Applying For FHA Loan With Non-Occupant Co-Borrower

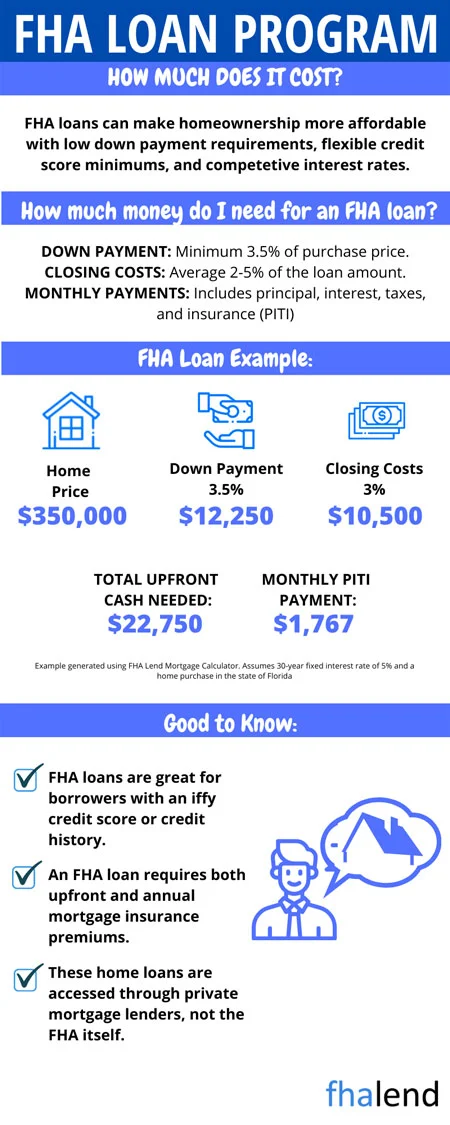

An FHA loan with non-occupant co-borrower involves using a government-insured mortgage program (FHA loan) with the financial support of a co-borrower who won’t reside in the property. This arrangement helps borrowers, especially first-time buyers, qualify for a mortgage by leveraging the income and creditworthiness of a non-occupant co-borrower, typically a family member. Both parties share responsibility for repaying the loan, potentially making homeownership more accessible.

Most individuals would want to own their own homes however in some cases they cannot qualify in this example for an FHA Loan. After reading the below article you will understand what it takes to qualify for an FHA loan with a non-occupant co-borrower. Many young people, on the other hand, are unwilling to wait 5+ years after graduation before investing in a down payment on a house. Fortunately, because FHA and Freddie Mac provide a mechanism for a parent or other relative to co-sign for a home without having to reside in it, there is hope. It is referred to as the non-occupying co-borrower. Each mortgage loan program has its own mortgage requirements for Non-Occupant Co-Borrowers for borrowers with high debt-to-income ratios.

