FHA Student Loan Guidelines on Student Debt

In this blog, we will cover and discuss FHA student loan guidelines on student debt calculations on FHA loans. One of the most frequently asked questions from our borrowers at FHA Lend Mortgage is can I get an FHA loan with high student loan debt? FHA student loan guidelines were recently changed. The hypothetical 1.0% used on outstanding student loan debts and deferred student loans is now 50%.

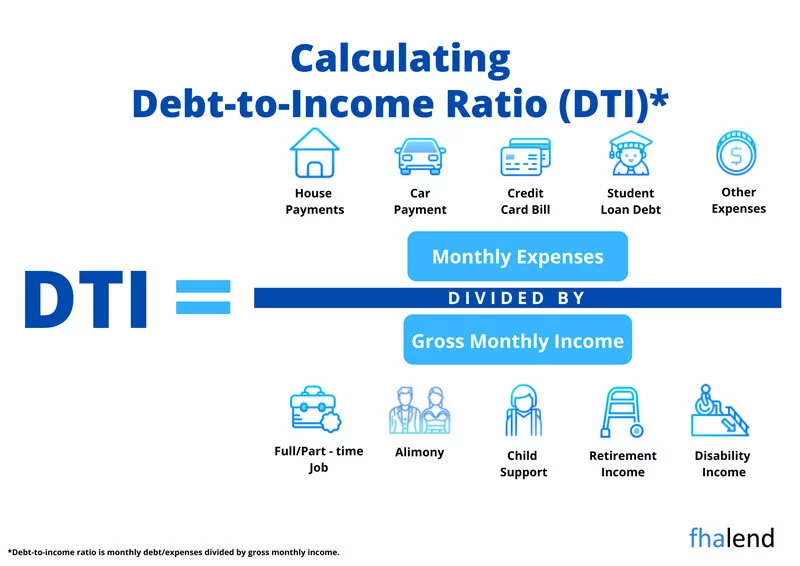

Mortgage underwriters can now use 0.50% versus 1.0% of outstanding student loan debts in debt-to-income ratio calculations. FHA student loan guidelines on an income-based repayment (IBR payments) have also changed. Mortgage underwriters can now use income-based repayment on student loans for FHA loans. IBR payments of zero monthly payments can also be used.

In this article (Skip to…)

FHA Student Loan Guidelines on Deferred Student Loans

Deferred student loans that are deferred longer than 12 months can no longer be used on FHA loans. All deferred student loan debts need to be factored into the debt-to-income ratio when applying for FHA-insured loans. Many mortgage borrowers faced hurdles and challenge to qualify for mortgages with large outstanding student loan debt.

Large outstanding student loan debt can affect mortgage borrowers qualifying for a mortgage. This holds true for student loans that have been deferred for longer than 12 months. Deferred student loans deferred longer than 12 months are no longer exempt from debt-to-income ratio calculations on FHA and conventional loans. VA loans are the only mortgage loan program that allows exemption of student loans deferred longer than 12 months.

It’s critical to note that, regardless of whether you qualify for your loans to be forgiven, canceled, or erased, you are still responsible for paying back your loan—whether you complete your studies, find a job associated with your program of study, or are satisfied with the education you paid for. You are responsible for repaying your loan whether you were a minor (under the age of 18) when you signed your promissory note or obtained the loan, even if it was under false pretenses.

How Student Loan is Calculated for Mortgage in 2022

FHA Student Loan Guidelines are now the same as conventional loans. The lender needs to use the actual monthly payment for the student loan or the monthly student payment reported by 3 credit bureaus (Transunion, Equifax, Experian) on a credit report on both FHA and conventional loans.

In some cases, the lender or mortgage broker will use half percent (.5%), of the student loan balance if the student loan balance doesn’t appear on the credit report on both FHA and conventional loans. So if your loan balance is $100,000 then the lender will use $500 against your Debt To Income Ratio to qualify you for an FHA loan. Prior to June of 2021, this rule required 1% of the loan balance versus 0.50%.

Have More Questions on FHA Student Loan Guidelines? Click Here:

Comparison of Conforming Versus FHA Student Loan Guidelines

Let’s take a case scenario on FHA and conventional student loan calculations. With a $50,000 student loan balance, the mortgage underwriter will take 0.50% of the outstanding loan balance as a hypothetical debt or $250 monthly payment counted against your debt-to-income ratio. Now if you are on an income-based repayment plan, there is good news. The income-based repayment plan is very easy to utilize compared to a 0.50% payment.

Your lender will verify your income-based repayment plan and complete a credit supplement to update the income-based payment on your credit report. This is for both FHA and conventional loans. Assuming those items are complete, an underwriter may use the income-based payment now reflected on your credit report.

FHA Student Loan Guidelines Versus Lender Overlays

The truth is many loan officers do not know specific guidelines surrounding student loans and mortgage qualifications. We are experts when it comes to student loan debt and how that will affect your mortgage. We offer all of our mortgage products without lender overlays. Student loan guidelines are different on every mortgage product.

