FHA Chapter 13 Mortgage Guidelines on FHA Loans

In this article, we will discuss and cover FHA Chapter 13 bankruptcy mortgage guidelines during Chapter 13 bankruptcy. Can a person qualify for an FHA loan during Chapter13 Bankruptcy and if Yes, then what is the process and waiting period to obtain FHA-insured financing? Chapter 13 Bankruptcies generally have a three to five-year repayment period prior can be discharged.

In this article (Skip to…)

Average Repayment Plan on Chapter 13 Bankruptcy Mortgage Repayment Plans

Three to five years is a long time for a person not to be able to purchase a home during this booming housing market. The great news is homebuyers can qualify for an FHA and/or VA loan during the Chapter 13 Bankruptcy repayment plan without the Chapter 13 Bankruptcy being discharged. FHA and VA loans are the only two loan programs that allow borrowers during the Chapter 13 Bankruptcy repayment plan to qualify for a home mortgage.

The Automated Underwriting System (AUS) findings

The automated underwriting system will not approve you (approve/eligible findings) during the Chapter 13 bankruptcy repayment period. The AUS will render a refer/eligible. Therefore, it needs to be a manual underwrite. FHA and VA loans are the only home loan programs that allow manual underwriting. Not all mortgage companies can do manual underwriting. However, We are experts in FHA and VA manual underwriting. A large percentage of our business are manual underwrites.

Eligibility Requirements To Qualify For An FHA Loans During Chapter 13 Bankruptcy

Home Buyers can qualify for FHA Loan one year into the Chapter 13 Bankruptcy:

- Chapter 13 Bankruptcy does not have to be discharged.

- Need approval of Chapter 13 Bankruptcy Trustee.

- HUD, the parent of FHA, requires that the home buyer needs to have at least 12 months of payment history.

- Payment history needs to be timely for at least 12 months with no late payments during the Chapter 13 Bankruptcy repayment plan.

- All FHA Loan During Chapter 13 are manual underwriting.

Only FHA-approved lenders who are able to do manual underwriting can do FHA Loan During the Chapter 13 repayment plan.

Importance Of Verification Of Rent On Manual Underwriting

Verification Of Rent is normally required, but not always necessary, on manual underwriting. The importance of verification of rent is to determine payment shock. Lenders want to know that borrowers have a history of paying monthly housing payments for the past 12 months. The new mortgage payment should be close to their rental payment.

The difference in the new mortgage payment versus rental payments is known as payment shock. FHA Lend will exempt rental verification if the borrower lives rent-free with family. Rent Free letter provided by us needs to be completed, signed, and dated in order to be used in lieu of verification of rent.

FHA Chapter 13 Bankruptcy and Manual Underwriting

FHA Manual Underwriting Guidelines apply when qualifying for an FHA loan during the Chapter 13 Bankruptcy process. One of the criteria with manual underwrites is that verification of rent is required. The only way verification of rent can be valid is by providing 12 months of canceled checks the renter has paid to their landlord. Or 12 months of bank statements showing that the monthly rental payments have been paid out of the renter’s bank account into the bank account of the landlord.

FHA Chapter 13 Mortgage Guidelines On Timely Payments

All 12 months of rental payments need to have been made timely. No late payments are allowed in the past 12 months in order for the verification of rent to be valid. If the renter has been renting their apartment and/or home from a registered property management company, the following can apply. the VOR provided and signed by the property manager of the property management company can be used in lieu of 12 months canceled checks and/or 12 months bank statements.

Verification Of Rent For FHA Insured Loan After Chapter 13 Bankruptcy

All FHA Chapter 13 Bankruptcy Mortgage Guidelines on FHA loans are manual underwriting. All FHA manual underwriting requires verification of rent. Verification Of Rent is extremely important because it determines rental payment shock. Payment Shock is the difference between what a new home buyer is paying for rent to what he or she will be paying on his or her new mortgage payment.

For example, if a renter is paying $1,000 for rent and his or her new proposed housing payment, P.I.T.I. (Principal, Interest, Taxes, Insurance) is $1,500. The new home buyer will have a payment shock of 50%. The lower the payment shock, the better lenders will view the borrower.

