VA Home Loans Down To 550 Fico Score

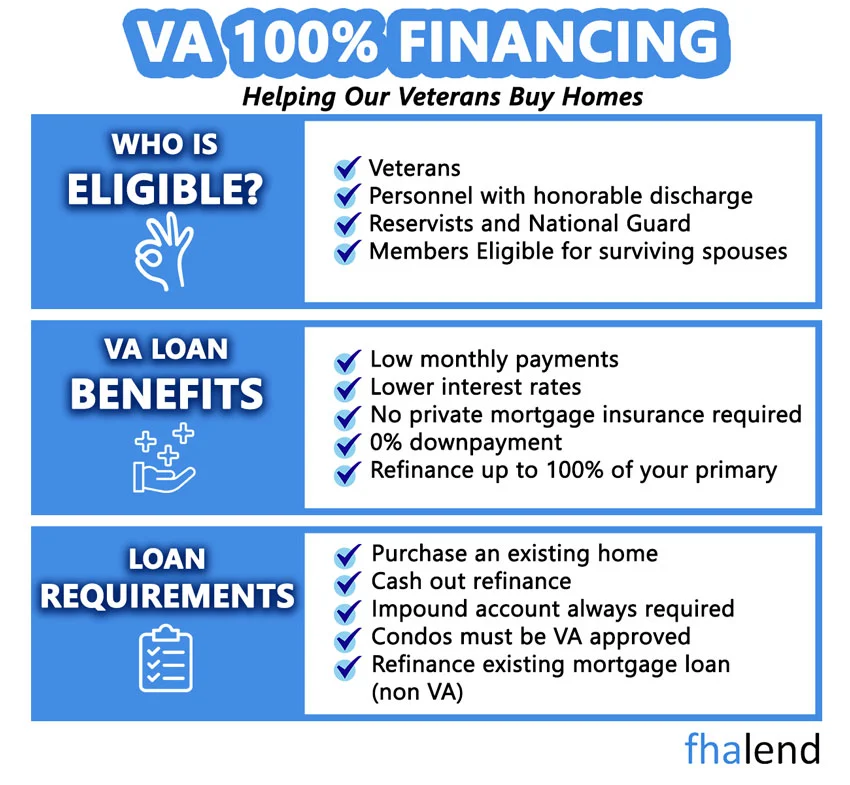

If you’re a qualified veteran, you may be eligible for a VA home loan. In order to get a VA home loan, there are a few requirements that you’ll need to meet. In this blog post, we’ll go over some of the main requirements for getting a VA home loan. Veterans, both current and retired, and their qualified spouses, are eligible for VA loans. One popular type of loan is the VA loan. Benefits are available to America’s eligible active-duty and returning military personnel.

With VA home loans down to 550 fico score, people can still get a decent mortgage rate but they have to find a lender with no overlays on VA loans. It’s easy to see why, with low rates and the option to put no money down on a property or to refinance all your equity. Lenders do, however, impose some criteria. Anyone pursuing a mortgage, including a VA loan, should have a solid credit score as a starting point. VA loans feature low-interest rates and frequently do not demand a down payment. However, the VA loan program’s eased credit standards are one of its most delicate features.

How To Find Out If I Qualify For a VA Loan With 550 FICO?

One of the first things you’ll need to do is get a Certificate of Eligibility (COE). You can get your COE through the Veterans Administration or through an approved lender. Once you have your COE, you’ll need to fill out a loan application and provide any required documentation.

The eligibility requirements for a VA home loan are as follows:

- You must have served in the military, either full-time or as a reservist, for at least 90 days during wartime or 180 days during peacetime.

- You must have been honorably discharged from service.

- If you are the spouse of a service member who died in the line of duty or as a result of a service-related disability, you may be eligible for a VA mortgage loan.

- You must meet the credit and income requirements set by the lender.

- You must have a valid COE (Certificate of Eligibility ) from the VA.

- You must occupy the home as your primary residence.

