FHA Loans With Low Credit Score

In this article (Skip to…)

What is a Low Credit and How Affect FHA Qualification?

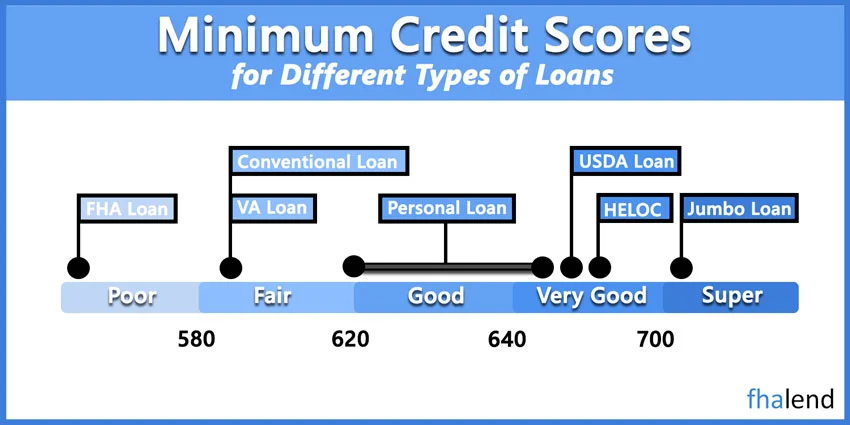

Although the FHA will certify loans for borrowers with credit scores as low as 500, many FHA lenders are unwilling to work with clients with such low credit. They’ll frequently impose their own restrictions (lender overlays), so you may encounter situations where certain lenders will refuse to deal with you if your score is below 620.

If you are looking for a mortgage that is designed for borrowers with low credit scores, an FHA loan is a great option to consider. FHA loans offer a low down payment, flexible credit requirements, and assumably. Contact your local FHA lender to learn more about FHA loans and how they can help you buy your dream home or click here to get matched with a preferred lender.

The answer varies depending on the loan program, from a lending standpoint. Some lenders refuse to give FHA loans if your credit is too low.

15 Tips To Get FHA Loans With Low Credit Score

1. Check your credit score and credit history.

Your credit score is one of the most important factors in determining whether you will be approved for a mortgage. Before you apply for a mortgage, be sure to check your credit score and credit history. If you have a low credit score, you may want to work on improving your credit before you apply for a mortgage.

2. Compare interest rates.

Interest rates vary from lender to lender, and it is important to compare interest rates before you apply for a mortgage. If you have a low credit score, you may be charged a higher interest rate than borrowers with high credit scores. Be sure to compare interest rates from multiple lenders before you choose a mortgage.

3. Have a down payment saved up.

FHA loans require a down payment of just 3.5 percent, but you will need to have the money saved up in order to cover the down payment. If you do not have enough money saved up to cover the down payment, you may want to consider other types of mortgages.

4. Have a steady income.

Lenders will want to see that you have a steady income before they approve you for a mortgage. If you have a low credit score, you may need to show that you have a stable job and a good income history.

5. Avoid applying for new credit cards.

If you are trying to improve your credit score, avoid applying for new credit cards. New credit inquiries can lower your credit score, so it is best to wait until you have improved your credit score before you apply for a mortgage.

6. Pay your bills on time.

One of the best ways to improve your credit score is to pay your bills on time. If you have a history of paying your bills on time, your credit score will be higher and you will be more likely to be approved for a mortgage.

7. Avoid late payments.

If you have a history of late payments, your credit score will be lower and it will be harder to get approved for a mortgage. Lenders will want to see that you have a good credit history and that you are able to make your payments on time.

8. Keep your credit utilization low.

Your credit utilization ratio is another factor that lenders look at when determining your credit score. You should aim to keep your credit utilization ratio below 30 percent, and lower is always better.

9. Don’t open new credit accounts.

As mentioned before, new credit inquiries can lower your credit score. If you are trying to improve your credit score, it is best to avoid opening new credit accounts.

10. Dispute inaccurate information on your credit report.

If you find inaccurate information on your credit report, be sure to dispute it. If you have a low credit score, inaccurate information can hurt your credit even more.

11. Get a copy of your credit report. Here you can get a free annual credit report

It is important to get a copy of your credit report so that you can see what is being reported. You can get a free copy of your free annual credit report from each of the three credit bureaus once a year.

12. Stay current on your student loan payments.

If you have student loans, make sure to stay current on your payments. Late payments can lower your credit score and make it harder to get approved for a mortgage.