Importance Of Compensating Factors On Manual Underwriting

A lower payment shock is considered a compensating factor. Compensating factors are positive factors for borrowers. Without verification of rent, the payment shock cannot be proven. This is because the borrower is going from paying zero monthly rent to a new housing payment, P.I.T.I. Those who are living with family or cannot provide verification of rent and are seeking an FHA loan During the Chapter 13 Bankruptcy Process can get a rent-free. letter completed, signed, and dated in lieu of VOR.

Verification of Rent During Manual Underwriting

Rental Verification is mandatory by most lenders because they have lender overlays on VOR. Borrowers who are paying their rental payments timely but are paying with cash and are getting a paid receipt by their landlords do not have a valid verification of rent. This holds true even with a cash-paid receipt by the landlord.

Cash payments do not count in the mortgage. Only 12 months of canceled checks and/or bank statements is what can be used for verification of rent. Verification of rent can be waived at FHA Lend if the borrower has been living rent-free with family so they can save money for the down payment and closing costs on a home purchase.

FHA Chapter 13 Bankruptcy And Late Payments

Lenders require borrowers to have been timely with all of their monthly payments during and after their Chapter 13 Bankruptcy Process. The past 24 months of the repayment period will be looked at very carefully with regard to monthly timely payments. Late payments during the Chapter 13 Bankruptcy repayment plan will be carefully looked at and it will not be viewed favorably. Same with late payments after a Chapter 13 Bankruptcy discharge.

Late Payments During Chapter 13 Bankruptcy Repayment Plan

Lenders do not like to see any late payments on any of the borrower’s creditors during and/or after a Chapter 13 Bankruptcy discharged date. Most lenders will not approve and automatically deny any borrowers who had any late payments during and after a Chapter 13 Bankruptcy. We can work with borrowers who had a few late payments during and after a Chapter 13 Bankruptcy. This only holds true if they have a good letter of explanation on why they were late and it was not due to financial irresponsibility.

Qualifying For A Mortgage With Recent Late Payments

We can also help borrowers to see if we can work with the creditor. See if the creditor can help in getting the late payments removed. Or advise with some other credit repair alternative program to offset the late payments during the Chapter 13 Bankruptcy repayment period. If you had any late payments during and/or after a Chapter 13 Bankruptcy and cannot qualify for an FHA Loan with another lender please call us or apply and start your process of getting into you dream home

Late Payments After Bankruptcy

Another requirement to qualify for a mortgage after bankruptcy is borrowers cannot have any late payments after bankruptcy. Late payments after bankruptcy and/or housing event is not a deal killer. However, it will be tightly scrutinized and reviewed by mortgage underwriters.

A good letter of explanation to the mortgage underwriter will be required. Borrowers also need re-established credit after bankruptcy. Many mortgage lenders will require at least three credit tradelines. A credit tradeline is a credit history with at least 12 months of payment history.

How to Qualify For FHA Loan After Chapter 13 Bankruptcy

Although HUD, the parent of the Federal Housing Administration or FHA, allows FHA Loan During the Chapter 13 Bankruptcy Process. Most lenders have FHA Investor Overlays. Investor Overlays are additional lending guidelines that the individual lender places on top of the minimum HUD mortgage guidelines. For example, HUD allows home buyers to qualify for an FHA Loan During the Chapter 13 Bankruptcy Process. However, a lender may not allow it.

Mortgage Companies With Lender Overlays

Lenders may not accept any borrowers who had a Chapter 13 Bankruptcy until two years after a Chapter 13 Bankruptcy discharged date. This holds true even though borrowers meet all the minimum HUD guidelines and qualify for an FHA loan. Lenders can have additional lending requirements that are above and beyond the minimum HUD agency guidelines on FHA loans. The higher lending requirements from the mortgage company that is above and beyond the minimum HUD agency guidelines are called lender overlays. Lender overlays are very common by most mortgage companies.

FHA Lenders With No Lender Overlays

FHA Lend has no lender overlays on government and conventional loans. The minimum credit score required to qualify for FHA Loan During the Chapter 13 Bankruptcy process for a 3.5% down payment FHA home purchase loan is 580 FICO. HUD allows borrowers with credit scores down to 500 to qualify for an FHA loan. Any borrowers with under 580 FICO and down to 500 credit scores require a 10% versus a 3.5% down payment per HUD guidelines.