5 Types of Properties That Qualify for a VA Home Loan

There are a number of different types of properties that may qualify for a VA home loan. These include primary residences, second homes, condominiums, townhouses, and manufactured homes. In order to obtain a VA home loan, borrowers must first meet certain eligibility requirements.

1. Primary residences

Primary residences are those in which the borrower intends to live full-time. In order to qualify for a VA loan on a primary residence, the property must be owner-occupied. This means that the borrower must live in the home as their primary residence for at least one year after the loan is closed.

2. Second homes

Second homes are properties that are not intended to be the borrower’s primary residence. In order to qualify for a VA loan on a second home, the property must be owner-occupied. This means that the borrower must live in the home as their primary residence for at least one year after the loan is closed.

3. Condominiums

Condominiums are a type of property that can be either a primary residence or a second home. In order to qualify for a VA loan on a condominium, the borrower must live in the unit as their primary residence for at least one year after the loan is closed.

4. Townhouses

Townhouses are another type of property that can be either a primary residence or a second home. In order to qualify for a VA loan on a townhouse, the borrower must live in the unit as their primary residence for at least one year after the loan is closed.

5. Manufactured homes

Manufactured homes are a type of property that can be either a primary residence or a second home. In order to qualify for a VA loan on a manufactured home, the borrower must live in the home as their primary residence for at least one year after the loan is closed.

VA’s Role in the Loan Procedure and Credit Score Requirements

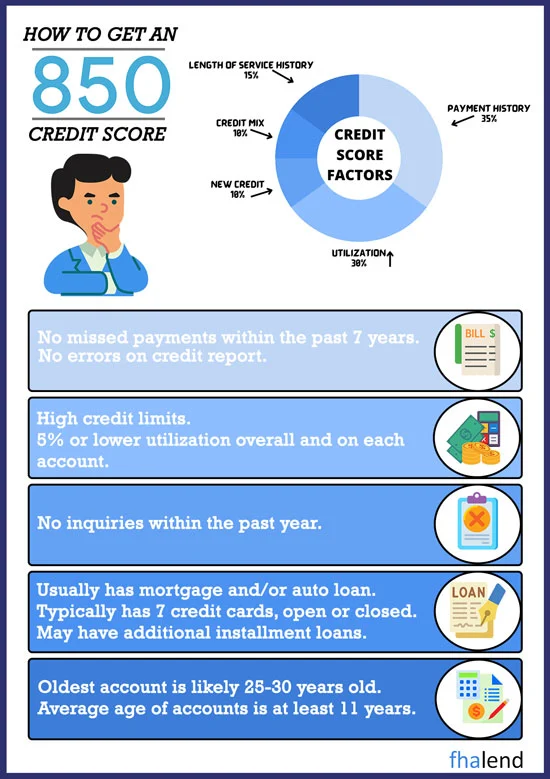

Understanding the VA’s role in the VA loan procedure is critical. The VA does not establish a credit score requirement, but it does advise lenders to make informed decisions. Most VA lenders use credit score benchmarks. Increasing your credit score is an excellent goal to set for yourself, especially if you want to take out a loan to finance a significant purchase. If you have a perfect credit score, you can save significant amounts of money over the course of your life.

Are VA Loans Better Than Conventional Loans?

