FHA Loan With 1099 Income Qualification

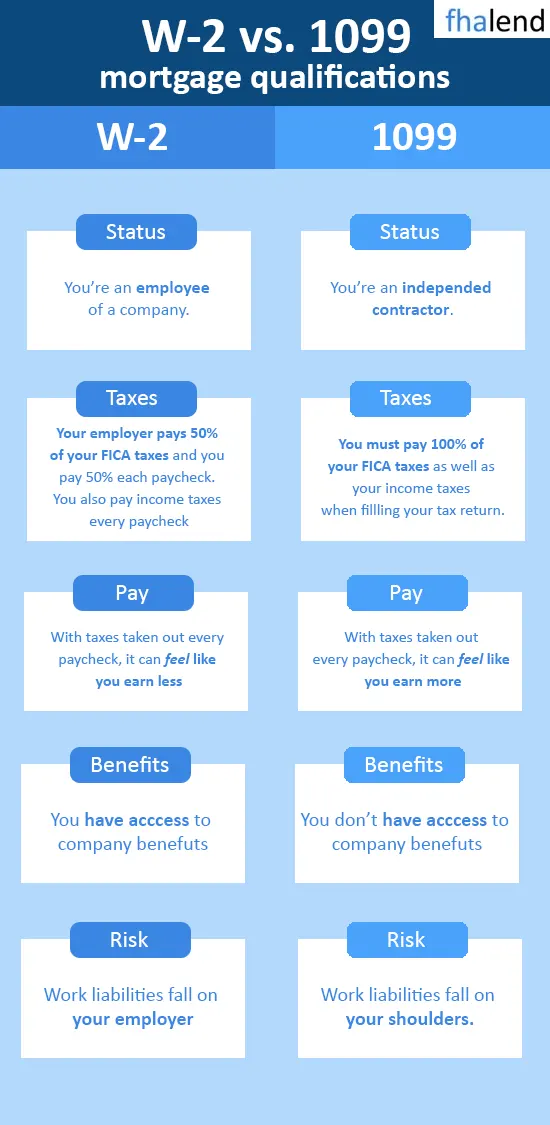

People who are on 1099 instead of W2 can still qualify for an FHA mortgage loan based on FHA guidelines. If you are making at least 25% of your total annual income then you can get approved for an FHA loan by providing 2 years of your 1099 statements.

As a 1099 individual, it can be difficult to qualify for a traditional mortgage. However, the Federal Housing Administration (FHA) offers loans that can accommodate 1099 borrowers as long as they can provide proof of a steady income. If you’re a commission-based employee or a business owner and receive a Form 1099 instead of a W-2, here’s what you need to know in order to qualify for an FHA loan.

Many people who are self-employed or who work on a 1099 basis often wonder if they can get an FHA loan. The simple answer is YES. Below we’ll discuss what a 1099 income is and how it can affect your ability to qualify for an FHA loan.

In this article (Skip to…)

What is a 1099 Income?

A 1099 income is income that is not subject to payroll taxes. This means that the income is not reported on a W-2 form. Instead, it is reported on a 1099 form. 1099 income is typically earned by self-employed individuals, but it can also be earned by those who work on a contract basis. If you work as an independent contractor, own a business, you are a real estate agent, lawyer, dentist or accountant you are probably getting paid via 1099 and you are treated as a self-employed individual.

How Does 1099 Income Affect FHA Loan Eligibility?

