Qualifying For FHA Loan With Recent Late Payments

There can be many reasons why someone might make a late payment. The FHA has in place rules and regulations specifically addressing late payments one of the main factors for disqualifying borrowers from getting financing via FHA– approved mortgage lenders or wholesale lenders even if they have a good credit score. Perhaps they forgot to make the payment on time, or maybe they didn’t have enough money to cover the bill. Whatever the reason, late payments can have a major impact on your finances.

Late payments also called (late fees, overdue fines, late fines or past due fees) can damage your credit score, making it more difficult to get approved for loans or credit cards in the future. They can also lead to late fees and additional interest charges, which can add up quickly. If you’re having trouble making ends meet, it’s important to take action to avoid late payments.

Prior payments, charge-offs, collections, late payments, and negative credit items on your credit report are all permissible under owner-occupied mortgage loan programs. The keyword here is PRIOR. To get a mortgage with excellent credit but recent late payments, you must first look at the finest mortgage alternatives. We’ll teach you the insider secrets of obtaining approval for a mortgage with good credit but past late payments in this article on getting accepted for a loan with bad credit and late payments over the past year.

Any individual with excellent credit may be approved for a mortgage by most lenders, but recent late payments will often result in eligibility being denied.

In this article (Skip to…)

Getting Approved For FHA Loan With Lates on Your Credit Report

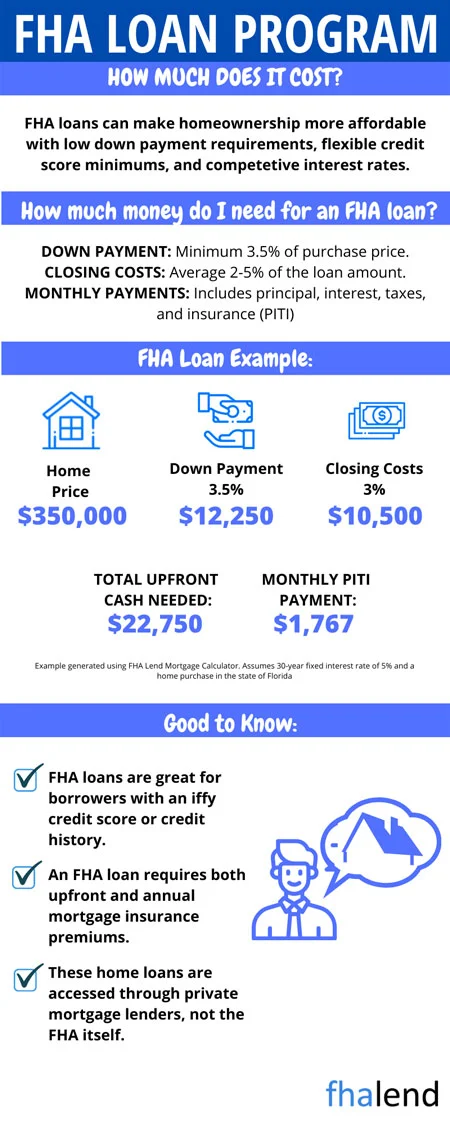

If you have late payments on your credit report, you may be wondering if you can still qualify for an FHA loan. The short answer is that it is possible to get an FHA loan with late payments, but it will depend on a number of factors. In this blog post, we’ll take a look at what those factors are and how they can impact your ability to get an FHA loan. One factor that will be considered is the severity of the late payments. If you have only had one or two late payments in the past 12 months, it’s likely that you will still be able to qualify for an FHA loan.

However, if you have had multiple late payments, or if your late payments are more than 90 days past due, it’s less likely that you will be approved for an FHA loan. Another factor that will be considered is the reason for the late payments. If the late payments were due to extenuating circumstances beyond your control (such as a job loss or medical emergency), you may still be able to qualify for an FHA loan. However, if the late payments were due to financial mismanagement on your part, it’s less likely that you will be approved for an FHA loan.

Finally, your credit score will also be a factor in determining whether or not you can qualify for an FHA loan. If your credit score is at 550 FICO or 500, it’s possible that you will be approved for an FHA loan or VA Loan (you just need 10% in saving for a downpayment and go through a process that lenders call manual underwriting). However, if your credit score is 580 or above, you may be approved for an FHA loan with a higher interest rate. If you’re thinking about applying for an FHA loan, it’s important to understand all of the factors that will be considered in the decision-making process.

