Disqualification From FHA Mortgage Loan

All of the disqualification questions are related to strict raw FHA guidelines. if you don’t follow them you can be sure you can get denied (disqualified) from obtaining a loan and getting into your dream home.

If you are thinking of buying a home, it is important to check with your lender to see if the home you are interested in meets all of the requirements for FHA financing. Otherwise, you may need to look into other financing options. There are a few things that could disqualify a home from being FHA approved. One is if the home is in need of major repairs. Another is if the home is not up to code with current safety standards.

And finally, if the home has any outstanding liens or judgments against it, that could also disqualify the home from being FHA approved. There are certain conditions that would cause a home to be ineligible for FHA financing. Some of these conditions include:

- The home must be free from any hazardous materials or conditions that could pose a health or safety risk to the occupants.

- The home must be structurally sound and in good repair. Any significant damage or defects would need to be repaired before the home could be eligible for FHA financing.

- The home must have adequate access to utilities and services such as water, sewer, and electricity.

- The home must meet the minimum property requirements set forth by the FHA. These requirements include things like having a minimum number of rooms, adequate heating and cooling, and more.

- The home must be located in an eligible area. This includes areas that are not prone to flooding, earthquakes, or other natural disasters.

- The home must be owner-occupied. Investment properties and vacation homes are not eligible for FHA financing.

In this article (Skip to…)

Getting Disqualify When Buying a Home

If you’re in the process of buying a home, there are a few things that can disqualify you from getting a mortgage. In this blog post, we’ll go over three of the most common reasons why people get disqualified when buying a home.

Getting disqualified when buying a home can be a real bummer. It can feel like you’ve been kicked when you’re down, and it’s definitely not something that anyone wants to experience. There are a few common reasons why people get disqualified from buying a home, and understanding these reasons can help you avoid them in the future.

One of the most common reasons people get disqualified from buying a home is because they don’t have a steady income. Lenders want to see that you have a consistent source of income so that they know you’ll be able to make your mortgage payments on time each month. If you’re self-employed or have an erratic income, it may be difficult to qualify for a loan.

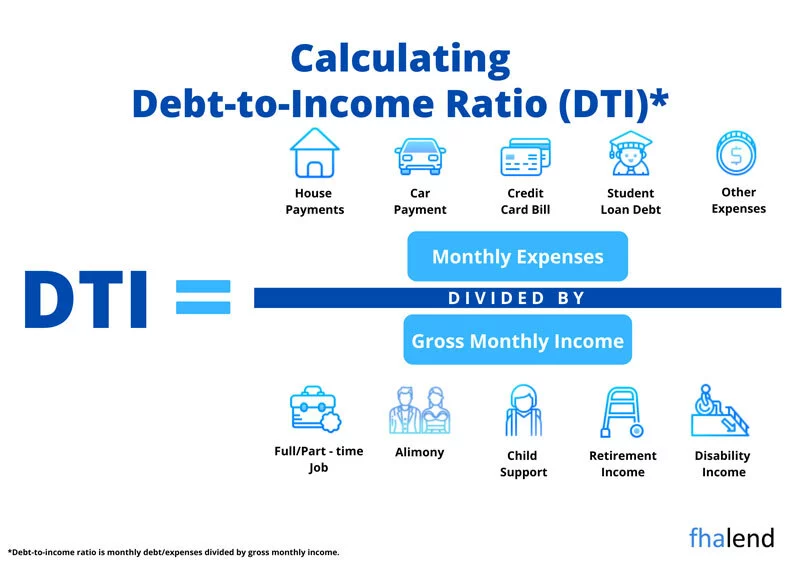

Another reason people may get disqualified is because of their credit score. If your credit score is low, it may be difficult to get approved for a loan. Lenders also look at your debt-to-income ratio when determining whether or not to approve you for a loan. This ratio compares your monthly debts to your monthly income, and if it’s too high, you may be disqualified. If you’re looking to buy a home, there are a few things you can do to increase your chances of getting approved for a loan.

First, make sure you have a steady income. If you’re self-employed, consider getting a co-signer with good credit who can help guarantee the loan. You should also try to improve your credit score by paying down debts and making all of your payments on time. Finally, keep your debt-to-income ratio low by keeping your monthly debts as low as possible. By following these tips, you can increase your chances of getting approved for a loan and avoid getting disqualified when buying a home.

1. Not Having a Steady Income

2. Having too Much Debt

3. Having a Poor Credit score

4. High DTI

For conventional loans, the ideal DTI is 36% or less. But if you’re considering an FHA loan with a lower down payment, you may be able to get approved with a higher DTI. The maximum DTI for an FHA loan is 55%. If your DTI is too high, you may need to work on paying down some of your debts before you can qualify for an FHA loan. You can also try to get a cosigner for your loan, which may help you qualify with a higher DTI.

When you’re ready to apply for an FHA loan, be sure to shop around at different lenders to compare rates and terms. And remember, even if you have a high DTI, there are still plenty of mortgage options available to you.

5. Down Payment

6. Missed Payments

7. Occupancy

Requirements for an FHA loan?

The occupancy requirements for an FHA loan are that the borrower must intend to occupy the property as their primary residence. The property must also be suitable for a primary residence, which means it must have adequate space, utilities, and safety features. The borrower must also be able to demonstrate that they have a reasonable expectation of being able to continue occupying the property as their primary residence for the foreseeable future.

Can I Occupy The Property Right Away?

