FHA Loan With Collection Accounts

You can qualify for an FHA loan with collection accounts based on HUD guidelines. HUD, the parent of FHA, does not require borrowers to pay off outstanding collection accounts in order to qualify for FHA Loan. FHA loans do have specific rules and regulations when it comes to qualifying for a mortgage with large collection accounts. You do not have to pay outstanding collections and/or charged-off accounts to qualify for an FHA loan.

Collection and charged-off accounts need to be seasoned for at least 12 months from the date of last activity (DLA). To get an approve/eligible per automated underwriting system, the outstanding collection and charged-off accounts need to have been seasoned and should have timely payments in the past 12 months. Manual underwriting on FHA loans requires timely payments in the past 24 months.

How To Qualify For FHA Loan With Collections?

Can people qualify for an FHA loan with the outstanding collection? HUD, the parent of FHA does not require borrowers to pay outstanding collections and charged-off accounts to qualify for an FHA loan. All government and conventional loan programs do not mandate borrowers to qualify for outstanding collections and/or charged-off accounts to be paid prior to qualifying for a mortgage.

However, HUD has the most lenient agency guidelines when it comes to getting an approve/eligible per automated underwriting system (AUS). VA and USDA do not require borrowers to pay outstanding collections and charged-off accounts.

Fannie Mae and Freddie Mac do not require borrowers to pay outstanding collections and/or charged-off accounts on owner-occupant conventional loans. Paying down the collections and settling for less is one of the major mistakes our clients make when applying for a mortgage. In this article, we will discuss and cover qualifying for an FHA loan with outstanding collections and/or charged-off accounts.

Types Of Derogatory Credit

FHA has three different types of collection account categories:

- Medical Collection Accounts

- Non-Medical Collection Accounts

- Charge Off Accounts

Again, HUD does not require applicants to pay off outstanding collection accounts:

- With medical collection accounts, FHA exempts all medical collection accounts with outstanding balances from the calculation of debt to income ratios

- Qualifying for FHA Mortgage with large Collection Accounts that is medical collection accounts, lenders can ignore it

- Charge-off accounts also can be ignored

- FHA-approved lenders can ignore charges off accounts

This holds true even if the charge-off account balance was a large balance.

FHA Loan With Non-Medical Collection Accounts

Collection accounts that are non-medical collection accounts are treated differently. FHA does not require borrowers to pay off the non-medical collection account. However, with non-medical collection accounts that total an outstanding collection balance of $2,000 or more, HUD requires lenders to take 5% of the outstanding collection account balance and use that as part of the borrower’s monthly debt-to-income ratio calculations.

Starting in 2024, the FHA mandates a payment plan for non-medical collections exceeding $2,000. It’s important to note that the FHA doesn’t mandate the settlement of collection accounts as a prerequisite for mortgage approval. Nevertheless, any court-ordered judgments must be settled before the FHA insurance endorsement becomes applicable to the mortgage loan.

This holds true even though borrowers do not have to make any payments. Many borrowers may have a hard time qualifying for FHA Loan With Large Collection Accounts if the collection account balance is substantially high on non-medical collection accounts.

Case Scenario Of FHA Loan With Collection Accounts

For example, here is a case scenario:

- if the borrower had a $10,000 outstanding collection account balance on a non-medical collection account

- the lender needs to use 5% of the $10,000 or $500 per month as part of the borrower’s monthly expenses this holds true even though the borrower does not need to make this payment

The reason the Federal Housing Administration requires this is in the event that the collection agency decides legal action against borrowers, the collection account can turn into a judgment where a lien can be placed on the borrower and placed on the property as well assets of the borrower. In the creditworthiness analysis, collections and judgments might suggest a borrower’s lack of respect for credit obligations and must be considered. This subject is addressed in greater detail in the section on consumer credit scoring below. Medical collection accounts and charge-offs are not covered by this advice.

