Mortgage After Chapter 7 Bankruptcy

In this article, we will cover and discuss mortgages after Chapter 7 Bankruptcy waiting period guidelines. To get approved for a loan and start shopping for a house when you had a bankruptcy in previous years you need to know what are chapter 7 bankruptcy mortgage waiting period is. In the following paragraphs, we will discuss the keys to qualifying for a mortgage after Chapter 7 Bankruptcy waiting period guidelines.

In this article (Skip to…)

Mortgage Options After Bankruptcy and Foreclosure

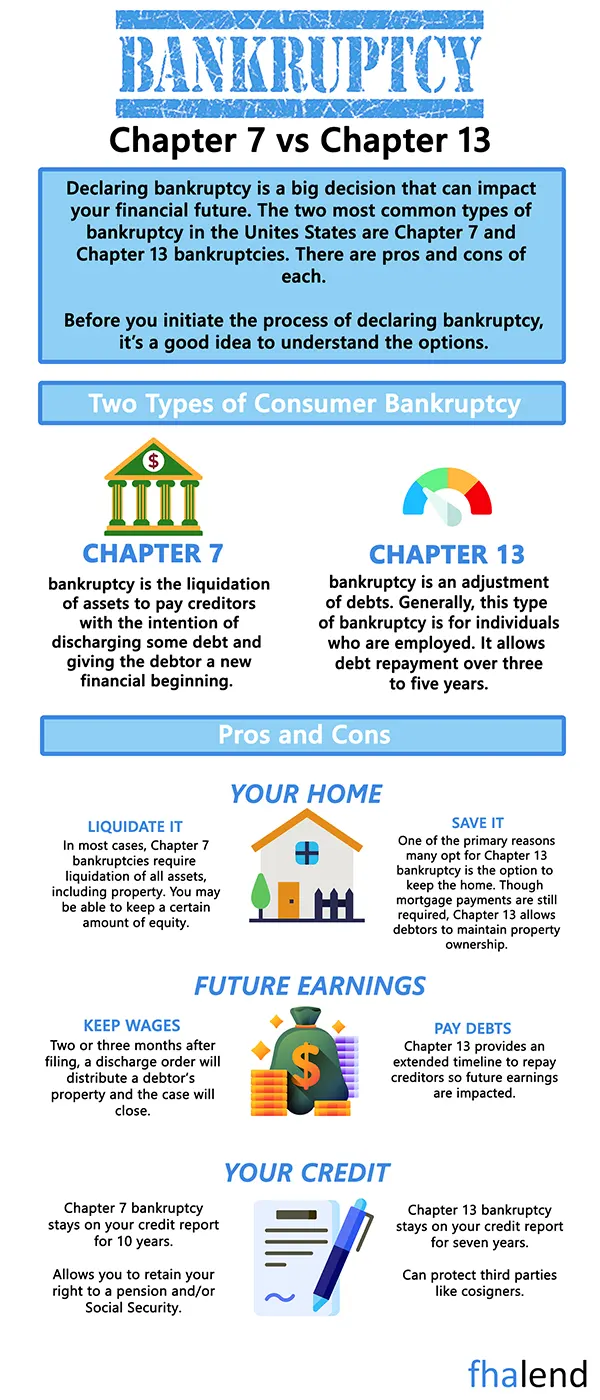

We will go into depth in qualifying for mortgages after the Chapter 7 Bankruptcy discharged date and the mortgage options homebuyers have. We will show you how to rebuild and reestablish your credit so when you meet the mandatory waiting period requirements, you will be ready to go through the process of obtaining a mortgage. Mortgage Lending Guidelines with regards to the mortgage part of bankruptcy are different for all mortgage loan programs. FHA has its own mortgage lending guidelines with regards to lending guidelines on the mortgage part of the bankruptcy. Fannie Mae has just come up with new mortgage lending guidelines with regards to guidelines on the mortgage part of the bankruptcy

Qualifying For Conventional Loans With A Prior Mortgage Included In Bankruptcy

If a mortgage loan debt was discharged through a Chapter 7 bankruptcy, the mandatory waiting period after a bankruptcy discharge date is the waiting period start date. The date of the foreclosure, deed in lieu of foreclosure, and short sale after the bankruptcy do not matter. The mortgage cannot be reaffirmed after the bankruptcy. There is a four-year waiting period after the discharge date of the bankruptcy to qualify for a conventional loan. This is a great benefit with conventional versus FHA loans.