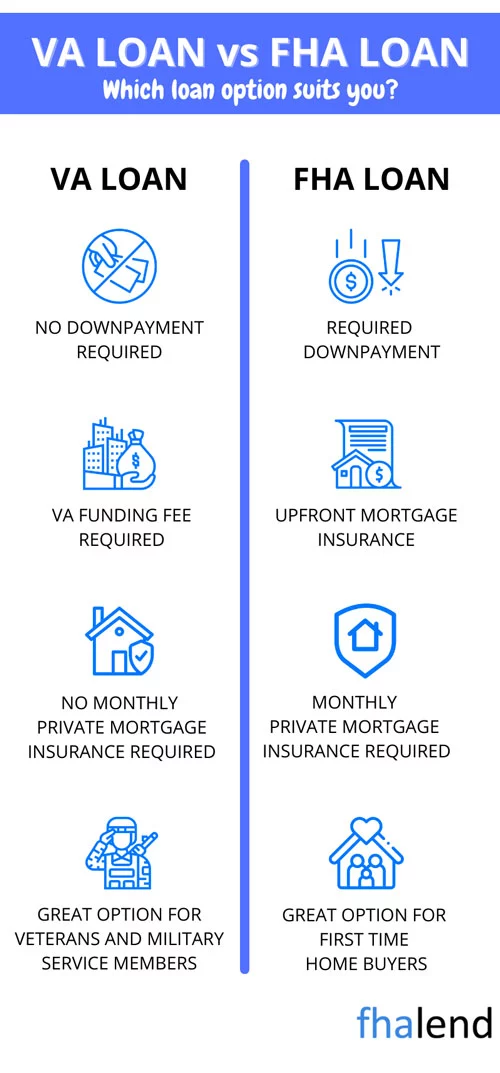

If you’re a veteran, you may be wondering if a VA loan is the right choice for you. While conventional loans are also an option, there are some advantages to VA loans that may make them a better fit. Here’s a look at some of the key differences between VA and conventional loans.

VA Loans vs. Conventional Loans: Key Differences

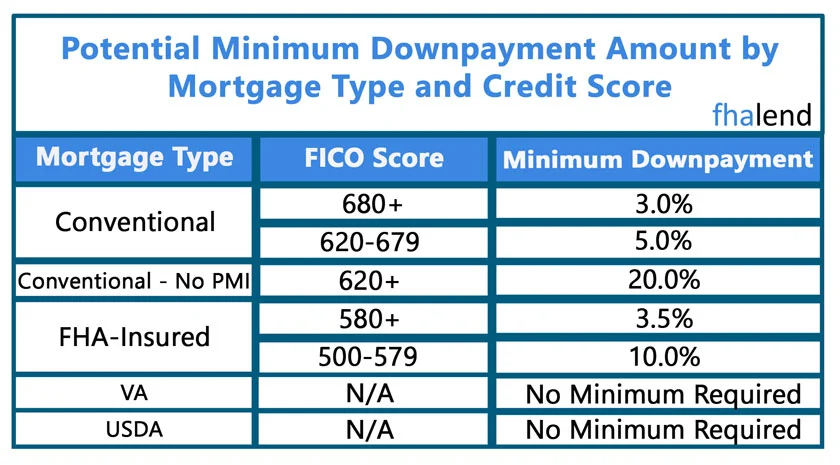

No down payment on VA loans. One of the biggest benefits of a VA loan is that you can buy a home with no money down. In contrast, most conventional loans require at least a 3% down payment. If you don’t have the cash on hand for a down payment, a VA loan could be a good option.

interest rates on VA loans are typically lower than on conventional loans. This could save you money over the life of the loan.

Credit requirements for VA loans often are more relaxed than conventional loans. If you have less-than-perfect credit, a VA loan could be a good option.

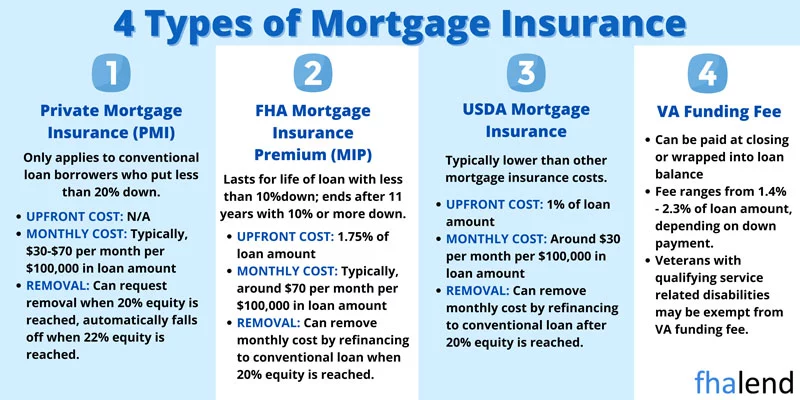

Private mortgage insurance (PMI): is required on most conventional loans with less than 20% down. However, PMI is not required on VA loans. This could save you hundreds of dollars per month, depending on the size of your loan and your down payment amount.