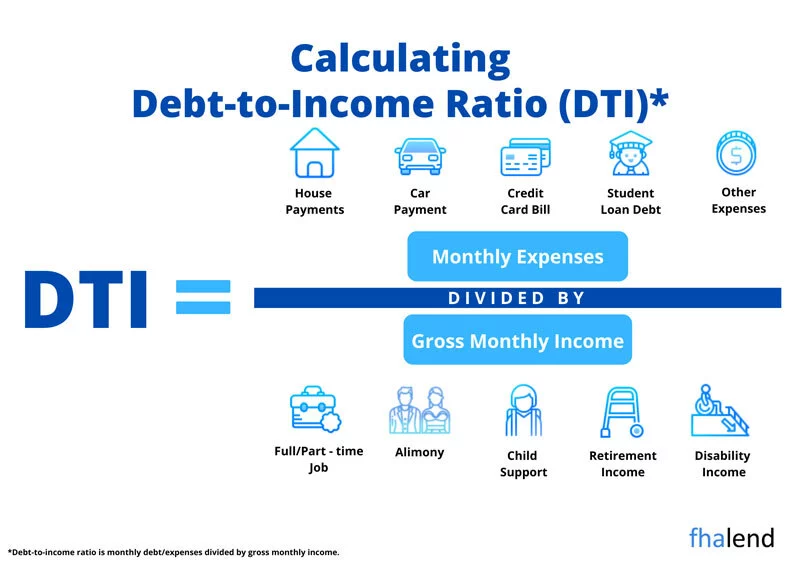

DTI Issues With FHA Loan With Collection Accounts

For consumers with higher debt-to-income ratios, there may be issues if they need an FHA loan with large collection accounts that are non-medical collection accounts. With non-medical collection accounts with outstanding balances, lenders are required to take 5% of the unpaid outstanding collection balance and use it towards calculating the borrower’s debt to income ratios. If the outstanding collection account balances are tens of thousands of dollars, this may disqualify borrowers due to higher debt-to-income ratios.

Should you have unresolved collections, your lender may require proof of your enrollment in a repayment plan. In the absence of such evidence, the lender will need to determine a monthly payment amount equivalent to 5% of the outstanding balance.

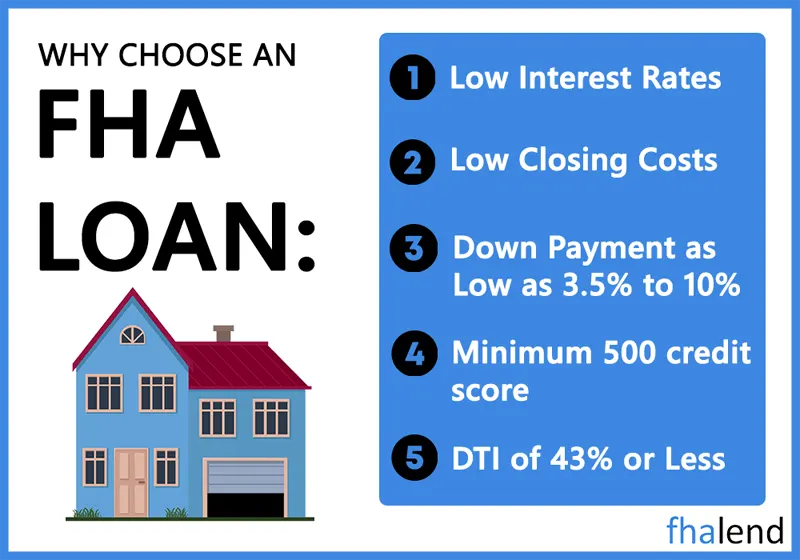

FHA DTI Requirements allow up to a maximum of 46.9% front-end debt to income ratio and 56.9% back-end debt to income ratio for borrowers with at least a 620 credit score back end to get an approve/eligible per automated underwriting system. For those with under 620 credit scores, the maximum debt to income ratio is capped at 31% front-end and 43% back-end to get an AUS approval.