Options When Having Late Payments on Your FHA Loan

If you have late payments on your FHA loan, you do have options. You can try to work with your lender to see if they are willing to work with you on a payment plan. It is possible for housebuyers to obtain a mortgage with excellent credit, but they must first establish a track record of paying bills on time. The key is to get an approval/eligibility via an automated underwriting system (AUS).

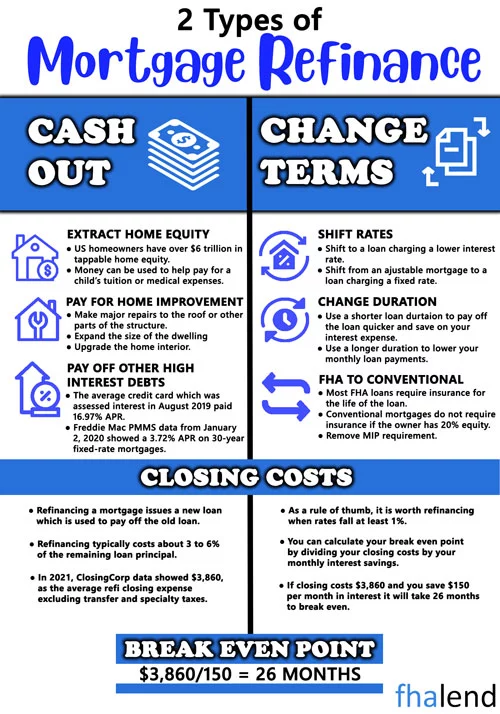

Refinancing – If your lender is not willing to work with you, you can look into another option, which is refinancing an FHA loan into a conventional mortgage. This may be a good choice if you have equity in your home and can get a lower interest rate. When you apply for a new mortgage, lenders will look at your credit history and score to determine your eligibility. If you have late payments on your record, it could lead to a higher interest rate or even disqualification from refinancing altogether.

NON-QM Loans – Non-QM loans usually require a 20% to 30% down payment and non-QM rates are typically higher than government and/or conforming loans. What Is An Automated Underwriting System? (AUS) How Can I Get An Approve/Eligible Per This System? The greatest loan program for an acceptable or qualified per AUS is FHA loans with larger down payments. In the following paragraphs, we’ll go through this approach in detail. We can assist you in receiving a non-QM mortgage with recent late payments, most especially a late payment on your home payment.

Short Sale – You may also be able to sell your home and pay off the loan that way. If you are not able to make the payments on your FHA loan, you may be able to sell your home through a short sale and still be able to qualify after the short sale. This is when you sell the home for less than what is owed on the mortgage and the lender agrees to accept the amount as full payment.

Jumbo Loan – if your loan amount is over FHA loan limits in your county then you can qualify for a NON-QM Jumbo loan and you might need to put an even higher downpayment.

Getting Approve/Eligible per Automated Underwriting System

For at least one year after a period of bad credit, automated underwriting (AUS) and mortgage lenders demand borrowers to have recovered and been on time with all of their monthly payments. To get an approved/eligibility, according to AUS findings, mortgage loan applicants must have made timely payments during the previous 12 months.On FHA and VA loans, manual underwriting is permitted.

On both FHA and VA home loan applications, mortgage customers must have been timely with all of their monthly payments for the previous 24 months. FHA Lend can waive up to two late payments on manual underwriting customers in the previous 24 months.

Timely Payments in the Past 12 Months

The key to obtaining an approved/eligible per automated underwriting system (AUS) for a mortgage is to have made on-time payments in the previous 12 months. The likelihood of receiving an AUS approval increases for a borrower with a lower credit score, but timely payments in the last year versus recent late payments. The ability to make timely payments is critical in obtaining a loan approved or accepted under an automated underwriting system.

VA and FHA loans have manual underwriting procedures. To be eligible, you must make regular payments in the past 24 months. Lenders recognize that borrowers may have bad credit. Lenders, nevertheless, want applicants to have recovered and been on time in the last year. We’ll look at how to get a home loan with higher credit scores if you’ve had recent late payments but no major transgressions in the previous 12 months.

