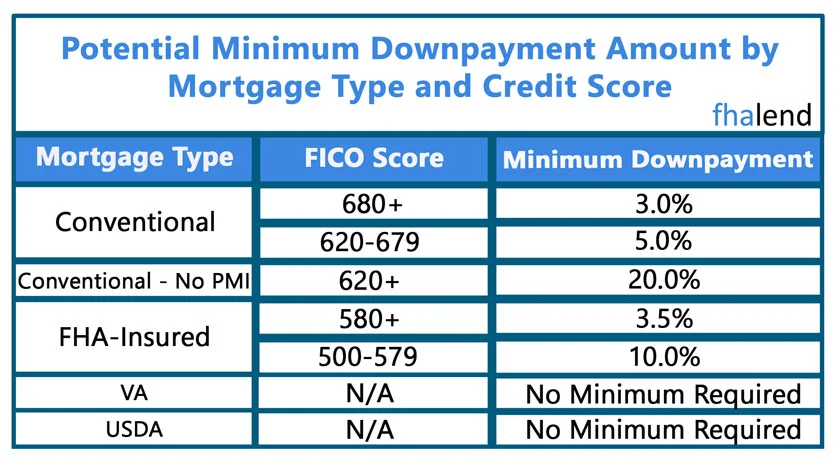

The 12-month bank statement mortgage loan program is also referred to as non-QM loans or non-conforming loans. There is no maximum loan limit cap like with FHA loan limits in TX. There is no private mortgage insurance required on non-QM loans. 10% to 30% down payment is required. The amount of down payment depends on the layered risk the lender needs to take. For example, if a borrower has lower credit scores and needs approval on non-QM mortgages one day out of bankruptcy and/or foreclosure, a 30% down payment will be required. A homebuyer with a 740 credit score but three out of bankruptcy and/or foreclosure may only require a 10% down payment. Mortgage rates on non-QM loans are dependent on the borrower’s credit scores and their down payment.

Who Benefits From Bank Statement Loans in Texas

Bank statement loans benefit self-employed borrowers. Here are the people who can greatly benefit from our non-QM bank statement mortgages:

- Small business owners

- Freelance self-employed 1099 wage earner employees

- Business consultants

- Third-party contract workers

- Independent contractors paid via 1099

- Sole proprietors

- Gig economy wage earners

- Licensed real estate agents

- Entrepreneurs

- Retirees

To become eligible to qualify for a bank statement loan, the wage earner needs to have been self-employed for the past two years.

Self-Employed Homebuyers

These types of loans have provided a solution to borrowers’ challenge of using the net income claimed on their tax returns rather than the true net income that they make. This makes many borrowers ineligible for a loan. To apply for a bank statement loan, the self-employed borrower can provide the mortgage lender with as little as 12 months of bank statements which show regular deposits. This allows the lender to see how much you can afford to borrow. The lender would then verify your bank statements by calling your bank or by filling out a verification of deposit (VOD) request and mailing or faxing it to your bank. If you are using your business bank statements to qualify the lender will still need to see the expenses you incur as a result of owning a business but will not penalize you for expenses that you have written off on your tax returns.

Advantages Of Bank Statement Loans

The following bullet points are the benefits of bank statement loans. The mortgage underwriter does not need income tax returns and/or income tax transcripts to determine the borrower’s income. Qualified income will be solely based on monthly bank deposits reflected on bank statements. Mortgage underwriters will go off the deposits of the past 12 months. The average of the past 12 months of deposits in your bank statement will be your qualified income. A Profit and Loss statement by a certified public accountant may need to be provided in some cases. 10 to 30% down payment.

Down Payment Requirements on Non-QM Mortgages in Texas

The down payment depends on the layered risk factors by lenders. The lower the risk, the lower the down payment. Non-QM mortgage rates are dependent on the down payment and the borrower’s credit scores. Up to 85% LTV on cash-out refinances. Loan amounts up to $5 million are not a problem. Any mortgage loan amounts higher than $5 million will be evaluated on a case-by-case scenario basis. Debt to income ratios up to 55% DTI with compensating factors. Non-QM wholesale lending partners are very open-minded. Exceptions can be made on a case-by-case scenario basis on non-QM loans.

Borrowers With Co-Borrowers

If the main borrower on a bank statement loan is self-employed but the co-borrower spouse is a full-time W2 wage earner, the non-QM wholesale lender will allow the W2 wage earner’s income to be used as qualified income along with the bank statement loan main borrower. This is a great benefit for borrowers who need a larger loan amount. As mentioned earlier, non-QM lenders are very open-minded and can evaluate a unique borrower on a case-by-case scenario basis. Not all non-QM lenders have the same guidelines on non-QM loans.

How to Qualify On Bank Statement Loans and Non-QM Mortgages

Deposits from a business account transferred to a personal account can be used. Foreign assets and bank statement loans in Texas can be used as long as they are translated into English. Bank overdrafts in the past 12 months can be an issue. Some non-QM lenders will automatically disqualify borrowers with any bank overdrafts. Make sure the loan officer check with the wholesale representative before submitting your mortgage loan application.

Credit Tradeline Requirements on Non-QM and Bank Statement Loans in Texas

Most wholesale lenders will require at least three credit tradelines that have been seasoned for at least the past 12 months. Many non-QM lenders will require verification of rent (VOR). Remember non-QM lenders are open-minded and can make exceptions for strong borrowers in a case-by-case scenario. If you have any questions on the content of this blog or have any other questions on any mortgage-related topics, please apply at this start your process of pre-approval or contact us at FHA Lend Mortgage at [email protected] with any questions related to the mortgage or call us at 262-716-8151. Text us for a faster response.

February 14, 2022 - 6 min read