FHA Guidelines On Mortgage Part of Bankruptcy

To qualify for an FHA loan if you have a mortgage part of bankruptcy, the waiting period starts from the recorded date of the foreclosure and not the discharge date of the bankruptcy. For example, if you filed for bankruptcy in June of 2010. And you included your mortgage as part of your bankruptcy. And the discharge date of your bankruptcy was October of 2010 but your foreclosure did not get recorded until October 2012. The waiting period to qualify for an FHA loan starts 3 years from the October 2012 recorded date of your foreclosure. Even though the loan balance was wiped out from the Chapter 7 bankruptcy, the waiting period does not start from the recorded date the deed was transferred out of your name into the name of the lender.

Guidelines On Mortgage Part Of Bankruptcy For Conventional Loans

The mandatory waiting period to qualify for a conventional loan is 4 years from the date of the bankruptcy discharge date. The great news with Fannie Mae conventional loan programs is that if you had a mortgage part of bankruptcy, the waiting period starts from the discharge date of your bankruptcy and not the recorded date of the foreclosure. The foreclosure can be recorded past the discharge date of the bankruptcy. For example, if you filed for bankruptcy in January 2010. And the bankruptcy was discharged in May 2010 and had a mortgage part of the bankruptcy. And the foreclosure was not recorded until January 2013. The 4-year waiting period starts from the discharge bankruptcy date of May 2014.

The waiting period for a Chapter 7 bankruptcy is two years after you submit paperwork with the court, three years for USDA mortgages, and four years for a regular mortgage. This is a new Fannie Mae guideline on the mortgage part of bankruptcy which will enable home buyers who had their foreclosures recorded at a later date than the date of their discharged bankruptcy dates.

| Derogatory Event Status | Waiting Period Requirements to Qualify for Conventional Loan | Waiting Period with Extenuating Circumstances per Fannie Mae Guidelines |

| Bankruptcy — Chapter 7 or 11 Filing | 4 years from Bankruptcy Discharge Date | 2 years from the bankruptcy discharge date |

| Bankruptcy — Chapter 13 Filing | 2 years from the discharge date of the Bankruptcy Date of the Bankruptcy 4 years from the dismissal date of the Chapter 13 Bankruptcy | 2 years from the discharge date of the bankruptcy. 2 years from the dismissal date of the Chapter 13 date of the Bankruptcy |

| Multiple Bankruptcy Filings | 5 years if more than one filing BANKRUPTCY within the past 7 years | 3 years from the most recent discharge or dismissal date of bankruptcy |