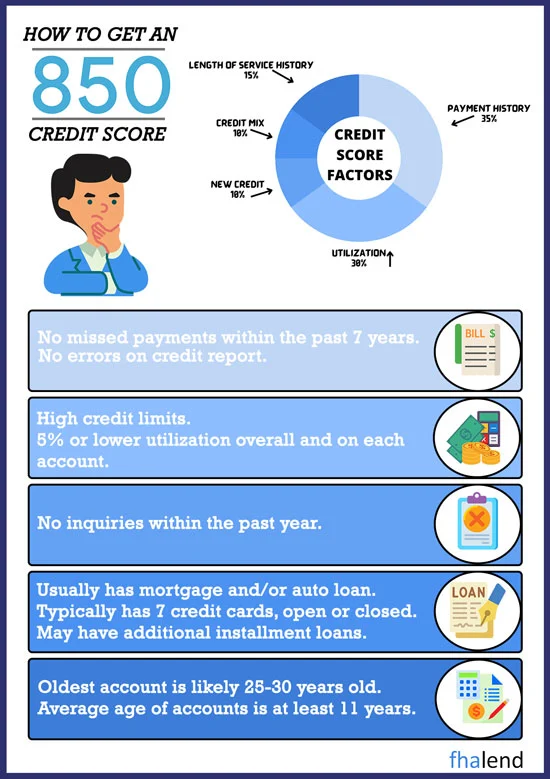

How Late Payments Affect Credit Score

Late payments in the last year are not always a deal breaker for mortgage acceptance. However, many late payments in the past 12 months may be a dealbreaker, but not one or two. It’s all about obtaining a positive response from an automated underwriting system. It is preferable to have a lower credit score and on-time payments in the last 12 months than a higher credit score and late payments in the previous 12 months, as stated by simplified financial planning. It’s entirely feasible to have a good credit score and recent late payments in the last year.

Borrowers unable to obtain an automated findings approval may be underwritten manually for FHA and VA loans. However, VA and FHA loan underwriting standards require timely payments in the last 24 months, therefore manual underwriting will be impossible.

Credit Score Requirements to Get Mortgage When Having Late Payments

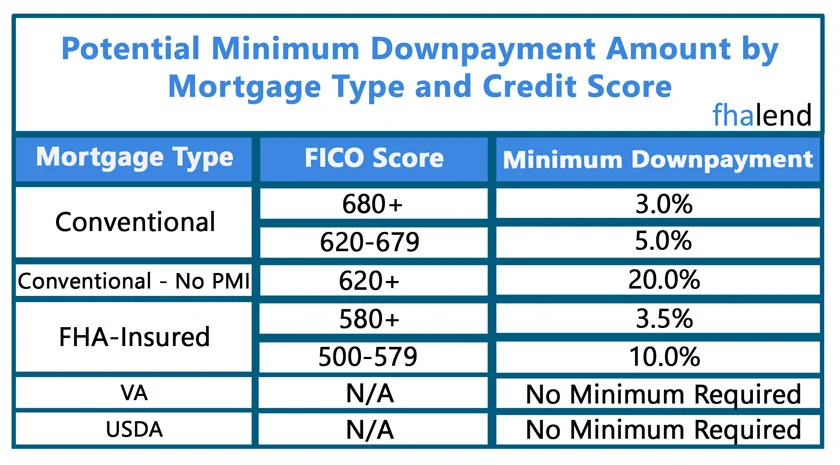

To be eligible for a residential mortgage loan, you must have a certain credit score. However, borrowers may have difficulty qualifying for a mortgage with excellent credit if they have recent late payments. Borrowers must meet minimum credit score requirements. The majority of conventional loans, including FHA and VA loans, accept credit scores as low as 500. A 620 credit score is required for a conventional loan. Non-QM portfolio lending requires a down payment between 20% and 30%.

Mortgage Qualification Exceptions With Late Payments

You can’t get a manual underwrite with late payments in the last 24 months, as we previously said. You may describe your case for obtaining a mortgage loan with poor credit and late payments on your credit tradelines on a manual underwrite.

If you had a medical problem that affected you and/or your family, and have proof, you can document your reasons for the late payments. A divorce is not considered a mitigating circumstance.