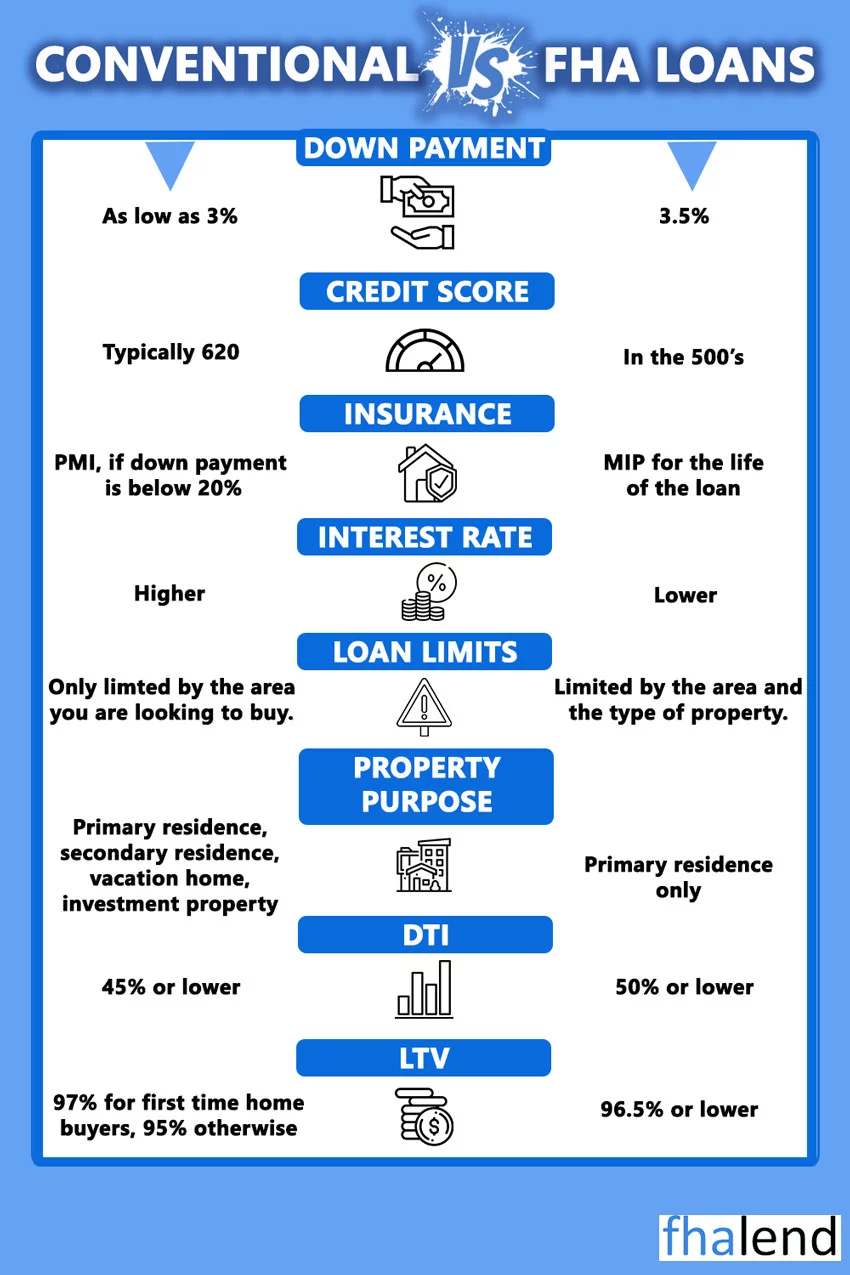

FHA and conventional loans allow the addition of non-occupants as co-borrowers. There are no restrictions on the number of non-occupant co-borrowers that may be added to an FHA or conventional loan. Only married spouses of the veteran borrower can be added as joint borrowers on VA loans. Non-residential co-borrowers cannot be included in USDA loans. The only co-borrowers who may be included in the main loaners on USDA loans are married spouses.

In this article (Skip to…)

Mortgage Requirements on Non-Occupant Co-Borrower VS Fannie Mae Guidelines

The great news for borrowers with higher debt-to-income ratios is that FHA allows borrowers who do not have income or have proof of income. FHA allows borrowers to add family members to become non-occupant co-borrowers. More than one non-occupant co-borrower can be added to FHA Loans. FHA loans are the only mortgage loan program that allows non-occupant co-borrower to be added to the mortgage loan. Non-occupant co-borrower or co-borrowers are added to the mortgage loan note but are not on the title. The borrower can have more than one non-occupant co-borrower.

The great news for borrowers with higher debt-to-income ratios is that FHA allows borrowers who do not have income or have proof of income. FHA allows borrowers to add family members to become non-occupant co-borrowers. More than one non-occupant co-borrower can be added to FHA Loans. FHA loans are the only mortgage loan program that allows non-occupant co-borrower to be added to the mortgage loan. Non-occupant co-borrower or co-borrowers are added to the mortgage loan note but are not on the title. The borrower can have more than one non-occupant co-borrower.

HUD Non-Occupant Co-Borrower Guidelines On FHA Loans

A non-occupant co-borrower needs to be related to the main borrower either.

- marriage

- blood

- law

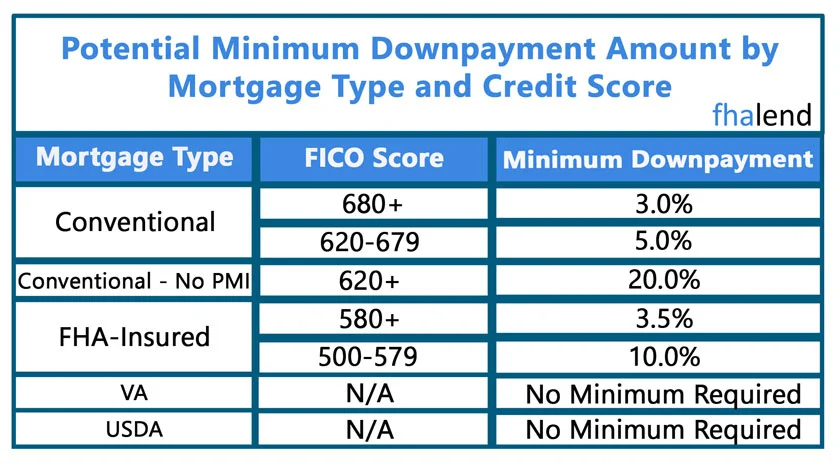

Non-occupant co-borrowers on a 3.5 percent down payment FHA loan must be connected to the main borrower in order to be eligible for one. Although non-occupant co-borrowers who are not family members and are not related to the primary borrower will require a 25% down payment, HUD allows them.

Family versus Non-Family Relationship to Main Borrower

There are lenders who will accept very close friends of the borrower as non-occupant co-borrowers. The friend and the borrower must show that they have known each other for at least five years. The non-occupant co-borrowers income will be used to verify eligibility for the mortgage. Mortgage underwriters will examine and ensure that debt to income ratios are appropriate for both the non-occupant co-borrowers primary house and the borrower’s new purchase.