Trustee Permission By The Bankruptcy Courts

Chapter 13 Bankruptcy Trustee approval is necessary: Most Chapter 13 Bankruptcy Trustees will approve. We ever had an issue with a Chapter 13 Bankruptcy Trustee not approving a home purchase for an FHA loan During the Chapter 13 Bankruptcy Process. Verification Of Rent is definitely required unless it can be substituted with a rent-free letter. This is because all FHA loans during the Chapter 13 Bankruptcy Process are manual underwrites.

All manual underwriting FHA loans require verification of rent. We might get you financing for an FHA loan with recent late payments in sometimes, but there are no late payments allowed for an FHA loan during the Chapter 13 Bankruptcy process. At least 12 months’ worth of payments needs to have been made to all creditors in the Chapter 13 Bankruptcy Repayment Plan. Compensating Factors will be looked at. Compensating factors can offset late payments and/or other derogatory credit tradelines and/or events.

Examples of compensating factors include the following:

- reserves

- larger down payment

- income such as part-time income or second jobs that the borrower has but is not used to qualify in the mortgage loan approval process

If you need an FHA loan During the Chapter 13 Bankruptcy Process and are looking for a lender with no FHA Investor Overlays, please contact us at FHA Lend at (312) 869-2731.

Mortgage After Chapter 13 Bankruptcy Guidelines And Requirements

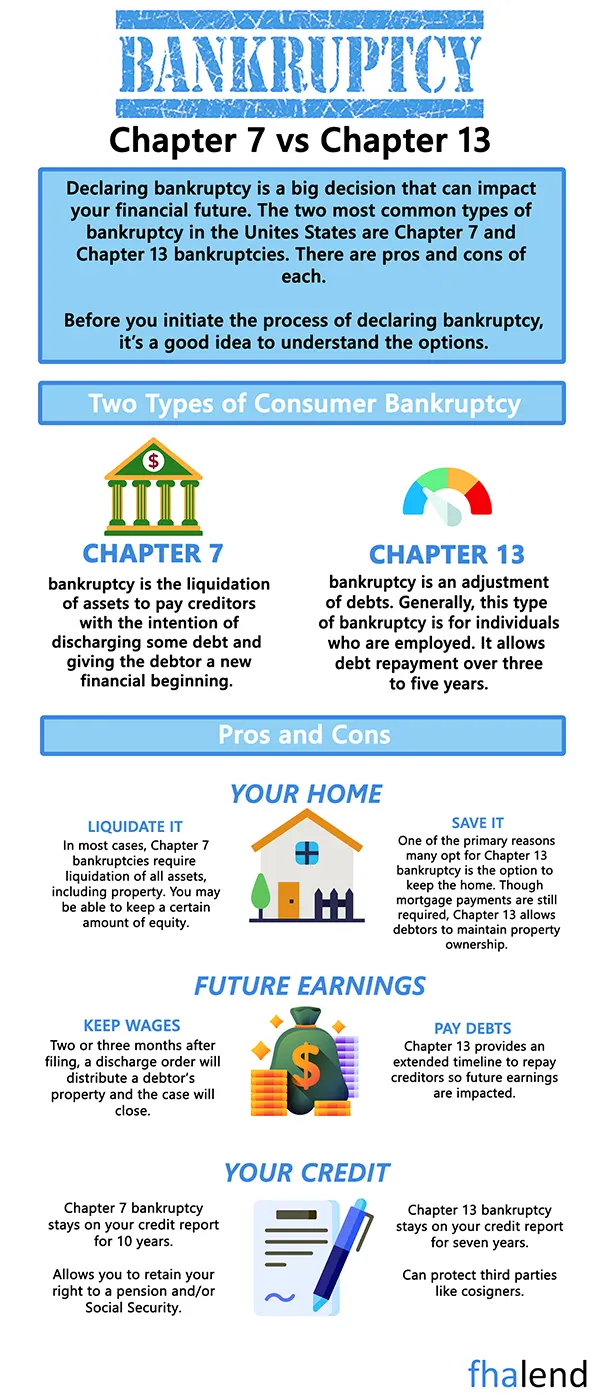

There are two types of bankruptcy:

- A Chapter 7 bankruptcy

- Chapter 13 bankruptcy for individuals

Chapter 7 Bankruptcy is the bankruptcy of choice for many. However, not everyone qualifies for Chapter 7 Bankruptcy. Chapter 7 benefits petitioners with little to no income, without a permanent stable job, and those with little to no assets. This type of bankruptcy gives people a fresh start just 3 months after the filing date. Most Chapter 7 Bankruptcy gets discharged about 90 days after it is filed.