13. Seek help from a credit counseling agency.

If you are struggling to manage your credit, you may want to seek help from a credit counseling agency. A credit counseling agency can help you create a plan to improve your credit score and manage your debt.

14. Use a secured credit card.

If you are trying to improve your credit score, using a secured credit card can be helpful. A secured credit card is a credit card that is backed by a savings account. You will need to deposit money into the savings account in order to use the credit card. This will help you build your credit score over time.

15. Get a co-signer (here we prepared an article about adding a co-borrower).

If you are having trouble getting approved for a mortgage, you may want to get a co-signer. A cosigner is a person who agrees to be responsible for your debt if you are unable to make your payments. Having a cosigner can help you get approved for a mortgage with a low credit score.

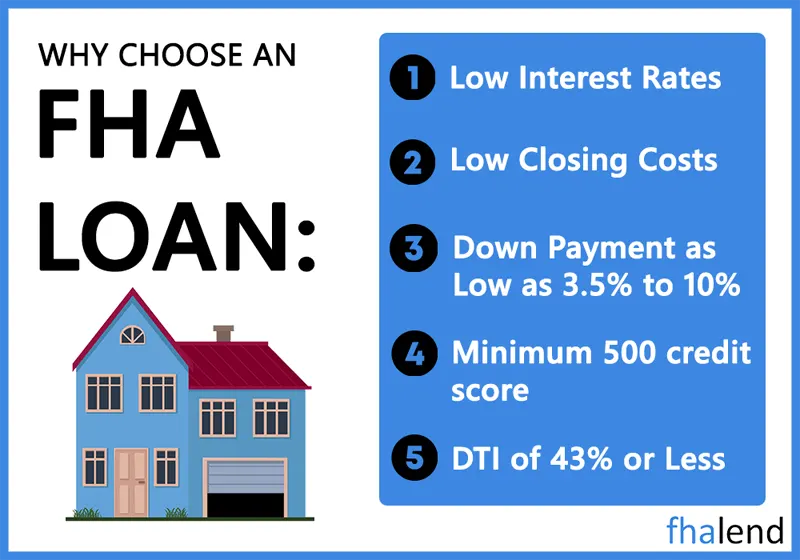

FHA Loans With Low Credit Score Benefits

You can use gift funds To qualify for an FHA loan with low credit. The FHA’s rules on gift funds allow homebuyers to receive a gift from a family member for the down payment and closing costs of a property purchase. Homebuyers may get complete gifted funds for the down payment and closing costs of a house.

High Debt To Income Ratio is allowed for low credit customers. The debt-to-income ratio (DTI) to qualify for an FHA loan is the proportion that compares your planned mortgage payment to your total monthly obligations divided by your total monthly income. The typical FHA limits allow for a DTI of 43%, but higher ratios up to 56.9% are permitted with compensating factors for FHA loan low credit borrowers.

500 credit is the minimum to qualify for an FHA loan. You will not be able to get approved for a conventional loan if your low credit score is 580 or lower. There are very few mortgage lenders who will lend to individuals with credit scores as low as 580, so if your score is at 550 or higher you can still qualify for VA or FHA Loan. Fortunately, there are a few non-prime mortgage lenders that cater to borrowers with terrible credit. This includes alternatives for people with credit ratings between 500 and 579 (or even below 500).

You can qualify with low income for an FHA loan. There is no such thing as a low or high salary that would disqualify you from obtaining an FHA-insured mortgage. However, you must satisfy the following requirements:

- At least two established credit accounts are required. For example, a credit card and a vehicle loan are examples of popular types of credit.

- Have no outstanding debts to the IRS, tax authorities, or any other entity. Or have past FHA-insured loans on which you still owe money.

- Make a down payment by adding those funds to your gift. This might be money from a friend or family member, a charity, your employer or union, or government assistance. These donations must first be acknowledged in writing and signed and dated by the donor.

A non-occupying Co-Borrower is allowable to qualify fr an FHA mortgage loan with a low credit score. Child, parent, or grandparent, Spouse or domestic partner, Foster child, Brother or stepbrother, Sister or stepsister, Uncle or aunt Legally adopted child, Son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law can help you as a co-borrower on the FHA loan. They can still co-sign the loan even if they have already obtained the FHA financing (FHA 100-mile rule)

FHA loans are a great option for borrowers with low credit scores, but they come with a few downsides. FHA loans have a higher interest rate than conventional mortgages, and they require mortgage insurance. FHA loans are available in all 50 states, and they offer a variety of mortgage products, including fixed-rate mortgages and adjustable-rate mortgages.