If you’re a veteran, a VA loan could be a great option for buying a home. With no money down and relaxed credit requirements, it can make homeownership more attainable. And with lower interest rates, you could save money over the life of the loan. So if you’re considering buying a home, be sure to check out VA loans as an option.

How Much Is The Funding Fee For a VA Loan?

The funding fee for a VA home loan is a fee charged by the Department of Veterans Affairs (VA) to help cover the costs of the VA home loan program. The fee is charged to all borrowers, regardless of whether they are using the VA home loan program for the first time or if they are refinancing an existing loan. The funding fee is generally 1% of the loan amount but can vary depending on the type of loan and the borrower’s status.

For first-time borrowers using the VA home loan program, the funding fee is 2.15% of the loan amount. For borrowers who are refinancing an existing loan, the funding fee is 1.25% of the loan amount. Borrowers who are considered exempt from the funding fee include those who are receiving disability benefits from the VA, as well as surviving spouses of veterans who died in service or as a result of a service-related injury.

The funding fee for a VA home loan is typically financed into the loan amount, so borrowers do not have to pay it out-of-pocket. However, borrowers who choose to make a down payment of at least 5% may elect to pay the funding fee in cash, which can help to reduce the overall cost of the loan.

If you’re a veteran or active duty service member who is interested in purchasing a home, the VA home loan program can be a great option. However, it’s important to understand the costs associated with the loan, including the funding fee, before you apply. Working with a knowledgeable lender can help ensure that you get the best possible deal on your VA home loan.

Do I Need To Pay Mortgage Insurance for a VA Home Loan?

Mortgage insurance is required for all borrowers who obtain a VA home loan. The insurance protects the lender in the event that the borrower defaults on the loan. The fee for mortgage insurance is paid by the borrower and is usually included in the monthly mortgage payment. There are two types of mortgage insurance for a VA home loan: private mortgage insurance (PMI) and lender-paid mortgage insurance (LPMI). PMI is typically required for loans with less than 20% down payment, while LPMI is typically required for loans with more than 20% down payment.

Mortgage insurance is a type of insurance that protects lenders against loss in the event that a borrower defaults on their home loan. VA home loans are guaranteed by the Department of Veterans Affairs, and they are available to eligible service members, veterans, and surviving spouses. VA home loans are available with no down payment and no monthly mortgage insurance premiums. VA home loans Down To 550 Fico Score means that even if your credit score is not perfect, you may still be able to qualify for a VA home loan.

Should You Improve You Credit Score If You Are at 550?

People with good credit can get better deals on mortgages, car loans, and other forms of credit. But If your score is at 550 you can get a loan without improving any scores. Your mortgage rate will be higher however you can lower it by refinancing your mortgage in 6 months or so when your credit score improves. Making on-time payments to your creditors and lenders is one of the most critical aspects of your credit score. Past issues, such as missed or late payments, are difficult to rectify. Applicants with credit ratings below a lender’s minimum are unlikely to be approved for VA loans. The minimum will differ depending on the lender.

To qualify for VA financing or to receive favorable rates and conditions, borrowers do not need to have spotless credit histories or high credit scores. Your credit score informs lenders on how they should evaluate you as a borrower. Lenders seek proof that you pay your expenses and repay your debts. A solid credit score and a history of using credit give a lender confidence that you’ll return the significant sum of money you’ve been given. While there are many different forms of credit scores.

How to Increase Credit Score?