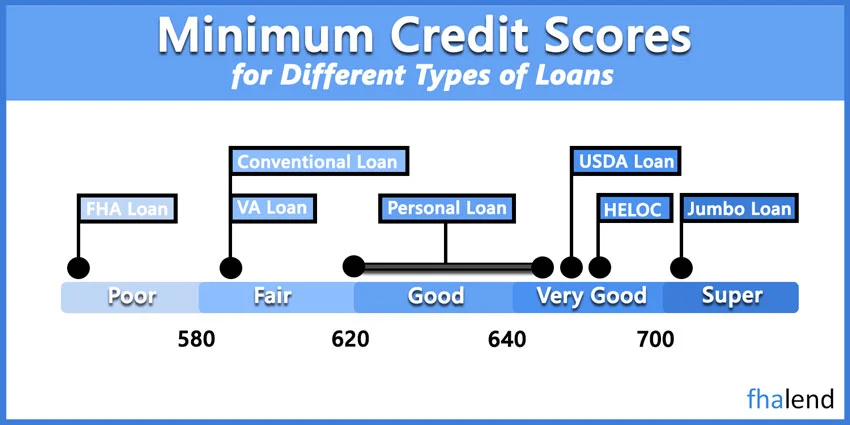

Credit Score Check

The non-occupant co-borrowers credit scores will be taken into effect. Underwriters will use the lower of either the borrower’s or non-occupant co-borrower credit scores. If the non-occupant co-borrower has lower credit scores than the main borrower’s, then the non-occupant co-borrowers credit scores will be used. If the borrower’s credit scores are lower than the non-occupant co-borrowers credit scores, then the borrower’s credit scores will be used.

FHA Jumbo Loan 50% DTI Non-Occupant Co-Borrower

Non-occupant co-borrower are allowed with Jumbo loans however Fannie Mae’s maximum total DTI ratio for manually underwritten loans is 36% of the borrower’s stable monthly income. If the borrower satisfies the credit score and reserve standards established in the Eligibility Matrix, the maximum may be exceeded up to 45%. The maximum permissible DTI ratio for loan case files underwritten by DU is 50%. A single-unit principal residence, for example, must have LTV ratios of no more than 95 percent, a credit score of at least 680, and a DTI ratio of no more than 36. A higher credit score is necessary if the DTI ratio is greater than 36 but less than 45. A credit score of 620 is acceptable if the LTV ratios are less than 75%. Check If You Are Eligible The lender’s assessment of the mortgage delinquency risk, the evaluation of the property’s security for the loan, whether the mortgage is Fannie Mae-qualifying, and whether the documentation in the mortgage file is acceptable should all influence whether or not to give out the mortgage to Fannie Mae. The lender must document the outcomes of its comprehensive risk assessment and concluding underwriting decision, as well as ensure that the data used in reaching its comprehensive risk assessment is valid, reliable, and justified. For a more precise or final recommendation on whether to give a specific mortgage to Fannie Mae, the lender should send the application to DU.DU assesses the risk of future significant delinquency and determines an underwriting decision by looking at a variety of risk factors in a mortgage application. Furthermore, all mortgages sold to Fannie Mae are judged against DU as the standard for evaluating delinquency risk.

Co-signing On A Mortgage For A Family Member

Will co-borrowers hurt their chance of qualifying for their own home loan in the future by co-signing on a home loan for a family member? The answer to this commonly asked question is yes and no. Co-borrowers renting and wanting to purchase their own home will need to qualify for their own mortgage loan. However, if they do not want the payments on the mortgage they co-signed, they need to wait 12 months for the co-signed loan not to count towards debt-to-income ratios on the new loan. The co-signed mortgage loan will not count towards debt to income ratios as long as they can provide a new lender that they are not responsible for the co-signed mortgage loan. This is done by providing 12 months of the canceled checks and/or bank statements of the main borrowers making the payments. The non-occupant co-borrower needs to provide documentation that someone else is making the payments.

Exemption From FHA DTI Calculations

Providing 12 months’ canceled checks and/or bank statements from the main borrower proves the co-borrower is not liable for the monthly payments. The monthly debt will be exempt from the debt-to-income ratio calculations when processing and underwriting the new mortgage loan application of the co-borrower. Once the main borrower provides the 12 months of canceled checks and/or 12 months of bank statements, the main borrower’s monthly mortgage payments will be exempt. However. The risk is the co-borrowers needs to wait until the main borrower has owned the home for at least 12 months and has made two monthly timely payments. If the main borrower has paid off the mortgage loan, the co-signer will be exempt from the co-signed mortgage as well.

Risks With Being A Co-Borrower

There are more risks with becoming a non-occupant co-borrower. Rewards for being a non-occupant co-borrower are the reward of helping a family member or relative the chance of becoming a homeowner. Without the non-occupant co-borrower, they would not have qualified for an FHA loan. Chances are that they will still be renting. If the primary applicant (borrower) is late on their monthly mortgage payments, it will really adversely affect non-occupant co-borrowers’ credit.