Getting Approved For FHA Loan With 24 Months Recent Late Payments

With several late payments, I’ve seen FHA loans get accepted/eligible per AUS, including numerous mortgage late payments with a 20 percent down payment. To obtain an approval/eligibility per Automated Underwriting System Approval, timely payment history in the previous 12 months is usually required.

Borrowers with good credit and recent late payments may qualify for a mortgage with good credit but recent late payments, however, the main consideration is how many late payments in the last year. One or two late payments throughout the previous 12 months do not cause to rejection of a loan. Late payments will be a problem. If you have several late payments, including a mortgage payment that is late, you may wish to consider an FHA loan with at least a 10 percent down payment.

How Long Late Payments Affect Ability To Buy a House?

It is perfectly valid to have negative credit, outstanding payments, repossessions, late payments, and other negative tradelines in order to get government and conforming loans. FHA, VA, USDA, and conventional loans do not require you to pay off pending or charged-off accounts. Lenders, however, want to see that borrowers have reestablished themselves and built their credit back up with on-time payments in the last year.

FHA loans are the easiest and most effective government and/or conforming loan program for recent late payments. If the borrowers have just one or two past-due payments, FHA loans will accept late payments in the previous 12 months. You can get an AUS on FHA loans if you put a bigger down payment if borrowers have a lot of late payments throughout the previous 12 months, including mortgage late payments.

Can I Have Late Payments When Having a Good FICO Score?

The minimum credit score needed to join a mortgage loan program varies by lender. It’s preferable for you to have 500 FICO credit scores with good payments in the last 12 months than a 680 FICO credit score with late payments in the previous 12 months. The federal government agency sets the minimal credit score standards for government loans. The credit and/or income parameters for conventional financing are determined by Fannie Mae and/or Freddie Mac. They have distinct lending criteria.

Qualifying Loan Programs and Requirements With Late Payments

The following are the minimum credit standards for government, conventional, jumbo, and non-QM loans.

- The minimum credit score for FHA loan is 500.

- USDA loans require a credit score of 580 or above.

- A minimum down payment of 10% is required for housebuyers with credit scores between 500 and 579. A home buyer with a 3.5 percent down payment must have a 580 credit score in order to obtain an FHA loan with a minimum credit score of 580.

- To be eligible for a conventional loan, your credit score must be at least 620.

- There are no minimum credit score requirements for VA loans. However, an Automated Underwriting System (AUS) Approval of 580 or higher is required to be approved/eligible.

- Jumbo loans are reserved for individuals with excellent credit, and a 43 percent debt-to-income ratio is required. Jumbos are generally taken out by people with good credit who have a score of at least 700 and a DTI of more than 43%.

- Traditional 90 percent LTV jumbo loans with debt-to-income ratios up to 50 percent and credit scores as low as 660 FICO are available through FHA Lend Mortgage.

- Non-QM loans have varying minimum credit score requirements, depending on the non-QM lender. Bank Statement Loans For Self-Employed Borrowers depend on the individual non-QM mortgage lender

- A minimum of 680 credit scores is required for condotel and non-warrantable condominium mortgage loans.

Late Payments on Credit Report and FICO Credit Score

The specific requirements for each mortgage loan program are outlined above, all mortgage lenders take into account the borrower’s entire credit history while evaluating his or her eligibility. All lenders recognize that mortgage applicants may have periods of bad credit or even bankruptcy in the past.

Late payments, particularly those that occurred in the last year, maybe a problem for obtaining mortgage loan approval, even if the applicant has excellent credit scores. A borrower with a lower credit score has a far better chance of receiving a mortgage loan approval than one with a higher credit score but who has had recent late payments.

First-Time Home Buyers With Late Payments

Any late credit payment that is 30 days old is considered a recent late payment on the credit report. A late payment can seriously harm a person’s credit score by 40 points. There are times when a homeowner sells their house and must buy a new one, as well as apply for a new mortgage. But the issue is the new home buyers need a new mortgage but had a late mortgage payment on the house they sold.Not many lenders can accomplish this, but our loan officers at FHA Lend are trained in assisting clients with new mortgages and missed payments.

It does not matter how large the minimum monthly payment is. A 30-day late payment is not graded any differently whether it’s $5 per month or $1,000 per month. It will harm your credit scores and have an impact on how mortgage underwriters evaluate your credit history, which may influence whether you get a mortgage.