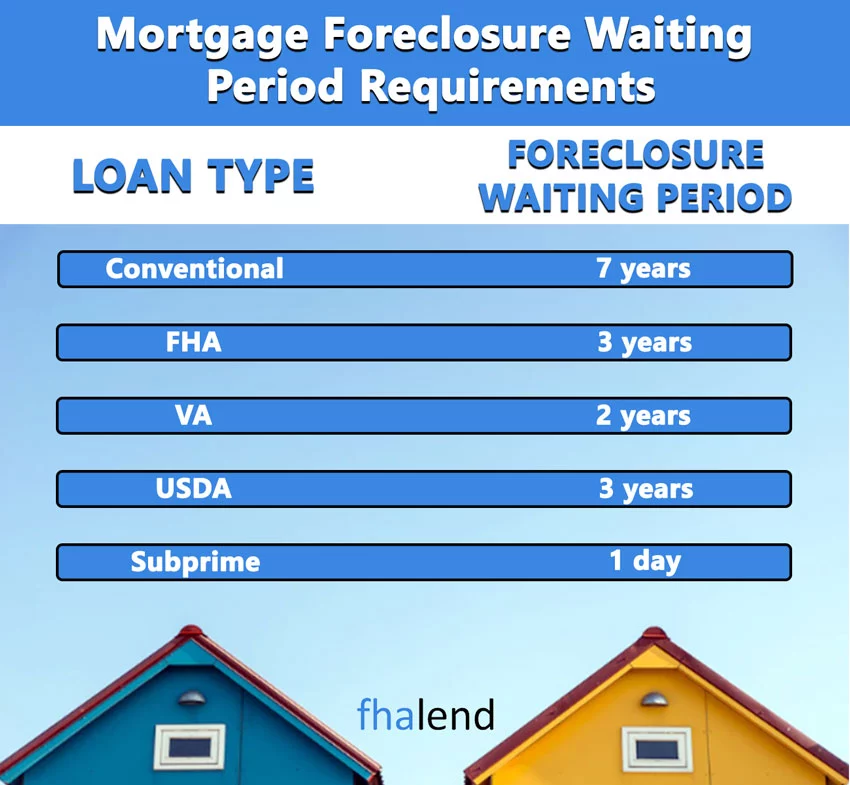

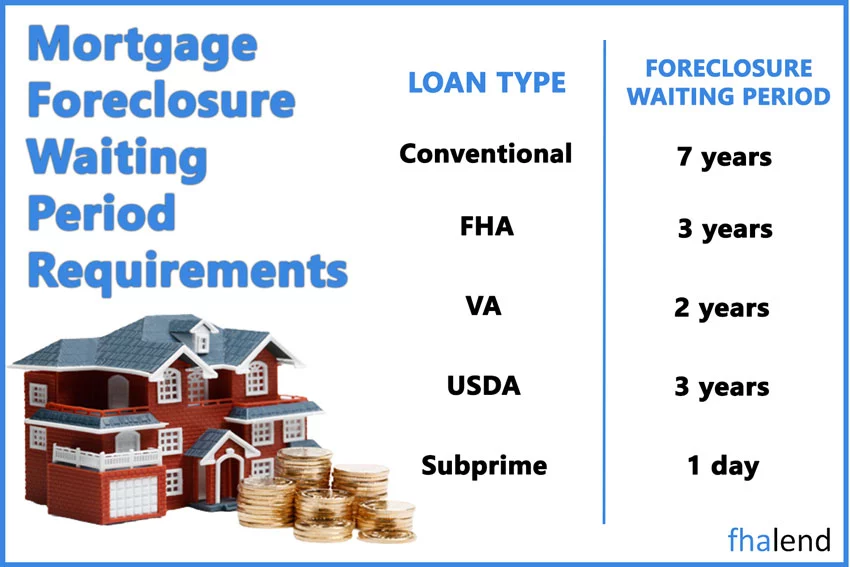

| Foreclosure | 7 years from the recorded date of the foreclosure which is reflected on the county records or the date of the sheriff’s sale | 3 years from the recorded date of the foreclosure which is reflected on county records or the date of the sheriff’s sale. Additional requirements after 3 years up to 7 years: 90% maximum LTV ratios Purchase, principal residence Limited cash-out refinance, all occupancy types |

| Deed-in-Lieu of Foreclosure, Preforeclosure Sale, or Charge-Off of Mortgage Account | 4 years from the recorded date of the deed in lieu of foreclosure or the 4 years from the date of the short sale which is reflected on the HUD-1 Settlement Statement. | 2 years |

This story begins around October of 2009. When our borrower married his wife. The wife had already owned what would be their primary residence, so he was not on the mortgage or note. He also owned an investment property. The borrower’s wife purchased the primary residence in October of 2007 utilizing an eighty percent first mortgage, ten percent second mortgage, and a ten percent down payment also known as an 80/10/10 mortgage.

Adjustable-Rate Versus Fixed-Rate Mortgages

The first mortgage was financed on a two-year arm, meaning it is fixed for two years and converts to an adjustable-rate mortgage after the loan’s two-year anniversary date. Depending on the annual and lifetime rate caps this can have a significant impact on the adjusted payment. In this particular case, in 2009, after the two-year fixed period was over and the new adjustments were applied, the borrower’s wife was confronted with a new payment that was well above their budget.

What Is Payment Shock From Going From Renter to Homeowner

Unable to deal with the “payment shock,” the borrower’s wife made several attempts with her existing first mortgage company to modify the loan back to its original payment and was unsuccessful. While this happened our borrower was having difficulty renting the investment property he owned, creating an additional burden they could not overcome. Dealing with real estate values that were rapidly declining the borrower’s wife was able to get permission from the first mortgage company to proceed with a short sale which was finalized in 2013.

The Benefit of Filing For Bankruptcy For a Fresh Financial Start

The borrower and his wife decided to file Chapter 7 Bankruptcy in 2010 and start over. Included in that Chapter 7 bankruptcy was the borrower’s investment property, which would be playing a significant role in the borrower’s pursuit of homeownership in the future. In this article, we will discuss the mortgage part of the Bankruptcy case scenario on Conventional loans.