Bankruptcy and Foreclosure with Co-Borrowers

If the main borrower forecloses on their home, non-occupant co-borrowers are responsible for the deficit judgment if there is one. Foreclosure, deed in lieu of foreclosure, or short sale on non-occupant co-borrower records will affect the chances of getting a new mortgage. The same guidelines after foreclosure apply to non-occupant co-borrowers. The three-year waiting period from the date the deed is transferred out of the borrower’s name into the mortgage lender’s name or from the date of the short sale to qualify for FHA loans. Prior to committing to being a non-occupant co-borrower carefully think about the risks versus rewards. Make sure the person you are co-signing for is a financially responsible person and that their income and job are secured. In this blog, we will discuss and cover HUD non-occupant co-borrower mortgage guidelines on FHA loans. HUD Non-Occupant Co-Borrowers Mortgage Guidelines allow non-occupant co-borrowers to be added to main borrowers on FHA loans. HUD implemented and launched the new HUD FHA 4000.1 Handbook on September 14, 2015, where many changes have been made to HUD Lending Guidelines. HUD is the parent of FHA.

Why Are FHA Loans So Popular?

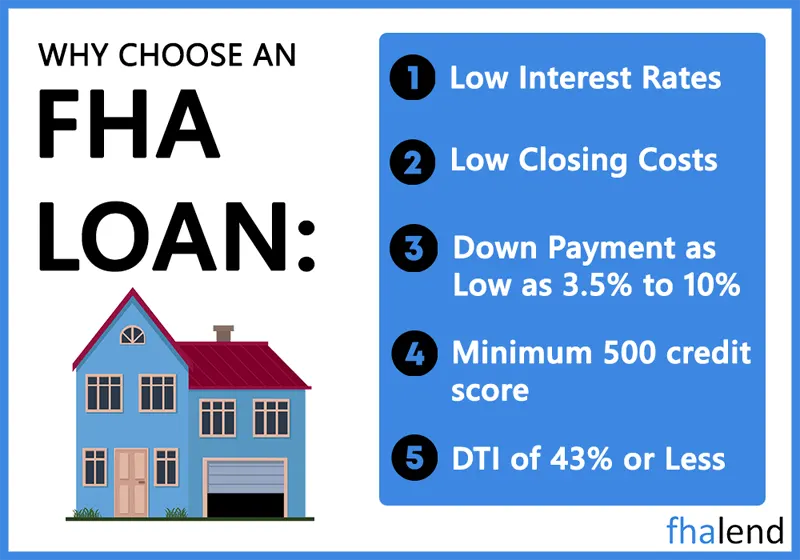

FHA loans are hands down the most popular residential mortgage loan program in this country. FHA loans normally have more lenient mortgage lending guidelines than Freddie Mac’s and Fannie Mae’s conventional loan programs. Homebuyers with less than perfect credit, low credit scores, outstanding collection accounts, prior bankruptcy, prior foreclosure, prior deed in lieu of foreclosure, prior short sale, judgments, tax liens, charge-off accounts, and higher debt to income ratios often can get an FHA loan approval where they cannot qualify for conventional loan programs.

Benefits Of Adding Non-Occupant Co-Borrowers

FHA Guidelines On Co-Borrowers make homeownership possible for homebuyers who are self-employed. Or those with little or no income or those homebuyers who work for cash and do not have documented income for mortgage lenders to be able to use. Fannie Mae and Freddie Mac now allow non-occupant co-borrowers to be added to main borrowers. Homebuyers with low credit scores can often qualify for FHA loans. This holds true as long as they have documented income. However, those with perfect credit scores and no income cannot qualify for any other mortgage loan programs. Income is key when qualifying for a home loan In this article, we will discuss and cover FHA Non-Occupant Co-Borrowers Mortgage Guidelines Versus Other Mortgage Programs.

FHA Guidelines On Co-Borrowers make homeownership possible for homebuyers who are self-employed. Or those with little or no income or those homebuyers who work for cash and do not have documented income for mortgage lenders to be able to use. Fannie Mae and Freddie Mac now allow non-occupant co-borrowers to be added to main borrowers. Homebuyers with low credit scores can often qualify for FHA loans. This holds true as long as they have documented income. However, those with perfect credit scores and no income cannot qualify for any other mortgage loan programs. Income is key when qualifying for a home loan In this article, we will discuss and cover FHA Non-Occupant Co-Borrowers Mortgage Guidelines Versus Other Mortgage Programs.

A non-occupying co-borrower can benefit from a variety of situations. A young married couple fresh out of college with a good job and the potential for an improvement in salary is one such example. Another example is a young person who is studying away from their family home. Parents may sign off on the purchase of a house or condominium to assist with the mortgage payments. It’s conceivable to let other students stay in one or two rooms while you’re renting out the rest of the property for income. Finally, the desire for senior citizens to live closer to their children and require their child’s income to get approved for a mortgage is becoming more popular. This is usually due to an elderly person wanting more medical care or attention, necessitating that they are close to the family who can look after them.