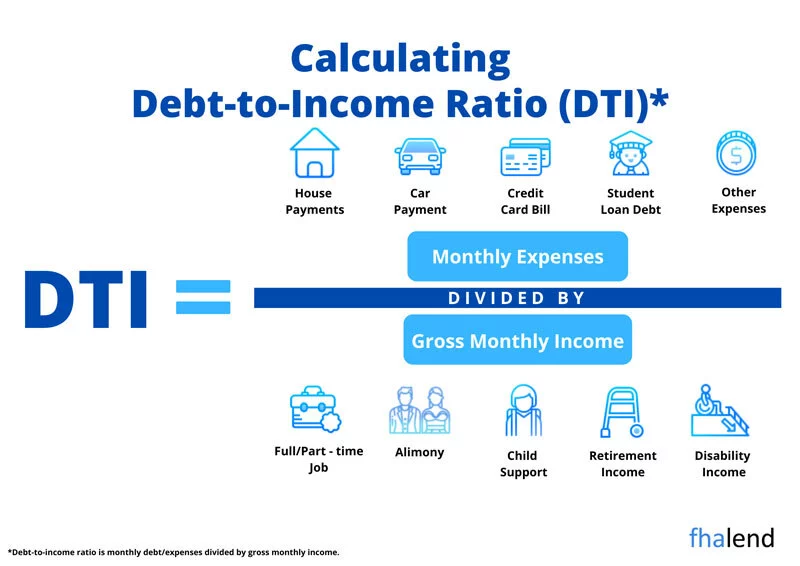

The main way that 1099 income affects FHA loan eligibility is through the debt-to-income ratio (DTI). The DTI is a metric that lenders use to determine how much of your monthly income is available to make payments on debts such as a mortgage. For an FHA loan, the maximum DTI ratio is 31% for the “front-end” ratio and 43% for the “back-end” ratio.

This means that 31% of your monthly income (before taxes) can go towards your housing payment, and 43% of your monthly income (after taxes) can go towards your housing payment and other debts.

If you have a lot of 1099 income, it’s important to calculate your DTI ratio correctly. This is because 1099 income is not subject to payroll taxes, which means that more of your monthly income will be available to make payments on debts. For example, let’s say you have a monthly income of $7,000 from your job and $4,000 from freelance work.

Your total monthly income would be $11,000. If you divide this by 12 (to get your monthly income), and your total monthly debt payments are $5,000 you would get a front-end DTI ratio of 41.6%. However, if you only included your job income in the calculation, your front-end DTI ratio would be 25% if your mortgage payment is at $3,000 per month.

Your gross monthly income is generally the amount of money you have coming in each month before taxes and other deductions are taken out. This is different from your net monthly income, which is the amount of money you have left after taxes and other deductions have been made. When you’re applying for an FHA loan, lenders will look at your gross monthly income to determine if you’re eligible for the loan.

It’s important to include all sources of income when calculating your DTI ratio. This will give you the most accurate picture of how much debt you can afford to take on.

How Much Money Do You Need on 1099 To Qualify For FHA Loan

To qualify for an FHA loan, you’ll need to have a gross monthly income that’s at least $1,500. If you’re married, you and your spouse will both need to have incomes that meet this requirement. Lenders (mortgage underwriters) will also look at your employment history and make sure that you’ve been employed for at least two years.

In addition to looking at your gross monthly income, lenders will also consider your debts when determining if you qualify for an FHA loan. Your debt-to-income ratio is the amount of money you owe each month divided by the amount of money you bring in each month. To qualify for an FHA loan, you’ll need a debt-to-income ratio of 43% or less.

Additional Documents Required for 1099 FHA Loan

If you’re self-employed, you’ll need to provide additional documentation to prove your income. This may include

- Tax returns for the past two years (personal and business)

- Bank statements for your business and personal accounts

- Documentation of your business income and expenses

- A copy of your 1099 form(s)

- A letter from your accountant verifying your income

- (extra) financial statements from your business (P&L – Profit and Loss statement balance sheet).

- For S-corporations, or partnerships, copies of federal business income tax returns for the last two years

- (extra) a business credit report for s-corporations

Lenders will also look at your work history to make sure that you’ve been self-employed for at least two years. The 1099 income qualification process is one way that you can show your income and ensure that you’re eligible for an FHA loan. If you have any questions about the process or whether you qualify, talk to a lender today.

A mortgage underwriter might ask for a P&L and balance sheet or income directly from the IRS website if you filled in your last taxes seven or more months ago and your income from each business is higher than 5% of your stable monthly income.

