VA Manual Underwriting Guidelines For VA Mortgage Loans

In this blog, we will cover and discuss VA manual underwriting guidelines for VA mortgage loans. While many lenders offer VA mortgages, most do not know how to manually underwrite a VA loan. Since the majority of lenders do not participate in manual underwriting we have made this our specialty. In this blog, we will go over the difference between VA Manual Underwriting Versus AUS Approval on VA loans. We will cover VA Manual Underwriting Versus AUS Approval. We will discuss in detail how to successfully get a VA loan to the finish line, whether you have an automated approval or require a manual underwrite.

In this article (Skip to…)

When Do You Find Out Whether The Process Will Be VA Manual Underwriting Guidelines Versus AUS Approval

When applying for a VA loan, you will not know if you require a manual underwrite or if you will receive an automated approval. Your loan officer will need to provide you with this information. To the veteran, there is not much of a difference when applying for a mortgage. In order to start an application, you will need to call FHA Lend Mortgage directly. You can reach to us at 888-900-1020 or text us for a faster response or send an email to [email protected]. From there, either Mike or one of his highly-skilled loan officers will assist you through the application process.

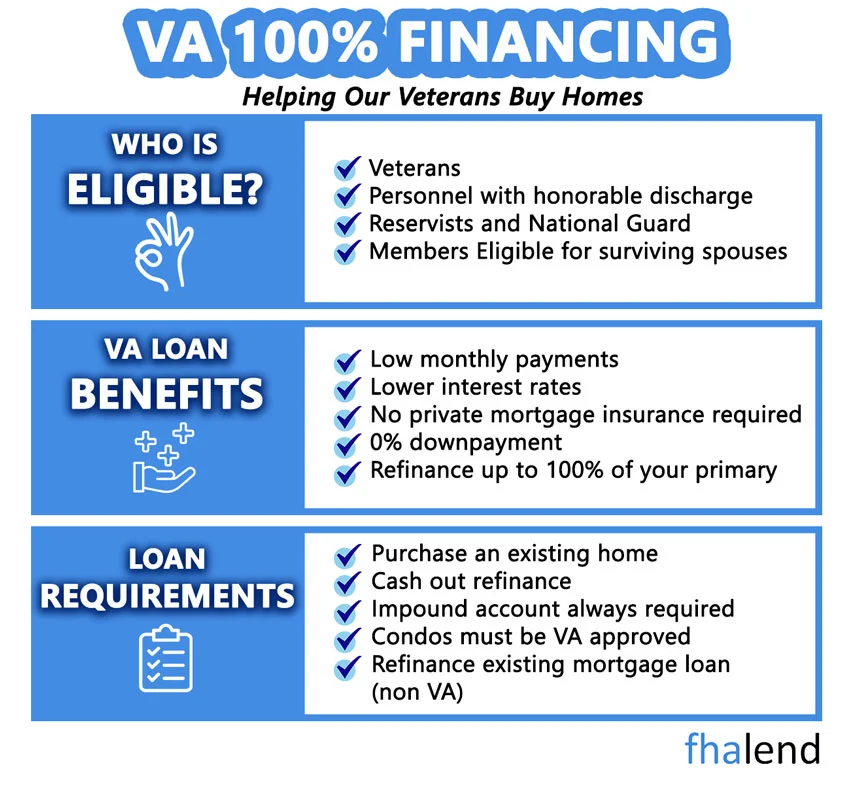

Who is Eligible to Receive VA Benefits For a Home Loan?

- Veterans who have a DD-214 with the credentials below

- Members of the military

- Active duty members qualify after the first six months of active service

- National Guard and Reserve members: Must serve six years or be called up to active duty for at least 181 days. If called up during wartime you should be eligible after 90 days

- Surviving spouses: If a military member dies during active duty or as the result of a service-related disability

- A surviving spouse will receive the VA form 26-1817

Documents Required For VA Manual Underwriting Guidelines

It is quite simple, you will gather the documents below:

- Last 60 Days Bank Statements – to source money for escrows.

- Last 30 Days Pay Stubs.

- Last Two Years W2’S.

- Last Two Years’ Tax Returns.

- Driver’s License.

- Certificate of Eligibility.

From there, your loan officer will send you an application link. Once you complete that link, that will allow us to verify your credit profile and get the process started. During this pre-approval process, your loan officer will run AUS (automated underwriting system). This will determine if we need to manually underwrite your loan or if you received an automated approval. For more specifics on AUS please read our AUS blog.

Main Differences Between VA Manual Underwriting Guidelines Versus AUS Approval

What are the differences between VA Manual Underwriting Guidelines Versus AUS Approval? An automated approval does make the process slightly easier, but it is, for the most part, the same process. An automated approval means your AUS came back with an APPROVE / ELIGIBLE findings report.

VA Manual Underwriting Guidelines on Debt to Income Ratio on VA Loans

An automated approval on a VA mortgage will determine the max debt to income ratio (DTI) you can go up to. Technically there is no maximum debt to income guideline for VA mortgages. The highest we have closed in recent history was a 65% back-end debt-to-income ratio. The VA does spell out very specific residual income requirements that must be met.