Chapter 7 Versus 13 Bankruptcy Explained

A Chapter 7 bankruptcy is total liquidation and is often filed by consumers who have no assets and either little income or no income. There are assets petitioners of Chapter 7 Bankruptcy can keep. Petitioners can have a car, cash up to a certain amount, personal belongings, and other assets. There are maximum income caps by petitioners. People filing for bankruptcy need to meet the Chapter 13 means test.

Chapter 7 Bankruptcy Means Test

The means test determines whether the petitioner meets the maximum income requirements. Petitioners can file a Chapter 7 bankruptcy and still keep home. Homeowners can reaffirm their mortgages. Reaffirming their mortgages means the petitioner will keep the home mortgage outside the bankruptcy and keep on making the monthly housing payments.

Starting A Fresh Financial Start After Chapter 7 Bankruptcy

A Chapter 7 bankruptcy gives consumers a fresh start. We helped countless people rebuild, re-establish, and boost their credit scores to over 700 FICO in less than a year after bankruptcy and qualify for a mortgage. Homebuyers can qualify for a mortgage after the Chapter 7 Bankruptcy discharge date.

Qualifying For an FHA and VA Loan During Chapter 13 Bankruptcy

Borrowers can qualify for an FHA and/or VA loan during Chapter 13 Bankruptcy without Chapter 13 is discharged. There is no waiting period after the Chapter 13 Bankruptcy discharge date to qualify for an FHA and/or VA loan. Discharges relieve consumers of all outstanding debts, collection accounts, and judgments. However, tax liens, student loans, child support, debts incurred due to fraud, and all types of government loans or government obligations cannot be discharged with a Chapter 7 bankruptcy.

Mortgage Manual Underwriting Guidelines on Chapter 13 Bankruptcy

Chapter 13 bankruptcy is the second type of consumer bankruptcy which is filed by consumers who are employed or have income and assets or consumers who want to protect their assets. Petitioners need income in order to qualify for Chapter 13 bankruptcy Petitioners with no income will not qualify for a Chapter 13 bankruptcy. In the following paragraphs, we will cover and discuss the mortgage process after Chapter 13 and Chapter 7 Bankruptcy guidelines and requirements.

Is it possible to refinance my house after bankruptcy?

The requirements are the same whether you’re refinancing a house or borrowing money for the first time. You may be able to obtain a cash-out refinance following a bankruptcy as well.

What credit score do you need after bankruptcy?

The credit score required for a mortgage after bankruptcy will differ by lender. The higher your credit score is, the more likely you are to be accepted, but a 620 FICO score is the minimum recommended. However, certain of our subprime lenders can help borrowers with lower scores.

What is the duration of time that must pass before you may take out a mortgage following a Chapter 13 bankruptcy?

If you have a chapter 13 bankruptcy, you will most likely have to wait at least two years before receiving your loan. You won’t have to wait if you obtain a subprime loan.

Which lenders would give me a loan if I declare bankruptcy?

With a recent bankruptcy, not all lenders will be able to provide you with mortgage solutions. In most cases, the major banks in your region are unable to assist you. We’re in touch with the lenders who offer these services.

Is it true that I must obtain a job in order to get a mortgage after declaring bankruptcy?

Regardless of whether you’ve recently filed for bankruptcy, you must have a source of income. Lenders want to be sure you can pay back the loan.

Can I buy a house After a bankruptcy?

You can acquire a home after bankruptcy. Much will be determined by your unique circumstances, as well as the aforementioned factors.

How long do I have to wait before being accepted for a mortgage after filing for chapter 7 bankruptcy?