How To Qualify For An FHA Loan With Low Credit Score

FHA loans are government-backed mortgages that have been designed for borrowers with low credit scores. FHA loans require a minimum FICO score of 500, and they also require a down payment of 3.5%. FHA loans are a good option for borrowers who have been denied a mortgage by a traditional lender. FHA loans are also a good option for borrowers who have low credit scores and who are unable to afford a down payment on a mortgage. FHA loans are available in all 50 states, and they offer a variety of terms and conditions. FHA loans are the most popular type of government-backed mortgage, and they account for more than one-third of all mortgages issued in the United States.

Low Credit FHA Loan Requirements

FHA loans offer a number of benefits, including:

- Low minimum FICO score of 500

- Low down payment of 3.5%

- Available in all 50 states

- Variety of terms and conditions

- Flexible credit requirements

- Low-interest rates

- 30-year fixed-rate mortgage

What Will Disqualify You From an FHA Loan?

There are a number of factors that can disqualify you from obtaining an FHA loan. These factors include:

- having a credit score of 499 or lower (from 3 credit bureaus)

- having a high debt-to-income ratio

- being behind on your mortgage or other debts

- having recently filed for bankruptcy Chapter 13 or Chapter 7 or gone through a foreclosure

- being a recent immigrant or not having a Social Security number (option here is an ITIN loan but you need 15% downpayment)

- Going over FHA loan limits for particular states and counties. HUD sets FHA loan limits every year based on a county and a state, make sure your house price range will qualify. Sometimes you might need to get a piggyback mortgage.

Can I Get an FHA Loan With Collections?

Yes, you can still get an FHA loan with collections on your credit report. However, the amount you are able to borrow will be based on your debt-to-income ratio and your credit score.

Do Unpaid Medical Bills Affect Getting FHA Loan?

Unpaid medical bills can affect your ability to get a mortgage. Medical bills are one of the biggest causes of debt, and if you have a lot of unpaid medical bills, it could hurt your chances of getting approved for a mortgage.

Low Credit Score FHA Lenders

Although the FHA has established criteria, not all lenders that create FHA loans adhere to them exactly. They are free to add their own restrictions in instances where they would prevent you from obtaining an FHA loan with poor credit.

Although we work with a network of lenders who can help you if your credit score is as low as 500, there are many lenders that only deal with clients with higher credit scores. If you went to your local bank and discovered they couldn’t assist you, this may be the case. If you have a low credit score, the major banks will not want your business. We already know who the low credit FHA lenders are. Now is the time to connect with an FHA lender.

FHA Low Credit Score Mortgage Approval

We frequently hear that there are no certainties in life. However, if you can satisfy the following conditions, your FHA mortgage application is almost certain to be accepted.

- The home is zoned residential and will be your primary residence, which it is in fine working order.

- You haven’t had a bankruptcy in the last two years or a foreclosure in the past three years.

- Your income is sufficient to meet the loan amount you are looking for.

- For the previous two years, you’ve been paid on time and in full.

- You fulfill the credit score and down-payment criteria described above.

First-Time Home Buyers With Low Credit Score

Low credit is common among first-time buyers due to previous financial setbacks. If you have terrible credit as a first-time house buyer, it will be nearly impossible for you to obtain a normal loan.

Not all government loans are created equal. For example, while VA and USDA loans are not as lenient as FHA loans, they aren’t as stringent either (except in some states). To be eligible for most lenders, you’ll need a credit score of 620 or higher. You will also have to be a veteran or live in a rural location to get qualify.

Low Credit FHA Loan Refinance

If you have low credit, the options outlined above hold true for both a traditional FHA Refinance and an FHA cash-out refinance. With an FHA streamlined refinance, the process is even easier because they require less paperwork. If your credit worsened since you were approved for your original FHA loan, your recent low credit history will not be an issue unless you have been missing payments.

If you are a first-time home buyer and have low credit combined with a low down payment, a low credit score FHA loan may be the best option for you.

Low Credit FHA Loan Rates

The interest rates on FHA loans are frequently lower than those offered by traditional lenders. While this is true, if your credit scores are terrible, your FHA rate will be somewhat higher than if you applied with much better credit.

You should still anticipate a low-interest rate for an FHA home loan with the low credit to be competitive. To discover what your current mortgage rate will be and to get pre-qualify.

December 9, 2022 - 9 min read