There are some exceptions to the occupancy requirements for FHA loans. If the borrower is a member of the military or is employed by certain government agencies, they may be eligible for an exception to the occupancy requirements. Additionally, if the borrower is planning to purchase a multi-unit property, they may be able to rent out the other units and still qualify for an FHA loan.

Not Sure If You Can Occupy The Property Long-term?

If you’re not sure you can occupy the property long-term, you may still be eligible for an FHA loan if you meet certain conditions. For example, if you’re a first-time homebuyer or you’re purchasing a property in an underserved area, you may be eligible for an exception to the occupancy requirements.

What are the consequences of not meeting the occupancy requirements?

If you fail to meet the occupancy requirements for an FHA loan, you could be subject to penalties including but not limited to fines, suspension of your FHA loan privileges, and even foreclosure.

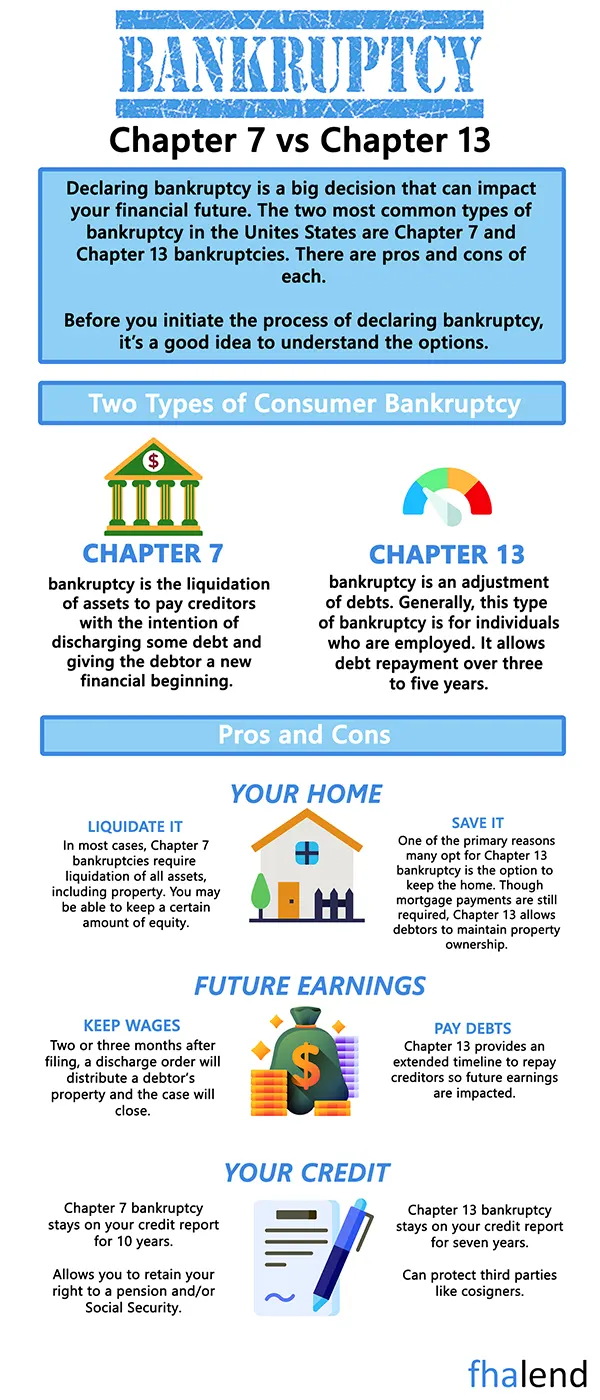

8. Bankruptcies or Foreclosures

If you have had a bankruptcy or foreclosure in the recent past, you may also be disqualified for an FHA loan. If you’ve filed for bankruptcy, you’ll need to wait at least two years before you can apply for an FHA loan. And if you’ve had a foreclosure, you’ll need to wait at least three years before you can get an FHA loan. Lenders want to see that you have a good credit history, and bankruptcy or foreclosure can make it difficult to get approved for a loan.

9. Short Sale

An FHA loan after a short sale may be possible if you meet certain conditions. The main thing to consider is the waiting period, which is typically three years. If you can show that the financial hardship that caused the short sale was due to circumstances beyond your control, you may be able to get a loan sooner. You’ll also need to have re-established good credit and have a steady income. If you’re looking to buy a home again after a short sale, an FHA loan may be an option. Here’s what you need to know about qualifying for an FHA loan after a short sale.

Refinancing a Property And Disqualification

If you’re thinking of refinancing your home, make sure you understand the process and the potential risks involved. It could save you a lot of money, but it’s not for everyone. Talk to your lender about your options and compare different offers before making a decision.

When it comes to refinancing a property, there can be some disadvantages that come along with it – one of which is the potential for disqualification. In this blog post, we’ll outline what refinancing is, when you might be disqualified from doing so, and offer some alternatives if you are.

Refinancing is the process of taking out a new loan to replace an existing one. There are many reasons why someone might choose to refinance their loan, such as getting a lower interest rate, extending the term of the loan, or tapping into equity.

However, there are also some potential drawbacks to refinancing, such as having to pay closing costs and fees associated with taking out the new loan. Additionally, if you have been delinquent on your existing loan, you may be disqualified from refinancing. If you are facing disqualification from refinancing, there are a few alternatives that you can consider.

One option is to try and negotiate with your lender to see if they will allow you to refinance despite your delinquency. Another option is to look into government programs that offer assistance for those who are struggling to make their mortgage payments. Finally, you could sell the property in order to pay off the existing loan and avoid any potential negative consequences of refinancing.

January 8, 2023 - 7 min read