There is a solution for borrowers seeking a mortgage with large collection accounts. If the FHA mortgage loan borrower can have a written payment agreement with the creditor, the written payment agreement that was agreed upon can be used in lieu of 5% of the unpaid outstanding collection account balance.

For example, if the consumer has a written payment agreement with a creditor for $100 on an outstanding collection account balance of $10,000, the $100 per month of the written payment agreement will be used for debt to income calculation instead of the 5% of the $10,000 or $500. Having written payment agreements with creditors on large outstanding collection account balances can be one way of solving high debt to income ratios due to large outstanding non-medical collection account balances.

HUD Has The Most Lenient Agency Guidelines On Collections And Charged-Off Accounts

Home Buyers can qualify for an FHA loan with collection accounts without having to pay off their outstanding collection account balance under FHA mortgage lending guidelines. However, just because borrowers can qualify for an FHA loan under FHA guidelines with collection accounts does not mean that every lender will allow it. Banks and lenders often have additional mortgage lending guidelines that are in addition to the minimum FHA Guidelines. This additional FHA requirement by lenders is called mortgage lender overlays.

FHA Loan With Collection Accounts: Agency Guidelines Versus Lender Overlays

Banks and lenders do have to meet the minimum FHA lending guidelines. However, they are allowed to be more strict and impose higher lending standards that are in addition to FHA Guidelines. Even though HUD does not require borrowers to pay outstanding collections and charged-off accounts, lenders can have overlays. Lender overlays are higher lending requirements that are above and beyond the minimum agency mortgage guidelines. Many lenders will require outstanding collection/charged-off accounts to be paid off. This holds true even though agency mortgage guidelines do not require outstanding collections and/or charged-off accounts to be paid.

Qualifying For FHA Loan With Collection Accounts And Debt To Income Calculations

FHA classifies collection accounts into three categories:

- Medical Collection Accounts

- Non-Medical Collection Accounts

- Charge Off Accounts

Non-Medical Collections Guidelines

FHA requires that any outstanding non-medical collection accounts with an aggregate total unpaid collection account balance of greater than $2,000, and that 5% of the unpaid outstanding collection balance be used in the calculation of the borrower’s debt to income ratio.

- For example, if the borrower has a total outstanding collection balance of $10,000 from creditors who are non-medical collection accounts, then FHA will require that 5% of the outstanding unpaid collection balance or $500 ( 5% of the $10,000 unpaid collection account balance ) be used in calculating borrower’s debt to income ratio

- The $500 will be considered a monthly debt payment

- This holds true even though the borrower does not have to pay for it

Borrowers with large unsatisfied outstanding non-medical collection accounts can be affected by the FHA Guidelines On Outstanding Non-Medical Collection Accounts.

Medical Collections Vs. Non-Medical

If you want to qualify for an FHA loan, the type of debt plays a role in your eligibility. Fortunately, medical debts are not taken into account when deciding on a borrower’s qualification status – they’re completely disregarded by the FHA! This means that if you have outstanding medical collections but no non-medical collections, then obtaining an FHA loan is still possible for you.

Conversely, non-medical collections may present a few difficulties; however, if you take the right steps to demonstrate your financial stability and creditworthiness, you could still be eligible for approval.

The guideline below does not apply to medical collections or charge-offs, which are not required to be addressed.

Any of the following activities might be taken during a capacity analysis:

| Doesn’t Apply To Collections & Charge-Offs |

|---|

| At the time of or prior to closing, the collection account (verification of acceptable source of funds required) must be paid completely. |

| The borrower negotiates payments with the lender. If the borrower has a payment plan in place with the lender, a credit report or letter from the creditor confirming this is necessary. The monthly payment must be taken into account when computing the debt-to-income ratio. |

| If no evidence of a payment arrangement is discovered, the lender must estimate the monthly payment using 5% of each collection’s outstanding balance and include it in the debt-to-income ratio. |

FHA Loan With Medical Collections Mortgage Guidelines

With medical collection accounts, outstanding unpaid balances on medical collection accounts do not count and are excluded from debt-to-income ratio calculations. This is always the case no matter how high the outstanding unpaid medical collection account balance is.