High Credit Score With Late Payments are Worst Than Low Credit Score and Payments on Time

Borrowers with credit scores of more than 620 may qualify. However, because they have a number of recent late payments, they may need to wait until their payment history has been restored. Borrowers may have a dozen or more late payments on their track record. They should be accepted/eligible using the Automated Underwriting System after having had re-established credit for at least 12 months.

It’s preferable to have lesser credit ratings and timely payments in the previous year than higher credit scores and late payments in the same period.

Mortgage Underwriters And Recent Payments

That’s not good. One of the most damaging derogatory credit tradelines on your credit report is having late payments for more than a year in a row. Borrowers who have had late payments in the previous 12 months are automatically rejected by some mortgage underwriters. Borrowers who have received recent late payments may be declined by mortgage underwriters.

The mortgage underwriter will want a letter of explanation regarding the borrower’s past late payments, as well as an explanation for the negative credit score. Being out of work or having other extenuating circumstances are two examples. However, depending on the borrower’s overall history, the underwriter may give approval after the borrower obtained full-time employment and recovered from their financial difficulties. Found full-time employment and got back on track.

FHA Mortgage Denial When Having Late Payments

Lenders have a mandatory policy that a mortgage loan applicant must have been timely with paying their bills for the past 12 months. Other lenders want to see 24-month on-time payment history. Banks and credit unions have tougher guidelines when it comes to seeing a 24 monthly on-time payment history. Despite the fact that borrowers’ credit scores are over 700, one late payment on their credit report can significantly reduce their chances of receiving a mortgage.

Getting VA Loan With Late Payments

Apart from this, VA and FHA loans have considerably fewer lending restrictions. You may get an FHA loan or a VA loan with credit scores as low as 500 on the FICO scale. With significant down payments, FHA will accept late payments in the last 12 months, but not VA loans. AUS will not accept you regardless of how much down payment you put on a property with recent late payments in the last year.

Try manual underwriting if you have exceptional circumstances that you can document and cannot qualify for a VA loan with late payments. If you can’t provide evidence of exceptional circumstances, AUS approval is your best bet. With recent late payments on VA loans, there’s no way you’ll be accepted/eligible via automated underwriting using recent late payments.

Do My Late Payments Remove When I Sell My House

We received quite a bit of questions about late payments if they are getting removed if they pay off their mortgage. The answer is NO, your late payments will not be removed even if you paid off your current mortgage and trying to qualify for a new FHA loan. They must meet the requirements for a mortgage with an outstanding mortgage payment in the previous year as they sell their present house. The worst form of late payment on your credit report is a late mortgage payment in the last year.

Mortgage lenders take late mortgage payments seriously, and they are regarded as one of the most severe types of credit problems. We are experts in helping borrowers qualify for a mortgage with late payments on a house that just sold. We have a few options we will be covering in the next few paragraphs.

How To Remove Late Payments From a Credit Report?

There are potential solutions in taking steps to try and get a recent late payment removed from your credit report. The first solution is to contact the creditor and see if they can give a one-time break and see if they can remove the late payment record. If you’re a homeowner who has been late with your mortgage payments, talk to them cordially and explain your circumstance and how this late payment will prevent you from receiving a mortgage loan approval.

If you strike gold with a sympathetic agent, all the better. If the rep is unable to do so or is unwilling to do so, nicely request for the. Your chances of getting a late payment removed are not very good, but there is a possibility. When you call, who you get and luck are two factors you need to have on your side. If this remedy fails, try calling again in two or three days and calling them during a new shift time. Repeat the mercy procedure one more time. There’s a 10% chance that the late payment will be reversed. However, nothing is preventing you from trying.

If you’ve made your payments on time with the company in the past and just received a recent late fee, there’s a good chance the creditor will delete your current late payment history. If the person on the phone says no to a request for assistance, ask to speak with a manager. If you are late on your mortgage payments, the lender will usually place a derogatory late payment on your credit report. If you have any information that might be helpful to this post, please share it in the comments below. Please keep in mind that we’re not lawyers or lenders so take anything we say with a grain of salt.

You may obtain an If you have a 10% to 20% down payment, you’ll be shocked at how quickly you can get an approval/eligibility via an automated underwriting system. This is why so many veterans with VA eligibility choose FHA loans rather than VA loans if they have had late payments in the previous year.