Why People Are Adding a Non-Occupying Co-Borrower To Their FHA Loan?

Why would you need to ask your parent or another close relative to sign as a non-occupying co-borrower? After all, it gives the co-borrower more control over the borrower’s finances. It is mostly done to allow individuals to purchase a house after their future income catches up with their financial obligations. Many graduates of college have spent years on a frugal lifestyle while paying a high rent and utility bills. With a new job and increased earnings, it should not take long to pay off some of your smaller obligations and provide money for the house. Many young individuals fresh out of school have student loan debt that has become current and necessitates a payment. This monthly contribution might prevent certain borrowers from qualifying for a mortgage loan because they are just beyond the threshold.

While it’s true that several careers and professional paths frequently result in greater yearly salaries for new professionals, mortgage requirements do not take advantage of these probable hikes to qualify for a loan. Only the borrower’s current salary is considered when determining mortgage eligibility. Another reason why family members sometimes ask for a co-borrower is to assist with minor credit issues. With the alteration in mortgage lending regulations, a lot of individuals have a good credit score and other qualifying criteria that will allow them to acquire an automobile or obtain a credit card. In fact, they may even have a comfortable salary and enough money set aside for a small down payment on a house. However, without a mortgage, their credit scores are not yet adequate to obtain one on their own. A non-occupying co-borrower with a good credit history, little debt, and enough income to meet their requirements as well as assist one of their relatives can help broaden an overall mortgage application. Since interest rates are likely to rise in the next years, it may be more beneficial for a younger relative to purchase a house now while rates are lower.

FHA Guidelines On Relationship To Main Borrowers

FHA Mortgage Loan Guidelines On Co-Borrowers:

- To be eligible to be a non-occupant co-borrower on an FHA loan, you must be related to the main borrower by blood, law, or marriage.

- This simply implies that non-occupant co-borrowers can be parents, brothers, sisters, grandparents, grandchildren, sons, daughters, daughter-in-law, son-in-law, father-, mother-, and grandparent in-laws

- There are a few lenders, such as myself, who do not require borrowers to have an established relationship.

- We just take the borrower’s word for it most of the time.

- There are certain lenders who demand proof of the connection between non-occupant co-borrowers.

- Non-occupant co-borrowers will be on the mortgage note, but they do not have to stay there unless they need to.

The non-occupant co-borrowers in FHA Loans with a 3.5% down payment must be related to the main borrower by law, blood, or marriage in order for home buyers to qualify. Non-occupant co-borrowers are not subject to the same restrictions as main borrowers. They may become non-occupant co-borrowers, however, a 15% down payment is required. Non-resident co-borrowers who are not connected by blood, marriage or the law can be added if the primary house buyer wishes to acquire a property with a 3.5 percent down payment.

FHA Mortgage Guidelines With Credit Scores

When the main borrower adds a non-occupant co-borrower or just a co-borrower on the mortgage loan, the co-borrower’s credit scores will be reviewed also. The credit scores used in qualifying for the mortgage loan when it involves co-borrowers are lenders use the lower of the two mortgage loan borrower’s middle credit scores. For example, let’s take this case scenario in explaining what qualifying credit scores mortgage lenders will use when qualifying for a mortgage loan:

- Main Borrower: John Smith: Credit Scores are 780 TransUnion, 680 Experian, 580 Equifax

- The middle credit score for John Smith is 680 Experian

- Co-Borrower: Jesse Smith: Credit Scores are 650 TransUnion, 581 Experian, 500 Equifax

- The middle credit score for Jesse Smith is 581 Experian

In the above case scenario, the co-borrower credit score of 581 will be used for qualifying purposes because Jesse Smith, the co-borrower, has the lower middle score among the two borrowers.

FHA Non-Occupying Co-Borrower Rules and Guidelines

A non-occupied borrower may be either a close friend or a relative, according to the FHA. However, it is highly suggested that the borrower is a relative. If there is no direct blood relationship between the buyer and co-borrower, FHA may want an explanation of the connection between them.

There are a variety of options for those who don’t want to live in the property:

- Both credit, employment, and residency information will be required for a complete two-year record.

- A social security number must be supplied.

- A co-borrower can be a non-permanent alien as long as the main primary resident borrower is a citizen

FHA Mortgage Loan Specific Requirements

Anyone who is not living in the home must meet additional criteria and conditions, as well as the following provisions.

- They will be subjected to all mortgage underwriting criteria in regards to their proof of income, debt ratios, credit report, assets and work history, as well as the consistency of their residence history.

- After the getting CTC, the loan is approved and all docs signed, the co-borrower will not live on the property

- The co-borrower is equally responsible for the mortgage as the primary borrower.

- They must have a primary residence in the United States.