A higher credit score can help you get a better mortgage interest rate when you apply for a loan. Here are 5 simple steps to increase your credit score:

- Apply For Secured Cards – You can’t begin building a solid credit history as a borrower until you have accounts in your name. The most crucial step is to obtain a credit report from a credit bureau.

- Don’t Forget to Pay – If you have a habit of making on-time payments, your credit score will rise. You can prevent skipping a payment by setting up automatic payments for the minimum amount required.

- Pay Off Past-Due Accounts – Late payments might affect your credit score, so keeping all of your accounts current will help

- Pay off revolving account debt – Compared to credit limitations, maintaining a modest amount can help you raise your credit score.

- Limit the number of new accounts you apply – Limit the number of times you apply for credit. Each application may result in a formal investigation.

The VA Loan Program Down To 550 Credit Score

This program aims to provide a straightforward and accessible mortgage to as many military buyers as possible. The flexibility of a VA loan is one of its most appealing characteristics. VA loan is that acceptance is based on less stringent credit requirements. In truth, the VA does not demand a credit score. As a result, a few VA lenders have remained the same, manually underwriting VA mortgage applications while staying within the Department of Veterans Affairs criteria.

A VA lender manually examined a credit report line item by line item before the introduction of credit scores. The document also contained information on any outstanding or paid collection claims, Charge-offs, and judgments. If the underwriter discovered any bad credit when looking into your application, the loan would undoubtedly be rejected or denied. Unless it’s just a few missed payments, the VA lender will handle all of the approval procedures.

Credit Score Requirement For VA Mortgage Loans

The VA does not support the loan, but it establishes the requirements that lenders must follow to qualify for a VA loan guarantee. In fact, a VA loan has no minimum credit score requirement. Most lenders, however, now require a minimum score of 550. It’s not a simple score to achieve, but it’s a reasonable starting point compared to other loan possibilities. VA loans, like FHA loans, are not subject to uncertainty pricing modifications. How to Increase FICO Scores?

FICO Scores are the most important because most lenders use them to determine whether to approve loan applicants and at what interest rates. Here are some things to keep in mind to increase your scores:

- Verify the accuracy of your credit reports.

It’s critical to double-check your credit reports after receiving them from the three major bureaus. This could significantly enhance your credit score. - Always make timely payments on your credit cards.

Making on-time payments regularly shows prospective lenders that you are responsible for your money. - Reduce your credit card debt

Lowering your credit usage makes you more appealing to lenders because it shows you aren’t overextended and are more likely to use credit wisely. - Look after credit accounts that have been referred to collections.

It’s common for banks to sell your loans to other financial institutions. You risk paying the wrong lender if you pay without first asking for verification.

VA Loan Requirements for 2022

In reality, most VA lenders utilize the ‘AUS,’ or ‘Automated Underwriting System,’ to determine a Veteran’s eligibility these days. To assess your creditworthiness, the three main credit reporting agencies use algorithmic scores. To avoid harming your score if you’re rebuilding your credit after a bankruptcy or foreclosure, or if you don’t know, check it on a regular basis using simple questions.

The most straightforward method to determine if your credit is good enough for a VA loan is to use a VA loan finder. If this is the case, the lender will gladly answer any queries you might have and guide you through the procedure. Because of a poor credit score, potential VA loan applicants are not forced to give up their house ownership chances. The degree to which something adjusts is considered its mobility. Your credit score will rise if you improve your financial habits!

- You must have a good credit rating.

- The VA requires a certificate of eligibility.

- A valid Social Security number is required.

- You must be a US citizen or permanent resident alien to apply. (non-citizens can apply for ITIN loans)

- Veterans who are not disabled must be employed full-time.

- Your earning must comply with certain standards.

- Applicants with a strong rental history will be more likely to be approved.

- You cannot have any federal debts in collections

- You may not have declared bankruptcy in the last two years.

- A down payment is required (usually 0-5%).

If you meet all of the above requirements, you should be eligible for a VA Home Loan. If you have any questions about the process or your eligibility, be sure to contact us at Apply Now

July 14, 2022 - 10 min read