Meaning conventional guidelines look at student loans differently compared to FHA guidelines. Even VA guidelines are different once again. In this blog, we will detail how student loans affect your mortgage qualifications based on each mortgage product.

Qualifying For an FHA Loan With Income-Based Repayment (IBR)

Conventional mortgages and student loan guidelines:

- A conventional mortgage is a great option for thousands of Americans

- In the long term, conventional loans are usually a cheaper alternative compared to FHA financing (depending on the credit profile and down payment available)

- If you need higher loan amounts, typically the conventional route will be your best option

- Conventional loans have higher loan limits than FHA loans

- Fannie Mae guidelines allow the use of an income-based repayment plan referred to as “IBR” just like FHA student loan guidelines

If you are not on an income-based repayment plan, your student loan debt will be 0.50% with Freddie Mac and Fannie Mae of your student loan balance to use as a monthly payment. HUD came up with updated student loan guidelines where they now accept IBR payments. For deferred student loans on FHA loans, HUD allows 0.50% of the outstanding student loan balance to be used just like Freddie Mac.

Can You Get FHA Loan If You Have $80,000 in Student Loans?

FHA Student Loan Guidelines on Student Loan Debt:

FHA mortgages are way less forgiving with student loan debt. The general rule of thumb with FHA, 0.50% of your student loan balances will be used as a monthly payment. Example and case scenario on how student loan debt is treated on FHA loans:

- $80,000 student loan balance will have a $400.00 monthly payment counting against your debt to income ratio.

- This means if you have high student loan balances, your student loans may impede your FHA qualifications.

- There is a way around 0.50% of the outstanding student loan balance.

- HUD now accepts IBR payments including zero IBR payments.

- Or you can get a hypothetical “fully amortized” monthly student loan payment.

- This means you are on a fixed payment to pay off all of your student loan debt.

- Typically, this comes out to be just under 0.5% of your student loan balance as a monthly payment.

- The caveat is, that you actually need to enter the payment agreement and start paying back your student loans.

- An underwriter must verify you have started to make payments on the new student loan plan before closing.

Many Americans are not in a position to start paying back their student loans and buying a house at the same time. We hope to see HUD loosen student loan restrictions in the future on FHA loans.

VA Agency Student Loan Mortgage Guidelines On VA Loans

VA mortgages look at student loans a little differently. The equation for calculating your monthly payment on a VA mortgage is 5% of your student loan balance divided by 12. So 5% of your total balance is divided by 12 months which reflects as a monthly payment. This generally comes out to way less than 1% of the student loan balance as a monthly payment. Once again giving veterans every opportunity to achieve homeownership.

Student Loan Debt On VA Loans

Below is a case scenario and example of how student loan debt is calculated by mortgage underwriters on VA loans:

- $87,800 student loan balance. $87,800 * 5% = $4,390. $4,390 / 12 months = $365.84

- So, for $87,800 in student loan debt, you only need to count a $365.84 payment against a veterans debt to income ratio

- With a VA loan, if your student loan is deferred for 12 months or longer from your closing date, a $0 monthly payment is applied to that student loan

This can greatly increase your mortgage qualifications.

How Non-QM Lenders Treat Outstanding Student Loan Debt

NON-QM loans and student loan debt. NON-QM Mortgage loans look at student loans in a similar way to FHA mortgages. Typically, they will use 1% of your student loan balance as a monthly payment. However, if you can verify you have enough liquid assets to pay your student loans in full, you may zero out the student loan payment.

Student Loan Guidelines on Non-QM Loans

You don’t need to pay off your student loan balance, you need to verify you have the liquid capital to do so. Otherwise, they will use 1% of your loan balance as a monthly obligation against your debt-to-income ratio. Non-QM Lenders often can make exceptions to their lending guidelines. NON-QM does have the ability to look at a loan file on a case-by-case basis.

Student Loan Debt In Forbearance

Even though you have student loan debt in forbearance, with the exception of VA loans, all loan programs will require a hypothetical monthly debt payment to be used by mortgage underwriters. The hypothetical debt can impact your debt-to-income ratios for borrowers with high outstanding student loan debt.

During the COVID-19 coronavirus outbreak, many Americans put their student loans into forbearance based on the cares act. While this is not an issue when it comes to qualifying for a mortgage, it is important to understand that your loans will still affect your qualifications. Just because your loan is in forbearance, does not remove your obligation for paying the loan back.

Getting FHA Loan With a Lender Without Mortgage Overlays

If you have been turned down for a mortgage loan based on student loan debt, we encourage you to call us today after learning about FHA student loan guidelines. We do not have lender overlays on any of our mortgage products. This allows us to help more families than most banks and lenders. About 75% of our clients have been turned down by the current bank or are not getting the answers they deserve for their current lender.

We are available seven days a week and would love to answer any questions you have surrounding student loan debt and mortgage qualifications. Please call us at 888 900 1020 or send an email to [email protected] for more information. We look forward to helping you and your family.

July 6, 2022 - 7 min read