How To Calculate 1099 Income For FHA Loan

Mortgage underwriters will calculate your monthly income by dividing two years’ average income by 12 to qualify you for an FHA mortgage loan in most cases (if your income from your two last years is similar).

If your income is lower this year than the previous one (for example you made this year $82,000 and last year $60,000) then mortgage underwriters will take just the last year to calculate your DTI based on 1 year of income which is declining. In some cases, lenders might not approve your loan even if the current income and debt ratios meet FHA guidelines. Sometimes, mortgage brokers, and lenders will look into your tax deductions and this is the main reason why some 1099 applicants are getting denied for an FHA loan when applying.

Does a Lender Call My Company To Check my 1099 Income?

The answer is short, Yes. Your mortgage broker, bank, or lender will call your company to check if you are currently working there on 1099 and if you are making the money listed on your 1099 tax returns. If you are working for multiple companies as a 1099 individual and making a commission on working on a contract, the lender might call all of them to check if the information you provided is true and accurate.

Can I Combine my 1099 and W2 Tax Returns to Get an FHA Loan?

Yes, based on FHA guidelines you can combine 1099 with W2 income to qualify for FHA Loan. In some cases, you can still qualify if your income changed from W2 from the last year. If you are now working as an independent contractor on 1099 as soon as you provided proof of all that income and provided bank statements.

Qualifying For an FHA Loan And Getting Paid in Cash

Some commission earners are making extra money in cash. Professions like a waiter, lawnmowers, bartenders, babysitters, food delivery, or dog walkers still can get approved for FHA loans, they just need to regularly deposit cash into their bank account. To use cash for a downpayment or get them calculated as a bonus the money needs to be sourced for at least 60 days in your bank account. Based on HUD guidelines you need to prove your income based on deposits when a lender will ask you for your bank statements.

What FHA Mortgage Lenders Are Looking For When Applying

Mortgage lenders are looking for stability, they want to be sure that a person who applies for an FHA loan will afford to pay off the FHA loan. That’s why the lenders will check if you are a steady income for the last two years and they would like to see that the income will continue or increase in the future. That’s why they will take the last 1 year of tax 1099 returns if your income is declining.

Your FICO credit score is also an important factor in your FHA qualification process. The lenders would like to see a credit score over 600 and that you are responsible with your credit decisions. They don’t want to see any bankruptcies or foreclosures in past years.

In order to qualify for an FHA loan with 1099 income, self-employed borrowers must:

- Have been self-employed for at least two years

- Have a good credit history

- Have a consistent income

- Be able to show proof of income with tax returns and financial statements

If you can meet these requirements, you may be eligible for an FHA loan. For more information on qualifying for an FHA loan, contact us by filling out the quote or sending us an email at [email protected]

Can I Add My Rental Income to the 1099 Income To Qualify For a Mortgage?

If you own any properties and they are rented out, you can add any income received from your rental properties or royalties. This income can be used as income, after adding back any depreciations which can be found on Schedule E.

Can I use My Interest and Dividend Income To Qualify For FHA Loan?

Interest and dividend income from schedule B can be added to your total income for FHA qualifications. The taxable/tax-exempt income can be added to your ADI (adjusted gross income) only if you’ve been receiving it for the last 2 years and the income is likely will continue. The Lender will adjust the gross income amount if the interest-bearing assets are liquidated as a source of cash investment.

What if My 1099 Income is Seasonal?

If your 1099 income is seasonal, you may still be able to qualify for an FHA loan. Lenders typically want to see that you have at least two years of consistent 1099 income before they will approve a loan. However, if you can show that you have a steady work history and that your income is likely to continue, you may still be able to qualify.

If you’re self-employed and you’re thinking of applying for an FHA loan, don’t let the 1099 income hold you back. You may still be able to qualify! Just be sure to work with a lender who understands how to correctly calculate your DTI ratio.

October 10, 2022 - 7 min read