FHA LTV and Down Payment For Co-Borrowers

With as little as a 3.5% down payment, consumers can borrow up to 97.5% of the property’s value and buy a home for $0 down with excellent credit. The maximum loan-to-value ratio is 96.5 percent, with as little as 3.5 percent* down payment required (the actual amount could be higher.

Freddie Mac Non-Occupying Co-Borrower Rules and Guidelines

The general rules for a Freddie Mac loan are quite similar to the rules for an FHA loan. If a borrower and co-borrower are approved for the mortgage, the online underwriting system will determine what debt ratios are allowed for their particular loan. One of the primary distinctions between Freddie Mac and Fannie Mae is that a cash deposit from the borrower must be placed. This money must be at least 5% of the sales price of the property. Acceptable down payments include those that may be used to finance part or all of a purchase price.

- checking account

- savings account

- money market account

- certificates of deposit

- stock and bond investments

- retirement account funds if the money can be accessed easily by the borrower

Adding Multiple Co-Borrowers on FHA Loan

FHA Guidelines On Co-Borrowers allow more than one co-borrower to be added to the FHA loan for income qualification purposes. The main borrower can have multiple co-borrowers to qualify for income in the event that one co-borrower does not have sufficient income or have a higher debt to income ratio. Co borrowers on FHA loans can be folks who are on a fixed income like social security, disability income, or retirement income. Non-taxable income borrowers can have their non-taxable income grossed up by 15%.

Adding Non-Occupant Co-Borrowers to FHA Loan

VA Home Loans does not allow non-occupant co-borrowers. Only legally married spouses to the main borrower can be added to VA Mortgages. USDA does not allow non-occupant co-borrowers. Conventional Loans do allow non-occupant co-borrowers. Co-borrowers do not have to be related to the main borrower by blood, law, and/or marriage on conventional loans. FHA Non-Occupant co-Borrowers mortgage guidelines allow family members to be on a homebuyer FHA Loan for income qualification. There can be more than one non-occupant co-borrowers. FHA allows a non-occupant cosigner is allowed with FHA loans. Non-Occupant Co-Borrowers need to be related to the borrower by law, blood, and/or marriage. A non-occupant co-borrowers need to meet all FHA Guidelines like the borrower. The main borrower can have non-occupant co-borrowers who are not related by law, marriage, or blood but if that is the case, a 25% down payment is required. In the following paragraphs, we will discuss FHA requirements for non-occupant Co-Borrowers And Borrowers on FHA Loans.

VA Home Loans does not allow non-occupant co-borrowers. Only legally married spouses to the main borrower can be added to VA Mortgages. USDA does not allow non-occupant co-borrowers. Conventional Loans do allow non-occupant co-borrowers. Co-borrowers do not have to be related to the main borrower by blood, law, and/or marriage on conventional loans. FHA Non-Occupant co-Borrowers mortgage guidelines allow family members to be on a homebuyer FHA Loan for income qualification. There can be more than one non-occupant co-borrowers. FHA allows a non-occupant cosigner is allowed with FHA loans. Non-Occupant Co-Borrowers need to be related to the borrower by law, blood, and/or marriage. A non-occupant co-borrowers need to meet all FHA Guidelines like the borrower. The main borrower can have non-occupant co-borrowers who are not related by law, marriage, or blood but if that is the case, a 25% down payment is required. In the following paragraphs, we will discuss FHA requirements for non-occupant Co-Borrowers And Borrowers on FHA Loans.

High Debt To Income Ratios

There are many cases where an individual would not qualify for a home loan due to high debt-to-income ratios. HUD Guidelines on debt on debt to income ratio allow 46.9% front end and 56.9% back end DTI. However, many qualified homebuyers exceed this ratio because they cannot document their income so non-occupant co-borrowers are needed. Folks in the restaurant industry are often paid in cash and do not declare their cash income so the lender cannot use the undeclared income.

Self-employed Non-Occupant Co-Borrower Qualification

Another group of individuals who often have high debt-to-income ratios is self-employed individuals and business owners. Self-employed individuals and business owners often use the tax loopholes in writing expenses off and often get away with declaring less income in order to pay fewer taxes. This is great because it saves the person from paying more taxes but it is a major problem when it comes to applying for a mortgage loan.

Bankruptcy And Foreclosure

Other cases where the debt to income ratio problem comes in is when a married person has a bankruptcy or foreclosure but the other person does not. The married person without bankruptcy or foreclosure can qualify for an FHA loan. But the married person with bankruptcy or foreclosure cannot be on the loan and therefore their income cannot be used in qualifying for a mortgage loan. Non-Occupant Co-Borrowers can make situations like the above possible in qualifying for FHA Loans

Other cases where the debt to income ratio problem comes in is when a married person has a bankruptcy or foreclosure but the other person does not. The married person without bankruptcy or foreclosure can qualify for an FHA loan. But the married person with bankruptcy or foreclosure cannot be on the loan and therefore their income cannot be used in qualifying for a mortgage loan. Non-Occupant Co-Borrowers can make situations like the above possible in qualifying for FHA Loans

Qualified Income: Child Support Payments And Other Debts

Other typical scenarios include mortgage loan borrowers who have child support payments. Two, three, or four kids can take up a chunk of a person’s gross monthly income and although not every dollar is used on the kids, the lender considers every dollar awarded as child support as a monthly liability. Folks with high monthly child support payments often run into high debt to income ratio problems and the only solution is a cosigner for them to qualify for a mortgage loan.