If you take out a chapter 13 loan, you may be able to reduce your wait to just one year if you choose a traditional or government loan. You won’t have to wait at all if you get a subprime loan.

How much of a down payment is required after bankruptcy?

The down payment requirement after bankruptcy is usually 10-20% of the purchase price, depending on your situation. Each lender has different criteria, so it’s best to let us handle it.

How Does Chapter 13 Bankruptcy Help Consumers

Filing Chapter 13 bankruptcy will halt all collection activities by the creditor and a bankruptcy trustee will be appointed to the petitioner by the United States Bankruptcy Courts. The Chapter 13 Bankruptcy Trustee will be in charge of restructuring debts and approving a re-payment plan with creditors. The Chapter 13 bankruptcy trustee will review income and will allocate a percentage of income to pay creditors.

Once a Chapter 13 bankruptcy is filed, there will be a re-payment plan for a number of years. Petitioners make a reduced monthly payment to creditors from a percentage of their gross income that is taken out of their gross monthly income. It can be a 3-year re-payment plan, a 4-year repayment plan, or a 5-year repayment plan.

Chapter 13 Bankruptcy Discharge

Once petitioners are timely on all of their payments within the period of the repayment plan, Chapter 13 bankruptcy will get discharged which means that whatever balance owed to creditors will be discharged and there will be no mortgage debts owed. If during the re-payment plan of Chapter 13 bankruptcy petitioners default, Chapter 13 bankruptcy will be dismissed and petitioners will still have those liabilities.

Check If You Are Eligible

Many consumers who start out by filing a Chapter 13 bankruptcy and lose their jobs during the re-payment plan often convert to a Chapter 7 bankruptcy. There are many cases where a Chapter 13 bankruptcy gets dismissed. If consumers lose their job and cannot meet their payments to creditors, Chapter 13 Bankruptcy can get converted to a Chapter 7 bankruptcy. Consumers who have filed either a Chapter 7 bankruptcy or Chapter 13 bankruptcy can qualify for a mortgage after Chapter 13 bankruptcy or Chapter 7 bankruptcy.