VA Manual Underwriting Guidelines on Residual Income on VA Loans

The residual income requirement is different based on the region of the country you live in and the size of your family. Once your loan officer has a complete application, they can compute the residual income requirement for you and your family. When you receive an automated approval, there is less paperwork required compared to a manual underwrite. For the most part, you do not need to have a verification of rent completed. Depending on credit score and reserves in the bank, the AUS report may allow for a late payment here and there within the past 12 months.

Paperwork Required On VA Manual Underwriting Guidelines Versus AUS Approval

What additional paperwork is needed to complete VA Manual Underwriting Guidelines Versus AUS Approval? If the automated underwriting system report does not get an automated approval, do not panic, we are experts in manual underwriting. In order to start a manual underwrite, your AUS report will come back with a REFER / ELIGIBLE findings report. Refer means you must downgrade to a manual underwrite. When a VA mortgage must be manually underwritten, we now have to limit our maximum debt-to-income ratio to 54% (back end). You will still need to pass the residual income requirements based on location and family size.

Major Differences Between AUS Versus VA Manual Underwriting Guidelines

The main difference between an automated approval and a manual underwrite is a verification of rent. For manually underwritten VA loans, the lender must verify that your last 12 rental payments have all been on time. If you rent from a private landlord, you will need to verify that the past 12 rental payments have been on time by sending in canceled checks. The underwriter must be able to document that there have not been any payments 30 days late or greater in the past 12 months.

VA Manual Underwriting Guidelines on Verification of Rent

If you rent from a management company, the lender may send the verification of the rent form. That form will document the dates your payments were received. This is required on every manually underwritten VA mortgage. If you do not pay rent, you will get a rent-free letter from the owner of where you are staying. For the most part, this is from a family member. They will sign and date a letter saying that you live there and you are not required to pay rent.

VA Manual Underwriting Guidelines on Reserves

You will also be required to have one month of reserves in the bank after closing. This is a requirement on every manual underwrites for a single-family property. If you are buying a three to four-unit property, you will need three months of reserves in the bank after closing. The team at FHA Lend Mortgage are experts in manually underwriting VA mortgages. Please reach out with any general or specific questions about the process.

Advice To Loan Officers On How To Get A Refer/Eligible To AUS Approval

What are some ways to get automated approval? If you are currently receiving a REFER / ELIGIBLE AUS report and would like to get an automated approval, here are a few tips. Assets, assets, assets. Having reserves in the bank above and beyond the minimum requirement of 1 month will it help your VA loan tremendously. AUS likes to see financial consistency. If you have a history of saving money and have assets in the bank, you are more likely to get automated approval.

How To Increase Your Credit Scores to Get an AUS Approval

Raise your credit score! This may sound obvious but having a credit score above 620 and even above 640 will help your AUS get an APPROVE / ELIGIBLE report. The higher the credit score, the lower the risk in the eyes of the lender. We have seen every credit profile under the sun and can give pointers on how to get your scores up.

VA Manual Underwriting Guidelines on Timely Payments In The Past 12 Months

Season late payments. Seasoning your late payments, a minimum of 12 months is a great way to help the AUS for a VA mortgage. If you are required to downgrade to a manual underwrite, late payments within the past 12 months are usually a deal-killer. The VA likes to see a clean 12 months on your credit report. Waiting to apply for a mortgage until late payments are over 12 months will help to receive automated approval.

VA Manual Underwriting Guidelines Versus AUS Approval With Bankruptcies

Chapter 7 And 13 Bankruptcies and VA mortgages. VA Chapter 13 Bankruptcy Mortgage Guidelines. If you are in an active chapter 13 bankruptcy and have made at least 12 on-time payments to the trustee (and all other debts), you are eligible to receive VA mortgage financing. If the bankruptcy is active or discharged less than 2 years ago, you will need a manual underwrite no matter what. You will NOT receive an automated approval until your bankruptcy has been discharged for a minimum of 24 months.

VA Loans After Chapter 7 Bankruptcy Guidelines

VA Chapter 7 Bankruptcy Mortgage Guidelines. If you have filed for chapter 7 bankruptcy, you will need to wait a minimum of two years from the date of discharge before you’re eligible to enter into a VA mortgage. After the 2-year seasoning, it is possible to receive an automated approval.

Qualifying For VA Manual Underwriting Guidelines With A Mortgage Company With No Overlays

From reading the information above, you can see that manual underwriting is not much different than an automated approval. It is important to choose a lender who knows how to get VA mortgages to the finish line. We are experts in VA mortgages and FHA Lend Mortgage does not have any LENDER OVERLAYS to get in the way. This is part of the reason we are able to close more mortgages than many lenders.

Qualify and Getting Pre-Approved For VA Loans With No Lender Overlays

Please read our reviews, the majority of our clients have received a last-second denial from their current lender or are simply not getting the customer service they deserve. If for some reason you do not qualify for a mortgage today, we will create a financial road map of how to qualify as soon as possible. We encourage you to reach out to us directly with any questions regarding VA mortgages. We can be reached seven days a week and are available in the evenings. Your path to homeownership is just one phone call away. We look forward to hearing from you!

April 1, 2022 - 7 min read