How Does Being A Non-Occupant Co-Borrower Affect The Cosigner When Qualifying For Another Mortgage Loan?

Non-Occupant Co-Borrowers can own another home and do not have to live with the borrower. However, they do have to meet all HUD Guidelines and qualify with the lenders’ credit, and income guidelines. Homebuyers who are looking for an FHA Lender with no overlays and have more questions on this topic, please contact us at this link.

Job History & Outstanding Student Loans

There are instances where homebuyers can afford the proposed new housing payment on a home purchase but do not qualify do to not having qualified verified income. For example, mortgage applicants may have part-time income and/or other income that may not be considered qualified income when qualifying for home loans.  Or they may have large outstanding student loan balances that will be forgiven or in long-term deferment but lenders want to count that when calculating debt to income ratios. Conventional and FHA loans allow non-occupant co-borrowers to be added to the main borrower. However, there are specific non-occupant co-borrower guidelines

Or they may have large outstanding student loan balances that will be forgiven or in long-term deferment but lenders want to count that when calculating debt to income ratios. Conventional and FHA loans allow non-occupant co-borrowers to be added to the main borrower. However, there are specific non-occupant co-borrower guidelines

Agency Mortgage Guidelines

Every mortgage loan program has its own non-occupant co-borrower guidelines. The only two loan programs that allow Non-occupant co-borrowers are FHA and Conventional loans. Conventional loans are also called conforming loans. This is because they need to conform to Fannie Mae and/or Freddie Mac Guidelines. Conforming loans are not insured nor guaranteed by the government. The roles of Fannie Mae and Freddie Mac are to purchase conforming loans originated and funded by private lenders.

FHA Government Guarantee

Due to this government guarantee, private lenders are able to offer low down payments and low-interest owner-occupant home mortgages to home buyers with higher debt-to-income ratios and less than perfect credit. Having the ability to add multiple non-occupant co-borrowers is one of the benefits of FHA loans. HUD also has the most generous debt-to-income ratios out of any loan program. To get an approve/eligible per Automated Underwriting System, the max front end cap is 46.9% and the max back end is capped at 56.9%.

Relation Co-Borrowers Needs To Be To Main Borrowers

Both HUD and Fannie/Freddie has distinct different non-occupant co-borrower guidelines. HUD Non-Occupant Co-Borrower Guidelines require that non-occupant co-borrowers be related to main borrowers by the following:

- Blood

- Marriage

- Law

Being related by blood means mom, dads, brothers, sisters, children, grandchildren, grandparents, or anyone relative related by blood. Spouses are related by marriage so they will qualify. Being related by law means in-laws. Some lenders are more strict in enforcing their relations with borrowers than other lenders. At FHA Lend Mortgage, we just ask the relation the non-occupant co-borrower is to the borrower and just take the word of the borrower. Other lenders may be more strict and ask for documentation. If non-occupant co-borrowers are not related to main borrowers, then HUD requires a 25% down payment on a home purchase versus a 3.5% down payment.

Down Payment Requirements On Multi-Family Home Financing

To recap, HUD allows non-occupant co-borrowers. To qualify for a 3.5% down payment FHA Loan on single-family homes, the non-occupant co-borrowers need to be related to the main borrower by marriage, law, or blood. Otherwise, HUD requires a 25% down payment.  However, on 2 to 4-unit multi-family homes, FHA requires a 25% down payment if Non-occupant co-borrowers are added to purchase 2 to 4-unit homes. Fannie Mae requires a 15% down payment on two to four-unit homes if Non-occupant co-borrowers are added which is the same if one person purchases a two to four-unit home. Freddie Mac HomePossible requires a 5% down payment on two to four-unit multi-family homes if co-borrowers are added. However, 3% out of the 5% of the down payment needs to come from the main borrower.

However, on 2 to 4-unit multi-family homes, FHA requires a 25% down payment if Non-occupant co-borrowers are added to purchase 2 to 4-unit homes. Fannie Mae requires a 15% down payment on two to four-unit homes if Non-occupant co-borrowers are added which is the same if one person purchases a two to four-unit home. Freddie Mac HomePossible requires a 5% down payment on two to four-unit multi-family homes if co-borrowers are added. However, 3% out of the 5% of the down payment needs to come from the main borrower.

Conventional Loans

Fannie Mae and Freddie Mac enable non-occupant co-borrowers to be added to conventional loans. Unlike HUD’s non-occupant co-borrower mortgage guidelines, conventional loans do not need non-resident co-borrowers to be related to the primary borrower by law, marriage, or blood. Non-occupant co-borrowers may be added to conventional loans for owner-occupied primary residences.