FHA Guidelines On Charge Off accounts exclude any charge-off accounts from debt to income calculations and charge-off accounts are exempt for FHA Loans.

Medical Collections under $500 Will Disappear in 2022

Starting this summer, millions of people’s credit reports will be cleared of medical debt comments. The elimination of 70% of bad medical debt criticisms is expected to provide many individuals with a boost in their credit rating.

Here are the details of the new changes effective July 1, 2024:

-

- This provision will exclude medical bills that were in collections from your credit reports.

- Unpaid medical debt that is still in collections for one year will be reported on your credit report. This was increased from six months, which was passed in 2017.

- Medical bills below $500 will no longer be included in collections for Equifax, Experian, and TransUnion beginning in the second half of 2024.

While poor credit ratings can have a long-term impact, medical debt necessitates immediate sacrifice. According to the poll, one in four Gen Z and Millennials with medical debt skipped rent or mortgage payments because of their debt. Being late on your mortgage payment might also damage your credit rating.

But in recent years, the number of Americans with medical insurance has risen dramatically — where did all this medical debt come from?

FHA Loan With Collection Accounts And Credit Disputes

FHA has strict lending guidelines on credit disputes with collection accounts. HUD requires that all credit disputes on non-medical outstanding FHA collection accounts need to be retracted prior to the mortgage process. This applies if the total unpaid outstanding non-medical collection account balances are greater than $1,000. The issue with retracting credit disputes is that once the credit disputes are retracted, they will drop the borrower’s credit scores. HUD allows borrowers with charge-off accounts to qualify for FHA Loans no matter how much the charge-off account balance is.

However, you cannot have credit disputes on charge-off accounts. Charge-off account credit disputes need to be distracted in order for the mortgage process to proceed or the mortgage approval process will be held in suspense. Non-medical collection credit disputes that are 24 months or older are exempt from retractions.

Credit Disputes Mortgage Guidelines

FHA allows credit disputes on medical collection accounts with balances and non-medical collection accounts with zero balances. FHA will also allow non-medical collection accounts with total unpaid outstanding collection balances of up to $1,000. Any credit disputes on non-medical collection accounts with unpaid outstanding balances of greater than $1,000 need to get retracted and/or need to get downgraded to a manual underwrite. Any credit disputes that are two years or older are exempt from retraction. This is for non-medical and medical collection accounts.

Disputed derogatory credit accounts of a non-purchasing spouse in a community property state are not included in the cumulative balance for determining if the mortgage application is downgraded to a “Refer”. Non-derogatory disputed accounts are excluded from the $1,000 cumulative total. They are defined as follows:

| Disputed Derogatory Credit Accounts |

|---|

| disputed charge-off accounts |

| disputed collection accounts, and |

| disputed accounts with late payments in the last 24 months. |

Why Do Lenders Require Collection Accounts Be Paid Off

Most banks and many mortgage lenders will require that collection accounts be paid off in order to qualify with their bank and/or lending institution even though Guidelines On FHA Loan With Collection Accounts do not require that.

-

-

- The reason why most banks and lenders require outstanding unpaid collection accounts to be paid off is that they have FHA lender overlays on collection accounts

- Lender overlays are requirements that are above and beyond the minimum FHA Guidelines that any bank and/or FHA-approved mortgage lender can require

-

Borrowers denied or do not qualify for an FHA loan by a bank or other lender due to their lender overlays on collection accounts, contact us at FHA Lend. We are a no-lender overlay FHA-approved mortgage lender and just go off the FHA minimum required lending guidelines. Please apply below if you need help with getting approved for an FHA loan.

January 1, 2024 - 11 min read