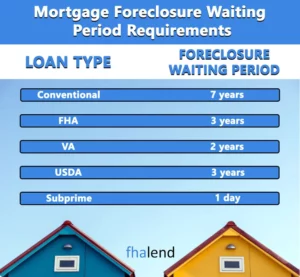

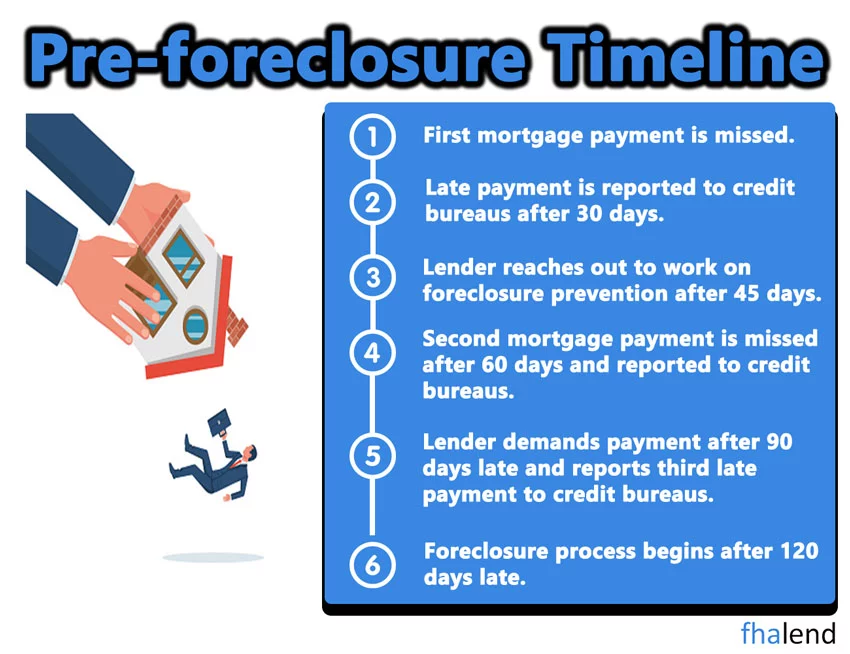

Mortgage Waiting Period During and After Bankruptcy

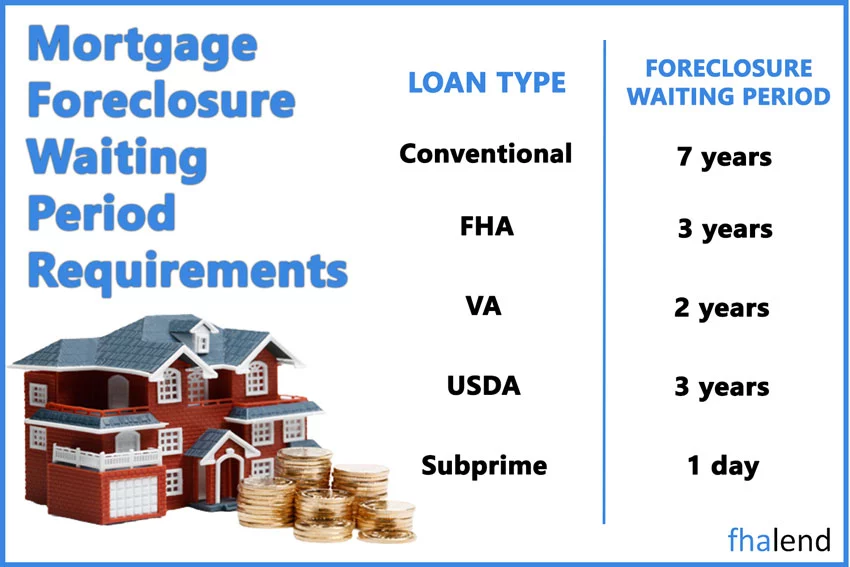

There are certain mandatory waiting periods after bankruptcy for FHA, VA, USDA, and Conventional Loans. Mortgage after Chapter 13 Bankruptcy is different than Chapter 7 bankruptcy. Each bankruptcy type has separate waiting period requirements after bankruptcy. Requirements to qualify for a mortgage after bankruptcy will depend on the type of bankruptcy filed, the type of mortgage loan type and credit scores, income, assets, and liabilities.

Waiting Period For Mortgage After Chapter 13 Bankruptcy And Chapter 7 Bankruptcy For FHA And VA loans

For FHA loans and VA loans, the waiting period to qualify for a mortgage after Chapter 7 bankruptcy is two years from the discharge date of the Chapter 7 bankruptcy. To qualify for FHA and VA mortgage during Chapter 13 bankruptcy, homebuyers can qualify one year into a Chapter 13 Repayment Plan. However, need to have the U.S. Bankruptcy Court Trustee approval.

Lenders need a history of 12 months of timely payments of the Chapter 13 re-payment plan. Lenders will require a detailed letter of explanation as to what initiated the Chapter 7 bankruptcy and/or Chapter 13 bankruptcy. There is no waiting period after a Chapter 13 discharge date. Borrowers will not get an automated approval per DU FINDINGS VA and FHA loans. If Chapter 13 Bankruptcy has not been seasoned for at least two years, borrowers need to be manually underwritten in order to get an FHA and/or VA mortgage approval.

Waiting Period For USDA Loan After Bankruptcy

USDA loan lending guidelines on the waiting period after Chapter 7 bankruptcy discharge is a mandatory waiting period of 3 years from the Chapter 7 discharge date. For those who had a discharge of Chapter 13 bankruptcy, there is a 24-month waiting period of the discharge date of Chapter 13.

Conventional Loan Guidelines On Mortgage After Bankruptcy

Conventional loan guidelines with regards to qualifying for a mortgage after Chapter 7 bankruptcy is a mandatory waiting period of four years after the discharge date. There is a mandatory two-year waiting period to qualify for a mortgage after the Chapter 13 bankruptcy discharge date. In the event, that borrowers had a Chapter 13 dismissed, there is a four-year waiting period from the dismissal date of Chapter 13 bankruptcy to qualify for a conventional mortgage.

Homebuyers with a prior bankruptcy or had lower credit scores or issues and were told they do not qualify from another mortgage company, please apply here

January 27, 2022 - 12 min read