Maximum Amount Of Late Payments When Qualifying For FHA Loan

How many late payments does it take to qualify for a mortgage, as far as our customers are concerned? One 30-day delay in the past year is considered too many. Just because you pass an approval/eligibility per AUS does not guarantee that the lender will do the transaction. Lender overlays are common on late payment durations.

They don’t care whether you received an AUS approval, have extenuating circumstances, or if the late payment was a mistake. The bottom line is that most lenders will not want individuals with past-12-month overdue payments on their credit reports. Don’t let that discourage you. We can assist customers with good credit to obtain mortgage approval despite recent late payments.

Some of our clients have had numerous late payments in the previous year, including mortgage late payments. The top two mortgage qualification standards for approval with late charges in the last 12 months are FHA loans and non-QM mortgages.

Forgiving Late Payments and Timeline on a Credit Report

Borrowers who have a track record of paying bills on time and have credit reports with several late payment histories may experience difficulties obtaining automatic AUS Approval. However, if the late payments on the credit report are forgiven and age is taken into account, mortgage loan applicants will be able to qualify for a mortgage loan. Lenders that accept Australian subprime mortgages, on the other hand, may require financial information over a shorter time period. In this case, borrowers would be required to wait one year before receiving their loan.

However, mortgage lenders do exist that will approve Mortgage With Good Credit But Recent Late Payments with an AUS Approval. If you miss a monthly payment, your score will take a hit. Regardless of how little the monthly charge is, consumers must pay their monthly minimum obligations on time. One or two recent late payments might cause credit ratings to drop and perhaps prevent you from receiving a mortgage loan approval.

Can I Refinance My Mortgage If I Got Late Payments This Year?

If the borrower is attempting to refinance their mortgage and has a late payment history in the past year, they will have a difficult time obtaining a new refinancing loan. You can get a rate and term refinance if you make just one 30-day late payment during the last 12 months. For FHA cash-out refinance mortgages, you cannot have had any late payments in the previous 12 months.

They may have to wait at least 12 months after reestablishing their on-time mortgage payment before applying. As part of their overlays, most banks and credit unions demand a history of on-time mortgage payments of at least 24 months.

Qualifying For NON-QM Loans With Late Payments

Homebuyers may also qualify for non-QM mortgages with late payments, which are becoming increasingly popular. Non-QM loans enable borrowers to make late mortgage payments in the previous year. A 20% to 30% down payment is required for non-QM loans. Non-QM mortgage lenders demand even larger down payments and charge higher non-QM mortgage rates if their risk level is high.

The likelihood of being approved for a mortgage loan with a bank in the last year on government and conventional loans that have late payments will be very small. Although this is not common, it isn’t impossible. One or two late payments in the previous year are acceptable, provided they were made on time for a relatively long period of time.

Mortgage lenders will examine AUS Findings. Borrowers with good credit and recent late payments can get accepted/eligible per AUS for a mortgage. However, having several or recurring late payments in the previous 12 months may be difficult to get an approval/eligibility per AUS.

How To Get Clear To Close For FHA Loan

FHA loans offer the best loan for late payments in the previous year. With a large down payment, FHA loans will approve recent late payments in the last 12 months. VA loans will not do so. If you’ve had recent late payments on your mortgage, you may be eligible for a down payment as low as 10% on FHA mortgages.

Continue to add money to the down payment until you are approved/eligible by an automated underwriting system (AUS). With late payments, including mortgage late payments in the previous 12 months, you have a high likelihood of being accepted and/or qualified for an AUS with a 20% down payment on an FHA loan.

How To Avoid Having Late Payments on FHA Loan in the Future?

If you’re concerned about making late payments on your FHA loan in the future, there are a few things you can do to avoid it. First, make sure you keep up with your monthly mortgage payments. You can also set up automatic payments so you don’t have to worry about missing a payment. Finally, if you know you’re going to be unable to make a payment, contact your lender as soon as possible to discuss your options.

By taking these steps, you can help ensure that you won’t have any problems making timely payments on your FHA loan in the future. When it comes to making payments on your FHA loan, it’s important to stay up to date and avoid falling behind. Here are a few tips to help you avoid late payments in the future:

July 10, 2022 - 17 min read