Mortgage After Chapter 7 Bankruptcy Waiting Period Guidelines: Fast Forward To 2021

Fast forward to February of 2021 and after several conversations with the borrower, we felt that the borrower could qualify for a Conventional mortgage utilizing the “Foreclosure and Bankruptcy on the Same Mortgage” guideline offered by Fannie Mae. The waiting period on this program is four years from the discharge of the bankruptcy and the foreclosure must be satisfied or completed. In July of 2020 our borrower’s investment property, which was included in the bankruptcy, was sold and per Fannie Mae allowed us to use the bankruptcy discharge date as the beginning of the waiting period – well past the four-year minimum required by Fannie Mae.

Mortgage After Chapter 7 Bankruptcy and Foreclosure

Since the borrower’s wife completed her short sale less than four years prior to the loan application and the short sale was not considered an extenuating circumstance, she was not eligible to be on the loan. Armed with a cautious sense of optimism we proceeded in qualifying our borrower using the “Foreclosure and Bankruptcy on the Same Mortgage” guideline. We informed the borrower it would probably take forty-five days to close and would have to be very diligent about documenting the file with updated pay stubs, bank statements, and other items requested by the underwriting. The file went through the process without any problems and closed in sixty days. The only reason it did not close in forty-five days or less was that the seller wanted to close at the end of the month, adding three weeks. All in all a success and we have a happy homeowner!

FHA Versus Conventional Mortgage After Chapter 7 Bankruptcy Guidelines

Dale Elenteny is an associate contributing editor for FHA Lend Mortgage. Dale is a 20-plus-year veteran in the mortgage industry. Dale Elenteny is an expert on FHA, VA, USDA, Non-QM, and Conventional loans. The good news for homebuyers who had a mortgage part of bankruptcy is that there is a four-year waiting period to qualify for a Conventional loan from the discharged date of their chapter 7 bankruptcy regardless of when the actual recorded date of the foreclosure is.

What Type of Loan I can Get When I Had a Bankruptcy?

After you have been discharged from bankruptcy and it is closed, you may be eligible for a conventional mortgage as well as an FHA, VA or USDA loan if you qualify. However, you will need to meet the waiting period rule and show that you have worked to repair your credit.

Conventional Mortgage Loan Program

A credit score of at least 620 is usually required by conventional mortgages. The interest rate you are quoted will be determined by your credit rating and the amount you can put toward a down payment (many lenders prefer 20 percent).

The conventional BK waiting period after bankruptcy is – four years after the discharge date for Chapter 7. For chapter 13 bankruptcy for the conventional bk is – two years. In some extenuating circumstances, a three-year bk conventional waiting period is permitted if the circumstances can be documented. The waiting period is measured from the most recent bankruptcy discharge or dismissal.

FHA Loan Mortgage Program

To qualify for an FHA loan, you’ll need to show that your credit has been improved and that you haven’t taken on additional debt since your bankruptcy.

USDA Loan Mortgage Program

USDA loan rates are typically lower than conventional mortgages (as low as 580 and 3.5 percent down, or 500 and 10 % down) due to their unique lending criteria (e.g., no credit requirements). No money down VA loans may be gotten by eligible veterans, service members, and qualified surviving spouses with a minimum credit score of 620.

5 Steps To Qualify For a Home Loan After Bankruptcy

Get a Copy Of Your Free Credit Report

Collect All Docs

Keep An Eye on Your Debt

Save $

Follow Rules

Mortgage Options With Bankruptcy and Foreclosure at the Same Time

Homebuyers can qualify for a mortgage after Chapter 7 Bankruptcy. The foreclosure can be recorded after the discharged date of the Chapter 7 Bankruptcy and it will not affect the waiting period. This is not the case with FHA loans. With FHA, if you had a mortgage or mortgage after the Chapter 7 Bankruptcy with a prior mortgage part of your Chapter 7 Bankruptcy, there is a three-year mandatory waiting period from the actual recorded date of the foreclosure and/or date of the sheriff’s sale. This holds true even though the mortgage was included in the Chapter 7 Bankruptcy and the mortgage has been discharged. If you had a mortgage or mortgage as part of your Chapter 7 Bankruptcy and have passed the 4-year waiting period and need a direct lender with no overlays, please contact us and check if you qualify below.

June 20, 2022 - 9 min read