Non-QM Requirements on Non-Occupant Co-Borrowers

Non-QM loans allow non-occupant co-borrowers. However, the individual wholesale non-QM lender will have their own lending requirements when it comes to the occupant and/or non-occupant co-borrowers. Non-QM loans are portfolio loans and lenders can negotiate terms and conditions depending on the non-QM lender.

VA Non-Occupant Co-Borrower Mortgage Guidelines

The U.S. Department of Veterans Administration (VA) only allows a married spouse to the veteran borrower to be co-borrowers. Non-occupant co-borrowers are not allowed on VA loans. There is no maximum debt-to-income ratio caps on VA loans as long as you can get an approve/eligible per automated underwriting system (AUS). The key to getting an automated underwriting system approval on VA loans is strong residual income.

USDA Loans Non-Occupant Co-Borrower Guidelines

Non-occupant co-borrowers are not allowed on USDA loans. Only married spouses to the main borrower are allowed to become co-borrowers on USDA loans. USDA loans have maximum household income limits. The income limit cap depends on the region where the property is located.

Non-Occupant Co-Borrower Relationship On Conforming Loans

Fannie Mae and Freddie Mac do allow non-occupant co-borrowers to be added to main borrowers. However, both Fannie Mae and Freddie Mac do not require that non-occupant co-borrowers be related to the main borrower by blood, law, or marriage. With Fannie Mae, the main borrower needs income. With Freddie Mac, the main borrower does not need income and all income used in DTI can be used by co-borrowers. As mentioned earlier, the Department of Veterans Affairs does not allow non-occupant co-borrowers.

For the right family, the non-occupying co-borrower rule can be an excellent method to meet a pressing housing need without having to deal with one relative borrowing money from another.

Only married spouses of veterans can be added to VA Home Loans as occupant co-borrowers. Homebuyers who need to start the pre-approval process with a direct lender with no overlays on government and conventional loans can contact us at FHA Lend Mortgage at 888-900-1020 or text us for a faster response. Or email us at [email protected]. The team at FHA Lend Mortgage is available 7 days a week, on evenings, weekends, and holidays.

FHA Mortgage Rates in 2024 and Current Market

Last week, mortgage interest rates witnessed a significant surge across all categories, with the rate for the government’s low down payment option reaching its highest point in 21 years. This substantial increase had a notable impact on mortgage demand, leading to a 3.1% drop in total application volume compared to the preceding week. The Mortgage Bankers Association’s seasonally adjusted index reported these findings. For 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less), the average contract interest rate rose from 6.93% to 7.09%. Additionally, points increased from 0.68 to 0.70 (including the origination fee) for loans requiring a 20% down payment. Meanwhile, the average rate for jumbo loans reached 7.04%.

Notably, the rate for Federal Housing Administration (FHA) loans, often favored by first-time or lower-income borrowers due to their low down payment requirements, reached 7.02%—marking the highest level since 2002. This surge in rates underlines the evolving landscape of mortgage lending, impacting both current homeowners and prospective buyers. Mortgage applications for home purchases experienced a 3% decline over the week, marking a 27% decrease compared to the corresponding week in the previous year.

The surge in mortgage rates is posing challenges not only for aspiring homebuyers in affording properties but also for existing homeowners contemplating a move. With prevailing mortgage interest rates ranging from 3% to 4%, current homeowners are hesitant to pursue a new home investment that could potentially entail rates twice as high. Furthermore, applications for refinancing home loans followed a similar trend, plummeting by 4% over the week and revealing a substantial 37% drop compared to the same period the previous year.

Lates Updates For Non-Occupant Co-Borrower From HUD in 2024

In a recent development, the U.S. Department of Housing and Urban Development (HUD) unveiled a noteworthy decrease in the annual mortgage insurance premium imposed on individuals with FHA-insured loans. This move is anticipated to result in a yearly average savings of approximately $800 for FHA borrowers. HUD’s initiative extends further with the release of Mortgagee Letter 2024-05, which outlines the specifics of the premium reduction. Moreover, HUD has introduced a comprehensive fact sheet that highlights various additional measures aimed at enhancing the affordability of homeownership. These strategic actions underscore HUD’s commitment to fostering accessible and affordable housing opportunities for a broader range of individuals.

Check If You Are Eligible The updated guidelines mark a significant shift, providing a fresh avenue for individuals seeking FHA loans. The inclusion of Non-Occupant Co-Borrowers empowers applicants to explore broader eligibility criteria and increased borrowing potential, redefining the path to homeownership. Our comprehensive resources and expert guides break down these new guidelines, ensuring a seamless understanding of how to capitalize on the advantages of Non-Occupant Co-Borrowers. Embrace the future of lending by embracing the HUD 2024 guidelines for FHA Loans With Non-Occupant Co-Borrowers, and embark on your homeownership journey with newfound flexibility and financial feasibility.

January 15, 2024 - 19 min read